Biopharmaceutical CDMO Market: Growth, Size, Share, and Trends

Biopharmaceutical Contract Manufacturing Market by Service (Manufacturing, Fill-Finish), Type (Drug Substance, Drug Product), Scale (Clinical), Source (Mammalian), Therapy Area (Oncology), Molecule Type (mAbs, ADC, CGT, Vaccines) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

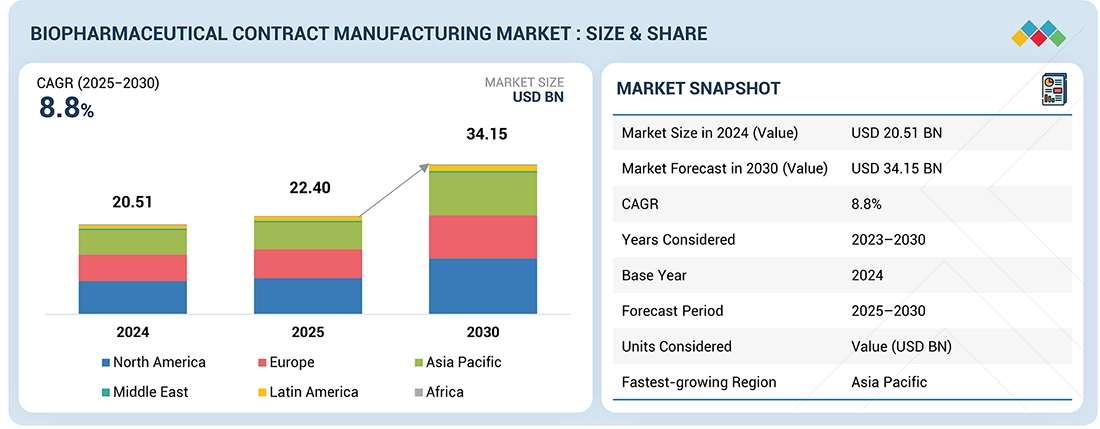

The biopharmaceutical contract manufacturing market was valued at USD 22.40 billion in 2025 and is projected to grow at a CAGR of 8.8% during the forecast period. The primary growth drivers for this market include the rising demand for biologics and a growing focus on personalized medicine. Additional factors contributing to market growth include advancements in manufacturing technologies and increasing collaborations between pharmaceutical companies and contract manufacturing organizations (CMOs) that specialize in biologics. However, concerns regarding intellectual property rights are expected to hinder the growth of this market.

KEY TAKEAWAYS

- The North America biopharmaceutical contract manufacturing market accounted for the largest share of 36.7% in 2024.

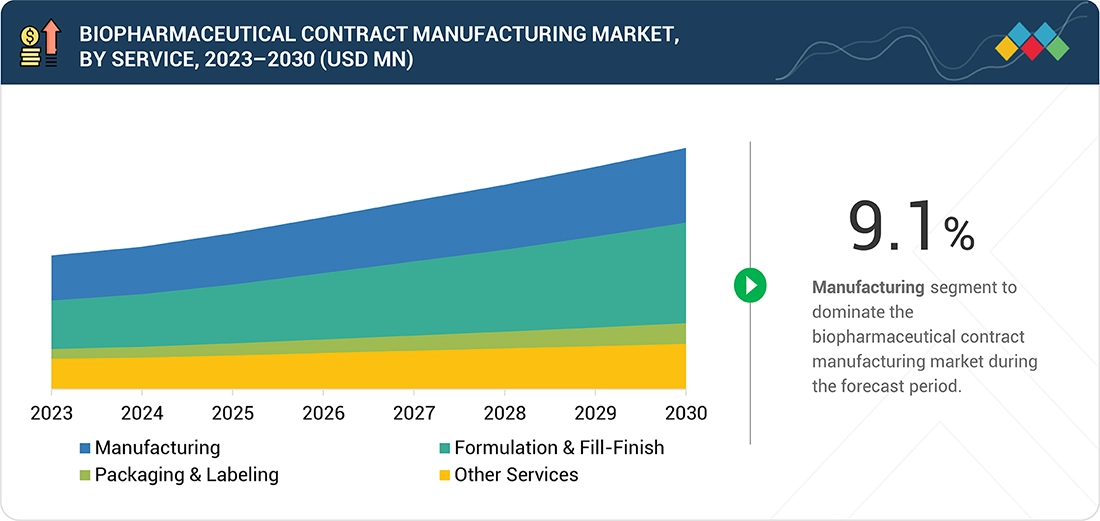

- By service, the manufacturing services segment held the largest share of 47.5% of the biopharmaceutical contract manufacturing market in 2024.

- By type, the biologic drug product manufacturing segment is expected to register the highest CAGR of 9.0%.

- Based on the scale of operation, the commercial operations segment dominated the market in 2024 and is expected to grow at the highest CAGR.

- By sources, the mammalian expression systems segment is projected to grow at the fastest rate from 2025 to 2030.

- Based on molecule type, the monoclonal antibodies segment led the market share in 2024.

- By therapeutic area, the oncology segment held the dominant position in the market in 2024.

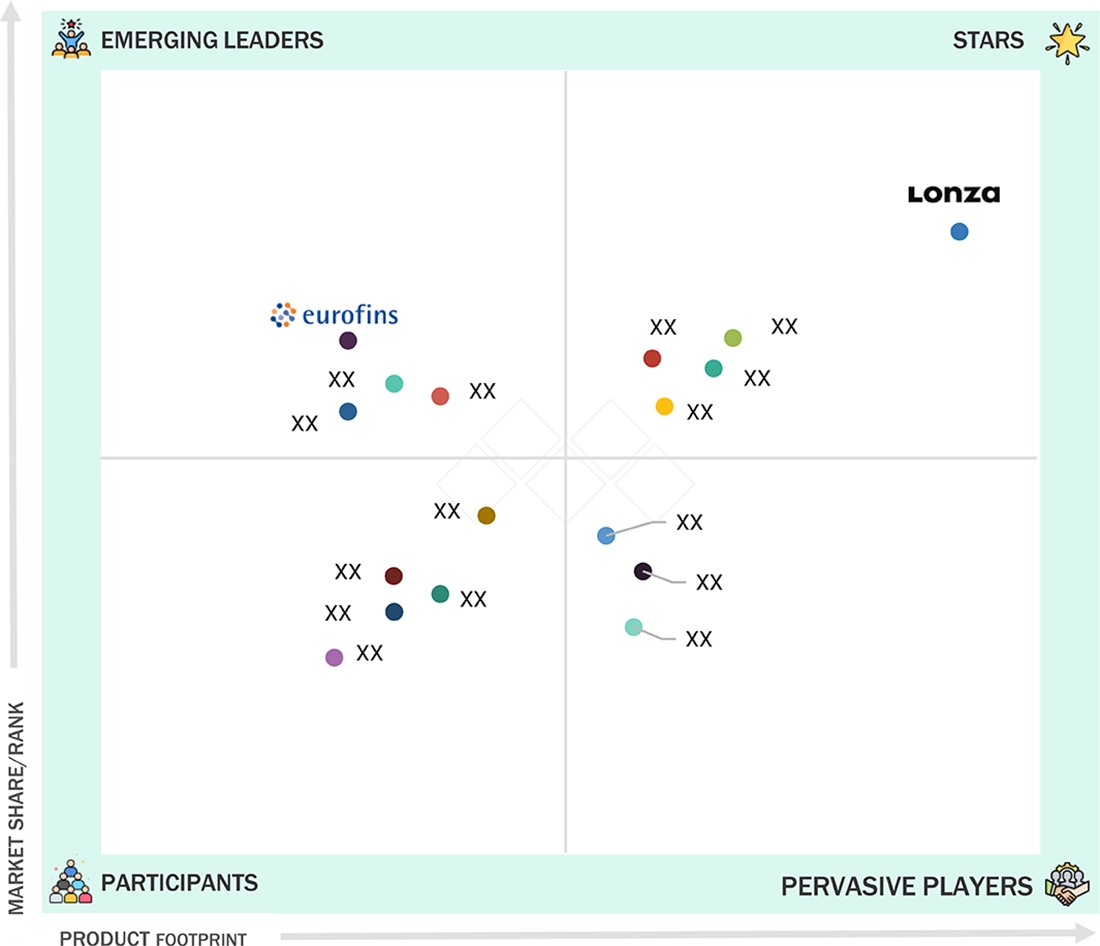

- Lonza, Thermo Fisher Scientific Inc., and WuXi Biologics were identified as Star players in the biopharmaceutical contract manufacturing market, as they have focused on innovation and have broad industry coverage and strong operational & financial strength.

- Emergent, OneSource Specialty Pharma Limited, Asymchem Inc., among others, have distinguished themselves among startups and SMEs due to their strong service portfolio and business strategy.

The biopharmaceutical contract manufacturing (CDMO) market is expanding as sponsors seek faster scale-up, lower capex, and access to specialized capabilities across mAbs, recombinant proteins, vaccines, and advanced therapies (cell/gene, mRNA). Key demand drivers include a larger, more complex pipeline, rising biologics penetration, and the shift to single-use, modular plants that shorten timelines. Capacity is tightening in selective areas—sterile fill-finish, high-potency/ADC handling, and viral vectors, supporting firm pricing and favoring partners with proven tech transfer and regulatory track records. Sponsors increasingly prefer “end-to-end” offerings from cell-line development through commercial supply, with dual-sourcing and nearshoring used to bolster resilience. Digital/PAT adoption and high-intensity upstream (e.g., perfusion) are boosting productivity, while supply risks for resins/filters and occasional insourcing by big pharma remain watch-outs.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The biopharmaceutical contract manufacturing market is driven in part by the rise of decentralized and point-of-care (POC) manufacturing. This emerging trend is especially impactful in areas like cell therapies and personalized vaccines, where speed and customization are critical. Traditional centralized manufacturing approaches often involve complex logistics and longer turnaround times, which can be a bottleneck for autologous treatments that require patient-specific processing. Decentralized manufacturing models reduce the time from production to patient delivery by enabling on-site or near-site manufacturing, which is particularly valuable in time-sensitive therapies like CAR-T.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing outsourcing of biologics manufacturing among biopharmaceutical companies

-

Rising demand for biologics & biosimilars

Level

-

Intellectual property rights issues

Level

-

Rising demand for cell & gene therapy

-

Significant growth opportunities offered by emerging markets

Level

-

Compliance challenges with regulatory reforms

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing outsourcing of biologics manufacturing among biopharmaceutical companies.

The growing use of biologics in medicine has fueled a significant rise in outsourcing. Specialized contract manufacturers have the expertise and infrastructure required to produce these complex treatments efficiently, while strictly following quality regulations. They have deep knowledge of protein chemistry, cell culture, downstream processing, and the impact of process conditions on yield and structure when moving from laboratory to GMP-scale production. As a result, biopharmaceutical companies increasingly collaborate with CDMOs and CMOs, relying on their proficiency in biologics, chemistry, and commercial manufacturing. This approach allows them to speed up the development and production of new therapies. By outsourcing clinical and commercial manufacturing, biopharmaceutical firms can reduce internal costs and mitigate risks associated with in-house production. In turn, this trend contributes to the overall growth of the biologics market.

Restraint: Intellectual property rights issues.

Safeguarding intellectual property (IP) is a critical concern in contract manufacturing. When an innovative pharmaceutical company partners with a contract manufacturer, it must disclose detailed information about its patented drug to enable production. This disclosure poses a risk of unauthorized use or replication of the proprietary formulation. Therefore, it is essential for innovator companies to establish clear agreements outlining the terms of IP usage to prevent potential infringements. Recently, outsourcing core manufacturing functions has become a growing trend, particularly in the production of complex biologics that demand specialized capabilities and infrastructure to meet personalized treatment needs. For this trend to thrive, a transparent and trustworthy relationship between pharmaceutical firms and contract manufacturing organizations (CMOs) is vital to ensuring IP protection. For example, pharmaceutical firms are outsourcing the manufacturing of complex biologics as it requires expertise and infrastructure to manufacture them in a manner that meets the requirements. For this trend to continue in the market, it is necessary to maintain an honest relationship between the pharmaceutical company and CMOs to ensure the protection of intellectual property.

Opportunity: Rising demand for cell & gene therapy.

Cell and gene therapies have emerged as highly targeted treatments with the potential to address medical needs that traditional small-molecule drugs and other biologics often cannot tackle. Their ability to treat complex or rare conditions has encouraged many pharmaceutical companies to focus on the development and commercialization of these advanced treatments. As a result, the demand for specialized manufacturing services for cell and gene therapies has surged. In 2024, 38 such treatments had already gained US FDA approval, highlighting the growing clinical success of these approaches. Meanwhile, a rapidly expanding pipeline of new candidates across various phases of clinical trials, combined with the intricate nature of their production, has further intensified the need for dedicated manufacturing facilities and expertise. The complexity and precision required to produce these treatments make it challenging for many firms to build in-house capabilities. Consequently, contract manufacturing has become an increasingly vital resource, providing a pathway for developers to scale up production, maintain quality, and meet regulatory demands. This trend is expected to drive significant growth opportunities in the contract manufacturing sector, cementing its role in the future of cell and gene therapy.

Challenge: Compliance challenges with regulatory reforms.

FDA regulations require manufacturers to adhere closely to the guidelines set by relevant regulatory authorities. Contract Manufacturing Organizations (CMOs) have the challenging responsibility of obtaining approvals from different regional authorities for the same molecule, often customizing their submissions to meet specific client and market requirements. This process is highly complex due to variations in regulations across countries and differing submission criteria. Even minor errors can create significant delays and barriers for innovators seeking to gain access to regulated markets. The challenge is further compounded by the need for CMOs to adjust their manufacturing practices to stay aligned with constantly evolving regulatory standards. As a result, CMOs must maintain deep expertise and remain vigilant to adapt quickly, ensuring their processes remain compliant across diverse global regions. This constant pressure to meet stringent, shifting regulations makes it challenging for CMOs to operate smoothly and efficiently. It also underscores their vital role in supporting pharmaceutical and biotech innovators as they navigate the path from clinical trials to successful commercialization across international markets.

Biopharmaceutical Contract Manufacturing Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Moderna collaborated CDMOs like Lonza and Thermo Fisher for large-scale mRNA drug substance manufacturing for COVID-19 vaccine and subsequent mRNA pipeline and fill-finish/packaging for commercial supply. | Rapid global scale-up, de-risked capacity via multi-site network, faster lot release and launch readiness. |

|

AstraZeneca partnered with Catalent, a biologics CDMO service Provider for sterile fill-finish and packaging of AZD1222 vaccine across regions to meet surge demand. | Speed to market via established aseptic capacity, device/packaging integration, and global cold-chain. |

|

In collaboration with ACG biologics Novartis expanded its AAV vector manufacturing capacity for commercial gene therapy (Zolgensma) supply. | Added AAV capacity and redundancy; tech-transfer into a specialized CGT network to stabilize supply. |

|

Sarepta Therapeutics and Catalent (Paragon) developed AAV viral-vector DS/DP for Duchenne gene therapy programs (clinical to launch prep). | Access to high-intensity AAV suites and experienced analytics; shortened clinical material lead times. |

|

Amgen has partnered with biologics CDMOs like Boehringer Ingelheim (BioXcellence) and Fujifilm Diosynth for Microbial & mammalian DS overflow and lifecycle support for commercial biologics. | Cost-efficient lifecycle manufacturing, dual-sourcing resilience, and proven inspection track record. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The biopharmaceutical contract manufacturing market includes various players who contribute to the development, manufacturing, and distribution of biosimilars. Key participants include raw material suppliers who provide essential components such as cell lines, cell culture media, process chemicals, bioprocessing equipment, and consumables. Contract manufacturers use these raw materials to produce biological drug substances, formulate them into drug products, fill primary containers like vials and prefilled syringes, and handle packaging, labeling, and shipping to customers. Throughout this process, contract manufacturers must ensure compliance with quality and regulatory standards. These stakeholders interact and collaborate, which facilitates progress in the research and development of biopharmaceutical contract manufacturing.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Biopharmaceutical Contract Manufacturing Market, By Service

The global biopharmaceutical contract manufacturing market is segmented by services into manufacturing, formulation and fill-finish, packaging & labeling, and other services. Among these, the manufacturing services segment has established itself as the dominant category in 2024. This segment includes contract manufacturing services such as upstream and downstream manufacturing. In the biopharmaceutical contract manufacturing process, upstream manufacturing plays a vital role as the initial step. This phase involves cultivating and manipulating living cells or microorganisms to create the desired therapeutic proteins. It begins with a selection of the right cell line and then nurturing it through cell culture and fermentation. Vector amplification, editing, and expansion are critical steps in cellular therapies and viral vector & plasmid DNA manufacturing, as they directly impact the quantity, quality, and functionality. The success of upstream manufacturing determines the quantity and quality of the biologic product, setting the stage for the rest of the manufacturing process.

Biopharmaceutical Contract Manufacturing Market, By Type

In 2024 the biologic drug substance manufacturing segment accounted for the largest share in the market. Biologic drug substance manufacturing involves creating the active ingredient of biologic drugs, which are complex molecules derived from living organisms. This process includes cultivating cells or microorganisms, engineering to produce the desired molecule, and then purifying and ensuring the quality of the final product. Strict regulatory standards must be followed to meet health authority requirements. Many pharmaceutical companies choose to outsource this intricate process to specialized contract manufacturing organizations to focus on research and development while ensuring the safety and effectiveness of biologic drugs.

Biopharmaceutical Contract Manufacturing Market, By Scale of Operation

The biopharmaceutical contract manufacturing market is segmented into clinical operations and commercial operations. The commercial operations segment accounted for the larger market share in the market in 2024. The large share of this segment can be attributed to the launch of biosimilars, growing cell & gene therapy approvals, and capacity expansion by biologic CMOs for commercial manufacturing. The commercial production of biologics is a crucial aspect of the biopharmaceutical industry, responding to the rising need for advanced medical treatments. Biologics, which are complex molecules derived from living organisms, hold promising activities for treating a variety of conditions, from cancer to autoimmune diseases. This has prompted increased research and development, leading to more biologics gaining regulatory approval. Commercial production involves upscaling the manufacturing of biologics from lab setups to larger industrial facilities. This expansion is essential to meet the growing demand for these therapies. The process includes stages such as cell culture or fermentation, purification, formulation, and final packaging and labeling. Cutting-edge facilities, advanced technologies, and strict adherence to regulations ensure the creation of safe and effective biologics.

Biopharmaceutical Contract Manufacturing Market, By Source

The biopharmaceutical contract manufacturing market is segmented into mammalian expression systems and non-mammalian expression systems such as microbial, yeast, and insects. The mammalian expression systems segment accounted for the largest market share in biopharmaceutical contract manufacturing market in 2024. Mammalian expression systems facilitate the production of a wide spectrum of biopharmaceuticals, including monoclonal antibodies, cytokines, hormones, and viral vectors for gene and cell therapies. The advantages of mammalian cells include proven post-translational modifications, correct protein folding, and improved bioactivity. These advantages are vital for producing biologics necessitating complex 3D arrangements and precise glycosylation patterns, ensuring both therapeutic effectiveness and safety. The versatility of mammalian expression has contributed significantly to its widespread adoption among end users.

Biopharmaceutical Contract Manufacturing Market, By Molecule Type

The biopharmaceutical contract manufacturing market is segmented into monoclonal antibodies, therapeutic peptides & proteins, cell & gene therapy, vaccines, ADCs, and other molecules. The monoclonal antibodies segment accounted for the largest market share in 2024. The dominance of the segment is mainly attributed to their ability to precisely target cancer cells, marking a significant advancement in the field of cancer therapy. This segment covers both innovator monoclonal antibodies and biosimilar monoclonal antibodies. The rising prevalence of diseases, increasing government initiatives for the development of monoclonal antibody drugs, and the growing number of mAb product candidates currently in development have increased the demand for contract manufacturing of this molecule type.

Biopharmaceutical Contract Manufacturing Market, By Therapeutic Area

The biopharmaceutical contract manufacturing market is segmented into oncology, autoimmune diseases, metabolic diseases, cardiovascular diseases, neurology, infectious diseases, and other therapeutic areas. The oncology segment accounted for the largest market share, followed by the autoimmune diseases segment in 2024. Biologics have significantly impacted the field of cancer treatment, offering innovative therapeutic options with targeted mechanisms of action. Biologics offer targeted and often less toxic alternatives to traditional chemotherapy. It provides more customized treatments and potentially better outcomes for cancer patients. Their development has led to advancements in precision medicine and immunotherapy, transforming the landscape of cancer treatment. Biologic drugs target different aspects of cancer biology, including immune checkpoint inhibitors, monoclonal antibodies, antibody-drug conjugates, and cell-based therapies like CAR-T cell therapy. These drugs are approved for a range of cancer types, including melanoma, lung cancer, breast cancer, leukemia, and lymphoma. These approvals subsequently increase the demand for outsourced manufacturing for oncology therapies.

REGION

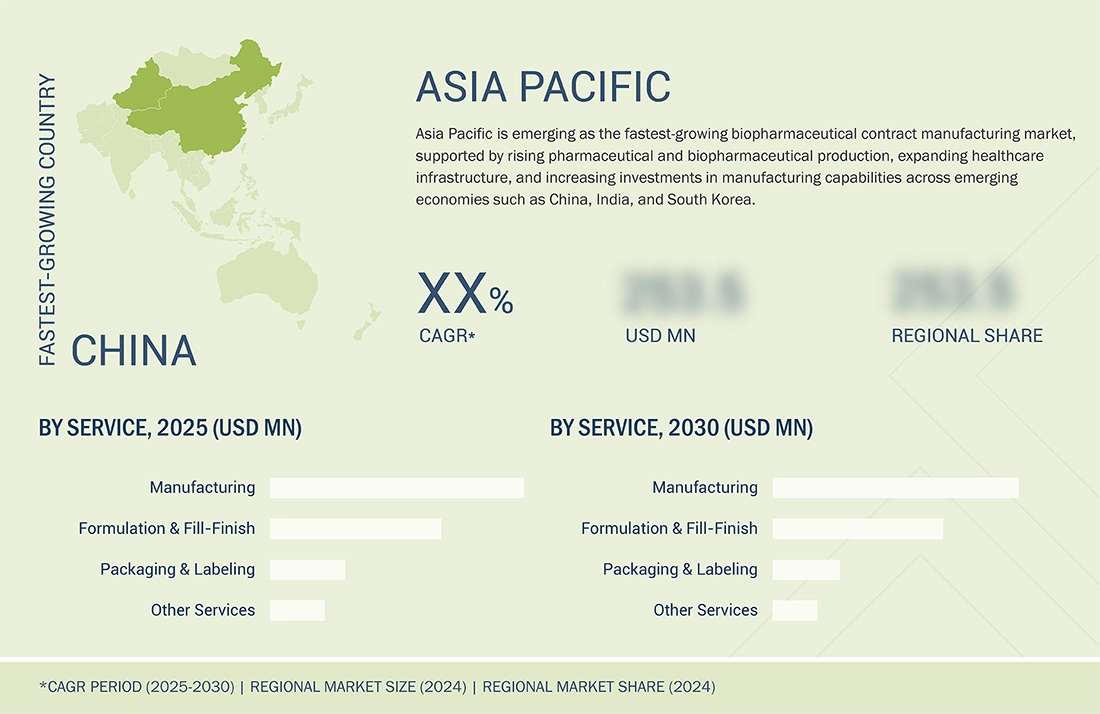

Asia Pacific to be fastest-growing region in global biopharmaceutical contract manufacturing market during forecast period

The Asia Pacific biopharmaceutical contract manufacturing market is expected to register the highest CAGR during the forecast period, driven by rising pharmaceutical and biopharmaceutical production, expanding healthcare infrastructure, and increasing investments in manufacturing capabilities across emerging economies such as China, India, and South Korea. The region is witnessing strong demand for injectable therapies, fueled by a growing burden of chronic and infectious diseases, a rising geriatric population, and greater access to healthcare services. Additionally, governments and private sectors in Asia Pacific are actively supporting domestic manufacturing through favorable policies, incentives, and public-private partnerships. The cost-effectiveness of operations in this region also makes it an attractive hub for contract manufacturing and outsourcing by global pharmaceutical companies. Moreover, local manufacturers are increasingly adopting advanced aseptic processing technologies to meet international regulatory standards, enabling them to participate more competitively in the global market. The rise in biologics development, clinical research activities, and a skilled workforce further strengthens the region's potential.

Biopharmaceutical Contract Manufacturing Market: COMPANY EVALUATION MATRIX

In the biopharmaceutical contract manufacturing market matrix, Lonza stands as the Star player, underpinned by end-to-end capabilities from cell-line development through commercial drug substance and sterile drug product, deep expertise in complex modalities (mAbs, ADCs, viral vectors, mRNA/LNP), and a long, clean regulatory track record that enables reliable tech transfers and on-time launches. Eurofins Scientific is positioned as an Emerging Leader, leveraging its global BioPharma testing network, strong analytical/CMC services, and growing development and release-testing support for biologics that de-risk programs and shorten cycle times. While Lonza continues to lead on scale, modality breadth, and global redundancy, Eurofins is accelerating up-market by bundling method development, stability, bioassays, and QP/release with selective DP partnerships, putting it on a trajectory toward the leaders’ quadrant as it deepens biologics development offerings, expands CGT analytics, and integrates digital QA/QC for faster, right-first-time compliance.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 20.51 Billion |

| Market Forecast in 2030 (Value) | USD 34.15 Billion |

| Growth Rate | CAGR of 8.8% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

WHAT IS IN IT FOR YOU: Biopharmaceutical Contract Manufacturing Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Service specific | Detailed breakdown by Service type (Manufacturing, Fill Finish) |

|

| End user |

|

|

| Geographic (market entry & access) |

|

|

| Company profiles | Company profiles: platform,recent data, partnerships, key developments |

|

| Investment and capacity tracking |

|

|

RECENT DEVELOPMENTS

- June 2025 : WuXi Biologics announced the construction of its new microbial manufacturing site for drug product (DP) facility for commercial manufacturing in the Wenjiang district of Chengdu.with capacity of 60,000L.

- October 2024 : Samsung Biologics launched high-concentration formulation platform to accelerate high-dose drug development.

- May 2024 : Lonza acquired the Genentech large-scale biologics manufacturing site in Vacaville, California (US) from Roche.

- January 2023 : WuXi Biologics entered into a licensing agreement with GSK plc for using WuXi Biologics’ proprietary technology platforms. Under this, GSK was granted an exclusive global license for the research, development, manufacturing, and commercialization of bispecific antibodies in the WuXi Biologics plant.

Table of Contents

Methodology

This research study extensively utilized secondary sources, directories, and databases to gather valuable information for analyzing the global biopharmaceutical contract manufacturing market. In-depth interviews were conducted with a variety of primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives from major market players, and industry consultants. These interviews were essential for obtaining and verifying critical qualitative and quantitative information, as well as assessing the growth prospects of the market. The global market size estimated through secondary research was then validated and refined using inputs from primary research to determine the final market size.

Secondary Research

Secondary research was primarily utilized to gather information for a comprehensive study focused on the biopharmaceutical contract manufacturing market, emphasizing technical and commercial aspects. The sources consulted for this research included Pharmaceutical Research and Manufacturers of America (PhRMA), European Federation of Pharmaceutical Industries and Associations (EFPIA), Bioprocess and Biosystems Engineering, Bioprocess International, PLOS Biology, European Medicines Agency (EMA), Pharma & Biopharma Outsourcing Association (PBOA), Generics and Biosimilars Initiative (GaBI), Parenteral Drug Association (PDA), American Association of Pharmaceutical Scientists (AAPS), Global Cancer Observatory, American Chemical Society, National Center for Biotechnology Information (NCBI), Food and Drug Administration (FDA), Biotechnology and Biological Sciences Research Council (BBSRC), and World Journal of Pharmaceutical Sciences.

In addition to these sources, the study also included corporate and regulatory filings such as annual reports, SEC filings, investor presentations, and financial statements. Other resources included business magazines, research journals, press releases, and information from trade, business, and professional associations, along with analyses from MarketsandMarkets. These sources were instrumental in acquiring essential information about key market players, classifications, and segmentation based on industry trends, regional and country-level markets, market developments, and technological perspectives.

Primary Research

After conducting an initial assessment of the global biopharmaceutical contract manufacturing market through secondary research, we carried out comprehensive primary research. This involved conducting in-depth interviews with experts from the demand side, including stakeholders from pharmaceutical and biotechnology companies, contract research organizations (CROs), contract manufacturing organizations (CMOs), and academic and research institutions.

Additionally, we interviewed key supply-side participants, such as C-suite executives, senior executives, product managers, and marketing and sales leaders from leading manufacturers, distributors, and channel partners. Our research focused on six major geographical regions: North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. Approximately 70% of the primary interviews were conducted with supply-side participants, while 30% involved demand-side experts.

Data collection methods included structured questionnaires, email correspondence, online surveys, personal interviews, and telephone discussions to gain a comprehensive understanding of the market dynamics.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

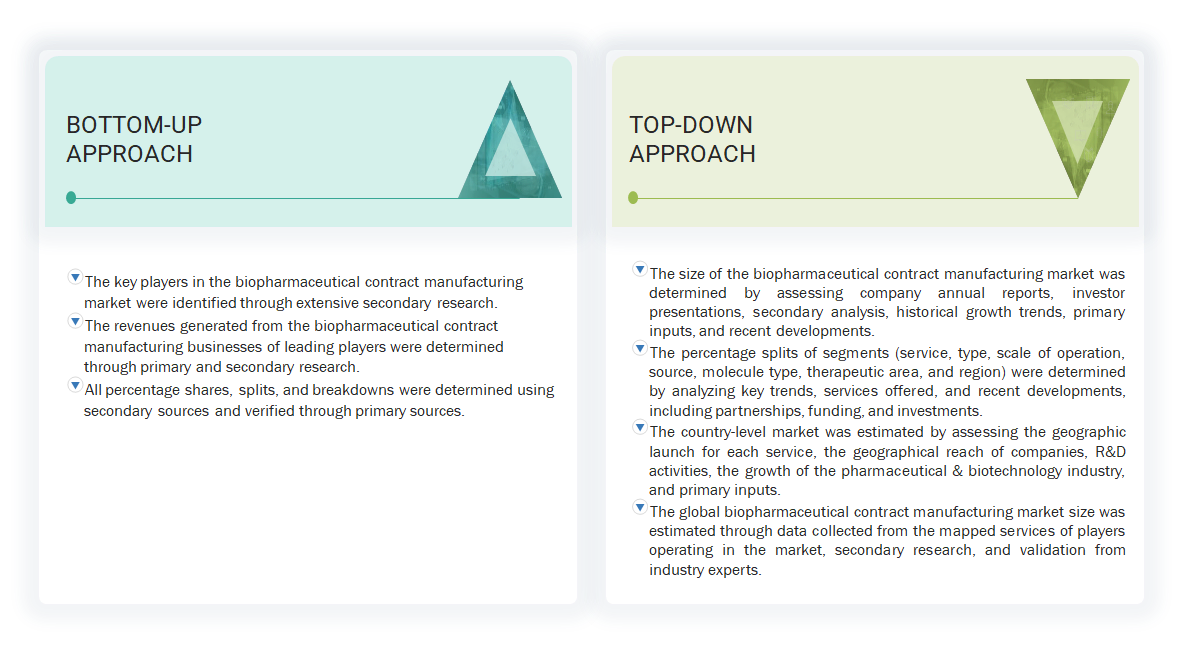

Market Size Estimation

Both bottom-up and top-down approaches were used to estimate and validate the total size of the biopharmaceutical contract manufacturing market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- A list of the major global players operating in the biopharmaceutical contract manufacturing market was generated.

- The revenues generated from their services have been determined through annual reports and secondary sources (including paid databases).

- The services were mapped according to market segments. Percentage shares and splits were determined based on the revenue contributed to each segment. This was verified using secondary sources and industry experts.

- All assumptions, approaches, and individual shares/revenue estimates were validated through expert interviews.

Global Biopharmaceutical Contract Manufacturing Market Size: Bottom-up and Top-down Approach

Data Triangulation

After estimating the total market size, it was divided into several segments and subsegments. To refine the overall market analysis and obtain accurate statistics for each segment and subsegment, we employed data triangulation and market breakdown procedures wherever applicable. This involved studying various factors and trends from both the demand and supply sides to validate the findings.

Market Definition

Biopharmaceutical contract manufacturing involves outsourcing biological manufacturing services to specialized organizations known as contract manufacturing organizations (CMOs). Biologics are intricate pharmaceutical products derived from living organisms, including proteins, peptides, nucleic acids, cells or tissues, and other molecules produced through biotechnology. The market study encompasses an assessment of various services, sources, types, scales of operation, molecules, and therapeutic areas within the field of biopharmaceutical contract manufacturing.

Stakeholders

- Pharmaceutical and Biotechnology Companies

- Research and Consulting Firms

- Academic Medical Centers

- Government Research Organizations

- Clinical Research Institutes

- Contract Research Organizations

- Pharmaceutical Distributors and Suppliers

- Corporate Entities

- Contract Development and Manufacturing Organizations

Report Objectives

- To define, describe, and forecast the biopharmaceutical contract manufacturing market based on service, type, source, scale of operation, molecule type, therapeutic area, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets concerning individual growth trends, prospects, and contributions to the biopharmaceutical contract manufacturing market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments concerning six main regions—North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa

- To profile the key players in the global biopharmaceutical contract manufacturing market and comprehensively analyze their service portfolios, market positions, and core competencies

- To track and analyze competitive developments such as service launches, expansions, agreements, and collaborations in the biopharmaceutical contract manufacturing market

- To benchmark players within the biopharmaceutical contract manufacturing market using the company evaluation matrix framework, which analyzes market players based on various parameters within the broad categories of business and service strategy

Key Questions Addressed by the Report

Who are the key players in the biopharmaceutical contract manufacturing market?

The key players in the global biopharmaceutical contract manufacturing market are Lonza (Switzerland), WuXi Biologics (China), Samsung Biologics (South Korea), Thermo Fisher Scientific, Inc. (US), and AbbVie (US).

Which type segment dominates the biopharmaceutical contract manufacturing market?

The biologic drug substance manufacturing segment held the largest market share in 2024. Increasing research and development activities for the development of novel drugs are driving the growth of this market.

Which service segment dominates the biopharmaceutical contract manufacturing market?

The manufacturing segment held the largest share of the global biopharmaceutical contract manufacturing market in 2024. This is primarily due to the rising demand for biologics in the biopharmaceutical industry.

Which source segment of the biopharmaceutical contract manufacturing market is expected to dominate the market?

The mammalian expression systems segment held the largest share in 2024 due to increasing pipelines of mammalian-based biologics and the advantages of mammalian expression systems, like proven post-translational modifications, correct protein folding, and improved bioactivity.

What is the market size for the biopharmaceutical contract manufacturing market?

The biopharmaceutical contract manufacturing market is estimated to reach USD 34.15 billion by 2030 from USD 22.40 billion in 2025, at a CAGR of 8.8% during the forecast period of 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Biopharmaceutical Contract Manufacturing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Biopharmaceutical Contract Manufacturing Market