Various secondary sources, directories, and databases have been used to identify and collect information for an extensive specialty vehicle market study. The study involved four main activities in estimating the current size of the specialty vehicle market: secondary research, validation through primary research, assumptions, and market analysis. Exhaustive secondary research was carried out to collect information on the market, such as the number of specialty vehicles sold globally, upcoming technologies in specialty vehicles, and electric powertrain development for specialty vehicles. The next step was to validate these findings, assumptions, and market analysis with industry experts across the value chain through primary research. The top-down approach was employed to estimate the complete market size for different segments considered in this study.

Secondary Research

In the secondary research process, various secondary sources, such as company annual reports, presentations, and press releases; associations, such as Fire Apparatus Manufacturers' Association (FAMA), National Fire Protection Association (NFPA), National Waste & Recycling Association (NWRA), American Public Works Association (APWA), National Association of Sewer Service Companies (NASSCO), American Ambulance Association (AAA), Solid Waste Association of India (SWAI), Japan Road Contractors Association (JRCA), European Road Transport Research Advisory Council (ERTRAC), European Federation of Cleaning Industries (EFCI), European Emergency Number Association (EENA), European Caravan Federation (ECF), Recreational Vehicle Industry Association (RVIA), Committee of European Fire Equipment and Services Manufacturers (CEFE), European Fire Services (EFS), The European Committee of the Manufacturers of Fire Protection Equipment and Fire Fighting Vehicles (EUROFEU), Asian Firefighting and Rescue Association (AFRA), The Institution of Fire Engineers Asia (IFE Asia) ,and National Institute of Statistics and Censuses (INDEC). Secondary research was used to obtain critical information about the industry's value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

Various sources from both the supply and demand sides were interviewed in the primary research process to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as research and development experts, CEOs, CTOs, COOS, vice presidents, marketing directors, technology and innovation directors, and related key executives from different vital companies operating in the specialty vehicle market.

After the complete market engineering, which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation, extensive primary research has been conducted to gather information and verify and validate the critical numbers arrived at. Primary research has also been undertaken to identify and validate the segmentation, industry trends, key players, competitive landscape, and market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies. Extensive qualitative and quantitative analysis has been performed on the complete market engineering process to list key information/insights throughout the report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter expert's opinions have led us to the conclusions described in this report's remainder.

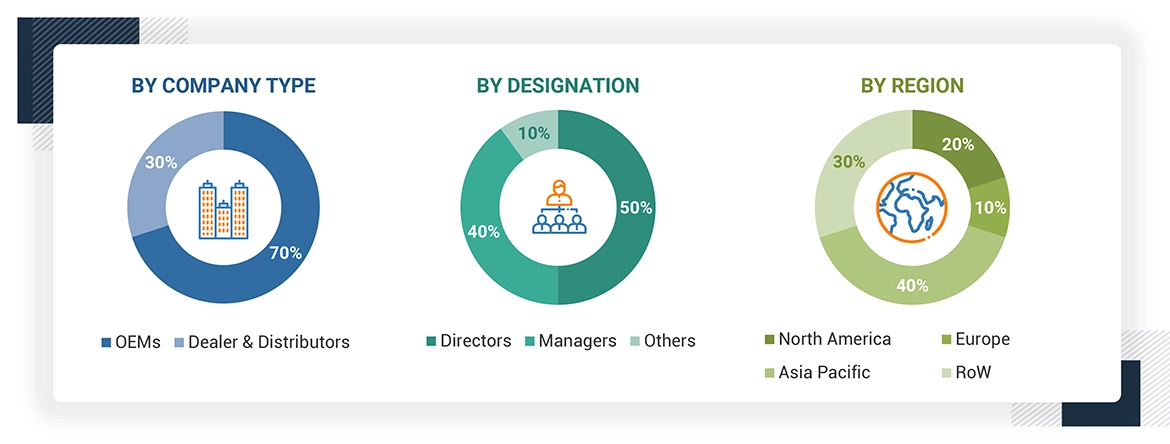

Source: MarketsandMarkets Analysis

Note: Other designations include refurbished specialty vehicle manufacturers, aftermarket sales and services manufacturers. The company tiers are based on the value chain; the company's revenue was not considered. Other designations include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach has been followed to estimate and validate the value and volume of the specialty vehicles market and other dependent submarkets, as mentioned below:

-

The bottom-up approach has been used to estimate and validate the size of the specialty vehicles market. The specialty vehicles market volume, by type, has been derived by identifying the country-level sales of each type (ambulance, fire truck, garbage truck, vacuum truck, street sweeper, recreational vehicle, and fuel-carrying tanker).

-

The country-level specialty vehicles market by Type (volume) has then been multiplied by each specialty vehicle type's country-level average selling price (ASP) to get the country-level specialty vehicle type market by value.

-

The summation of the country-level market would give the regional level, and then, in further addition, it provides the global specialty vehicle market by type. The total value of each country was then summed up to derive the total value of the specialty vehicles market.

-

A similar methodology has been followed for the specialty vehicles market by application and end-use industry.

-

The top-down approach has been used to estimate the market by propulsion and battery chemistry at the regional level.

-

All key macro indicators affecting the revenue growth of the market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

-

The gathered market data has been consolidated and added with detailed inputs, analyzed, and presented in this report.

SPECIALTY VEHICLE MARKET SIZE: BOTTOM-UP APPROACH (REGIONAL AND TYPE)

The bottom-up approach has been used to estimate and validate the size of the specialty vehicles market in terms of volume. Country-level sales of each specialty vehicle type have been derived through secondary sources such as industry associations, such as the Recreational Vehicle Industry Association (RVIA), China SPV, and company investor presentations, annual reports, and industry experts' validation. In case of non-availability of direct sales of specialty vehicles for a few countries, the regional economic development, industrialization, urbanization, development of hospitals, smart city projects, and in-hand supply contracts of OEMs are identified to estimate the number of that country.

Country-level specialty vehicle sales have been added to derive the regional-level market size by type. Similarly, the global market is derived by adding a regional-level specialty vehicle market. Further, the average selling price of each specialty vehicle is derived through country-level model mapping. The derived country-level average selling price of different specialty vehicles has multiplied with the country-level volume market to arrive at the country-level market size in terms of value. The specialty vehicles market forecast has been estimated based on multiple factors, such as growth in specialty vehicle sales, population/urbanization/industrialization, upcoming smart cities, and supplier product offerings & future launches. The data has been validated through primary interviews with industry experts.

SPECIALTY VEHICLE MARKET SIZE: TOP-DOWN APPROACH (PROPULSION TYPE, AND BATTERY CHEMISTRY)

Extensive secondary and primary research has been conducted to understand the global market scenario and penetration for specialty vehicles by propulsion and battery chemistry per region.

The top-down approach estimates and validates the market by propulsion in terms of volume and value. The global specialty vehicle market value (USD million) by region (Asia Pacific, North America, Europe, and RoW) was derived from the worldwide specialty vehicle market. The penetration of each propulsion (ICE and Electric) at the regional level was derived from secondary sources and validated through primaries. The penetration of each propulsion is then multiplied by the regional specialty vehicle market to get the specialty vehicle market value (USD million) for each region. All region-wise markets were summated to derive the total specialty vehicle market value (USD million) by propulsion. This resulted in regional-level market size, in terms of value, by propulsion. This information has been validated through primary interviews with OEMs and Tier I suppliers. The specialty vehicle market followed the top-down approach regarding battery capacity.

Specialty Vehicle Market : Top-Down and Bottom-Up Approach

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed input and analysis and presented in the report. The following figure illustrates this study's overall market size estimation process.

Market Definition

Definition: Specialty Vehicles are custom-made vehicles designed for a specific purpose. These vehicles are often engineered to meet operational, regulatory, or environmental requirements and are used in various industries, including emergency services, waste management, and leisure.

Specialty vehicles come in various types, each designed to serve a specific purpose in multiple ways. The emergency response services include fire trucks, ambulances, and waste management vehicles, which include garbage trucks, vacuum trucks, and street sweepers; Fuel carrying tankers; and recreational vehicles. Additionally, each type of specialty vehicle plays a crucial role in the overall waste management, recreational, and emergency response segment, ensuring that they can effectively address various purposes and emergencies within their community.

Stakeholders

-

Manufacturers of Fire Trucks, Garbage Truck Manufacturers, Vacuum Trucks, Street Sweepers, Fuel Carrying Tankers, Ambulances and Recreational Vehicles

-

Battery, Motor, and Drivetrain Suppliers for Specialty Vehicles

-

Other Component Suppliers for Specialty Vehicles

-

Government and Regulatory Authorities

-

Regional Manufacturing Associations

-

Traders, Dealers, and Distributors of Specialty Vehicles

Report Objectives

-

To define, describe, and forecast the specialty vehicles market in terms of volume (thousand/million units) and value (USD million)

-

By Type (Fire Truck, Garbage Truck, Vacuum Truck, Street Sweeper, Ambulance, Fuel Carrying Tanker, Recreational Vehicle)

-

By Application (Medical and Healthcare, Public Services & Safety, Waste Management, and Leisure)

-

By Propulsion (ICE and Electric)

-

Electric Specialty Vehicles Market, By Battery Chemistry (Lithium Iron Phosphate (LFP), Nickel Manganese Cobalt (NMC), Others)

-

By End-use Industry (Emergency Response Services, Utilities and Municipalities, and Others)

-

By Region (Asia Pacific, Europe, North America, and Rest of the World)

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To analyze the market shares of key players operating in the market, company evaluation matrix, and company valuation & financial metrices of the key players.

-

To analyze the company profiles, including business overview, three-year financial snapshot, product offerings, and recent developments.

-

To analyze the competitive landscape, including key players' right-to-win strategies, market ranking analysis of key players operating in different specialty vehicle types, and brand comparison.

-

To strategically analyze the market using patent, trade, technology, ecosystem, case study, and supply chain analysis.

-

To analyze and understand the OEM analysis: electric specialty vehicles, by battery capacity vs battery output and electric fire truck gallon capacity vs. battery capacity

-

To analyze recent developments, alliances, joint ventures, expansions, mergers & acquisitions, product launches, and other activities carried out by key industry participants in the market

Available Customizations

WWith the given market data, MarketsandMarkets offers customizations that follow a company's specific needs.

FIRE TRUCK MARKET, BY TYPE

-

Rescue Fire Trucks

-

Light Rescue Trucks

GARBAGE TRUCK MARKET, BY TONNAGE CAPACITY

-

Light-Duty Garbage Trucks (Up to 6 Tons)

-

Medium-Duty Garbage Trucks (6 to 12 Tons)

-

Heavy-Duty Garbage Trucks (12 to 20 Tons)

-

Extra Heavy-Duty Garbage Trucks (Above 20 Tons)

ELECTRIC FIRE TRUCK MARKET, BY BATTERY CAPACITY

-

<50 kWh

-

50 – 200 kWh

-

100 – 500 kWh

-

>500 kWh

ELECTRIC FIRE TRUCK MARKET, BY BATTERY CAPACITY

-

Small-Capacity Vacuum Trucks (Up to 1,500 Gallons / 5,700 Liters)

-

Medium-Capacity Vacuum Trucks (1,500 to 3,000 Gallons / 5,700 to 11,400 Liters)

-

Large-Capacity Vacuum Trucks (3,000 to 5,000 Gallons / 11,400 to 19,000 Liters)

-

Extra Large-Capacity Vacuum Trucks (Above 5,000 Gallons / 19,000 Liters)

Growth opportunities and latent adjacency in Specialty Vehicle Market