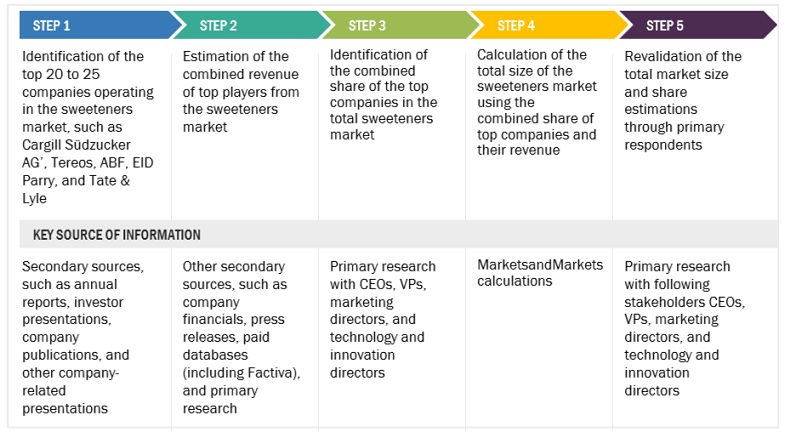

The study involved four major activities in estimating the current size of the sweeteners market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the sweeteners market.

In the secondary research process, various sources, such as the International Sugar Organization (ISO), Food and Agriculture Organization (FAO), Food and Drug Administration (FDA), United States Department of Agriculture (USDA), European Food Safety Agency (EFSA), Food Safety and Standards Authority of India (FSSAI), and academic references pertaining to sweeteners were referred to identify and collect information for this study. The secondary sources also include food journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to the industry trends to the bottom-most level and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

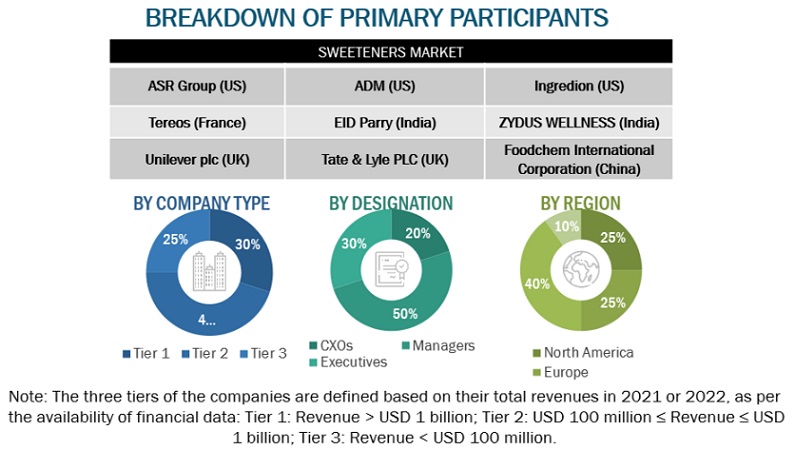

Extensive primary research was conducted after obtaining information regarding the sweeteners market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, research, and development teams, and related key executives from distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to types of sweeteners, products, forms, sales channels, applications, and regions. Stakeholders from the demand side, such as food and beverage companies and health and personal care companies who are using sweeteners were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of sweeteners and the outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

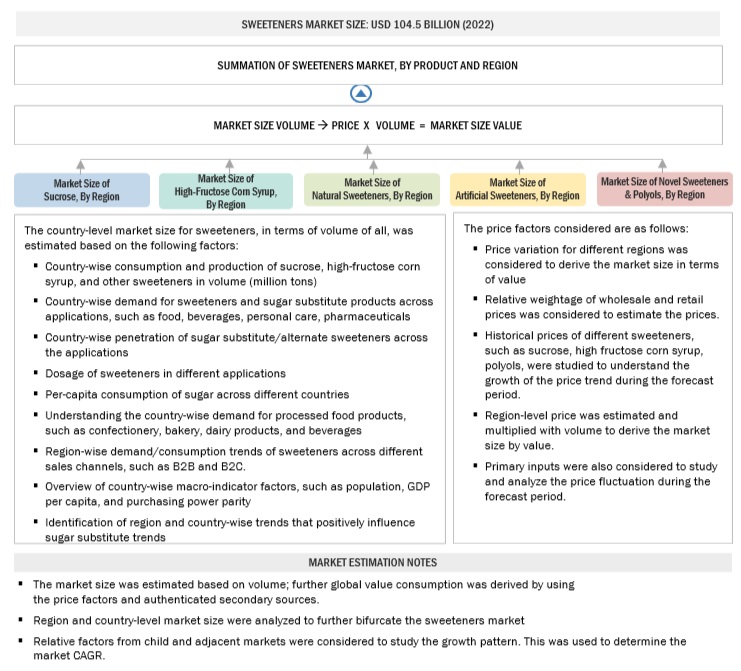

Market Size Estimation

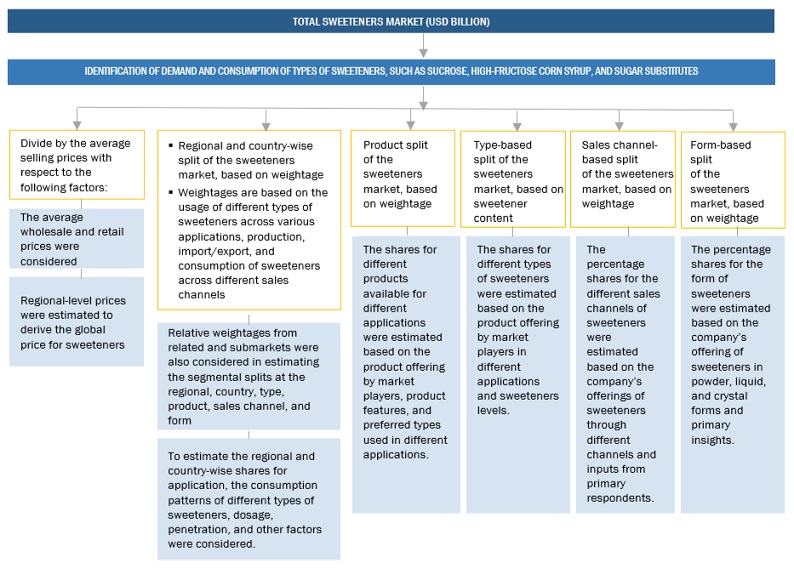

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the sweeteners market. These approaches were also used extensively to determine the size of various subsegments in the market for the base year in terms of value. The research methodology used to estimate the market size includes the following details:

-

The key players in the industry and the overall markets were identified through extensive secondary research.

-

The revenues of the major players were determined through primary and secondary research, which were used as the basis for market sizing and estimation.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

-

All macroeconomic and microeconomic factors affecting the growth of the sweeteners market were considered while estimating the market size.

-

All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Bottom-up Approach (Demand Side):

Through the bottom-up approach, the data extracted from secondary research was utilized to validate the market segment sizes obtained. The approach was employed to arrive at the overall size of the sweeteners market in particular regions, and its share in the market was validated through primary interviews conducted with sweetener manufacturers, suppliers, dealers, and distributors. With the data triangulation procedure and data validation through primary, the overall size of the parent market and each segmental market were determined.

To know about the assumptions considered for the study, Request for Free Sample Report

Top-down Approach:

Market Size Estimation (Supply Side):

supply-side analysis was conducted to triangulate the market for sweeteners. The market for sweeteners was analyzed for each product.

-

Going at a granular level, the share of sweetener products was analyzed among key players operating in the sweeteners market.

-

The other factors considered include the demand for natural sweeteners, adoptions, increase in innovations, new product launches, consumer awareness, pricing trends, the adoption rate, patents registered, and organic & inorganic growth attempts.

The top-down procedure has been employed to determine the overall size of the sweeteners market from the revenues of key players (companies) and their product share.

-

The market share was then estimated for each company to verify the revenue share used earlier in the bottom-up procedure. With the data triangulation procedure and data validation through primaries, the exact values of the overall parent and each individual market have been determined and confirmed in this study.

Data Triangulation

After arriving at the overall market size from the above estimation process, the total market was split into several segments and subsegments. Where applicable, data triangulation and market breakdown procedures were employed to estimate the overall sweetener market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

Market Definition

As per the European Food Safety Authority (EFSA), Sweeteners are food additives that are used to impart a sweet taste to foodstuffs. It is an artificial substance that tastes sweet. It is a low-calorie synthetic product used instead of sugar.

Sweeteners are substances employed to add a sweet taste to food, beverages, or other items. They serve as alternatives to natural sugars, providing sweetness without the caloric content associated with conventional sugars. Sweeteners can be categorized into two primary groups: natural sweeteners, sourced from plants or natural origins, and artificial sweeteners, which are chemically manufactured.

Key Stakeholders

-

Raw material suppliers

-

Regulatory bodies that include the following:

-

Food safety agencies, such as the Food and Drug Administration (FDA), European Food Safety Authority (EFSA), US Department of Agriculture (USDA), Food Standards Australia New Zealand (FSANZ), Health Canada – Food Directorate, China National Center for Food Safety Risk Assessment (CFSA), and World Health Organization (WHO)

-

Government agencies and NGOs

-

End users include the following:

-

Food & beverage manufacturers/suppliers

-

Health & personal care product manufacturers/suppliers

-

Retailers

-

Commercial Research & Development (R&D) institutions and financial institutions

-

Importers and exporters of sugar substitutes

-

Traders, distributors, and suppliers

-

Research organizations

-

Trade associations and industry bodies

Report Objectives

-

To determine and project the size of the sweeteners market, concerning type, product, form, sales channel, application, and region, over five years, ranging from 2023 to 2028

-

To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

-

To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

-

To analyze the micro-markets concerning individual growth trends, prospects, and their contribution to the total market

-

Identifying and profiling the key players in the sweeteners market

-

Providing a comparative analysis of market leaders based on the following:

-

Product offerings

-

Business strategies

-

Strengths and weakness

-

Key financials

-

Understanding the competitive landscape and identifying the major growth strategies players adopt across the key regions

-

Analyzing the value chain and products across key regions and their impact on prominent market players

-

Providing insights on key product innovations and investments in the sweeteners market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

-

Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

-

Further breakdown of the Rest of Europe into Sweden, Belgium, Switzerland, Ukraine, and other EU and non-EU countries.

-

Further breakdown of the Rest of Asia Pacific sweeteners market into key countries

-

Further breakdown of the Rest of European sweeteners market into key countries.

Company Information

-

Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Sweeteners Market