The research study conducted on the unmanned systems market involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, and Factiva, to identify and collect relevant information. Primary sources included industry experts from the market as well as suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this industry. In-depth interviews of various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the market as well as assess the growth prospects of the market. A deductive approach, also known as the bottom-up approach combined with the top-down approach, was used to forecast the market size of different market segments.

Secondary Research

The share of companies in the unmanned systems market was determined based on secondary data made available through paid and unpaid sources and an analysis of the product portfolios of major companies. These companies were rated based on their performance and quality. These data points were further validated by primary sources. Secondary sources for this research study included corporate filings, such as annual reports, investor presentations, and financial statements from trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the unmanned systems market through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across different regions. This primary data was collected through questionnaires, emails, and telephonic interviews.

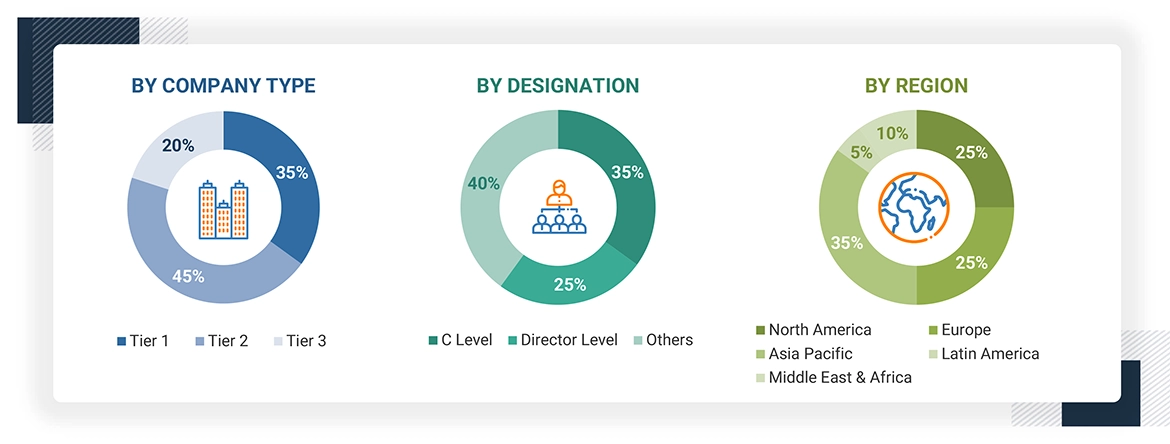

Note: Tiers of companies are based on their revenue in 2023. Tier 1: company revenue greater than USD

1 billion; tier 2: company revenue between USD 100 million and USD 1 billion; and tier 3: company revenue

less than USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the unmanned systems market. The research methodology used to estimate the market size includes the following details.

Key players in the market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews with industry stakeholders such as CEOs, technical advisors, military experts, marine vessel maintenance professionals, and SMEs of leading companies operating in the unmanned systems market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the unmanned systems market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up approach

Market size estimation methodology: Top- Down approach

Data Triangulation

After arriving at the overall size of the unmanned systems market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the unmanned systems market size was validated using the top-down and bottom-up approaches.

Market Definition

Unmanned Systems or Unmanned Vehicles refer to vehicles that operate without direct human intervention, often controlled remotely or autonomously through pre-programmed instructions or AI. These systems are commonly used in a variety of sectors, including defense, agriculture, logistics, and transportation. They include different types of vehicles and platforms such as:

UNMANNED AERIAL VEHICLES (UAVS)

Unmanned aerial vehicles (UAVs) are remotely piloted, optionally piloted, or fully autonomous aerial vehicles that play a significant role in the defense and commercial sectors. They are commonly termed drones and are mostly known for their wide use in various military missions, such as border surveillance and combat operations. These vehicles are also used for mapping, surveying, and determining the weather conditions of a specific area.

UNMANNED GROUND VEHICLES (UGVs)

Unmanned ground vehicles (UGVs) operate on the ground without human presence onboard. These vehicles are used for protection or rescue duties in hazardous environments or for carrying out repetitive tasks. Unmanned ground vehicles are actively developed for both commercial and military use. They are typically deployed for reconnaissance, monitoring buildings and infrastructures, border surveillance, rescue missions, transportation of goods, explosive ordnance disposal, and mine clearance.

UNMANNED MARINE VEHICLES (UMVs)

Unmanned marine vehicles (UGVs) are vehicles that operate on or below the water, including surface and underwater operations. These vehicles are used for surveillance, environmental monitoring, and naval missions. There are two types of UMVs: Unmanned Surface Vehicles (USVs), and Unmanned Underwater Vehicles (UUVs).

-

Unmanned Surface Vehicles (USVs): An unmanned surface vehicle (USV) is a marine vessel that operates on the water surface without human intervention. It has a complex system, including system integration, environment perception, and autonomous decision & control. USVs are powered by diesel/gasoline engines, rechargeable lithium-ion batteries, or solar energy. These vehicles are also equipped with various sensors, cameras, communication systems, and other payloads to collect data, perform tasks, and communicate information back to a control station or operator. They are primarily utilized for ocean exploration and various maritime applications.

-

Unmanned Underwater Vehicles (UUVs): An unmanned underwater vehicle (USV) is a submersible marine vessel that operates under the water surface without human intervention. These vehicles are deployed to conduct tasks, such as measuring oceanographic data, capturing bottom images, bathymetric imaging, collecting intelligence, obtaining intelligence, surveillance, and reconnaissance (ISR) data, cable laying, and mine detecting. The size of UUVs varies from small to large depending on various factors, such as their capabilities, dimensions, power, speed, and sensors.

Stakeholders

-

Unmanned Systems Suppliers

-

Unmanned Systems Component Manufacturers

-

Unmanned Systems Manufacturers

-

Unmanned Systems pilot training institutes

-

Technology Support Providers

-

Unmanned Systems Software/Hardware/Service and Solution Providers

-

Regulatory Bodies

-

Unmanned Systems Consultants

-

Defense Forces

Report Objectives

-

To define, describe, segment, and forecast the size of the Unmanned Systems Market based on type, application, mode of operation, and region.

-

To forecast sizes of various segments of the market with respect to six major regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, along with major countries in each of these regions.

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market across the globe.

-

To identify industry trends, market trends, and technology trends that are currently prevailing in the market.

-

To provide an overview of the regulatory landscape with respect to drone regulations across regions.

-

To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market.

-

To analyze opportunities in the market for stakeholders by identifying key market trends.

-

To profile key market players and comprehensively analyze their market shares and core competencies.

-

To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, product launches, contracts, and partnerships, adopted by leading market players.

-

To identify detailed financial positions, key products, and unique selling points of leading companies in the market.

-

To provide a detailed competitive landscape of the market, along with market ranking analysis, market share analysis, and revenue analysis of key players.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

-

Further breakdown of the market segments at country-level

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Unmanned Systems Market