This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg L.P., Factiva, ICIS, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study of the global structural adhesives market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the value chain of this industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess growth prospects of the market.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, regulatory bodies, trade directories, certified publications, articles from recognized authors, gold & silver standard websites, and databases.

Secondary research has been used to obtain key information about the industry's value chain, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

In the primary research process, various sources from both the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include CEOs, vice presidents, marketing and sales directors, business development managers, technology and innovation directors of adhesives manufacturing companies, and suppliers and distributors. Primary sources from the demand side include industry experts—directors of end-use industries and related key opinion leaders.

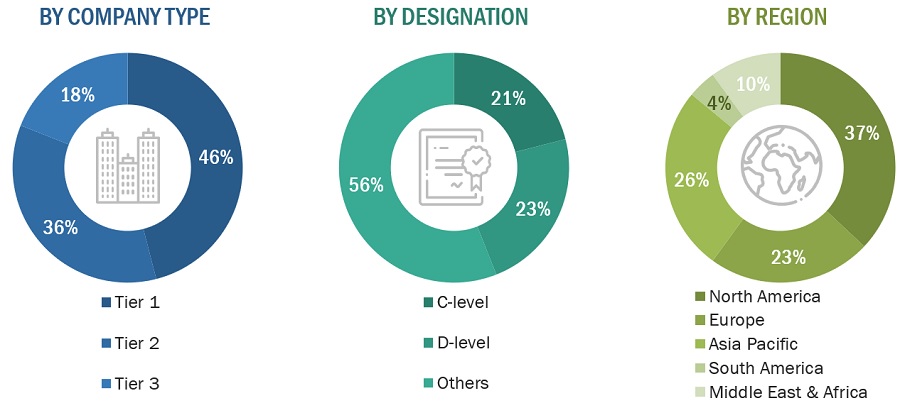

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

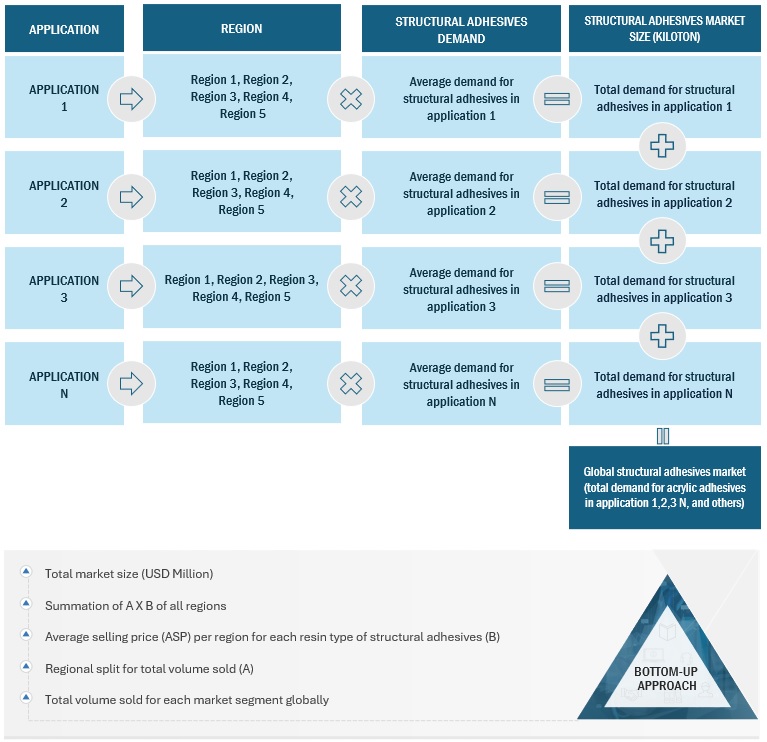

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the structural adhesives market in various applications in each region. The research methodology used to estimate the market size includes the following steps:

-

The key players in the market have been identified in the respective regions through primary and secondary research.

-

All percentage shares, splits, and breakdowns have been determined by using secondary sources and verified through primary sources.

All possible parameters that affect the market and submarkets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data has been consolidated and supplemented with detailed inputs and analysis from the MNM data repository and presented in this report.

Global Structural Adhesives Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and sub-segments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand & supply sides. In addition, the market has been validated using both the top-down and bottom-up approaches. It has then been verified through primary interviews. Hence, for each data segment, there are three sources — the top-down approach, the bottom-up approach, and expert interviews. Only when the values from the three sources matched the data have been assumed to be correct.

Market Definition.

According to FEICA, the Association of the European Adhesive and Sealant Industry, structural adhesives are adhesives which are used to bond load-bearing joints or substrates. They are capable of handling high tensile, shear, cleavage, and peel strength between the substrates and provide excellent mechanical performance. They enable weight reduction and improve the aesthetic appeal of end products without any visible bolts, rivets, and welds. These adhesives offer excellent strength, load-bearing capability, durability, and resistance against impact, heat, fatigue, and solvents. All structural adhesives provide at least 1,000 psi or 7 Mpa of overlap shear strength to the substrates. Structural adhesives come in many forms, including low viscosity liquids and non-sag pastes, one- and two-component formulations, and short and long work lives, among others.

Key Stakeholders

-

Senior Management

-

End User

-

Finance/Procurement Department

-

R&D Department

Report Objectives

-

To define, describe, and forecast the structural adhesives market in terms of value and volume

-

To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing market growth

-

To analyze and forecast the market by substrate, resins, technology, application, and region

-

To project the structural adhesives market size for North America, Europe, Asia Pacific, the Middle East & Africa, and South America

-

To strategically analyze micromarkets1 concerning individual growth trends, growth prospects, and their contribution to the overall market

-

To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

-

To analyze competitive developments, such as product launches, acquisitions, investments, expansion, and agreements in the market

-

To strategically profile the key players and comprehensively analyze their market shares and core competencies2

1. Micromarkets are defined as the sub-segments of the structural adhesives market included in the report.

2. Core competencies of companies are determined in terms of the key developments and important strategies adopted by them to sustain in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

-

Further breakdown of the structural adhesives market, by country

Company Information

-

Detailed analysis and profiling of additional market players (up to five)

Eileene

Aug, 2015

Report view of section 4.2 for Structural Adhesive market report.

Oiane

Aug, 2019

Market prosprection on structural adhesive market with specific interest on epoxy adhesives..

CONCHOU

Jan, 2016

Interest in a specific section of the report.

Sami

Aug, 2019

Production and consumption data on each type of adhesives for the Saudi Arabia and the Gulf region.