The study involved four major activities for estimating the current size of the global urea market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of urea through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the urea market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred, to identify and collect information for this study on the urea market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

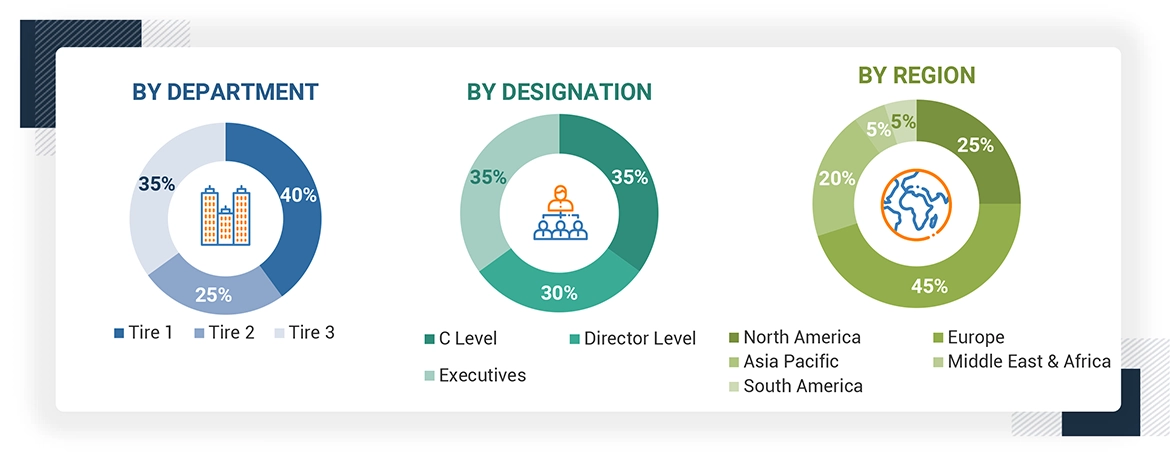

The urea market comprises several stakeholders in the supply chain, which include raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the urea market. Primary sources from the supply side include associations and institutions involved in the urea industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

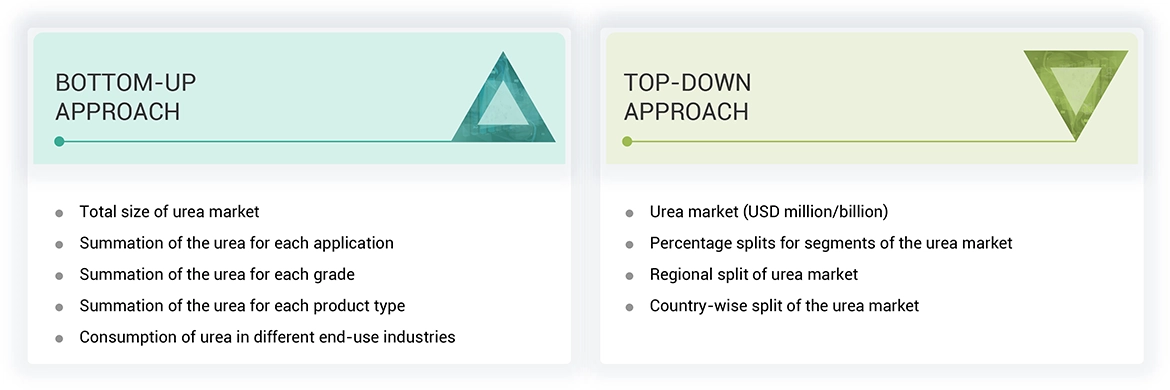

The bottom-up and top-down approaches have been used to estimate the urea market by product type, grade, technology, application, end-use industry, and region. The research methodology used to calculate the market size includes the following steps:

-

The key players in the industry and markets were identified through extensive secondary research.

-

In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

-

The research included studying reports, reviews, and newsletters of top market players and extensive interviews with leaders such as directors and marketing executives to obtain opinions.

-

The following figure illustrates the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall size of the urea market from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Urea is an organic compound that exists as a white odorless and tasteless crystalline solid, consisting of carbon, nitrogen, oxygen, and hydrogen. It is highly soluble in water and hence is crucially necessary in the majority of industrial and agricultural sectors all over the world. Urea primarily acts as a fertilizer, which contains high percentages of nitrogen, making it proficiently efficient in transport and application in agriculture. Besides its strategic position in agriculture, urea serves as a raw material for chemical manufacturing, and pharmaceuticals, and through animal feed, it serves as the source of important nutrients. Urea is a critical component of high productivity in agriculture and assists other industrial operations, and it is also substantially applied in environmental applications, like diesel exhaust fluid, to reduce the nitrogen oxide concentration that diesel engines emit, thereby paving its way toward cleaner air standards.

Stakeholders

-

Urea manufacturers

-

Urea suppliers

-

Fertilizer manufacturers

-

Pharmaceutical companies

-

Chemical industries

-

Government agencies

-

Raw material suppliers

Report Objectives

-

To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

-

To forecast the market size based on product type, grade, technology, application, end-use industry, and region.

-

To forecast the market size for the five main regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America—along with their key countries

-

To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

-

To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders

-

To strategically profile leading players and comprehensively analyze their key developments such as new product launches, expansions, and acquisitions in the urea market

-

To define, describe, and forecast the size of the global urea market in terms of value and volume

-

To strategically profile key players and comprehensively analyze their market shares and core competencies.

Growth opportunities and latent adjacency in Urea Market