This research elucidates the approach used to compile this report on Cleanroom Lighting market. The study employs two fundamental information sources, secondary and primary sources, which collectively provide a comprehensive, technical, and commercial analysis of Cleanroom Lighting market. Secondary sources encompass data derived from sources like company websites, publications, industry associations, and databases such as OneSource, Factiva, and Bloomberg. Additionally, primary sources were tapped, including insights from key opinion leaders spanning various sectors, experts from governmental entities and associations, preferred suppliers, cleanroom lighting manufacturers, distributors, technology experts, subject matter specialists (SMEs), C-level executives of prominent firms, and industry consultants. These interviews were instrumental in acquiring, validating, and comprehending crucial information and in gauging the future prospects and trends within the Cleanroom Lighting market. Key market players were identified through secondary research, and their market positioning was assessed via a combination of primary and secondary research methods. Furthermore, this research integrated an examination of the annual reports of market participants to pinpoint the leading players in the Cleanroom Lighting market.

Secondary Research

In the secondary research phase, we referred to a variety of secondary sources to identify and collect pertinent information for this Cleanroom Lighting market study. These secondary sources encompassed materials such as companies' annual reports, press releases, and investor presentations, as well as white papers, accredited publications, and articles authored by recognized experts. We also consulted directories and databases. The global size of the Cleanroom Lighting market was determined through secondary data obtained from both paid and freely available sources. This involved evaluating the product portfolios of leading companies and assessing the quality of their offerings. The secondary research process was instrumental in gathering essential data related to the industry's supply chain, the financial aspects of the market, the total count of major market players, and the segmentation of the market in alignment with industry trends down to the most granular level, including geographic markets. Furthermore, this phase allowed for the identification and examination of industry trends and significant developments from both market and technology perspectives.

Primary Research

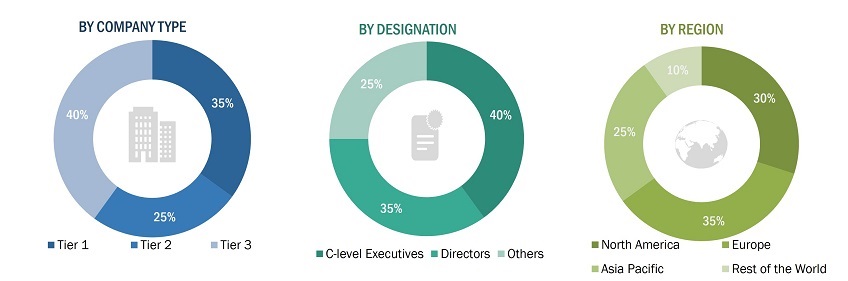

In the primary research phase, we conducted interviews with a range of primary sources to acquire both qualitative and quantitative data concerning the market in four primary regions: Asia Pacific, North America, Europe, and the Rest of the World (Middle East, Africa, and South America). On the supply side, primary sources included industry experts occupying various roles, such as CEOs, vice presidents, marketing directors, technology directors, and other key executives from major companies and organizations operating within the Cleanroom Lighting market or closely related sectors. This primary research was instrumental in gathering, verifying, and validating critical data that had been sourced from other channels following the market engineering phase.

Primary research also served to identify various market segments, industry trends, key players, the competitive landscape, and the pivotal market dynamics, encompassing factors such as drivers, constraints, opportunities, and challenges, as well as the key strategies adopted by market players. The majority of the primary interviews focused on engaging with the supply side of the market, and the collection of this primary data was carried out through questionnaires, email correspondence, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

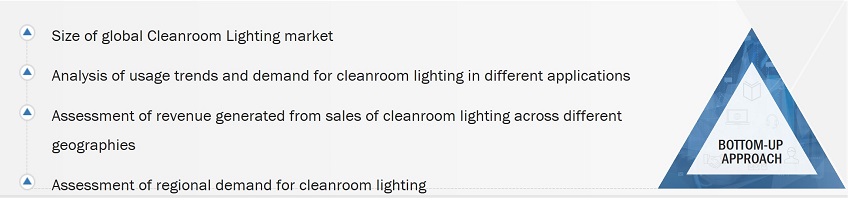

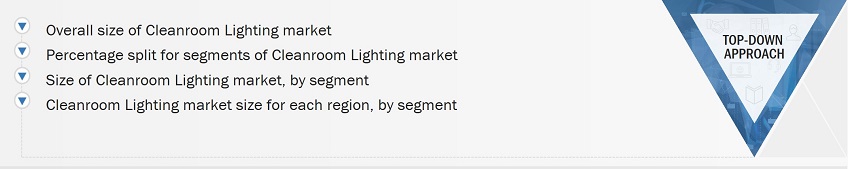

Both the top-down and bottom-up approaches were used extensively in the market engineering process. This entire research methodology includes the study of annual and financial reports of top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative). The key players in the cleanroom lighting market have been identified through secondary research, and their market share in the respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. Several data triangulation methods were also used to perform market forecasting and market estimation for the overall market segments and sub-segments in the report. Multiple qualitative and quantitative analyses were performed on the market engineering process to gain key insights throughout the report. All the possible parameters that affect the markets covered in this research have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figures depict the overall market size estimation process employed for the purpose of this study.

The revenues were identified geographically as well as market segment-wise, using financial statements and analyzing annual reports of the key market players. Interviews with CEOs, VPs, directors, and marketing executives were also conducted to gain insights on the key players and the cleanroom lighting market. All the market shares were estimated using secondary and primary research. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

Global Cleanroom Lighting Market Size: Bottom-Up Approach

Global Cleanroom Lighting Market Size: Top-down Approach

Data Triangulation

Following the determination of the comprehensive market size through the previously described market size estimation process, the entire market was subsequently divided into multiple segments and sub-segments. To accomplish this and attain precise statistical data for all segments and sub-segments, the market engineering process employed a data triangulation method. This triangulation involved a thorough examination of diverse factors and trends originating from both the demand and supply aspects of the market. In addition to this, the market's accuracy and reliability were substantiated through a combination of both top-down and bottom-up approaches.

Market Definition

The cleanroom lighting market refers to the industry involved in the design, manufacturing, and distribution of specialized lighting solutions tailored for cleanroom environments. Cleanrooms are controlled spaces where the concentration of airborne particles, temperature, humidity, and other environmental factors are regulated to meet specific cleanliness standards. Cleanroom lighting plays a critical role in these environments by providing illumination while minimizing the risk of particle contamination. These lighting solutions are designed to comply with strict industry standards and regulations governing cleanliness, safety, and performance in sectors such as pharmaceuticals, biotechnology, semiconductor manufacturing, healthcare, and other industries where maintaining a controlled and sterile environment is crucial.

Stakeholders

-

Cleanroom product manufacturers

-

Cleanroom construction companies

-

Biotechnology companies

-

Medical device manufacturers

-

Pharmaceuticals manufacturers

-

Hospitals, research laboratories, and clinical laboratories

-

Solution integrators

-

Technology providers

-

Research organizations and consulting companies

-

Associations, organizations, forums, and alliances related to cleanroom lighting

-

Government bodies such as regulatory authorities and policymakers

-

Venture capitalists, private equity firms, and startups

Study Objectives

-

To estimate, segment, and forecast the overall size of the Cleanroom Lighting market, by mounting type, offering, light source, and region, in terms of value.

-

To forecast the market size, in terms of value, for Cleanroom Lighting market with regard to four main regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

-

To describe and forecast the cleanroom lighting market, in terms of volume, by light source

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To analyze the value chain of Cleanroom Lighting market

-

To strategically analyze macro and micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

-

To analyze industry trends, pricing data, patents and innovations, and trade data (export and import data) in the Cleanroom Lighting market

-

To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape

-

To study technology analysis, key buying criteria, and key conferences (2024 -2025)

-

To strategically profile the key players and comprehensively analyze their market position in terms of their ranking and core competencies2, and to provide detailed information about the competitive landscape of the market

-

To analyze the annual revenues generated by key players in Cleanroom Lighting market

-

To analyze growth strategies such as product developments, agreements, expansion, and mergers and acquisitions in the cleanroom lighting market

-

To analyze competitive developments, such as product launches & developments, collaborations, contracts, partnerships, acquisitions, and expansions, in the Cleanroom Lighting market

-

To analyze the overall, as well as regional impact of the recession on the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the specific requirements of companies. The following customization options are available for the report:

Company Information

-

Market size based on different subsegments of the Cleanroom Lighting Market

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Cleanroom Lighting Market