Cloud FinOps Market

Cloud FinOps Market Size by Application (Cost Management & Optimization, Budgeting & Forecasting, Cost Allocation & Chargeback, Reporting & Analytics, Workload Management & Optimization), Deployment (Single Cloud, Multi Cloud) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

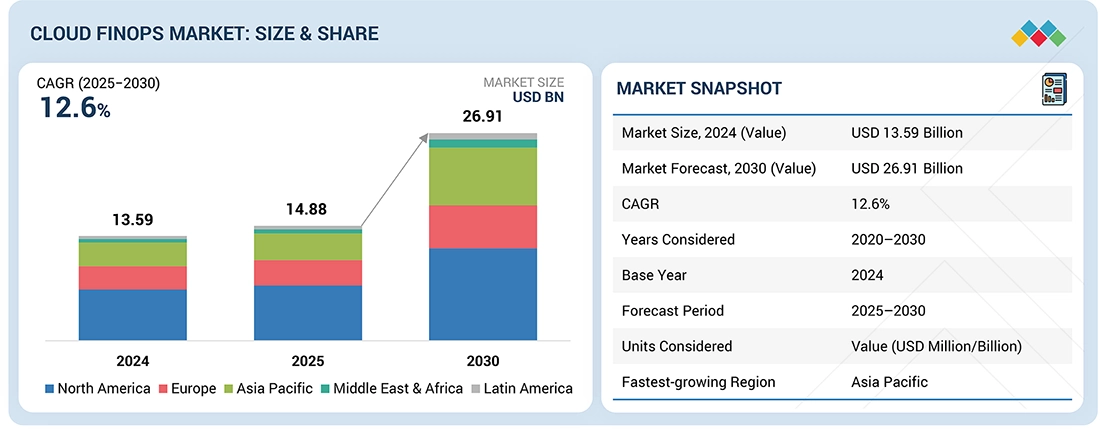

The cloud FinOps market is projected to reach USD 26.91 billion by 2030 from USD 14.88 billion in 2025, at a CAGR of 12.6%. Growth is driven by accelerating cloud adoption across enterprises, increasing cost pressure from AI-intensive and multi-cloud workloads, and the growing need for disciplined cloud financial management. Organizations are prioritizing cloud cost optimization, FinOps governance, and real-time spend visibility to control budgets, reduce waste, and align cloud consumption with business outcomes while maintaining operational agility.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is estimated to grow at the highest rate in the cloud FinOps market, as India, Japan, and Australia enforce stricter public cloud budgeting rules, driven by government cloud programs and enterprise-scale SaaS migrations.

-

BY SOLUTIONThe native solutions segment is projected to grow at the fastest rate of 15.0% during the forecast period of the cloud FinOps market.

-

BY SERVICESupport & maintenance services are set to register a CAGR of 15.5% during the forecast period.

-

BY APPLICATION/CAPABILITYBy application/capability, cost management and optimization is estimated to account for the largest market of USD 6,978.7 million in 2030 in the global cloud FinOps market.

-

BY DEPLOYMENT ENVIRONMENTMulti-cloud deployment is poised to register the largest market share by 2030 as enterprises prioritize unified cloud FinOps, cross-cloud cost visibility, chargeback governance, and cost optimization.

-

BY DEPLOYMENT MODEHybrid cloud is emerging as the fastest-growing segment by deployment mode as enterprises require integrated cloud FinOps for unified cost visibility, governance, and optimization across on-premises and public cloud environments.

-

BY VERTICALThe IT and ITeS vertical is estimated to register the largest market share as large-scale cloud consumption drives demand for cloud FinOps, cost optimization, usage governance, and continuous financial accountability.

-

BY SERVICE MODELIaaS is estimated to register the highest growth rate as variable infrastructure consumption increases reliance on cloud FinOps for cost optimization, budget control, and usage-based financial governance.

-

BY ORGANIZATION SIZESMEs are expected to grow at the fastest rate as rapid SaaS adoption and limited cloud budgets accelerate demand for automated cloud FinOps, spend controls, and real-time cost optimization.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSAWS, Microsoft, Google, IBM, and Oracle are among the major players in the cloud FinOps market, collaborating with enterprises to deliver cloud financial management platforms, cost optimization automation, multi-cloud spend visibility, policy-driven governance, and real-time cost intelligence across cloud environments.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMESnOps, Cast AI, and KubeCost have distinguished themselves among startups and SMEs due to their robust product portfolios and effective business strategies.

The cloud FinOps market is strengthening as organizations deepen reliance on consumption-based cloud models that increase spend variability and financial exposure. Enterprises are implementing cloud FinOps disciplines to improve budget accuracy, cost transparency, and accountability across engineering, finance, and operations teams. Modern cloud financial management solutions emphasize automated cost controls, granular chargeback and showback, and continuous optimization workflows to curb inefficiencies. As cloud usage expands across regions, services, and deployment models, cloud FinOps is emerging as a core governance function that stabilizes cloud economics, strengthens cost discipline, and supports scalable digital operations.

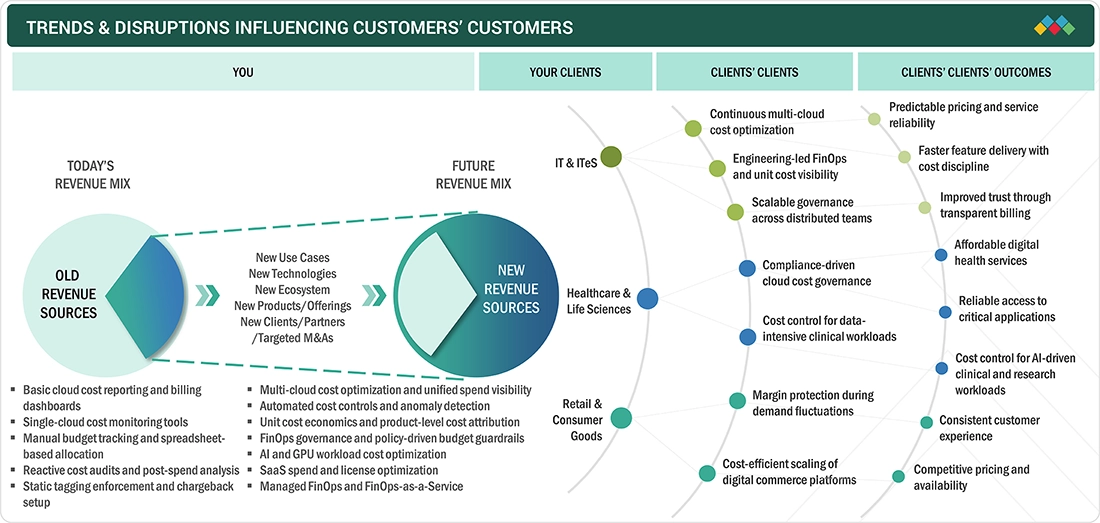

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The section highlights the critical trends and disruptions reshaping enterprise cloud strategies in the cloud FinOps market, focusing on how cost governance and financial accountability are redefining operational priorities. It examines evolving needs across IT and ITeS, healthcare and life sciences, and retail and consumer goods as organizations adopt cloud financial management platforms to manage complex consumption models, AI workloads, and multi-cloud environments. It connects these strategic priorities to measurable outcomes such as improved cost visibility, optimized cloud spend, stronger budget control, and enhanced financial governance, positioning cloud FinOps as a foundational capability for sustainable and business-aligned cloud operations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising regulatory audits compel enterprises to implement financial control mechanisms

-

Cloud FinOps enhances data visibility for accountability and optimization

Level

-

Fragmented financial data systems obstruct centralized cloud cost intelligence deployment

-

Unnecessary cloud expense (cloud waste)

Level

-

Embedding FinOps into SaaS offerings enables differentiated value propositions

-

Opportunity to maximize cloud ROI using cloud FinOps strategies

Level

-

Scaling FinOps maturity across global business units strains operating consistency

-

Effective management of relationships and negotiations with several cloud service providers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising regulatory audits compel enterprises to implement financial control mechanisms

Rising regulatory audits are driving the adoption of cloud FinOps as enterprises face higher compliance and licensing scrutiny across hybrid and multi-cloud environments. Increased audit frequency is accelerating demand for structured cost tracking, transparent usage reporting, and audit-ready financial governance embedded within cloud FinOps platforms.

Restraint: Fragmented financial data systems obstruct centralized cloud cost intelligence deployment

Fragmented financial data systems are limiting effective cloud FinOps adoption by preventing a consolidated view of cloud spend across multi-cloud and SaaS environments. Disconnected billing records, inconsistent cost structures, and siloed financial systems reduce transparency, weaken cost accountability, and delay corrective actions. As a result, enterprises struggle to track usage accurately, control overspending, and enforce financial discipline, directly constraining the impact of cloud financial management initiatives.

Opportunity: Embedding FinOps into SaaS offerings enables differentiated value propositions

Embedding FinOps capabilities into SaaS platforms creates a strong differentiation opportunity by extending cloud financial management beyond infrastructure to subscription-based applications. As enterprises increasingly manage cloud and SaaS spend under a single cost governance framework, integrated FinOps enables unified visibility, usage tracking, and cost control across the full technology stack, expanding vendor relevance and market reach.

Challenge: Scaling FinOps maturity across global business units strains operating consistency

Scaling Cloud FinOps consistently across global business units remains a key challenge as multinational organizations struggle with inconsistent tagging standards, fragmented billing structures, and uneven governance practices across regions. Variations in FinOps maturity limit unified cost visibility, weaken centralized control, and reduce confidence in enterprise-wide cloud cost data, constraining effective financial governance at scale.

CLOUD FINOPS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

OpenText optimizes cloud spend with HCMX FinOps express | 35% Cost Reduction: Achieved a USD 5 million annual savings by optimizing cloud expenses | Improved Financial Visibility: Enhanced decision-making with detailed cost insights | Better Resource Utilization: Automated governance policies ensuring optimal resource allocation |

|

Zorgspectrum optimizes cloud spending and efficiency with SoftwareOne’s FinOps | Cost Reduction: A significant 75% reduction in cloud spending through targeted cost-saving measures | Streamlined Cloud Management: Simplified cloud environment management with easier resource labeling, budget structuring, and optimization |

|

CoreStack helps Logicalis transform FinOps into new business opportunities | Expanded MSP Product Offerings: Logicalis leveraged advanced FinOps capabilities to enhance its cloud governance services and add new product offerings | Seamless Customer Onboarding: A scalable solution allowed for efficient onboarding of multi-cloud customers |

|

Adoption of Apptio helped TUI Group achieve informed cloud investment decision-making and better budget tracking | 50% reduction in cloud cost in 2020 without compromising business continuity | TUI’s Cloudability implementation enabled informed cloud investment decision-making and better budget tracking at the team level |

|

AWS offered enhanced accountability and governance across Medibank’s business units | Established a cost-aware culture through cost visibility improvement and efficient resource consumption accountability | Enabled identification of spending trends or disruptions and cost optimization opportunities | Reduced costs and improved resource utilization using automated workflows through AWS Trusted Advisor |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The cloud FinOps market ecosystem comprises interconnected stakeholders that enable cost transparency, financial governance, and optimization across cloud environments. Native cloud providers embed foundational billing, budgeting, and cost management capabilities within their platforms. Third-party FinOps solution providers deliver advanced cloud financial management, multi-cloud cost optimization, unit economics, and governance automation. Service providers, including consulting firms and system integrators, support FinOps strategy design, implementation, and ongoing operations. These participants form a cohesive ecosystem that strengthens cost accountability, operational efficiency, and business-aligned cloud consumption for enterprises.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Cloud FinOps Market, by Solution

By solution, third-party solutions play a critical role in the global cloud FinOps market by addressing gaps left by native cloud billing tools. These solutions enable multi-cloud cost visibility, granular cost allocation, automated governance, and unit economics, positioning emerging vendors to differentiate, scale adoption, and capture enterprise demand for unified cloud financial management.

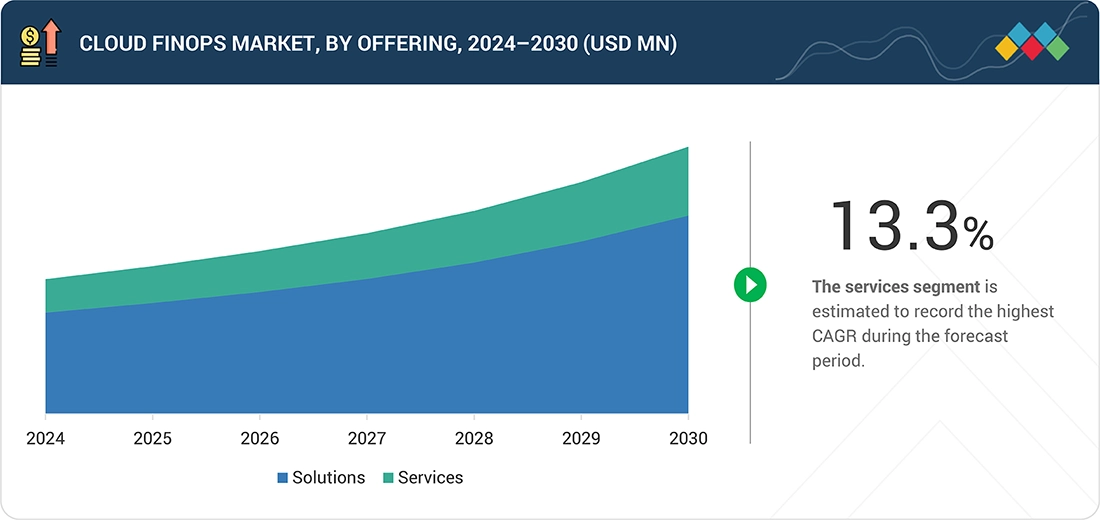

Cloud FinOps Market, by Service

By service, implementation & integration services account for the largest share of the cloud FinOps market as enterprises struggle with fragmented billing data, inconsistent tagging, and finance tool integration. Service providers accelerate operationalization by embedding FinOps into existing ERP, procurement, and cloud governance frameworks, enabling faster value realization.

Cloud FinOps Market, by Application/Capability

By application/capability, the reporting & analytics segment is estimated to grow at the fastest rate as enterprises demand normalized multi-cloud cost data, unit cost breakdowns, and finance-ready dashboards. These capabilities support chargeback accuracy, budget enforcement, and consistent FinOps governance across complex cloud environments.

Cloud FinOps Market, by Deployment Environment

By deployment environment, single-cloud plays an important role in the cloud FinOps market by allowing enterprises to establish disciplined cost visibility, standardized tagging, and budget governance within a controlled environment. This foundation simplifies financial accountability, accelerates FinOps maturity, and prepares organizations to scale cost governance across more complex multi-cloud deployments.

Cloud FinOps Market, by Deployment Mode

By deployment mode, public cloud is estimated to account for the largest market share in the cloud FinOps market, as usage-based pricing, rapid workload scaling, and expanding service portfolios intensify cost complexity. Enterprises rely on cloud FinOps to enforce spend controls, improve accountability, and maintain financial discipline at scale.

Cloud FinOps Market, by Service Model

By service model, SaaS is estimated to hold the largest market share in the global cloud FinOps market as enterprises face growing subscription sprawl, unmanaged renewals, and limited license utilization visibility. Cloud FinOps platforms increasingly extend into SaaS financial management, enabling usage-based optimization, chargeback alignment, contract oversight, and unified governance across infrastructure and application expenditure.

Cloud FinOps Market, by Organization Size

By organization size, large enterprises are expected to capture the largest market share as expansive multi-cloud footprints, high-volume consumption, and distributed cost centers increase financial complexity. These organizations require mature cloud FinOps capabilities such as unit economics, chargeback and showback, policy-driven budget controls, and audit-ready reporting to manage spend at enterprise scale.

Cloud FinOps Market, by Vertical

By vertical, healthcare & life sciences are expected to grow at the fastest rate in the global cloud FinOps market as regulatory compliance, clinical data workloads, and digital transformation initiatives increase pressure on cost governance. Providers and life sciences organizations must manage escalating spend on cloud-hosted EMR, genomics analytics, and telehealth platforms while ensuring spend transparency, audit readiness, and alignment with patient outcomes and research budgets.

REGION

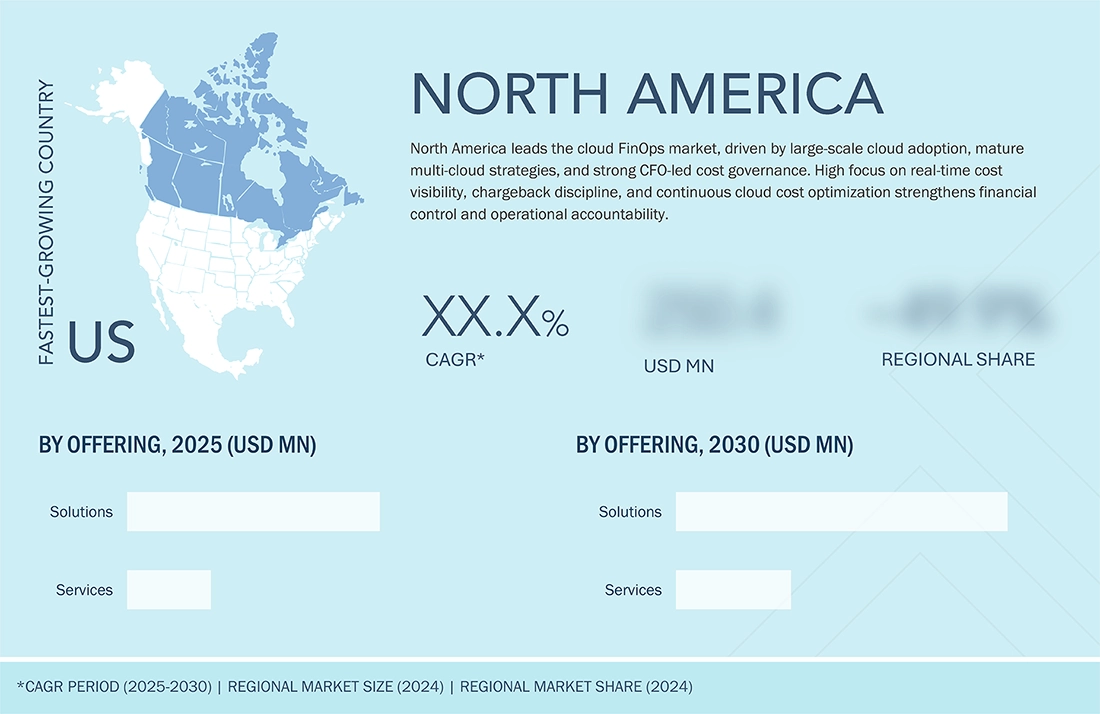

North America to be largest region in global cloud FinOps market during forecast period

North America represents the most attractive region for emerging cloud FinOps vendors and solution providers due to the concentration of cloud-intensive enterprises in the US and Canada. US organizations operate large, multi-account cloud estates with strict CFO oversight, creating sustained demand for advanced cost allocation, unit economics, and automated FinOps governance. In Canada, growing cloud adoption across the public sector, healthcare, and regulated industries is increasing the need for audit-ready reporting and standardized cost controls, opening strong expansion opportunities for differentiated FinOps platforms and services.

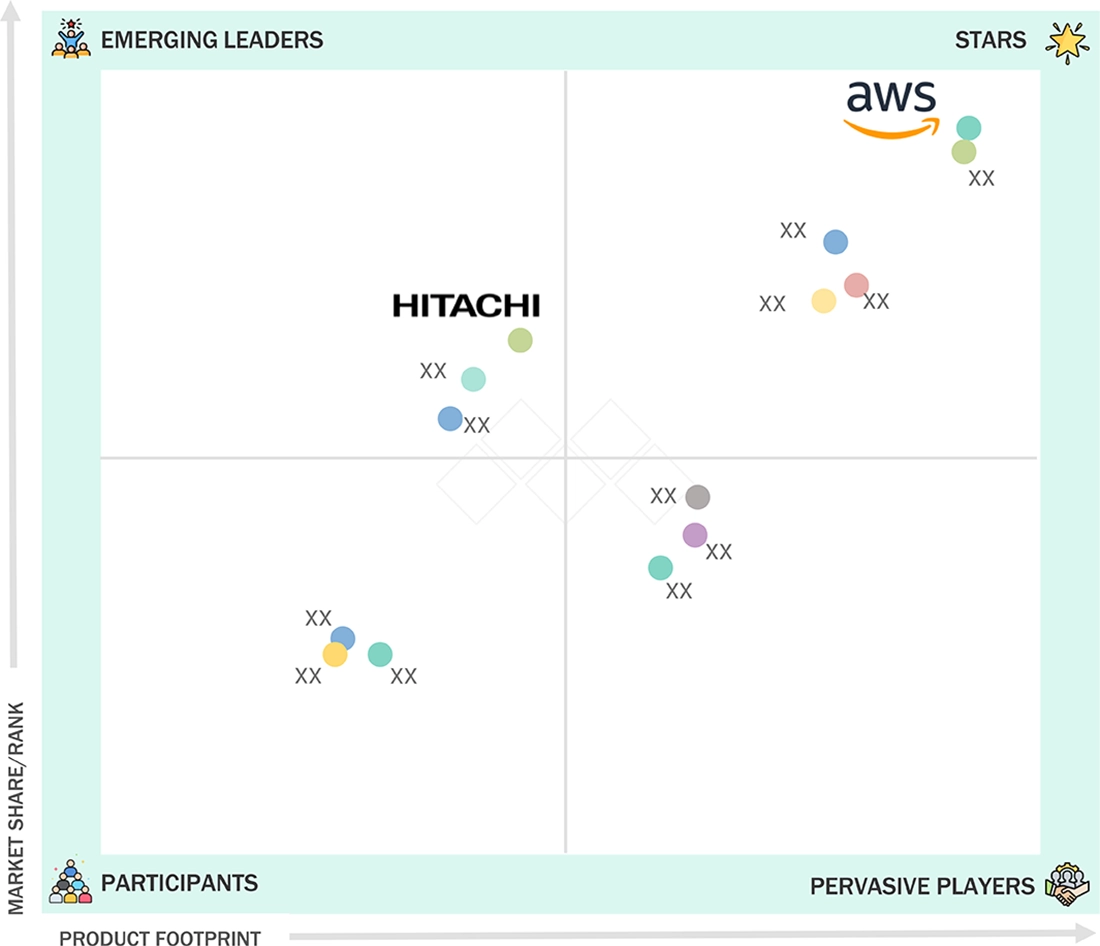

CLOUD FINOPS MARKET: COMPANY EVALUATION MATRIX

In the cloud FinOps market matrix, AWS (Star) leads through deeply integrated native cost management, granular usage data, and broad enterprise adoption across large public cloud environments. Hitachi (Emerging Leader) is progressing with governance-focused FinOps services, hybrid cloud integration, and enterprise-centric cost optimization. While AWS leads on scale and ecosystem depth, Hitachi is advancing toward the leaders’ quadrant by aligning FinOps with regulated, service-led cloud environments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- AWS (US)

- Microsoft (US)

- Google (US)

- IBM (US)

- Oracle (US)

- Hitachi (Japan)

- VMware (US)

- ServiceNow (US)

- Datadog (US)

- Flexera (US)

- Lumen Technologies (US)

- DoiT (US)

- Nutanix (US)

- Amdocs (US)

- BMC Software (US)

- HCL (India)

- Virtasant (US)

- OpenText (Canada)

- Accenture (Ireland)

- ManageEngine (US)

- SoftwareOne (US)

- CoreStack (US)

- Virtana (US)

- Cast AI (US)

- Anodot (US)

- Harness (US)

- CloudZero (US)

- PepperData (US)

- Spot (US)

- Unravel Data (US)

- KubeCost (US)

- Deloitte (UK)

- Alibaba Cloud (Chiina)

- Zesty (US)

- nOps (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 13.59 Billion |

| Market Forecast, 2030 (Value) | USD 26.91 Billion |

| Growth Rate | CAGR of 12.6% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

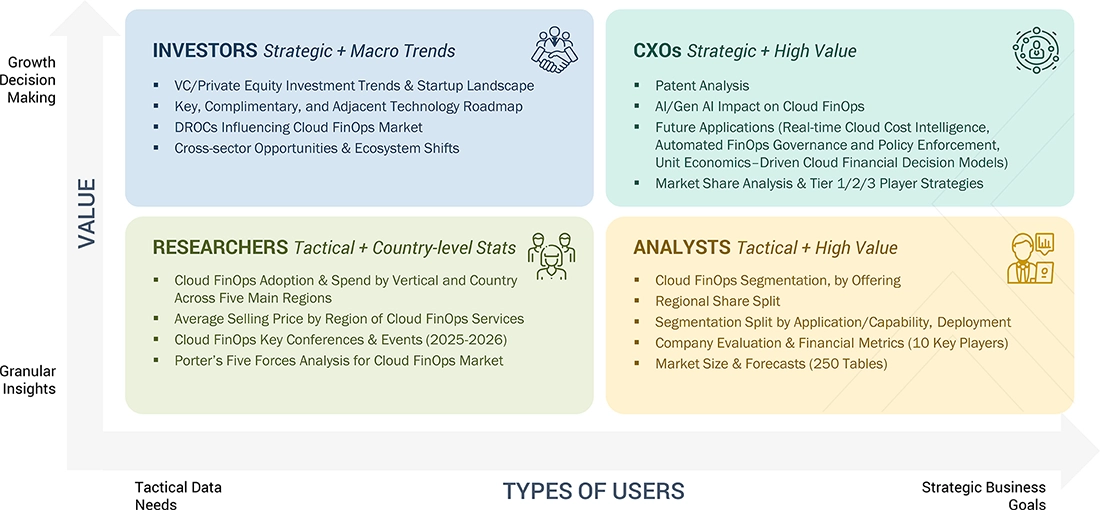

WHAT IS IN IT FOR YOU: CLOUD FINOPS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Large Enterprise with Complex Multi-Cloud Estate (US) | Regional Deployment Analysis: Assessment of cloud spend structures, billing formats, compliance needs, and FinOps maturity across US multi-cloud environments | Improves cost transparency, ensures audit readiness, and enables consistent financial governance across regions |

| Cloud-Intensive IT & ITeS Provider (Asia Pacific) | Competitive Portfolio Mapping: Comparative analysis of native and third-party Cloud FinOps platforms across cost optimization, governance automation, and reporting capabilities | Supports informed vendor selection, accelerates FinOps adoption, and strengthens cost control outcomes |

| Global Retail & Consumer Goods Enterprise (US) | Extra Vendor Profiling: Identification of specialized FinOps vendors focused on SaaS expenditure, unit economics, chargeback, and retail-scale cost optimization | Enhances spend efficiency, improves margin protection, and enables business-aligned cloud financial management |

RECENT DEVELOPMENTS

- October 2025 : Finout achieved Integrated with Oracle Cloud Expertise status and listed its Enterprise FinOps platform on Oracle Cloud Marketplace. The integration enabled OCI customers to ingest cost and usage data into Finout’s MegaBill layer for unified multicloud visibility, allocation, and governance. The collaboration expanded access to cost optimization workflows without requiring the deployment of agents or modification of existing cloud configurations.

- October 2025 : TD SYNNEX partnered with IBM to launch a Global FinOps Practice powered by IBM Cloudability, delivering end-to-end cloud financial management for partners. The initiative combined analytics, governance, and enablement services to help resellers, MSPs, and integrators optimize multicloud spending, strengthen budgeting discipline, and build scalable FinOps practices for customers.

- October 2025 : Flexera and SHI International Corp. formed a strategic alliance to deliver integrated IT asset management and FinOps services to SHI’s global customer base. The partnership embedded Flexera One into SHI’s managed services portfolio, extending unified visibility across cloud, SaaS, software, and AI environments. The collaboration aimed to enhance cost control, compliance management, and operational governance for enterprise technology estates.

- September 2025 : AWS partnered with the UK’s Department for Work and Pensions, supported by Apptio, to institutionalize FinOps practices across one of Europe’s largest public sector IT estates. The collaboration delivered cost transparency, automated optimization, and cultural change through standardized tagging, Savings Plans adoption, and Cloudability-driven analytics, enabling measurable reductions in consumption costs while improving digital service delivery and sustainability performance across government operations.

- August 2025 : Flight Centre Travel Group selected Datadog to standardize observability across its global operations with a strong focus on cloud cost control. The deployment unified monitoring, user experience tracking, and synthetic testing. At the same time, Cloud Cost Management connected spending data with operational metrics, enabling faster issue resolution, improved resilience, and tighter governance of cloud expenditure.

- June 2025 : The FinOps Foundation and the ITAM Forum announced a strategic partnership to align cloud financial management and IT asset management practices. The collaboration focuses on joint events, working groups, and shared guidance to integrate cost governance with asset visibility and transparency. The initiative supports enterprises managing SaaS, licensing, and hybrid infrastructure through coordinated operational and financial practices.

Table of Contents

Methodology

This research study on the cloud FinOps market involved extensive secondary sources, including directories, IEEE Communication-Efficient: Algorithms and Systems, and the International Journal of Innovation and Technology Management, as well as paid databases. Primary sources were mainly industry experts from core and related industries, preferred cloud FinOps providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews with primary respondents, including key industry participants and subject matter experts, were conducted to gather and verify critical qualitative and quantitative information, as well as assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, the cloud FinOps spending of various countries was extracted from the respective sources.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), and directors specializing in business development, marketing, and cloud FinOps services. It also included key executives from cloud FinOps vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

Note: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 billion and USD 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion. Other designations include sales, marketing, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the cloud FinOps market. The first approach involved estimating the market size by companies’ revenue generated through the sale of cloud FinOps products.

Market Size Estimation Methodology: Top-down Approach

The top-down approach prepared an exhaustive list of all the vendors offering products in the cloud FinOps market. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on offering, application/capability, service model, deployment, organization size, vertical, and region. The markets were triangulated through primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology: Bottom-up Approach

The bottom-up approach identified the adoption rate of cloud FinOps products across different verticals in key countries, considering the regions that contribute the most to the market share. For cross-validation, the adoption of cloud FinOps products among enterprises and other use cases for their regions was identified and extrapolated. Use cases identified in different areas were weighed for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the cloud FinOps market’s regional penetration. Based on secondary research, the regional spending on information and communications technology (ICT), socioeconomic analysis of each country, strategic vendor analysis of major cloud FinOps service providers, and organic and inorganic business development activities of regional and global players were estimated.

Data Triangulation

After determining the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. Data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The overall market size was then used in the top-down approach to estimate the size of other individual markets by applying percentage splits to the market segmentation.

Market Definition

Considering the views of various sources and associations, MarketsandMarkets defines Cloud FinOps as “a set of practices and tools designed to manage, optimize, and govern financial expenditures in cloud computing environments. It involves a combination of financial management, cost optimization, and operational practices to maximize the business value of cloud spending. Cloud FinOps aims to provide organizations with visibility, accountability, and control over their cloud costs, enabling them to optimize cloud resource usage, manage budgets, and implement cost-saving strategies effectively.”

According to the FinOps Foundation, “FinOps is an operational framework and cultural practice which maximizes the business value of cloud, enables timely data-driven decision making, and creates financial accountability through collaboration between engineering, finance, and business teams.

According to Microsoft, “FinOps is a discipline that combines financial management principles with cloud engineering and operations to provide organizations with a better understanding of their cloud spending. It also helps them make informed decisions on how to allocate and manage their cloud costs

Key Stakeholders

- Cloud FinOps solution providers

- Cloud financial analysts

- Cloud engineers

- Cloud architects

- Cloud operations teams

- Chief financial officers (CFOs)

- IT procurement managers

- Cloud service providers (CSPs)

- Finance and accounting teams

- Compliance and governance teams

Report Objectives

- To define, describe, and forecast the cloud FinOps market based on offering (solutions [native solutions, third party solutions], services [managed cloud FinOps services, professional services {FinOps advisory & strategy services, implementation & integration services, support & maintenance}]), application/capability (cost management & optimization, budgeting & forecasting, cost allocation & chargeback, reporting & analytics, workload optimization & management, other applications), deployment (deployment environment [single cloud, multi-cloud], deployment mode [public, private, hybrid]), service model (IaaS, PaaS, SaaS), organization size (large enterprises, SMEs), and vertical (IT & ITeS, BFSI, retail & consumer goods, healthcare & life sciences, media & entertainment, manufacturing, telecommunications, government & public sector, other verticals [energy & utilities, education])

- To forecast the market size of five major regional segments: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micro markets with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To analyze the impact of AI/generative AI on the market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product launches, and partnerships & collaborations, in the market

Available Customization

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information:

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic analysis based on feasibility

- Further breakup of the North American cloud FinOps market

- Further breakup of the European cloud FinOps market

- Further breakup of the Asia Pacific cloud FinOps market

- Further breakup of the Middle East & Africa cloud FinOps market

- Further breakup of the Latin American cloud FinOps market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Cloud FinOps Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Cloud FinOps Market