Agentic AI Market

Agentic AI Market by Offering (Agentic AI Infrastructure, Agentic AI SaaS, Agentic AI Platforms, Agentic AI Services), Horizontal Use Case (Customer Experience, Data Analytics & BI, Sales, Marketing, Coding & Testing, SecOps) - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

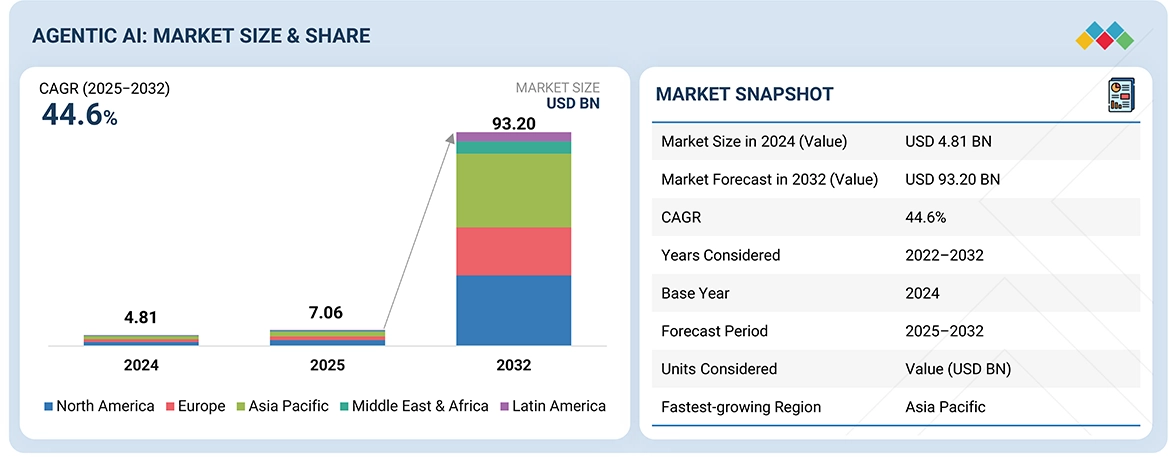

The Agentic AI market is on a steep growth trajectory, set to expand from USD 7.06 billion in 2025 to USD 93.20 billion by 2032, at an impressive CAGR of 44.6%. This surge reflects a fundamental shift toward intelligent software agents capable of autonomous reasoning, adaptive learning, and dynamic action. Fueled by the convergence of Generative AI, orchestration frameworks, and reinforcement learning, Agentic AI enables enterprises to deploy modular, context-aware, and decision-capable agents that optimize workflows, enhance agility, and drive AI-native transformation at scale.

KEY TAKEAWAYS

- The North America Agentic AI market is projected to hold the largest market share in 2025.

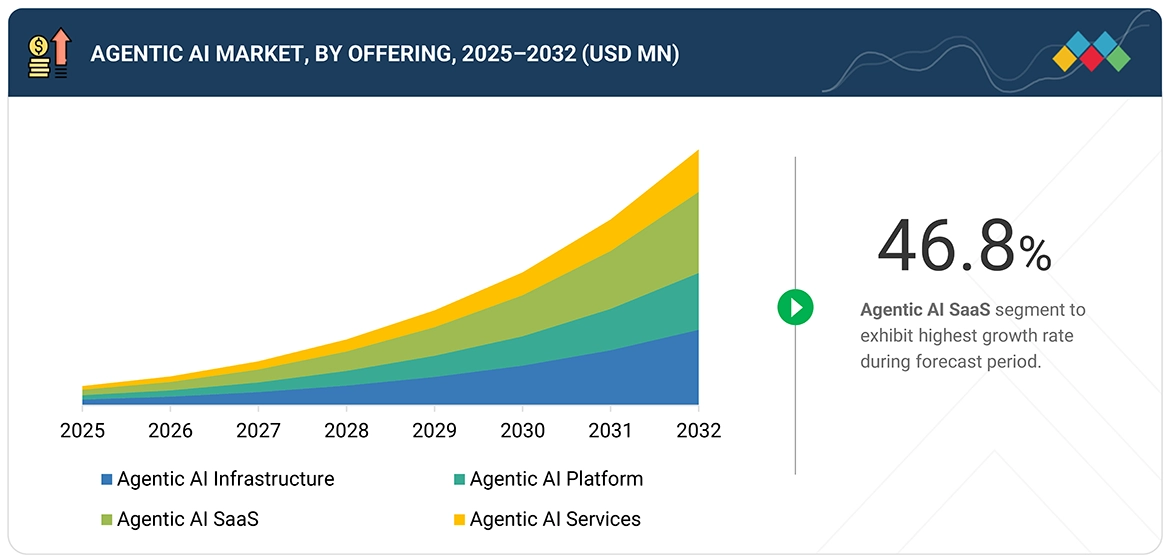

- By offering, Agentic AI SaaS segment is expected to register highest CAGR of 46.8% during the forecast period 2025-2032.

- By horizontal use cases, the workplace experience segment is expected to register the higest CAGR of 48.7% during the forecast period.

- By vertical use cases, the proposal & RFP generation segment for professional services is expected to register a higher CAGR of 57.2% during the forecast period.

- By end users, Professional service providers are projected to register the fastest CAGR.

- Companies such as OpenAI, UiPath, and Snowflake were identified as some of the star players in the Agentic AI platforms segment, given their strong market share and product footprint.

Agentic AI represents autonomous AI systems that operate independently, pursue specific goals, interact with environments, learn continuously, optimize workflows, and coordinate with multiple agents without constant human supervision. Defining features of Agentic AI include autonomy (operates independently without requiring constant human supervision), goal-oriented (pursues specific objectives and optimizes toward desired outcomes), environment interaction (actively perceives and responds to changes), learning capability (incorporates machine learning to improve performance), workflow optimization (enhances processes through real-time decision making), and multi-agent coordination (enables seamless collaboration between multiple AI agents).

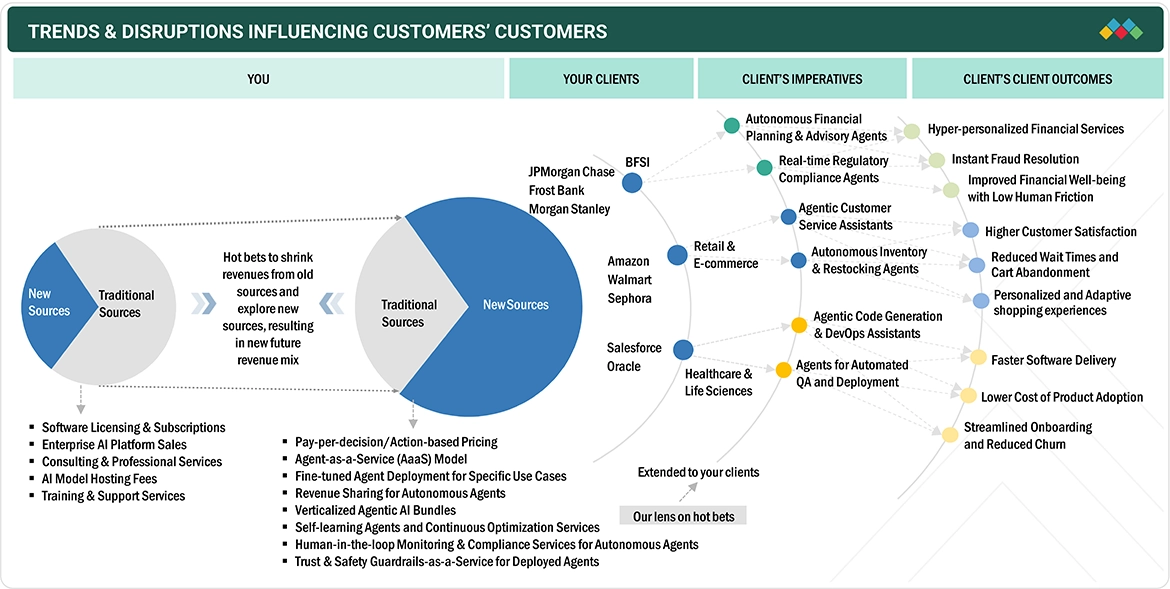

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact of Agentic AI on enterprises is being shaped by evolving customer trends and market disruptions that are redefining how value is created across industries. As these shifts unfold, they influence the revenue models of end users, which in turn cascade to key clients (“hotbets”) and ultimately to Agentic AI providers. This interconnected cycle highlights how changing business imperatives and emerging disruptions are driving new growth opportunities and reshaping the competitive landscape for AI-driven enterprises.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Enterprise Push for Hyper-Automation

-

Breakthroughs in LLMs, Memory, and Orchestration

Level

-

Lack of Standardization Across Geographies

-

Unclear ROI in Simpler Use Cases

Level

-

Collaborative Orchestration Engines

-

Sectoral Scaling in BFSI, Telecom, and Manufacturing

Level

-

Fragmented Autonomy Stacks & Interoperability Gaps

-

Legal & Ethical Uncertainty in Regulated Sectors

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising convergence of LLMs, RPA, and tool orchestration is accelerating market adoption

Agentic AI market is being driven by the integration of Large Language Models(LLMs) , Robotic Process Automation (RPA), and autonomous tool orchestration. This convergence enables Context-aware, adaptive automation, Cross-application task execution without human intervention, Embedded agents for knowledge search, decision augmentation, and workflow coordination. Enterprises are moving beyond static automation toward intelligent, self-directed systems that reduce time-to-insight and elevate productivity.

Restraint: Fragmented agent architectures are slowing enterprise-scale deployment

Enterprise-scale deployment is hindered by fragmented agent architectures and platform silos. For example, Disconnected toolchains and runtimes, Inconsistent memory handling, and Limited cross-application fluidity. Most deployments remain tethered to isolated copilots, restricting persistent, context-rich task execution across departments. The absence of standardized orchestration protocols and composable infrastructure increases technical debt and slows time-to-value. Enterprises need unified intelligence layers and interoperable agent frameworks to scale Agentic AI effectively.

Opportunity: Plug-and-play agent ecosystems are creating new growth pathways for enterprises

The emergence of agent marketplaces and domain-specific agent builders is unlocking new growth pathways. These platforms offer Ready-to-integrate agents for financial forecasting, compliance, legal summarization, engineering design, and troubleshooting, Agent-as-a-Service models with retraining, optimization, and governance controls, and Rapid experimentation without deep in-house model engineering. Enterprises gain agility and control, while vendors tap into new monetization channels through modular, context-aligned agent deployments.

Challenge: Lack of standardized evaluation metrics and benchmarking protocols for agent performance

A major challenge in the Agentic AI market is the absence of enterprise-grade evaluation frameworks to benchmark agent performance under real-world conditions. Traditional metrics—such as accuracy, latency, and intent resolution—fail to capture the nuanced capabilities of autonomous agents, including Dynamic reasoning, Tool use efficiency, and Goal alignment across workflows. This gap creates uncertainty for enterprise leaders in Measuring ROI, Validating safety thresholds, and Ensuring reliability across deployments. The issue is especially critical in high-stakes workflows like legal review, financial auditing, and operational control, where agent actions carry business risk. While open-source tools like AgentBench, CAMEL, and APE are emerging, they often lack alignment with enterprise needs such as Long-context continuity, Permissioned tool access, and Regulatory audit trails.

Agentic AI Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Cencora integrated Infinitus’s voice AI agents into their benefit verification ecosystem to automate calls, streamline patient access to therapy, and address seasonal spikes in demand. | Scalable solution that handles 10x or more demand Spikes | 4x faster turnaround than traditional methods | Consistently high quality and reliability | Reduced need for seasonal hiring and training | Empowered staff to focus on higher-value patient support tasks |

|

Teva Pharmaceuticals launched an AI agent named Medi, powered by Amelia’s conversational AI platform, to help patients and users better access and understand medication information from drug leaflets. | Improved patient understanding of medication instructions and safety information | Enhanced medication adherence and safer use of medicines | Streamlined access to critical drug information in a user-friendly conversational format |

|

Caltrans transforms highway project monitoring with skydios autonomous drone technology | Significant savings in time, cost, and reduction of costly construction mistakes | Consistent and accurate project monitoring despite staffing shortages | Faster dispute resolution through drone-captured imagery | Scalable operations with plans to further integrate AI for automated issue detection and analysis |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Agentic AI ecosystem comprises a multilayered value chain that integrates core infrastructure, orchestration platforms, verticalized SaaS offerings, and professional services. At the foundation are infrastructure and framework providers enabling agent memory, context-awareness, and compute orchestration. Platform vendors build modular environments for designing, deploying, and scaling agentic workflows across industries. SaaS players are embedding agentic intelligence within enterprise applications to automate decision-making, user interactions, and complex task flows. Complementing this, services firms provide implementation, integration, and advisory capabilities that bridge technology with business outcomes. This convergence ensures enterprise readiness, interoperability, and sustained adoption across domains.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Agentic AI market, By Offering

Agentic AI delivered via Software-as-a-Service (SaaS) is experiencing the highest CAGR due to its low infrastructure overhead, on-demand scalability, and ease of integration. Enterprises and SMEs are adopting SaaS-based agentic platforms to accelerate deployment and reduce time-to-value. SaaS models are democratizing access to agentic AI, enabling continuous updates, multi-cloud orchestration, and modular integration across business functions.

Agentic AI market, By Horizontal Use Case

Organizations are embedding agentic AI into workplace systems to drive intelligent task automation, personalized digital assistance, and collaborative productivity. The rise of hybrid and remote work is accelerating demand for AI-driven employee experience platforms. Workplace experience is becoming a strategic lever for talent engagement, workflow optimization, and cost reduction, positioning it as the most dynamic horizontal use case.

Agentic AI market, By Vertical Use Case

The Banking, Financial Services & Insurance (BFSI) sector accounted for largest market share in 2024, driven by early adoption of agentic AI for fraud detection, compliance automation, personalized financial advisory, and risk management. BFSI is setting the benchmark for mission-critical AI integration, leveraging agentic systems to enhance accuracy, regulatory alignment, and operational efficiency.

Agentic AI market, By End User

Large enterprises are leading adoption due to their need for advanced automation, cross-functional decision support, and scalable AI infrastructure. Agentic AI is being deployed across finance, HR, and operations to manage complex workflows. Enterprises are investing in agentic AI as a core pillar of digital transformation , reflecting their greater budgets, integration capabilities, and long-term strategic focus.

REGION

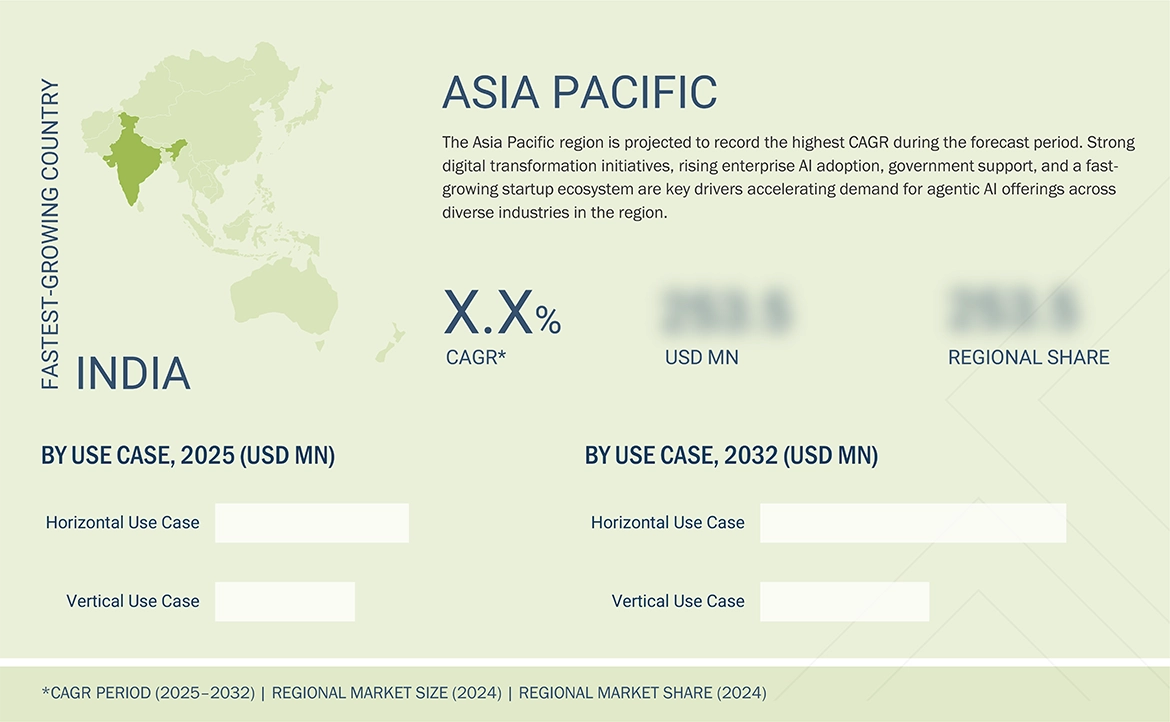

Asia Pacific to be fastest-growing region in global Agentic AI Market during forecast period

Asia Pacific is the fastest-growing region in the Agentic AI market (2025–2032), driven by Government-led AI initiatives (e.g., India’s USD 1.2B AI mission), Enterprise-scale deployments in BFSI and telecom, and Cloud infrastructure expansion and developer ecosystem maturity.Vendors are witnessing accelerated traction across key markets including India (Boosting foundational model integration across sectors), China (ICBC & Ping An piloting multi-agent systems for BFSI), Southeast Asia (Grab & DBS deploying agentic copilots for CX and productivity). Asia Pacific is becoming a launchpad for scalable agentic AI platforms, with strong public-private momentum and improving regulatory clarity.

Agentic AI Market: COMPANY EVALUATION MATRIX

In the agentic AI market, SAP is positioned as a Star, reflecting its strong market presence, advanced product footprint, and wide adoption across industries driven by enterprise-grade AI integration. Meanwhile, Avanade is identified as an Emerging Leader, supported by its innovative AI-driven solutions, consulting expertise, and growing influence in enabling enterprises to scale AI adoption effectively. This highlights SAP’s dominance and Avanade’s rising momentum in the market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.81 Billion |

| Market Forecast in 2032 (Value) | USD 93.20 Billion |

| Growth Rate | 44.6% |

| Years Considered | 2022–2032 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2032 |

| Units Considered | USD Mn |

| Report Coverage | Company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

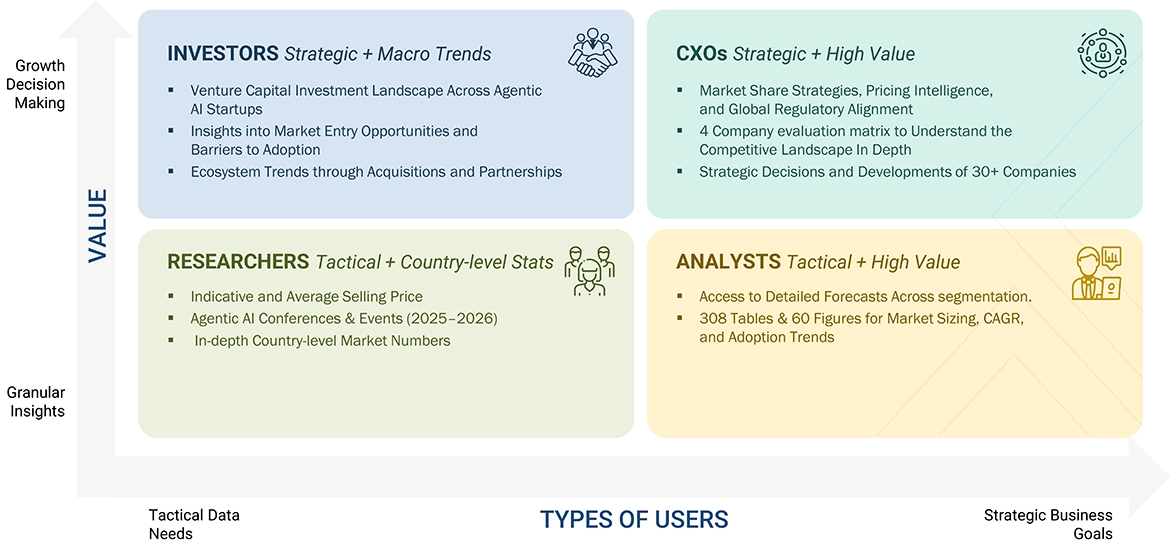

WHAT IS IN IT FOR YOU: Agentic AI Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Agentic AI Vendor | Delivered region-wise market sizing and growth forecasts across North America, Europe, and APAC, conducted competitive benchmarking covering pricing models, product capabilities, and go-to-market strategies, and performed pricing elasticity and profitability analysis across enterprise deployment tiers. | Enabled the client to identify high-growth regional clusters, refine localized pricing strategies, and strengthen market entry positioning. Insights supported data-driven decisions for channel prioritization and investment allocation. |

| Top-Tier Agentic AI Platform Provider | Provided strategic insights on growth acceleration, including technology convergence mapping (GenAI + RL + orchestration frameworks), vertical-specific adoption trends, and untapped enterprise use cases. Delivered an opportunity heatmap highlighting early-stage sectors with scalable automation potential. | Helped the client align product roadmap with emerging demand zones, prioritize partnerships in high-value verticals (e.g., BFSI, healthcare), and capture first-mover advantage in agent-based enterprise automation. Resulted in enhanced GTM precision and accelerated customer acquisition. |

RECENT DEVELOPMENTS

- July 2025 : OpenAI unveiled the ChatGPT Agent, a significant leap in the evolution of autonomous AI, integrating its existing Operator and Deep Research functionalities into a unified agentic system. Designed to handle complex, multi-step workflows, the ChatGPT Agent can navigate web interfaces, generate editable presentations, manage calendars, complete forms, and conduct advanced research, marking a shift from conversational AI to functional autonomy.

- May 2025 : IBM announced new tools and frameworks for building and managing networks of AI agents, including pre-built domain agents for HR, procurement, and sales, now integrated with AWS Marketplace technologies. A key highlight is the planned integration between Amazon Q index and IBM watsonx Orchestrate, enabling AI agents to access and act on data from multiple third-party applications like Salesforce, Slack, and Zendesk for more personalized automation.

- April 2025 : Microsoft updated Microsoft Dynamics 365, with hundreds of new features across all major modules. Key updates include expanded AI-powered Copilot and agent capabilities to automate tasks, improve customer service, enhance sales productivity, streamline finance and supply chain operations, and boost HR and commerce experiences. The release also brings better integration, automation, and analytics to help businesses work smarter and faster.

- April 2025 : Google launched Agent Space, a new platform that allows businesses and developers to build AI agents that can work together, even across different organizations. These agents can perform tasks, find information, and interact with each other using an open Agent-to-Agent (A2A) protocol. This platform simplifies AI agent creation, enabling users to automate workflows, conduct real-time research, and streamline tasks, potentially leading to a marketplace for AI agents.

- April 2025 : Amazon Lex V2 was updated with agentic AI capabilities, including support for Bedrock Knowledge Base, Guardrails, Anthropic Claude 3 Haiku and Sonnet models. These enhancements are integrated within the QnA built-in slot. Furthermore, Lex V2 now also supports the QinConnect built-in intent to connect bots with Amazon Connect.

Table of Contents

Methodology

The research methodology for the global agentic AI market report involved the use of extensive secondary sources and directories, as well as various reputed open-source databases, to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including agentic AI SaaS providers, agentic AI platform providers, agentic AI service providers, agentic AI infrastructure providers, individual end users, and enterprise end users; high-level executives of multiple companies offering agentic AI solutions; and industry consultants to obtain and verify critical qualitative and quantitative information and assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications such as Journal of Artificial Intelligence Research (JAIR), Transactions of the Association for Computational Linguistics (TACL), Journal of Machine Learning Research (JMLR), IEEE Transactions on Neural Networks and Learning Systems, Nature Machine Intelligence, Artificial Intelligence Journal (AIJ), ACM Transactions on Information Systems (TOIS), Pattern Recognition Journal, and Neural Computation (MIT Press); and articles from recognized associations and government publishing sources including but not limited to Association for Computational Linguistics (ACL), International Association for Machine Learning (IAMLE), Artificial Intelligence Industry Association (AIIA), International Speech Communication Association (ISCA), Natural Language Processing Association (NLPA), Machine Learning and AI Industry Research Association (MLAIRA), and AI Infrastructure Alliance (AIIA).

The secondary research was used to obtain key information about the industry’s value chain, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

In the primary research process, a diverse range of stakeholders from both the supply and demand sides of the agentic AI ecosystem were interviewed to gather qualitative and quantitative insights specific to this market. From the supply side, key industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology & innovation directors, as well as technical leads from vendors offering agentic AI software & services, were consulted. Additionally, system integrators, service providers, and IT service firms that implement and support agentic AI were included in the study. On the demand side, input from IT decision-makers, infrastructure managers, and business heads of prominent enterprise end users was collected to understand the user perspectives and adoption challenges within targeted industries.

The primary research ensured that all crucial parameters affecting the agentic AI market—from technological advancements and evolving use cases (workflow automation, inspection & monitoring, navigation & mobility, planning & decision support, etc.) to regulatory and compliance needs (GDPR, CCPA, Europe AI Act, AIDA, etc.) were considered. Each factor was thoroughly analyzed, verified through primary research, and evaluated to obtain precise quantitative and qualitative data for this market.

Once the initial phase of market engineering was completed, including detailed calculations for market statistics, segment-specific growth forecasts, and data triangulation, an additional round of primary research was undertaken. This step was crucial for refining and validating critical data points, such as agentic AI offerings (software & services), industry adoption trends, the competitive landscape, and key market dynamics like demand drivers (Increasing enterprise need for hyper-automation to streamline workflows end-to-end, breakthroughs in LLMs, memory, and orchestration frameworks enable autonomous multi-step task execution, widespread access to high-performance computing and scalable AI deployment environments, growing maturity of digital twins with agentic orchestration for real-world simulation), challenges (fragmented autonomy stacks and missing interoperability standards restrict system integration, legal and ethical gaps around autonomous actions are delaying adoption in regulated sectors), and opportunities (New orchestration engines for multiple autonomous agents working collaboratively, scaling autonomous agents across BFSI, telecom, and manufacturing for digital transformation, emerging AI regulations are unlocking new markets for complaint autonomy).

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to record the critical information/insights throughout the report.

Note: Three tiers of companies are defined based on their total revenue as of 2024; tier 1 = revenue more than

USD 500 million, tier 2 = revenue between USD 500 million and 100 million, tier 3 = revenue less than USD 100 million

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To estimate and forecast the agentic AI market and its dependent submarkets, both top-down and bottom-up approaches were employed. This multi-layered analysis was further reinforced through data triangulation, incorporating both primary and secondary research inputs. The market figures were also validated against the existing MarketsandMarkets repository for accuracy. The following research methodology has been used to estimate the market size:

Agentic AI Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Agentic AI represents autonomous AI systems that operate independently, pursue specific goals, interact with environments, learn continuously, optimize workflows, and coordinate with multiple agents without constant human supervision. Defining features of agentic AI include:

- Autonomy - Operates independently without requiring constant human supervision

- Goal-oriented - Pursue specific objectives and optimize toward desired outcomes

- Environment Interaction - Actively perceives and responds to changes

- Learning Capability - Incorporates machine learning to improve performance

- Workflow Optimization - Enhances processes through real-time decision making

- Multi-agent Coordination - Enables seamless collaboration between multiple AI agents

Stakeholders

- Agentic AI platform providers

- Agentic AI infrastructure providers

- Agentic AI service providers

- Agentic AI SaaS providers

- AI training dataset providers

- LLM providers

- Cloud service providers

- Enterprise end users

- Distributors and Value-added Resellers (VARs)

- Government agencies

- Independent Software Vendors (ISVs)

- Managed service providers

- Market research and consulting firms

- Support & maintenance service providers

- System Integrators (SIs)/Migration service providers

- Technology providers

- Business analysts

- Academia & research institutions

- Investors & venture capital firms

Report Objectives

- To define, describe, and forecast the agentic AI market, by offering, horizontal use case, vertical use case, and end user

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the agentic AI market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments, such as partnerships, product launches, mergers, and acquisitions, in the agentic AI market

- To analyze the impact of the recession on the agentic AI market across all regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakup of the North American market for agentic AI

- Further breakup of the European market for agentic AI

- Further breakup of the Asia Pacific market for agentic AI

- Further breakup of the Middle East & African market for agentic AI

- Further breakup of the Latin American market for agentic AI

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is agentic AI?

Agentic AI represents autonomous AI systems that operate independently, pursue specific goals, interact with environments, learn continuously, optimize workflows, and coordinate with multiple agents without constant human supervision. Defining features of agentic AI include autonomy (operates independently without requiring constant human supervision), goal-oriented (pursues specific objectives and optimizes toward desired outcomes), environment interaction (actively perceives and responds to changes), learning capability (incorporates machine learning to improve performance), workflow optimization (enhances processes through real-time decision making), and multi-agent coordination (enables seamless collaboration between multiple AI agents).

What is the total CAGR expected to be recorded for the agentic AI market between 2025 and 2032?

The agentic AI market is expected to record a CAGR of 44.6% from 2025 to 2032.

How is the agentic AI market different from AI agents?

The agentic AI market is broader than the AI agents market, as it includes autonomous agents and the full stack of technologies, orchestration frameworks, and service layers that enable goal-directed, adaptive behavior across digital and physical systems. While AI agents are the end products (software or robotic systems) that act with autonomy, agentic AI encompasses the infrastructure, development tools, and governance models that support scalable, multi-agent intelligence in real-world applications.

Which are the key drivers supporting the growth of the agentic AI market?

Some factors driving the growth of the agentic AI market include the increasing enterprise need for hyper-automation to streamline end-to-end workflows; breakthroughs in LLMs, memory, and orchestration frameworks enabling autonomous multi-step task execution; widespread access to high-performance computing and scalable AI deployment environments; and growing maturity of digital twins with agentic orchestration capabilities for real-world simulation.

Which are the top 3 end users prevailing in the agentic AI market?

BFSI, retail and e-commerce, and professional service providers lead the agentic AI market due to their need for automation, contextual decision-making, and workflow intelligence. BFSI applies agentic AI for risk scoring, compliance checks, and dynamic underwriting. Retail uses it for personalized recommendations, inventory optimization, and campaign execution. Professional service firms deploy agents for legal research, audit support, and document generation. These sectors face high volumes of data-driven tasks and demand scalable, adaptive systems that boost efficiency while maintaining traceability, making them ideal candidates for deploying task-specific, memory-enabled autonomous agents across functions.

Who are the key vendors in the agentic AI market?

Some major players in the agentic AI market include Aisera (US), Avanade (US), PwC (UK), Wipro (India), HCL Tech (India), Cognizant (US), Cisco (US), Ericsson (Sweden), NTT Data (Japan), SAS (US), Capgemini (France), Appian (US), IBM (US), ServiceNow (US), Accenture (Ireland), EY (UK), Salesforce (US), Pega (US), SAP (Germany), Snowflake (US), Altair (US), CyberArk (Israel), Zycus (US), Oracle (US), OpenAI (US), UiPath (US), Deloitte (UK), AWS (US), Microsoft (US), NVIDIA (US), Google (US), Newgen (India), Hexaware (India), AMD (US), Amdocs (US), ValueLabs (India), TCS (India), and Datamatics (US), Rewind AI (US), Ema (US), Exa (US), Orby AI (US), Artisan AI (US), Dexa AI (US), Simular, relevance AI (US), and Adept AI (US).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Agentic AI Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Agentic AI Market