2

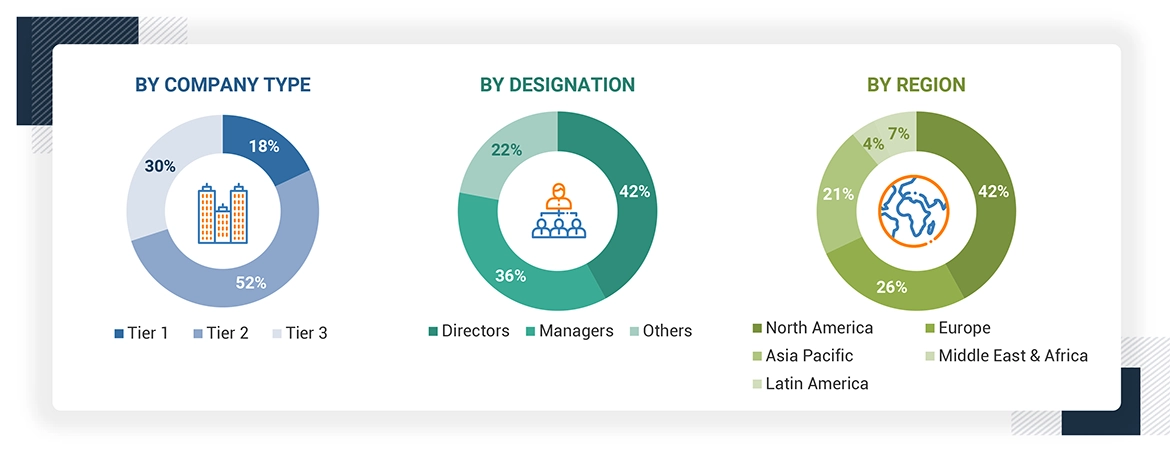

RESEARCH METHODOLOGY

50

5

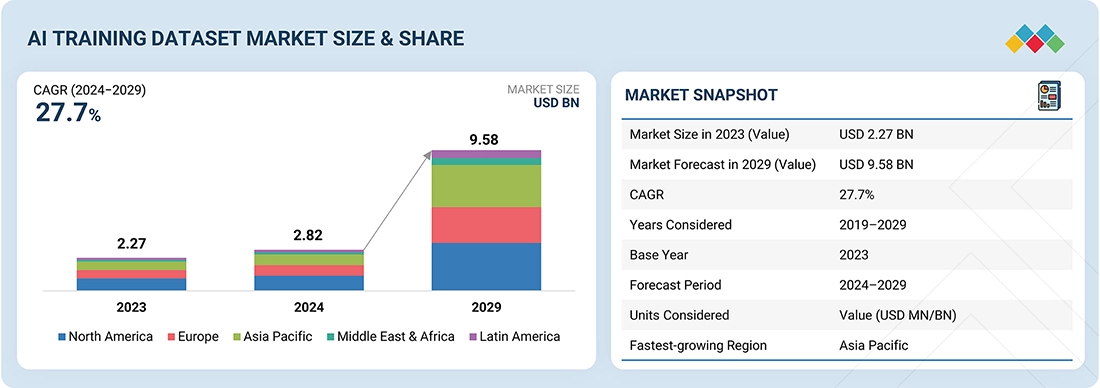

MARKET OVERVIEW AND INDUSTRY TRENDS

Generative AI drives demand for diverse, high-quality datasets, reshaping data collection and annotation markets.

73

5.2.1.1

INCREASING NEED FOR DIVERSE AND CONTINUOUSLY UPDATED MULTIMODAL DATASETS FOR GENERATIVE AI MODELS

5.2.1.2

RISING USE OF MULTILINGUAL DATASETS IN CONVERSATIONAL AI

5.2.1.3

GROWING DEMAND FOR HIGH-QUALITY LABELED DATA FOR AUTONOMOUS VEHICLES

5.2.1.4

RISING ADOPTION OF SYNTHETIC DATA FOR RARE EVENT SIMULATION

5.2.2.1

LEGAL RISKS OF WEB-SCRAPED DATA DUE TO COPYRIGHT INFRINGEMENT

5.2.2.2

LIMITED ACCESS TO HIGH-QUALITY MEDICAL DATASETS DUE TO HIPAA COMPLIANCE

5.2.3.1

GROWING DEMAND FOR SPECIALIZED DATA ANNOTATION SERVICES IN DIVERSE FIELDS

5.2.3.2

SYNTHETIC DATA GENERATION AND PRIVACY-PRESERVING TECHNIQUES FOR AUGMENTED TRAINING DATA

5.2.3.3

CREATION OF CUSTOMIZED AI DATASETS AND SPECIALIZED FORMATS FOR ENTERPRISE SOLUTIONS

5.2.4.1

DATA QUALITY AND RELEVANCE ISSUES

5.2.4.2

DIVERSE DATASET FORMATS AND INCONSISTENT ANNOTATION PRACTICES

5.3

EVOLUTION OF AI TRAINING DATASET

5.4

SUPPLY CHAIN ANALYSIS

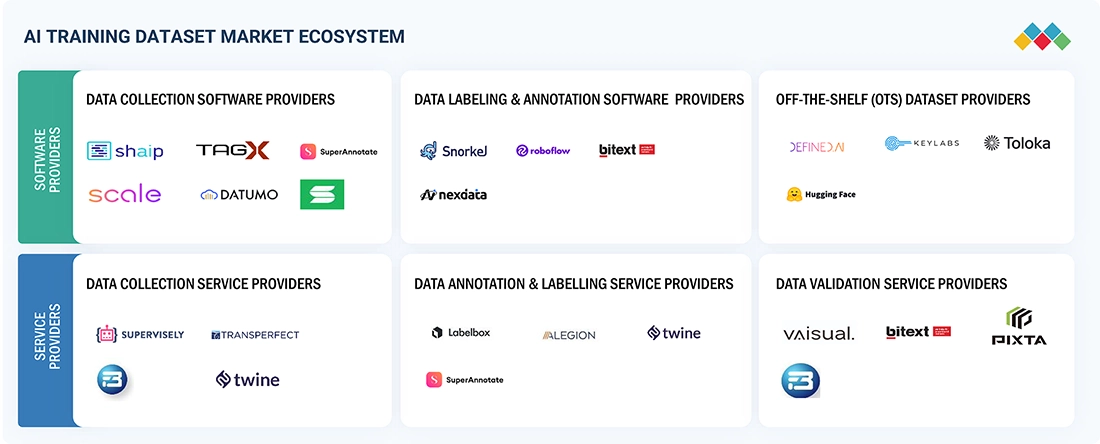

5.5.1

DATA COLLECTION SOFTWARE PROVIDERS

5.5.2

DATA LABELING AND ANNOTATION SOFTWARE PROVIDERS

5.5.3

OFF-THE-SHELF (OTS) DATASET PROVIDERS

5.5.4

DATA COLLECTION SERVICE PROVIDERS

5.5.5

DATA ANNOTATION & LABELLING SERVICE PROVIDERS

5.5.6

DATA VALIDATION SERVICE PROVIDERS

5.6

INVESTMENT AND FUNDING SCENARIO

5.7

IMPACT OF GENERATIVE AI ON AI TRAINING DATASET MARKET

5.7.1

DATA AUGMENTATION FOR IMAGE RECOGNITION

5.7.2

SYNTHETIC TEXT GENERATION FOR NLP

5.7.3

SPEECH AND AUDIO DATA SYNTHESIS

5.7.4

SIMULATED USER INTERACTION DATA

5.7.5

BIAS MITIGATION IN DATASETS

5.7.6

SCENARIO TESTING FOR PREDICTIVE MODELS

5.8.1

CASE STUDY 1: CLICKWORKER BOOSTS AI TRAINING DATASET FOR AUTOMOTIVE SYSTEMS, IMPROVING SPEECH RECOGNITION ACCURACY

5.8.2

CASE STUDY 2: APPEN ENHANCES MICROSOFT TRANSLATOR WITH COMPREHENSIVE AI TRAINING DATASETS FOR 110 LANGUAGES

5.8.3

CASE STUDY 3: COGITO TECH LLC ENHANCES CARDIAC SURGERY WITH AI-DRIVEN AORTIC VALVE DATASETS

5.8.4

CASE STUDY 4: ENHANCING AI TRAINING DATASETS FOR PAIN REDUCTION THROUGH HINGE HEALTH'S SUCCESS WITH SUPERANNOTATE

5.8.5

CASE STUDY 5: OUTREACH ENHANCES AI TRAINING WITH LABEL STUDIO

5.8.6

CASE STUDY 6: ENCORD ADDRESSES KEY CHALLENGES IN SURGICAL VIDEO ANNOTATION FOR ENHANCED DATA QUALITY AND EFFICIENCY

5.9.1.1

DATA LABELING AND ANNOTATION

5.9.1.2

SYNTHETIC DATA GENERATION

5.9.1.3

DATA AUGMENTATION

5.9.1.4

HUMAN-IN-THE-LOOP (HITL) FEEDBACK SYSTEMS

5.9.1.6

DATA CLEANSING AND PREPROCESSING

5.9.1.7

BIAS DETECTION AND MITIGATION

5.9.1.8

DATASET VERSIONING AND MANAGEMENT

5.9.2

COMPLEMENTARY TECHNOLOGIES

5.9.2.1

CLOUD STORAGE AND DATA LAKES

5.9.2.2

MLOPS AND MODEL MANAGEMENT

5.9.2.4

MACHINE LEARNING FRAMEWORKS

5.9.3

ADJACENT TECHNOLOGIES

5.9.3.1

FEDERATED LEARNING

5.9.3.2

EDGE AI FOR DATA PROCESSING

5.9.3.3

DIFFERENTIAL PRIVACY

5.9.3.5

TRANSFER LEARNING

5.10

REGULATORY LANDSCAPE

5.10.1

REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.2

REGULATIONS: AI TRAINING DATASET

5.10.2.1.1

BLUEPRINT FOR AN AI BILL OF RIGHTS (US)

5.10.2.1.2

DIRECTIVE ON AUTOMATED DECISION-MAKING (CANADA)

5.10.2.2.1

UK AI REGULATION WHITE PAPER

5.10.2.2.2

GESETZ ZUR REGULIERUNG KÜNSTLICHER INTELLIGENZ (AI REGULATION LAW - GERMANY)

5.10.2.2.3

LOI POUR UNE RÉPUBLIQUE NUMÉRIQUE (DIGITAL REPUBLIC ACT - FRANCE)

5.10.2.2.4

CODICE IN MATERIA DI PROTEZIONE DEI DATI PERSONALI (DATA PROTECTION CODE - ITALY)

5.10.2.2.5

LEY DE SERVICIOS DIGITALES (DIGITAL SERVICES ACT - SPAIN)

5.10.2.2.6

DUTCH DATA PROTECTION AUTHORITY (AUTORITEIT PERSOONSGEGEVENS) GUIDELINES

5.10.2.2.7

THE SWEDISH NATIONAL BOARD OF TRADE AI GUIDELINES

5.10.2.2.8

DANISH DATA PROTECTION AGENCY (DATATILSYNET) AI RECOMMENDATIONS

5.10.2.2.9

ARTIFICIAL INTELLIGENCE 4.0 (AI 4.0) PROGRAM - FINLAND

5.10.2.3.1

PERSONAL DATA PROTECTION BILL (PDPB) & NATIONAL STRATEGY ON AI (NSAI) - INDIA

5.10.2.3.2

THE BASIC ACT ON THE ADVANCEMENT OF UTILIZING PUBLIC AND PRIVATE SECTOR DATA & AI GUIDELINES - JAPAN

5.10.2.3.3

NEW GENERATION ARTIFICIAL INTELLIGENCE DEVELOPMENT PLAN & AI ETHICS GUIDELINES - CHINA

5.10.2.3.4

FRAMEWORK ACT ON INTELLIGENT INFORMATIZATION – SOUTH KOREA

5.10.2.3.5

AI ETHICS FRAMEWORK (AUSTRALIA) & AI STRATEGY (NEW ZEALAND)

5.10.2.3.6

MODEL AI GOVERNANCE FRAMEWORK - SINGAPORE

5.10.2.3.7

NATIONAL AI FRAMEWORK - MALAYSIA

5.10.2.3.8

NATIONAL AI ROADMAP - PHILIPPINES

5.10.2.4

MIDDLE EAST & AFRICA

5.10.2.4.1

SAUDI DATA & ARTIFICIAL INTELLIGENCE AUTHORITY (SDAIA) REGULATIONS

5.10.2.4.2

UAE NATIONAL AI STRATEGY 2031

5.10.2.4.3

QATAR NATIONAL AI STRATEGY

5.10.2.4.4

NATIONAL ARTIFICIAL INTELLIGENCE STRATEGY (2021-2025)- TURKEY

5.10.2.4.5

AFRICAN UNION (AU) AI FRAMEWORK

5.10.2.4.6

EGYPTIAN ARTIFICIAL INTELLIGENCE STRATEGY

5.10.2.4.7

KUWAIT NATIONAL DEVELOPMENT PLAN (NEW KUWAIT VISION 2035)

5.10.2.5.1

BRAZILIAN GENERAL DATA PROTECTION LAW (LGPD)

5.10.2.5.2

FEDERAL LAW ON THE PROTECTION OF PERSONAL DATA HELD BY PRIVATE PARTIES - MEXICO

5.10.2.5.3

ARGENTINA PERSONAL DATA PROTECTION LAW (PDPL) & AI ETHICS FRAMEWORK

5.10.2.5.4

CHILEAN DATA PROTECTION LAW & NATIONAL AI POLICY

5.10.2.5.5

COLOMBIAN DATA PROTECTION LAW (LAW 1581) & AI ETHICS GUIDELINES

5.10.2.5.6

PERUVIAN PERSONAL DATA PROTECTION LAW & NATIONAL AI STRATEGY

5.11.2

PATENTS FILED, BY DOCUMENT TYPE

5.11.3

INNOVATION AND PATENT APPLICATIONS

5.12.1

PRICING DATA, BY OFFERING

5.12.2

PRICING DATA, BY PRODUCT TYPE

5.13

KEY CONFERENCES AND EVENTS, 2025–2026

5.14

PORTER’S FIVE FORCES ANALYSIS

5.14.1

THREAT OF NEW ENTRANTS

5.14.2

THREAT OF SUBSTITUTES

5.14.3

BARGAINING POWER OF SUPPLIERS

5.14.4

BARGAINING POWER OF BUYERS

5.14.5

INTENSITY OF COMPETITIVE RIVALRY

5.15

KEY STAKEHOLDERS AND BUYING CRITERIA

5.15.1

KEY STAKEHOLDERS IN BUYING PROCESS

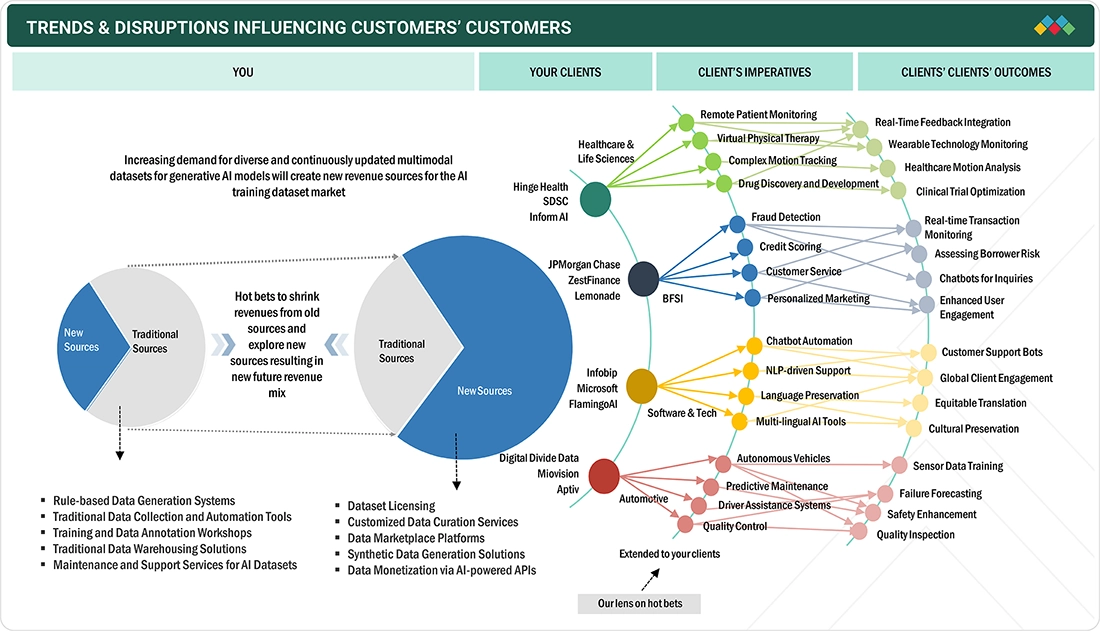

5.16

TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

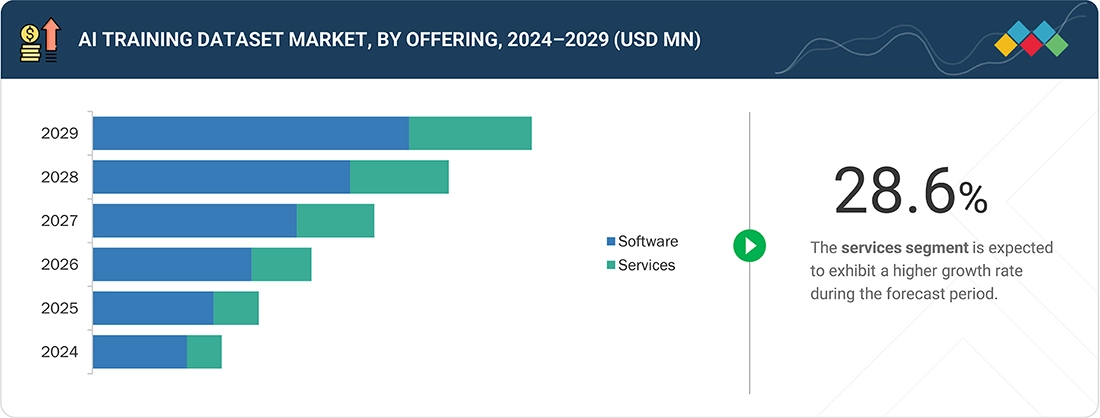

6

AI TRAINING DATASET MARKET, BY OFFERING

Market Size & Growth Rate Forecast Analysis to 2029 in USD Million | 42 Data Tables

128

6.1.1

OFFERING: AI TRAINING DATASET MARKET DRIVERS

6.2.1

DATA COLLECTION SOFTWARE

6.2.1.1

INCREASING DEMAND FOR REAL-TIME, DIVERSE, AND DOMAIN-SPECIFIC DATASETS TO ENHANCE AI MODEL ACCURACY

6.2.1.2

WEB SCRAPING TOOLS

6.2.1.3

DATA SOURCING API

6.2.1.4

CROWDSOURCING PLATFORMS

6.2.1.5

SENSOR DATA COLLECTION SOFTWARE

6.2.2

DATA LABELING & ANNOTATION

6.2.2.1

RISING ADOPTION OF AI-ASSISTED ANNOTATION TOOLS AND HUMAN-IN-THE-LOOP PLATFORMS FOR SCALABLE DATA LABELING TO PROPEL MARKET

6.2.2.6

3D DATA ANNOTATION

6.2.3

SYNTHETIC DATA GENERATION SOFTWARE

6.2.3.1

GROWING NEED FOR PRIVACY-COMPLIANT, BIAS-FREE, AND SCALABLE TRAINING DATA FOR AI APPLICATIONS

6.2.4

DATA AUGMENTATION SOFTWARE

6.2.4.1

DEMAND FOR IMPROVING AI MODEL GENERALIZATION AND PERFORMANCE WITH ENRICHED, DIVERSE DATASETS

6.2.5

OFF-THE-SHELF (OTS) DATASETS

6.2.5.1

ACCELERATED AI ADOPTION DRIVING THE NEED FOR PRE-LABELED, HIGH-QUALITY DATASETS TO REDUCE DEVELOPMENT TIME AND COSTS

6.3.1

DATA COLLECTION SERVICES

6.3.1.1

EXPANDING AI APPLICATIONS ACROSS INDUSTRIES TO DRIVE DEMAND FOR DOMAIN-SPECIFIC, HIGH-QUALITY TRAINING DATA

6.3.2

DATA ANNOTATION & LABELING SERVICES

6.3.2.1

GROWTH IN AI/ML ADOPTION REQUIRING SCALABLE, HUMAN-IN-THE-LOOP ANNOTATION PLATFORMS FOR PRECISE MODEL TRAINING

6.3.3

DATA VALIDATION SERVICES

6.3.3.1

RISING NEED FOR HIGH-QUALITY, BIAS-FREE, AND CONSISTENT DATASETS TO IMPROVE AI MODEL RELIABILITY AND COMPLIANCE

6.3.4

DATASET MARKETPLACES

6.3.4.1

INCREASING DEMAND FOR READY-TO-USE, PRE-LABELED DATASETS TO ACCELERATE AI MODEL DEVELOPMENT AND REDUCE TIME-TO-MARKET

7

AI TRAINING DATASET MARKET, BY ANNOTATION TYPE

Market Size & Growth Rate Forecast Analysis to 2029 in USD Million | 8 Data Tables

152

7.1.1

ANNOTATION TYPE: AI TRAINING DATASET MARKET DRIVERS

7.2.1

HIGH-QUALITY PRE-LABELED DATASETS ACCELERATE AI DEVELOPMENT ACROSS VARIOUS SECTORS

7.3.1

UNLABELED DATASETS ENABLE ROBUST AI MODEL TRAINING

7.4.1

ADVANCEMENTS IN GENERATIVE MODELS ENHANCE QUALITY OF SYNTHETIC DATASETS

8

AI TRAINING DATASET MARKET, BY DATA MODALITY

Market Size & Growth Rate Forecast Analysis to 2029 in USD Million | 62 Data Tables

159

8.1.1

DATA TYPE: AI TRAINING DATASET MARKET DRIVERS

8.2.1

BUSINESSES PRIORITIZE CURATING DIVERSE, LABELED TEXT DATASETS TO ENHANCE MODEL ACCURACY

8.2.2

TEXT CLASSIFICATION

8.2.6

OTHER TEXT DATA MODALITIES

8.3.1

ADVANCEMENTS IN DEEP LEARNING TECHNIQUES, PARTICULARLY CONVOLUTIONAL NEURAL NETWORKS, ELEVATE ROLE OF IMAGE DATA IN AI DEVELOPMENT

8.3.6

OTHER IMAGE DATA MODALITIES

8.4.1

RISING POPULARITY OF VOICE-ACTIVATED TECHNOLOGIES FUELS DEMAND FOR DIVERSE, HIGH-QUALITY AUDIO DATASETS

8.4.3

AUDIO CLASSIFICATION

8.4.6

OTHER AUDIO & SPEECH DATA MODALITIES

8.5.1

SURGE IN DEMAND FOR HIGH-QUALITY LABELED VIDEO DATASETS AS ORGANIZATIONS SEEK TO HARNESS VIDEO CONTENT POTENTIAL

8.5.5

VIDEO CONTENT MODERATION

8.5.6

OTHER VIDEO DATA MODALITIES

8.6.1

RISING DEMAND FOR MULTIMODAL DATASETS BOOSTS INNOVATION AND ADVANCES IN AI APPLICATIONS

8.6.3

CONTENT RECOMMENDATION

8.6.4

VISUAL QUESTION ANSWERING (VQA)

8.6.5

MULTIMODAL ANALYTICS

8.6.6

OTHER MULTIMODALITIES

9

AI TRAINING DATASET MARKET, BY TYPE

Market Size & Growth Rate Forecast Analysis to 2029 in USD Million | 71 Data Tables

193

9.1.1

TYPE: AI TRAINING DATASET MARKET DRIVERS

9.2.1

GENERATIVE AI REVOLUTIONIZES CREATIVITY ACROSS INDUSTRIES THROUGH DIVERSE TRAINING DATASETS

9.2.5

CONVERSATIONAL AGENTS

9.2.8

OTHER GENERATIVE AI

9.3.1

RISING ROLE OF NLP AND COMPUTER VISION IN ENTERPRISE AI APPLICATIONS TO BOOST OTHER AI DATASET DEMAND

9.3.2

NATURAL LANGUAGE PROCESSING (NLP)

9.3.2.1

TEXT CLASSIFICATION

9.3.2.2

NAMED ENTITY RECOGNITION (NER)

9.3.2.3

SENTIMENT ANALYSIS

9.3.2.4

DOCUMENT PARSING AND EXTRACTION

9.3.3.1

IMAGE CLASSIFICATION

9.3.3.4

OPTICAL CHARACTER RECOGNITION (OCR)

9.3.4

PREDICTIVE ANALYTICS

9.3.4.1

TIME SERIES FORECASTING

9.3.4.2

ANOMALY DETECTION

9.3.4.3

CUSTOMER BEHAVIOR PREDICTION

9.3.4.4

RISK SCORING AND MANAGEMENT

9.3.5

RECOMMENDATION SYSTEMS

9.3.5.1

PRODUCT AND CONTENT RECOMMENDATIONS

9.3.5.2

PERSONALIZED MARKETING AND ADS

9.3.5.3

COLLABORATIVE FILTERING

9.3.6

SPEECH AND AUDIO PROCESSING

9.3.6.1

SPEECH RECOGNITION

9.3.6.2

AUDIO CLASSIFICATION

9.3.6.3

VOICE COMMAND RECOGNITION

9.3.6.4

SPEECH-TO-TEXT TRANSCRIPTION

10

AI TRAINING DATASET MARKET, BY END USER

Market Size & Growth Rate Forecast Analysis to 2029 in USD Million | 36 Data Tables

232

10.1.1

END USER: AI TRAINING DATASET MARKET DRIVERS

10.2.1

FINANCIAL INSTITUTIONS LEVERAGE AI TRAINING DATASETS TO ENHANCE FRAUD DETECTION AND RISK MANAGEMENT

10.2.3

FINANCIAL SERVICES

10.3.1

TELECOM COMPANIES BOOST PERFORMANCE AND CUSTOMER SERVICES WITH AI-POWERED INTELLIGENT SYSTEMS

10.4

GOVERNMENT & DEFENSE

10.4.1

AI TRAINING DATASETS PROPEL ADVANCES IN NATIONAL SECURITY AND DEFENSE OPERATIONS

10.5

HEALTHCARE & LIFE SCIENCES

10.5.1

AI TRAINING DATASETS SPEARHEAD TRANSFORMATIVE BREAKTHROUGHS IN PRECISION MEDICINE AND DIAGNOSTICS

10.6.1

AI TRAINING DATASETS DRIVE EFFICIENCY IN MANUFACTURING WITH AUTOMATION AND PREDICTIVE MAINTENANCE

10.7

RETAIL & CONSUMER GOODS

10.7.1

RETAILERS ENHANCE PERSONALIZED CUSTOMER EXPERIENCES WITH AI-DRIVEN RECOMMENDATIONS AND OPTIMIZED SUPPLY CHAINS

10.8

SOFTWARE & TECHNOLOGY PROVIDERS

10.8.1

INNOVATION ACCELERATES AS SOFTWARE AND TECHNOLOGY PROVIDERS HARNESS AI TRAINING DATASETS FOR CUTTING-EDGE SOLUTIONS

10.8.2

CLOUD HYPERSCALERS

10.8.3

FOUNDATION MODEL/LLM PROVIDERS

10.8.4

AI TECHNOLOGY PROVIDERS

10.8.5

IT & IT-ENABLED SERVICE PROVIDERS

10.9.1

RAPID ADVANCEMENTS IN AUTONOMOUS VEHICLE DEVELOPMENT FUELED BY AI TRAINING DATASETS CAPTURING REAL-WORLD DRIVING BEHAVIORS AND CONDITIONS

10.10

MEDIA & ENTERTAINMENT

10.10.1

AI TRAINING DATASETS FUEL INNOVATION IN CONTENT CREATION ACROSS MEDIA, GAMING, AND ENTERTAINMENT INDUSTRIES

11

AI TRAINING DATASET MARKET, BY REGION

Comprehensive coverage of 7 Regions with country-level deep-dive of 21 Countries | 156 Data Tables.

254

11.2.1

NORTH AMERICA: AI TRAINING DATASET MARKET DRIVERS

11.2.2

NORTH AMERICA: MACROECONOMIC OUTLOOK

11.2.3.1

RELIANCE OF COMPANIES ACROSS VARIOUS SECTORS ON LARGE, DIVERSE DATASETS TO IMPROVE ACCURACY AND PERFORMANCE OF AI ALGORITHMS TO DRIVE MARKET

11.2.4.1

GOVERNMENT FOCUS ON GATHERING INSIGHTS FROM STAKEHOLDERS TO MAXIMIZE AI INVESTMENT BENEFITS TO DRIVE MARKET

11.3.1

EUROPE: AI TRAINING DATASET MARKET DRIVERS

11.3.2

EUROPE: MACROECONOMIC OUTLOOK

11.3.3.1

RISING DEMAND FOR QUALITY DATA AND INNOVATIVE SOLUTIONS FROM VARIOUS SECTORS TO DRIVE MARKET

11.3.4.1

INDUSTRY DEMAND, GOVERNMENT SUPPORT, AND DATA PRIVACY REGULATIONS TO DRIVE MARKET

11.3.5.1

INCREASING ADOPTION OF AI SOLUTIONS BY TECH COMPANIES AND STARTUPS TO MAINTAIN COMPETITIVE EDGE

11.3.6.1

ADVANCES IN DATA COLLECTION AND MANAGEMENT ENABLE COMPANIES TO ACCESS DIVERSE DATASETS TAILORED TO VARIOUS AI APPLICATIONS

11.3.7.1

STRATEGIC GOVERNMENT INITIATIVES AND INDUSTRY INNOVATION TO DRIVE MARKET

11.3.8.1

FOCUS ON ETHICAL AI AND EXPANDING DIGITAL INFRASTRUCTURE TO ACCELERATE DEMAND FOR HIGH-QUALITY, DIVERSE TRAINING DATASETS

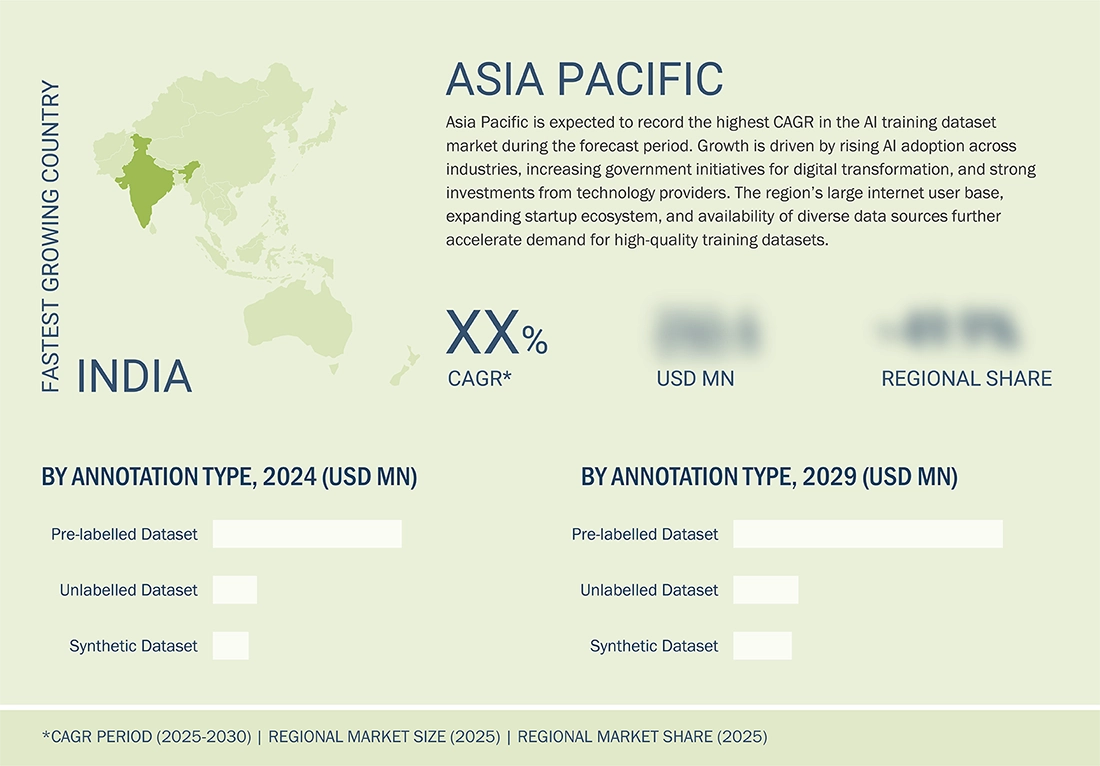

11.4.1

ASIA PACIFIC: AI TRAINING DATASET MARKET DRIVERS

11.4.2

ASIA PACIFIC: MACROECONOMIC OUTLOOK

11.4.3.1

INCREASING DEMAND FOR HIGH-QUALITY DATA FOR TRAINING MODELS FROM VARIOUS SECTORS TO DRIVE MARKET

11.4.4.1

SUPPORTIVE GOVERNMENT POLICIES AND STRATEGIC CORPORATE INITIATIVES TO DRIVE MARKET

11.4.5.1

INCREASING DEMAND FOR AI SOLUTIONS ACROSS VARIOUS SECTORS TO DRIVE MARKET

11.4.6.1

INCREASING AI ADOPTION AND NECESSITY FOR HIGH-QUALITY DATASETS TO DRIVE MARKET

11.4.7.1

DEMAND FOR QUALITY DATA AND ETHICAL STANDARDS TO DRIVE MARKET

11.4.8.1

INITIATIVES LIKE INFOCOMM MEDIA DEVELOPMENT AUTHORITY (IMDA) PROMOTE DATA LITERACY AND USE OF AI

11.4.9

REST OF ASIA PACIFIC

11.5

MIDDLE EAST & AFRICA

11.5.1

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET DRIVERS

11.5.2

MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

11.5.3.1.1

INITIATIVES BY HEALTHCARE SECTOR TO BUILD VAST MEDICAL DATASETS FOR PREDICTIVE ANALYTICS AND DISEASE DETECTION TO DRIVE MARKET

11.5.3.2.1

LAUNCH OF SAUDI OPEN DATA PLATFORM AND PARTNERSHIP WITH GLOBAL TECH FIRMS TO ACCELERATE AI TRAINING DATASET DEVELOPMENT

11.5.3.3.1

STRATEGIC INVESTMENTS IN STARTUPS SPECIALIZING IN STREAMING DATA TO DRIVE MARKET

11.5.3.4.1

GOVERNMENT INITIATIVES AND INCREASING DEMAND FOR HIGH-QUALITY DATASETS FROM VARIOUS SECTORS TO DRIVE MARKET

11.5.3.5

REST OF MIDDLE EAST

11.5.4.1

INCREASING POTENTIAL FOR AI APPLICATION IN VARIOUS SECTORS TO DRIVE MARKET

11.6.1

LATIN AMERICA: AI TRAINING DATASET MARKET DRIVERS

11.6.2

LATIN AMERICA: MACROECONOMIC OUTLOOK

11.6.3.1

GROWTH IN IT AND HEALTHCARE SECTORS TO DRIVE MARKET

11.6.4.1

GOVERNMENT INITIATIVES AND PRIVATE SECTOR INVESTMENTS TO DRIVE MARKET

11.6.5.1

GOVERNMENT TRANSPARENCY INITIATIVES AND STARTUP SUPPORT TO DRIVE MARKET

11.6.6

REST OF LATIN AMERICA

12

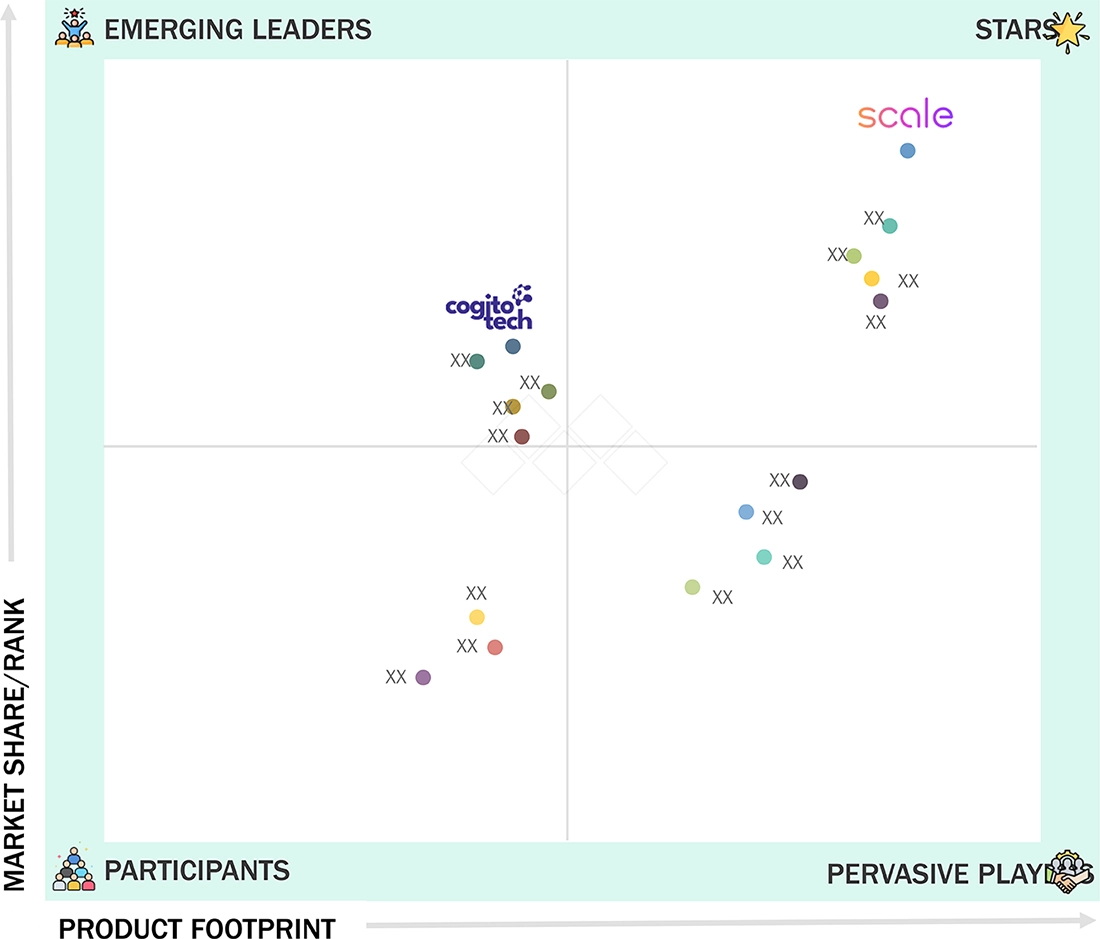

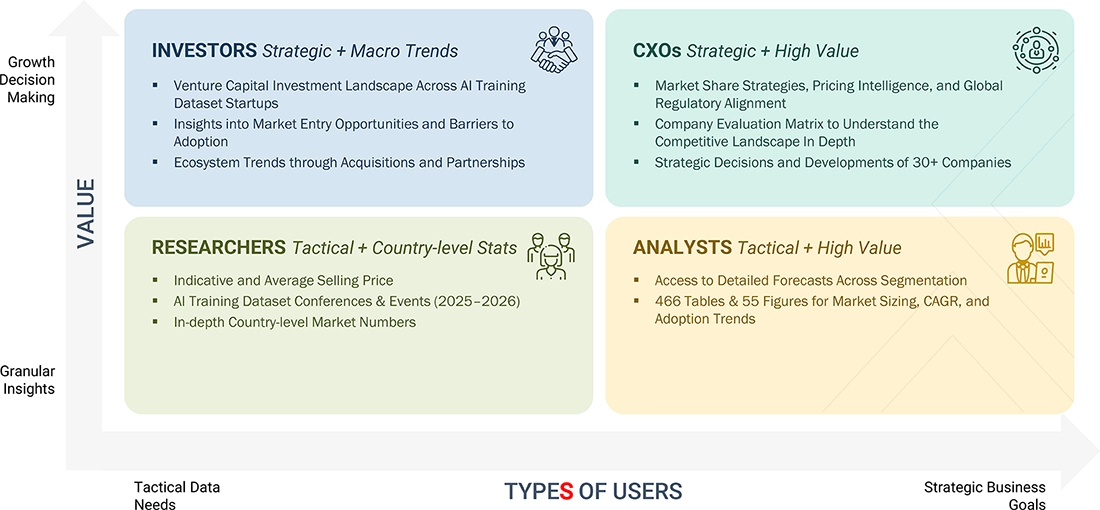

COMPETITIVE LANDSCAPE

Analyze strategic maneuvers and market dominance of AI platform leaders in a rapidly evolving landscape.

322

12.2

KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2024

12.3

REVENUE ANALYSIS, 2019–2023

12.4

MARKET SHARE ANALYSIS, 2023

12.4.1

MARKET RANKING ANALYSIS

12.5

PRODUCT COMPARATIVE ANALYSIS

12.5.1

AWS SAGEMAKER (AWS)

12.5.2

AI DATA PLATFORM (APPEN)

12.5.3

SAMA PLATFORM (SAMA)

12.5.4

DATA ENGINE, SCALE GEN AI PLATFORM (SCALE AI)

12.5.5

IMERIT PLATFORMS (IMERIT)

12.6

COMPANY VALUATION AND FINANCIAL METRICS, 2024

12.7

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

12.7.1

SOFTWARE PROVIDERS

12.7.1.2

EMERGING LEADERS

12.7.1.3

PERVASIVE PLAYERS

12.7.2

COMPANY FOOTPRINT: KEY PLAYERS (SOFTWARE PROVIDERS), 2023

12.7.2.1

COMPANY FOOTPRINT (SOFTWARE PROVIDERS)

12.7.2.2

REGIONAL FOOTPRINT (SOFTWARE PROVIDERS)

12.7.2.3

OFFERING FOOTPRINT (SOFTWARE PROVIDERS)

12.7.2.4

DATA MODALITY FOOTPRINT (SOFTWARE PROVIDERS)

12.7.2.5

END-USER FOOTPRINT (SOFTWARE PROVIDERS)

12.7.3.2

EMERGING LEADERS

12.7.3.3

PERVASIVE PLAYERS

12.7.4

COMPANY FOOTPRINT: KEY PLAYERS (SERVICE PROVIDERS), 2023

12.7.4.1

COMPANY FOOTPRINT (SERVICE PROVIDERS)

12.7.4.2

REGIONAL FOOTPRINT (SERVICE PROVIDERS)

12.7.4.3

OFFERING FOOTPRINT (SERVICE PROVIDERS)

12.7.4.4

DATA MODALITY FOOTPRINT (SERVICE PROVIDERS)

12.7.4.5

END USER FOOTPRINT (SERVICE PROVIDERS)

12.8

COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

12.8.1

SOFTWARE PROVIDERS

12.8.1.1

PROGRESSIVE COMPANIES

12.8.1.2

RESPONSIVE COMPANIES

12.8.1.3

DYNAMIC COMPANIES

12.8.2

COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

12.8.2.1

DETAILED LIST OF KEY STARTUPS/SMES (SOFTWARE PROVIDERS)

12.8.2.2

COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (SOFTWARE PROVIDERS)

12.8.3.1

PROGRESSIVE COMPANIES

12.8.3.2

RESPONSIVE COMPANIES

12.8.3.3

DYNAMIC COMPANIES

12.8.4

COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

12.8.4.1

DETAILED LIST OF KEY START-UPS/SMES (SERVICE PROVIDERS)

12.8.4.2

COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES (SERVICE PROVIDERS)

12.9

COMPETITIVE SCENARIO

12.9.1

PRODUCT LAUNCHES AND ENHANCEMENTS

13

COMPANY PROFILES

In-depth Company Profiles of Leading Market Players with detailed Business Overview, Product and Service Portfolio, Recent Developments, and Unique Analyst Perspective (MnM View)

355

13.2.1.1

BUSINESS OVERVIEW

13.2.1.2

PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.1.3

RECENT DEVELOPMENTS

13.2.1.3.1

PRODUCT ENHANCEMENTS

13.2.1.4.2

STRATEGIC CHOICES

13.2.1.4.3

WEAKNESSES AND COMPETITIVE THREATS

13.2.7

TELUS INTERNATIONAL

14

ADJACENT AND RELATED MARKETS

410

14.2

DATA ANNOTATION AND LABELING MARKET

14.2.2.1

DATA ANNOTATION AND LABELING MARKET, BY COMPONENT

14.2.2.2

DATA ANNOTATION AND LABELING MARKET, BY DATA TYPE

14.2.2.3

DATA ANNOTATION AND LABELING MARKET, BY DEPLOYMENT TYPE

14.2.2.4

DATA ANNOTATION AND LABELING MARKET, BY ORGANIZATION SIZE

14.2.2.5

DATA ANNOTATION AND LABELING MARKET, BY ANNOTATION TYPE

14.2.2.6

DATA ANNOTATION AND LABELING MARKET, BY APPLICATION

14.2.2.7

DATA ANNOTATION AND LABELING MARKET, BY VERTICAL

14.2.2.8

DATA ANNOTATION AND LABELING MARKET, BY REGION

14.3

SYNTHETIC DATA GENERATION MARKET

14.3.2.1

SYNTHETIC DATA GENERATION MARKET, BY OFFERING

14.3.2.2

SYNTHETIC DATA GENERATION MARKET, BY DATA TYPE

14.3.2.3

SYNTHETIC DATA GENERATION MARKET, BY APPLICATION

14.3.2.4

SYNTHETIC DATA GENERATION MARKET, BY VERTICAL

14.3.2.5

SYNTHETIC DATA GENERATION MARKET, BY REGION

15.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3

CUSTOMIZATION OPTIONS

TABLE 1

AI TRAINING DATASET MARKET DETAILED SEGMENTATION

TABLE 2

USD EXCHANGE RATE, 2019–2023

TABLE 3

PRIMARY INTERVIEWS

TABLE 5

AI TRAINING DATASET MARKET SIZE AND GROWTH RATE, 2019–2023 (USD MILLION, Y-O-Y %)

TABLE 6

AI TRAINING DATASET MARKET SIZE AND GROWTH RATE, 2024–2029 (USD MILLION, Y-O-Y %)

TABLE 7

AI TRAINING DATASET MARKET: ECOSYSTEM

TABLE 8

NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9

EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10

ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11

MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12

LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13

PATENTS FILED, 2015–2025

TABLE 14

LIST OF FEW PATENTS IN AI TRAINING DATASET MARKET, 2022–2024

TABLE 15

PRICING DATA OF AI TRAINING DATASETS, BY OFFERING

TABLE 16

PRICING DATA OF AI TRAINING DATASETS, BY PRODUCT TYPE

TABLE 17

AI TRAINING DATASET MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025–2026

TABLE 18

IMPACT OF PORTER’S FIVE FORCES ON AI TRAINING DATASET MARKET

TABLE 19

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

TABLE 20

KEY BUYING CRITERIA FOR TOP THREE END USERS

TABLE 21

AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 22

AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 23

SOFTWARE: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 24

SOFTWARE: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 25

DATA COLLECTION SOFTWARE: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 26

DATA COLLECTION SOFTWARE: : AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 27

WEB SCRAPING TOOLS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 28

WEB SCRAPING TOOLS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 29

DATA SOURCING API: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 30

DATA SOURCING API: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 31

CROWDSOURCING PLATFORMS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 32

CROWDSOURCING PLATFORMS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 33

SENSOR DATA COLLECTION SOFTWARE: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 34

SENSOR DATA COLLECTION SOFTWARE: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 35

DATA LABELING & ANNOTATION SOFTWARE: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 36

DATA LABELING & ANNOTATION: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 37

IMAGE ANNOTATION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 38

IMAGE ANNOTATION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 39

TEXT ANNOTATION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 40

TEXT ANNOTATION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 41

VIDEO ANNOTATION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 42

VIDEO ANNOTATION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 43

AUDIO ANNOTATION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 44

AUDIO ANNOTATION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 45

3D DATA ANNOTATION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 46

3D DATA ANNOTATION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 47

SYNTHETIC DATA GENERATION SOFTWARE: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 48

SYNTHETIC DATA GENERATION SOFTWARE: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 49

DATA AUGMENTATION SOFTWARE: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 50

DATA AUGMENTATION SOFTWARE: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 51

OFF-THE-SHELF (OTS) DATASETS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 52

OFF-THE-SHELF (OTS) DATASETS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 53

SERVICES: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 54

SERVICES: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 55

DATA COLLECTION SERVICES: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 56

DATA COLLECTION SERVICES: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 57

DATA ANNOTATION & LABELING SERVICES: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 58

DATA ANNOTATION & LABELING SERVICES: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 59

DATA VALIDATION SERVICES: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 60

DATA VALIDATION SERVICES: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 61

DATASET MARKETPLACES: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 62

DATASET MARKETPLACES: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 63

AI TRAINING DATASET MARKET, BY ANNOTATION TYPE, 2019–2023 (USD MILLION)

TABLE 64

AI TRAINING DATASET MARKET, BY ANNOTATION TYPE, 2024–2029 (USD MILLION)

TABLE 65

PRE-LABELED DATASETS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 66

PRE-LABELED DATASETS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 67

UNLABELED DATASETS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 68

UNLABELED DATASETS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 69

SYNTHETIC DATASETS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 70

SYNTHETIC DATASETS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 71

AI TRAINING DATASET MARKET, BY DATA MODALITY, 2019–2023 (USD MILLION)

TABLE 72

AI TRAINING DATASET MARKET, BY DATA MODALITY, 2024–2029 (USD MILLION)

TABLE 73

TEXT: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 74

TEXT: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 75

TEXT CLASSIFICATION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 76

TEXT CLASSIFICATION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 77

CHATBOTS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 78

CHATBOTS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 79

SENTIMENT ANALYSIS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 80

SENTIMENT ANALYSIS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 81

DOCUMENT PARSING: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 82

DOCUMENT PARSING: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 83

OTHER TEXT DATA MODALITIES: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 84

OTHER TEXT DATA MODALITIES: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 85

IMAGE: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 86

IMAGE: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 87

OBJECT DETECTION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 88

OBJECT DETECTION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 89

FACIAL RECOGNITION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 90

FACIAL RECOGNITION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 91

MEDICAL IMAGING: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 92

MEDICAL IMAGING: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 93

SATELLITE IMAGERY: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 94

SATELLITE IMAGERY: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 95

OTHER IMAGE DATA MODALITIES: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 96

OTHER IMAGE DATA MODALITIES: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 97

AUDIO & SPEECH: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 98

AUDIO & SPEECH: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 99

SPEECH RECOGNITION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 100

SPEECH RECOGNITION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 101

AUDIO CLASSIFICATION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 102

AUDIO CLASSIFICATION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 103

MUSIC GENERATION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 104

MUSIC GENERATION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 105

VOICE SYNTHESIS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 106

VOICE SYNTHESIS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 107

OTHER AUDIO & SPEECH DATA MODALITIES: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 108

OTHER AUDIO & SPEECH DATA MODALITIES: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 109

VIDEO: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 110

VIDEO: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 111

ACTION RECOGNITION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 112

ACTION RECOGNITION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 113

AUTONOMOUS DRIVING: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 114

AUTONOMOUS DRIVING: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 115

VIDEO SURVEILLANCE: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 116

VIDEO SURVEILLANCE: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 117

VIDEO CONTENT MODERATION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 118

VIDEO CONTENT MODERATION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 119

OTHER VIDEO DATA MODALITIES: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 120

OTHER VIDEO DATA MODALITIES: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 121

MULTIMODAL: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 122

MULTIMODAL: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 123

SPEECH-TO-TEXT: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 124

SPEECH-TO-TEXT: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 125

CONTENT RECOMMENDATION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 126

CONTENT RECOMMENDATION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 127

VISUAL QUESTION ANSWERING (VQA): AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 128

VISUAL QUESTION ANSWERING (VQA): AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 129

MULTIMODAL ANALYTICS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 130

MULTIMODAL ANALYTICS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 131

OTHER MULTIMODALITIES: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 132

OTHER MULTIMODALITIES: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 133

GENERATIVE AI SEGMENT TO REGISTER HIGHER CAGR THAN OTHER AI SEGMENT DURING FORECAST PERIOD

TABLE 134

AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 135

AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 136

GENERATIVE AI: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 137

GENERATIVE AI: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 138

LLM EVALUATION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 139

LLM EVALUATION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 140

RAG OPTIMIZATION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 141

RAG OPTIMIZATION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 142

LLM FINE TUNING: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 143

LLM FINE TUNING: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 144

CONVERSATIONAL AGENTS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 145

CONVERSATIONAL AGENTS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 146

CONTENT CREATION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 147

CONTENT CREATION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 148

CODE GENERATION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 149

CODE GENERATION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 150

OTHER GENERATIVE AI: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 151

OTHERS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 152

OTHER AI: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 153

OTHER AI: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 154

NATURAL LANGUAGE PROCESSING: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 155

NATURAL LANGUAGE PROCESSING: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 156

TEXT CLASSIFICATION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 157

TEXT CLASSIFICATION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 158

NAMED ENTITY RECOGNITION (NER): AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 159

NAMED ENTITY RECOGNITION (NER): AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 160

SENTIMENT ANALYSIS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 161

SENTIMENT ANALYSIS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 162

DOCUMENT PARSING AND EXTRACTION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 163

DOCUMENT PARSING AND EXTRACTION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 164

COMPUTER VISION: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 165

COMPUTER VISION: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 166

IMAGE CLASSIFICATION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 167

IMAGE CLASSIFICATION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 168

OBJECT DETECTION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 169

OBJECT DETECTION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 170

VIDEO ANALYSIS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 171

VIDEO ANALYSIS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 172

OPTICAL CHARACTER RECOGNITION (OCR): AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 173

OPTICAL CHARACTER RECOGNITION (OCR): AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 174

PREDICTIVE ANALYTICS: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 175

PREDICTIVE ANALYTICS: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 176

TIME SERIES FORECASTING: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 177

TIME SERIES FORECASTING: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 178

ANOMALY DETECTION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 179

ANOMALY DETECTION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 180

CUSTOMER BEHAVIOR PREDICTION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 181

CUSTOMER BEHAVIOR PREDICTION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 182

RISK SCORING AND MANAGEMENT: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 183

RISK SCORING AND MANAGEMENT: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 184

RECOMMENDATION SYSTEMS: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 185

RECOMMENDATION SYSTEMS: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 186

PRODUCT AND CONTENT RECOMMENDATIONS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 187

PRODUCT AND CONTENT RECOMMENDATIONS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 188

PERSONALIZED MARKETING AND ADS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 189

PERSONALIZED MARKETING AND ADS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 190

COLLABORATIVE FILTERING: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 191

COLLABORATIVE FILTERING: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 192

SPEECH AND AUDIO PROCESSING: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 193

SPEECH AND AUDIO PROCESSING: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 194

SPEECH RECOGNITION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 195

SPEECH RECOGNITION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 196

AUDIO CLASSIFICATION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 197

AUDIO CLASSIFICATION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 198

VOICE COMMAND RECOGNITION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 199

VOICE COMMAND RECOGNITION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 200

SPEECH-TO-TEXT TRANSCRIPTION: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 201

SPEECH-TO-TEXT TRANSCRIPTION: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 202

OTHER TYPES: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 203

OTHER TYPES: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 204

AI TRAINING DATASET MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 205

AI TRAINING DATASET MARKET, BY END USER, 2024–2029 (USD MILLION)

TABLE 206

BFSI: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 207

BFSI: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 208

BANKING: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 209

BANKING: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 210

FINANCIAL SERVICES: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 211

FINANCIAL SERVICES: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 212

INSURANCE: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 213

INSURANCE: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 214

TELECOMMUNICATIONS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 215

TELECOMMUNICATIONS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 216

GOVERNMENT & DEFENSE: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 217

GOVERNMENT & DEFENSE: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 218

HEALTHCARE & LIFE SCIENCES: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 219

HEALTHCARE & LIFE SCIENCES: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 220

MANUFACTURING: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 221

MANUFACTURING: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 222

RETAIL & CONSUMER GOODS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 223

RETAIL & CONSUMER GOODS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 224

SOFTWARE & TECHNOLOGY PROVIDERS: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 225

SOFTWARE & TECHNOLOGY PROVIDERS: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 226

CLOUD HYPERSCALERS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 227

CLOUD HYPERSCALERS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 228

FOUNDATION MODEL/LLM PROVIDERS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 229

FOUNDATION MODEL/LLM PROVIDERS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 230

AI TECHNOLOGY PROVIDERS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 231

AI TECHNOLOGY PROVIDERS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 232

IT & IT-ENABLED SERVICE PROVIDERS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 233

IT & IT-ENABLED SERVICE PROVIDERS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 234

AUTOMOTIVE: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 235

AUTOMOTIVE: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 236

MEDIA & ENTERTAINMENT: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 237

MEDIA & ENTERTAINMENT: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 238

OTHER END USERS: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 239

OTHER END USERS: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 240

AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 241

AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 242

NORTH AMERICA: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 243

NORTH AMERICA: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 244

NORTH AMERICA: AI TRAINING DATASET MARKET, BY SOFTWARE, 2019–2023 (USD MILLION)

TABLE 245

NORTH AMERICA: AI TRAINING DATASET MARKET, BY SOFTWARE, 2024–2029 (USD MILLION)

TABLE 246

NORTH AMERICA: AI TRAINING DATASET MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 247

NORTH AMERICA: AI TRAINING DATASET MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 248

NORTH AMERICA: AI TRAINING DATASET MARKET, BY ANNOTATION TYPE, 2019–2023 (USD MILLION)

TABLE 249

NORTH AMERICA: AI TRAINING DATASET MARKET, BY ANNOTATION TYPE, 2024–2029 (USD MILLION)

TABLE 250

NORTH AMERICA: AI TRAINING DATASET MARKET, BY DATA MODALITY, 2019–2023 (USD MILLION)

TABLE 251

NORTH AMERICA: AI TRAINING DATASET MARKET, BY DATA MODALITY, 2024–2029 (USD MILLION)

TABLE 252

NORTH AMERICA: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 253

NORTH AMERICA: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 254

NORTH AMERICA: AI TRAINING DATASET MARKET, BY GENERATIVE AI, 2019–2023 (USD MILLION)

TABLE 255

NORTH AMERICA: AI TRAINING DATASET MARKET, BY GENERATIVE AI, 2024–2029 (USD MILLION)

TABLE 256

NORTH AMERICA: AI TRAINING DATASET MARKET, BY OTHER AI, 2019–2023 (USD MILLION)

TABLE 257

NORTH AMERICA: AI TRAINING DATASET MARKET, BY OTHER AI, 2024–2029 (USD MILLION)

TABLE 258

NORTH AMERICA: AI TRAINING DATASET MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 259

NORTH AMERICA: AI TRAINING DATASET MARKET, BY END USER, 2024–2029 (USD MILLION)

TABLE 260

NORTH AMERICA: AI TRAINING DATASET MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 261

NORTH AMERICA: AI TRAINING DATASET MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 262

US: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 263

US: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 264

CANADA: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 265

CANADA: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 266

EUROPE: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 267

EUROPE: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 268

EUROPE: AI TRAINING DATASET MARKET, BY SOFTWARE, 2019–2023 (USD MILLION)

TABLE 269

EUROPE: AI TRAINING DATASET MARKET, BY SOFTWARE, 2024–2029 (USD MILLION)

TABLE 270

EUROPE: AI TRAINING DATASET MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 271

EUROPE: AI TRAINING DATASET MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 272

EUROPE: AI TRAINING DATASET MARKET, BY ANNOTATION TYPE, 2019–2023 (USD MILLION)

TABLE 273

EUROPE: AI TRAINING DATASET MARKET, BY ANNOTATION TYPE, 2024–2029 (USD MILLION)

TABLE 274

EUROPE: AI TRAINING DATASET MARKET, BY DATA MODALITY, 2019–2023 (USD MILLION)

TABLE 275

EUROPE: AI TRAINING DATASET MARKET, BY DATA MODALITY, 2024–2029 (USD MILLION)

TABLE 276

EUROPE: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 277

EUROPE: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 278

EUROPE: AI TRAINING DATASET MARKET, BY GENERATIVE AI, 2019–2023 (USD MILLION)

TABLE 279

EUROPE: AI TRAINING DATASET MARKET, BY GENERATIVE AI, 2024–2029 (USD MILLION)

TABLE 280

EUROPE: AI TRAINING DATASET MARKET, BY OTHER AI, 2019–2023 (USD MILLION)

TABLE 281

EUROPE: AI TRAINING DATASET MARKET, BY OTHER AI, 2024–2029 (USD MILLION)

TABLE 282

EUROPE: AI TRAINING DATASET MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 283

EUROPE: AI TRAINING DATASET MARKET, BY END USER, 2024–2029 (USD MILLION)

TABLE 284

EUROPE: AI TRAINING DATASET MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 285

EUROPE: AI TRAINING DATASET MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 286

UK: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 287

UK: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 288

GERMANY: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 289

GERMANY: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 290

FRANCE: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 291

FRANCE: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 292

ITALY: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 293

ITALY: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 294

SPAIN: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 295

SPAIN: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 296

NETHERLANDS: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 297

NETHERLANDS: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 298

REST OF EUROPE: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 299

REST OF EUROPE: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 300

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 301

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 302

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY SOFTWARE, 2019–2023 (USD MILLION)

TABLE 303

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY SOFTWARE, 2024–2029 (USD MILLION)

TABLE 304

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 305

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 306

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY ANNOTATION TYPE, 2019–2023 (USD MILLION)

TABLE 307

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY ANNOTATION TYPE, 2024–2029 (USD MILLION)

TABLE 308

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY DATA MODALITY, 2019–2023 (USD MILLION)

TABLE 309

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY DATA MODALITY, 2024–2029 (USD MILLION)

TABLE 310

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 311

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 312

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY GENERATIVE AI, 2019–2023 (USD MILLION)

TABLE 313

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY GENERATIVE AI, 2024–2029 (USD MILLION)

TABLE 314

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY OTHER AI, 2019–2023 (USD MILLION)

TABLE 315

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY OTHER AI, 2024–2029 (USD MILLION)

TABLE 316

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 317

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY END USER, 2024–2029 (USD MILLION)

TABLE 318

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 319

ASIA PACIFIC: AI TRAINING DATASET MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 320

CHINA: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 321

CHINA: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 322

JAPAN: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 323

JAPAN: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 324

INDIA: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 325

INDIA: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 326

SOUTH KOREA: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 327

SOUTH KOREA: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 328

AUSTRALIA: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 329

AUSTRALIA: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 330

SINGAPORE: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 331

SINGAPORE: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 332

REST OF ASIA PACIFIC: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 333

REST OF ASIA PACIFIC: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 334

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 335

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 336

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY SOFTWARE, 2019–2023 (USD MILLION)

TABLE 337

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY SOFTWARE, 2024–2029 (USD MILLION)

TABLE 338

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 339

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 340

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY ANNOTATION TYPE, 2019–2023 (USD MILLION)

TABLE 341

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY ANNOTATION TYPE, 2024–2029 (USD MILLION)

TABLE 342

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY DATA MODALITY, 2019–2023 (USD MILLION)

TABLE 343

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY DATA MODALITY, 2024–2029 (USD MILLION)

TABLE 344

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 345

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 346

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY GENERATIVE AI, 2019–2023 (USD MILLION)

TABLE 347

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY GENERATIVE AI, 2024–2029 (USD MILLION)

TABLE 348

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY OTHER AI, 2019–2023 (USD MILLION)

TABLE 349

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY OTHER AI, 2024–2029 (USD MILLION)

TABLE 350

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 351

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY END USER, 2024–2029 (USD MILLION)

TABLE 352

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY REGION, 2019–2023 (USD MILLION)

TABLE 353

MIDDLE EAST & AFRICA: AI TRAINING DATASET MARKET, BY REGION, 2024–2029 (USD MILLION)

TABLE 354

MIDDLE EAST: AI TRAINING DATASET MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 355

MIDDLE EAST: AI TRAINING DATASET MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 356

UAE: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 357

UAE: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 358

SAUDI ARABIA: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 359

SAUDI ARABIA: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 360

QATAR: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 361

QATAR: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 362

TURKEY: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 363

TURKEY: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 364

REST OF MIDDLE EAST: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 365

REST OF MIDDLE EAST: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 366

AFRICA: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 367

AFRICA: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 368

LATIN AMERICA: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 369

LATIN AMERICA: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 370

LATIN AMERICA: AI TRAINING DATASET MARKET, BY SOFTWARE, 2019–2023 (USD MILLION)

TABLE 371

LATIN AMERICA: AI TRAINING DATASET MARKET, BY SOFTWARE, 2024–2029 (USD MILLION)

TABLE 372

LATIN AMERICA: AI TRAINING DATASET MARKET, BY SERVICE, 2019–2023 (USD MILLION)

TABLE 373

LATIN AMERICA: AI TRAINING DATASET MARKET, BY SERVICE, 2024–2029 (USD MILLION)

TABLE 374

LATIN AMERICA: AI TRAINING DATASET MARKET, BY ANNOTATION TYPE, 2019–2023 (USD MILLION)

TABLE 375

LATIN AMERICA: AI TRAINING DATASET MARKET, BY ANNOTATION TYPE, 2024–2029 (USD MILLION)

TABLE 376

LATIN AMERICA: AI TRAINING DATASET MARKET, BY DATA MODALITY, 2019–2023 (USD MILLION)

TABLE 377

LATIN AMERICA: AI TRAINING DATASET MARKET, BY DATA MODALITY, 2024–2029 (USD MILLION)

TABLE 378

LATIN AMERICA: AI TRAINING DATASET MARKET, BY TYPE, 2019–2023 (USD MILLION)

TABLE 379

LATIN AMERICA: AI TRAINING DATASET MARKET, BY TYPE, 2024–2029 (USD MILLION)

TABLE 380

LATIN AMERICA: AI TRAINING DATASET MARKET, BY GENERATIVE AI, 2019–2023 (USD MILLION)

TABLE 381

LATIN AMERICA: AI TRAINING DATASET MARKET, BY GENERATIVE AI, 2024–2029 (USD MILLION)

TABLE 382

LATIN AMERICA: AI TRAINING DATASET MARKET, BY OTHER AI, 2019–2023 (USD MILLION)

TABLE 383

LATIN AMERICA: AI TRAINING DATASET MARKET, BY OTHER AI, 2024–2029 (USD MILLION)

TABLE 384

LATIN AMERICA: AI TRAINING DATASET MARKET, BY END USER, 2019–2023 (USD MILLION)

TABLE 385

LATIN AMERICA: AI TRAINING DATASET MARKET, BY END USER, 2024–2029 (USD MILLION)

TABLE 386

LATIN AMERICA: AI TRAINING DATASET MARKET, BY COUNTRY, 2019–2023 (USD MILLION)

TABLE 387

LATIN AMERICA: AI TRAINING DATASET MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

TABLE 388

BRAZIL: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 389

BRAZIL: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 390

MEXICO: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 391

MEXICO: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 392

ARGENTINA: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 393

ARGENTINA: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 394

REST OF LATIN AMERICA: AI TRAINING DATASET MARKET, BY OFFERING, 2019–2023 (USD MILLION)

TABLE 395

REST OF LATIN AMERICA: AI TRAINING DATASET MARKET, BY OFFERING, 2024–2029 (USD MILLION)

TABLE 396

AI TRAINING DATASET MARKET: DEGREE OF COMPETITION

TABLE 397

AI TRAINING DATASET MARKET: REGIONAL FOOTPRINT

TABLE 398

AI TRAINING DATASET MARKET: OFFERING FOOTPRINT

TABLE 399

AI TRAINING DATASET MARKET: DATA MODALITY FOOTPRINT

TABLE 400

AI TRAINING DATASET MARKET: END-USER FOOTPRINT

TABLE 401

AI TRAINING DATASET MARKET: REGIONAL FOOTPRINT

TABLE 402

AI TRAINING DATASET MARKET: OFFERING FOOTPRINT

TABLE 403

AI TRAINING DATASET MARKET: DATA MODALITY FOOTPRINT

TABLE 404

AI TRAINING DATASET MARKET: END USER FOOTPRINT

TABLE 405

AI TRAINING DATASET MARKET: KEY STARTUPS/SMES

TABLE 406

AI TRAINING DATASET MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 407

AI TRAINING DATASET MARKET: KEY START-UPS/SMES

TABLE 408

AI TRAINING DATASET MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

TABLE 409

AI TRAINING DATASET MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021–OCTOBER 2024

TABLE 410

AI TRAINING DATASET MARKET: DEALS, JANUARY 2021–OCTOBER 2024

TABLE 411

GOOGLE: COMPANY OVERVIEW

TABLE 412

GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 413

GOOGLE: PRODUCT ENHANCEMENTS

TABLE 415

MICROSOFT: COMPANY OVERVIEW

TABLE 416

MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 417

MICROSOFT: PRODUCT ENHANCEMENTS

TABLE 418

AWS: COMPANY OVERVIEW

TABLE 419

AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 420

AWS: PRODUCT ENHANCEMENTS

TABLE 422

APPEN: COMPANY OVERVIEW

TABLE 423

APPEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 424

APPEN: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 426

NVIDIA: COMPANY OVERVIEW

TABLE 427

NVIDIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 428

NVIDIA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 429

IBM: COMPANY OVERVIEW

TABLE 430

IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 431

TELUS INTERNATIONAL: COMPANY OVERVIEW

TABLE 432

TELUS INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 433

INNODATA: COMPANY OVERVIEW

TABLE 434

INNODATA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 435

INNODATA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 436

COGITO TECH: COMPANY OVERVIEW

TABLE 437

COGITO TECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 438

SAMA: COMPANY OVERVIEW

TABLE 439

SAMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 440

SAMA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 441

DATA ANNOTATION AND LABELING MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 442

DATA ANNOTATION AND LABELING MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 443

DATA ANNOTATION AND LABELING MARKET, BY DATA TYPE, 2019–2021 (USD MILLION)

TABLE 444

DATA ANNOTATION AND LABELING MARKET, BY DATA TYPE, 2022–2027 (USD MILLION)

TABLE 445

DATA ANNOTATION AND LABELING MARKET, BY DEPLOYMENT TYPE, 2019–2021 (USD MILLION)

TABLE 446

DATA ANNOTATION AND LABELING MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 447

DATA ANNOTATION AND LABELING MARKET, BY ORGANIZATION SIZE, 2019–2021 (USD MILLION)

TABLE 448

DATA ANNOTATION AND LABELING MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 449

DATA ANNOTATION AND LABELING MARKET, BY ANNOTATION TYPE, 2019–2021 (USD MILLION)

TABLE 450

DATA ANNOTATION AND LABELING MARKET, BY ANNOTATION TYPE, 2022–2027 (USD MILLION)

TABLE 451

DATA ANNOTATION AND LABELING MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 452

DATA ANNOTATION AND LABELING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 453

DATA ANNOTATION AND LABELING MARKET, BY VERTICAL, 2019–2021 (USD MILLION)

TABLE 454

DATA ANNOTATION AND LABELING MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 455

DATA ANNOTATION AND LABELING MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 456

DATA ANNOTATION AND LABELING MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 457

SYNTHETIC DATA GENERATION MARKET, BY OFFERING, 2019–2022 (USD MILLION)

TABLE 458

SYNTHETIC DATA GENERATION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 459

SYNTHETIC DATA GENERATION MARKET, BY DATA TYPE, 2019–2022 (USD MILLION)

TABLE 460

SYNTHETIC DATA GENERATION MARKET, BY DATA TYPE, 2023–2028 (USD MILLION)

TABLE 461

SYNTHETIC DATA GENERATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

TABLE 462

SYNTHETIC DATA GENERATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 463

SYNTHETIC DATA GENERATION MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

TABLE 464

SYNTHETIC DATA GENERATION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

TABLE 465

SYNTHETIC DATA GENERATION MARKET, BY REGION, 2019–2022 (USD MILLION)

TABLE 466

SYNTHETIC DATA GENERATION MARKET, BY REGION, 2023–2028 (USD MILLION)

FIGURE 1

AI TRAINING DATASET MARKET: RESEARCH DESIGN

FIGURE 2

DATA TRIANGULATION

FIGURE 3

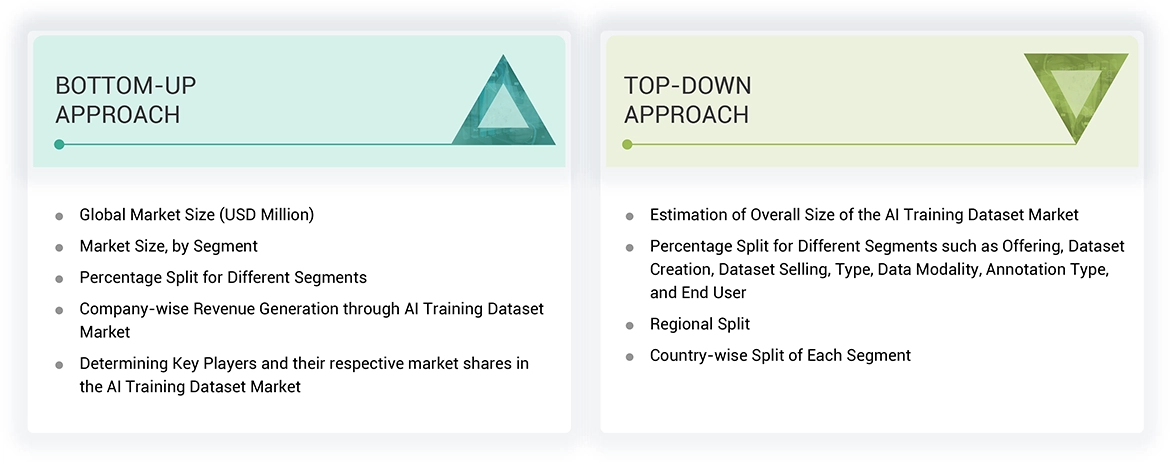

AI TRAINING DATASET MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 4

MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1, BOTTOM-UP (SUPPLY-SIDE): REVENUE FROM PRODUCT TYPES OF AI TRAINING DATASET MARKET

FIGURE 5

MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL PRODUCT TYPES OF AI TRAINING DATASET MARKET

FIGURE 6

MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL PRODUCT TYPES OF AI TRAINING DATASET MARKET

FIGURE 7

MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF AI TRAINING DATASETS THROUGH OVERALL AI SPENDING

FIGURE 8

SOFTWARE SEGMENT TO LEAD MARKET IN 2024

FIGURE 9

DATASET LABELLING & ANNOTATION SOFTWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

FIGURE 10

DATA LABELING & ANNOTATION SERVICES SEGMENT TO LEAD MARKET IN 2024

FIGURE 11

PRE-LABELED DATASETS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2024

FIGURE 12

TEXT DATA MODALITY SEGMENT TO LEAD MARKET IN 2024

FIGURE 13

OTHER AI SEGMENT TO DOMINATE MARKET IN 2024

FIGURE 14

LLM FINE TUNING SEGMENT TO LEAD MARKET IN 2024

FIGURE 15

NATURAL LANGUAGE PROCESSING SEGMENT TO EMERGE MARKET LEADER IN 2024

FIGURE 16

HEALTHCARE & LIFE SCIENCES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 17

ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

FIGURE 18

SOARING DEMAND FOR HIGH-QUALITY, SCALABLE, AND PRIVACY-COMPLIANT DATASETS TO DRIVE MARKET

FIGURE 19

MULTIMODAL SEGMENT TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

FIGURE 20

PRE-LABELED DATASETS AND SOFTWARE & TECHNOLOGY PROVIDERS TO ACCOUNT FOR LARGEST MARKET SHARES IN NORTH AMERICA IN 2024

FIGURE 21

NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2024

FIGURE 22

AI TRAINING DATASET MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 23

EVOLUTION OF AI TRAINING DATASET

FIGURE 24

AI TRAINING DATASET MARKET: SUPPLY CHAIN ANALYSIS

FIGURE 25

AI TRAINING DATASET MARKET: ECOSYSTEM

FIGURE 26

AI TRAINING DATASET MARKET: INVESTMENT LANDSCAPE AND FUNDING SCENARIO (USD MILLION AND NUMBER OF FUNDING ROUNDS)

FIGURE 27

VALUATION OF PROMINENT AI TRAINING DATASET PROVIDERS

FIGURE 28

MARKET POTENTIAL OF GENERATIVE AI IN VARIOUS AI TRAINING DATASET USE CASES

FIGURE 29

NUMBER OF PATENTS GRANTED IN LAST 10 YEARS, 2015–2024

FIGURE 30

REGIONAL ANALYSIS OF PATENTS GRANTED, 2015–2024

FIGURE 31

AI TRAINING DATASET MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 32

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

FIGURE 33

KEY BUYING CRITERIA FOR TOP THREE END USERS

FIGURE 34

TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 35

SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

FIGURE 36

DATA LABELLING & ANNOTATION SOFTWARE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

FIGURE 37

DATA COLLECTION SERVICES SEGMENT TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

FIGURE 38

SYNTHETIC DATASETS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 39

MULTIMODAL SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

FIGURE 40

LLM FINE TUNING SEGMENT TO LEAD MARKET FROM 2024 TO 2029

FIGURE 41

RECOMMENDATION SYSTEMS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 42

HEALTHCARE & LIFE SCIENCES SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

FIGURE 43

NORTH AMERICA TO BE LARGEST MARKET DURING FORECAST PERIOD

FIGURE 44

INDIA TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

FIGURE 45

NORTH AMERICA: AI TRAINING DATASET MARKET SNAPSHOT

FIGURE 46

ASIA PACIFIC: AI TRAINING DATASET MARKET SNAPSHOT

FIGURE 47

OVERVIEW OF STRATEGIES ADOPTED BY KEY AI TRAINING DATASET VENDORS, 2021–2024

FIGURE 48

AI TRAINING DATASET MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019–2023

FIGURE 49

SHARE ANALYSIS OF LEADING COMPANIES IN AI TRAINING DATASET MARKET, 2023

FIGURE 50

PRODUCT COMPARATIVE ANALYSIS

FIGURE 51

COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

FIGURE 52

YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

FIGURE 53

AI TRAINING DATASET MARKET: COMPANY EVALUATION MATRIX, KEY PLAYERS (SOFTWARE PROVIDERS), 2023

FIGURE 54

AI TRAINING DATASET MARKET: COMPANY FOOTPRINT

FIGURE 55

AI TRAINING DATASET MARKET: COMPANY EVALUATION MATRIX, KEY PLAYERS (SERVICE PROVIDERS), 2023

FIGURE 56

AI TRAINING DATASET MARKET: COMPANY FOOTPRINT

FIGURE 57

AI TRAINING DATASET MARKET: COMPANY EVALUATION MATRIX, STARTUPS/SMES (SOFTWARE PROVIDERS), 2023

FIGURE 58

AI TRAINING DATASET MARKET: COMPANY EVALUATION MATRIX, START-UPS/SMES (SERVICE PROVIDERS), 2023

FIGURE 59

GOOGLE: COMPANY SNAPSHOT

FIGURE 60

MICROSOFT: COMPANY SNAPSHOT

FIGURE 61

AWS: COMPANY SNAPSHOT

FIGURE 62

APPEN: COMPANY SNAPSHOT

FIGURE 63

NVIDIA: COMPANY SNAPSHOT

FIGURE 64

IBM: COMPANY SNAPSHOT

FIGURE 65

TELUS INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 66

INNODATA: COMPANY SNAPSHOT

Growth opportunities and latent adjacency in AI Training Dataset Market