Aspiration & Biopsy Needles Market by Product (Aspiration Needle, CNB, VAB), Application (Breast, Lung, Bone Cancer), Procedure (Image-guided (Ultrasound, MRI, Stereotactic), Non-image-guided), End User (Hospital, ASC, Academia) & Region - Global Forecast to 2027

Updated on : February 08, 2023

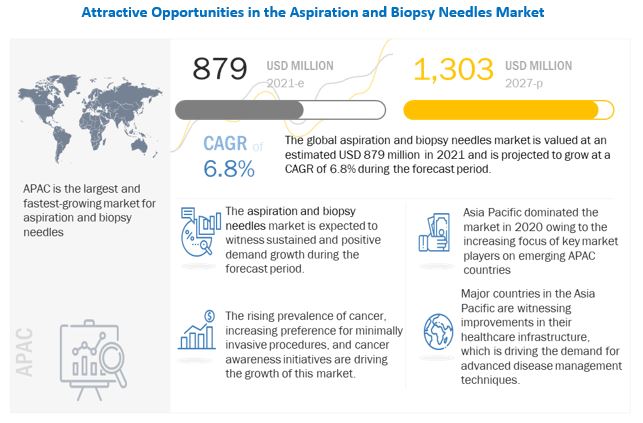

The global aspiration needles market in terms of revenue was estimated to be worth $879 million in 2021 and is poised to reach $1,303 million by 2027, growing at a CAGR of 6.8% from 2021 to 2027. Factors such as the rising prevalence of cancer, initiatives undertaken by the government and global health organizations, and the increasing preference for minimally invasive procedures are the major factors driving the growth of the aspiration and biopsy needle market.

To know about the assumptions considered for the study, Request for Free Sample Report

Aspiration Needles Market Dynamics

Driver: Rising prevalence of cancer

Globally, there has been a significant increase in the number of people suffering from cancer. This can be attributed to a number of factors, such as lifestyle changes, unhealthy diets, and increasing tobacco consumption. According to estimates from the International Agency for Research on Cancer (IARC), in 2018, there were 17.0 million new cancer cases and 9.5 million cancer deaths worldwide. By 2040, the global burden is expected to grow to 27.5 million new cancer cases and 16.3 million cancer deaths, primarily due to the growth and aging of the population.

The incidence of cancer is the highest in more-developed regions, but mortality is relatively higher in less-developed countries due to a lack of access to treatment facilities and a lack of awareness regarding the benefits of early detection. According to the American Cancer Society, about 9.6 million people die from cancer every year, and 70% of cancer deaths occur in low-to-middle income countries such as China and India; these proportions are expected to increase further by 2025. With the rising prevalence of cancer in major regions across the globe, the demand for effective cancer diagnosis is expected to increase in the coming years. This, in turn, is expected to support the growth of the aspiration and biopsy needles market during the forecast period.

Restraint: Risk of infection associated with the use of aspiration and biopsy needles

Biopsy needle procedures, such as core-needle and fine-needle procedures, assist radiologists and surgeons in examining abnormalities at a particular site. However, patients can contract infections during these procedures as they involve cuts and incisions for removing tissue samples. Also, in several cases, aspiration and biopsy needles are reused, which further increases the risk of infection during these procedures. Even though the reuse of some needles is not recommended by healthcare authorities as well as product manufacturers, this practice is still prevalent, especially in developing countries.

Opportunity: Emerging economies

Emerging markets (such as India, China, Brazil, and Mexico) are expected to offer significant growth opportunities for players operating in the aspiration and biopsy needles market. This can be attributed to improvements in the standard of living, presence of a huge target population base (as a result of the rising prevalence of cancer), improvements and expansions in healthcare infrastructure, growing healthcare expenditure, and the modernization of healthcare research facilities in these countries. Also, the rapid economic development and increasing healthcare expenditure in these emerging countries have improved access to quality healthcare, including quality cancer care.

Challenge: Underdeveloped healthcare infrastructure and dearth of well-trained radiologists and oncologists.

With the growing awareness about different types of cancers, the demand for biopsy procedures is expected to increase in the coming years. However, there is a dearth of skilled surgeons to perform minimally invasive biopsy procedures. For instance, a shortage of more than 2,300 medical oncologists is expected in the US by 2025 (Source: Journal of Global Oncology). The effect of this factor will be more pronounced in developing and underdeveloped regions. For instance, one of the major obstacles in the delivery of care for patients with curable cancers in the Sub-Saharan African region is the dearth of medical oncologists, radiation oncologists, and other healthcare workers required for cancer care. Similarly, India is facing an acute shortage of oncologists, radiotherapists, and surgical oncologists. With 1.8 million cancer patients in the country, there is only one oncologist to treat every 2,000 patients.

Aspiration Needles Market Ecosystem:

To know about the assumptions considered for the study, download the pdf brochure

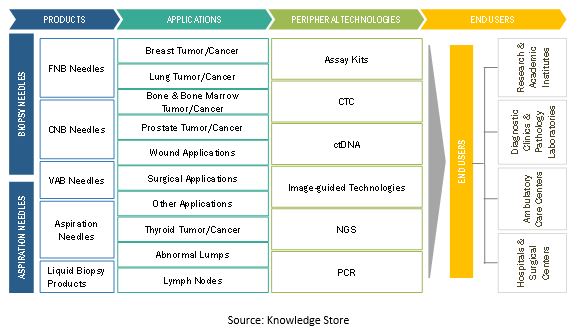

By product, the biopsy needles segment accounted for the largest share of the aspiration needles market

On the basis of product, the market is segmented into aspiration and biopsy needles. The biopsy needles segment accounted for the largest share of the aspiration and biopsy needles market in 2020. This can be attributed to the rising prevalence of cancer and the increasing preference for minimally invasive diagnostic procedures (over excision biopsies).

By application, the tumor/cancer segment held the largest share of the aspiration needles market market

On the basis of application, the aspiration and biopsy needles market is segmented by tumor/cancer applications (breast, lung, colorectal, prostate, kidney, bone & bone marrow, and other cancers), wound applications, and other applications. In 2020, the breast cancer segment accounted for the largest share of the market. This segment is also estimated to grow at the highest CAGR during the forecast period. The large share of this segment is mainly attributed to the rising prevalence of breast cancer, growing awareness about the disease, and increasing research activity pertaining to breast screening and diagnosis.

Image-guided procedures accounted for the largest share of the aspiration needles market, by procedure

On the basis of procedure, the global market is segmented into image-guided procedures (ultrasound-guided biopsy, stereotactic-guided biopsy, MRI-guided biopsy, and other image-guided procedures) and nonimage-guided procedures. Image-guided procedures accounted for the largest share of this market in 2020, primarily due to the rising preference for minimally invasive biopsy and aspiration procedures.

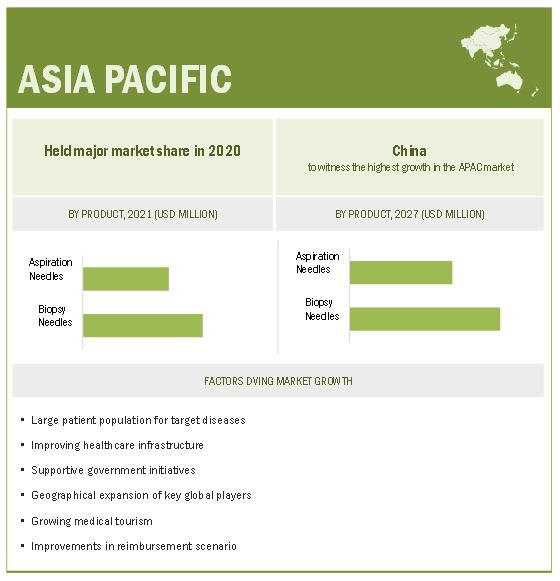

Asia Pacific accounted for the largest share of the aspiration needles market in 2020

This report covers the global market across five major geographies-North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific commanded the largest share of the global market in 2020. Increasing initiatives by government for the cancer diagnostics and screening, rising research activity, and the high incidence of cancer in key APAC countries such as India and China are the major factors driving the growth of this regional market.

CONMED Corporation (US), Medtronic Plc (Ireland), Olympus Corporation (Japan), Becton, Dickinson and Company (US), Boston Scientific Corporation (US), Cook Group Incorporated (US), Argon Medical Devices, Inc (US), INRAD Inc. (US), Somatex Medical Technologies (Germany), Stryker Corporation (US), Cardinal Health (US), Remington Medical (US), Ranfac Corporation (US), HAKKO CO., LTD (Japan), and Merit Medical Systems (US) are some of the major players in the aspiration needles market.

Becton, Dickinson and Company (US) is a leading player in the global market. The company offers a wide range of biopsy products, including breast biopsy, bone marrow biopsy, and soft tissue biopsy forceps and needles. With a strong presence in North America, Europe, and APAC, the company focuses on expanding its geographic presence in emerging countries with expanding healthcare systems in Eastern Europe, the Middle East, Africa, Latin America, and certain countries within APAC. The company also focuses on inorganic strategies such as acquisitions to strengthen its product portfolio and market position. For instance, in April 2017, the company acquired C. R. Bard, Inc. (US) for USD 24 billion. It also acquired CareFusion Corporation (US) in March 2015 and positioned itself as a major player in the aspiration and biopsy needle market. These acquisitions are expected to boost the company’s presence in the market.

Aspiration Needles Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$879 million |

|

Estimated Value by 2026 |

$1,303 million |

|

Growth Rate |

poised to grow at a CAGR of 6.8% |

|

Segments Covered |

Product, Application, Procedure, End User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Latin America and Middle East & Africa. |

This report categorizes the global aspiration needles market into following segments and sub-segments:

By Product Type

-

Biopsy Needles

- CNB Needles

- VAB Needles

- Aspiration Needles

By Application

- Tumor/ Cancer Applications

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Kidney Cancer

- Bone & Bone Marrow Cancer

- Other Cancers

- Wound Applications

- Other Applications

By Procedure

- Image-guided Procedures

- Ultrasound-guided Procedures

- Stereotactic Procedures

- CT-guided Procedures

- MRI-guided Procedures

- Other Image-guided Procedures

- Nonimage-guided Procedures

By End User

- Hospitals & surgical centers

- Diagnostic Clinics & pathology laboratories

- Ambulatory care centers

- Research & Academic Institutes

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

Recent Developments

- In December 2021, Olympus (Japan) launched the FDA 510(k)-cleared BF-UC190F endobronchial ultrasound (EBUS) bronchoscope

- In January 2021, Hologic Inc. acquired Somatex Medical Technologies, Hologic’s strategy to provide comprehensive suite of innovative solutions across the continuum of breast health care

- In May 2019, Argon Medical acquired Mana tech Ltd., its exclusive distributor for the UK and Ireland

- In January 2019, IZI Medical Products acquired Cook Medical’s soft tissue biopsy and breast localization needle product line

Frequently Asked Questions (FAQs):

What is the projected market value of the global Aspiration Needles Market?

The global market of Aspiration Needles Market is projected to reach USD 1,303 Million.

What is the estimated growth rate (CAGR) of the global Aspiration Needles Market for the next five years?

The global Aspiration Needles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% from 2021 to 2027.

What are the major revenue pockets in the Aspiration Needles Market currently?

Asia Pacific commanded the largest share of the global market in 2020. Increasing initiatives by government for the cancer diagnostics and screening, rising research activity, and the high incidence of cancer in key APAC countries such as India and China are the major factors driving the growth of this regional market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKETS COVERED

FIGURE 1 ASPIRATION MARKET SEGMENTATION

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

TABLE 1 STANDARD CURRENCY CONVERSION RATES

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

2.2 RESEARCH DESIGN

FIGURE 2 GLOBAL MARKET: RESEARCH DESIGN

2.2.1 SECONDARY RESEARCH

2.2.1.1 Secondary sources

2.2.2 PRIMARY DATA

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET ESTIMATION METHODOLOGY

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.3.1 TOP-DOWN AND BOTTOM-UP APPROACHES FOR MARKET ESTIMATION

2.3.2 REVENUE MAPPING-BASED MARKET ESTIMATION

FIGURE 5 GLOBAL MARKET: REVENUE MAPPING-BASED MARKET ESTIMATION APPROACH

FIGURE 6 GLOBAL MARKET: TOP-DOWN APPROACH

2.3.3 PRIMARY RESEARCH VALIDATION

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 MARKET DATA TRIANGULATION METHODOLOGY

2.5 RESEARCH ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 8 ASPIRATION NEEDLES MARKET, BY PRODUCT, 2021 VS. 2027 (USD MILLION)

FIGURE 9 GLOBAL MARKET, BY APPLICATION, 2021 VS. 2027 (USD MILLION)

FIGURE 10 GLOBAL MARKET, BY PROCEDURE, 2021 VS. 2027 (USD MILLION)

FIGURE 11 GLOBAL MARKET SHARE, BY END USER, 2021 VS. 2027

FIGURE 12 GLOBAL MARKET, BY REGION

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ASPIRATION NEEDLES MARKET OVERVIEW

FIGURE 13 INCREASING PREVALENCE OF CANCER ACROSS THE GLOBE IS DRIVING MARKET GROWTH

4.2 NORTH AMERICA: MARKET, BY PRODUCT, 2021 VS. 2027 (USD MILLION)

FIGURE 14 BIOPSY NEEDLES SEGMENT TO HOLD MAJOR SHARE OF THE NORTH AMERICAN MARKET

4.3 ASIA PACIFIC: MARKET, BY PROCEDURE, 2021 VS. 2027 (USD MILLION)

FIGURE 15 ULTRASOUND-GUIDED PROCEDURES SEGMENT TO DOMINATE THE ASIA PACIFIC MARKET

4.4 MEA: MARKET, BY APPLICATION, 2021 VS. 2027 (USD MILLION)

FIGURE 16 BREAST CANCER APPLICATIONS SEGMENT TO DOMINATE THE MEA MARKET

4.5 EUROPE: MARKET, BY END USER, 2021 VS. 2027 (USD MILLION)

FIGURE 17 HOSPITALS & SURGICAL CENTERS FORMED THE LARGEST END-USER SEGMENT IN THE EUROPEAN MARKET

4.6 GEOGRAPHIC SNAPSHOT OF THE GLOBAL MARKET

FIGURE 18 CHINA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 50)

5.1 MARKET DYNAMICS

FIGURE 19 ASPIRATION NEEDLES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Rising prevalence of cancer

FIGURE 20 NUMBER OF NEW CANCER CASES (GLOBAL), 2018 VS. 2020

5.1.1.2 Cancer awareness initiatives undertaken by governments and global health organizations

5.1.1.3 Increasing preference for minimally invasive biopsies

5.1.2 RESTRAINTS

5.1.2.1 Risk of infections associated with the use of aspiration and biopsy needles

5.1.2.2 Product recalls

TABLE 2 RECENT PRODUCT RECALLS BY FDA

5.1.3 OPPORTUNITIES

5.1.3.1 Emerging economies

5.1.4 CHALLENGES

5.1.4.1 Underdeveloped healthcare infrastructure and dearth of well-trained radiologists and oncologists

5.2 INDUSTRY TRENDS

5.2.1 EMERGENCE OF LIQUID BIOPSY

5.3 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS: MAXIMUM VALUE IS ADDED DURING THE MANUFACTURING PHASE

5.4 REGULATORY ANALYSIS

5.4.1 NORTH AMERICA

5.4.1.1 US

TABLE 3 US FDA: MEDICAL DEVICE CLASSIFICATION

TABLE 4 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.4.1.2 Canada

TABLE 5 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

FIGURE 22 CANADA: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES

5.4.2 EUROPE

FIGURE 23 EUROPE: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES (MDR)

5.4.3 ASIA PACIFIC

5.4.3.1 Japan

TABLE 6 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

5.4.3.2 China

TABLE 7 CHINA: CLASSIFICATION OF MEDICAL DEVICES

5.4.3.3 India

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 ASPIRATION NEEDLES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5.1 THREAT OF NEW ENTRANTS

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF SUPPLIERS

5.5.4 BARGAINING POWER OF BUYERS

5.5.5 DEGREE OF COMPETITION

5.6 IMPACT OF COVID-19 ON THE GLOBAL MARKET

5.7 ECOSYSTEM COVERAGE: GLOBAL MARKET

5.8 TRADE ANALYSIS

5.8.1 TRADE ANALYSIS FOR BIOPSY NEEDLES

TABLE 9 EXPORT DATA FOR BIOPSY NEEDLES, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 10 IMPORT DATA FOR BIOPSY NEEDLES, BY COUNTRY, 2018–2020 (USD MILLION)

5.9 TECHNOLOGY ANALYSIS

5.10 PATENT ANALYSIS

FIGURE 24 TOP 10 PATENT APPLICANTS FOR ASPIRATION AND BIOPSY NEEDLES (DECEMBER 2021)

FIGURE 25 PATENT APPLICATIONS FOR ASPIRATION AND BIOPSY NEEDLES (JANUARY 2011 TO DECEMBER 2021)

FIGURE 26 TOP 10 PATENT APPLICANTS FOR BIOPSY NEEDLES (JANUARY 2011 TO DECEMBER 2021)

FIGURE 27 PATENT APPLICATIONS FOR ASPIRATION NEEDLES (JANUARY 2011 TO DECEMBER 2021)

6 ASPIRATION NEEDLES MARKET, BY PRODUCT (Page No. - 71)

6.1 INTRODUCTION

TABLE 11 GLOBAL MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

6.2 BIOPSY NEEDLES

TABLE 12 BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 13 BIOPSY NEEDLES MARKET, BY REGION, 2019–2027 (USD MILLION)

6.2.1 BIOPSY NEEDLES MARKET SPLIT, BY PROCEDURE, 2019–2027 (USD MILLION)

TABLE 14 BIOPSY NEEDLES MARKET, BY PROCEDURE, 2019–2027 (USD MILLION)

6.2.2 BIOPSY NEEDLES MARKET SPLIT, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 15 BIOPSY NEEDLES MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

6.2.3 BIOPSY NEEDLES MARKET SPLIT, BY END USER, 2019–2027 (USD MILLION)

TABLE 16 BIOPSY NEEDLES MARKET, BY END USER, 2019–2027 (USD MILLION)

6.2.4 CORE BIOPSY NEEDLES

6.2.4.1 Core biopsy needles are widely used for sample collection in most prevalent cancer types

TABLE 17 CORE BIOPSY NEEDLES MARKET, BY REGION, 2019–2027 (USD MILLION)

6.2.5 CORE BIOPSY NEEDLES MARKET SPLIT, BY PROCEDURE, 2019–2027 (USD MILLION)

TABLE 18 CORE BIOPSY NEEDLES MARKET, BY PROCEDURE, 2019–2027 (USD MILLION)

6.2.6 CORE BIOPSY NEEDLES MARKET SPLIT, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 19 CORE BIOPSY NEEDLES MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

6.2.7 CORE BIOPSY NEEDLES MARKET SPLIT, BY END USER, 2019–2027 (USD MILLION)

TABLE 20 CORE BIOPSY NEEDLES MARKET, BY END USER, 2019–2027 (USD MILLION)

6.2.8 VACUUM-ASSISTED BIOPSY NEEDLES

6.2.8.1 High-volume sampling and greater specificity of VAB procedures to drive the growth of this market segment

TABLE 21 VACUUM-ASSISTED BIOPSY NEEDLES MARKET, BY REGION, 2019–2027 (USD MILLION)

6.2.9 VACUUM-ASSISTED BIOPSY NEEDLES MARKET SPLIT, BY PROCEDURE, 2019–2027 (USD MILLION)

TABLE 22 VACUUM-ASSISTED BIOPSY NEEDLES MARKET, BY PROCEDURE, 2019–2027 (USD MILLION)

6.2.10 VACUUM-ASSISTED BIOPSY NEEDLES MARKET SPLIT, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 23 VACUUM-ASSISTED BIOPSY NEEDLES MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

6.2.11 VACUUM-ASSISTED BIOPSY NEEDLES MARKET SPLIT, BY END USER, 2019–2027 (USD MILLION)

TABLE 24 VACUUM-ASSISTED BIOPSY NEEDLES MARKET, BY END USER, 2019–2027 (USD MILLION)

6.3 ASPIRATION NEEDLES

6.3.1 ASPIRATION NEEDLES ARE ESTIMATED TO ACCOUNT FOR A SMALLER SHARE OF THE MARKET

TABLE 25 ASPIRATION NEEDLES MARKET, BY REGION, 2019–2027 (USD MILLION)

6.3.2 ASPIRATION NEEDLES MARKET SPLIT, BY PROCEDURE, 2019–2027 (USD MILLION)

TABLE 26 ASPIRATION NEEDLES MARKET, BY PROCEDURE, 2019–2027 (USD MILLION)

6.3.3 ASPIRATION NEEDLES MARKET SPLIT, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 27 ASPIRATION NEEDLES MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

6.3.4 ASPIRATION NEEDLES MARKET SPLIT, BY END USER, 2019–2027 (USD MILLION)

TABLE 28 ASPIRATION NEEDLES MARKET, BY END USER, 2019–2027 (USD MILLION)

7 ASPIRATION NEEDLES MARKET, BY PROCEDURE (Page No. - 83)

7.1 INTRODUCTION

TABLE 29 ASPIRATION NEEDLES MARKET, BY PROCEDURE, 2019–2027 (USD MILLION)

7.2 IMAGE-GUIDED PROCEDURES

TABLE 30 ASPIRATION AND BIOPSY NEEDLES MARKET FOR IMAGE-GUIDED PROCEDURES, BY TYPE, 2019–2027 (USD MILLION)

7.2.1 ULTRASOUND-GUIDED PROCEDURES

7.2.1.1 Ultrasound imaging is the preferred imaging standard for most common cancer types

TABLE 31 ASPIRATION AND BIOPSY NEEDLES MARKET FOR ULTRASOUND-GUIDED PROCEDURES, BY REGION, 2019–2027 (USD MILLION)

7.2.2 STEREOTACTIC PROCEDURES

7.2.2.1 Stereotactic procedures are still considered the global standard in biopsies

TABLE 32 ASPIRATION AND BIOPSY NEEDLES MARKET FOR STEREOTACTIC PROCEDURES, BY REGION, 2019–2027 (USD MILLION)

7.2.3 CT-GUIDED PROCEDURES

7.2.3.1 CT imaging is the preferred imaging standard for lung and liver cancers

TABLE 33 ASPIRATION NEEDLES MARKET FOR CT-GUIDED PROCEDURES, BY REGION, 2019–2027 (USD MILLION)

7.2.4 MRI-GUIDED PROCEDURES

7.2.4.1 MRI imaging is the preferred imaging standard for several common cancer types

TABLE 34 ASPIRATION AND BIOPSY NEEDLES MARKET FOR MRI-GUIDED PROCEDURES, BY REGION, 2019–2027 (USD MILLION)

7.2.5 OTHER IMAGE-GUIDED PROCEDURES

TABLE 35 ASPIRATION AND BIOPSY NEEDLES MARKET FOR OTHER IMAGE-GUIDED PROCEDURES, BY REGION, 2019–2027 (USD MILLION)

7.3 NON-IMAGE-GUIDED PROCEDURES

7.3.1 NON-IMAGE-GUIDED PROCEDURES SEGMENT TO ACCOUNT FOR A SMALLER SHARE OF THE MARKET

TABLE 36 ASPIRATION AND BIOPSY NEEDLES MARKET FOR NON-IMAGE-GUIDED PROCEDURES, BY REGION, 2019–2027 (USD MILLION)

8 ASPIRATION NEEDLES MARKET, BY APPLICATION (Page No. - 92)

8.1 INTRODUCTION

TABLE 37 ASPIRATION NEEDLES MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

8.2 TUMOR/CANCER APPLICATIONS

TABLE 38 ASPIRATION AND BIOPSY NEEDLES MARKET FOR TUMOR/CANCER APPLICATIONS, BY TYPE, 2019–2027 (USD MILLION)

8.2.1 BREAST CANCER

8.2.1.1 Increasing awareness of breast cancer to drive the growth of this market segment

TABLE 39 ASPIRATION AND BIOPSY NEEDLES MARKET FOR BREAST CANCER, BY REGION, 2019–2027 (USD MILLION)

8.2.2 LUNG CANCER

8.2.2.1 Growing prevalence of lung cancer to support the growth of this market segment

TABLE 40 ASPIRATION AND BIOPSY NEEDLES MARKET FOR LUNG CANCER, BY REGION, 2019–2027 (USD MILLION)

8.2.3 COLORECTAL CANCER

8.2.3.1 Advancements in alternative diagnosis techniques to reduce the adoption of colorectal biopsy needles

TABLE 41 ASPIRATION NEEDLES MARKET FOR COLORECTAL CANCER, BY REGION, 2019–2027 (USD MILLION)

8.2.4 PROSTATE CANCER

8.2.4.1 Availability of funds for prostate cancer research by different government authorities to support the growth of this market segment

TABLE 42 ASPIRATION AND BIOPSY NEEDLES MARKET FOR PROSTATE CANCER, BY REGION, 2019–2027 (USD MILLION)

8.2.5 KIDNEY CANCER

8.2.5.1 Rising prevalence of kidney cancer to support the growth of this market segment

TABLE 43 ASPIRATION AND BIOPSY NEEDLES MARKET FOR KIDNEY CANCER, BY REGION, 2019–2027 (USD MILLION)

8.2.6 BONE & BONE MARROW CANCER

8.2.6.1 Rising incidence of bone cancer to fuel the growth of this market segment

TABLE 44 ASPIRATION NEEDLES MARKET FOR BONE & BONE MARROW CANCER, BY REGION, 2019–2027 (USD MILLION)

8.2.7 OTHER CANCERS

TABLE 45 ASPIRATION AND BIOPSY NEEDLES MARKET FOR OTHER CANCERS, BY REGION, 2019–2027 (USD MILLION)

8.3 WOUND APPLICATIONS

8.3.1 THE DEMAND FOR WOUND BIOPSIES IS EXPECTED TO INCREASE WITH THE INCREASE IN PREVALENCE OF DIABETIC FOOT ULCERS

TABLE 46 ASPIRATION AND BIOPSY NEEDLES MARKET FOR WOUND APPLICATIONS, BY REGION, 2019–2027 (USD MILLION)

8.4 OTHER APPLICATIONS

TABLE 47 ASPIRATION AND BIOPSY NEEDLES MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2027 (USD MILLION)

9 ASPIRATION NEEDLES MARKET, BY END USER (Page No. - 103)

9.1 INTRODUCTION

TABLE 48 ASPIRATION NEEDLES MARKET, BY END USER, 2019–2027 (USD MILLION)

9.2 HOSPITALS & SURGICAL CENTERS

9.2.1 HOSPITALS AND SURGICAL CENTERS ARE THE LARGEST END USERS OF ASPIRATION AND BIOPSY NEEDLES

TABLE 49 ASPIRATION AND BIOPSY NEEDLES MARKET FOR HOSPITALS & SURGICAL CENTERS, BY REGION, 2019–2027 (USD MILLION)

9.3 AMBULATORY CARE CENTERS

9.3.1 PREFERENCE FOR NEEDLE BIOPSIES IN AMBULATORY CARE CENTERS IS INCREASING DUE TO ONE-DAY OUTPATIENT SURGERY TIMELINES

TABLE 50 ASPIRATION AND BIOPSY NEEDLES MARKET FOR AMBULATORY CARE CENTERS, BY REGION, 2019–2027 (USD MILLION)

9.4 DIAGNOSTIC CLINICS & PATHOLOGY LABORATORIES

9.4.1 A MAJORITY OF SAMPLE DIAGNOSIS IS PERFORMED BY DIAGNOSTIC/PATHOLOGY LABORATORIES

TABLE 51 ASPIRATION NEEDLES MARKET FOR DIAGNOSTIC CLINICS & PATHOLOGY LABORATORIES, BY REGION, 2019–2027 (USD MILLION)

9.5 RESEARCH & ACADEMIC INSTITUTES

9.5.1 MARKET FOR BIOPSY NEEDLES IN RESEARCH & ACADEMIC INSTITUTES IS EXPECTED TO GROW WITH GROWTH IN CANCER RESEARCH

TABLE 52 ASPIRATION AND BIOPSY NEEDLES MARKET FOR RESEARCH & ACADEMIC INSTITUTES, BY REGION, 2019–2027 (USD MILLION)

10 ASPIRATION NEEDLES MARKET, BY REGION (Page No. - 109)

10.1 INTRODUCTION

TABLE 53 GLOBAL MARKET, BY REGION, 2019–2027 (USD MILLION)

10.2 ASIA PACIFIC

FIGURE 28 ASIA PACIFIC: ASPIRATION NEEDLES MARKET SNAPSHOT

TABLE 54 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 55 ASIA PACIFIC: MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 56 ASIA PACIFIC: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 57 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 58 ASIA PACIFIC: MARKET, BY PROCEDURE, 2019–2027 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET, BY END USER, 2019–2027 (USD MILLION)

10.2.1 CHINA

10.2.1.1 China is the largest market for aspiration and biopsy needles in APAC

TABLE 60 CHINA: ASPIRATION NEEDLES MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 61 CHINA: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

10.2.2 JAPAN

10.2.2.1 Japan is the second-largest market for aspiration and biopsy needles in APAC

TABLE 62 JAPAN: ASPIRATION NEEDLES MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 63 JAPAN: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

10.2.3 INDIA

10.2.3.1 Improving healthcare infrastructure to drive market growth in India

TABLE 64 INDIA: ASPIRATION AND BIOPSY NEEDLES MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 65 INDIA: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

10.2.4 SOUTH KOREA

10.2.4.1 Growing healthcare expenditure to drive market growth in South Korea

TABLE 66 SOUTH KOREA: ASPIRATION NEEDLES MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 67 SOUTH KOREA: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

10.2.5 AUSTRALIA

10.2.5.1 Increasing prevalence of cancer to drive market growth in Australia

TABLE 68 AUSTRALIA: ASPIRATION NEEDLES MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 69 AUSTRALIA: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

10.2.6 REST OF ASIA PACIFIC

TABLE 70 ROAPAC: ASPIRATION AND BIOPSY NEEDLES MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 71 ROAPAC: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

10.3 EUROPE

TABLE 72 EUROPE: ASPIRATION NEEDLES MARKET, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 73 EUROPE: MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 74 EUROPE: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 76 EUROPE: MARKET, BY PROCEDURE, 2019–2027 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY END USER, 2019–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Higher per capita spending on healthcare and presence of notable players to drive market growth in Germany

TABLE 78 GERMANY: ASPIRATION NEEDLES MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 79 GERMANY: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 Increasing prevalence of cancer to drive market growth in France

TABLE 80 FRANCE: ASPIRATION AND BIOPSY NEEDLES MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 81 FRANCE: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

10.3.3 UK

10.3.3.1 Higher per capita spending on healthcare and the presence of notable players are expected to support market growth in the UK

TABLE 82 UK: ASPIRATION NEEDLES MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 83 UK: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Increasing geriatric population to drive market growth in Italy

TABLE 84 ITALY: ASPIRATION NEEDLES MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 85 ITALY: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Growing prevalence of cancer to drive market growth in Spain

TABLE 86 SPAIN: ASPIRATION AND BIOPSY NEEDLES MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 87 SPAIN: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 88 ROE: ASPIRATION NEEDLES MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 89 ROE: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

10.4 NORTH AMERICA

FIGURE 29 NORTH AMERICA: ASPIRATION NEEDLES MARKET SNAPSHOT

TABLE 90 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 92 NORTH AMERICA: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET, BY PROCEDURE, 2019–2027 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET, BY END USER, 2019–2027 (USD MILLION)

10.4.1 US

10.4.1.1 The US dominates the North American aspiration and biopsy needles market

TABLE 96 US: ASPIRATION NEEDLES MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 97 US: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

10.4.2 CANADA

10.4.2.1 Growing incidence of cancer to drive market growth in Canada

TABLE 98 CANADA: MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 99 CANADA: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

10.5 LATIN AMERICA

TABLE 100 LATIN AMERICA: ASPIRATION NEEDLES MARKET, BY COUNTRY, 2019–2027 (USD MILLION)

TABLE 101 LATIN AMERICA: MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 102 LATIN AMERICA: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 103 LATIN AMERICA: MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 104 LATIN AMERICA: MARKET, BY PROCEDURE, 2019–2027 (USD MILLION)

TABLE 105 LATIN AMERICA: MARKET, BY END USER, 2019–2027 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Brazil is the largest market for aspiration and biopsy needles in LATAM

TABLE 106 BRAZIL: ASPIRATION NEEDLES MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 107 BRAZIL: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

10.5.2 MEXICO

10.5.2.1 Increasing healthcare spending to drive market growth in Mexico

TABLE 108 MEXICO: ASPIRATION NEEDLES MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 109 MEXICO: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

10.5.3 REST OF LATIN AMERICA

TABLE 110 ROLA: ASPIRATION NEEDLES MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 111 ROLA: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 INCREASING PREVALENCE OF CANCER TO DRIVE MARKET GROWTH IN MEA

TABLE 112 MIDDLE EAST & AFRICA: ASPIRATION NEEDLES MARKET, BY PRODUCT, 2019–2027 (USD MILLION)

TABLE 113 MIDDLE EAST & AFRICA: BIOPSY NEEDLES MARKET, BY TYPE, 2019–2027 (USD MILLION)

TABLE 114 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2027 (USD MILLION)

TABLE 115 MIDDLE EAST & AFRICA: MARKET, BY PROCEDURE, 2019–2027 (USD MILLION)

TABLE 116 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2019–2027 (USD MILLION)

`

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

11.3 MARKET SHARE ANALYSIS: ASPIRATION MARKET, BY KEY PLAYER (2020)

FIGURE 30 BECTON, DICKINSON AND COMPANY HELD THE LEADING POSITION IN THE GLOBAL MARKET IN 2020

11.4 COMPANY EVALUATION QUADRANT FOR 25 MAJOR PLAYERS (2020)

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 31 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

11.5 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2020)

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 DYNAMIC COMPANIES

11.5.4 STARTING BLOCKS

FIGURE 32 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING FOR SMES/START-UPS (2020)

11.6 COMPETITIVE BENCHMARKING

TABLE 117 APPLICATION FOOTPRINT ANALYSIS OF THE TOP PLAYERS IN THE GLOBAL MARKET

TABLE 118 REGIONAL FOOTPRINT ANALYSIS OF THE TOP PLAYERS IN THE ASPIRATION NEEDLES MARKET

11.7 COMPETITIVE SCENARIO (2018–2021)

11.7.1 NEW PRODUCT LAUNCHES AND APPROVALS

11.7.2 DEALS

12 COMPANY PROFILES (Page No. - 155)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

12.2.1 BECTON, DICKINSON AND COMPANY (BD)

TABLE 119 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

FIGURE 33 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2021)

12.2.2 MERIT MEDICAL SYSTEMS

TABLE 120 MERIT MEDICAL SYSTEMS: BUSINESS OVERVIEW

FIGURE 34 MERIT MEDICAL SYSTEMS: COMPANY SNAPSHOT (2020)

12.2.3 COOK GROUP INCORPORATED

TABLE 121 COOK GROUP INCORPORATED: BUSINESS OVERVIEW

12.2.4 OLYMPUS CORPORATION

TABLE 122 OLYMPUS CORPORATION: BUSINESS OVERVIEW

FIGURE 35 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2021)

12.2.5 MEDTRONIC, PLC

TABLE 123 MEDTRONIC, PLC: BUSINESS OVERVIEW

FIGURE 36 MEDTRONIC, PLC: COMPANY SNAPSHOT (2020)

12.2.6 ARGON MEDICAL DEVICES, INC.

TABLE 124 ARGON MEDICAL DEVICES, INC: BUSINESS OVERVIEW

12.2.7 BOSTON SCIENTIFIC CORPORATION

TABLE 125 BOSTON SCIENTIFIC CORPORATION: BUSINESS OVERVIEW

FIGURE 37 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2020)

12.2.8 CARDINAL HEALTH, INC.

TABLE 126 CARDINAL HEALTH, INC.: BUSINESS OVERVIEW

FIGURE 38 CARDINAL HEALTH, INC.: COMPANY SNAPSHOT (2021)

12.2.9 CONMED CORPORATION

TABLE 127 CONMED CORPORATION: BUSINESS OVERVIEW

FIGURE 39 CONMED CORPORATION: COMPANY SNAPSHOT (2020)

12.2.10 HAKKO CO., LTD.

TABLE 128 HAKKO CO., LTD.: BUSINESS OVERVIEW

12.2.11 INRAD INC.

TABLE 129 INRAD INC.: BUSINESS OVERVIEW

12.2.12 RANFAC CORPORATION

TABLE 130 RANFAC CORPORATION: BUSINESS OVERVIEW

12.2.13 REMINGTON MEDICAL INC.

TABLE 131 REMINGTON MEDICAL INC.: BUSINESS OVERVIEW

12.2.14 SOMATEX MEDICAL TECHNOLOGIES

TABLE 132 SOMATEX MEDICAL TECHNOLOGIES: BUSINESS OVERVIEW

12.2.15 STRYKER CORPORATION

TABLE 133 STRYKER CORPORATION: BUSINESS OVERVIEW

FIGURE 40 STRYKER CORPORATION: COMPANY SNAPSHOT (2020)

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

12.3 OTHER PLAYERS

12.3.1 CREGANNA

12.3.2 STERYLAB SRL

12.3.3 DR. JAPAN CO., LTD.

12.3.4 DTR MEDICAL

12.3.5 ISCON SURGICALS LTD.

12.3.6 JOHNSON & JOHNSON MEDICAL DEVICES

12.3.7 SHANGHAI SA MEDICAL & PLASTIC INSTRUMENTS

12.3.8 MEDAX MEDICAL DEVICES

12.3.9 MEDITECH DEVICES

12.3.10 WELLGO MEDICAL PRODUCTS GMBH

13 APPENDIX (Page No. - 197)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

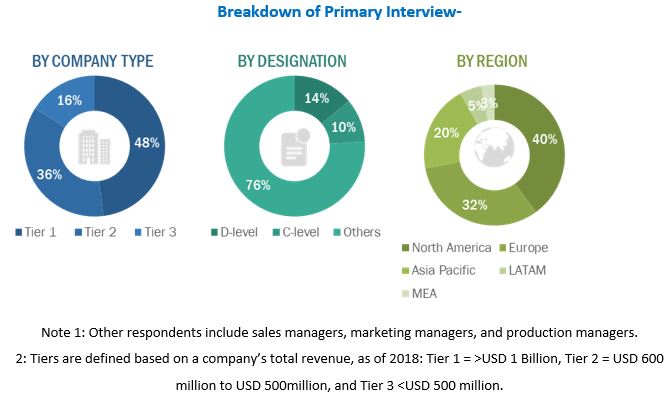

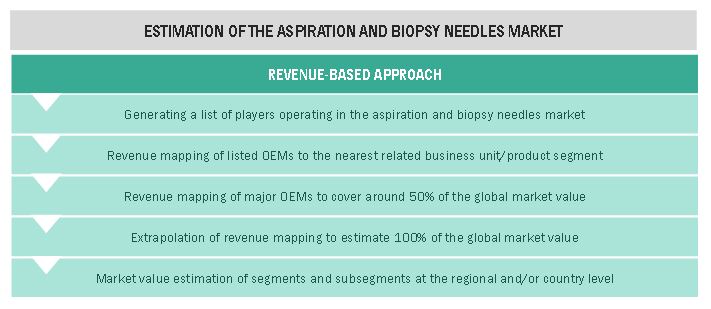

This study involved four major activities in estimating the current size of the aspiration and biopsy needles market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was conducted to obtain key information about the market classification and segmentation, geographical scenario, key developments undertaken by major market players, and the identification of key industry trends. The secondary sources used for this study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles from recognized websites, databases, and directories.

Primary Research

Extensive primary research was conducted after acquiring a preliminary understanding of the aspiration and biopsy needles market scenario through secondary research. Primary interviews were conducted with market experts from both the demand-side (such as department heads at hospitals, oncologists, radiologists, and diagnostic centers) and supply-side respondents (such as C & D-level executives & product managers of key manufacturers, distributors, and channel partners) across North America, Europe, Asia Pacific, Latin America and Middle East & Africa. Approximately 30% and 70% of primary interviews were conducted with both the demand- and supply-side respondents, respectively. Primary data was collected through questionnaires, e-mails, online surveys, and telephonic interviews. A breakdown of primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

- A detailed market estimation approach was followed to estimate and validate the size of the aspiration and biopsy needles market and other dependent submarkets.

- The key players in the aspiration and biopsy needles market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology includes the study of the annual and quarterly financial reports of top market players as well as interviews with industry experts to gather key insights on various market segments and subsegments.

- All segmental shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- Major Macroindicators in play have been accounted for, viewed in detail, verified through primary research, and analyzed to understand their impact on market growth and various segments and subsegments.

- The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation:

After deriving the overall aspiration and biopsy needles market value from the market size estimation process explained above, the total market value data was split into several segments and subsegments. Data triangulation and market breakdown procedures were undertaken to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data was triangulated by studying various qualitative & quantitative variables as well as by analyzing regional trends for both the demand- and supply-side macroindicators.

Report Objectives:

- To define, describe, and forecast the aspiration and biopsy needles market on the basis of product, site, procedure, end user, and region

- To provide detailed information regarding the major factors influencing the aspiration and biopsy needles market (such as drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the aspiration and biopsy needles market.

- To analyze key growth opportunities in the aspiration and biopsy needles market for key stakeholders and provide details of the competitive landscape for key market players

- To forecast the market value of various segments and/or subsegments with respect to four major regional segments—North America, Europe, Asia Pacific, and the Rest of the World

- To profile the key players in the aspiration and biopsy needles market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments undertaken by major players in the aspiration and biopsy needles market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the aspiration and biopsy needles market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies in the aspiration and biopsy needles market.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe aspiration and biopsy needles market into Belgium, Austria, the Czech Republic, Denmark, Greece, Poland, and Russia, among other

- Further breakdown of the Rest of Asia Pacific aspiration and biopsy needles market into wan, New Zealand, Vietnam, the Philippines, Singapore, Malaysia, Thailand, and Indonesia among other

- Further breakdown of the Latin American aspiration and biopsy needles market into Argentina, Chile, Peru, and Colombia, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aspiration & Biopsy Needles Market

Which are the key growth opportunities in the aspiration and biopsy needles market for key stakeholders?

How much is the forecast value of the various segments and/or sub-segments with respect to different regions covered in Global aspiration and biopsy needles market?

Which are the competitive measures undertaken by leading companies in the global aspiration and biopsy needles market?