The present size of the centrifugal pump market in Africa was estimated by this study using a number of important procedures. To acquire information about the market, related markets, and the larger parent market, a significant amount of secondary research was done. The conclusions, suppositions, and market size were then confirmed by primary research involving professionals from the industry at every stage of the value chain. Next, a country-by-country analysis was used to estimate the size of the overall market. Ultimately, to ascertain the size of distinct market segments and sub-segments, market segmentation and data triangulation were executed.

Secondary Research

The secondary research process collected data relevant to a technical, market-oriented, and commercial analysis of the Africa centrifugal pump market by consulting a variety of sources, including directories and databases like Hoover's, Bloomberg BusinessWeek, Factiva, and OneSource. White papers, certified publications, articles by renowned experts, trade directories, manufacturers, associations, investor presentations, press releases and presentations from the companies themselves were some additional secondary sources.

Primary Research

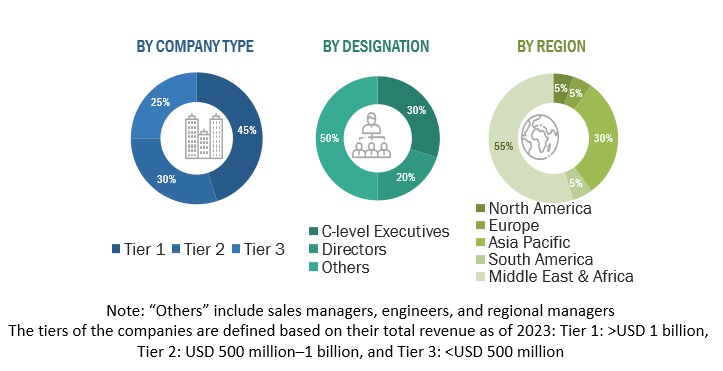

A wide range of supply chain participants are involved in the Africa centrifugal pump market, including distributors, end users, manufacturers of components, raw material suppliers, and producers and assemblers of centrifugal pumps. End users are the main force behind the demand side, especially in the expanding industrial sector. The market is impacted by mergers and acquisitions among major players as well as the growing demand for contracts from the industrial sector on the supply side. Primary sources from the supply and demand sides of the market were interviewed in order to obtain qualitative and quantitative insights. Below is a breakdown of these primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

-

The bottom-up approach has been used to estimate and validate the size of the Africa centrifugal pump market.

-

This method considers the amount of centrifugal pumps used in different African industries, as well as the associated revenue and market statistics for centrifugal pumps in Africa.

-

Extensive secondary and primary research has been carried out to obtain an understanding of the global market environment for various centrifugal pump types in Africa.

-

Extensive primary interviews have been carried out with influential figures in Africa's centrifugal pump system development, such as top original equipment manufacturers and first-rate suppliers.

-

h2>Qualitative aspects including market drivers, constraints, opportunities, and challenges have been carefully taken into account when estimating and projecting the market size.

Global Africa Centrifugal Pump Market Size: Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Africa Centrifugal Pump Market Size: Top-down Approach

Data Triangulation

The market is divided into numerous segments and subsegments as part of a thorough estimation process that determines the total market size. In order to obtain accurate statistics for every segment and subsegment, a thorough market engineering methodology is utilized. When necessary, techniques for breaking down the market and triangulating data are used. By examining numerous variables and patterns from the supply and demand sides of the Africa centrifugal pump market ecosystem, data triangulation is carried out. By using this method, the market estimates are guaranteed to be precise and to reflect the dynamics and trends of the present market.

Market Definition

Typically derived from a motor, a centrifugal pump is a mechanical device that transfers fluids by transforming rotational energy into hydrodynamic energy within the fluid flow. It works by introducing velocity into the fluid through a rotating impeller, which is subsequently transformed into pressure energy as the fluid leaves through a discharge pipe. Centrifugal pumps are used in a broad variety of industries, including mining, chemicals, oil and gas, power generation, water and wastewater treatment, and industrial processes. This market is distinguished by its segmentation according to variables like end-user applications (e.g., residential, commercial, industrial), operation type (e.g., electrical, hydraulic), stage (e.g., single-stage, multi-stage), and pump type (e.g., overhung impeller, between bearing, vertically suspended). Centrifugal pumps are in high demand. Driven by the need for efficient fluid transfer solutions, technological advancements in pump design, and increasing industrialization and urbanization, which necessitate reliable and effective pumping systems for a range of critical operations.

Key Stakeholders

-

Government Utility Providers

-

Independent Power Producers

-

Pump manufacturers

-

Power equipment and garden tool manufacturers

-

Consulting companies in the energy & power sector

-

Distribution utilities

-

Government and research organizations

-

Organizations, forums, and associations

-

Raw material suppliers

-

State and national regulatory authorities

-

Pump manufacturers, distributors, and suppliers

-

Pump original equipment manufacturers (OEMs)

Objectives of the Study

-

To determine the value of the Africa centrifugal pump market by type, operation type, stage, end user, and countries

-

To estimate market size for Africa's major countries while taking the effects of the recession into account

-

To offer a thorough understanding of the factors influencing market growth, including the drivers, restraints, opportunities, and industry-specific challenges

-

To strategically assess each subsegment in terms of its growth trends, potential, and impact on the overall market size

-

To identify market opportunities for stakeholders and provide insights into the competitive landscape for key market leaders

-

To strategically profile the leading players in the market and thoroughly analyze their market shares and core competencies

-

To monitor and evaluate competitive developments, including agreements, sales contracts, partnerships, new product launches, acquisitions, contracts, expansions, and investments within the Africa centrifugal pump market

-

The value of the Africa centrifugal pump market is covered in this report

Available Customization

Based on the available market data, MarketsandMarkets provides tailored customizations to meet specific company requirements. The report can be customized with the following options:

PRODUCT ANALYSIS

-

Product Matrix, which provides a detailed comparison of the product portfolio of each company

COMPANY INFORMATION

-

Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Africa Centrifugal Pump Market