Industrial Air Compressor Market by Product Type (Positive Displacement, Dynamic), Output Power (Up to 50 kW, 51–250 kW, 251–500 kW, & Above 500 kW), Seal (Oil-flooded & Oil-free), End-user, Design, Pressure, Coolant and Region - Global Forecast to 2026

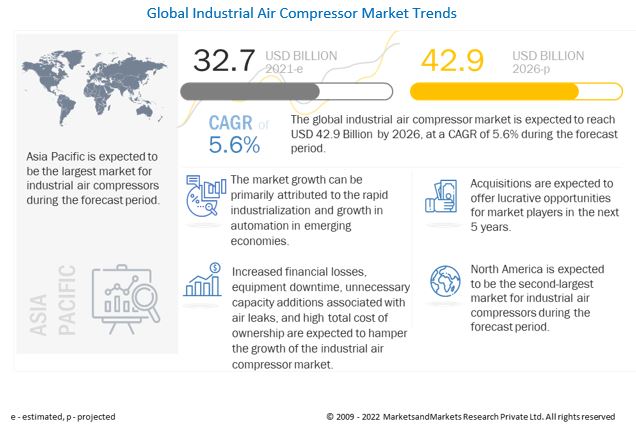

The global industrial air compressor market in terms of revenue was values at an estimated $32.7 billion in 2021 and is projected to reach $42.9 billion by 2026, growing at a CAGR of 5.6 % from 2021 to 2026. Rapid industrialization and increasing automation in emerging economies, inflow of investments and rising demand for oil-free compressors in food & beverages industry and the surging demand from HVAC industry are the driving factors for the industrial air compressor market.

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial Air Compressor Market Dynamics

Driver: Rapid industrialization and increasing automation in emerging economies

Industrial air compressors have a wide range of applications in industries such as chemicals and petrochemicals, oil & gas, pharmaceuticals, construction, automotive and transportation, packaging industry, power generation, healthcare, metals and mining, and others. Moreover, 70% of all manufacturers use compressed air systems. Rapidly increasing industrialization and manufacturing activities offer immense potential for the growth of the industrial air compressor market due to increasing investments and capacity expansions. Several emerging economies, such as Asia Pacific and Africa, have boosted their industrial and economic developments. In addition, government initiatives to promote industrial automation and emphasis on industrial automation for optimum utilization of resources are also driving the demand for industrial air compressors as they can be used for powering pneumatic tools, packaging, automation equipment, and conveyors.

According to the International Energy Agency’s World Energy Investment Report 2021, the annual global energy investment is expected to increase back to pre-crisis levels. The composition has evolved from traditional fuel production to power and end-user industries. New oil refineries are being constructed in Russia, China, Brunei, India, Saudi Arabia, and the US, while new power generation projects are being undertaken in Asia Pacific, Africa, and the Middle East. Additionally, capacity expansion and construction of new chemical plants are taking place on a global scale in major economies such as China, India, South Korea, and Russia, among others. Subsequently, the chemical and oil & gas refining sectors require compressors for processing and operating mechanisms. For instance, compressors are used in oil & gas refineries to provide a steady flow of process gases through the close conduct to the reactor.

With the government in India pushing large infrastructure projects, demand for cement is expected to increase by an estimated 45 million tons in the next three to four years. By 2025, India’s demand for cement is expected to reach 550–600 million Tons Per Annum (MTPA). In China, the pulp and paper industry has been developing rapidly since 2001. China is currently one of the largest pulp and paper product manufacturers globally. Approximately, 50% of the total global pulp and paper production capacity is located in China, the US, and Canada. The growth of the chemical, refining, and power generation sectors would also drive the industrial air compressor industry, especially in Asia Pacific.

Restraints: Increased financial losses, equipment downtime, and unnecessary capacity additions associated with air leaks.

Leaks, artificial demand, and poor practices can result in increased financial losses, equipment downtime, and unnecessary capacity additions. The average compressed system loses between 25 to 35% of compressed air to leaks; so cost controls require routine monitoring and repairs. Air leaks can be the largest waste of compressed air energy at a manufacturing plant. For example, an eighth-of-an-inch diameter leak in a 100 psi system can cost more than USD 12,000 annually in unused energy. Depending on pressure requirements and energy costs, a single fourth-of-an-inch leak in a compressed air line in a facility can cost USD 2,500 to more than USD 8,000 per year. Many air systems operate at high pressures to account for peaks in usage, and also to compensate for leaks, pressure drops, and flow fluctuations. However, operating at high pressures can require as much as 25% more compressor capacity than required, generating wasted air called artificial demand. Consequently, several SMEs may find it difficult to conduct air audits and manage leaks resulting in production losses and increased non-productive time.

Opportunities: Increasing demand for energy-efficient air compressors

With the adoption of the Paris Agreement in 2015, the world needs to harness low-carbon energy sources to control greenhouse gas (GHG) emissions and limit the increase of global mean surface temperature to below 2°C relative to pre-industrial levels by the end of the century. With a growing focus on energy costs and rising greenhouse gas emissions, attention has shifted toward the use of energy-efficient compressed air solutions. The European Union (EU) has proposed the 2030 Climate Target Plan, which proposes to raise the EU's ambition on reducing greenhouse gas emissions to at least 55% below 1990 levels by 2030.

A compressed air system is one of the key industry equipment that has to follow this energy policy. Meanwhile, easy and safe generation of compressed air is increasing the use of air compressors in various industrial applications. According to the US DOE, 50% of industrial plant air systems harbor opportunities for large energy savings with relatively low project costs. To achieve energy savings, compressed air systems require proper maintenance and high-level monitoring. This results in an enhanced life cycle of pneumatic devices and ensures higher reliability of compressed air systems.

Modern compressors can achieve long-term savings and ensure a cleaner environment. Environment-friendly compressor industry need less fuel and make less noise. Also, the modern generation air compressor systems have a heat recovery feature, which helps recover up to 94% of the heat generated by the compressors. This recovered energy can be used for pre-heating of the feedwater or air. This is a major advancement for power generation industries. The modern air system also recommends using IE4 compliant motors as they help reduce electricity consumption. All these factors have created better growth opportunities for the industrial air compressor market during the forecast period.

Challenges: Adherence to stringent quality standards

Countries such as the US, Canada, the UK, and other European countries have introduced new emission standards for compressors to improve air quality by decreasing the discharge of contaminants. The standards are regularly updated time-to-time, which may require the manufacturer to make drastic adjustments in the design and performance of the industrial air compressors. Moreover, contamination of compressed air is a severe issue for several industries such as food & beverages, healthcare, pharmaceuticals, and chemicals. A safer compressed air supply is required to uphold an efficient and cost-effective production.

The majority of the industrialized nations have imposed stringent rules and regulations, which must be adhered to during the use of compressors, to limit the emission of contaminants by air compressors and prevent health hazards due to contaminated compressed air. For instance, the US has released a Tier 4B regulation for compressor manufacturers. The US DOE is adopting new energy conservation standards for compressors, which is expressed in package isentropic efficiency (the ratio of the theoretical isentropic power required for a compression process to the actual power required for the same process). These standards would be applied to all compressors and manufactured in or imported to the US starting from January 10, 2025.

In addition, the British Compressed Air Society (UK) and British Retail Consortium (UK) have jointly designed and developed a Code of Practice for compressed air used in the food & beverages industry, to assist food manufacturers. This ensures minimum quality standards for compressed air and also defines permissible levels for dirt, water, and oil along with air quality levels as specified in ISO8573-1, the International Standard for Compressed Air purity. Furthermore, in the compressed air industry, standards may also be produced by trade associations such as PNEUROP (European Association of Manufacturers of Compressors, Vacuum Pumps, Pneumatic Tools, and Air & Condensate Treatment Equipment) and CAGI (United States Compressed Air and Gas Institute).

Market Trends

To know about the assumptions considered for the study, download the pdf brochure

By Product Type, the positive displacement segment is expected to make the largest contribution to the industrial air compressor market during the forecast period.

The positive displacement segment held the largest share of the industrial air compressor market size in 2020, and a similar trend is likely to continue in the near future. Such compressors can be bifurcated into reciprocating and rotary compressors. These compressors can be oil-free or lubricated, depending upon the application requirement. Positive displacement air compressors are commonly used in construction, automotive and transportation, packaging, food & beverages, metals and mining, and other end-user industries. These sectors are expected to experience a growth in investments, propelling the demand for positive displacement air compressors.

By Design Type, the stationary segment is expected to be the largest segment during 2021-2026.

The stationary segment accounted for a larger market share in 2020. The stationary design enables the industrial air compressors to be fixed at a specific location. The cfm rating of these air compressors is higher than portable air compressors as they can produce an enormous quantity of compressed air at a single time. The growing food & beverages, chemical, and automobile industries are likely to drive the demand for stationary industrial compressors during the forecast period.

By Pressure Type, the up to 20 bar segment is expected to grow at the fastest rate during the forecast period.

The up to 20 bar pressure segment held a larger share of the industrial air compressor market in 2020. The expanding food and beverages, and pharmaceuticals companies are rapidly investing in the deployment of such industrial air compressors. Growth in these industries during the forecast period will also drive the demand for compressors providing pressures in this range.

By Output Power, the 51–250 kW segment is expected to dominate to the market during the forecast period.

The larger share of the market in 2020 was held by the 51–250 kW segment. Compressors in this range have an approximate rated pressure in the range of 0.3–20 bar. They find applications in power generation, water and wastewater treatment plants, chemical and petrochemical industry, food & beverages industry, mining, automotive and transportation industry, packaging industry, construction, metals industry, and manufacturing, among others. Several large-scale investments in chemical projects, especially in developing countries, have contributed to an increase in demand for industrial air compressors within the 51–250 kW output power range and are expected to further increase in demand during the forecast period.

By Seal Type, the oil-flooded segment is expected to dominate to the industrial air compressor market during the forecast period.

Oil-flooded compressors use oil to lubricate the air compression chamber, lubricate parts, and seal in the air. They held a larger share of the industrial air compressor market in 2020 and are expected to maintain their lead during the forecast period. They find increasing usage as they are more economical than an oil-free compressor and generally complete the compression process in a single stage. The compressor is commonly used in industries such as oil & gas, textiles, rubber and plastics, and metals and mining, where cleaner compressed air requirement is optional.

By Coolant Type, the air-cooled segment is expected to be the largest contributor to the market during the forecast period.

An air-cooled industrial air compressor uses air to reduce the temperature of the compressed air and any other material present. Air-cooled industrial air compressors are used in different applications, such as PET mold bottles and power generation. Modern compressors are mostly air-cooled, consisting of forced ventilation, which cools the fluid with the help of blowers, heat exchangers, and others. These compressors held a larger share of the market in 2020, and their demand is expected to grow during the forecast period as well.

By End-User Industry, the chemicals & petrochemicals segment is expected to dominate the market during the forecast period.

The chemicals and petrochemical end-user industry held the largest share of the industrial air compressor market in 2020. The chemicals and petrochemicals segment is expected to be the largest consumer of industrial air compressors during the forecast period, with growing demand for chemical and petrochemical products from emerging economies. Moreover, large-scale new chemical and petrochemical projects, including expansions of current projects, are planned in the emerging economies of Asia, which are expected to drive the growth. Industrial air compressors are typically used in material handling, equipment cleaning, nitrogen generation required in many chemical processes, in the cleaning of product systems and aeration processes of products, or in mixing procedures to accelerate their drying.

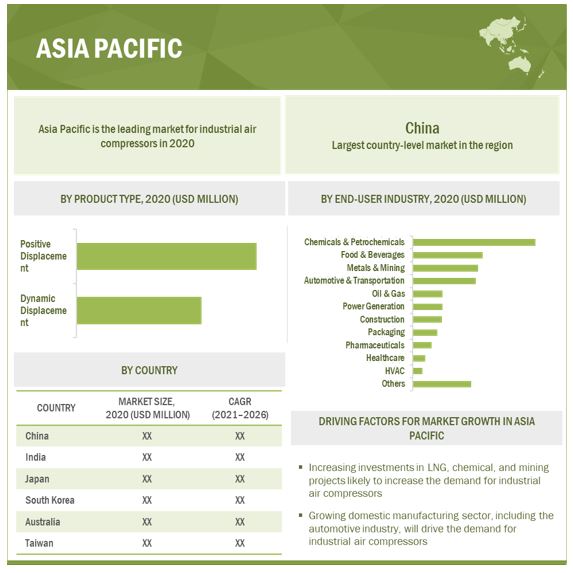

Asia Pacific is expected to be the largest market during the forecast period.

North America, Europe, South America, Asia Pacific, and Middle East & Africa are the major regions considered for the study of the industrial air compressor market. The growth of the Asia Pacific market is driven by the increasing investments in LNG, chemical, and mining projects. and the growth of the manufacturing industry.

Key Market Players

The major players in the global industrial air compressor market are Atlas Copco (Sweden), Ingersoll Rand (US), Doosan Infracore (South Korea), Hitachi (Japan), Kobe Steel (Japan), BOGE Kompressoren (Germany), Volkswagen (MAN Energy Solutions), ELGi Equipments (India), Kirloskar Pneumatic (India), Kaeser Kompressoren (Germany), Danfoss (Denmark), Coaire (UAE), Siemens Energy (Germany), Sulzer (Switzerland), Baker Hughes (US), Nidec, EBARA Corporation (Elliott Group), Howden Group (US), Fusheng Group (Taiwan), Mitsubishi Heavy Industries (Japan), Aerzener Maschinenfabrik (Germany), Hubei Teweite Power Technology (China), SungShin Compressor (South Korea), Air Squared (US), Oasis Manufacturing (US), Saimona Compressor (India), VMAC (Canada), and others.

Scope of the report

|

Report Attributes |

Details |

|

Market size value in 2021: |

USD 32.7 Billion |

|

Projected to reach 2026: |

USD 42.9 Billion |

|

CAGR: |

5.6% |

|

Base Year Considered: |

2020 |

|

Forecast Period: |

2021-2026 |

|

Largest Market: |

Asia Pacific |

|

Region Covered: |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Segments Covered: |

Product Type, Design, Pressure, Output Power, Seal Type, Coolant Type, and End-User Industry |

|

Companies Covered: |

Atlas Copco (Sweden), Ingersoll Rand (US), Doosan Infracore (South Korea), Hitachi (Japan), and Kobe Steel (Japan), BOGE Kompressoren (Germany), Volkswagen (MAN Energy Solutions), ELGi Equipments (India), Kirloskar Pneumatic (India), Kaeser Kompressoren (Germany), Danfoss (Denmark), Coaire (UAE), Siemens Energy (Germany), Sulzer (Switzerland), Baker Hughes (US), Nidec, EBARA Corporation (Elliott Group), Howden Group (US), Fusheng Group (Taiwan), Mitsubishi Heavy Industries (Japan), Aerzener Maschinenfabrik (Germany), Hubei Teweite Power Technology (China), SungShin Compressor (South Korea), Air Squared (US), Oasis Manufacturing (US), Saimona Compressor (India), VMAC (Canada), and others. |

This research report categorizes the industrial air compressor market based on product type, design, pressure, output power, seal type, coolant type, end-user industry, and geography.

Based on Product Type:

-

Positive Displacement

- Reciprocating

-

Rotary

- Screw

- Scroll

- Others (Vane and Lobe industrial air compressors)

-

Dynamic Displacement

- Centrifugal

- Axial

Based on Design:

- Stationary

- Portable

Based on Pressure:

- Up To 20 Bar

- 21–100 Bar

- Above 100 Bar

Based on Output Power:

- Up To 50 kW

- 51–250 kW

- 251–500 kW

- Above 500 kW

Based on Seal Type:

- Oil-flooded

- Oil-free

Based on Coolant Type:

- Air-Cooled

- Water-Cooled

Based on End-user Industry:

- Chemicals & Petrochemicals

- Food & Beverages

- Oil & Gas

- Pharmaceuticals

- Construction

- Automotive & Transportation

- Packaging (includes PET Blowing)

- Power Generation

- Healthcare

- Metals & Mining

- HVAC

- Others (Textiles, Paper & Pulp, Rubber & Plastics, Agriculture, Water & Wastewater Treatment, and Aerospace & Defense)

Based on the Geography:

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Recent Developments

- In November 2021, Atlas Copco acquired S.T.E.R.I. srl (STERI), an Italy-based compressor distributor and service provider located in Turin. The company mainly serves a wide range of local industrial companies in the Piedmont and Valle d’Aosta regions in Italy. Its range includes compressors, filters, and ancillary equipment. The business has become part of the Compressor Technique Service division within the Compressor Technique Business Area.

- In October 2021, Ingersoll Rand acquired Air Dimensions Inc. for an all-cash purchase of USD 70.5 million. Based in Deerfield Beach, Fla., Air Dimensions designs, manufactures, and sells vacuum diaphragm pumps primarily for environmental applications in high-growth, sustainable end markets, such as emission monitoring, biogas, utility, and chemical processes.

- In June 2021, Doosan Infracore (Doosan Portable Power) launched its new Evolution Series portable air compressors. These new machines are a significant technological update for Doosan portable air compressors. Three of the four models of this new line have Doosan FlexAir technology, a new feature that allows operators to adjust air pressure to a wide psi range. Two of the new models with Doosan FlexAir technology, the Doosan Evolution Series P185-HP150WDO-T4F and XP185-VHP165WDO-T4F, are in the 185 cfm class.

- In June 2021, Kobe Steel and Miura Co., Ltd., signed an agreement concerning Miura’s investment in Kobe Steel’s wholly owned subsidiary Kobelco Compressors Corporation and Kobe Steel’s investment in Miura as well as a shareholders agreement concerning Kobelco Compressors. Through integrating the standard compressor business into Kobelco Compressors and converting the company into a joint venture, Kobe Steel and Miura aim to work together to implement strategies centered on the standard compressor business and achieve synergies.

- In March 2021, Hitachi Global Life Solutions, a subsidiary of Hitachi, signed an agreement to transfer all outstanding shares of Hitachi Compressor (Thailand), Ltd., a wholly owned subsidiary in Thailand that manufactures compressors for refrigerators, to Midea Electric Trading (Singapore) Co. Pte, Ltd., a subsidiary of China's Midea Group and a trading company for home appliances sales.

Frequently Asked Questions (FAQ):

What is the current size of the industrial air compressor market?

The current market size of global market is USD 31.5 billion in 2020.

What are the major drivers?

Rapid industrialization and increasing automation in emerging economies, inflow of investments and rising demand for oil-free compressors in food & beverages industry and the surging demand from HVAC industry are the driving factors for the market.

Which is the fastest-growing region during the forecasted period?

Asia Pacific is the fastest-growing region and its growth is driven by the increasing investments in LNG, chemical, and mining projects. and the growth of the manufacturing industry.

Which is the largest segment, by end-user industry during the forecasted period?

The chemicals and petrochemicals end-user industry held the largest share of market during the forecast period, as a result growing demand for chemical and petrochemical products from emerging economies. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 OBJECTIVES OF THE STUDY

1.2 DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 INDUSTRIAL AIR COMPRESSOR MARKET, BY PRODUCT TYPE

1.3.2 MARKET, BY PRESSURE

1.3.3 MARKET, BY OUTPUT POWER

1.3.4 MARKET, BY COOLANT TYPE

1.3.5 MARKET, BY SEAL TYPE

1.3.6 MARKET, BY END-USER INDUSTRY

1.4 MARKET SCOPE

FIGURE 1 INDUSTRIAL AIR COMPRESSOR MARKET SEGMENTATION

1.4.1 REGIONAL SCOPE

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 2 INDUSTRIAL AIR COMPRESSOR MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

2.3 IMPACT OF COVID-19 ON INDUSTRY

2.4 SCOPE

FIGURE 4 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR INDUSTRIAL AIR COMPRESSORS

2.5 MARKET SIZE ESTIMATION

2.5.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.5.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5.3 DEMAND-SIDE ANALYSIS

2.5.3.1 Regional analysis

2.5.3.2 Country analysis

2.5.3.3 Assumptions for demand-side

2.5.3.4 Calculation for demand-side

2.5.4 SUPPLY-SIDE ANALYSIS

FIGURE 7 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF INDUSTRIAL AIR COMPRESSORS

FIGURE 8 MARKET: SUPPLY-SIDE ANALYSIS

2.5.4.1 Supply-side calculation

2.5.4.2 Assumptions for supply-side

FIGURE 9 COMPANY REVENUE ANALYSIS, 2020

2.5.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 57)

TABLE 1 INDUSTRIAL AIR COMPRESSOR MARKET SNAPSHOT

FIGURE 10 ASIA PACIFIC DOMINATED MARKET IN 2020

FIGURE 11 POSITIVE DISPLACEMENT TYPE TO ACCOUNT FOR LARGEST SHARE OF MARKET, BY PRODUCT TYPE, FROM 2021 TO 2026

FIGURE 12 RECIPROCATING TYPE TO LEAD MARKET, FROM 2021 TO 2026

FIGURE 13 SCREW TYPE TO LEAD MARKET, FROM 2021 TO 2026

FIGURE 14 CENTRIFUGAL TYPE TO LEAD MARKET, FROM 2021 TO 2026

FIGURE 15 STATIONARY SEGMENT TO HOLD LARGER SHARE OF MARKET, BY DESIGN, FROM 2021 TO 2026

FIGURE 16 UP TO 20 BAR SEGMENT TO ACCOUNT FOR LARGER SHARE OF MARKET, BY PRESSURE, FROM 2021 TO 2026

FIGURE 17 51—250 KW SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET, BY OUTPUT POWER, FROM 2021 TO 2026

FIGURE 18 OIL-FLOODED SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET, BY SEAL TYPE, FROM 2021 TO 2026

FIGURE 19 AIR-COOLED SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET, BY COOLANT TYPE, FROM 2021 TO 2026

FIGURE 20 CHEMICAL & PETROCHEMICAL INDUSTRY TO ACCOUNT FOR LARGEST SHARE OF MARKET, BY END-USER INDUSTRY, FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 66)

4.1 ATTRACTIVE OPPORTUNITIES IN INDUSTRIAL AIR COMPRESSOR MARKET

FIGURE 21 RAPID INDUSTRIALIZATION AND GROWTH IN AUTOMATION IN EMERGING ECONOMIES TO DRIVE GROWTH OF MARKET BETWEEN 2021 AND 2026

4.2 MARKET, BY REGION

FIGURE 22 ASIA PACIFIC MARKET TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

4.3 ASIA PACIFIC MARKET, BY END-USER INDUSTRY AND COUNTRY

FIGURE 23 CHEMICAL & PETROCHEMICAL END-USER INDUSTRY AND CHINA HELD LARGEST SHARES OF MARKET IN ASIA PACIFIC IN 2020

4.4 MARKET, BY PRODUCT TYPE

FIGURE 24 POSITIVE DISPLACEMENT TYPE TO ACCOUNT FOR LARGEST MARKET SHARE, BY PRODUCT TYPE, BY 2026

FIGURE 25 ROTARY TYPE TO ACCOUNT FOR LARGEST MARKET SHARE, BY POSITIVE DISPLACEMENT PRODUCT TYPE, BY 2026

FIGURE 26 SCREW TYPE TO ACCOUNT FOR LARGEST MARKET SHARE, BY ROTARY INDUSTRIAL AIR COMPRESSOR TYPE, BY 2026

FIGURE 27 CENTRIFUGAL TYPE TO ACCOUNT FOR LARGEST MARKET SHARE, BY DYNAMIC DISPLACEMENT PRODUCT TYPE, BY 2026

4.5 MARKET, BY DESIGN

FIGURE 28 STATIONARY SEGMENT TO DOMINATE MARKET, BY USAGE TYPE, IN 2026

4.6 MARKET, BY PRESSURE

FIGURE 29 UP TO 20 BAR SEGMENT TO HOLD LARGEST SHARE OF MARKET, BY PRESSURE, IN 2026

4.7 MARKET, BY OUTPUT POWER

FIGURE 30 51—250 KW SEGMENT TO DOMINATE MARKET, BY OUTPUT POWER, IN 2026

4.8 MARKET, BY SEAL TYPE

FIGURE 31 OIL-FLOODED SEGMENT TO DOMINATE MARKET, BY SEAL TYPE, IN 2026

4.9 MARKET, BY COOLANT TYPE

FIGURE 32 AIR-COOLED SEGMENT TO HOLD LARGER SHARE OF MARKET, BY COOLANT TYPE, IN 2026

4.10 MARKET, BY END-USER INDUSTRY

FIGURE 33 CHEMICALS & PETROCHEMICALS SEGMENT TO DOMINATE MARKET, BY END-USER INDUSTRY, IN 2026

5 MARKET OVERVIEW (Page No. - 73)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 34 GLOBAL PROPAGATION OF COVID-19

FIGURE 35 PROPAGATION OF COVID-19 CASES IN SELECTED COUNTRIES

5.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 36 REVISED GDP FOR SELECTED G20 COUNTRIES IN 2020

5.4 MARKET DYNAMICS

FIGURE 37 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.4.1 DRIVERS

5.4.1.1 Rapid industrialization and increasing automation in emerging economies

TABLE 2 INDUSTRIAL SECTOR USES OF COMPRESSED AIR

FIGURE 38 GLOBAL ENERGY INVESTMENT, BY SOURCE, 2015–2021

5.4.1.2 Inflow of investments and rising demand for oil-free compressors in food & beverages industry

FIGURE 39 CAPITAL EXPENDITURE BY TOP 100 COMPANIES IN FOOD & BEVERAGES INDUSTRY, 2016–2020 (USD BILLION)

TABLE 3 ISO 8573-1:2010 COMPRESSED AIR CONTAMINANTS AND PURITY CLASSES

5.4.1.3 Surging demand from HVAC industry

FIGURE 40 HVAC SYSTEM MARKET, 2017–2026 (USD BILLION)

5.4.2 RESTRAINTS

5.4.2.1 Increased financial losses, equipment downtime, and unnecessary capacity additions associated with air leaks

5.4.2.2 High maintenance costs and total cost of ownership

5.4.3 OPPORTUNITIES

5.4.3.1 Increasing demand for energy-efficient air compressors

5.4.3.2 Rapid transformation of IoT in compressed air industry

5.4.3.3 Initiatives to set up new gas transportation infrastructure and upgrade existing infrastructure

TABLE 4 LIST OF NATURAL GAS PIPELINE PROJECTS IN US

5.4.3.4 Growing adoption of HVAC systems in Asia Pacific

5.4.4 CHALLENGES

5.4.4.1 Adherence to stringent quality standards

TABLE 5 INDUSTRY STANDARDS FOR INDUSTRIAL AIR COMPRESSORS IN EUROPE AND US

5.4.4.2 Reducing noise pollution and enabling quieter operations

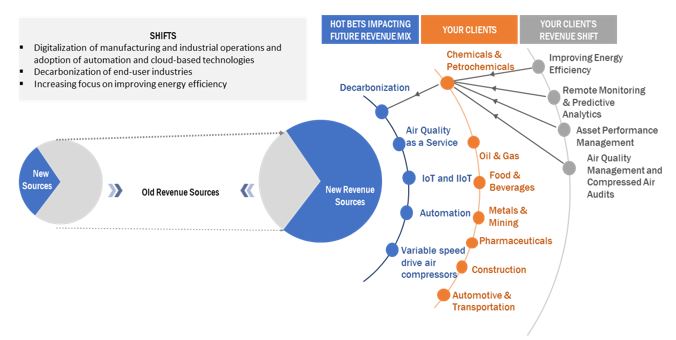

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR INDUSTRIAL AIR COMPRESSOR PROVIDERS

FIGURE 41 REVENUE SHIFT FOR INDUSTRIAL AIR COMPRESSOR PROVIDERS

5.6 MARKET MAP

FIGURE 42 GMARKET MAP: MARKET

TABLE 6 MARKET: ROLE IN ECOSYSTEM

5.7 VALUE CHAIN ANALYSIS

FIGURE 43 VALUE CHAIN ANALYSIS: MARKET

5.7.1 RAW MATERIAL PROVIDERS/SUPPLIERS

5.7.2 COMPONENT MANUFACTURERS

5.7.3 INDUSTRIAL AIR COMPRESSOR MANUFACTURERS/ASSEMBLERS

5.7.4 DISTRIBUTORS (BUYERS)/END USERS

5.7.5 POST-SALES SERVICES

5.8 TECHNOLOGY ANALYSIS

5.8.1 IOT-CONNECTED INDUSTRIAL AIR COMPRESSORS

5.9 AVERAGE SELLING PRICES

TABLE 7 AVERAGE SELLING PRICES OF INDUSTRIAL AIR COMPRESSORS IN INDIA, 2020

5.10 TARIFFS, CODES, & REGULATIONS

5.10.1 TARIFFS RELATED TO INDUSTRIAL AIR COMPRESSORS

TABLE 8 IMPORT TARIFFS FOR HS 8414 AIR OR VACUUM PUMPS, AIR OR OTHER GAS COMPRESSORS AND FANS; VENTILATING OR RECYCLING HOODS INCORPORATING A FAN, WHETHER OR NOT FITTED WITH FILTERS IN 2019

5.10.2 CODE AND REGULATIONS RELATED TO INDUSTRIAL AIR COMPRESSORS

TABLE 9 INDUSTRIAL AIR COMPRESSOR: CODES AND REGULATIONS

5.11 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 10 INDUSTRIAL AIR COMPRESSOR: INNOVATIONS AND PATENT REGISTRATIONS, JUNE 2017–AUGUST 2021

5.12 PORTER’S FIVE FORCES ANALYSIS

FIGURE 44 PORTER’S FIVE FORCES ANALYSIS FOR MARKET

TABLE 11 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT OF SUBSTITUTES

5.12.2 BARGAINING POWER OF SUPPLIERS

5.12.3 BARGAINING POWER OF BUYERS

5.12.4 THREAT OF NEW ENTRANTS

5.12.5 INTENSITY OF COMPETITIVE RIVALRY

5.13 CASE STUDY ANALYSIS

5.13.1 BOGE KOMPRESSOREN PROVIDES INDUSTRIAL AIR COMPRESSORS FOR PRODUCTION OF PET BOTTLES AT FONTI DI VINADIO SPA

5.13.1.1 Problem Statement

5.13.1.2 Solution

5.13.2 BOGE KOMPRESSOREN PROVIDES COMPRESSORS FOR AN EFFICIENT SUPPLY OF WORKING AIR FOR METAL-FORMING OPERATIONS

5.13.2.1 Problem Statement

5.13.2.2 Solution

5.13.3 AIR TECHNOLOGIES PROVIDES NEW COMPRESSOR THAT HELPS AUTOMOTOVE MANUFACTURERS TO IMPROVE PLANT OPERATIONS

5.13.3.1 Problem Statement

5.13.3.2 Solution

5.13.4 BOGE KOMPRESSOREN PROVIDED COMPRESSED AIR FOR FILLING BREWERY KEGS AT BLACK SHEEP BREWERY

5.13.4.1 Problem Statement

5.13.4.2 Solution

6 INDUSTRIAL AIR COMPRESSOR MARKET, BY PRODUCT TYPE (Page No. - 107)

6.1 INTRODUCTION

FIGURE 45 INDUSTRIAL AIR COMPRESSOR MARKET, BY PRODUCT TYPE, 2020

TABLE 12 MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 13 MARKET VOLUME, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

6.2 POSITIVE DISPLACEMENT

6.2.1 GROWING DEMAND FROM CONSTRUCTION, AUTOMOTIVE & TRANSPORTATION, PACKAGING, METALS & MINING, AND OTHER END-USER INDUSTRIES LIKELY TO FUEL GROWTH OF MARKET

FIGURE 46 POSITIVE DISPLACEMENT MARKET, BY TYPE, 2020

TABLE 14 POSITIVE DISPLACEMENT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 15 POSITIVE DISPLACEMENT MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.2.1.1 Reciprocating

TABLE 16 RECIPROCATING MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.2.1.2 Rotary

6.2.1.2.1 Screw

6.2.1.2.2 Scroll

6.2.1.2.3 Others

TABLE 17 ROTARY MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 18 ROTARY MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3 DYNAMIC DISPLACEMENT

6.3.1 LOWER MAINTENANCE, HIGH FLOW CAPACITIES, AND HIGH ENERGY & COMPRESSION EFFICIENCIES DRIVING GROWTH OF DYNAMIC DISPLACEMENT INDUSTRIAL AIR COMPRESSORS

FIGURE 47 DYNAMIC DISPLACEMENT MARKET, BY TYPE, 2020

TABLE 19 DYNAMIC DISPLACEMENT MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 20 DYNAMIC DISPLACEMENT MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.1.1 Centrifugal

TABLE 21 CENTRIFUGAL MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.1.2 Axial

TABLE 22 AXIAL MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7 INDUSTRIAL AIR COMPRESSOR MARKET, BY DESIGN (Page No. - 118)

7.1 INTRODUCTION

FIGURE 48 INDUSTRIAL AIR COMPRESSOR MARKET, BY DESIGN, 2020

TABLE 23 MARKET SIZE, BY DESIGN, 2019–2026 (USD MILLION)

7.2 STATIONARY

7.2.1 GROWING FOOD & BEVERAGES, CHEMICALS, AND AUTOMOBILE INDUSTRIES LIKELY TO FUEL DEMAND FOR STATIONARY INDUSTRIAL AIR COMPRESSORS

TABLE 24 STATIONARY MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7.3 PORTABLE

7.3.1 USE OF LOW-EMISSION ENGINE TECHNOLOGY AND ACCESSIBILITY TO REMOTE LOCATIONS DRIVING GROWTH FOR PORTABLE INDUSTRIAL AIR COMPRESSORS

TABLE 25 PORTABLE MARKET, BY REGION, 2019–2026 (USD MILLION)

8 INDUSTRIAL AIR COMPRESSOR MARKET, BY PRESSURE (Page No. - 122)

8.1 INTRODUCTION

FIGURE 49 INDUSTRIAL AIR COMPRESSOR MARKET, BY PRESSURE, 2020

TABLE 26 MARKET SIZE, BY PRESSURE, 2019–2026 (USD MILLION)

8.2 UP TO 20 BAR

8.2.1 GROWING APPLICATIONS OF UP TO 20 BAR COMPRESSORS IN PNEUMATIC TOOLS, CONTROLS, AND OTHER AUTOMATION SYSTEMS IN AUTOMOTIVE, AND FOOD & BEVERAGES LIKELY TO FUEL DEMAND FOR SEGMENT

TABLE 27 UP TO 20 BAR: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.3 21–100 BAR

8.3.1 INCREASING DEMAND FROM CHEMICALS, PETROCHEMICALS, FERTILIZERS, AND OTHER PROCESS INDUSTRIES EXPECTED TO DRIVE GROWTH FOR 21–100 BAR INDUSTRIAL AIR COMPRESSORS

TABLE 28 21–100 BAR: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

8.4 ABOVE 100 BAR

8.4.1 INCREASING DEMAND FOR GAS DISTRIBUTION AND SURGING ADOPTION OF ENHANCED OIL RECOVERY TECHNIQUES EXPECTED TO BOOST GROWTH OF MARKET

TABLE 29 ABOVE 100 BAR: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9 INDUSTRIAL AIR COMPRESSOR MARKET, BY OUTPUT POWER (Page No. - 127)

9.1 INTRODUCTION

FIGURE 50 MARKET, BY OUTPUT POWER, 2020

TABLE 30 MARKET SIZE, BY OUTPUT POWER, 2019–2026 (USD MILLION)

9.2 UP TO 50 KW

9.2.1 GROWING APPLICATIONS IN CONSTRUCTION, AUTOMOTIVE, FOOD & BEVERAGES, HEALTHCARE, AND PHARMACEUTICAL INDUSTRIES LIKELY TO FUEL DEMAND FOR UP TO 50 KW COMPRESSORS

TABLE 31 UP TO 50 KW: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.3 51–250 KW

9.3.1 INCREASING DEMAND FOR CHEMICALS AND OTHER PROCESS INDUSTRIES IN EMERGING COUNTRIES EXPECTED TO DRIVE GROWTH FOR 51–250 KW INDUSTRIAL AIR COMPRESSORS

TABLE 32 51–250 KW: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.4 251–500 KW

9.4.1 GROWING DEMAND FOR HVAC EXPECTED TO BOOST GROWTH OF MARKET

TABLE 33 251–500 KW: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.5 ABOVE 500 KW

9.5.1 INCREASING LNG STORAGE CAPACITY AND GROWING DEMAND FROM PETROCHEMICAL INDUSTRY EXPECTED TO BOOST MARKET GROWTH

TABLE 34 ABOVE 500 KW: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10 INDUSTRIAL AIR COMPRESSOR MARKET, BY SEAL TYPE (Page No. - 133)

10.1 INTRODUCTION

FIGURE 51 MARKET, BY SEAL TYPE, 2020

TABLE 35 MARKET SIZE, BY SEAL TYPE, 2019–2026 (USD MILLION)

10.2 OIL-FLOODED

10.2.1 LOWER INITIAL AND MAINTENANCE COSTS AND LONGER EQUIPMENT LIFE SPANS OF OIL-FLOODED INDUSTRIAL AIR COMPRESSORS LIKELY TO FUEL GROWTH OF MARKET

TABLE 36 OIL-FLOODED MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

10.3 OIL-FREE

10.3.1 INCREASING USE IN FOOD & BEVERAGES, CHEMICALS, PHARMACEUTICALS, AND HEALTHCARE SECTORS DRIVING GROWTH FOR OIL-FREE INDUSTRIAL AIR COMPRESSORS

TABLE 37 OIL-FREE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11 INDUSTRIAL AIR COMPRESSOR MARKET, BY COOLANT TYPE (Page No. - 137)

11.1 INTRODUCTION

FIGURE 52 MARKET, BY COOLANT TYPE, 2020

TABLE 38 MARKET SIZE, BY COOLANT TYPE, 2019–2026 (USD MILLION)

11.2 AIR-COOLED

11.2.1 TECHNOLOGICAL ADVANCEMENTS IN DESIGN OF AIR-COOLED INDUSTRIAL AIR COMPRESSORS LIKELY TO FUEL MARKET GROWTH

TABLE 39 AIR-COOLED MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

11.3 WATER-COOLED

11.3.1 LOWER POWER REQUIREMENTS AND INCREASED EFFICIENCY DRIVING GROWTH FOR WATER-COOLED INDUSTRIAL AIR COMPRESSORS

TABLE 40 WATER-COOLED MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

12 INDUSTRIAL AIR COMPRESSOR MARKET, BY END-USER INDUSTRY (Page No. - 141)

12.1 INTRODUCTION

FIGURE 53 INDUSTRIAL AIR COMPRESSOR MARKET, BY END-USER INDUSTRY, 2020

TABLE 41 MARKET SIZE, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

12.2 CHEMICALS & PETROCHEMICALS

12.2.1 INCREASING INVESTMENTS IN DOWNSTREAM OIL & GAS AND PETROCHEMICAL INDUSTRIES ALONG WITH MANUFACTURING CAPACITY EXPANSIONS IN CHEMICALS INDUSTRY LIKELY TO FUEL DEMAND FOR UP TO 20 BAR COMPRESSORS

TABLE 42 CHEMICALS & PETROCHEMICALS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

12.3 FOOD & BEVERAGES

12.3.1 INCREASING DEMAND FOR OIL-FREE COMPRESSED AIR EXPECTED TO DRIVE GROWTH OF INDUSTRIAL AIR COMPRESSORS IN FOOD & BEVERAGES INDUSTRY

TABLE 43 FOOD & BEVERAGES: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

12.4 OIL & GAS

12.4.1 INCREASING ADOPTON OF INDUSTRIAL AIR COMPRESSORS FOR ONSHORE AND OFFSHORE DRILLING, GAS COMPRESSION, AND PIPELINE AND PROCESS SERVICES (PPS) EXPECTED TO BOOST GROWTH OF OIL & GAS SEGMENT

TABLE 44 OIL & GAS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

12.5 PHARMACEUTICALS

12.5.1 SURGING DEMAND FOR CLASS “0” OIL-FREE AIR TO PREVENT RISK OF CONTAMINATION LIKELY TO FUEL DEMAND FOR PHARMACEUTICALS SEGMENT

TABLE 45 PHARMACEUTICALS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

12.6 CONSTRUCTION

12.6.1 INCREASING ADOPTION OF HEAVY-DUTY PORTABLE INDUSTRIAL AIR COMPRESSORS LIKELY TO BOOST DEMAND FOR CONSTRUCTION SEGMENT

TABLE 46 CONSTRUCTION: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

12.7 AUTOMOTIVE & TRANSPORTATION

12.7.1 GROWING USE OF AUTOMATION SYSTEMS IN AUTOMOTIVE INDUSTRY LIKELY TO FUEL DEMAND FOR INDUSTRIAL AIR COMPRESSORS

TABLE 47 AUTOMOTIVE & TRANSPORTATION: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

12.8 PACKAGING (INCLUDES PET BLOWING)

12.8.1 GROWING DEMAND FOR OIL-FREE COMPRESSORS LIKELY TO DRIVE GROWTH OF PACKAGING

TABLE 48 PACKAGING (INCLUDES PET BLOWING): MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

12.9 POWER GENERATION

12.9.1 RISING DEMAND FOR POWER AND RETROFIT AND MODERNIZATION PROJECTS IN EUROPE AND NORTH AMERICA EXPECTED TO BOOST GROWTH OF POWER GENERATION SEGMENT

TABLE 49 POWER GENERATION: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

12.10 HEALTHCARE

12.10.1 GROWING DEMAND FOR COMPRESSED AIR APPLICATIONS TO DRIVE SURGICAL TOOLS AND PROVIDE CENTRAL STERILE SUPPLY LIKELY TO FUEL DEMAND FOR UP HEALTHCARE SEGMENT

TABLE 50 HEALTHCARE: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

12.11 METALS & MINING

12.11.1 INCREASING APPLICATIONS OF INDUSTRIAL AIR COMPRESSORS IN TUNNELING, EXPLORATION DRILLING, AND SMELTING EXPECTED TO BOOST DEMAND FOR METALS & MINING SEGMENT

TABLE 51 METALS & MINING: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

12.12 HVAC

12.12.1 RISING DEMAND FOR HVAC SYSTEMS IN ASIA PACIFIC, ESPECIALLY IN CHINA AND INDIA, EXPECTED TO DRIVE DEMAND FOR INDUSTRIAL AIR COMPRESSORS

TABLE 52 HVAC: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

12.13 OTHERS

TABLE 53 OTHERS: MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

13 GEOGRAPHIC ANALYSIS (Page No. - 155)

13.1 INTRODUCTION

FIGURE 54 INDUSTRIAL AIR COMPRESSOR MARKET SHARE, BY REGION, 2020 (%)

FIGURE 55 MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

TABLE 54 MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 55 MARKET VOLUME, BY REGION, 2019–2026 (MILLION UNITS)

13.2 ASIA PACIFIC

FIGURE 56 SNAPSHOT: ASIA PACIFIC MARKET

13.2.1 BY PRODUCT TYPE

TABLE 56 ASIA PACIFIC: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 57 ASIA PACIFIC: MARKET VOLUME, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

TABLE 58 ASIA PACIFIC: MARKET SIZE FOR POSITIVE DISPLACEMENT, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET SIZE FOR ROTARY, BY TYPE, 2019–2026 (USD MILLION)

TABLE 60 ASIA PACIFIC: MARKET SIZE FOR DYNAMIC DISPLACEMENT, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

13.2.2 BY DESIGN

TABLE 61 ASIA PACIFIC: MARKET SIZE, BY DESIGN, 2019–2026 (USD MILLION)

13.2.3 BY PRESSURE

TABLE 62 ASIA PACIFIC: MARKET SIZE, BY PRESSURE, 2019–2026 (USD MILLION)

13.2.4 BY OUTPUT POWER

TABLE 63 ASIA PACIFIC: MARKET SIZE, BY OUTPUT POWER, 2019–2026 (USD MILLION)

13.2.5 BY SEAL TYPE

TABLE 64 ASIA PACIFIC: MARKET SIZE, BY SEAL TYPE, 2019–2026 (USD MILLION)

13.2.6 BY COOLANT TYPE

TABLE 65 ASIA PACIFIC: MARKET SIZE, BY COOLANT TYPE, 2019–2026 (USD MILLION)

13.2.7 BY END-USER INDUSTRY

TABLE 66 ASIA PACIFIC: MARKET SIZE, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.2.8 BY COUNTRY

TABLE 67 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

13.2.8.1 China

13.2.8.1.1 LNG capacity addition, new carbon capture, utilization, and storage projects along with growth of EV industry to fuel market in China

TABLE 68 CHINA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.2.8.2 Australia

13.2.8.2.1 Industry-friendly government policies for lithium mining and water and wastewater treatment, as well as increasing investments in hydrogen production, to drive growth of market in Australia

TABLE 69 AUSTRALIA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.2.8.3 India

13.2.8.3.1 Government initiatives to increase investments in manufacturing sector, as well as growth of chemical, healthcare, and pharmaceutical industry, to fuel growth of market in India

TABLE 70 INDIA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.2.8.4 Japan

13.2.8.4.1 Increasing investments in food & beverages sector, sustained growth of manufacturing industry, and demand for LNG to drive market in Japan

TABLE 71 JAPAN: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.2.8.5 South Korea

13.2.8.5.1 Growth of steel, chemical, and construction industries in South Korea to drive growth of market

TABLE 72 SOUTH KOREA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.2.8.6 Taiwan

13.2.8.6.1 Growing need for semiconductor chips and increasing LNG receiving capacity to meet energy demand to propel growth of market in Taiwan

TABLE 73 TAIWAN: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.2.8.7 Rest of Asia Pacific

TABLE 74 REST OF AISA PACIFIC: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.3 NORTH AMERICA

FIGURE 57 SNAPSHOT: NORTH AMERICAN MARKET

13.3.1 BY PRODUCT TYPE

TABLE 75 NORTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET VOLUME, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

TABLE 77 NORTH AMERICA: MARKET SIZE FOR POSITIVE DISPLACEMENT, BY TYPE, 2019–2026 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE FOR ROTARY, BY TYPE, 2019–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE FOR DYNAMIC DISPLACEMENT, BY TYPE, 2019–2026 (USD MILLION)

13.3.2 BY DESIGN

TABLE 80 NORTH AMERICA: MARKET SIZE, BY DESIGN, 2019–2026 (USD MILLION)

13.3.3 BY PRESSURE

TABLE 81 NORTH AMERICA: MARKET SIZE, BY PRESSURE, 2019–2026 (USD MILLION)

13.3.4 BY OUTPUT POWER

TABLE 82 NORTH AMERICA: MARKET SIZE, BY OUTPUT POWER, 2019–2026 (USD MILLION)

13.3.5 BY SEAL TYPE

TABLE 83 NORTH AMERICA: MARKET SIZE, BY SEAL TYPE, 2019–2026 (USD MILLION)

13.3.6 BY COOLANT TYPE

TABLE 84 NORTH AMERICA: MARKET SIZE, BY COOLANT TYPE, 2019–2026 (USD MILLION)

13.3.7 BY END-USER INDUSTRY

TABLE 85 NORTH AMERICA: MARKET SIZE, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.3.8 BY COUNTRY

TABLE 86 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

13.3.8.1 US

13.3.8.1.1 Increasing investments in automotive sector and surge in demand for food & beverages, petroleum, and chemical products to drive growth of market in US

TABLE 87 US: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.3.8.2 Canada

13.3.8.2.1 Increasing focus on oil & gas and water treatment plants expected to boost demand for industrial air compressors in Canada

TABLE 88 CANADA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.3.8.3 Mexico

13.3.8.3.1 Increasing investments in oil & gas and automotive industry will drive growth of market in Mexico

TABLE 89 MEXICO: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.4 EUROPE

13.4.1 BY PRODUCT TYPE

TABLE 90 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 91 EUROPE: MARKET VOLUME, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

TABLE 92 EUROPE: MARKET SIZE FOR POSITIVE DISPLACEMENT, BY TYPE, 2019–2026 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE FOR ROTARY, BY TYPE, 2019–2026 (USD MILLION)

TABLE 94 EUROPE: MARKET SIZE FOR DYNAMIC DISPLACEMENT, BY TYPE, 2019–2026 (USD MILLION)

13.4.2 BY DESIGN

TABLE 95 EUROPE: MARKET SIZE, BY DESIGN, 2019–2026 (USD MILLION)

13.4.3 BY PRESSURE

TABLE 96 EUROPE: MARKET SIZE, BY PRESSURE, 2019–2026 (USD MILLION)

13.4.4 BY OUTPUT POWER

TABLE 97 EUROPE: MARKET SIZE, BY OUTPUT POWER, 2019–2026 (USD MILLION)

13.4.5 BY SEAL TYPE

TABLE 98 EUROPE: MARKET SIZE, BY SEAL TYPE, 2019–2026 (USD MILLION)

13.4.6 BY COOLANT TYPE

TABLE 99 EUROPE: MARKET SIZE, BY COOLANT TYPE, 2019–2026 (USD MILLION)

13.4.7 BY END-USER INDUSTRY

TABLE 100 EUROPE: MARKET SIZE, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.4.8 BY COUNTRY

TABLE 101 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

13.4.8.1 Germany

13.4.8.1.1 Growth of water & wastewater treatment and chemical industries are prominent drivers for market in Germany

TABLE 102 GERMANY: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.4.8.2 UK

13.4.8.2.1 Growing demand from LNG market and for EV vehicles to increase deployment of industrial air compressors in UK

TABLE 103 UK: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.4.8.3 Italy

13.4.8.3.1 Rise in demand from crude steel and water treatment plants leading to growth of market in Italy

TABLE 104 ITALY: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.4.8.4 France

13.4.8.4.1 Rising demand for carbon fiber in chemical industry increases deployment of industrial air compressors in France

TABLE 105 FRANCE: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.4.8.5 Spain

13.4.8.5.1 Growing hydrocarbon and chemical sectors will drive growth of industrial air compressors in Spain

TABLE 106 SPAIN: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.4.8.6 Russia

13.4.8.6.1 Increasing production of oil and mining activities will lead to growth of market in Russia

TABLE 107 RUSSIA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.4.8.7 Rest of Europe

TABLE 108 REST OF EUROPE: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.5 MIDDLE EAST & AFRICA

13.5.1 BY PRODUCT TYPE

TABLE 109 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 110 MIDDLE EAST & AFRICA: MARKET VOLUME, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

TABLE 111 MIDDLE EAST & AFRICA: MARKET SIZE FOR POSITIVE DISPLACEMENT, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 112 MIDDLE EAST & AFRICA: MARKET SIZE FOR ROTARY, BY TYPE, 2019–2026 (USD MILLION)

TABLE 113 MIDDLE EAST & AFRICA: MARKET SIZE FOR DYNAMIC DISPLACEMENT, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

13.5.2 BY DESIGN

TABLE 114 MIDDLE EAST & AFRICA: MARKET SIZE, BY DESIGN, 2019–2026 (USD MILLION)

13.5.3 BY PRESSURE

TABLE 115 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRESSURE, 2019–2026 (USD MILLION)

13.5.4 BY OUTPUT POWER

TABLE 116 MIDDLE EAST & AFRICA: MARKET SIZE, BY OUTPUT POWER, 2019–2026 (USD MILLION)

13.5.5 BY SEAL TYPE

TABLE 117 MIDDLE EAST & AFRICA: MARKET SIZE, BY SEAL TYPE, 2019–2026 (USD MILLION)

13.5.6 BY COOLANT TYPE

TABLE 118 MIDDLE EAST & AFRICA: MARKET SIZE, BY COOLANT TYPE, 2019–2026 (USD MILLION)

13.5.7 BY END-USER INDUSTRY

TABLE 119 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.5.8 BY COUNTRY

TABLE 120 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

13.5.8.1 Saudi Arabia

13.5.8.1.1 Growing crude oil production is a prominent driver for market in Saudi Arabia

TABLE 121 SAUDI ARABIA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.5.8.2 UAE

13.5.8.2.1 Growing application in mature oil & gas fields and water treatment plants leading to growth of market in UAE

TABLE 122 UAE: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.5.8.3 South Africa

13.5.8.3.1 Developing automotive industry and mining activities will lead to growth of market in South Africa

TABLE 123 SOUTH AFRICA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.5.8.4 Rest of Middle East & Africa

TABLE 124 REST OF MIDDLE EAST & AFRICA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.6 SOUTH AMERICA

13.6.1 BY PRODUCT TYPE

TABLE 125 SOUTH AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 126 SOUTH AMERICA: MARKET VOLUME, BY PRODUCT TYPE, 2019–2026 (MILLION UNITS)

TABLE 127 SOUTH AMERICA: MARKET SIZE FOR POSITIVE DISPLACEMENT, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

TABLE 128 SOUTH AMERICA: MARKET SIZE FOR ROTARY, BY TYPE, 2019–2026 (USD MILLION)

TABLE 129 SOUTH AMERICA: MARKET SIZE FOR DYNAMIC DISPLACEMENT, BY PRODUCT TYPE, 2019–2026 (USD MILLION)

13.6.2 BY DESIGN

TABLE 130 SOUTH AMERICA: MARKET SIZE, BY DESIGN, 2019–2026 (USD MILLION)

13.6.3 BY PRESSURE

TABLE 131 SOUTH AMERICA: MARKET SIZE, BY PRESSURE, 2019–2026 (USD MILLION)

13.6.4 BY OUTPUT POWER

TABLE 132 SOUTH AMERICA: MARKET SIZE, BY OUTPUT POWER, 2019–2026 (USD MILLION)

13.6.5 BY SEAL TYPE

TABLE 133 SOUTH AMERICA: MARKET SIZE, BY SEAL TYPE, 2019–2026 (USD MILLION)

13.6.6 BY COOLANT TYPE

TABLE 134 SOUTH AMERICA: MARKET SIZE, BY COOLANT TYPE, 2019–2026 (USD MILLION)

13.6.7 BY END-USER INDUSTRY

TABLE 135 SOUTH AMERICA: MARKET SIZE, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.6.8 BY COUNTRY

TABLE 136 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

13.6.8.1 Brazil

13.6.8.1.1 Increasing investments due to privatization in oil & gas and power generation industries to propel demand for industrial air compressors in Brazil

TABLE 137 BRAZIL: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.6.8.2 Argentina

13.6.8.2.1 Favorable government policies along with investments in food & beverages, oil & gas, mining, and wind power industries to fuel demand for industrial air compressors in Argentina

TABLE 138 ARGENTINA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

13.6.8.3 Rest of South America

TABLE 139 REST OF SOUTH AMERICA: MARKET, BY END-USER INDUSTRY, 2019–2026 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 223)

14.1 KEY PLAYERS STRATEGIES

TABLE 140 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, JANUARY 2017– DECEMBER 2021

14.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 141 MARKET: DEGREE OF COMPETITION

FIGURE 58 MARKET SHARE ANALYSIS, 2020

14.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 59 TOP PLAYERS IN MARKET FROM 2016 TO 2020

14.4 COMPANY EVALUATION QUADRANT

14.4.1 STAR

14.4.2 PERVASIVE

14.4.3 EMERGING LEADER

14.4.4 PARTICIPANT

FIGURE 60 COMPETITIVE LEADERSHIP MAPPING: MARKET, 2020

14.5 START-UP/SME EVALUATION QUADRANT, 2020

14.5.1 PROGRESSIVE COMPANY

14.5.2 RESPONSIVE COMPANY

14.5.3 DYNAMIC COMPANY

14.5.4 STARTING BLOCK

FIGURE 61 MARKET: START-UP/SME EVALUATION QUADRANT, 2020

14.6 INDUSTRIAL AIR COMPRESSOR: COMPANY FOOTPRINT

TABLE 142 BY PRODUCT TYPE: COMPANY FOOTPRINT

TABLE 143 BY REGION: COMPANY FOOTPRINT

TABLE 144 BY END-USER INDUSTRY: COMPANY FOOTPRINT

TABLE 145 COMPANY FOOTPRINT

14.7 COMPETITIVE SCENARIO

TABLE 146 MARKET: PRODUCT LAUNCHES, JUNE 2020– OCTOBER 2021

TABLE 147 INDUSTRIAL AIR COMPRESSOR: DEALS, OCTOBER 2020– SEPTEMBER 2021

TABLE 148 MARKET: OTHERS, MAY 2017 – NOVEMBER 2021

15 COMPANY PROFILES (Page No. - 243)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

15.1 KEY PLAYERS

15.1.1 ATLAS COPCO

TABLE 149 ATLAS COPCO: BUSINESS OVERVIEW

FIGURE 62 ATLAS COPCO: COMPANY SNAPSHOT, 2020

TABLE 150 ATLAS COPCO: PRODUCTS OFFERED

TABLE 151 ATLAS COPCO: PRODUCT LAUNCHES

TABLE 152 ATLAS COPCO: DEALS

TABLE 153 ATLAS COPCO: OTHERS

15.1.2 INGERSOLL RAND

TABLE 154 INGERSOLL RAND: BUSINESS OVERVIEW

FIGURE 63 INGERSOLL RAND: COMPANY SNAPSHOT, 2020

TABLE 155 INGERSOLL RAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 156 INGERSOLL RAND: PRODUCT LAUNCHES

TABLE 157 INGERSOLL RAND: DEALS

15.1.3 DOOSAN INFRACORE

TABLE 158 DOOSAN IFNRACORE: BUSINESS OVERVIEW

FIGURE 64 DOOSAN INFRACORE: COMPANY SNAPSHOT, 2020

TABLE 159 DOOSAN INFRACORE: PRODUCTS OFFERED

TABLE 160 DOOSAN INFRACORE: PRODUCT LAUNCHES

TABLE 161 DOOSAN INFRACORE: DEALS

TABLE 162 DOOSAN INFRACORE: OTHERS

15.1.4 HITACHI

TABLE 163 HITACHI: BUSINESS OVERVIEW

FIGURE 65 HITACHI: COMPANY SNAPSHOT, 2020

TABLE 164 HITACHI: PRODUCTS OFFERED

TABLE 165 HITACHI: PRODUCT LAUNCHES

TABLE 166 HITACHI: DEALS

15.1.5 KOBE STEEL

TABLE 167 KOBE STEEL: BUSINESS OVERVIEW

FIGURE 66 KOBE STEEL: COMPANY SNAPSHOT, 2020

TABLE 168 KOBE STEEL: PRODUCTS OFFERED

TABLE 169 KOBE STEEL: PRODUCT LAUNCHES

TABLE 170 KOBE STEEL: DEALS

TABLE 171 KOBE STEEL: OTHERS

15.1.6 MITSUBISHI HEAVY INDUSTRIES

TABLE 172 MITSUBISHI HEAVY INDUSTRIES: BUSINESS OVERVIEW

FIGURE 67 MITSUBISHI HEAVY INDUSTRIES: COMPANY SNAPSHOT, 2020

TABLE 173 MITSUBISHI HEAVY INDUSTRIES: PRODUCTS OFFERED

TABLE 174 MITSUBISHI HEAVY INDUSTRIES: DEALS

15.1.7 EBARA CORPORATION (ELLIOTT GROUP)

TABLE 175 EBARA CORPORATION (ELLIOTT GROUP): BUSINESS OVERVIEW

FIGURE 68 EBARA CORPORATION (ELLIOTT GROUP): COMPANY SNAPSHOT, 2020

TABLE 176 EBARA CORPORATION (ELLIOTT GROUP): PRODUCTS OFFERED

TABLE 177 EBARA CORPORATION (ELLIOTT GROUP): DEALS

TABLE 178 EBARA CORPORATION (ELLIOTT GROUP): PRODUCT LAUNCHES

15.1.8 KIRLOSKAR PNEUMATIC

TABLE 179 KIRLOSKAR PNEUMATIC: BUSINESS OVERVIEW

FIGURE 69 KIRLOSKAR PNEUMATIC: COMPANY SNAPSHOT, 2020

TABLE 180 KIRLOSKAR PNEUMATIC: PRODUCTS OFFERED

TABLE 181 KIRLOSKAR PNEUMATIC: PRODUCT LAUNCHES

TABLE 182 KIRLOSKAR PNEUMATIC: DEALS

15.1.9 VOLKSWAGEN (MAN ENERGY SOLUTIONS)

TABLE 183 VOLKSWAGEN (MAN ENERGY SOLUTIONS): BUSINESS OVERVIEW

FIGURE 70 VOLKSWAGEN (MAN ENERGY SOLUTIONS): COMPANY SNAPSHOT, 2020

TABLE 184 VOLKSWAGEN (MAN ENERGY SOLUTIONS): PRODUCTS OFFERED

TABLE 185 VOLKSWAGEN (MAN ENERGY SOLUTIONS): DEALS

TABLE 186 VOLKSWAGEN (MAN ENERGY SOLUTIONS): OTHERS

15.1.10 ELGI EQUIPMENTS

TABLE 187 ELGI EQUIPMENTS: BUSINESS OVERVIEW

FIGURE 71 ELGI EQUIPMENTS: COMPANY SNAPSHOT, 2020

TABLE 188 ELGI EQUIPMENTS: PRODUCTS OFFERED

TABLE 189 ELGI EQUIPMENTS: OTHERS

TABLE 190 ELGI EQUIPMENTS: PRODUCT LAUNCHES

15.1.11 NIDEC

TABLE 191 NIDEC: BUSINESS OVERVIEW

FIGURE 72 NIDEC: COMPANY SNAPSHOT, 2020

TABLE 192 NIDEC: PRODUCTS OFFERED

TABLE 193 NIDEC: DEALS

TABLE 194 NIDEC.: OTHERS

TABLE 195 NIDEC: PRODUCT LAUNCHES

15.1.12 SIEMENS ENERGY

TABLE 196 SIEMENS ENERGY: BUSINESS OVERVIEW

FIGURE 73 SIEMENS ENERGY: COMPANY SNAPSHOT, 2021

TABLE 197 SIEMENS ENERGY: PRODUCTS OFFERED

TABLE 198 SIEMENS ENERGY: DEALS

TABLE 199 SIEMENS ENERGY: PRODUCT LAUNCHES

TABLE 200 SIEMENS ENERGY: OTHERS

15.1.13 SULZER

TABLE 201 SULZER: BUSINESS OVERVIEW

FIGURE 74 SULZER: COMPANY SNAPSHOT, 2020

TABLE 202 SULZER: PRODUCTS OFFERED

TABLE 203 SULZER: PRODUCT LAUNCHES

TABLE 204 SULZER: DEALS

15.1.14 BAKER HUGHES

TABLE 205 BAKER HUGHES: BUSINESS OVERVIEW

FIGURE 75 BAKER HUGHES: COMPANY SNAPSHOT, 2020

TABLE 206 BAKER HUGHES: PRODUCTS OFFERED

TABLE 207 BAKER HUGHES: DEALS

TABLE 208 BAKER HUGHES: OTHERS

15.1.15 DANFOSS

TABLE 209 DANFOSS: BUSINESS OVERVIEW

FIGURE 76 DANFOSS: COMPANY SNAPSHOT, 2020

TABLE 210 DANFOSS: PRODUCTS OFFERED

TABLE 211 DANFOSS: PRODUCT LAUNCHES

15.1.16 BOGE KOMPRESSOREN

TABLE 212 BOGE KOMPRESSOREN: BUSINESS OVERVIEW

TABLE 213 BOGE KOMPRESSOREN: PRODUCTS OFFERED

TABLE 214 BOGE KOMPRESSOREN: PRODUCT LAUNCHES

TABLE 215 BOGE KOMPRESSOREN: DEALS

15.2 OTHER PLAYERS

15.2.1 SAIMONA COMPRESSOR

15.2.2 COAIRE

15.2.3 SUNGSHIN COMPRESSOR

15.2.4 KAESER KOMPRESSOREN

15.2.5 FUSHENG GROUP

15.2.6 HUBEI TEWEITE POWER TECHNOLOGY

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 364)

16.1 INSIGHTS OF INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

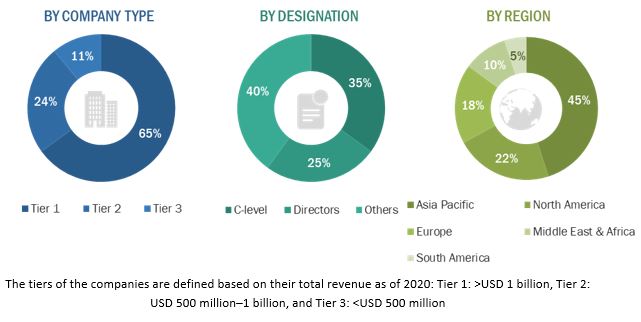

This study involved four major activities in estimating the current size of the industrial air compressor market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

The research study on the industrial air compressor market involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for this technical, market-oriented, and commercial study. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

Primary sources included several industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, standard and certification agencies of companies, and organizations related to all the segments of this industry’s value chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global industrial air compressor market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Industrial Air Compressor Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the industrial air compressor market by product type, design, pressure, output power, seal type, coolant type, end-user industry, and region based on market size and volume

- To forecast the market size for five key regions: North America, South America, Europe, Asia Pacific, and the Middle East & Africa, along with their key countries

- To provide detailed information about the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as sales contracts, agreements, investments, expansions, new product launches, alliances, mergers, partnerships, joint ventures, collaborations, and acquisitions, in the industrial air compressor market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Air Compressor Market

Rapid industrialization and increasing automation in emerging economies, inflow of investments and rising demand for oil-free compressors in food & beverages industry and the surging demand from HVAC industry are the driving factors for the industrial air compressor market. Regions Covered: Asia Pacific, North America, Europe, Middle East & Africa, South America. Country Covered: China, Australia, India, Japan, South Korea, Taiwan, US, Canada, Mexico, Germany, UK, Italy, France, Spain, Russia, Saudi Arabia, UAE, South Africa, Brazil, Argentina. Regarding your requirements on Brand level volumes of Industrial Air Compressor, my team has done the feasibility and they notified that this data is very niche and can be provided on subjected to availability. Regarding your requirements on key players in Asia Pacific & Indonesia Market, we will provide you the additional 10 company profile of the key players in Industrial Air Compressor space in Indonesia and Asia Pacific region covering their Product portfolio, Business Revenue analysis for last three years, product and business revenues, key financial analysis, organic and in-organic growth strategies, contract awarded & details of the contracts, key investments and expansions plans and all other key development including SWOT analysis.