Space Cybersecurity Market Size, Share & Analysis, 2025 To 2030

Space Cybersecurity Market by Offering (Solutions (Network, Endpoint, Cloud, Application Security), Services (Managed Security Services, professional Services)), Platform (Satellites, Launch Vehicles, Ground Stations, Spaceports & Launch Facilities, Command & Control Centers), End User (Defense, Commercial, Government) and Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The space cybersecurity market is projected to reach USD 6.96 billion by 2029, from USD 4.52 billion in 2024, at a CAGR of 9.0%. Market growth is propelled by various factors, including a surge in cyber threats to space assets, rapid militarization of space and defense initiatives, increased dependency on satellite infrastructure, and elevated demand for satellite-to-ground communication security

KEY TAKEAWAYS

- North America accounted for a 51.0% share of the space cybersecurity market in 2024.

- By offering, the service segment is expected to register the highest CAGR of 9.9%.

- By end user, the commercial segment is expected to dominate the market during the forecast period.

- By platform, the satellite segment is projected to grow at the highest rate of 9.5% from 2024 to 2029.

- Companies like Thales, Airbus, and Lockheed Martin Corporation were identified as some of the star players in the space cybersecurity market, given their strong market share and product footprint.

- Companies like Kongsberg, Redwire Corporation, and Telespazio S.p.A., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The space cybersecurity market is witnessing steady growth, driven by the adoption of advanced technologies such as zero trust architecture (ZTA), artificial intelligence & machine learning (AI/ML), quantum key distribution, and computing further accelerate innovation across the space cybersecurity landscape. These solutions enhance the integrity and confidentiality of satellite communications and enable proactive threat detection and autonomous response mechanisms.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business in the space cybersecurity market stems from evolving customer needs and industry disruptions. Satellite operators, space launch manufacturing, rovers, and spaceports companies are the primary users of space cybersecurity solutions, with command and control management as the key focus area. Shifts towards quantum-resistant encryption, AI-driven threat detection, and stricter regulatory compliance directly influence the operational performance and revenues of end users. These impacts, in turn, drive the demand for advanced space cybersecurity services, shaping the market's growth trajectory.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing cyberattacks on space assets.

-

Growing dependence on satellite infrastructure.

Level

-

Complexity of securing multi-orbit and multi-vendor space systems.

-

Resistance to security integration in legacy space infrastructure.

Level

-

Growth in cyber-resilient satellites.

-

Emergence of space-specific, zero-trust architecture.

Level

-

Data security challenges in inter-satellite communication links.

-

Complexity in real-time cybersecurity threat response in space.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing cyberattacks on space assets.

Cyberattacks on space assets are rapidly increasing, threatening national security and satellite operations. Incidents like Viasat’s 2022 KA-SAT hack and repeated NASA intrusions highlight vulnerabilities. With over 300% growth in such attacks, agencies now invest in quantum-resistant encryption, AI anomaly detection, and cyber-secure satellite architectures to protect critical space infrastructure.

Restraint: Complexity of securing multi-orbit and multi-vendor space systems.

The rise of multi-orbit and multi-vendor satellite networks creates complex cybersecurity challenges. Diverse hardware, protocols, and vendor practices hinder standardization, increasing risks of interception and breaches. Nearly 40% of satellite cyberattacks stem from integration flaws, highlighting the urgent need for harmonized, secure-by-design architectures to safeguard space systems effectively.

Opportunity: Growth in cyber-resilient satellites.

Cyber-resilient satellites present a major opportunity for the space cybersecurity market. Governments and companies like Lockheed Martin, Northrop Grumman, Airbus, and Thales are adopting encryption, AI-based threat detection, and zero-trust architectures. These secure-by-design systems mitigate hacking risks, driving demand for quantum-resistant communication and AI-powered cyber defense technologies.

Challenge: Data security challenges in inter-satellite communication links.

Inter-satellite communication links enhance data transfer efficiency but create new cybersecurity vulnerabilities. Unencrypted links risk interception and spoofing, while limited onboard processing hampers encryption and real-time patching. Over 30% of satellite cyberattacks stem from ISL weaknesses, highlighting the urgent need for quantum-resistant cryptography and decentralized security frameworks.

Space Cybersecurity Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Partnered with Bitsight for real-time monitoring of vendors’ cybersecurity risks. | Improved efficiency, reduced oversight by 50%, and strengthened mission data protection. |

|

Upgraded IT and cloud security with Snap Tech IT to meet defense standards. | Lowered IT risks and costs while boosting security and agility. |

|

Deployed SpiderOak’s OrbitSecure for encrypted, decentralized satellite communications. | Secured military and commercial data, ensuring confidentiality and cyber resilience. |

|

Partnered with Thales Alenia Space and Telespazio to build the Iris2 secure satellite network for the EU. | Strengthened Europe’s cybersecurity and established a sovereign alternative to non-European constellations. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The space cybersecurity market ecosystem consists of Prominent players such as Northrop Grumman and BAE Systems lead in developing cyber resilient satellite systems and defense grade communication networks. Meanwhile, private enterprises such as SpaceX, Blue Origin, and Maxar contribute innovation in satellite operations and in-orbit security. The end users like defense organizations, commercial satellite operators, and government agencies collectively drive demand for robust, integrated cybersecurity architectures protecting global space assets.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Space Cybersecurity Market, By Offering

As of 2023, the solutions segment dominates the space cybersecurity market, holding the largest share due to the growing demand for advanced security frameworks, encryption systems, and network monitoring platforms. Governments and commercial operators increasingly prioritize integrated cybersecurity solutions over standalone services to ensure end-to-end protection for satellite assets and communication networks

Space Cybersecurity Market, By Platform

In 2023, the satellite segment leads the market, accounting for the highest share as satellites form the core of space-based communication and navigation networks. With rising satellite deployments across LEO, MEO, and GEO orbits, cybersecurity measures for data integrity, transmission security, and mission continuity have become a critical operational priority.

Space Cybersecurity Market, By End User

In 2023, the defense segment is the largest end user of space cybersecurity solutions, driven by the escalating need to secure military satellite networks, ISR systems, and communication infrastructure from cyber threats. National security agencies are investing heavily in cyber-resilient space architectures to safeguard classified missions and strategic defense operations.

REGION

Asia Pacific to be fastest-growing region in global space cybersecurity market during forecast period

Asia Pacific is the fastest-growing region in the space cybersecurity market, driven by its increasing dependence on space technologies for defense, communication, and commercial applications. Countries like India, Japan, and Australia are rapidly expanding space programs, boosting the demand for advanced cybersecurity solutions to safeguard critical assets such as satellites and launch systems. Rising cyber threats targeting space infrastructure, coupled with strong government investments, public-private collaborations, and rapid adoption of innovative security technologies, are further propelling regional growth.

Space Cybersecurity Market: COMPANY EVALUATION MATRIX

In the space cybersecurity market, Thales S.A. leads as a Star, backed by advanced satellite protection and strong defense partnerships. BAE Systems plc (Emerging Leader) is gaining visibility with its innovative space communication security and launch-based cyber protection initiatives. Kratos Defense and Maxar Technologies are leveraging strong technical integration and diversified cybersecurity solutions across commercial and defense satellite domains reflecting significant growth potential in the evolving threat landscape..

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 4.15 Billion |

| Market Forecast in 2029 (Value) | USD 6.95 Billion |

| Growth Rate | CAGR of 9.0% from 2025-2030 |

| Years Considered | 2021-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East, Rest of the World |

WHAT IS IN IT FOR YOU: Space Cybersecurity Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Space Solution Provider |

|

|

RECENT DEVELOPMENTS

- March 2025 : General Dynamics Information Technology (GDIT) partnered with AWS to enhance digital modernization, focusing on cybersecurity, AI, and cloud migration for U.S. defense and civilian agencies, delivering secure, scalable, and cost-effective mission solutions.

- January 2025 : Thales Alenia and Hispasat launched Spain’s first QKD-GEO mission for secure quantum communications, funded under Spain’s Recovery Plan, ensuring encrypted satellite data exchange through field-tested quantum key technology.

- January 2025 : General Dynamics was awarded a USD 30 million contract to develop encryption solutions securing U.S. defense communications, reinforcing its leadership in safeguarding government data against emerging cyber threats.

- January 2025 : Space Development Agency (SDA) expanded its contract to strengthen satellite cybersecurity, deploying zero-trust solutions to protect U.S. space assets and enhance secure communications for defense operations.

- December 2024 : Booz Allen Ventures invested in Starfish Space to boost secure satellite servicing technologies, enhancing space sustainability and cybersecurity aligned with next-generation defense and communication infrastructure goals.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

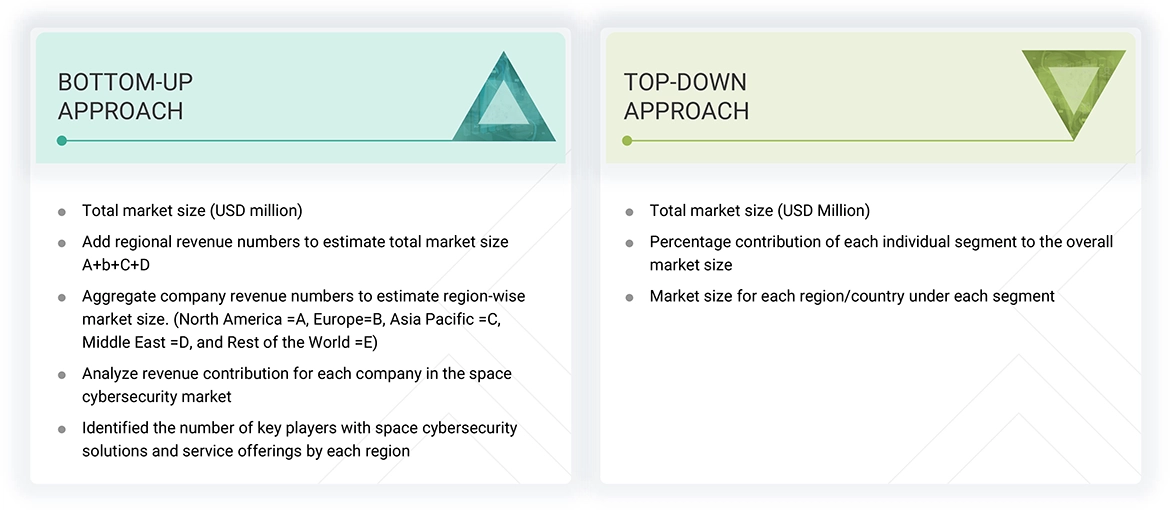

The research study on the space cybersecurity market involved secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, and Factiva, to identify and collect relevant information. Primary sources included industry experts from the market, as well as suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. In-depth interviews of various primary respondents, including industry participants, subject matter experts, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the market and assess the market’s growth prospects. A deductive approach, also known as the bottom-up approach, combined with the top-down approach, was used to forecast the market size of different segments.

Secondary Research

The share of companies in the space cybersecurity market was determined based on secondary data made available through paid and unpaid sources and an analysis of the product portfolios of major companies. These companies were rated based on their performance and quality. These data points were further validated by primary sources. Secondary sources for this research study included corporate filings, such as annual reports, investor presentations, and financial statements from trade, business, and professional associations. The secondary data was collected and analyzed to determine the overall market size.

Primary Research

After obtaining information about the current scenario of the space cybersecurity market through secondary research, extensive primary research was conducted. Several primary interviews were conducted with market experts across different regions from the demand and supply sides. This primary data was collected through questionnaires, emails, and telephone interviews.

Note: The tiers of companies are based on their revenue in 2023: tier 1 = company revenue greater than USD 1 billion; tier 2 = company revenue between USD 100 million and USD 1 billion; and tier 3 = company revenue less than USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the space cybersecurity market. The research methodology used to estimate the market size includes the following details.

Key market players were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top players and extensive interviews with industry stakeholders such as CEOs, technical advisors, military experts, and SMEs of leading companies operating in the space cybersecurity market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the space cybersecurity market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Space Cybersecurity Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the space cybersecurity market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The space cybersecurity market size was also validated using the top-down and bottom-up approaches.

Market Definition

Space cybersecurity refers to measures and technologies designed to protect space-based assets such as satellites, ground stations, and other space infrastructure from cyber threats. This market covers the development and deployment of solutions that ensure the security of data transmission, communication networks, and mission-critical operations. It addresses the unique challenges posed by the space environment, making cybersecurity crucial to military, commercial, and government space missions. As space technology becomes integral to various sectors, the scope of this market continues to expand, encompassing a wide range of applications from secure satellite communication to the protection of space infrastructure from cyberattacks.

Key Stakeholders

- Government and regulatory agencies

- Satellite and spacecraft manufacturers

- Cybersecurity solution providers

- Satellite operators and service providers

- Ground station infrastructure providers

- System integrators and service contractors

- End users and customers

- Investors and venture capitalists

- Industry associations

Report Objectives

- To define, describe, segment, and forecast the size of the space cybersecurity market based on offering, platform, end user, and region

- To forecast the size of various market segments with respect to five major regions: North America, Europe, Asia Pacific, the Middle East, and the Rest of the World

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing market growth

- To provide an overview of the regulatory landscape with respect to space cybersecurity regulations globally

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying market trends

- To profile key market players and comprehensively analyze their market share and core competencies

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, product launches, contracts, and partnerships, adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market ranking analysis, market share analysis, and revenue analysis of key players

Available Customizations

Along with the market data, MarketsandMarkets offers customizations that meet the specific needs of companies. The following customization options are available for the report:

Solution Analysis

- Product matrix, which involves a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of market segments at the country level

Company Information

- Detailed analysis and profiling of five additional market players

Key Questions Addressed by the Report

- Zero Trust Architecture

- Quantum Key Distribution

- End-to-End Data Encryption

- Blockchain

- Software-defined Network (SDN) Security

- Cognitive Cybersecurity System

- Edge Computing

- Increasing cyberattacks on space assets

- Rapid militarization of space and defense initiatives

- Growing dependency on satellite infrastructure

- High demand for satellite-to-ground communication security

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Space Cybersecurity Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Space Cybersecurity Market