This study involved multiple steps in estimating the current size of the threat modeling tools market. Exhaustive secondary research was carried out to collect information on the threat modeling tools industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. The top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the threat modeling tools market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of threat modeling tools vendors, forums, certified publications, and whitepapers. This research was used to obtain key information related to the industry's value chain, the total pool of key players, market classification, and segmentation from the market- and technology-oriented perspectives.

-

Gross Domestic Product (GDP) Growth

-

Information and Communication Technology (ICT) Security Spending

-

Recent Market Developments

-

Market Ranking Analysis of Major Threat Modeling Tools Providers

Primary Research

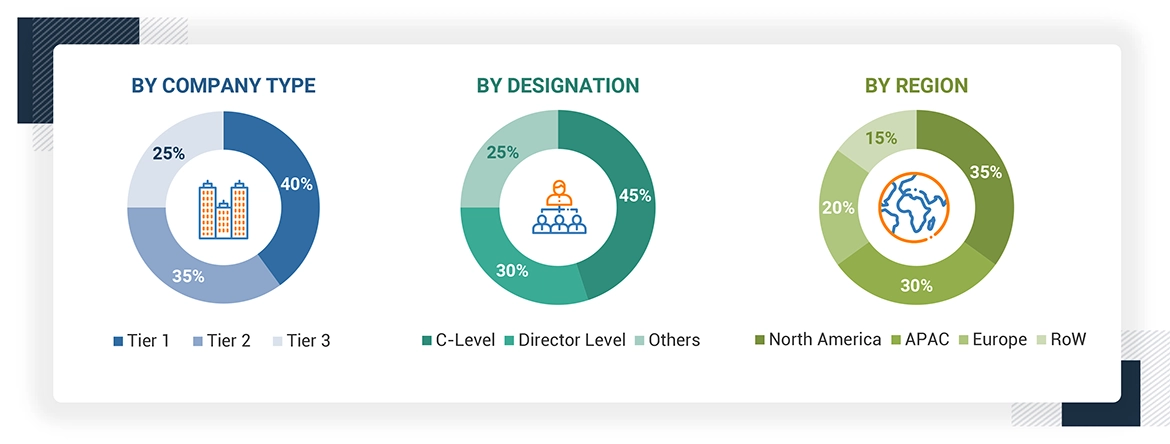

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. These sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the threat modeling tools market.

About the assumptions considered for the study, To know download the pdf brochure

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

-

To define, describe, and forecast the threat modeling tools market based on component, platform, organization size, vertical, and region

-

To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

-

To forecast the threat modeling tools market size across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

-

To analyze the sub-segments of the market with respect to individual growth trends, prospects, and contributions to the overall market

-

To profile the key players and comprehensively analyze their market rankings and core competencies

-

To map the companies to get competitive intelligence based on their profiles, key player strategies, and game-changing developments, such as product launches, collaborations, and acquisitions

-

To track and analyze competitive developments, such as product launches and enhancements, acquisitions, partnerships, and collaborations in the threat modeling tools market

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

-

Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

-

Further breakup of the North American market into countries contributing 75% to the regional market size

-

Further breakup of the Latin American market into countries contributing 75% to the regional market size

-

Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

-

Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Threat Modeling Tools Market