Common-mode Chokes Market Size, Share & Growth, 2030

Common-mode Chokes Market by Type (Data Line, Single Line, Power Line), Mounting Type (Surface-mount Chokes, Through-hole Chokes), Core Material (Ferrite Core, Nanocrystalline Core), Vertical and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

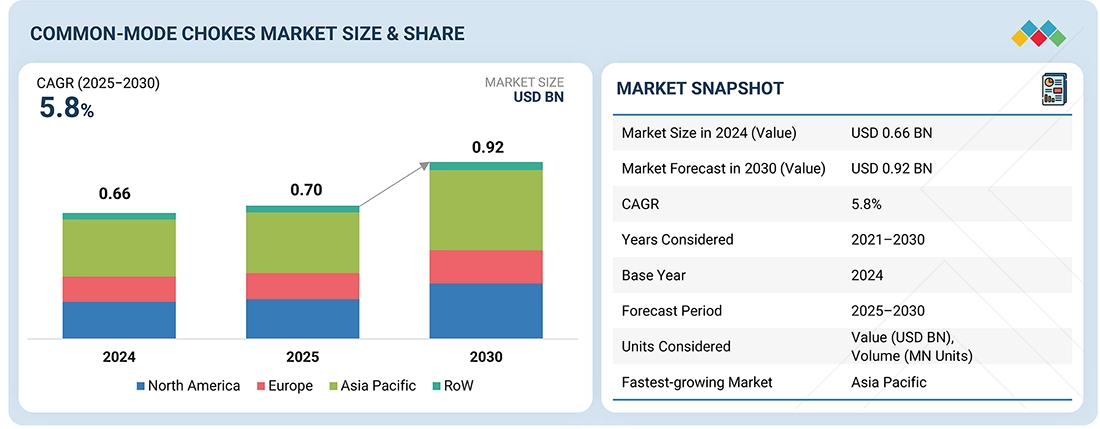

The common-mode chokes market is projected to grow from USD 0.70 billion in 2025 to USD 0.92 billion by 2030, at a CAGR of 5.8% from 2025 to 2030. The market is experiencing significant growth due to the rising use of common-mode chokes in automotive and transportation applications, increasing adoption of Industry 4.0 technologies by manufacturing firms, and growing deployment of common-mode chokes in consumer electronics. Further, increasing use of common-mode chokes in communications applications and stringent regulations related to electromagnetic emissions causing EMI creates an opportunity for the market growth.

KEY TAKEAWAYS

-

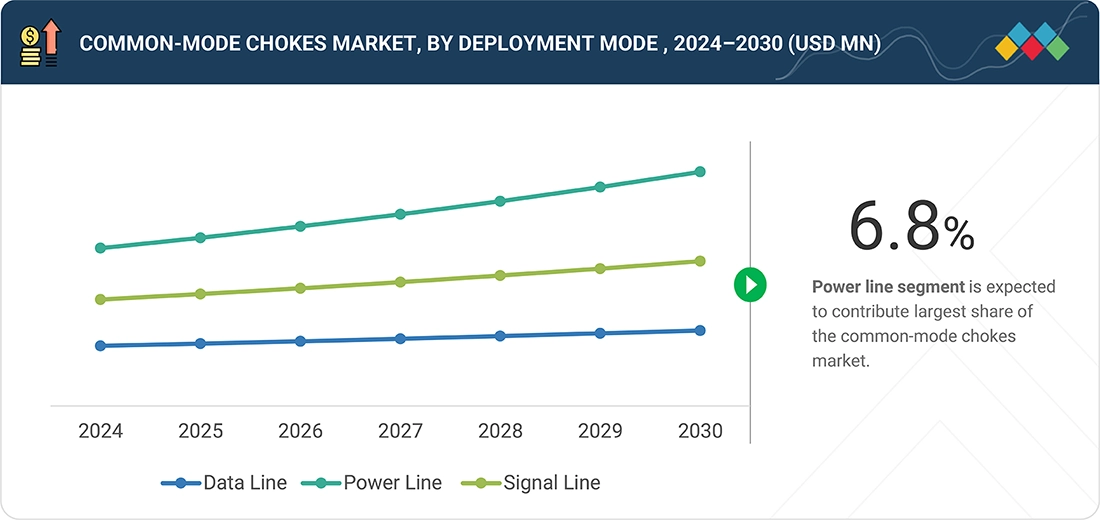

BY TYPEBy type, the power line segment is projected to grow at highest CAGR of 6.8% during the forecast period.

-

BY INDUSTRYBy industry, consumer electronics is expected to hold a share of 31.3% of the common-mode chokes market in 2025.

-

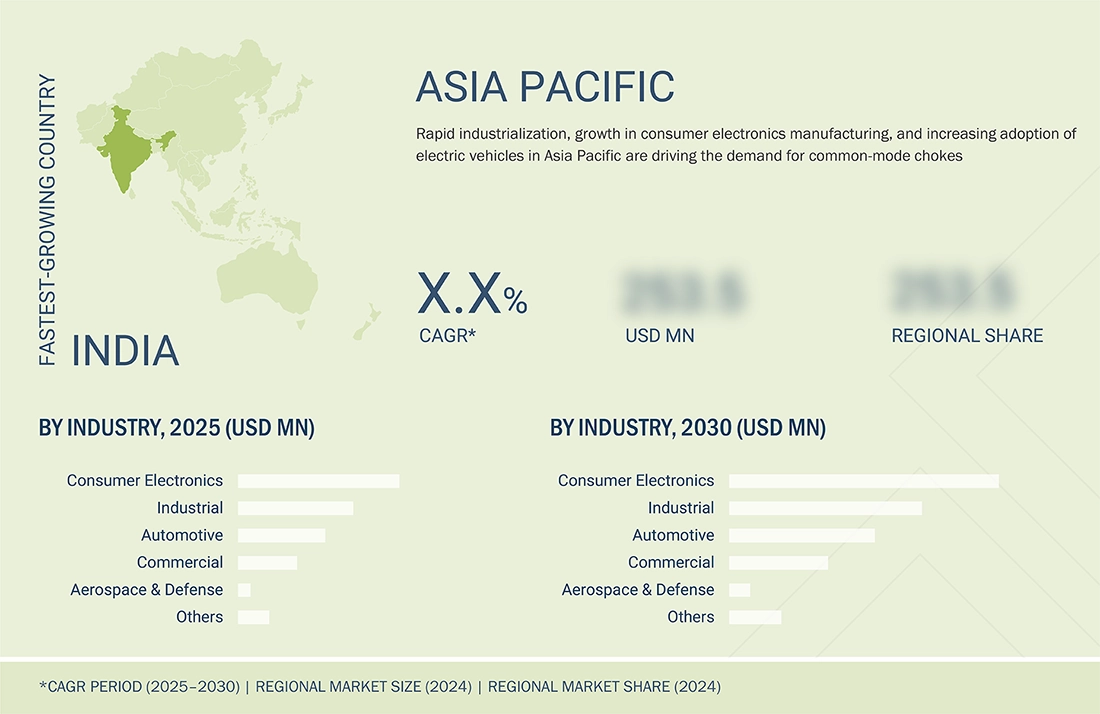

BY REGIONAsia Pacific is estimated to dominate the common-mode chokes market with a share of 45.3% in 2025.

-

COMPETITIVE LANDSCAPECoilcraft Inc (US), iNRCORE LLC (US), and FASTRON (Germany) have distinguished themselves among startups and SMEs due to their well-developed marketing channels and extensive funding to build their product portfolios.

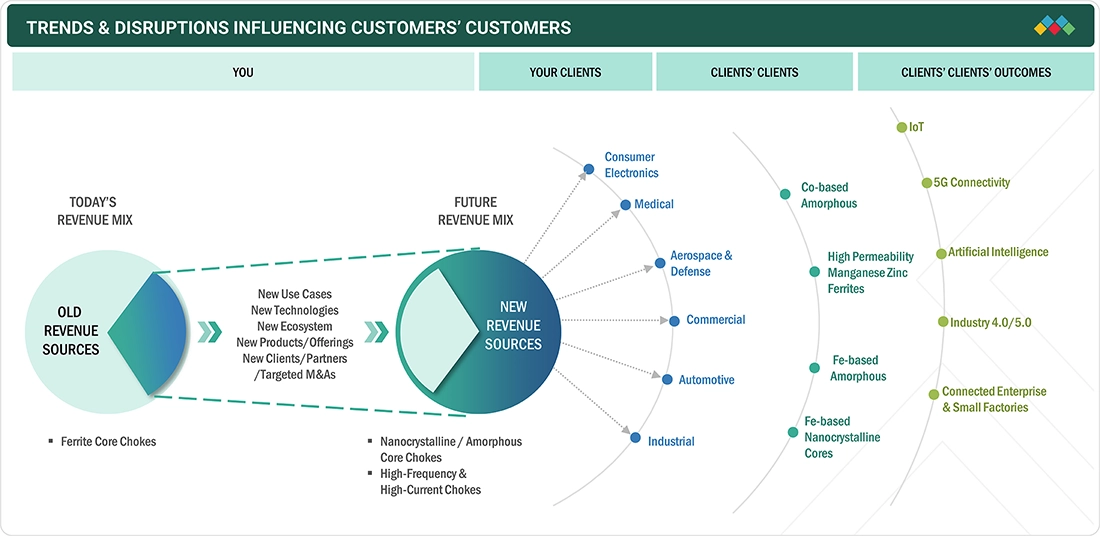

The common-mode chokes market is projected to grow steadily over the next decade, driven by factors such as stricter global EMC regulations, rapid adoption of high-frequency and miniaturized electronics, and the proliferation of electric vehicles, smart grids, and IoT devices. Opportunities within the market are emerging around advanced, high-attenuation, and miniaturized chokes that can deliver reliable noise filtering in compact devices, especially for 5G infrastructure, EV powertrains, factory automation, and high-speed consumer electronics.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

A common-mode choke is a passive device consisting of two-wire coils wound on a magnetic core that blocks (chokes) signals common to both lines in the device while being a low impedance to signals that are unique to one line or the other in the device. As the auto industry’s boom continues, the adoption of electronic devices in automobiles has grown rapidly. CAN bus (Controller Area Network) is one of the communication standards that allows all these features to function in unison. It utilizes two-wire differential signaling to transmit and receive data between different devices in the network. Moreover, a continuous inclination toward industrial automation and robotics is further likely to boost the adoption of common-mode chokes during the forecast period.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing adoption of Industry 4.0 technologies by manufacturing firms

-

Rising use of common-mode chokes in automotive and transportation applications

Level

-

Performance-related limitations of low-cost common-mode chokes

-

High qualification barriers in safety-critical applications

Level

-

Increasing use of common-mode chokes in communications applications

-

Stringent regulations related to electromagnetic emissions causing EMI

Level

-

High complexities related to common-mode chokes

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing adoption of Industry 4.0 technologies by manufacturing firms

The increasing adoption of automated machinery and industrial robots is propelling growth opportunities for common-mode chokes manufacturers and is driving the demand for common-mode chokes in various machines and robots.

Restraint: Performance-related limitations of low-cost common-mode chokes

To tackle the cost issues, low-cost common-mode chokes are utilized, but the functions of these low-cost chokes limit the magnitude of an over-voltage surge on the bus lines by functioning as a filter. This ultimately impacts the performance of chokes

Opportunity: Increasing use of common-mode chokes in communications applications

Increasingly high clock frequencies and the associated fast rise times mean that the signals used in modern data and telecommunications engineering are a serious potential source of RF interference that can influence other devices and systems. Thus, the necessity to implement common-mode chokes has increased to reduce the risk of external interference in communication devices.

Challenge: High complexities related to common-mode chokes

Not all filters can operate correctly in applications having high switching speeds, due to which some filters can result in failures. Also, depending on the system application and location, chokes are exposed to electrical disturbances such as voltage surge, voltage distortion, temporary overvoltage, high ripple currents, and lightning strikes. All these electrical disturbances can damage the insulation systems and capacitors of filters.

common-mode-chokes-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides compact SMT and power line common-mode chokes for suppression of EMI in automotive, industrial, and consumer electronic devices. | Reliable EMI filtering, enhanced system stability, and simplifies design for EMC compliance |

|

Delivers robust, high-temperature common-mode chokes for EMI filtering in automotive and industrial systems. | Enable extreme environment tolerance, reliable filtering for automotive/industrial, and also have extended product lifespan |

|

Provides nanocrystalline-based high-attenuation common-mode chokes for industrial, power electronics, robotics, EV charging, renewable inverters, and medical equipment. | High customization capability, proven EMC expertise and industrial-grade quality |

|

Specializes in high-impedance, compact, surface-mount common-mode chokes ideal for noise suppression in DC-DC converters, battery chargers, and portable power equipment. | Industry leadership in compact, high-performance components; extensive R&D and patented material innovation |

|

Offers a wide portfolio of automotive-grade and power circuit common-mode chokes for EMI suppression across automotive ECUs, LED lighting, renewables, and power applications. | Automotive-grade reliability, effective noise suppression across applications, and flexible formats for design needs |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis of the common-mode chokes market comprises raw material and component suppliers, common-mode chokes manufacturers, distributors, and end-users. Some key manufacturers in the common-mode chokes market include TDK Corporation (Japan), Eaton (Ireland), Murata Manufacturing Co., Ltd. (Japan), Schaffner Holding AG (Switzerland), and YAGEO Group (Taiwan), among others.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Common-mode Chokes Market, By Type

Power line exhibits the highest CAGR, driven by the growing demand in consumer electronics for power supply applications. The rising trend of automation in the manufacturing sector has created growth opportunities for the providers of data line common-mode chokes.

Common-mode Chokes Market, By Industry

The consumr electronics sector holds largest market share in 2024. Stringent regulations to reduce electromagnetic interference (EMI) in electronic and electrical equipment have boosted the adoption of common mode chokes in products such as LCD panels, USB drives, computers, laptops, power cables, enhancing signal integrity and overall device reliability.

REGION

Asia Pacific to grow at the fastest rate in the global biometric system market during the forecast period

Asia Pacific is projected to register the highest CAGR from 2025 to 2030, driven by growing demand for smart home systems and high demand for various control devices pertaining to lighting control and entertainment control. The growth of the market for common-mode chokes in Asia Pacific can be attributed to the increased investments in deploying industrial automation solutions, robotics, and smart manufacturing. Ongoing technological innovation and increasing adoption of automation technology in various industries have accelerated the demand for common-mode chokes in the region.

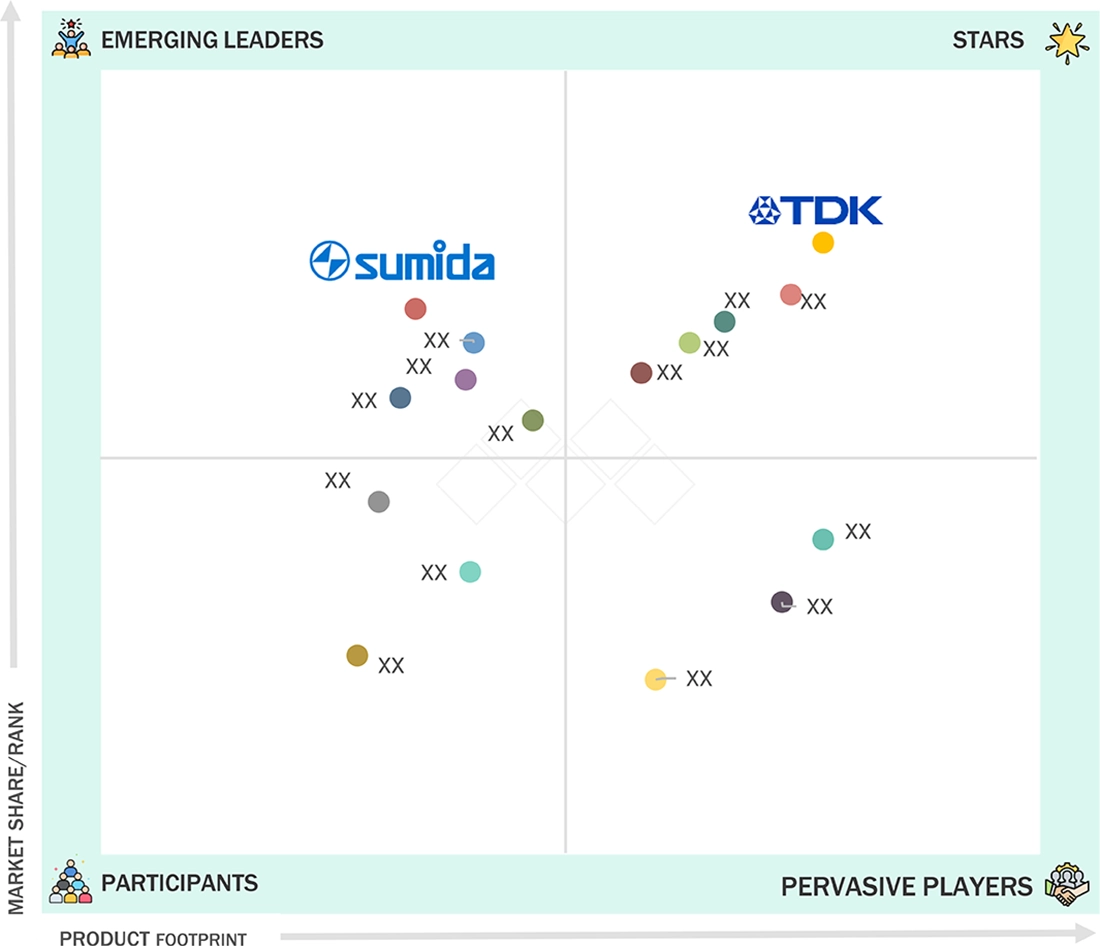

common-mode-chokes-market: COMPANY EVALUATION MATRIX

In the common-mode chokes market matrix, TDK (Star) leads with a strong global presence and a comprehensive common-mode chokes portfolio. The company’s robust manufacturing capacity across Japan, China, Malaysia, and Europe strengthens supply reliability, making it the preferred supplier for Tier-1 automotive and industrial OEMs. Sumida Corporation (Emerging Leader) is rapidly gaining momentum through its common-mode chokes product portfolio.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.66 Billion |

| Market Forecast in 2030 (Value) | USD 0.92 Billion |

| Growth Rate | CAGR of 5.8% from 2025-2030 |

| Years Considered | 2021-2024 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion/Million) and Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Regions Covered | North America, Europe, Asia Pacific, and RoW |

| Segment Covered | By Type, Mounting, Core Material, Deployment Mode & Vertcal |

| Leading Segments |

By Deployment Mode, Power Line Segment is expected shargest share at CAGR 6.8%

|

| Leading Region | Asia Pacific is estimated to dominate the common-mode chokes market with a share of 45.3% in 2025. |

| Driver | Increasing adoption of Industry 4.0 technologies by manufacturing firms |

| Restraint | Performance-related limitations of low-cost common-mode chokes |

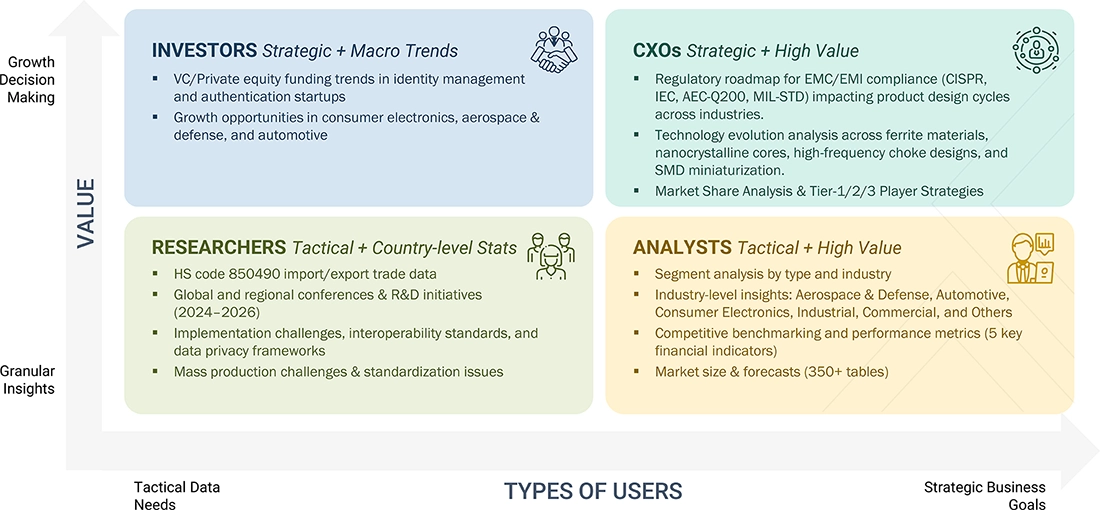

WHAT IS IN IT FOR YOU: common-mode-chokes-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Consumer Electronics OEM | PCB-level power integrity & EMI noise pathway mapping for adapter, charger, and home appliance product lines. | Optimized sourcing recommendations enabling 8–12% BOM cost rationalization. |

| European Industrial Automation OEM | Application benchmarking across PLCs, motor drives, and industrial power supplies. | Competitive product mapping across 20+ suppliers. |

RECENT DEVELOPMENTS

- January 2025 : TDK launched SurfIND, SMD common-mode chokes for rated currents of up to 36 A at high temperatures. The company launches the EPCOS SurfIND series, a new range of current-compensated ring core double chokes for high currents and surface mounting with SurfIND, for customers who prefer reflow soldering (e.g., sandwich packages in telecom equipment, industrial drives, etc.) but need high-current common-mode chokes (usually large and heavy).

- June 2024 : Schaffner’s launched its new RT series N choke, which delivers higher attenuation levels than previous versions while retaining the same mechanical volume. Based on nanocrystalline core technology, the new RT series N includes RT8121, RT8131, RT8521, and RT8531. This extension to Schaffner’s popular RT series achieves up to 15 dB higher attenuation performance than its ferrite-based predecessor across relevant frequency bands of the electromagnetic compatibility (EMC) frequency spectrum.

- June 2022 : Würth Elektronik GmbH & Co. KG and Valens Semiconductor collaborated to market their joint solution, enabling medical image diagnosis and procedures with unprecedented video resolution. The offering encompasses secure, cost-effective, uncompressed, high-bandwidth video connectivity and advanced camera imaging.

- October 2022 : TDK Corporation showcased more than 100 technology highlights across its component and solution portfolio for the entire spectrum of electronic applications at electronica 2022, occupying an exhibition area of 855 m² at the event, located in Munich, Germany, from November 15 to 18, 2022.

- January 2022 : The YAGEO Group announced the completion of the acquisition of Chilisin Electronics Corporation, a leading provider of inductors, power transformers, RF components, and Ethernet transformer products. YAGEO Group will merge Chilisin and its subsidiary brands, such as Mag. Layers, Magic & BothHand into Pulse Electronics.

Table of Contents

Methodology

The study involved four major activities in estimating the market size of the thin-film electrode market. Exhaustive secondary research was conducted to gather information on the market, its peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information relevant to this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research was primarily conducted to gather critical information about the industry's supply chain, value chain, the total pool of key players, and market classification and segmentation based on industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives. Secondary data has been gathered and analyzed to determine the overall market size, which has also been validated by primary research.

Primary Research

Extensive primary research was conducted after understanding and analyzing the current market scenario for common-mode chokes through secondary research. Several primary interviews were conducted with key opinion leaders from both the demand and supply sides in four key regions: North America, Europe, the Asia Pacific, and the rest of the world. Nearly 25% of the primary interviews were held with the demand side and 75% with the supply side. The primary data were gathered primarily through telephonic interviews, which accounted for 80% of the total primary interviews. Surveys and e-mails were also utilized to gather data.

Note: The three tiers of companies are defined based on their total revenue as of 2024; tier 1: revenue more than or equal to USD 500 million, tier 2: revenue between USD 100 million and USD 500 million, and tier 3: revenue less than or equal to USD 100 million. Other designations include sales and marketing executives and researchers, as well as members of various common-mode chokes organizations.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This report implemented both the top-down and bottom-up approaches to estimate and validate the size of the common-mode chokes market and various other dependent submarkets. Secondary research identified key players in this market, and their market shares in the respective regions were determined through primary and secondary research.

This report implemented both the top-down and bottom-up approaches to estimate and validate the size of the common-mode chokes market and various other dependent submarkets. Secondary research identified key players in this market, and their market shares in the respective regions were determined through primary and secondary research.

Bottom-Up Approach

- Identifying key players in the common-mode chokes market, along with their offerings

- Analyzing major manufacturers of common-mode chokes, studying their portfolios, and understanding several types of products based on their features and functions

- Analyzing trends pertaining to the use of common-mode chokes in verticals such as aerospace & defense, automotive, consumer electronics, commercial, and industrial

- Understanding and analyzing Y-o-Y projections to derive the projected market values of each common-mode type; initially, Y-o-Y projections showed moderate growth in 2021. Also, the market is expected to witness strong growth opportunities, thereafter, considering the surging demand for common-mode chokes in electronic devices.

- Tracking the ongoing and upcoming developments in the market, such as investments made, R&D activities, product launches, acquisitions, partnerships, agreements, contracts, and expansions, and forecasting the market based on these developments and other critical parameters

- Conducting multiple discussions with key opinion leaders to understand different types of common-mode chokes, verticals, and current trends in the market, thereby analyzing the breakup of the scope of work carried out by major manufacturing companies

- Arriving at the market estimates by analyzing revenues of these companies generated from different product types and then combining the same to get the market estimate by region

- Calculate the pricing of various common-mode chokes separately to analyze the shipment of each product category.

- Verifying and cross-checking the estimates at every level by discussing with key opinion leaders, such as CXOs, directors, and operations managers, and finally, with the domain experts in MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

- In the top-down approach, the overall market size has been used to estimate the size of individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research.

- To calculate the size of specific market segments, the size of the parent market has been considered to implement the top-down approach. The bottom-up approach has also been implemented for data extracted from secondary research to validate the market size of different segments.

- Each company's market share has been estimated to verify the revenue share used in the bottom-up approach earlier. With data triangulation and data validation through primaries, the size of the parent market and each segment has been determined and confirmed in this study.

Common-mode Chokes Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the common-mode chokes market from the estimation process explained above, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed (wherever applicable) to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The size of the common-mode chokes market was validated using both top-down and bottom-up approaches.

Market Definition

Common-mode chokes are being increasingly adopted across various industries, including automotive, consumer electronics, industrial automation, telecommunications, and power systems, to suppress electromagnetic interference (EMI) and enhance circuit reliability. These components are vital in filtering unwanted noise signals while allowing differential currents to pass, ensuring the stable operation of electronic devices. Leveraging advancements in materials such as nanocrystalline and ferrite cores, common-mode chokes offer superior noise attenuation, high impedance, and compact form factors, making them suitable for high-frequency and high-density applications. The growing integration of power electronics, electric mobility, and renewable energy systems continues to drive global demand for efficient EMI suppression solutions.

Key Stakeholders

- Raw material and manufacturing equipment suppliers

- Associations and regulatory authorities related to common-mode chokes

- Government bodies, venture capitalists, and private equity firms

- Original equipment manufacturers (OEMs)

- Electronic device manufacturers

- Common-mode choke distributors and sales firms

- Research organizations

- Organizations, forums, alliances, and associations

- End users from verticals such as automotive, consumer electronics, industrial, and commercial sector

Report Objectives

- To define and forecast the size of the common-mode chokes market based on type, industry, and region, in terms of value and volume

- To describe and forecast the size of the common-mode chokes market in four key regions, namely, North America, Europe, Asia Pacific, and RoW, along with their respective countries

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To offer a comprehensive overview of the value chain of the common-mode chokes market ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as product launches, acquisitions, collaborations, agreements, and partnerships, in the common-mode chokes market

Available Customizations

With the market data given, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Common-mode Chokes Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Common-mode Chokes Market