To estimate the size of the smart locker market, the study utilized four major activities. Exhaustive secondary research was conducted to gather information on the market, as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the smart locker market. Secondary sources for this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of key secondary sources

Primary Research

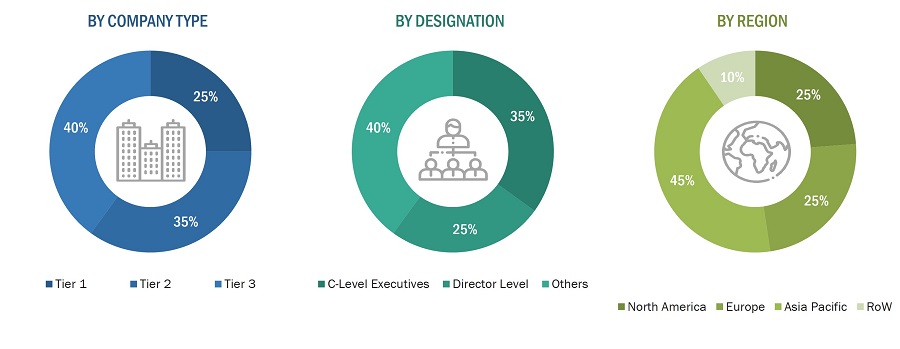

To gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting, primary interviews were conducted. Additionally, primary research was used to comprehend the various technology, application, vertical, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end-user installation teams using smart locker, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of smart locker, which will impact the overall market. Several primary interviews were conducted across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

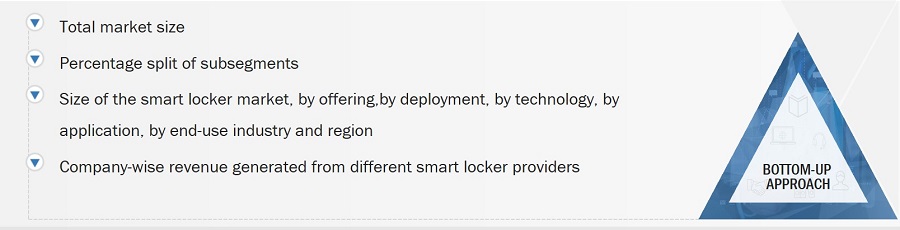

To estimate and validate the size of the smart locker market and its submarkets, both top-down and bottom-up approaches were utilized. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The entire process involved studying top players’ annual and financial reports and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were then verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

Global Smart Locker Market Size: Botton Up Approach

-

Identifying various smart locker manufacturers

-

Analyzing the penetration of each component through secondary and primary research

-

Analyzing integration of smart locker in different applications through secondary and primary research

-

Conducting multiple discussions with key opinion leaders to understand the detailed working of smart lockers and their implementation in multiple industries; this helped analyze the break-up of the scope of work carried out by each major company

-

Verifying and cross-checking the estimates at every level with key opinion leaders, including CEOs, directors, operation managers, and finally with the domain experts at MarketsandMarkets

-

Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

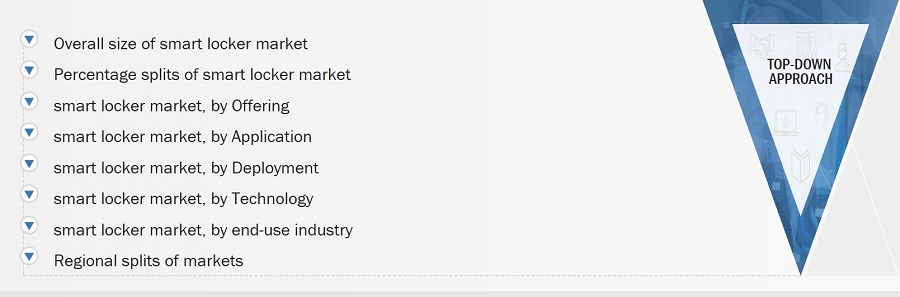

Global Smart locker Market Size: Top Down Approach

The top-down approach has been used to estimate and validate the total size of the smart locker market.

-

Focusing initially on the R&D investments and expenditures being made in the ecosystem of the smart locker market, further splitting the market on the basis of offering, technology, deployment, application, end-use industry, and region, and listing the key developments

-

Identifying leading players in the smart locker market through secondary research and verifying them through brief discussions with industry experts

-

Analyzing revenue, product mix, geographic presence, and key applications for which products are served by all identified players to estimate and arrive at percentage splits for all key segments

-

Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments

-

Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

Once the overall size of the smart locker market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both top-down and bottom-up approaches.

Market Definition

Smart lockers are storage containers that use Internet of Things (IoT) technology to connect to the Internet and provide people with a convenient way to store their belongings or to protect assets in factory and warehouse environments. The ultimate purpose of smart lockers is the usage of smart locker software. These smart locker systems are especially popular in offices, warehouses, retail chains, accounting firms, solicitor’s offices, and public service headquarters. Two main advantages include keeping items safe and secure, but more so, for the administrators gathering insightful data on usage and security via the provided software by these smart locker solutions.

Key Stakeholders

-

Smart locker Manufacturers

-

Smart locker Suppliers

-

Smart locker Integrators

-

Smart locker distributors

-

Smart locker software solution providers

-

Technology investors

-

Research organizations

-

Analysts and strategic business planners

-

Venture capitalists, private equity firms, and startups

-

Educational Institutes and Universities

-

Component Suppliers and Distributors

-

Logistics and shipment companies

Report Objectives

-

To define, describe, and forecast the smart locker market based on offering, technology, deployment, application, end-use industry and region

-

To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

-

To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

-

To study the complete value chain and allied industry segments and perform a market value chain analysis.

-

To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, porter’s five forces analysis, key stakeholders and buying criteria, key conferences and events, and regulatory bodies, government agencies, and regulations pertaining to the market

-

To strategically profile the key players and comprehensively analyze their market shares and core competencies2.

-

To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market.

-

To analyze competitive developments such as collaborations, agreements, contracts, partnerships, mergers & acquisitions, product launches, and research & development (R&D) in the market

-

To analyze the impact of the recession on the smart locker market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players (up to 5)

-

Additional country-level analysis of the smart locker market

Product Analysis

-

Product matrix, which provides a detailed comparison of the product portfolio of each company in the smart locker market.

Growth opportunities and latent adjacency in Smart Locker Market