The study involved four major activities in estimating the current size of the tumor ablation market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial tumor ablation market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the tumor ablation market. The primary sources from the demand side include hospitals, clinics, retailers, and other end users. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

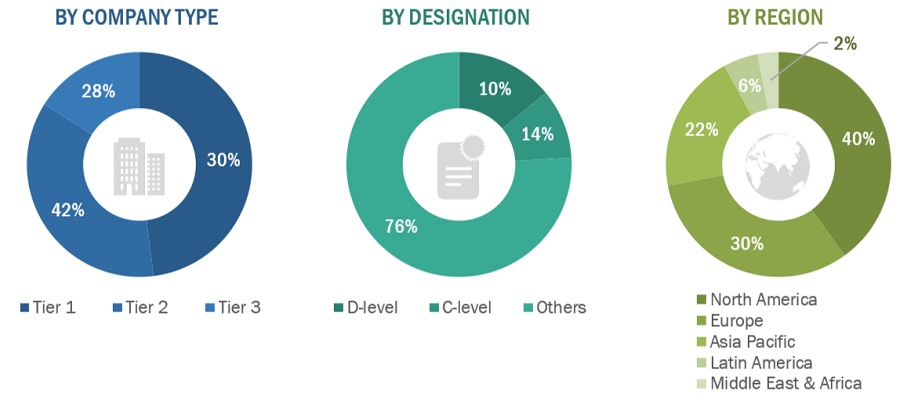

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The tiers of the companies are defined based on their total revenue. As of 2023: Tier 1 => USD 1 billion, Tier 2 = USD 200-500 million to USD 1 billion, and Tier 3 =< USD 200 million

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

In this report, the tumor ablation market’s size was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the market business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

Segmental revenues were calculated based on the revenue mapping of major solution/service providers to calculate the global market value. This process involved the following steps:

-

Generating a list of major global players operating in the tumor ablation market.

-

Mapping annual revenues generated by major global players from the product segment (or nearest reported business unit/product category)

-

Revenue mapping of major players to cover a major share of the global market share, as of 2022

-

Extrapolating the global value of the tumor ablation market industry

Bottom-up approach

In this report, the size of the global tumor ablation market was determined using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the tumor ablation business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and marketing executives.

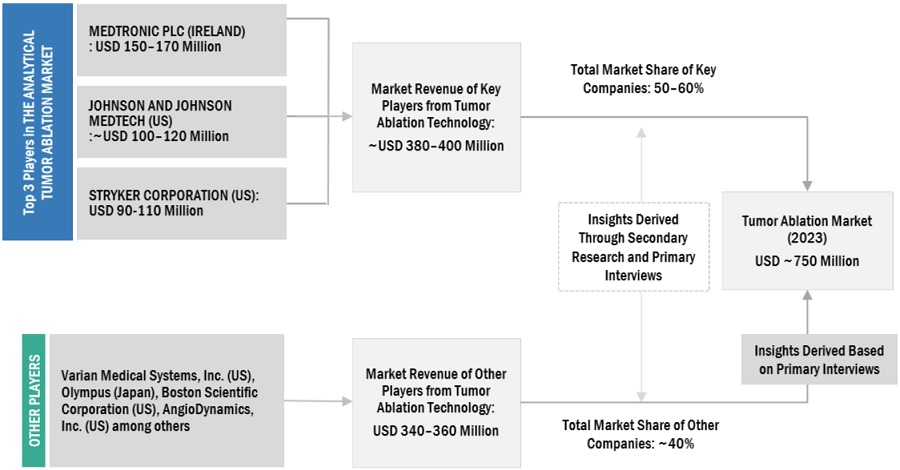

Approach 1: Company revenue estimation approach

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/product providers. This process involved the following steps:

-

Generating a list of major global players operating in the tumor ablation market

-

Mapping the annual revenues generated by major global players from the tumor ablation segment (or the nearest reported business unit/product category)

-

Mapping the revenues of major players to cover at least 50-55% of the global market share as of 2023

-

Extrapolating the global value of the tumor ablation industry

Market Size Estimation For Tumor Ablation: Approach 1 (Company Revenue Estimation)I

To know about the assumptions considered for the study, Request for Free Sample Report

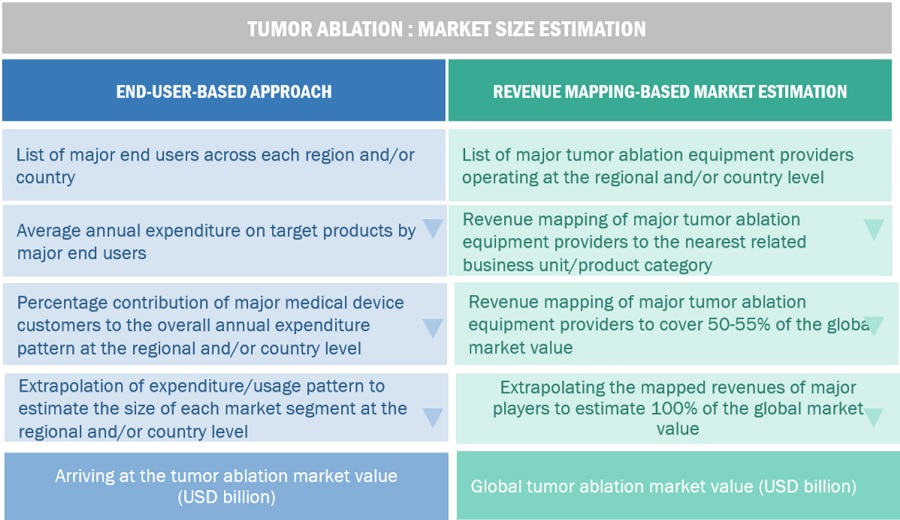

Approach 2: Customer-based market estimation

During preliminary secondary research, the total sales revenue of tumor ablation was estimated and validated at the regional and country level, triangulated, and validated to estimate the global market value. This process involved the following steps:

-

Generating a list of major customer facilities across each region and country

-

Identifying the average number of tumor ablation product supplies used by major customer facilities across each product type at the regional/country level, annually

-

Identifying the percentage contribution of major customer facilities to the overall tumor ablation expenditure and usage at the regional/country level, annually

-

Extrapolating the annual usage patterns for various products across major customer facilities to estimate the size of each product segment at the regional/country level, annually

-

Identifying the percentage contributions of individual market segments and subsegments to the overall tumor ablation market at the regional/country level

Tumor Ablation Market Size Estimation: Bottom-Up Approach

Source: MarketsandMarkets Analysis

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global tumor ablation market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the tumor ablation market was validated using top-down and bottom-up approaches.

Market Definition

Tumor ablation is a minimally invasive surgical procedure used to remove or destroy cancerous tissue from the affected area as part of cancer management and treatment. The targeted tissue is subjected to ablating energy through surgical, laparoscopic, or percutaneous methods. This technique is commonly used for treating liver, bone, lung, kidney, prostate, and other types of cancer.

Key Stakeholders

-

Tumor ablation product manufacturers

-

Original equipment manufacturers (OEMs)

-

Suppliers, distributors, and channel partners

-

Healthcare service providers

-

Hospitals and academic medical centers

-

Interventional radiologists

-

Research laboratories

-

Health insurance providers

-

Government bodies/organizations

-

Regulatory bodies

-

Medical research institutes

-

Business research and consulting service providers

-

Venture capitalists and other public-private funding agencies

-

Market research and consulting firms

Objectives of the Study

-

To define, describe, and forecast the tumor ablation market based on technology, product type, mode of treatment, application, end user, and region

-

To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

-

To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

-

To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the revenue of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, Middle East and Africa

-

To profile the key players and comprehensively analyze their market ranking and core competencies

-

To benchmark players within the market using a proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of market share and product footprint

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the present global tumor ablation market report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

-

Detailed analysis and profiling of additional market players (up to five)

Geographic Analysis

-

Further breakdown of the Rest of Europe tumor ablation market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal, among others

-

Further breakdown of the Rest of Asia Pacific tumor ablation market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

-

Further breakdown of the Rest of Latin America (RoLATAM), which comprises Argentina, Chile, Peru, Colombia, and Cuba

Growth opportunities and latent adjacency in Tumor Ablation Market