Automotive Composites Market

Automotive Composites Market by Fiber Type (Glass, Carbon), Resin Type (Thermoset, Thermoplastic), Manufacturing Process (Compression Molding, Injection Molding, Rtm), Application, Vehicle Type, & Region - Global Forecast to 2034

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

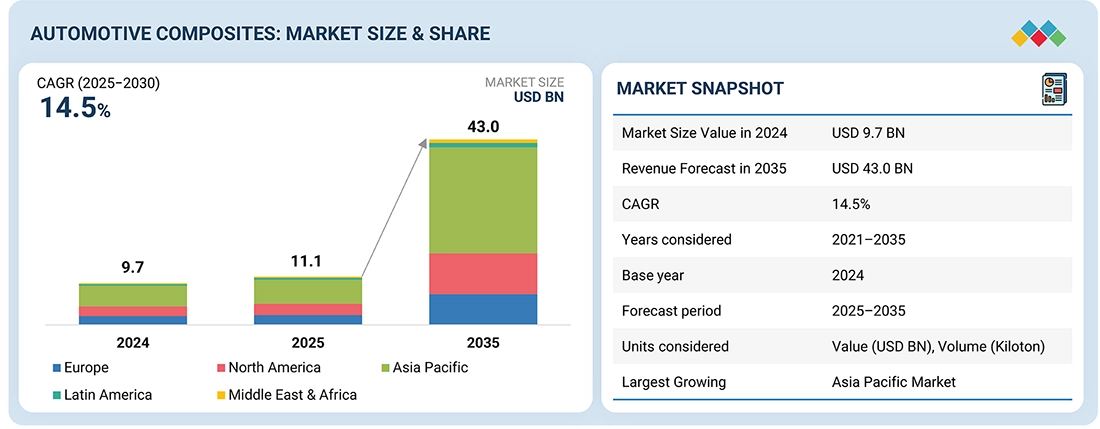

The automotive composites market is projected to reach USD 43.0 billion by 2035 from USD 11.1 billion in 2025, at a CAGR of 14.5% from 2025 to 2035. The growth of the automotive composites market is driven by the rising demand for advanced composites materials that deliver superior performance, efficiency, and sustainability in modern automotive fleet.

KEY TAKEAWAYS

-

BY FIBER TYPEThe automotive composites market comprises glass fiber, carbon fiber, and other fibers. Driven by the need for lighter, more fuel-efficient vehicles and tighter emissions standards, composites are seeing wider use in vehicle structures, interiors, and exterior parts. Advances in resin chemistries (e.g., toughened epoxies, PEEK) and manufacturing methods (automated fiber placement, out-of-autoclave processing) are enhancing performance while reducing cost and cycle times.

-

BY RESIN TYPEKey resin types in the automotive composites market include thermoset and thermoplastic resins. Thermosets like epoxy and polyester offer high strength and heat resistance, ideal for structural components. Thermoplastics such as polypropylene and polyamide enable faster processing, recyclability, and are suited for interior and high-volume parts.

-

BY MANUFACTURING PROCESSKey manufacturing processes in the automotive composites market include compression molding, injection molding, resin transfer molding (RTM), and other Manufacturing processes. Compression and injection molding are widely used for high-volume production due to their speed and cost efficiency. RTM and other methods like autoclaving and filament winding are used for high-performance parts requiring precision, strength, and lightweight characteristics.

-

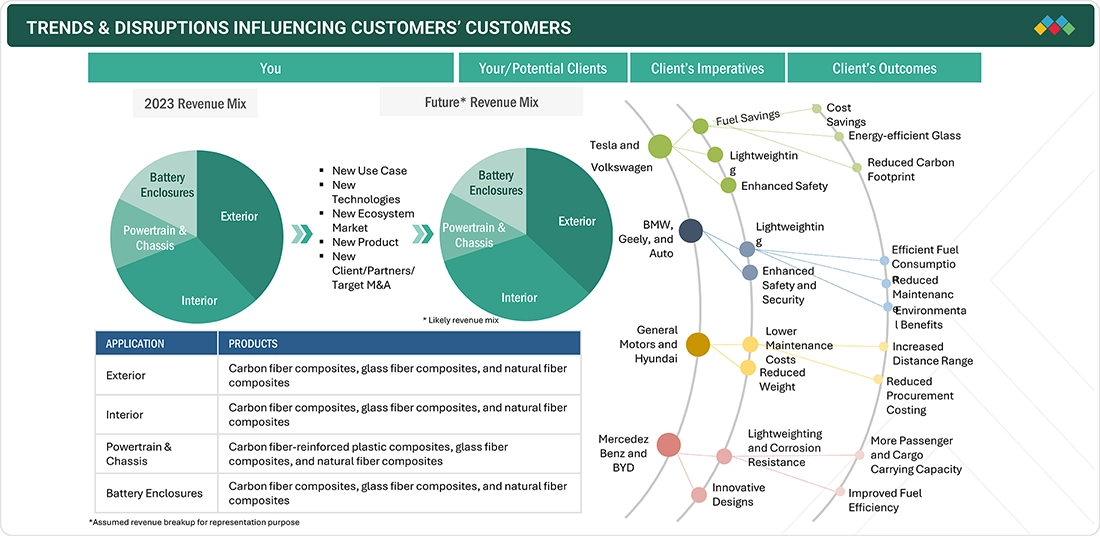

BY APPLICATIONKey applications in the automotive composites market include Exterior, Interior, Powertrain & Chassis, and Battery Enclosures. Exterior components such as bumpers, fenders, hoods, and roofs leverage composites for improved aesthetics, corrosion resistance, and significant weight reduction without compromising structural integrity. Interior applications like dashboards, door panels, seat structures, and trims benefit from the design flexibility, acoustic insulation, and reduced weight offered by composite materials. Powertrain and chassis components, including engine covers, cross members, and suspension parts, utilize high-performance composites for their excellent strength-to-weight ratio, vibration damping, and thermal resistance. Battery enclosures in electric vehicles are a rapidly growing application area, where composites offer superior thermal management, electrical insulation, fire resistance, and lightweight protection critical for battery safety and efficiency.

-

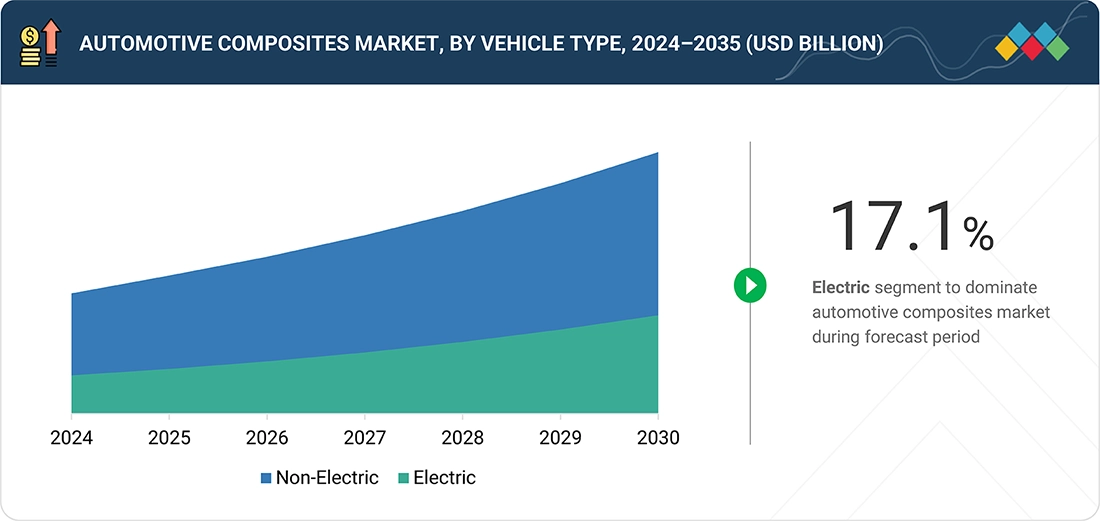

BY VEHICLE TYPEKey vehicle types in the automotive composites market include Electric Vehicles (EVs) and Non-Electric Vehicles. Electric vehicles increasingly rely on composites to offset the added weight of batteries, enhance driving range, and improve thermal management in battery enclosures, underbody shields, and lightweight structural parts. Non-electric vehicles, including internal combustion engine (ICE) use composites to meet fuel efficiency and emission regulations, especially in body panels, interiors, and suspension components, supporting overall vehicle performance and durability.

-

BY REGIONAutomotive composites market covers Europe, North America, Asia Pacific, Latin America and Middle East and Africa. Asia Pacific is the largest market for automotive composites. It is home to several prominent automotive composites manufacturing companies, and is witnessing new automotive manufacturing projects, all contributing to the increasing adoption of automotive composite products.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including partnerships and investments. For instance, Toray Industries, Inc. (Japan), SGL Carbon (Germany), POLYTEC HOLDING AG, ElringKlinger AG (Germany), Syensqo (Belgium), HENGRUI CORPORATION (HRC) (China), Exel Composites (Finland), Teijin Limited (Japan), Mitsubishi Chemical Group Corporation (Japan), are entered into number of agreements and partnerships to cater the growing demand for automotive composites across innovative applications.

The automotive composites market is witnessing steady growth, driven by the rising demand for lightweight, high-performance composites materials such as carbon fiber, glass fiber made advanced composites to enhance fuel efficiency, reduce emissions, and meet stringent safety standards. New deals and developments, including strategic partnerships between OEMs and material suppliers, investments in recycling technologies, and innovations in high-strength and sustainable composites, are reshaping the industry landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hot belts are the clients of automotive composites manufacturers, and target applications are the clients of automotive composites manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbeds, which will further affect the revenues of automotive composites manufacturers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising Demand for Lightweight Vehicles to Improve Fuel Efficiency and Reduce Emissions

-

Increasing Use of Carbon Fiber and Glass Fiber Composites in Automotive Structures

Level

-

High Initial Cost of Composite Materials Compared to Traditional Metals

-

Limited Recyclability and End-of-Life Challenges

Level

-

Surging Growth in Electric Vehicles (EVs) Driving the Need for Lightweighting

-

Technological Advancements in Recycled, Natural, and Bio-Based Composites

Level

-

Volatility in Raw Material Prices for Composite Resins and Fibers

-

Complex Manufacturing Processes and Specialized Equipment Requirements

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for lightweight and fuel-efficient aircraft

The global automotive industry is under growing pressure to meet strict emissions and fuel economy standards imposed by environmental regulatory bodies. Composite materials like carbon fiber reinforced polymer (CFRP) and glass fiber reinforced plastic (GFRP) help reduce the overall vehicle weight by 20–50% compared to traditional metal components. This directly enhances fuel efficiency and reduces CO2 emissions from internal combustion engine (ICE) vehicles. In electric vehicles (EVs), where battery weight is a major concern, composites play a critical role in offsetting the vehicle’s overall mass, extending driving range and improving energy efficiency.

Restraint: High Initial Cost of Composite Materials Compared to Traditional Metals

Despite notable advantages, composites remain significantly more expensive to manufacture due to complex raw material processing, energy consumption, and equipment costs. Carbon fiber, for example, is often 3–10 times more expensive than steel or aluminum. These cost barriers limit the use of composites to luxury vehicles, performance cars, or next-gen EVs unless innovations in scaling and material synthesis reduce the costs over time.

Opportunity: Surging Growth in Electric Vehicles (EVs) Driving the Need for Lightweighting

With governments worldwide pushing to increase EV penetration, OEMs are seeking innovative ways to minimize vehicle weight and maximize battery efficiency. Composites offer a high strength-to-weight ratio, making them ideal for EV battery enclosures, underbody shields, crossmembers, suspension systems, and structural housing components. Furthermore, thermal insulation, vibration dampening, and EMI shielding properties of certain composites add to their value in high-tech EV architectures.

Challenge: Volatility in Raw Material Prices for Composite Resins and Fibers

The cost of raw materials such as carbon fiber precursors (PAN), epoxy resins, curing agents, and fillers is susceptible to fluctuations in global commodity markets, energy prices, and supply demand imbalances. Geopolitical tension, trade controls on rare chemicals, and rising oil prices can lead to unexpected cost pressures for composite manufacturers and automotive tier-1 suppliers.

Automotive Composites Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Extensive use of carbon fiber reinforced plastic (CFRP) in BMW i3 and i8 chassis and body panels | 40–50% weight reduction versus steel, improved acceleration and energy efficiency in EVs |

|

CFRP used in rear cross members and B-pillars in high-performance models like Audi R8 | Enhanced structural rigidity, reduced center of gravity, and better crash performance |

|

Glass fiber reinforced composites used in underbody shields, transmission crossmembers | Cost-effective lightweighting with corrosion resistance and vibration dampening |

|

Natural fiber composites (e.g., kenaf, hemp) used in interior door trims and dashboards | Sustainable material integration with lower weight and improved recyclability |

|

Composite body panels and battery enclosures in Model S and Model X | Reduced body weight, extended battery range, and better thermal insulation |

|

Sheet molding composite (SMC) parts used in truck beds and liftgates (Chevrolet Silverado) | Impact resistance, reduced panel weight, increased corrosion resistance in exterior environments |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The automotive composites market ecosystem consists of raw material suppliers (e.g., SABIC, Jushi), automotive composites manufactuers (e.g., Toray, Syensqo), part manufacturers (e.g., 3A Composites, Exel composites), and end users (e.g., BMW, Audi, Tesla). Raw materials like composites are processed into lightweight, high-performance components for use in aircraft. End users drive demand for fuel efficiency and sustainability, while manufacturers deliver precision-engineered parts. Collaboration across the value chain is key to innovation and market growth

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Aerospace Composites Market, By Fiber Type

Glass fiber segment held the largest share of the automotive composites market in terms of both volume and value. This dominance is primarily due to the material’s strength, cost-effectiveness, impact resistance, and ease of processing. A major driver behind the widespread use of glass fiber composites is their ability to reduce vehicle weight, as they are significantly lighter than traditional materials such as metals and steel. Additionally, glass fiber composites offer lower manufacturing costs compared to carbon fiber, making them a more economical and attractive option for automakers focused on cost efficiency.

Aerospace Composites Market, By Resin Type

the global automotive composites market is categorized into thermoplastic and thermoset segments. Thermoset composites currently dominate the market in terms of value. However, thermoplastic composites are anticipated to experience significant growth in the coming years. Their recyclability, combined with superior performance characteristics, is expected to be a key factor driving their increased adoption in the automotive sector.

Aerospace Composites Market, By Manufacturing Process

The resin transfer molding (RTM) process is expected to register the highest CAGR in the automotive composites market during the forecast period. RTM is a vacuum-assisted molding technique that uses a flexible solid counter tool to compress the resin and fiber mix, resulting in high laminate quality, excellent fiber-to-resin ratios, and superior strength-to-weight properties. This process is ideal for producing large, complex, and high-precision automotive parts with smooth surface finishes on both sides such as powertrain housings and exterior body panels. While RTM has longer cycle times compared to injection molding (measured in minutes rather than seconds), it operates at lower temperatures and pressures, making it energy-efficient and suitable for medium-volume production.

Aerospace Composites Market, By Vehicle Type

The electric vehicles (EVs) segment is expected to witness the highest CAGR in the automotive composites market during the forecast period. As OEMs increasingly adopt lightweight materials to improve energy efficiency and meet stringent emission regulations, composites are playing a crucial role in EV design especially in body structures, battery enclosures, and structural reinforcements. Although EV production is still growing relative to conventional vehicles, rising concerns over climate change and fossil fuel depletion have accelerated demand. In 2024, global EV sales reached 17.5 million units, and this number is expected to continue rising with strong government support. Incentives like purchase subsidies, tax rebates, and the expansion of EV infrastructure such as widespread public charging stations in cities like Amsterdam are further boosting EV adoption.

Aerospace Composites Market, By Application

Based on application, the automotive composites market is segmented into interior, exterior, battery enclosures, and powertrain & chassis components. Among these, the exterior segment led the market in terms of value, followed by the interior segment. Key exterior applications include grilles, bumpers, spoilers, and body panels such as fenders, doors, roofs, and hoods. With the rapid growth of electric vehicles, the battery enclosure segment is expected to register the highest CAGR during the forecast period.

REGION

Asia Pcific to be fastest-growing region in global automotive composites market during forecast period

Asia Pacific is projected to be the fastest-growing region in the automotive composites market during the forecast period, driven by increasing demand for lightweight, fuel-efficient, and environmentally friendly vehicles. Stringent emission regulations and high pollution levels, particularly in China and India (with AQI levels averaging 86 and 119 respectively), are compelling automakers to adopt composite materials for vehicle lightweighting and sustainability. The rapid growth of electric vehicle (EV) sales in the region is a key driver China led global EV adoption with approximately 11 million units sold in 2024, followed by India with around 1.4 million units, South Korea with over 300,000, and Japan exceeding 200,000 units. These trends, combined with the presence of well-established raw material suppliers, component manufacturers, and OEMs, along with rising industrialization, urbanization, and consumer purchasing power, are significantly boosting the demand for automotive composites in Asia Pacific.

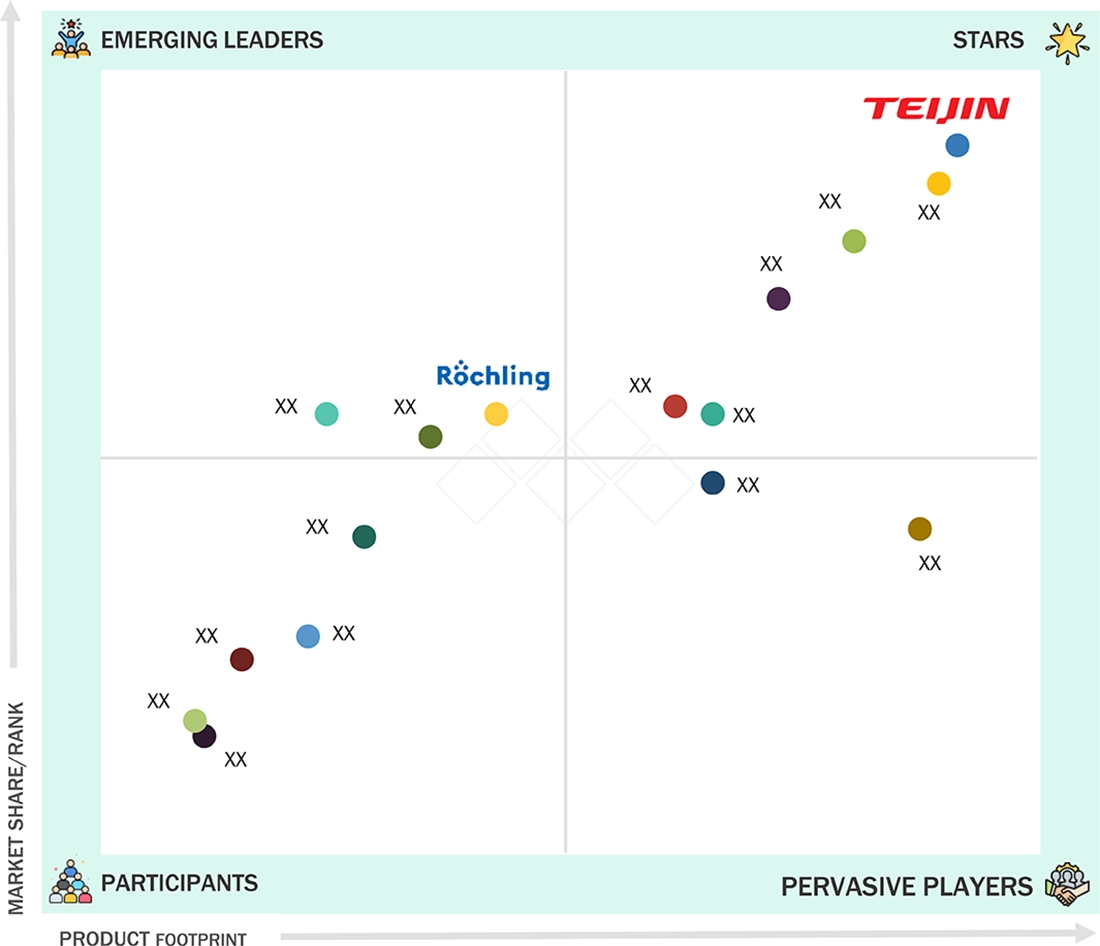

Automotive Composites Market: COMPANY EVALUATION MATRIX

Teijin Limited is positioned as a star player in the automotive composites market, backed by its strong market share and extensive product portfolio, including advanced carbon fiber reinforced thermoplastics (CFRTP) and multi-material solutions. Through its proprietary Sereebo technology and strategic acquisitions like Continental Structural Plastics (CSP), Teijin has established a global manufacturing footprint and supports OEMs with lightweight, high-strength components for electric and fuel-efficient vehicles. In contrast, Röchling Group is emerging as a key leader, leveraging its expertise in thermoplastic composite systems for underbody structures, battery housings, and interior parts. The company’s innovation-driven approach, focus on recyclability, and growing collaborations with automotive OEMs position it for accelerated growth in the evolving landscape of mobility and lightweight vehicle design.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Syensqo

- Toray Industries, Inc.

- Mitsubishi Chemical Group Corporation

- Hexcel Corporation

- Teijin Limited

- SGL Carbon

- POLYTEC HOLDING AG (Austria)

- ElringKlinger AG (Germany)

- HENGRUI CORPORATION (China)

- Exel Composites (Finland)

- Piran Advanced Composites (UK)

- IDI Composites International(US)

- Röchling SE & CO. KG (Germany)

- Kautex (Germany)

- Muhr und Bender KG (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 9.7 Billion |

| Revenue Forecast in 2035 | USD 43.0 Billion |

| Growth Rate | CAGR of 14.5% from 2025-2035 |

| Actual data | 2021-2035 |

| Base year | 2024 |

| Forecast period | 2025-2035 |

| Units considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, latin America, Middle East & Africa |

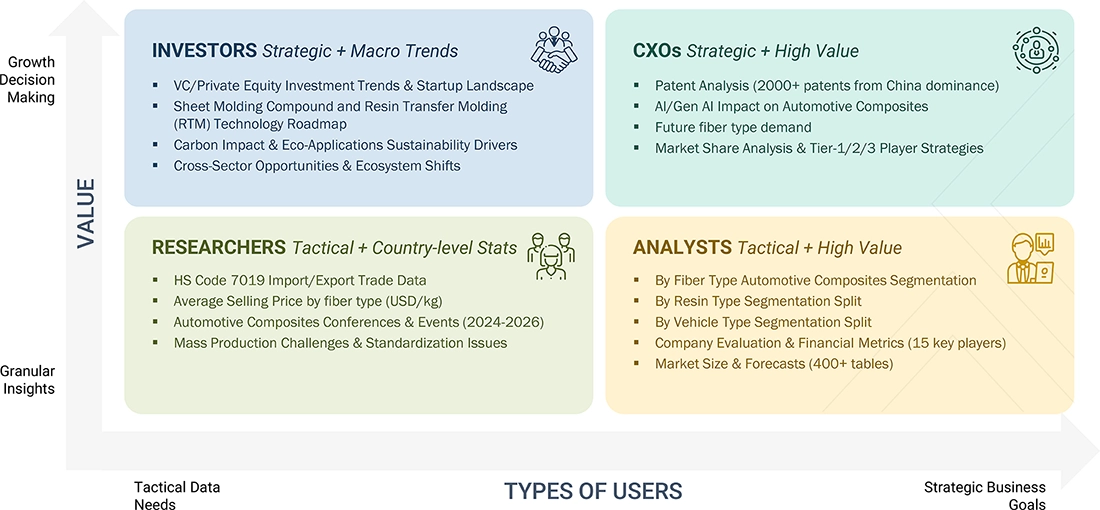

WHAT IS IN IT FOR YOU: Automotive Composites Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Automotive OEM | Competitive profiling of automotive composites suppliers (financials, certifications, product range). Benchmarking of composites usage across vehicle models. Supply chain and partnership analysis | Identify qualified composite material partners, Detect supplier gaps, Highlight opportunities for cost savings and efficiency |

| Composite Material Manufacturer | Market adoption benchmarking across vehicle segments (passenger, commercial, EVs). Cost-benefit analysis between composites and metals. Application roadmap for exteriors, interiors, and structural parts | Insight into growing composite usage trends. Minimize substitution risks. Target high-growth OEM programs |

| Component / Engine Manufacturer | Technical and economic feasibility analysis for composite integration in powertrain and chassis systems. Forecast of lightweight material usage in ICEs and EVs by 2035. R&D pipeline tracking for high-temp resins & hybrid composites | Strengthen positioning in next-gen vehicle platforms. Identify long-term opportunities in sustainable components |

| Raw Material Supplier | Global and regional capacity benchmarking for automotive composites. Mapping of resin/fiber capacity expansions. Customer profiling across OEMs and Tier-1s | Inform forward integration strategies. Identify OEMs with high composite consumption. Address supply-demand imbalance |

| Specialty/Defense Automotive Supplier | Patent landscaping and IP strength analysis for automotive-grade composite systems. Competitive benchmarking across electric and defense vehicles. Assessment of OEM adoption in lightweight armored or EV platforms | Support backward integration into high-value segments. Enable early entry into next-gen vehicle projects and specialty contracts |

RECENT DEVELOPMENTS

- In May 2025 : SGL Carbon announced a major restructuring of its Carbon Fibers business unit, including the phased closure of unprofitable sites such as Lavradio, Portugal, due to years of losses. This move is part of a broader strategy to reduce global capacity, cut costs, and focus on a profitable core of operations.

- October 2024 : IDI Composites International announced the opening of its new global headquarters and next-generation manufacturing facility in Noblesville, Indiana. This major investment represents the company’s commitment to innovation and excellence in the manufacturing of thermoset composite materials.

- November 2023 : the separation of Syensqo and Solvay S.A. marked one of the pivotal moments in the history of Solvay S.A., where Solvay S.A. completed its spin-off and formed a new company, Syensqo, with 99.53% votes from Solvay Shareholders. Syensqo focuses on green hydrogen and thermoplastic composites, and Solvay focuses on essential chemistry.

Table of Contents

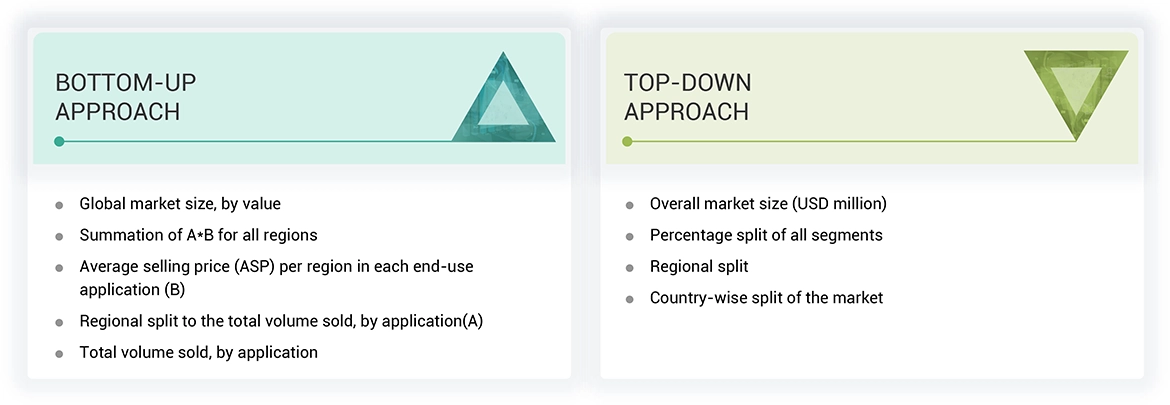

Methodology

The study involves two major activities in estimating the current market size for the automotive composites market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering automotive composites and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the automotive composites market, which was validated by primary respondents.

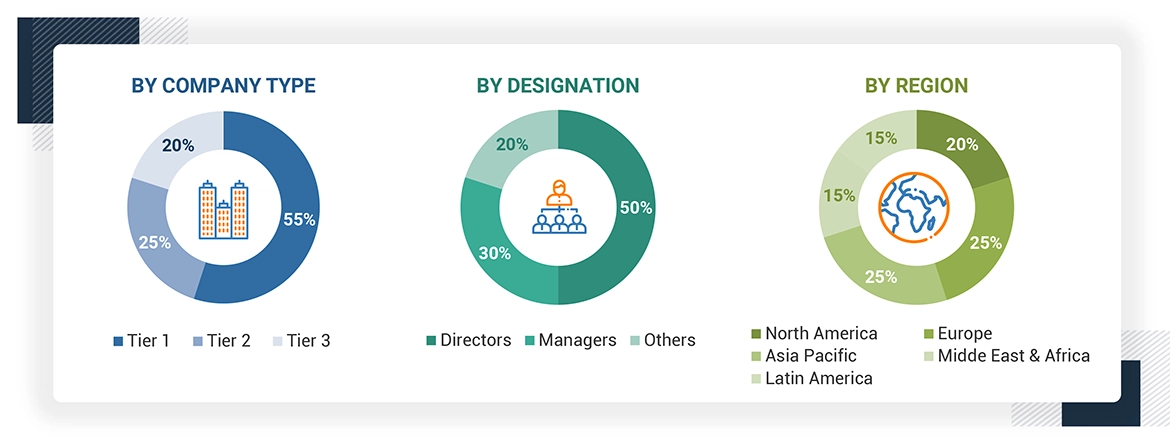

Primary Research

Extensive primary research was conducted after obtaining information regarding the automotive composites market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from automotive composites industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, storage & distribution and transportation, manufacturing process, function, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using automotive composites, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of automotive composites and future outlook of their business which will affect the overall market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the automotive composites market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in automotive composites in different end-use applications at a regional level. Such procurements provide information on the demand aspects of the automotive composites industry for each application. For each application, all possible segments of the automotive composites market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Automotive composites are composites that are formed by the combination of polymer matrix type and fiber reinforcement that are suitable for them. The polymer matrices are either made up of thermoplastic resins or thermoset resins. The reinforcement fibers used in automotive composites are carbon fiber, glass fiber and others that includes aramid, natural, hybrid, and basalt.

Stakeholders

- Fiber manufacturers

- Resin manufacturers

- Raw material suppliers

- Distributors and suppliers

- Industry associations

- Universities, governments & research organizations

- Associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Environmental support agencies

- Investment banks and private equity firms

Report Objectives

- To define, describe, and forecast the automotive composites market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global automotive composites market by resin type, fiber type, vehicle type, manufacturing process, application, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, and analyze the significant region-specific trends

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Automotive Composites Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Automotive Composites Market

Hannelore

Sep, 2017

Market information on composites with respect to different materials such as Polyethylene, Polypropylene, carbon fiber etc..

Achim

Jan, 2019

Focus on understanding composite market for automotive applications.

Victoria

Mar, 2019

Carbon composite market.

Bill

Nov, 2018

Information on composite demand for parts and assemblies for commercial truck industry in the US and Canada.

Bill

Nov, 2018

Composites for parts & assemblies of trucks and automotive in US and Canada..

Marcos

Jul, 2018

I work with Plastics Engineers, composites. It would be very interesting to pass on to my students some market information to explain the importance of the products..

Xavier

May, 2019

emerging Technology trend in composites material market.

Mahidhar

Dec, 2016

Looking for composite part data by each automotive manufacturer by country and region. Also, composite part consumption by major customers like MBW, Audi, Lamborgini, etc..

Swati

Jun, 2019

I am researching the total global addressable market for composite manufacturing equipment, and need to know how many composite manufacturing companies (not material/resin producer but intermediary/final product producer), across sectors (not just automotive), are there in the world, from the supplier of component part/products to OEM/end-user application and perhaps aftermarket. .

Eric

Mar, 2018

General information on automotive composite Market.

Michelle

Jan, 2019

Composite for automotive industry in Europe.