The study involved major activities in estimating the current size of the blower market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the blower market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the global Blower market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The blower market comprises several stakeholders such as generator manufacturers, manufacturers of subcomponents of blowers, manufacturing technology providers, and technology support providers in the supply chain. The demand side of this market is characterized by the rising offshore wind energy installations. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

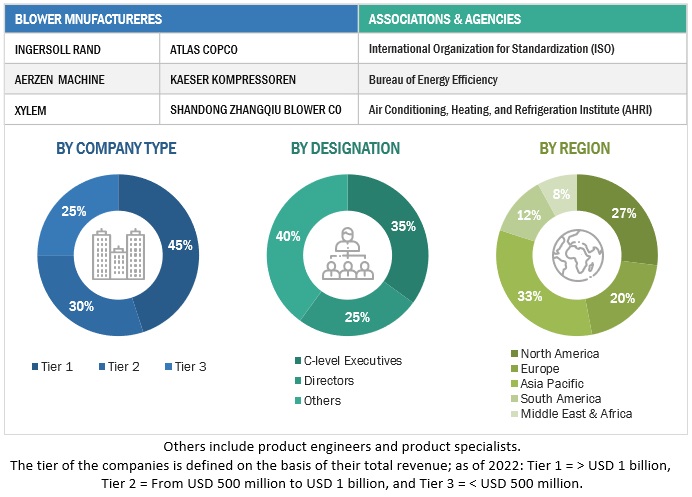

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

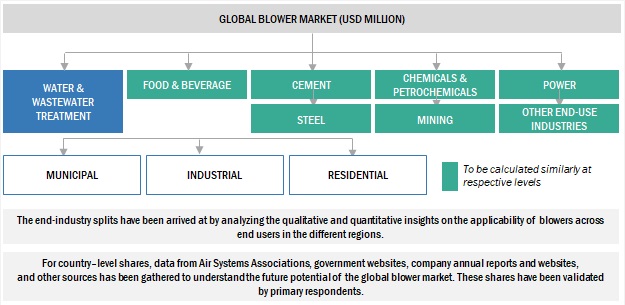

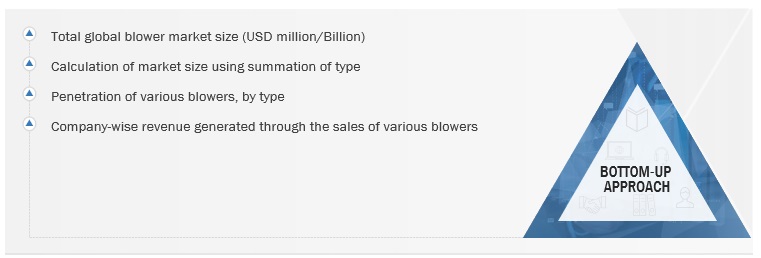

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Blower market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions has been determined through both primary and secondary research.

-

The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Blower Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Blower Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

Blowers are equipment or devices that increase the velocity of air or gas when passed through equipped impellers. Effectively, a blower is designed to move air and gas at low to high pressure to perform a specific function. In a blower, the inlet pressure is low and is higher at the outlet. The kinetic energy of the blades increases the pressure of the air at the outlet.

Key Stakeholders

-

Government & research organizations

-

Institutional investors and investment banks

-

Investors/shareholders

-

Environmental research institutes

-

Consulting companies in the energy & power sector

-

Raw materials and component manufacturers

-

Blower manufacturers, dealers, and suppliers

-

Manufacturers’ associations

-

Process industries and power industry associations

-

Refinery operators

-

Manufacturing industry

-

Energy efficiency consultancies

-

Air system manufacturers' associations

-

Water & Wastewater Treatment Associations

-

Water & wastewater treatment companies

-

Original equipment manufacturers (OEMs) and system integrators

-

Engineering, procurement, and construction (EPC) contractors

-

Standardization and testing firms

Objectives of the Study

-

To define, describe, analyze, and forecast the size of the global blower market by product type, pressure, distribution channel, end-use industry, and in terms of value and volume

-

To forecast the market size for five key regions: North America, South America, Europe, Asia Pacific, and Middle East & Africa, along with their key countries

-

To provide detailed information about the key drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

-

To analyze market opportunities for stakeholders and the competitive landscape of the market

-

To strategically profile the key players and comprehensively analyze their market shares and core competencies

-

To analyze competitive developments, such as sales contracts, agreements, investments, expansions, new product launches, mergers, partnerships, collaborations, and acquisitions, in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

-

Further breakdown of region or country-specific analysis

Company Information

-

Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Blower Market