Algae Products Market

Algae Products Market by Type (Lipids, Carotenoids, Carrageenan, Alginate, Algal Protein), Source (Microalgae, Macroalgae), Application (Food & Beverages, Dietary Supplements, Animal Feed), Form, Production Process, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

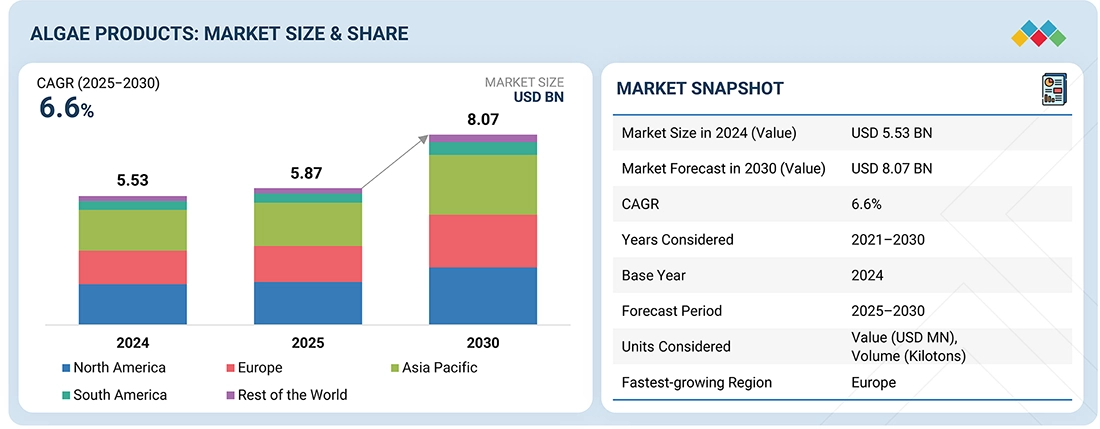

The algae products market is projected to reach USD 8.07 billion by 2030 from USD 5.87 billion in 2025, at a CAGR of 6.6% from 2025 to 2030. The market's growth is driven by the rising demand for sustainable protein products, growing consumer awareness regarding the health benefits of omega-3, and demand from the cosmetics & personal care industry.

KEY TAKEAWAYS

-

BY SOURCEThe source segment includes macroalgae (brown and red) and microalgae (green, blue-green, and other microalgae). The brown algae segment is expected to hold a major market share owing to its established hydrocolloid applications (alginates and fucoidans) in the food, pharmaceutical, and cosmetic industries.

-

BY TYPEKey types include lipids, carotenoids, carrageenan, alginates, algal proteins, and other types. The lipids segment is expected to hold a significant market share owing to the high demand for omega-3 fatty acids and the growing shift toward marine-based omega-3.

-

BY APPLICATIONThe food & beverages segment is expected to lead the market during the forecast period. Algae products are used in the development of functional foods and health-focused products. Algae contain bioactive compounds such as phycocyanins, carotenoids, and polysaccharides that offer potential health benefits.

-

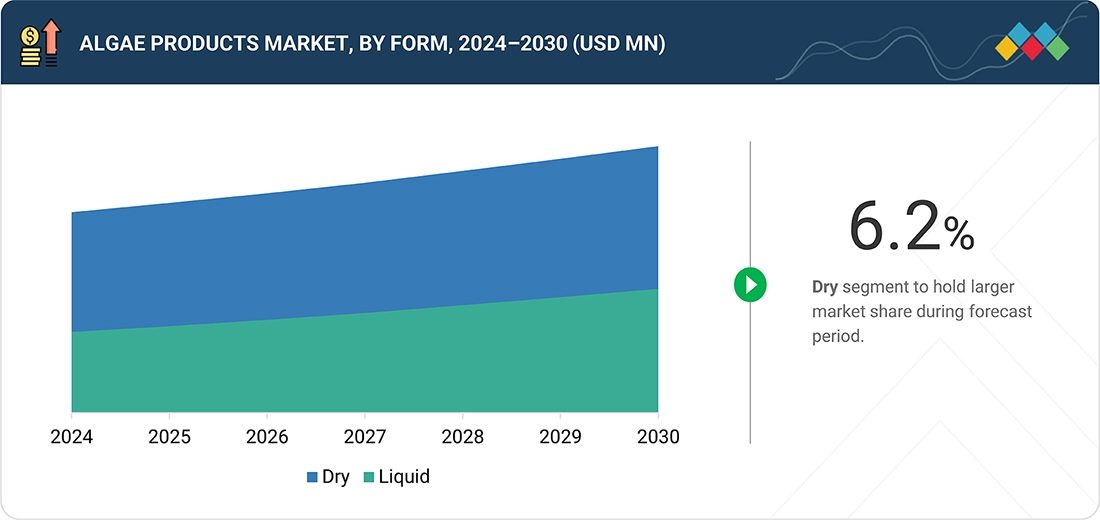

BY FORMThe dry form segment is expected to lead the market during the forecast period, due to its easy handling and storage.

-

BY REGIONThe algae products market covers North America, Europe, Asia Pacific, South America, and the Rest of the World. The Asia Pacific region is projected to exhibit a significant growth rate in this market due to the increasing use of algae products in food & beverages, pharmaceuticals, and animal feed.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including deals, product launches, and expansions. For instance, Corbion, CP Kelco U.S., Inc., and others have entered into numerous agreements and partnerships to meet the growing demand for algae products across various innovative applications.

The algae products market is expected to grow at a moderate rate due to the increasing demand for natural ingredients by consumers, diversification into multiple applications, and increasing awareness among consumers regarding the health benefits of algae.

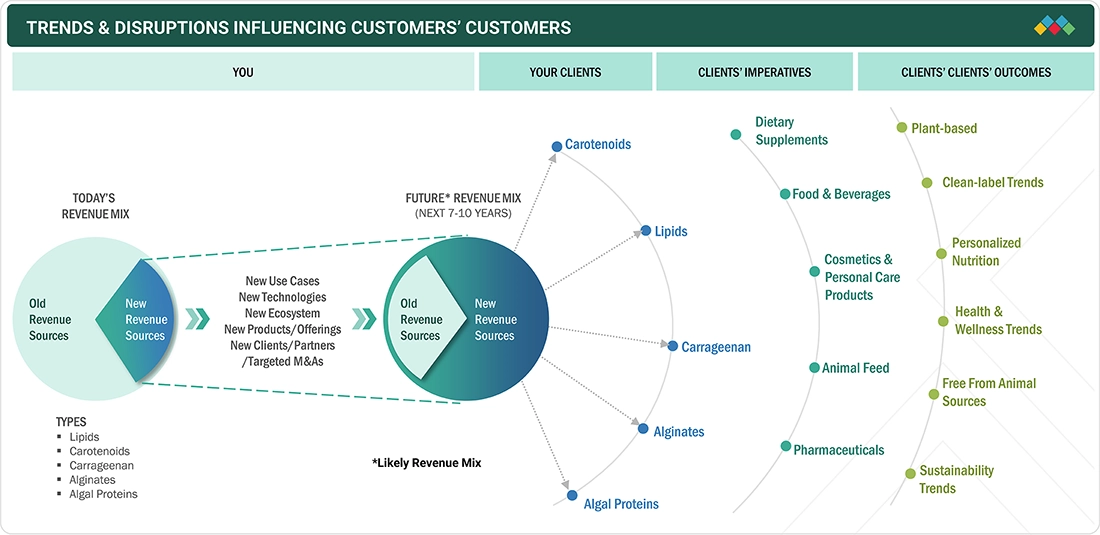

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are new emerging types of algae products, and the target end users are clients of algae product manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users, thus affecting the revenue of hotbets and further the revenues of algae product manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing applications of algae products

-

Growing consumer awareness regarding health benefits of Omega-3

Level

-

Lack of R&D activities in developing economies

-

Impact of climatic conditions on algae production

Level

-

Growing demand in pharmaceutical industry

-

Rising consumer demand for plant-based products

Level

-

High production costs are restricting entry of smaller players

-

Difficulty in meeting requisite quality standards

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing consumer awareness regarding health benefits of Omega-3

Algae are uniquely versatile, and algae-derived products find applications in multiple industries, including food & beverages, feed, nutraceuticals & dietary supplements, personal care, and pharmaceuticals. This is expected to be a major driver for the growth of the algae products market.

Restraint: Lack of R&D activities in developing economies

R&D is vital for innovation and the development of new algae-based products. It involves studying the properties of algae, exploring potential applications, and conducting experiments to improve product quality and efficiency. The absence of R&D activities in underdeveloped countries may result in limited product diversification, fewer value-added offerings, and a slower pace of innovation compared to countries with robust R&D sectors.

Opportunity: Growing demand in pharmaceutical industry

The potential applications of algae include antimicrobials, antivirals, therapeutic proteins, drugs, and antifungals in the pharmaceutical industry. The powerful water-soluble antioxidants found in algae are polyphenols, phycobiliproteins, and vitamins. Antioxidants help inhibit cancer growth by causing regression of premalignant lesions.

Challenge: High production costs restricting entry of smaller players

Establishing and maintaining algae production facilities require significant investments in infrastructure and specialized equipment. Algae cultivation systems, such as photobioreactors or open pond systems, need to be designed, constructed, and operated with careful monitoring and control. These infrastructural requirements involve substantial upfront costs, which can be a barrier for companies with limited financial resources, especially small and medium-sized enterprises (SMEs).

Algae Products Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Utilizing its innovative biotechnology platform, in April 2023, MiAlgae successfully launched NaturAlgae, a dry powder with a high concentration of DHA and other oils. This product can be seamlessly integrated into aquafeeds and pet food recipes, providing the well-known health benefits of omega-3. | Following the recent expansion of its commercial production site north of Glasgow, MiAlgae is poised for significant growth in the aquaculture and pet food sectors. |

|

In August 2025, Corbion partnered with the US-based biotech firm Kuehnle AgroSystems (KAS) to develop and commercialize high-quality, natural astaxanthin derived from non-GMO, heterotrophic microalgae (Haematococcus). | Through this collaboration, Corbion leverages KAS’s advanced heterotrophic fermentation platform and proprietary algae strains alongside its own large-scale industrial production, regulatory expertise, and established global distribution network. The partnership focuses on producing an esterified form of astaxanthin that is rich in the most bioavailable isomer, offering improved antioxidant capacity, stability, and fat solubility compared to conventional sources. |

|

Aker BioMarine leveraged Vitafoods Europe 2024 as a platform to showcase its dual expertise in marine (krill oil) and plant-based (algae oil) omega-3 solutions. By introducing FloraMarine, an algae-based DHA product, the company demonstrates its ability to meet growing B2B demand for sustainable, plant-based alternatives while maintaining its leadership in marine-derived nutrition. | Aker BioMarine gains stronger market positioning by expanding into the fast-growing plant-based omega-3 space while reinforcing its leadership in sustainable nutrition. The launch at Vitafoods drives brand visibility, customer engagement, and new B2B growth opportunities. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The algae products ecosystem is categorized into manufacturers, regulatory bodies, and end-use companies. The algae products market is a dynamic and rapidly expanding ecosystem characterized by diverse stakeholders and innovative products. Established companies and agile startups are central to this market, developing algae-based products.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Algae Products Market, By Source

The increasing use of brown algae in bioplastics manufacturing is expected to drive market growth. However, due to the high protein content and favorable essential amino acid composition, blue-green algae products are the most widely used for industrial applications.

Algae Products Market, By Type

The lipids segment dominates the algae products market, mainly due to the health benefits of nutritional lipids, such as omega-3 and omega- 6. The growing burden of obesity and cardiac diseases has also increased the demand for natural and low-calorie food products. Owing to this, food manufacturers are increasingly focusing on different applications of omega-3 polyunsaturated fatty acid (PUFA) products. These factors are expected to drive the market for lipids.

Algae Products Market, By Application

The growing use of algae ingredients in food, personal care, and nutraceutical products can be attributed to the nutritional benefits they offer. As demand for healthy and nutritious food increases, various food & beverage manufacturers, such as Terravia (US) and Earthrise (Japan), are now incorporating algae ingredients into their products, as they contain fewer calories, lower fat, and lower cholesterol levels. The growing preference for plant-derived food & beverages is another key factor driving the demand for algae products.

REGION

Asia Pacific to be fastest-growing region in global algae products market during forecast period

The Asia Pacific algae products market is expected to register the highest CAGR during the forecast period, driven by the increasing demand for algae-based omega-3 in dietary supplements, functional food & beverages, and infant formula applications, which have created lucrative growth opportunities for manufacturers.

Algae Products Market: COMPANY EVALUATION MATRIX

In the algae products market matrix, dsm-firmenich and BASF (Star) lead with strong market shares and extensive product footprints for various application segments, driven by their strong geographical presence, significant formulation and distribution capabilities, and strong ties with end-use application industries. Algarithm (Emerging Leader) is gaining traction with its product innovations in the algae products market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 5.53 Billion |

| Market Forecast in 2030 (Value) | USD 8.07 Billion |

| Growth Rate | CAGR of 6.6% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Kilotons) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, and Rest of the World |

| Leading Segments | Dry segment is expected to register a higher CAGR of 6.2%. |

| Leading Region | The Asia Pacific region accounted for a x.xx% share in 2025. |

| Driver | Growing consumer awareness regarding health benefits of Omega-3 |

| Constraints | Lack of R&D activities in developing economies |

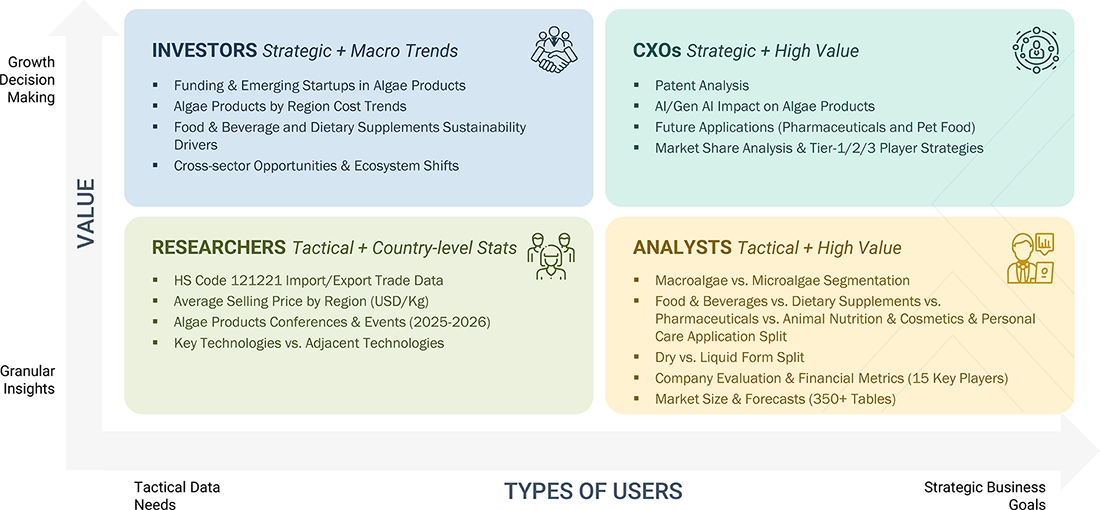

WHAT IS IN IT FOR YOU: Algae Products Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Asia Pacific-based Algae Products Manufacturers |

|

|

| Food & Beverages Segment Assessment |

|

|

RECENT DEVELOPMENTS

- July 2025 : Corbion received regulatory approval in China for its algae-based omega-3 solutions, marking a significant milestone in its global expansion strategy. These omega-3 ingredients, derived from microalgae, are designed for use in nutritional supplements, functional foods, and beverages, offering a sustainable and plant-based alternative to traditional fish oil. The approval enables Corbion to enter one of the world’s largest and fastest-growing markets for health and wellness products, reinforcing its commitment to innovation and environmental responsibility in the nutraceutical sector.

- May 2023 : Cyanotech Corporation, a producer of high-value natural products derived from microalgae, and Symbrosia, a pioneer in developing natural solutions to enhance planetary health, announced their partnership to grow Symbrosia's strain of seaweed at Cyanotech's facilities in Hawai`i to produce Symbrosia’s product, SeaGraze (trademarked).

- September 2023 : Corbion launches AlgaPrime DHA P3, addressing the demand for sustainable active nutrition in the pet food industry.

Table of Contents

Methodology

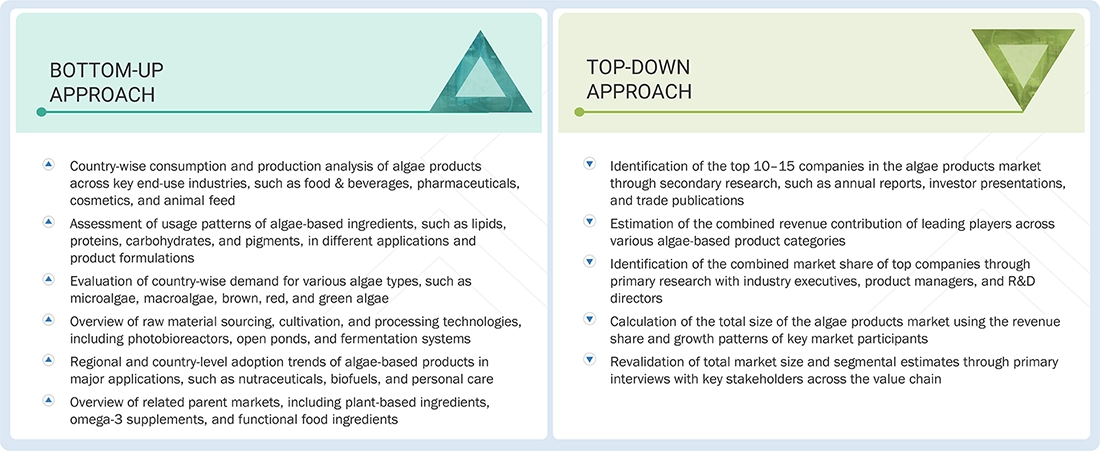

This study employed two primary approaches to estimate the current size of the algae products market. Exhaustive secondary research was conducted to collect information on the source, type, application, form, and production process (qualitative) segments of the market. The next step involved validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, data triangulation was used to estimate the market size of segments and subsegments.

Secondary Research

This research study utilized extensive secondary sources, including directories and databases such as Bloomberg Businessweek and Factiva, to identify and collect information for a technical, market-oriented, and commercial market study. In the secondary research process, sources such as annual reports, press releases & investor presentations of companies, white papers, feed journals, certified publications, articles from recognized authors, directories, and databases were referred to to identify and collect information. Secondary research was mainly used to obtain key information about the industry’s supply chain, the pool of key players, and market classification and segmentation based on the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the algae products market scenario through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), directors from business development, marketing, research, and development teams, as well as key executives from distributors and key opinion leaders.

Primary interviews were conducted to gather insights, including market statistics, revenue data from products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped to understand the various trends related to source, type, application, form, production process (qualitative), and region. Stakeholders from the demand side, such as distributors, importers, exporters, and end-use sectors such as food & beverages, dietary supplements, animal feed, cosmetics & personal care products, pharmaceuticals, and other applications, were interviewed to understand the buyers’ perspective on the suppliers, products, and the outlook of their business, which will affect the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2023 or 2024, based on the availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million = revenue = USD 1 billion; Tier 3: Revenue < USD 100 million. RoW includes Africa and the Middle East.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Cargill, Incorporated (US) |

Product Development Manager |

|

Kelco U.S., Inc. (Tate & Lyle) (US) |

Sales Manager |

|

Corbion (Netherlands) |

Marketing Head |

|

Fenchem (China) |

Sales Head |

|

AlgaTech Ltd. (Israel) |

Senior Sales Manager |

|

Algenol Biotech (US) |

Business Development Manager |

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the algae products market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Algae Products Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation procedure was employed, wherever applicable, to estimate the overall algae products market and obtain precise statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

Market Definition

According to the Indiana Department of Environmental Management, algae are simple, nonflowering plants that range in size from small, single-celled diatoms to giant, multicellular animals like kelp or seaweed (macroalgae). All algae have chlorophyll; however, most do not have stems, leaves, roots, or vascular tissue. As they provide the energetic foundation for the food web that supports all aquatic organisms, they are essential to aquatic ecosystems. Algae are autotrophic organisms that use photosynthesis to produce sugar from water and carbon dioxide. As a result of photosynthesis, oxygen is also produced, which helps fish and other aquatic species survive.

Products such as lipids (omega-3, omega-6, and omega-9), carotenoids, carrageenan, agar, algal protein, algal flour, and alginate are extracted from algae to serve various end-use applications. Algae are highly diversified in their properties, which makes them useful in applications such as food & beverages, personal care products, pharmaceuticals, animal feed, pet food, and nutraceuticals & dietary supplements.

Stakeholders

-

. Raw Material & Input Suppliers

- Algae strain providers (microalgae and macroalgae)

- Nutrient and culture media suppliers

- Equipment manufacturers (bioreactors, photobioreactors, and harvesting systems)

- Energy and water suppliers

-

Algae Cultivators & Producers

- Commercial algae farms (open pond and closed system cultivators)

- Biotechnology and aquaculture companies

- Integrated algae production facilities (producing lipids, proteins, pigments, etc.)

-

Processors & Manufacturers

- Algae extraction and refining companies (lipid, protein, pigment, and carbohydrate processors)

- Ingredient and formulation manufacturers for F&B, nutraceuticals, cosmetics, and feed industries

-

End-use Industries

- Food & Beverage manufacturers – using algae for colorants, stabilizers, and nutritional enrichment

- Pharmaceutical and nutraceutical companies – producing omega-3 supplements, antioxidants, and bioactive compounds

- Cosmetics & personal care companies – utilizing algae extracts for skincare and anti-aging formulations

- Animal feed and aquafeed producers – incorporating algae as a sustainable protein and lipid source

- Biofuel manufacturers – using algae biomass for renewable energy production

- Distribution & Retail Channels

- Investors & Supporting Entities

- Government Organizations, Institutes, and Research Organizations

-

Associations and Industry Bodies:

- Food and Agriculture Organization (FAO)

- US Department of Agriculture (USDA)

- International Organization for Standardization (ISO)

- International Federation of Organic Agriculture Movements (IFOAM)

- Canadian Organic Standards (COS)

Report Objectives

- To determine and project the size of the algae products market based on source, type, application, form, production process (qualitative), and region, over five years, ranging from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific needs.

- Further breakdown of the Rest of Europe algae products market into key countries

- Further breakdown of the Rest of Asia Pacific algae products market into key countries

- Further breakdown of the Rest of South America algae products market into key countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Algae Products Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Algae Products Market