The research study involved extensive secondary sources, such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the autonomous trucks market. Primary sources, such as experts from related industries, automobile OEMs, and suppliers, were interviewed to obtain and verify critical information and assess the growth prospects and market estimations.

Secondary Research

Secondary sources for this research study include corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; whitepapers, marklines, and the OICA (International Organization of Motor Vehicle Manufacturers); certified publications; articles by recognized authors; directories; and databases. Secondary data was collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

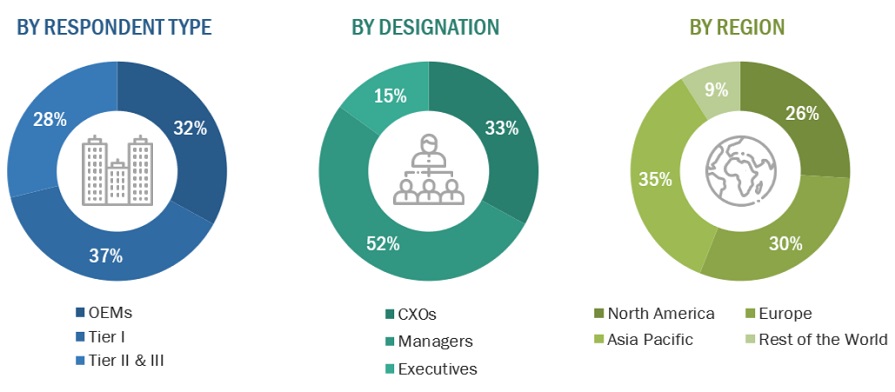

Extensive primary research was conducted after understanding the autonomous trucks market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side (vehicle manufacturers, country-level government associations, and trade associations) and the supply side (autonomous trucks and buses manufacturers, component providers, and system integrators). The regions considered for the research include North America, Europe, the Asia Pacific, and the Rest of the World. Approximately 17% and 83% of primary interviews were conducted from the demand and supply sides. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in this report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, led to the findings described in this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the volume and value of the autonomous trucks market and other submarkets, as mentioned below.

-

Secondary research identified key players in the autonomous trucks market. Their global market share was determined through primary and secondary research.

-

The research methodology included studying the annual and quarterly financial reports & regulatory filings of major market players and interviews with industry experts for detailed market insights.

-

All major penetration rates, percentage shares, splits, and breakdowns for the market across end users were determined using secondary sources and verified through primary sources.

-

All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

-

The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

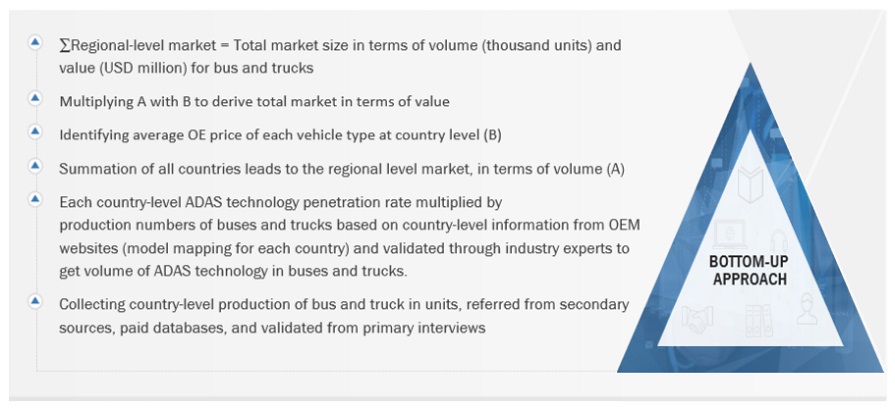

Autonomous trucks market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

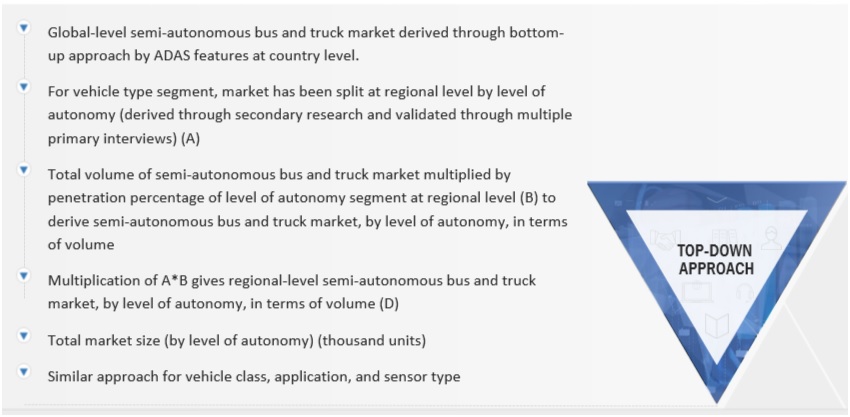

Autonomous trucks market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size through bottom-up approach, the autonomous truck market was split into several segments and subsegments. Where applicable, the data triangulation procedure was employed to complete the overall market engineering process and arrive at the exact market value for key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Market Definition

Autonomous trucks market: Autonomous truck technology requires human intervention to control the vehicle while simultaneously using some of the advanced technologies such as Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Lane Keep Assist (LKA), Intelligent Park Assist (IPA), Blind Spot Detection (BSD), Traffic Jam Assist (TJA) and highway pilot to reduce the effort required to maneuver the bus. Autonomous (self-driving) bus technology runs an artificial intelligence program that controls the entire bus without human intervention.

Autonomous truck technology requires human intervention to control the vehicle while simultaneously using some advanced technologies such as Adaptive Cruise Control (ACC), Autonomous Emergency Braking (AEB), Lane Assist (LA), Intelligent Park Assist (IPA), Blind Spot Detection (BSD), Traffic Jam Assist (TJA) and highway pilot to reduce the effort required to maneuver the truck. Autonomous (self-driving) truck technology runs an artificial intelligence program that controls the entire truck without human intervention.

Key Stakeholders

-

Automobile Original Equipment Manufacturers (OEMs)

-

Automotive Insurance Providers

-

Automobile Industry (End-use Industry and Regional Automobile Associations)

-

Cybersecurity Providers for Autonomous Trucks

-

Legal and Regulatory Authorities

-

Manufacturers of Autonomous Trucks

-

Manufacturers of Autonomous Truck Components

-

Raw Material Suppliers

-

Sensor Manufacturers

-

Software Providers

-

Traders, Distributors, and Suppliers

Report Objectives

-

To segment and forecast the size of the autonomous trucks market in terms of volume (thousand units) and value (USD million)

-

To define, describe, and forecast the size of the autonomous trucks market based on ADAS feature, Application, Vehicle type, Level of Autonomy, Vehicle class, Propulsion type, Sensor type, and region

-

To analyze regional markets for growth trends, prospects, and their contribution to the overall market

-

To provide qualitative insights on the market based on ADAS features [(Adaptive Cruise Control (ACC), Automatic Emergency Braking (AEB), Blind Spot Detection (BSD), Lane Keep Assist (LKA), Intelligent Park Assist (IPA), Traffic Jam Assist (TJA), Highway Pilot (HP)]

-

To segment and forecast the market size, by vehicle type (Buses and Trucks)

-

To segment and forecast the market size, by vehicle class [Class1-Class3, Class4-Class6, and Class7-Class8]

-

To segment and forecast the market size, by Application (Last-mile Delivery Trucks, Mining Trucks, Shuttles, and Intercity/Intracity Buses)

-

To segment and forecast the market size, by Level of Autonomy (L1, L2 and L3, L4, and L5)

-

To segment and forecast the market size, by propulsion type (Diesel, Electric, and Hybrid)

-

To segment and forecast the market size, by sensor type (Cameras, Radars sensors, LiDAR, and Ultrasonic sensors)

-

To forecast the market size by region [North America, Europe, Asia Pacific, and Rest of the World (RoW)]

-

To analyze technological developments impacting the market

-

To provide detailed information about the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

-

To strategically analyze the market, considering individual growth trends, prospects, and contributions to the total market

-

To study the following concerning the market

-

Value Chain Analysis

-

Ecosystem Analysis

-

Technology Analysis

-

HS Code

-

Case Study Analysis

-

Patent Analysis

-

Regulatory Landscape

-

Key Stakeholders and Buying Criteria

-

Key Conferences and Events

-

To estimate the following with respect to the autonomous trucks market:

-

Pricing Analysis

-

Key Players, By Vehicle Type

-

By Region

-

Market Ranking Analysis

-

To strategically profile key players and comprehensively analyze their market ranking and core competencies

-

To analyze the impact of the recession on the market

-

To track and analyze competitive developments such as deals, product developments, expansion, and other activities carried out by key industry participants

Available Customizations

-

Autonomous trucks market, by propulsion type at the country level (for countries not covered in the report

-

Autonomous trucks market, by sensor type at the country level (for countries not covered in the report

Company Information:

-

Profiling of additional market players (Up to 10)

Growth opportunities and latent adjacency in Autonomous Trucks Market