4

MARKET OVERVIEW

5G and IoT surge drive demand amid challenges in high-speed data and cost pressures.

46

4.2.1.1

RAPID EXPANSION OF 5G NETWORKS AND ESCALATED DEMAND FOR HIGH-SPEED DATA COMMUNICATION

4.2.1.2

SIGNIFICANT DEMAND FOR INDUSTRIAL AUTOMATION AND ROBOTICS

4.2.1.3

ELEVATED ADOPTION OF IOT DEVICES

4.2.2.1

TECHNOLOGICAL COMPLEXITIES IN DEVELOPING APPLICATION-SPECIFIC CONNECTORS

4.2.2.2

HIGH COST OF ENVIRONMENTAL COMPLIANCE

4.2.3.1

RISING ADOPTION OF ELECTRIC VEHICLES

4.2.3.2

INCREASING DEMAND FOR RUGGED, DURABLE, AND FIELD-RELIABLE ELECTRONICS AND HEAVY-DUTY MACHINERY

4.2.4.1

SIGNAL INTEGRITY AND HIGH-SPEED DATA TRANSMISSION CHALLENGES

4.2.4.2

COST OPTIMIZATION AND PRICING PRESSURE

4.3

INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

4.4

STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5

INDUSTRY TRENDS

Uncover competitive dynamics and pricing shifts shaping the future of board-to-board connectors.

54

5.1

PORTER’S FIVE FORCES ANALYSIS

5.1.1

INTENSITY OF COMPETITIVE RIVALRY

5.1.2

BARGAINING POWER OF SUPPLIERS

5.1.3

BARGAINING POWER OF BUYERS

5.1.4

THREAT OF SUBSTITUTES

5.1.5

THREAT OF NEW ENTRANTS

5.2

MACROECONOMICS OUTLOOK

5.2.2

GDP TRENDS AND FORECAST

5.2.3

TRENDS IN GLOBAL CONSUMER ELECTRONICS INDUSTRY

5.2.4

TRENDS IN AUTOMOTIVE INDUSTRY

5.5.1

PRICING RANGE OF BOARD-TO-BOARD CONNECTORS OFFERED BY KEY PLAYERS, BY PITCH, 2024

5.5.2

AVERAGE SELLING PRICE TREND OF BOARD-TO-BOARD CONNECTORS, BY PITCH, 2020–2024

5.5.3

AVERAGE SELLING PRICE TREND OF BOARD-TO-BOARD CONNECTORS, BY REGION, 2020–2024

5.6.1

IMPORT SCENARIO (HS CODE 8536)

5.6.2

EXPORT SCENARIO (HS CODE 8536)

5.7

KEY CONFERENCES AND EVENTS, 2026–2027

5.9

TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.10

INVESTMENT AND FUNDING SCENARIO

5.11.1

AUTOMOBILE MANUFACTURER ACHIEVES RELIABLE HIGH-SPEED COMMUNICATION BETWEEN ECUS USING BOARD-TO-BOARD CONNECTORS FROM JAE

5.11.2

GCT DELIVERS GROUND-FIRST CONNECTOR SOLUTION FOR ENHANCED SYSTEM PROTECTION

5.11.3

GCT DEVELOPS CUSTOMIZED PIN HEADER INSULATOR TO IMPROVE PCB ASSEMBLY ACCURACY

5.12

IMPACT OF 2025 US TARIFF ON BOARD-TO-BOARD CONNECTOR MARKET

5.12.3

PRICE IMPACT ANALYSIS

5.12.4

IMPACT ON COUNTRIES/REGIONS

5.12.5

IMPACT ON END USERS

6

TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, AND INNOVATIONS

AI-driven innovations redefine board-to-board connectors with intelligent, sustainable, and ultra-miniature systems.

76

6.1

KEY EMERGING TECHNOLOGIES

6.1.1

HIGH-SPEED DATA TRANSMISSION

6.1.2

SURFACE-MOUNT TECHNOLOGY

6.2

COMPLEMENTARY TECHNOLOGIES

6.2.1

CONNECTOR LOCKING AND LATCHING MECHANISM

6.2.2

ELECTROMAGNETIC INTERFERENCE/RADIO FREQUENCY INTERFERENCE SHIELDING AND FILTERING

6.3

ADJACENT TECHNOLOGIES

6.3.1

POWER DELIVERY AND MANAGEMENT

6.4

TECHNOLOGY/PRODUCT ROADMAP

6.4.1

MID-TERM EVOLUTION (2027-2030): HIGH-SPEED & HYBRID ARCHITECTURES

6.4.2

LONG-TERM OUTLOOK (2025-2035+): INTELLIGENT, ULTRA-MINIATURE & SUSTAINABLE SYSTEMS

6.6

IMPACT OF AI ON BOARD-TO-BOARD CONNECTOR MARKET

6.6.1

TOP USE CASES AND MARKET POTENTIAL

6.6.2

BEST PRACTICES FOLLOWED BY COMPANIES IN BOARD-TO-BOARD CONNECTOR MARKET

6.6.3

CASE STUDIES RELATED TO AI IMPLEMENTATION IN BOARD-TO-BOARD CONNECTOR MARKET

6.6.4

INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

6.6.5

CLIENTS’ READINESS TO ADOPT AI IN BOARD-TO-BOARD CONNECTOR MANUFACTURING

7

REGULATORY LANDSCAPE

Navigate complex global regulations with insights into key regional compliance and industry standards.

83

7.1

REGIONAL REGULATIONS AND COMPLIANCE

7.1.1

REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

8

CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

Uncover decision influencers, unmet needs, and adoption hurdles shaping buyer behavior.

87

8.1

DECISION-MAKING PROCESS

8.2

KEY STAKEHOLDERS AND BUYING CRITERIA

8.2.1

KEY STAKEHOLDERS IN BUYING PROCESS

8.3

ADOPTION BARRIERS AND INTERNAL CHALLENGES

8.4

UNMET NEEDS OF VARIOUS END USERS

9

INNOVATION TRENDS IN BOARD-TO-BOARD TO CONNECTORS

Explore hybrid connectors' AI integration and miniaturization driving next-gen board-to-board solutions.

92

9.2

SHIFT TO HYBRID CONNECTORS

9.3

INTEGRATION WITH AI AND EDGE COMPUTING HARDWARE

9.4

DEVELOPMENT OF EMI-SHIELDED AND HIGH-SPEED CONNECTOR SOLUTIONS

9.5

MINIATURIZATION AND DEMAND FOR FINE-PITCH CONNECTORS

9.6

ADVANCEMENTS IN AUTOMATED TESTING AND INSPECTION DURING MANUFACTURING

10

BOARD-TO-BOARD CONNECTOR MARKET, BY TYPE

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 12 Data Tables

94

10.2.1.1

STRONG FOCUS ON DESIGNING COMPACT AND HIGH-DENSITY DEVICES TO SPIKE DEMAND

10.2.2.1

PRESSING NEED FOR SECURE, ROBUST, AND ERROR-PROOF CONNECTIONS BETWEEN BOARDS AND CABLES TO FOSTER SEGMENTAL GROWTH

10.3.1

INCREASING DEMAND FOR MULTI-BOARD ARCHITECTURES TO CREATE OPPORTUNITIES

11

BOARD-TO-BOARD CONNECTOR MARKET, BY CONNECTOR TYPE

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

101

11.2

MEZZANINE CONNECTORS

11.2.1

INCREASING DEMAND FOR COMPACT CONSUMER ELECTRONICS TO FUEL SEGMENTAL GROWTH

11.3

BACKPLANE CONNECTORS

11.3.1

SURGING NEED FOR FASTER DATA TRANSMISSION TO STIMULATE SEGMENTAL GROWTH

11.4

OTHER CONNECTOR TYPES

12

BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million and Units | 36 Data Tables

105

12.2.1.1

RISING DEMAND FOR ULTRA-COMPACT ELECTRONICS TO SUPPORT SEGMENTAL GROWTH

12.2.2.1

ONGOING REQUIREMENT FOR ULTRA-FINE PITCH CONNECTORS, MAINTAINING SIGNAL INTEGRITY AND MECHANICAL STABILITY TO DRIVE MARKET

12.2.3

OTHER FINE PITCH CATEGORIES

12.3.1.1

SHRINKING SIZE OF ELECTRONIC DEVICES TO CREATE GROWTH OPPORTUNITIES

12.3.2.1

GROWING DEMAND FOR HIGH MECHANICAL RELIABILITY IN HARSH ENVIRONMENTS TO SUPPORT SEGMENTAL GROWTH

12.3.3.1

EXCELLENCE IN BALANCING HIGH CURRENT CAPACITY WITH EFFICIENT SPACE UTILIZATION TO FACILITATE MARKET GROWTH

12.3.4.1

WIDE USE IN INDUSTRIAL, TRANSPORTATION, AND AEROSPACE APPLICATIONS TO CONTRIBUTE TO MARKET GROWTH

12.4.1.1

ELEVATING DEMAND FOR INDUSTRIAL AUTOMATION, POWER ELECTRONICS, AND RUGGED EMBEDDED SYSTEMS TO FAVOR SEGMENTAL GROWTH

12.4.2.1

SUPERIOR RESISTANCE TO VIBRATION AND THERMAL STRESS TO STIMULATE DEMAND

12.4.3

OTHER STANDARD PITCH CATEGORIES

13

BOARD-TO-BOARD CONNECTOR MARKET, BY MOUNTING TYPE

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 2 Data Tables

123

13.2.1

ABILITY TO SUPPORT HIGH-FREQUENCY SIGNALS AND DENSE CIRCUITRY TO BOOST DEMAND

13.3.1

RISING USE IN INDUSTRIAL EQUIPMENT, POWER SUPPLIES, AND MILITARY ELECTRONICS TO CONTRIBUTE TO MARKET GROWTH

13.4.1

POTENTIAL TO HANDLE HIGH CURRENTS AND FREQUENT MECHANICAL STRESS TO ACCELERATE DEMAND

13.5.1

RISING DEMAND FOR HIGH-PERFORMANCE ELECTRONICS IN SPACE-CONSTRAINED ENVIRONMENTS TO PROPEL MARKET

14

BOARD-TO-BOARD CONNECTOR MARKET, BY APPLICATION

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 4 Data Tables

127

14.2.1

HIGH-SPEED/HIGH-FREQUENCY

14.2.1.1

ESCALATING DEMAND FOR HIGH-PERFORMANCE COMPUTING TO FUEL MARKET GROWTH

14.2.2.1

GROWING NEED FOR COMPACT MULTIFUNCTIONAL INTERCONNECTS IN INDUSTRIAL AUTOMATION TO FUEL MARKET GROWTH

14.3.1

ABILITY TO ENSURE STABLE POWER FLOW EVEN IN COMPACT ASSEMBLIES TO BOOST DEMAND

14.4.1

GROWING INCLINATION TOWARD 5G, IOT, AND EDGE COMPUTING TO SPUR DEMAND

15

BOARD-TO-BOARD CONNECTOR MARKET, BY END USER

Market Size & Growth Rate Forecast Analysis to 2030 in USD Million | 148 Data Tables

132

15.2

CONSUMER ELECTRONICS

15.2.1

RISING ADOPTION OF ULTRA-THIN AND COMPACT DEVICE DESIGNS TO SUPPORT MARKET GROWTH

15.3

INDUSTRIAL AUTOMATION

15.3.1.1

RAPID INTEGRATION OF SMART SENSORS AND AI-BASED CONTROL SYSTEMS TO DRIVE MARKET

15.3.2.1

INCREASING USE OF INTELLIGENT ROBOTS IN LOGISTICS APPLICATIONS TO FUEL MARKET GROWTH

15.3.3

FACTORY CONTROL SYSTEMS

15.3.3.1

TRANSITION TOWARD CONNECTED AUTOMATION TO FUEL GROWTH

15.3.4

INDUSTRIAL IOT DEVICES

15.3.4.1

EXPANSION OF SMART FACTORIES TO EXPEDITE MARKET GROWTH

15.4.1

GLOBAL EXPANSION OF 5G NETWORKS TO SUPPORT MARKET GROWTH

15.5.1

INTERNAL COMBUSTION ENGINES

15.5.1.1

NEED FOR EFFICIENT COMMUNICATION AND POWER DISTRIBUTION ACROSS COMPLEX POWERTRAIN ARCHITECTURES TO DRIVE MARKET

15.5.2.1

SHIFT TOWARD INTEGRATED ELECTRONIC ARCHITECTURES TO CREATE GROWTH OPPORTUNITIES

15.5.3

SELF-DRIVING VEHICLES

15.5.3.1

SURGING ADOPTION OF AUTONOMOUS DRIVING TECHNOLOGIES TO BOOST DEMAND

15.6.1

PRESSING NEED FOR PORTABILITY, CONNECTIVITY, AND REAL-TIME DATA HANDLING TO ACCELERATE MARKET GROWTH

15.7.1.1

FOCUS ON SIMPLIFYING WIRING, REDUCING AIRCRAFT WEIGHT, AND ENSURING HIGH PERFORMANCE TO DRIVE DEMAND

15.7.2.1

INCREASING DEMAND FOR AUTONOMOUS AND LONG-ENDURANCE DRONES TO FOSTER MARKET GROWTH

15.7.3

WEAPONS & ELECTRONIC WARFARE SYSTEMS

15.7.3.1

SURGING DEMAND FOR ADVANCED AND MECHANICALLY ROBUST ELECTRONIC WARFARE SYSTEMS TO STIMULATE MARKET GROWTH

15.7.4

OTHER AEROSPACE & DEFENSE APPLICATIONS

16

BOARD-TO-BOARD CONNECTOR MARKET, BY REGION

Comprehensive coverage of 8 Regions with country-level deep-dive of 21 Countries | 22 Data Tables.

189

16.2.1.1

SURGING DEMAND FOR CLOUD SERVICES WITH INTEGRATION OF AI MODELS TO ACCELERATE MARKET GROWTH

16.2.2.1

EVOLVING INDUSTRIAL AND ELECTRONICS LANDSCAPE TO CREATE GROWTH OPPORTUNITIES

16.2.3.1

EXPANSION OF PRODUCTION FACILITIES TO BOOST DEMAND

16.3.1.1

GROWING FOCUS OF INDUSTRIAL SECTOR ON SMART MANUFACTURING TO SUPPORT MARKET GROWTH

16.3.2.1

INCREASING INVESTMENTS IN DATA CENTERS TO FOSTER MARKET GROWTH

16.3.3.1

SIGNIFICANT FOCUS ON EXPANDING SEMICONDUCTOR PACKAGING AND ELECTRONIC MANUFACTURING CAPACITY TO BOOST DEMAND

16.3.4.1

MODERNIZATION OF RAILWAY NETWORKS AND INDUSTRIAL ELECTRONICS TO SPUR DEMAND

16.3.5.1

STRONG FOCUS ON STRENGTHENING DOMESTIC ELECTRONICS MANUFACTURING BASE TO CREATE OPPORTUNITIES

16.3.6.1

RAPID EXPANSION OF 5G AND TELECOM INFRASTRUCTURE TO ACCELERATE DEMAND

16.4.1.1

EXPANSION OF ELECTRONICS AND ELECTRIC VEHICLE MANUFACTURING ECOSYSTEM TO EXPEDITE MARKET GROWTH

16.4.2.1

STRONG FOCUS OF ELECTRONICS MANUFACTURERS ON MINIATURIZATION AND PRECISION ENGINEERING TO SUPPORT MARKET GROWTH

16.4.3.1

RAPID EXPANSION OF 5G AND SEMICONDUCTOR ECOSYSTEM TO FACILITATE DEMAND

16.4.4.1

BOOMING ELECTRONICS MANUFACTURING INDUSTRY TO CONTRIBUTE TO MARKET GROWTH

16.4.5.1

ONGOING RENEWABLE ENERGY AND SMART GRID INFRASTRUCTURE PROJECTS TO DRIVE MARKET

16.4.6.1

GROWING INCLINATION TOWARD INDUSTRIAL AUTOMATION TO SURGE DEMAND

16.4.7.1

INCREASING INVESTMENTS IN ADVANCED PACKAGING, AUTOMOTIVE ELECTRONICS, AND SMART DEVICES TO CREATE OPPORTUNITIES

16.4.8.1

GROWING EMPHASIS ON SMART MANUFACTURING TO EXPEDITE DEMAND

16.4.9.1

EMPHASIS ON EXPANDING CONSUMER ELECTRONICS AND INDUSTRIAL EQUIPMENT MANUFACTURING BASE TO FUEL DEMAND

16.4.10

REST OF ASIA PACIFIC

16.5.1.1.1

FOCUS ON DIGITAL MANUFACTURING AND INDUSTRIAL AUTOMATION TO FUEL MARKET GROWTH

16.5.1.2.1

EXPANSION OF DATA CENTERS, TELECOMMUNICATIONS NETWORKS, AND IOT-ENABLED SYSTEMS TO SPIKE DEMAND

16.5.1.3.1

GROWTH IN IT INFRASTRUCTURE TO DRIVE DEMAND

16.5.1.4.1

MODERNIZATION OF ENERGY AND INDUSTRIAL INFRASTRUCTURE TO FAVOR MARKET GROWTH

16.5.1.5.1

DIGITAL TRANSFORMATION OF INDUSTRIAL SECTOR TO BOOST DEMAND

16.5.1.6.1

INCREASING INVESTMENTS IN ADVANCED MANUFACTURING TO PROPEL MARKET

16.5.1.7

REST OF MIDDLE EAST

16.5.2.1

GROWING RENEWABLE ENERGY INFRASTRUCTURE TO DRIVE MARKET

16.5.3.1.1

GROWING RENEWABLE ENERGY PROJECTS AND BOOMING POWER ELECTRONICS SECTOR TO SUPPORT MARKET GROWTH

17

COMPETITIVE LANDSCAPE

Discover key players' strategies and market shares shaping the competitive landscape through 2024.

215

17.2

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2025

17.3

REVENUE ANALYSIS, 2020–2024

17.4

MARKET SHARE ANALYSIS, 2024

17.5

COMPANY VALUATION AND FINANCIAL METRICS

17.6.2

AMPHENOL CORPORATION

17.6.3

HIROSE ELECTRIC CO., LTD.

17.6.5

JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.

17.7

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

17.7.5

COMPANY FOOTPRINT: KEY PLAYERS, 2024

17.7.5.1

COMPANY FOOTPRINT

17.7.5.2

REGION FOOTPRINT

17.7.5.4

CONNECTOR TYPE FOOTPRINT

17.7.5.6

END USER FOOTPRINT

17.8

COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

17.8.1

PROGRESSIVE COMPANIES

17.8.2

RESPONSIVE COMPANIES

17.8.5

COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

17.8.5.1

DETAILED LIST OF KEY STARTUPS/SMES

17.8.5.2

COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

17.9

COMPETITIVE SCENARIO

17.9.1

PRODUCT LAUNCHES & ENHANCEMENTS

18

COMPANY PROFILES

In-depth Company Profiles of Leading Market Players with detailed Business Overview, Product and Service Portfolio, Recent Developments, and Unique Analyst Perspective (MnM View)

242

18.1.1.1

BUSINESS OVERVIEW

18.1.1.2

PRODUCTS/SOLUTIONS/SERVICES OFFERED

18.1.1.3

RECENT DEVELOPMENTS

18.1.1.3.1

PRODUCT LAUNCHES & ENHANCEMENTS

18.1.1.4.1

KEY STRENGTHS/RIGHT TO WIN

18.1.1.4.2

STRATEGIC CHOICES

18.1.1.4.3

WEAKNESSES/COMPETITIVE THREATS

18.1.2

AMPHENOL CORPORATION

18.1.3

HIROSE ELECTRIC CO., LTD.

18.1.5

JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.

18.1.7

CSCONN CORPORATION

18.1.9

KYOCERA CORPORATION

18.1.10

FIT HON TENG LIMITED

18.1.11

HARTING TECHNOLOGY GROUP

18.2.7

ACES ELECTRONICS CO., LTD.

18.2.10

JST SALES AMERICA, INC.

18.2.11

IRISO ELECTRONICS CO. LTD.

18.2.12

YAMAICHI ELECTRONICS CO. LTD

18.2.14

DON CONNEX ELECTRONICS CO., LTD.

18.2.15

WEITRONIC ENTERPRISE CO., LTD.

18.2.16

AMTEK TECHNOLOGY CO., LTD.

18.2.17

TAITEK COMPONENTS CO.,LTD.

18.2.18

GREENCONN CO., LTD

18.2.19

WCON ELECTRONICS (GUANGDONG) CO., LTD.

18.2.20

KUNSHAN CONNECTORS ELECTRONICS CO., LTD.

18.2.21

UNICORN ELECTRONICS COMPONENTS CO., LTD.

18.2.23

CVILUX CORPORATION

19

RESEARCH METHODOLOGY

300

19.1.1

SECONDARY AND PRIMARY RESEARCH

19.1.2.1

LIST OF MAJOR SECONDARY SOURCES

19.1.2.2

KEY DATA FROM SECONDARY SOURCES

19.1.3.1

LIST OF PRIMARY INTERVIEW PARTICIPANTS

19.1.3.2

KEY DATA FROM PRIMARY SOURCES

19.1.3.3

KEY INDUSTRY INSIGHTS

19.1.3.4

BREAKDOWN OF PRIMARIES

19.2

MARKET SIZE ESTIMATION

19.2.2

BOTTOM-UP APPROACH

19.2.3

MARKET SIZE ESTIMATION METHODOLOGY

19.3

MARKET FORECAST APPROACH

19.5

RESEARCH ASSUMPTIONS

19.6

RESEARCH LIMITATIONS

20.1

INSIGHTS FROM INDUSTRY EXPERTS

20.3

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

20.4

CUSTOMIZATION OPTIONS

TABLE 1

INCLUSION AND EXCLUSION-RELATED DETAILS

TABLE 2

INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

TABLE 3

KEY MOVES AND STRATEGIC FOCUS

TABLE 4

BOARD-TO-BOARD CONNECTOR MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 5

GDP OF KEY COUNTRIES, 2021–2030

TABLE 6

ROLE OF COMPANIES IN BOARD-TO-BOARD CONNECTOR ECOSYSTEM

TABLE 7

PRICING RANGE OF BOARD-TO-BOARD CONNECTORS BASED ON DIFFERENT PITCHES, BY KEY PLAYER, 2024 (USD)

TABLE 8

AVERAGE SELLING PRICE TREND OF BOARD-TO-BOARD CONNECTORS, BY PITCH, 2020–2024 (USD)

TABLE 9

AVERAGE SELLING PRICE TREND OF BOARD-TO-BOARD CONNECTORS, BY REGION, 2020–2024 (USD)

TABLE 10

IMPORT DATA FOR HS CODE 8536-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD MILLION)

TABLE 11

EXPORT DATA FOR HS CODE 8536-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD MILLION)

TABLE 12

KEY CONFERENCES AND EVENTS, 2026–2027

TABLE 13

MFN TARIFF FOR HS CODE 8536-COMPLIANT PRODUCTS EXPORTED BY US

TABLE 14

US-ADJUSTED RECIPROCAL TARIFF RATES

TABLE 15

PATENTS IN BOARD-TO-BOARD CONNECTOR MARKET

TABLE 16

TOP USE CASES AND MARKET POTENTIAL

TABLE 17

BEST PRACTICES IMPLEMENTED BY KEY COMPANIES

TABLE 18

BOARD-TO-BOARD CONNECTOR MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION

TABLE 19

INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

TABLE 20

NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21

EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 22

ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 23

ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 24

GLOBAL INDUSTRY STANDARDS IN BOARD-TO-BOARD CONNECTOR MARKET

TABLE 25

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

TABLE 26

KEY BUYING CRITERIA, BY END USER

TABLE 27

UNMET NEEDS IN BOARD-TO-BOARD CONNECTOR MARKET, BY END USER

TABLE 28

BOARD-TO-BOARD CONNECTOR MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 29

BOARD-TO-BOARD CONNECTOR MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 30

BOARD-TO-BOARD CONNECTOR MARKET, BY MALE CONNECTOR TYPE, 2021–2024 (USD MILLION)

TABLE 31

BOARD-TO-BOARD CONNECTOR MARKET, BY MALE CONNECTOR TYPE, 2025–2030 (USD MILLION)

TABLE 32

MALE CONNECTORS: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 33

MALE CONNECTORS: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 34

STACKED HEADERS: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 35

STACKED HEADERS: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 36

SHROUDED HEADERS: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 37

SHROUDED HEADERS: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 38

SOCKETS: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 39

SOCKETS: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 40

BOARD-TO-BOARD CONNECTOR MARKET, BY CONNECTOR TYPE, 2021–2024 (USD MILLION)

TABLE 41

BOARD-TO-BOARD CONNECTOR MARKET, BY CONNECTOR TYPE, 2025–2030 (USD MILLION)

TABLE 42

BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH, 2021–2024 (USD MILLION)

TABLE 43

BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH, 2025–2030 (USD MILLION)

TABLE 44

BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH, 2021–2024 (MILLION UNITS)

TABLE 45

BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH, 2025–2030 (MILLION UNITS)

TABLE 46

LESS THAN 1 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 47

LESS THAN 1 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 48

LESS THAN 1 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 49

LESS THAN 1 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 50

0.80 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 51

0.80 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 52

0.65 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 53

0.65 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 54

OTHER FINE PITCH CATEGORIES: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 55

OTHER FINE PITCH CATEGORIES: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 56

1 TO 2 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 57

1 TO 2 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 58

1 TO 2 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 59

1 TO 2 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 60

1.00 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 61

1.00 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 62

1.27 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 63

1.27 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 64

1.50 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 65

1.50 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 66

2.00 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 67

2.00 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 68

GREATER THAN 2 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 69

GREATER THAN 2 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 70

GREATER THAN 2 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 71

GREATER THAN 2 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 72

2.54 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 73

2.54 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 74

3.00 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 75

3.00 MM: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 76

OTHER STANDARD PITCH CATEGORIES: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 77

OTHER STANDARD PITCH CATEGORIES: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 78

BOARD-TO-BOARD CONNECTOR MARKET, BY MOUNTING TYPE, 2021–2024 (USD MILLION)

TABLE 79

BOARD-TO-BOARD CONNECTOR MARKET, BY MOUNTING TYPE, 2025–2030 (USD MILLION)

TABLE 80

BOARD-TO-BOARD CONNECTOR MARKET, BY APPLICATION, 2021–2024 (USD MILLION)

TABLE 81

BOARD-TO-BOARD CONNECTOR MARKET, BY APPLICATION, 2025–2030 (USD MILLION)

TABLE 82

SIGNAL TRANSMISSION: BOARD-TO-BOARD CONNECTOR MARKET, BY APPLICATION TYPE, 2021–2024 (USD MILLION)

TABLE 83

SIGNAL TRANSMISSION: BOARD-TO-BOARD CONNECTOR MARKET, BY APPLICATION TYPE, 2025–2030, (USD MILLION)

TABLE 84

BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 85

BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 86

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 87

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 88

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH, 2021–2024 (USD MILLION)

TABLE 89

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH, 2025–2030 (USD MILLION)

TABLE 90

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET FOR LESS THAN 1 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 91

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET FOR LESS THAN 1 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 92

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET FOR 1 TO 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 93

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET FOR 1 TO 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 94

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET FOR GREATER THAN 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 95

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET FOR GREATER THAN 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 96

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED), BY PITCH, 2021–2024 (USD MILLION)

TABLE 97

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED), BY PITCH, 2025–2030 (USD MILLION)

TABLE 98

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR LESS THAN 1 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 99

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR LESS THAN 1 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 100

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR 1 TO 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 101

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR 1 TO 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 102

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR GREATER THAN 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 103

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR GREATER THAN 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 104

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 105

CONSUMER ELECTRONICS: BOARD-TO-BOARD CONNECTOR MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 106

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET, BY APPLICATION TYPE, 2021–2024 (USD MILLION)

TABLE 107

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET, BY APPLICATION TYPE, 2025–2030 (USD MILLION)

TABLE 108

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 109

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 110

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH, 2021–2024 (USD MILLION)

TABLE 111

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH, 2025–2030 (USD MILLION)

TABLE 112

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET FOR LESS THAN 1 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 113

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET FOR LESS THAN 1 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 114

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET FOR 1 TO 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 115

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET FOR 1 TO 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 116

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET FOR GREATER THAN 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 117

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET FOR GREATER THAN 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 118

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED), BY PITCH, 2021–2024 (USD MILLION)

TABLE 119

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED), BY PITCH, 2025–2030 (USD MILLION)

TABLE 120

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR LESS THAN 1 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 121

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR LESS THAN 1 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 122

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR 1 TO 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 123

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR 1 TO 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 124

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR GREATER THAN 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 125

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR GREATER THAN 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 126

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 127

INDUSTRIAL AUTOMATION: BOARD-TO-BOARD CONNECTOR MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 128

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 129

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 130

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH, 2021–2024 (USD MILLION)

TABLE 131

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH, 2025–2030 (USD MILLION)

TABLE 132

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET FOR LESS THAN 1 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 133

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET FOR LESS THAN 1 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 134

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET FOR 1 TO 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 135

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET FOR 1 TO 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 136

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET FOR GREATER THAN 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 137

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET FOR GREATER THAN 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 138

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED), BY PITCH, 2021–2024 (USD MILLION)

TABLE 139

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED), BY PITCH, 2025–2030 (USD MILLION)

TABLE 140

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR LESS THAN 1 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 141

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR LESS THAN 1 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 142

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR 1 TO 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 143

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR 1 TO 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 144

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR GREATER THAN 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 145

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR GREATER THAN 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 146

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 147

TELECOMMUNICATIONS: BOARD-TO-BOARD CONNECTOR MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 148

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET, BY APPLICATION TYPE, 2021–2024 (USD MILLION)

TABLE 149

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET, BY APPLICATION TYPE, 2025–2030 (USD MILLION)

TABLE 150

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 151

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 152

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH, 2021–2024 (USD MILLION)

TABLE 153

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH, 2025–2030 (USD MILLION)

TABLE 154

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET FOR LESS THAN 1 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 155

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET FOR LESS THAN 1 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 156

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET FOR 1 TO 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 157

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET FOR 1 TO 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 158

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET FOR GREATER THAN 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 159

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET FOR GREATER THAN 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 160

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED), BY PITCH, 2021–2024 (USD MILLION)

TABLE 161

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED), BY PITCH, 2025–2030 (USD MILLION)

TABLE 162

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR LESS THAN 1 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 163

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR LESS THAN 1 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 164

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR 1 TO 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 165

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR 1 TO 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 166

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR GREATER THAN 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 167

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR GREATER THAN 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 168

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 169

AUTOMOTIVE: BOARD-TO-BOARD CONNECTOR MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 170

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 171

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 172

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH, 2021–2024 (USD MILLION)

TABLE 173

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH, 2025–2030 (USD MILLION)

TABLE 174

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET FOR LESS THAN 1 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 175

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET FOR LESS THAN 1 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 176

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET FOR 1 TO 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 177

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET FOR 1 TO 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 178

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET FOR GREATER THAN 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 179

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET FOR GREATER THAN 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 180

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED), BY PITCH, 2021–2024 (USD MILLION)

TABLE 181

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED), BY PITCH, 2025–2030 (USD MILLION)

TABLE 182

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR LESS THAN 1 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 183

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR LESS THAN 1 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 184

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR 1 TO 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 185

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR 1 TO 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 186

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR GREATER THAN 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 187

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR GREATER THAN 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 188

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 189

HEALTHCARE: BOARD-TO-BOARD CONNECTOR MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 190

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET, BY APPLICATION TYPE, 2021–2024 (USD MILLION)

TABLE 191

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET, BY APPLICATION TYPE, 2025–2030 (USD MILLION)

TABLE 192

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 193

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 194

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH, 2021–2024 (USD MILLION)

TABLE 195

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH, 2025–2030 (USD MILLION)

TABLE 196

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET FOR LESS THAN 1 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 197

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET FOR LESS THAN 1 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 198

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET FOR 1 TO 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 199

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET FOR 1 TO 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 200

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET FOR GREATER THAN 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 201

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET FOR GREATER THAN 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 202

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED), BY PITCH, 2021–2024 (USD MILLION)

TABLE 203

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED), BY PITCH, 2025–2030 (USD MILLION)

TABLE 204

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR LESS THAN 1 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 205

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR LESS THAN 1 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 206

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR 1 TO 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 207

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR 1 TO 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 208

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR GREATER THAN 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 209

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR GREATER THAN 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 210

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 211

AEROSPACE & DEFENSE: BOARD-TO-BOARD CONNECTOR MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 212

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET, BY TYPE, 2021–2024 (USD MILLION)

TABLE 213

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET, BY TYPE, 2025–2030 (USD MILLION)

TABLE 214

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH, 2021–2024 (USD MILLION)

TABLE 215

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET, BY PITCH, 2025–2030 (USD MILLION)

TABLE 216

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET FOR LESS THAN 1 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 217

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET FOR LESS THAN 1 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 218

OTHERS: BOARD-TO-BOARD CONNECTOR MARKET FOR 1 TO 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 219

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET FOR 1 TO 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 220

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET FOR GREATER THAN 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 221

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET FOR GREATER THAN 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 222

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED), BY PITCH, 2021–2024 (USD MILLION)

TABLE 223

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED), BY PITCH, 2025–2030 (USD MILLION)

TABLE 224

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR LESS THAN 1 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 225

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR LESS THAN 1 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 226

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR 1 TO 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 227

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR 1 TO 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 228

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR GREATER THAN 2 MM, BY PITCH SIZE, 2021–2024 (USD MILLION)

TABLE 229

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET (STACKED HEADER EXCLUDED) FOR GREATER THAN 2 MM, BY PITCH SIZE, 2025–2030 (USD MILLION)

TABLE 230

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 231

OTHER END USERS: BOARD-TO-BOARD CONNECTOR MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 232

BOARD-TO-BOARD CONNECTOR MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 233

BOARD-TO-BOARD CONNECTOR MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 234

NORTH AMERICA: BOARD-TO-BOARD CONNECTOR MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 235

NORTH AMERICA: BOARD-TO-BOARD CONNECTOR MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 236

NORTH AMERICA: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 237

NORTH AMERICA: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 238

EUROPE: BOARD-TO-BOARD CONNECTOR MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 239

EUROPE: BOARD-TO-BOARD CONNECTOR MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 240

EUROPE: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 241

EUROPE: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 242

ASIA PACIFIC: BOARD-TO-BOARD CONNECTOR MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 243

ASIA PACIFIC: BOARD-TO-BOARD CONNECTOR MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 244

ASIA PACIFIC: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 245

ASIA PACIFIC: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 246

ROW: BOARD-TO-BOARD CONNECTOR MARKET, BY REGION, 2021–2024 (USD MILLION)

TABLE 247

ROW: BOARD-TO-BOARD CONNECTOR MARKET, BY REGION, 2025–2030 (USD MILLION)

TABLE 248

ROW: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2021–2024 (USD MILLION)

TABLE 249

ROW: BOARD-TO-BOARD CONNECTOR MARKET, BY END USER, 2025–2030 (USD MILLION)

TABLE 250

MIDDLE EAST: BOARD-TO-BOARD CONNECTOR MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 251

MIDDLE EAST: BOARD-TO-BOARD CONNECTOR MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 252

AFRICA: BOARD-TO-BOARD CONNECTOR MARKET, BY COUNTRY, 2021–2024 (USD MILLION)

TABLE 253

AFRICA: BOARD-TO-BOARD CONNECTOR MARKET, BY COUNTRY, 2025–2030 (USD MILLION)

TABLE 254

BOARD-TO-BOARD CONNECTOR MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021–2025

TABLE 255

BOARD-TO-BOARD CONNECTOR MARKET: DEGREE OF COMPETITION, 2024

TABLE 256

BOARD-TO-BOARD CONNECTOR MARKET: REGION FOOTPRINT

TABLE 257

BOARD-TO-BOARD CONNECTOR MARKET: TYPE FOOTPRINT

TABLE 258

BOARD-TO-BOARD CONNECTOR MARKET: CONNECTOR TYPE FOOTPRINT

TABLE 259

BOARD-TO-BOARD CONNECTOR MARKET: PITCH FOOTPRINT

TABLE 260

BOARD-TO-BOARD CONNECTOR MARKET: END USER FOOTPRINT

TABLE 261

BOARD-TO-BOARD CONNECTOR MARKET: LIST OF KEY STARTUPS/SMES

TABLE 262

BOARD-TO-BOARD CONNECTOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 263

BOARD-TO-BOARD CONNECTOR MARKET: PRODUCT LAUNCHES & EHANCEMENTS, JANUARY 2021−AUGUST 2025

TABLE 264

BOARD-TO-BOARD CONNECTOR MARKET: DEALS, JANUARY 2021−AUGUST 2025

TABLE 265

BOARD-TO-BOARD CONNECTOR MARKET: EXPANSIONS, JANUARY 2021−AUGUST 2025

TABLE 266

TE CONNECTIVITY: COMPANY OVERVIEW

TABLE 267

TE CONNECTIVITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 268

TE CONNECTIVITY: PRODUCT LAUNCHES/ENHANCEMENTS

TABLE 269

TE CONNECTIVITY: EXPANSIONS

TABLE 270

AMPHENOL CORPORATION: COMPANY OVERVIEW

TABLE 271

AMPHENOL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 272

AMPHENOL CORPORATION: PRODUCT LAUNCHES/ENHANCEMENTS

TABLE 273

HIROSE ELECTRIC CO., LTD.: COMPANY OVERVIEW

TABLE 274

HIROSE ELECTRIC CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 275

HIROSE ELECTRIC CO., LTD: PRODUCT LAUNCHES/ENHANCEMENTS

TABLE 276

MOLEX: COMPANY OVERVIEW

TABLE 277

MOLEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 278

MOLEX: PRODUCT LAUNCHES/ENHANCEMENTS

TABLE 280

MOLEX: EXPANSIONS

TABLE 281

JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.: COMPANY OVERVIEW

TABLE 282

JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 283

JAPAN AVIATION ELECTRONICS INDUSTRY, LTD: PRODUCT LAUNCHES/ENHANCEMENTS

TABLE 284

SAMTEC: COMPANY OVERVIEW

TABLE 285

SAMTEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 286

SAMTEC: PRODUCT LAUNCHES/ENHANCEMENTS

TABLE 287

CSCONN CORPORATION: COMPANY OVERVIEW

TABLE 288

CSCONN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 289

OMRON CORPORATION: COMPANY OVERVIEW

TABLE 290

OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 291

KYOCERA CORPORATION: COMPANY OVERVIEW

TABLE 292

KYOCERA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 293

KYOCERA CORPORATION: PRODUCT LAUNCHES/ENHANCEMENTS

TABLE 294

FIT HON TENG LIMITED: COMPANY OVERVIEW

TABLE 295

FIT HON TENG LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 296

FIT HON TENG LIMITED: EXPANSIONS

TABLE 297

HARTING TECHNOLOGY GROUP: COMPANY OVERVIEW

TABLE 298

HARTING TECHNOLOGY GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 299

HARTING TECHNOLOGY GROUP: PRODUCT LAUNCHES/ENHANCEMENTS

TABLE 300

HARTING TECHNOLOGY GROUP: DEALS

TABLE 301

HARTING TECHNOLOGY GROUP: EXPANSIONS

TABLE 302

LIST OF MAJOR SECONDARY SOURCES

TABLE 303

LIST OF INDUSTRY EXPERTS

TABLE 304

KEY DATA FROM PRIMARY SOURCES

TABLE 305

RISK ASSESSMENT AND IMPACT

FIGURE 1

BOARD-TO-BOARD CONNECTOR MARKET SEGMENTATION AND REGIONAL SCOPE

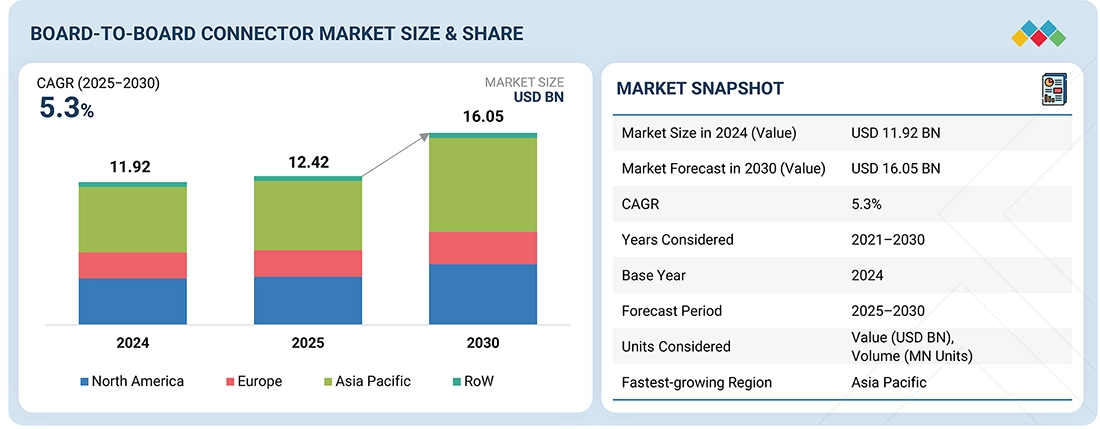

FIGURE 2

DURATION COVERED

FIGURE 4

GLOBAL BOARD-TO-BOARD CONNECTOR MARKET, 2021–2030

FIGURE 5

MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN BOARD-TO-BOARD CONNECTOR MARKET, 2021–2025

FIGURE 6

DISRUPTIONS INFLUENCING GROWTH OF BOARD-TO-BOARD CONNECTOR MARKET

FIGURE 7

HIGH-GROWTH SEGMENTS IN BOARD-TO-BOARD CONNECTOR MARKET, 2025–2030

FIGURE 8

ASIA PACIFIC TO REGISTER HIGHEST CAGR IN BOARD-TO-BOARD CONNECTOR MARKET, IN TERMS OF VALUE, DURING FORECAST PERIOD

FIGURE 9

RAPID EXPANSION OF ELECTRONICS MANUFACTURING IN EMERGING ECONOMIES TO CONTRIBUTE TO MARKET GROWTH

FIGURE 10

MALE CONNECTORS SEGMENT TO CAPTURE MAJORITY OF MARKET SHARE IN 2025

FIGURE 11

LESS THAN 1 MM SEGMENT TO RECORD HIGHEST CAGR FROM 2025 TO 2030

FIGURE 12

CONSUMER ELECTRONICS SEGMENT AND ASIA PACIFIC TO HOLD LARGEST SHARE OF BOARD-TO-BOARD CONNECTOR MARKET IN 2030

FIGURE 13

SOUTH KOREA TO REGISTER HIGHEST CAGR IN GLOBAL BOARD-TO-BOARD CONNECTOR MARKET FROM 2025 TO 2030

FIGURE 14

BOARD-TO-BOARD CONNECTOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 15

IMPACT OF DRIVERS ON BOARD-TO-BOARD CONNECTOR MARKET

FIGURE 16

IMPACT OF RESTRAINTS ON BOARD-TO-BOARD CONNECTOR MARKET

FIGURE 17

IMPACT OF OPPORTUNITIES ON BOARD-TO-BOARD CONNECTOR MARKET

FIGURE 18

IMPACT OF CHALLENGES ON BOARD-TO-BOARD CONNECTOR MARKET

FIGURE 19

BOARD-TO-BOARD CONNECTOR MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 20

BOARD-TO-BOARD CONNECTOR VALUE CHAIN

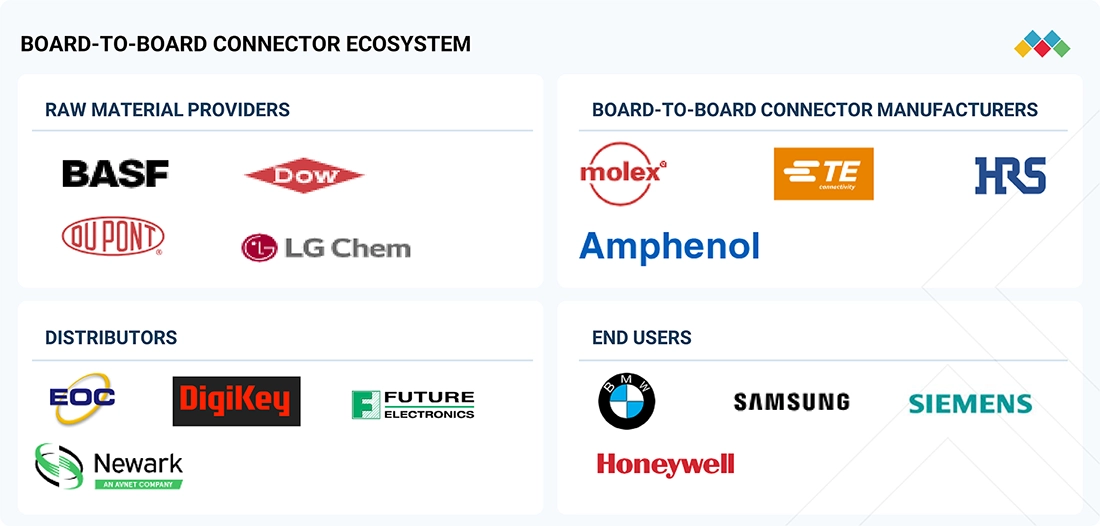

FIGURE 21

BOARD-TO-BOARD CONNECTOR ECOSYSTEM

FIGURE 22

AVERAGE SELLING PRICE TREND OF BOARD-TO-BOARD CONNECTORS, BY PITCH, 2020–2024

FIGURE 23

AVERAGE SELLING PRICE TREND OF BOARD-TO-BOARD CONNECTORS, BY REGION, 2020–2024

FIGURE 24

IMPORT SCENARIO FOR HS CODE 8536-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020–2024

FIGURE 25

EXPORT SCENARIO FOR HS CODE 8536-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020–2024

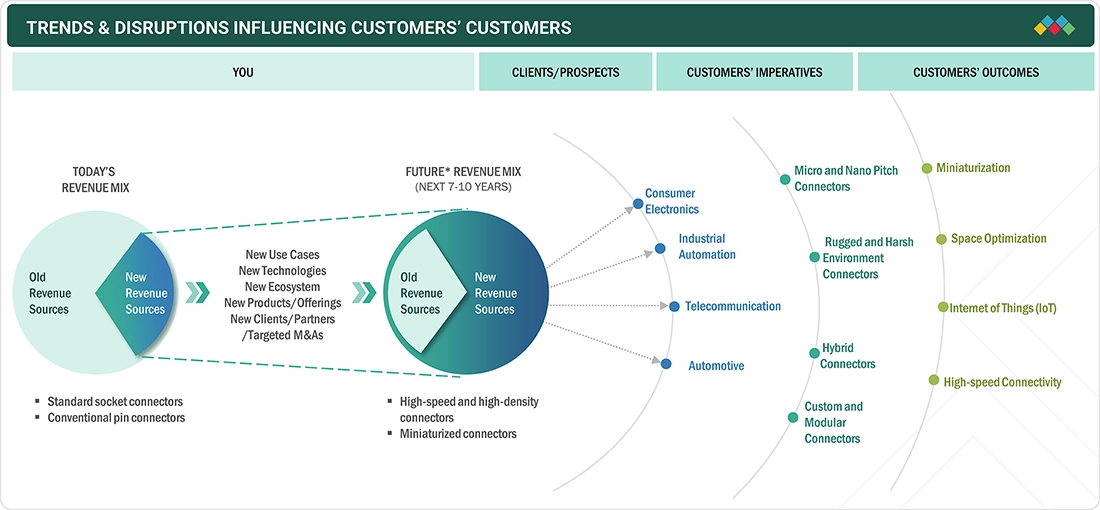

FIGURE 26

TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

FIGURE 27

INDUSTRIAL AUTOMATION STARTUP FUNDING, 2020–2024

FIGURE 28

BOARD-TO-BOARD CONNECTOR MARKET: PATENT ANALYSIS, 2015−2024

FIGURE 29

BOARD-TO-BOARD CONNECTOR MARKET: DECISION-MAKING FACTORS

FIGURE 30

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

FIGURE 31

END USERS’ KEY BUYING CRITERIA

FIGURE 32

ADOPTION BARRIERS AND INTERNAL CHALLENGES

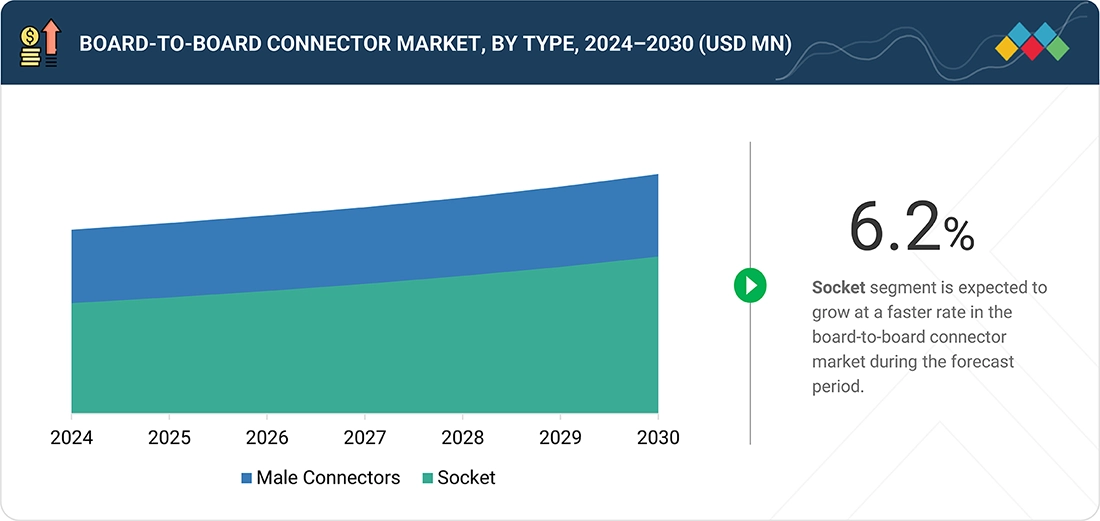

FIGURE 33

MALE CONNECTORS HELD PROMINENT MARKET SHARE IN 2024

FIGURE 34

MEZZANINE CONNECTORS TO ACCOUNT FOR LARGEST SHARE OF BOARD-TO-BOARD CONNECTOR MARKET IN 2025

FIGURE 35

1 TO 2 MM SEGMENT TO HOLD LARGEST SHARE OF BOARD-TO-BOARD CONNECTOR MARKET IN 2025

FIGURE 36

SURFACE-MOUNT CONNECTORS TO CAPTURE MAJORITY OF MARKET SHARE IN 2025

FIGURE 37

SIGNAL TRANSMISSION SEGMENT TO LEAD BOARD-TO-BOARD CONNECTOR MARKET IN 2025

FIGURE 38

CONSUMER ELECTRONICS SEGMENT TO COMMAND BOARD-TO-BOARD CONNECTOR MARKET IN 2025

FIGURE 39

BOARD-TO-BOARD CONNECTOR MARKET: GEOGRAPHIC SNAPSHOT

FIGURE 40

NORTH AMERICA: BOARD-TO-BOARD CONNECTOR MARKET SNAPSHOT

FIGURE 41

EUROPE: BOARD-TO-BOARD CONNECTOR MARKET SNAPSHOT

FIGURE 42

ASIA PACIFIC: BOARD-TO-BOARD CONNECTOR MARKET SNAPSHOT

FIGURE 43

REVENUE ANALYSIS OF TOP PLAYERS IN BOARD-TO-BOARD CONNECTOR MARKET, 2020–2024

FIGURE 44

MARKET SHARE ANALYSIS OF KEY PLAYERS OFFERING BOARD-TO-BOARD CONNECTORS, 2024

FIGURE 45

COMPANY VALUATION

FIGURE 46

FINANCIAL METRICS (EV/EBITDA)

FIGURE 47

BRAND COMPARISON

FIGURE 48

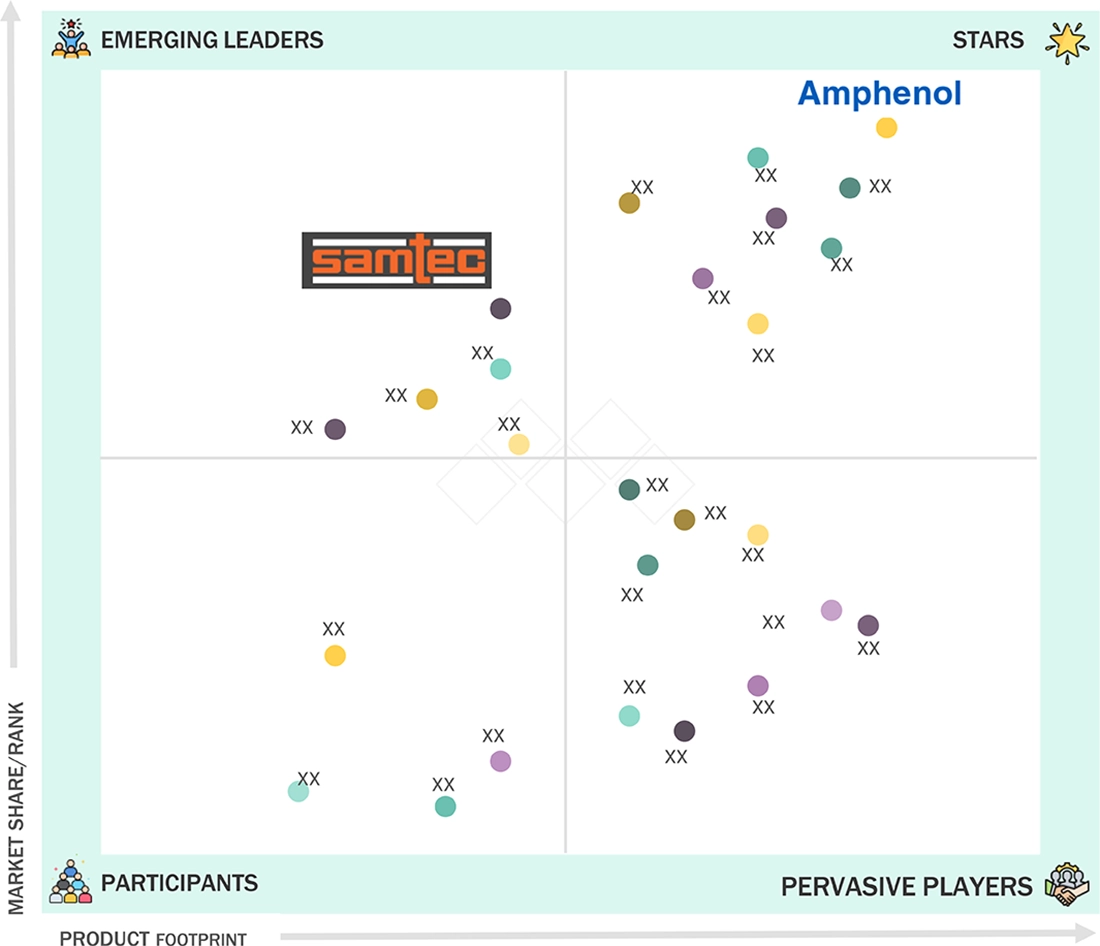

BOARD-TO-BOARD CONNECTOR MARKET: COMPANY EVALUATION MATRIX (KEY COMPANIES), 2024

FIGURE 49

BOARD-TO-BOARD CONNECTOR MARKET: COMPANY FOOTPRINT

FIGURE 50

BOARD-TO-BOARD CONNECTOR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

FIGURE 51

TE CONNECTIVITY: COMPANY SNAPSHOT

FIGURE 52

AMPHENOL CORPORATION: COMPANY SNAPSHOT

FIGURE 53

HIROSE ELECTRIC CO., LTD.: COMPANY SNAPSHOT

FIGURE 54

JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.: COMPANY SNAPSHOT

FIGURE 55

OMRON CORPORATION: COMPANY SNAPSHOT

FIGURE 56

KYOCERA CORPORATION: COMPANY SNAPSHOT

FIGURE 57

FIT HON TENG LIMITED: COMPANY SNAPSHOT

FIGURE 58

BOARD-TO-BOARD CONNECTOR MARKET: RESEARCH DESIGN

FIGURE 59

BOARD-TO-BOARD CONNECTOR MARKET: RESEARCH APPROACH

FIGURE 60

KEY DATA FROM SECONDARY SOURCES

FIGURE 61

KEY INSIGHTS FROM INDUSTRY EXPERTS

FIGURE 62

BREAKDOWN OF PRIMARIES, BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 63

MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 64

MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 65

MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

FIGURE 66

DATA TRIANGULATION

Growth opportunities and latent adjacency in Board-to-Board Connector Market