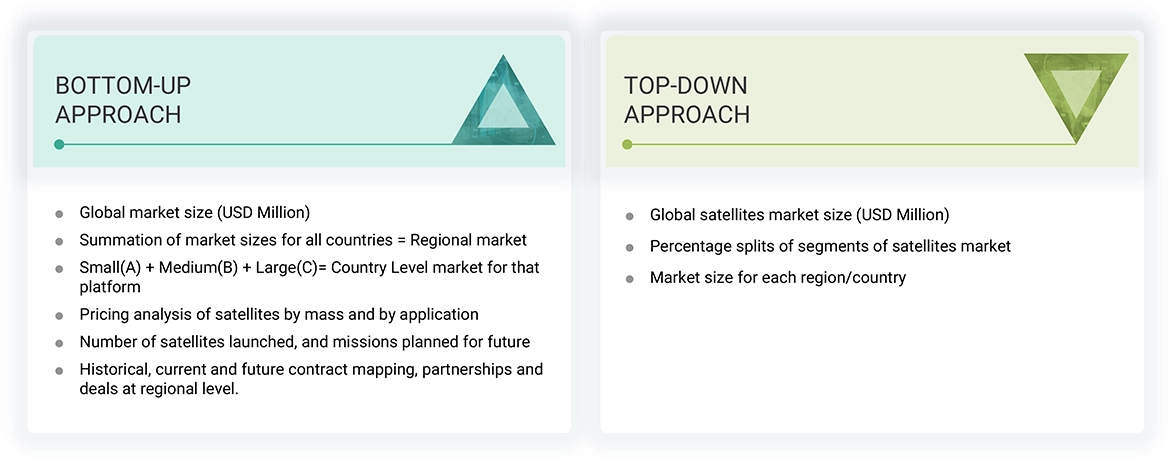

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect useful information on the satellites market. Secondary sources included the space library and product brochures of leading satellite providers. Primary sources included experts from core and related industries, preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information and assess the prospects of the satellites market. A deductive approach, also known as the bottom-up approach combined with the top-down approach, was used to forecast the market size of different market segments.

Secondary Research

The ranking of companies in the satellites market was carried out using secondary data from paid and unpaid sources and by analyzing their product portfolios and service offerings. These companies were rated based on the performance and quality of their products. The data points were further validated by primary sources.

Secondary sources referred to for this research study included the European Space Agency (ESA), the National Aeronautics and Space Administration (NASA), the United Nations Conference on Trade and Development (UNCTAD), the Satellite Industry Association (SIA), annual reports, investor presentations, and financial statements of trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the market, which was validated by primary respondents.

Primary Research

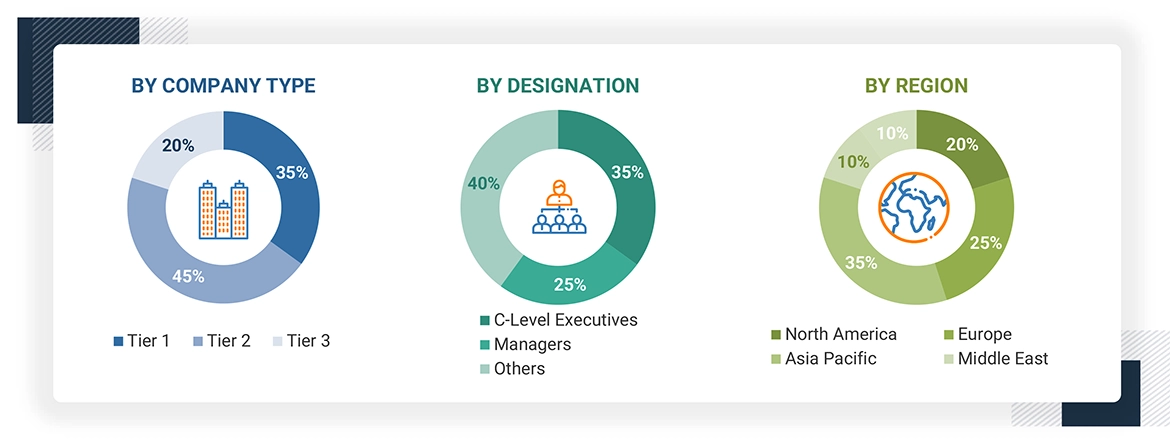

Extensive primary research was conducted after obtaining information about the current scenario of the satellites market through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across five regions, namely North America, Europe, Asia Pacific, the Middle East, and the Rest of the World. This primary data was collected through questionnaires, emails, and telephonic interviews. These interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market size forecasting, and data triangulation. They also helped analyze the mass, subsystem, orbit, end user, application, and frequency segments of the market for the regions mentioned above.

Note: The tier of the companies has been defined based on their total revenue as of 2023: Tier 1 = >USD 1 billion, Tier 2 = USD 100 million to USD 1 billion, and Tier 3 = < USD 100 million.

C-level designations include CEO, COO, and CTO.

Others include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the market. The research methodology used to estimate the market size also includes the following details:

-

Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. \

-

All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Data Triangulation

After arriving at the overall size of the satellites market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various segments and sub-segments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was validated using both top-down and bottom-up approaches.

Market Definition

A satellite is an artificial object placed in orbit around a planet or celestial body to perform specific functions, such as communication, Earth observation, navigation, or scientific research. Satellites collect and transmit data back to Earth, enabling a wide range of applications across industries. The classification includes various subcategories like small, medium and large, based on their mass. Satellites leverages advancements in miniaturization of technology and are launched either independently or as secondary payloads, allowing for cost-effective access to space and opportunities for high-frequency mission updates and constellation deployment. The satellites are typically used by businesses and governments for a variety of applications and depending on their function, satellites operate in different orbits such as low Earth orbit (LEO), medium Earth orbit (MEO), or geostationary orbit (GEO) and other orbits.

Stakeholders

-

Satellite Component Manufacturers

-

Satellite Manufacturers

-

Satellite Integrators

-

Launch Service Providers

-

Government and Civil Organizations Related to Satellite Market

-

Satellite Companies

-

Payload Suppliers

-

Scientific Institutions

-

Meteorological Organizations

-

Component Suppliers

-

Technologists

-

R&D Staff

Report Objectives

-

To define, describe, segment, and forecast the size of the satellite market based on satellite mass, subsystem, end user, application, frequency, orbit, and region

-

To forecast the size of market segments based on five regions: North America, Europe, Asia Pacific, the Middle East, and Rest of the World, along with key countries in each region

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To identify industry trends, market trends, and technology trends prevailing in the market

-

To analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

-

To strategically profile key market players and comprehensively analyze their market ranking and core competencies

-

To provide a detailed competitive landscape of the market and analyze competitive growth strategies such as product developments, contracts, partnerships, MOU’s, agreements, and collaborations adopted by key players in the market

-

To identify the detailed financial position, key products, unique selling points, and key developments of leading companies in the market

Growth opportunities and latent adjacency in Satellites Market