Centrifugal Pump Market

Centrifugal Pump Market by Type (Overhung Impeller, Between Bearing, Vertical Suspended), Operation Type (Electric, Hydraulic, Air-driven), Stage (Single Stage, Multistage), End User (Industrial, Commercial & Residential), and Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The centrifugal pump market is projected to reach USD 58.94 billion by 2030 from USD 41.33 billion in 2024, at a CAGR of 6.4% from 2025 to 2030. The demand for centrifugal pumps is rising due to expanding industrialization, infrastructure development, and urbanization worldwide. Growth in water and wastewater treatment projects, power generation, oil & gas, chemicals, and food processing is increasing the need for reliable fluid-handling systems. Rapid construction of residential and commercial buildings is also driving demand for HVAC and water supply pumps. Additionally, the shift toward energy-efficient and electrically driven pumping systems, supported by government efficiency standards and sustainability initiatives, is boosting replacement and upgrade cycles. Rising investments in agriculture irrigation and desalination projects further strengthen centrifugal pump adoption.

KEY TAKEAWAYS

-

BY END USERThe industrial segment is expected to dominate the market.

-

BY TYPEThe overhung impeller segment is expected to register the highest CAGR of 6.6%.

-

BY OPERATION TYPEThe electrical segment is expected to dominate the market.

-

BY STAGEThe single stage segment is the fastest-growing at a CAGR of 6.6%.

-

BY REGIONThe Asia Pacific region for the merging unit market accounted for 43.6% in 2024.

-

COMPETITIVE LANDSCAPEXyle, Grundfos Pumps Pty. Ltd., and Flowserve Corporation were identified as star players in the centrifugal pump market as they have focused on product launches and investments to strengthen their product portfolio in the market.

-

COMPETITIVE LANDSCAPECeleros Flow Technology, Grindex, and Mackwell Pumps were identified as SMEs in the centrifugal pump market.

Global demand for centrifugal pumps is driven by industrial expansion, urbanization, and large-scale infrastructure development. Growing investments in water and wastewater treatment, power generation, oil and gas, chemicals, and agricultural irrigation increase pump usage. Rising construction activity boosts demand for HVAC and building services pumps. Additionally, stricter energy-efficiency regulations and the shift toward electrified, low-emission systems are accelerating pump upgrades and replacements worldwide.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The centrifugal pump market is projected to grow at a CAGR of 6.4% during the forecast period by value. Key trends in the centrifugal pump market include increasing adoption of energy-efficient and smart pumps with IoT monitoring, emphasis on sustainable and low-emission operations, and digitalization in maintenance and performance optimization. Demand for corrosion-resistant materials is rising, while growth in water treatment, oil & gas, and industrial sectors fuels market expansion. Replacement of old pumps and customization for specific applications are also notable trends.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing exploration activities and industrial processes

-

Rising demand from agriculture sector

Level

-

Cavitation effect and dry-run failures in centrifugal pumps

-

Lack of technical skills, funding, and infrastructure to manage, operate, and maintain centrifugal pump systems

Level

-

Increased adoption of solar water pumps

-

Government-driven investment in advanced pumping and pipeline infrastructure

Level

-

High competition from unorganized sector

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing exploration activities and industrial processes

Centrifugal pumps find applications within a wide performance range in the oil & gas industry, from exploration through processing and up to transportation to the consumer, encompassing the entire value chain of the industry. Centrifugal pumps are primarily used for fluid transfer in this industry. Global oil markets continue to show increasing activity in production, supply, and industrial operations, according to the International Energy Agency’s oil market information. The continued demand of roughly 930,000 barrels per day in 2026, driven mainly by non-OECD economies and recovering petrochemical feedstock needs. At the same time, global oil supply is expanding, with output increases from OPEC+ and non-OPEC producers, even as inventories remain elevated, reflecting robust upstream and midstream activity worldwide.

Restraint: Cavitation effect and dry-run failures in centrifugal pumps

Cavitation remains a significant operational restraint for centrifugal pumps because it directly harms pump performance and longevity. According to the technical explanation on Crompton’s official pumps guide, cavitation occurs when the pressure within a centrifugal pump falls below the vapor pressure of the liquid being pumped, causing vapor bubbles to form and then implode as they move into higher-pressure regions of the pump. These implosions generate shockwaves that lead to erosion, pitting of impellers and casings, vibration, noise, reduced flow rates, and overall declines in hydraulic performance, often necessitating costly repairs and increasing operating expenses. Proper system design particularly ensuring adequate Net Positive Suction Head Available (NPSHa) relative to the pump’s requirements is critical to preventing cavitation and protecting pump efficiency. Regular maintenance and correct pump selection are also essential measures to mitigate this persistent technical challenge in centrifugal pump operation.

Opportunity: Increased adoption of solar water pumps

Solar water pump systems where electricity for an electric motor and centrifugal pump is supplied by one or more photovoltaic (PV) panels are increasingly recognized by governmental and inter-governmental bodies as an effective solution for sustainable water access in agriculture and rural water supply. These systems provide water lifting in remote areas that lack reliable grid electricity and help reduce dependence on fossil fuels, aligning with global water and energy goals. However, government deployment programs and policy discussions reflect rapid growth in solar irrigation solutions worldwide. For example, according to the World Bank Group in 2024, in South Asia and Sub-Saharan Africa, solar-powered groundwater irrigation has expanded significantly, with over 500,000 small, standalone solar pumps installed in the last decade, especially in countries like India and Bangladesh, supporting food security and rural livelihoods through renewable energy use.

Challenge: High competition from unorganized sector

The increasing competition from the unorganized sector poses notable challenges to the centrifugal pump market, especially in price-sensitive and agriculture-focused regions. Government-published surveys and official studies on the informal manufacturing landscape show that unorganized enterprises form a large share of small manufacturing and non-agricultural activities in India, contributing significantly to overall output and employment in a wide range of sectors. In the specific case of pump sets (which include centrifugal pumps widely used in irrigation and water supply), unorganized producers supply lower-priced pumps that undercut organized manufacturers, often at 30–40 % lower price points, drawing cost-conscious buyers away from higher-quality, certified products. This pricing advantage is strengthened by the presence of small producers in hubs, making it difficult for larger, formal sector companies to compete effectively on both price and distribution reach.

CENTRIFUGAL PUMP MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

It deploys centrifugal pumps extensively in municipal water supply and wastewater treatment plants to handle large volumes of water efficiently and reliably, supporting continuous urban water management operations. | High energy efficiency, reduced lifecycle costs, reliable continuous operation, and compliance with sustainability and efficiency regulations. |

|

It uses centrifugal pumps in oil & gas, chemicals, and power generation for handling corrosive, high-temperature, and high-pressure fluids in critical process applications. | Enhanced process reliability, safe handling of complex fluids, reduced downtime, and improved operational safety in demanding industrial environments. |

|

It supplies centrifugal pumps for power plants, desalination facilities, and industrial cooling systems, enabling large-scale fluid circulation and thermal management. | Improved thermal efficiency, robust performance under heavy-duty conditions, long service life, and optimized system efficiency. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The market map provides a quick snapshot of the key stakeholders involved in the centrifugal pump market, from component providers and end users to regulatory bodies/standards organizations. This list is not exhaustive and is meant to give an idea of the key market players.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Centrifugal Pump Market, By Type

The type segment includes overhung impeller, between bearing, and vertically suspended. Overhung impeller is the largest segment. Overhung impeller centrifugal pumps are growing rapidly due to their compact design, lower manufacturing cost, and ease of maintenance. They are widely used across water supply, HVAC, chemicals, oil & gas, and general industrial applications. Their ability to handle moderate pressures and flows efficiently makes them ideal for standardized, high-volume installations, driving strong adoption across both new projects and replacement demand.

Centrifugal Pump Market, By Operation Type

The operation type segment includes electrical, hydraulic, and air-driven. The electrical operation segment is growing the fastest due to global electrification trends, stricter emissions regulations, and the push for energy-efficient systems. Electrically driven centrifugal pumps offer precise control, lower operating costs, and easy integration with variable frequency drives. Expanding industrial automation, renewable energy integration, and government-led efficiency initiatives are accelerating the shift away from diesel-driven pumping systems.

Centrifugal Pump Market, By Stage

The stage segment includes single stage and multistage. Single-stage centrifugal pumps are the fastest-growing segment because they offer simple construction, high reliability, and cost-effective operation for low- to medium-head applications. Their widespread use in water and wastewater treatment, agriculture irrigation, building services, and industrial processes supports strong demand. Easy installation, lower maintenance needs, and energy-efficient operation further accelerate adoption across expanding infrastructure projects.

Centrifugal Pump Market, by End user

The end user includes industrial and commercial & rseidential. . The industrial end-user segment is growing fastest due to expanding water and wastewater, power generation, chemicals, oil & gas, and food processing activities worldwide. Rising demand for process efficiency, cooling, fluid transfer, and wastewater handling drives centrifugal pump adoption. Additionally, industrial upgrades, capacity expansions, and stricter environmental and safety regulations are increasing investments in reliable, high-performance pumping systems.

REGION

Asia Pacific to be fastest-growing region in global centrifugal pump market during forecast period

Asia Pacific is the fastest-growing region for centrifugal pumps due to rapid industrialization, urbanization, and large-scale infrastructure development across China, India, and Southeast Asia. Rising investments in water and wastewater treatment, power generation, chemicals, oil and gas, and manufacturing are driving strong pump demand. Expanding residential and commercial construction is boosting requirements for water supply and HVAC systems. Additionally, government-led initiatives supporting industrial growth, energy efficiency, irrigation, and urban infrastructure modernization are accelerating centrifugal pump installations across the region.

CENTRIFUGAL PUMP MARKET: COMPANY EVALUATION MATRIX

In the centrifugal pump market matrix, Xylem (Star) leads with a strong market presence and a wide product portfolio, driving large-scale adoption across industries like industrial and commercial. ALFA LAVAL (Emerging Leader) is gaining traction with high-efficiency centrifugal pumps. While Xylem dominates with scale, Grundfos shows strong growth potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 41.33 BN |

| Market Forecast in 2030 (Value) | USD 58.94 BN |

| Growth Rate | CAGR 6.4% during 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: CENTRIFUGAL PUMP MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Centrifugal Pump Manufacturer | Forecast of Centrifugal Pump by 2030 | Uncover long-term revenue streams in centrifugal pumps |

RECENT DEVELOPMENTS

- August 2023 : Grundfos launched its advanced end-suction pump range, notably including the NKE series with integrated Variable Frequency Drive (VFD) technology, in Australia, boosting energy efficiency and connectivity for industrial and municipal water applications.

- July 2025 : Grundfos opened a new manufacturing facility at Dantali in Gujarat, India, through its subsidiary Grundfos Pumps India Pvt Ltd. The plant focuses on producing stainless steel products, booster sets, and boxed pump solutions for customers in western and northern India and also serves as an export base for components to Europe, the Americas, and China.

- November 2023 : Launched e-80SCXL vertical in-line centrifugal pump series for high-flow/head applications in hydronic heating, cooling, and light industrial processes, featuring multiple seal options, NEMA Premium motors, and optimized condition monitoring.

- March 2025 : Flowserve Corporation launched INNOMAG TB-MAG Dual Drive, the world's first sealless magnetic drive centrifugal pump with true secondary containment for hazardous chemicals, enhancing safety and leak prevention.

- October 2025 : KSB GIW Inc., a US subsidiary of the KSB Group, specializes in manufacturing mining pumps. In early October, the company launched its LCC Gen2 pump in the market, designed specifically for medium-abrasion slurry applications.

Table of Contents

Methodology

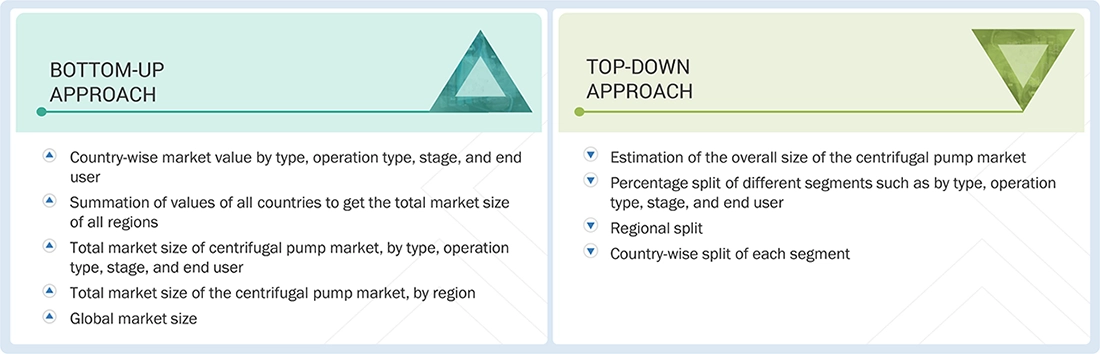

The study involved major activities in estimating the current size of the centrifugal pump market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the centrifugal pump market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect valuable information for a technical, market-oriented, and commercial study of the global centrifugal pump market. The other secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The centrifugal pump market comprises stakeholders such as centrifugal pump manufacturers, technology providers, and support providers in the supply chain. On the demand side, the market is driven by growing adoption of centrifugal pumps in industrial, commercial, and residential sectors, due to their high energy efficiency, compact design, and superior performance compared to conventional pump control systems. Rising infrastructure development and urbanization in emerging economies further fuel demand for advanced pump solutions. On the supply side, manufacturers are witnessing increasing opportunities through contracts from utility and industrial distribution networks, as well as strategic initiatives such as mergers, acquisitions, and partnerships among major players to expand their market presence and technological capabilities. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of primary respondents:

Note: “Others” include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3: USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were employed to estimate and validate the size of the centrifugal pump market, as well as its dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through a combination of primary and secondary research. The research methodology involves analyzing the annual and financial reports of top market players and conducting interviews with industry experts, including chief executive officers, vice presidents, directors, sales managers, and marketing executives, to gather key quantitative and qualitative insights related to the centrifugal pump market.

Centrifugal Pump Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size through the estimation process explained above, the total market has been divided into several segments and subsegments. To complete the overall market engineering process and obtain the exact statistics for all segments and subsegments, data triangulation and market breakdown processes have been employed, where applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market has been validated using both top-down and bottom-up approaches.

Market Definition

Centrifugal pumps are mechanical devices used to transport fluids by converting mechanical energy from an external source (e.g., an electric motor) into kinetic energy in the fluid being pumped. They work by using a rotating impeller to create a centrifugal force that moves the fluid through the pump and into the discharge pipe. It consists of three main components: an impeller, a casing, and a shaft. The impeller is a rotating component that contains blades or vanes that move the fluid. The casing is a stationary component that surrounds the impeller and guides the fluid to the discharge point. The shaft connects the impeller to the motor that rotates it. When the impeller rotates, it creates a centrifugal force that moves the fluid from the center of the impeller to the outer edge. As the fluid moves through the casing, it gains momentum and pressure. Finally, it is discharged from the pump through the discharge port.

Key Stakeholders

- Centrifugal pump manufacturers

- Pump manufacturer associations

- Oilfield service players

- Public and private water supply and pumping station operators

- Government and research organizations

- Centrifugal pump raw material providers

- Consulting companies

- Industrial users

Report Objectives

- To describe and forecast the centrifugal pump market, by type, operation type, stage, end user, and region in terms of value

- To describe and forecast the centrifugal pump market for various segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, in terms of value

- To describe and forecast the centrifugal pump market, by region, in terms of volume

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the centrifugal pump chain analysis, use case analysis, key stakeholders and buying criteria, patent analysis, trade analysis, tariff analysis, regulations, macroeconomic outlook, pricing analysis, Porter’s five forces analysis, impact of gen AI/AI, and the 2024 US tariff impact

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the market’s competitive landscape

- To analyze growth strategies, such as acquisitions, investments, expansions, and product launches, adopted by market players in the centrifugal pump market

Micromarkets are defined as the segments and subsegments of the centrifugal pump market included in the report.

2 Core competencies of companies are defined in terms of key developments and strategies adopted to sustain their positions in the centrifugal pump market.

Customization Options

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakdown of the centrifugal pump, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Centrifugal Pump Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Centrifugal Pump Market

Mokoena

Jul, 2022

Centrifugal Pumps market report was published in March 2021, it covers the market trends and growth factors with respect to Centrifugal Pump Market. It also covered the Market estimations of Centrifugal Pump in terms of Value (USD Million) by Type/ Operation/ Stage/ End User at regional and country level for the period 2019-2026. The report also covers the detail competitive landscape with key players Market Share Analysis, Developments of Key Market Players Like There Contracts & Agreements, Investments & Expansions, Joint Venture, Partnerships, And Collaborations and their Business Overview, Products/solutions/services Offered, Recent Developments, SWOT Analysis. .

Lisa

Jun, 2022

Interested in finding out the available customizations by company information of centrifugal pump market for the next five year..