Breast Biopsy Devices Market: Growth, Size, Share, and Trends

Breast Biopsy Devices Market by Product (Needle: Core, FNAB, VAB; Equipment, Wire, Guidance system, Table, Assay kit), Procedure (Needle, Liquid: CTC, CTDNA; Open), Application (Screening, Monitoring), End User (Hospital, Clinic) - Global Forecasts to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

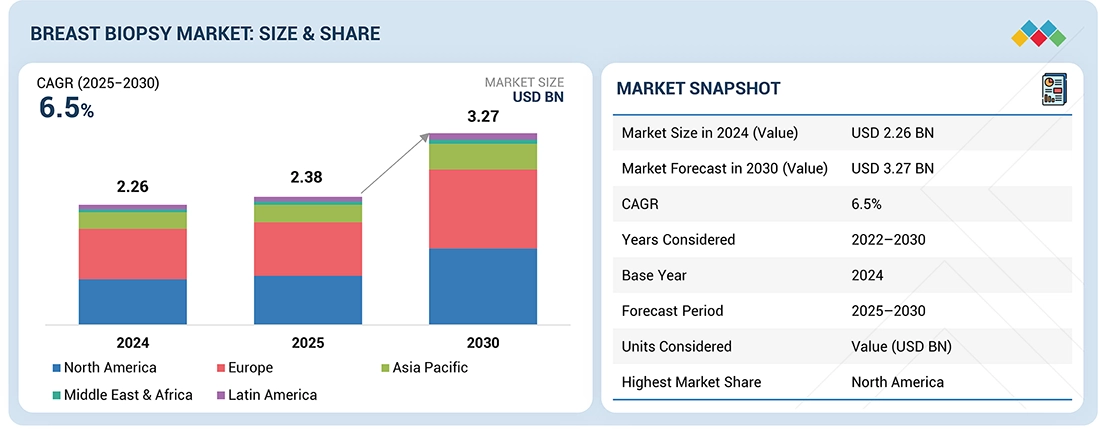

The global breast biopsy market is projected to reach USD 3270.9 million by 2030 from USD 2,384.2 million in 2025 at a CAGR of 6.5% from 2025 to 2030. The global breast biopsy devices market is witnessing significant growth driven by rising breast cancer prevalence, increasing adoption of minimally invasive diagnostic procedures, and continuous technological advancements in imaging-guided biopsy systems. As early detection becomes central to improving survival rates, hospitals and imaging centers are increasingly investing in advanced biopsy technologies such as vacuum-assisted and stereotactic-guided systems. The market is transitioning from conventional open surgical biopsies to image-guided and robot-assisted biopsy solutions, reflecting a broader shift toward precision diagnostics. Strategic collaborations among device manufacturers, imaging firms, and AI solution providers are accelerating product innovation, workflow efficiency, and clinical accuracy.

KEY TAKEAWAYS

-

BY PRODUCTBy product type include Biopsy Needles (Core Needles, Fine Aspiration Needles, Vaccum assissted biopsy needles), biopsy equipment (Core biopsy equipment, vaccum assissted biopsy equipment), guidance systems (Mammography-guided stereotactic biopsy, Ultrasound-guided biopsy, MRI-guided biopsy), biopsy tables, localization wires, assay kits, liquid biopsy instruments, other products. In 2024, the biopsy needles segment accounted for the largest market share. Biopsy needles lead the breast biopsy devices market primarily due to their essential role in both core-needle and vacuum-assisted biopsy systems, which are widely used for accurate and minimally invasive diagnoses of breast lesions.

-

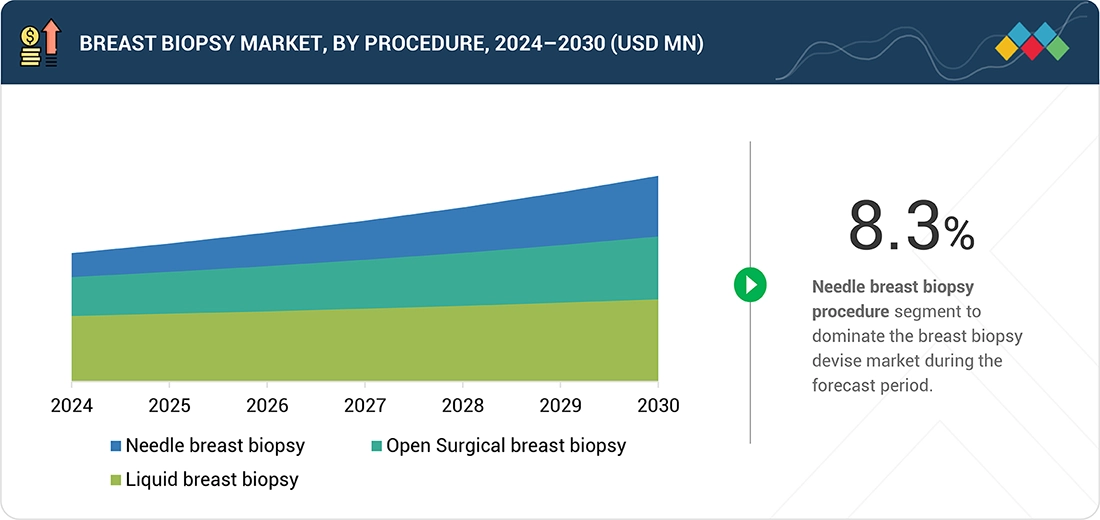

BY PROCEDUREKey procedure include Needle breast biopsy (Core needle biopsy, vacuum-assissted biopsy, fine needle aspiration biopsy), open surgical breast biopsy (Excisional biopsy, Incisional biopsy), liquid breast biopsy (circulating tumor cells, circulating tumor DNA, other biomarkers). In 2024, Needle breast biopsy accounts for the highest share in the breast biopsy devices market because it is minimally invasive, cost-effective, and widely accessible compared with surgical biopsies.

-

BY APPLICATIONThe global breast biopsy market is categorized based on application into four segments: early cancer screening, therapy selection, treatment monitoring, and recurrence monitoring. Among these, the therapy selection segment is experiencing the highest growth rate due to the growing focus on personalized medicine, which tailors treatment to the molecular and genetic profile of each patient’s tumor.

-

BY END USERBy end user segment consist of Hospitals & Surgical Centers, breast Care Centers, Imaging clinics & diagnostic centers.In 2024, hospitals & surgical centers held the largest share of the breast biopsy devices market due to their extensive diagnostic facilities, advanced imaging equipment, and multidisciplinary teams of experts.

-

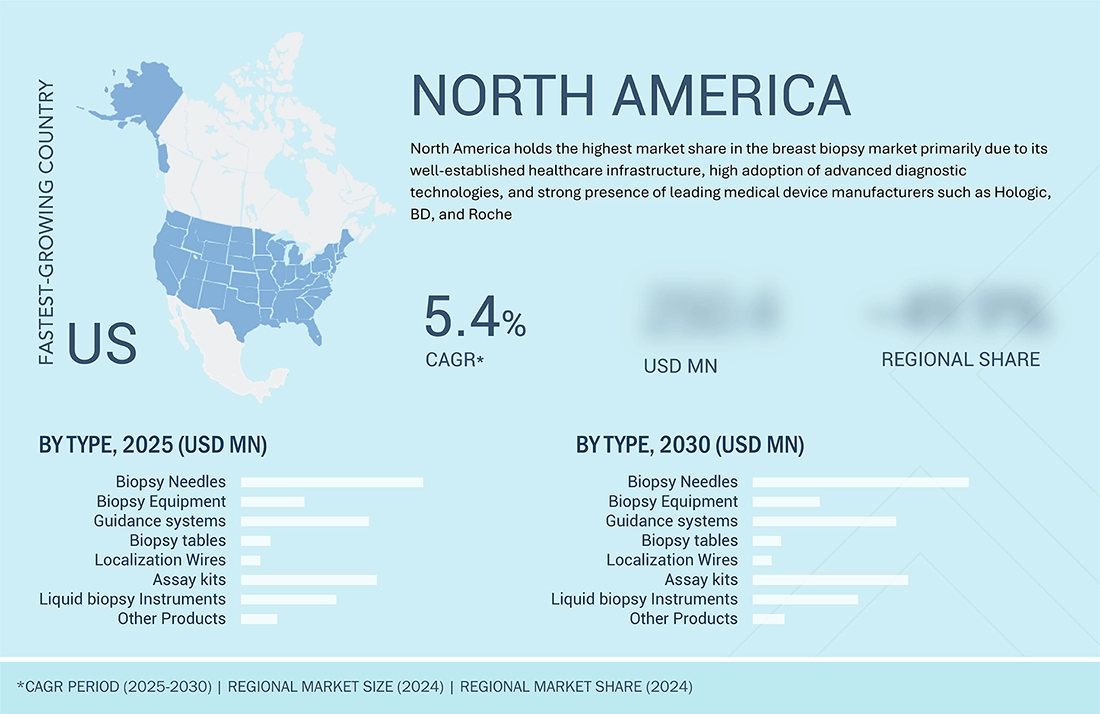

BY REGIONThe breast biopsy devices market covers North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. North America holds the largest market share for breast biopsy devices, due to a combination of advanced healthcare infrastructure, high breast cancer rates, and supportive policies.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, as Hologic Inc. (US), Danaher Corporation (US), Argon Medical Devices (US), Merit Medical Systems (US), Menarini-Silicon Biosystems (Italy), have entered into a number of agreements and partnerships to cater to the growing demand for breast biopsy devices across innovative applications.

Key trends shaping the market include the integration of AI and 3D imaging in biopsy guidance, growing use of disposable biopsy needles to minimize cross-contamination, and rising procedural automation through robotic arms and vacuum-assisted systems. The market is also witnessing a higher preference for stereotactic- and MRI-guided biopsy systems that offer improved lesion localization and tissue sampling accuracy. Moreover, the shift toward outpatient and ambulatory biopsy procedures and the introduction of portable, ultrasound-based biopsy systems are expanding accessibility in emerging markets.

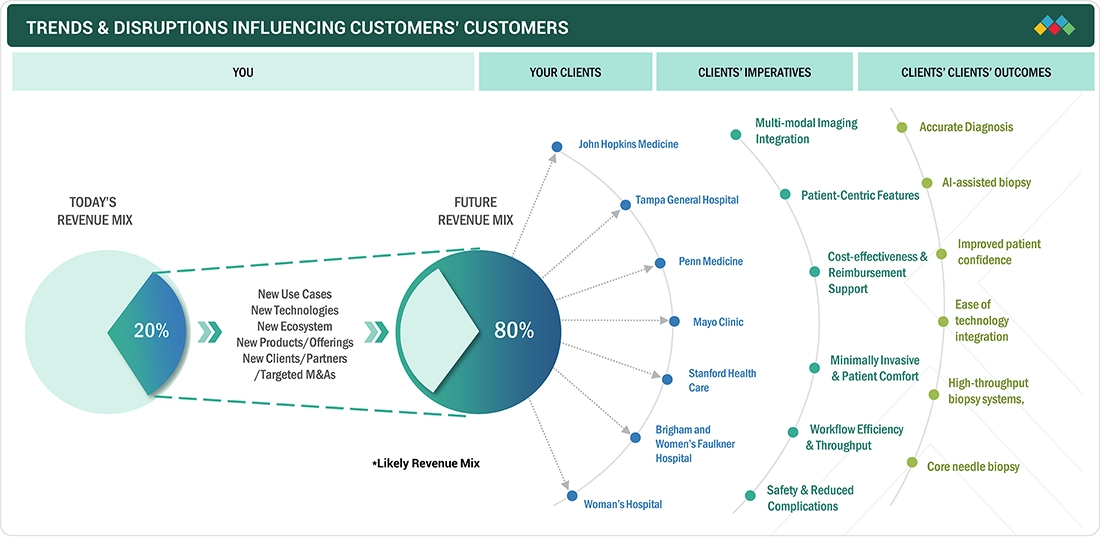

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

End users are facing transformative disruptions in workflow management, reimbursement models, and patient throughput optimization. The increasing demand for AI-enabled diagnostic support tools is reshaping equipment procurement decisions, while value-based healthcare and cost-containment pressures are driving hospitals to seek biopsy solutions that reduce procedure time and consumable waste. Vendors are innovating around single-use disposables, plug-and-play integration with mammography and MRI units, and digital biopsy data management systems, which are redefining procurement dynamics and service models for radiology departments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expansion of private diagnostic chains and imaging centers

-

Increasing demand for minimally invasive and noninvasive procedures

Level

-

High Cost of Liquid Biopsy Tests

-

Stringent regulatory approval procedures

Level

-

Advancements in Technologies used in breast biopsy

-

Growing collaboration and financial support from public and private sectors

Level

-

Shortage of skilled professionals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for minimally invasive and noninvasive procedures

The increasing demand for minimally invasive breast biopsy procedures is driven by several factors that emphasize their advantages over traditional surgical methods. Notably, procedures such as core-needle biopsy (CNB) and vacuum-assisted biopsy (VAB) are less invasive, leading to decreased patient discomfort, shorter recovery times, and fewer complications. As healthcare systems strive for greater efficiency and cost-effectiveness in treatments, minimally invasive procedures are becoming the preferred choice for both patients and healthcare providers. Additionally, the ability to perform these procedures in outpatient settings further reduces hospital stays, benefiting both patients and healthcare costs

Restraint: High cost of liquid biopsy tests

The high cost of liquid biopsy tests stems from several factors. They rely on advanced technologies such as next-generation sequencing (NGS) and sensitive assays to detect very small amounts of tumor DNA or circulating tumor cells in the blood, which are expensive to develop and operate. The tests require specialized reagents, sophisticated laboratory infrastructure, and highly trained personnel, all of which contribute to operational costs. The research and development (R&D) needed to validate and optimize these tests is substantial, and these costs are reflected in the final price. Limited insurance coverage and reimbursement means patients or providers often bear more of the cost, making liquid biopsy tests less accessible despite their minimally invasive nature and potential for early cancer detection.

Opportunity: Advancements in Technologies used in breast biopsy

Advancements in ultrasound technology have made guided biopsies more precise, due to improved probe sensitivity and real-time imaging. Clinicians can now target smaller or more ambiguous lesions with greater confidence. These improvements have led to earlier diagnoses and more accurate sampling, which has reduced the need for repeat interventions. Another significant advancement is the increasing use of magnetic resonance imaging (MRI) for breast biopsies. MRI-guided biopsies are particularly beneficial for detecting lesions that are not visible on mammograms or ultrasounds, especially in high-risk patients. Furthermore, the integration of artificial intelligence (AI) and machine learning algorithms into imaging platforms is enhancing diagnostic accuracy by assisting radiologists in identifying suspicious areas more effectively and reliably. These technologies not only improve diagnostic outcomes but also streamline workflows, making breast biopsy procedures more accessible, faster, and more patient-friendly.

Challenge: Shortage of skilled professionals

As awareness of cancer continues to grow, the demand for biopsy procedures is expected to increase in the coming years. However, a significant barrier to this is the shortage of trained professionals capable of performing minimally invasive biopsies. For example, the US is projected to face a shortfall of over 2,300 medical oncologists by 2025, according to the Journal of Global Oncology. This issue is even more severe in underdeveloped and developing countries. In Sub-Saharan Africa, the lack of medical and radiation oncologists, among other healthcare professionals, severely limits curative cancer care. Similarly, India faces a critical shortage of oncology experts, with only one oncologist available for every 2,000 cancer patients among the country's 1.8 million cases. These shortages in oncology and radiology personnel are likely to hinder the adoption of breast biopsy needle procedures, even in densely populated areas where diagnostic services are urgently needed.

biopsy devices breast biopsy market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The company’s systems, such as the Affirm Prone and Affirm Upright Breast Biopsy Systems and the Breast Biopsy Site Marker portfolio, enable minimally invasive tissue sampling with precise targeting of suspicious lesions identified through mammography, tomosynthesis, or ultrasound. | Hologic’s 3D mammography-guided biopsy systems provide superior visualization, allowing precise targeting of small or subtle lesions that may be missed with traditional 2D imaging. |

|

BD offers localization and tissue marker systems that help accurately identify biopsy sites for follow-up imaging or surgery | BD biopsy systems are compatible with ultrasound, stereotactic, and MRI guidance, offering flexibility for different clinical environments. |

|

Danaher’s integrated digital pathology and AI-powered image analysis tools support pathologists in detecting malignancies more efficiently | Integrated solutions streamline the biopsy-to-diagnosis process, reducing manual steps and minimizing the potential for human error |

|

QIAGEN supports companion diagnostics and next-generation sequencing (NGS) workflows that help identify actionable genetic alterations in breast cancer, facilitating personalized therapy decisions. | QIAGEN’s platforms support multi-omic analysis (DNA, RNA, and miRNA), giving a holistic view of tumor biology for better clinical interpretation. |

|

Roche’s Ventana automated staining systems and cobas molecular diagnostic platforms enable accurate detection of biomarkers such as HER2, ER, and PR, which are essential for breast cancer classification and targeted therapy selection. | Roche platforms seamlessly integrate with other laboratory instruments and information systems, optimizing workflow and data management. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem includes biopsy device manufacturers, imaging modality OEMs, pathology solution providers, consumable suppliers, AI & software vendors, hospitals, and diagnostic laboratories. Strategic collaborations between imaging companies (e.g., Hologic, GE Healthcare, Siemens Healthineers) and device innovators (e.g., BD, Mammotome, Argon Medical) are strengthening integration and clinical workflow capabilities. The ecosystem is gradually converging toward connected, real-time image-guided biopsy suites with integrated software support for histopathology validation.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Breast biopsy devices Market, By Type

In 2024, the biopsy needles segment accounted for the largest market share. Biopsy needles lead the breast biopsy devices market primarily due to their essential role in both core-needle and vacuum-assisted biopsy systems, which are widely used for accurate and minimally invasive diagnoses of breast lesions. Their cost-effectiveness, ease of use, and compatibility with various imaging modalities—such as ultrasound, mammography, and MRI—make them the preferred choice for clinicians. Additionally, the growing trend toward ambulatory and outpatient biopsy procedures, many of which utilize needle-based methods, along with increased awareness and screening rates, contributes to the high demand and widespread use of biopsy needles in clinical practice.

Breast biopsy devices Market, By Procedure

The image-guided biopsy segment accounts for the largest share, primarily due to its superior diagnostic yield and reduced complications compared to open surgical biopsies. Within this segment, ultrasound-guided biopsies lead due to their real-time visualization, lower cost, and wide availability. MRI-guided and stereotactic biopsies are expanding rapidly in developed markets, driven by the growing use of MRI for dense breast tissue evaluation.

Breast biopsy devices Market, By Application

The breast cancer diagnosis segment holds the largest share due to the global emphasis on early detection and diagnostic confirmation following abnormal screening results. The rising use of image-guided biopsies to confirm suspicious calcifications or masses identified through mammography is sustaining high procedure volumes. Tumor recurrence assessment and therapeutic response monitoring are emerging secondary applications driving incremental demand.

REGION

North America is the highest market share region in global breast biopsy devices market during forecast period

North America dominates the global market due to a strong screening infrastructure, favorable reimbursement policies, and high awareness of breast cancer diagnostics. The U.S. leads in adoption of vacuum-assisted and stereotactic biopsy systems supported by robust imaging networks and key OEM presence. Asia-Pacific (APAC), on the other hand, is the fastest-growing region due to increasing government-backed screening initiatives, expanding private diagnostic chains, and rapid technology adoption in urban centers of China, India, and South Korea. Growing healthcare investments and localization of device manufacturing are further propelling market growth in the region.

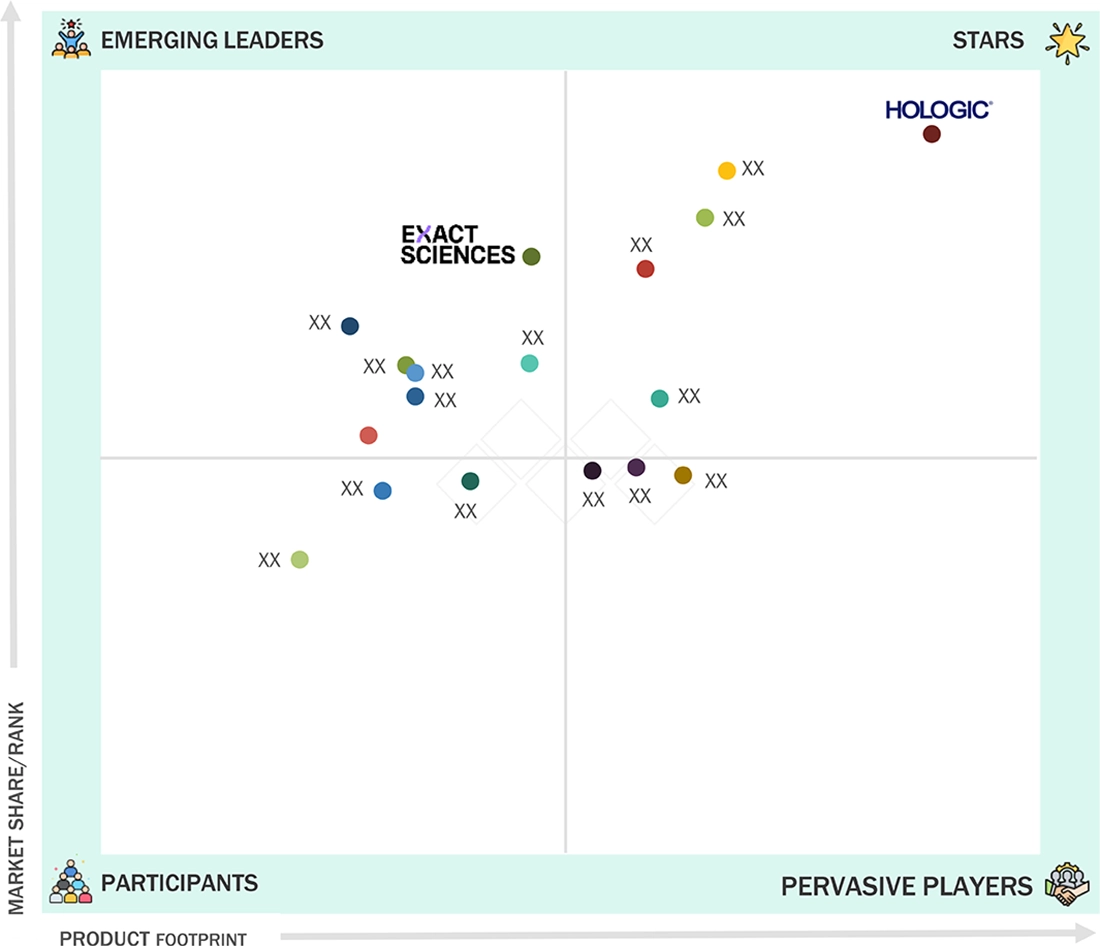

biopsy devices breast biopsy market: COMPANY EVALUATION MATRIX

The breast biopsy devices market is moderately consolidated, with leading players such as Hologic, BD, Mammotome (Danaher), Argon Medical Devices, Cook Medical, and Leica Biosystems dominating through strong imaging integration and product innovation. Hologic maintains a leadership position with its comprehensive portfolio of vacuum-assisted and stereotactic-guided biopsy systems, while BD and Mammotome emphasize consumable and needle innovations. Emerging players are focusing on AI-guided navigation systems, digital biopsy tracking, and portable biopsy solutions. Strategic focus areas for differentiation include real-time imaging integration, device ergonomics, workflow digitization, and global service support.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.26 Billion |

| Market Forecast in 2030 (Value) | USD 3.27 Billion |

| Growth Rate | CAGR of 6.5% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By product type include Biopsy Needles (Core Needles, Fine Aspiration Needles, Vaccum assissted biopsy needles), biopsy equipment (Core biopsy equipment, vaccum assissted biopsy equipment), guidance systems (Mammography-guided stereotactic biopsy, Ultrasound-guided biopsy, MRI-guided biopsy), biopsy tables, localization wires, assay kits, liquid biopsy instruments, other products. Key procedure include Needle breast biopsy (Core needle biopsy, vacuum-assissted biopsy, fine needle aspiration biopsy), open surgical breast biopsy (Excisional biopsy, Incisional biopsy), liquid breast biopsy (circulating tumor cells, circulating tumor DNA, other biomarkers).Application: Early cancer screening, therapy selection, treatment monitoring, and recurrence monitoring. End User: Hospitals & Surgical Centers, breast Care Centers, Imaging clinics & diagnostic centers |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

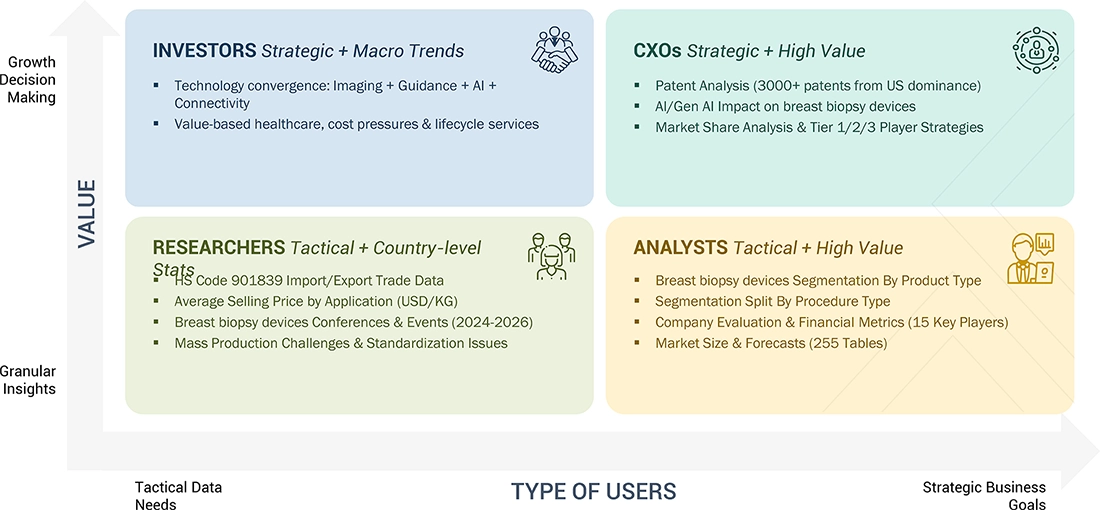

WHAT IS IN IT FOR YOU: biopsy devices breast biopsy market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Total number of biopsy procedures globally/regional level | Total number of biopsy procedure (Core needle, fine needle, vacuum assissted needle) | Total market assessment at global level (Core needle, fine needle, vacuum assissted needle) |

| Imaging modality compatibility and integration | Devices tailored for ultrasound, stereotactic mammography, MRI guidance | Better lesion access and diagnostic confidence |

| Workflow and sample handling customization | Integrated specimen verification, reusable/disposable driver options | Increased workflow efficiency, reduced contamination risk |

| Better guidance/tracking of biopsy site | Wire-free localization tags (e.g., RFID markers) placed prior to biopsy. Mayo Clinic Health System | More precise site targeting, greater scheduling flexibility, improved patient comfort |

| Real-time sample visualization and verification | Devices with real-time feedback/display of needle activity or specimen collection. bd.com+1 | Higher confidence in sampling, fewer repeat procedures, improved workflow |

RECENT DEVELOPMENTS

- January 2025 : Hologic (US) acquired Gynesonics, Inc (US). This strategic move enhances Hologic’s GYN Surgical portfolio, aligning with its mission to improve women’s health through innovative, minimally invasive solutions.

- February 2025 : Mammotome entered into an exclusive distribution agreement with Sirius Medical, the innovator of Surgical Marker Navigation, for the US and Germany. This partnership combines Mammotome's expertise in breast care with Sirius Medical's advanced technology and innovation.

- April 2025 : Guardant Health partnerd with Bayshore HealthCare to offer its precision oncology tests through Bayshore’s clinic network across Canada, improving the delivery of cancer care.

Table of Contents

Methodology

This research study used both primary and secondary sources. The research process involved examining various aspects that impact the industry, including segmentation types, industry trends, leading participants, the competitive landscape, major market dynamics, and the strategies employed by key market players.

Secondary Research

Secondary research extensively utilizes various secondary sources, including directories, databases (such as Bloomberg Business, D&B Hoovers, and Factiva), white papers, annual reports, company documents, investor presentations, and SEC filings related to companies. This research method helps gather and organize both general and technical data pertinent to the market study and commercial analysis of breast biopsy devices. It also collects crucial information about key players, market taxonomy, and segmentation according to industry trends, down to the foundational level, as well as significant developments concerning market and technology perspectives. Additionally, secondary research has created a database of key industry leaders.

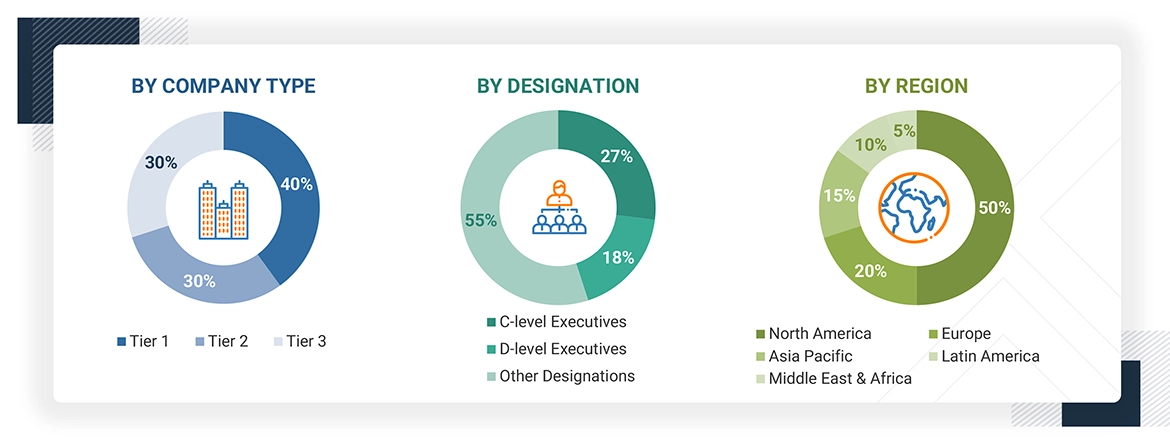

Primary Research

Various supply and demand sources were interviewed during the primary research process to collect both qualitative and quantitative information for this report. Key professionals involved in biopsy techniques and device usage include radiologists, breast surgeons, interventional radiologists, and oncologists. Insights are also gathered from hospital procurement managers, biomedical engineers, and department heads regarding purchasing decisions, product preferences, and barriers to adoption. On the industry side, product managers, sales directors, and R&D leaders from medical device companies provide perspectives on innovation, competition, and market dynamics. The aim of this primary research is to validate market segmentation, identify major players in the market, and gain insights into key industry trends and dynamics.

A breakdown of the primary respondents is provided below:

Note 1: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 2: Companies are classified into tiers based on their total revenue. As of 2025, Tier 1 = >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3 = < USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

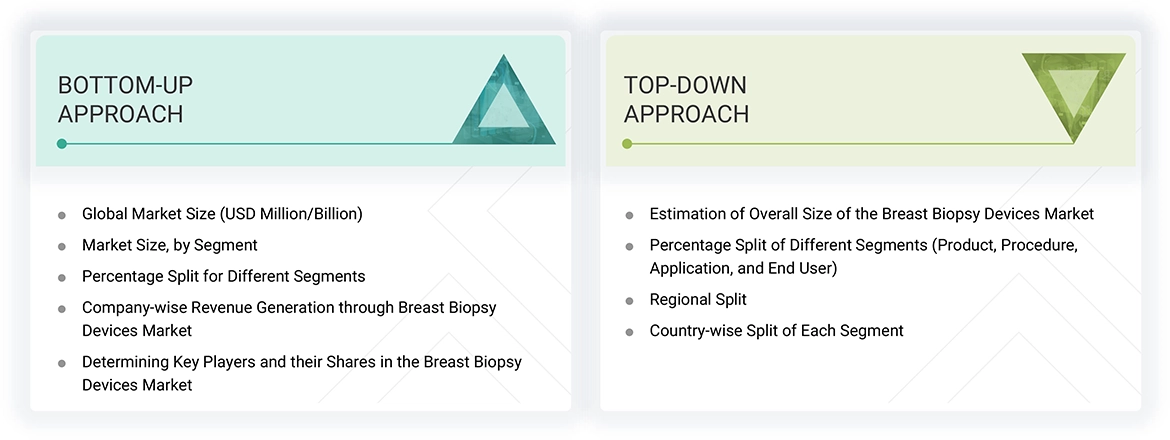

Market Size Estimation

This report analyzes the market size for breast biopsy devices based on estimated revenue figures from 15 major market players. To determine the market size, we first identified the key players and then derived their revenues using insights gathered from both primary and secondary research. The secondary research involved analyzing financial and annual reports from these key players, while the primary research included interviews with key opinion leaders (KOLs), such as CEOs, directors, and marketing leaders.

This report outlines a process that calculates segment revenues and projects them onto the global market value by using revenue mappings. These mappings helped create geographic and strategically defined segments based on data from large solutions and service providers. The process included:

- Compiling a list of key global players in the breast biopsy devices market.

- Mapping the annual revenues generated from the market (or the closest reported business unit/product category) for these major global players.

- Analyzing the revenue distribution among key players to determine their market share in the global market as of 2024.

- Estimating the global value of the breast biopsy devices market.

Global Breast Biopsy Devices Market: Top-down Approach and Bottom-up Approach

Data Triangulation

After determining the total market size through the previously outlined process, the breast biopsy devices market was divided into segments and subsegments. We used data triangulation and market breakdown methodologies to complete the market engineering process and calculate the precise figures for all segments and subsegments. This data was validated by analyzing various parameters and trends, including both demand and supply. Additionally, the breast biopsy devices market was validated using a combination of top-down and bottom-up approaches.

Market Definition

The breast biopsy devices market encompasses the global industry involved in designing, manufacturing, and distributing medical devices and technologies used to obtain tissue samples from the breast. This process is typically conducted to perform diagnostic testing and determine whether any cancerous or abnormal growths are present.

This market includes various biopsy techniques, such as core needle biopsy, fine needle aspiration, and vacuum-assisted biopsy, as well as surgical biopsy methods. Additionally, it comprises the imaging guidance systems necessary for performing biopsies, including ultrasound, MRI, and stereotactic systems.

The breast biopsy devices market serves a range of institutions, including hospitals, surgical centers, diagnostic laboratories, and research organizations. The demand for accurate, minimally invasive, and early diagnosis of breast cancer is continuously increasing.

Factors that influence the breast biopsy market include technological advancements, the rising incidence of breast cancer, and government-funded screening programs.

Stakeholders

- Manufacturers and distributors of breast biopsy needles, assay kits, and devices

- Healthcare institutions

- Research institutions

- Research and consulting firms

- Medical device suppliers, distributors, channel partners, and third-party suppliers

- Clinicians and healthcare professionals

- Global and national health agencies

- Academic medical centers and universities

- Contract research organizations (CROs) and contract manufacturing organizations (CMOs)

- Academic medical centers and universities

- Market research and consulting firms

- Group Purchasing Organizations (GPOs)

- Accountable Care Organizations (ACOs)

Report Objectives

- To define, describe, and forecast the breast biopsy devices market by product, procedure, application, and end user

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key market players and comprehensively analyze their market shares and core competencies

- To forecast the revenue of the market segments concerning five main regions: North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the Rest of Europe), the Asia Pacific (China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific), Latin America (Brazil, Mexico, and the Rest of Latin America), and the Middle East & Africa (GCC Countries and the Rest of Middle East & Africa)

- To track and analyze competitive developments such as new product launches & approvals; agreements, partnerships, expansions, acquisitions; and collaborations in the breast biopsy devices market

Frequently Asked Questions(FAQ)

What is the expected addressable market value of the global breast biopsy devices market over a 5-year period?

The global breast biopsy devices market is estimated to reach USD 3,261.7 million by 2030 from USD 2,384.1 million in 2025, at a CAGR of 6.5% during the forecast period.

Which product segment is expected to garner the highest traction within the breast biopsy devices market?

Based on type, the biopsy needles segment held the largest share of the breast biopsy devices market in 2024.

What are some of the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use partnerships, expansions, acquisitions, and collaborations as important growth tactics.

What are the major factors expected to limit the growth of the breast biopsy devices market?

High costs of advanced technologies, limited access to skilled professionals, regulatory challenges, varying approval standards, and concerns about false positives or negatives may limit market growth.

Are there any challenges that market manufacturers face?

Yes, manufacturers face challenges due to the need for significant investment in research and clinical validation to develop minimally invasive and highly accurate biopsy devices.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Breast Biopsy Devices Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Breast Biopsy Devices Market