LEO and GEO Satellite Internet Market Size, Share & Trends, 2025 To 2030

LEO and GEO Satellite Internet Market by Customer (Household & Community Wi-Fi, Mobility Internet, Business Connectivity, Telecom Backhaul, Emergency Response, Military Communications), Frequency (UHF, SHF, EHF), Speed, Orbit and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The satellite internet market is projected to grow from USD 14.56 billion in 2025 to USD 33.44 billion by 2030 at a CAGR of 18.1%. The satellite internet subscriber volume for the consumer broadband segment is anticipated to grow from 6.2 million in 2025 to 15.6 million in 2030. The satellite internet market is growing fast due to the rising demand for internet in places where cables cannot reach. These places include rural villages, farmlands, oceans, and mountains, positioning satellite internet networks as essential infrastructure for connectivity worldwide.

KEY TAKEAWAYS

-

BY CUSTOMER TYPEConsumers drive demand for affordable connectivity, enterprises focus on secure and reliable operations, and governments emphasize resilient networks for defense and critical missions. Each group shapes tailored offerings, reinforcing satellite internet’s role across commercial and sovereign applications.

-

BY FREQUENCYFrequency bands shape service capability, with SHF supporting high-throughput applications and UHF/EHF addressing specialized needs. Advances in spectrum efficiency and payload design are enabling greater capacity to support cloud services, streaming, and real-time enterprise connectivity.

-

BY ORBITLEO leads growth with low-latency networks, while GEO ensures broad coverage and multi-orbit strategies combine strengths for resilience. This segmentation enables operators to serve diverse needs, improve service quality, and ensure redundancy across consumer, enterprise, and government use cases.

-

BY DOWNLOAD SPEEDSpeed-based differentiation is key, with medium-speed plans balancing affordability and performance, while high-speed tiers target enterprise and mission-critical users. These options allow providers to tailor packages, expand accessibility, and capture both mass and premium demand.

-

BY REGIONRegional adoption of satellite internet is driven by diverse connectivity priorities, from bridging rural broadband gaps in underserved areas to enabling enterprise-grade services in offshore and mobility sectors. Developed markets emphasize high-speed resilient networks, while emerging economies prioritize affordable constellations to expand digital inclusion and economic opportunities

-

COMPETITIVE LANDSCAPELeading players in the satellite internet market employ aggressive growth strategies, including constellation expansion and vertical integration. For instance, SpaceX leverages its Starlink network and launch capabilities to scale global coverage, reduce latency, and capture both consumer and enterprise demand, reinforcing its leadership in the evolving satellite internet ecosystem

The future outlook for the satellite internet market is robust, fueled by broadband demand, and IoT expansion. Advancements in miniaturization, frequency technologies, and cost-efficient launches will enhance scalability, resilience, and mission diversity, driving commercial and governmental adoption through 2030.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Market growth is driven by the rapid expansion of LEO broadband constellations and increasing demand for high-speed connectivity in remote and mobile environments. Disruptive trends such as electronically steerable user terminals, AI/ML-driven traffic optimization, and the integration of satellite networks with 5G core infrastructure are reshaping service delivery models.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Need for global connectivity

-

Increasing launches of LEO satellites and constellations

Level

-

High investments to overcome bandwidth limitations

-

Government regulations and policies

Level

-

Increasing need for high-speed, reliable communication networks in remote areas

-

Adoption of on-demand connectivity services

Level

-

Satellite capacity and congestion-related challenges

-

Impact of latency on real-time applications

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Need for global connectivity

The growing need for global connectivity is driving satellite internet adoption, particularly in remote and hard-to-reach areas. It enables critical applications in education, healthcare, emergencies, and industries like mining and aviation. With rising demand for reliable networks, satellite internet is becoming a key solution to bridge global digital gaps.

Restraint: High investments to overcome bandwidth limitations

High investment costs for satellites and ground infrastructure remain a major barrier to scaling satellite internet. Building large LEO constellations and advanced systems requires billions in funding and long development cycles, making it difficult to deliver affordable, high-quality connectivity and limiting market expansion, especially for smaller players.

Opportunity: Increasing need for high-speed, reliable communication networks in remote areas

Rising demand for internet in remote and rural regions presents a strong opportunity for satellite internet. Governments and organizations push digital inclusion, while providers expand networks and services. With faster, more reliable satellites, the market is set to grow rapidly, bridging connectivity gaps and creating new revenue opportunities.

Challenge: Impact of latency on real-time applications

Latency remains a critical challenge for satellite internet, particularly in real-time applications like video calls, gaming, remote surgery, and trading. While LEO satellites reduce delays, performance still lags behind fiber networks. Persistent latency concerns hinder adoption, making it a key technical barrier the industry must address for wider acceptance.

Satellite Internet Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Starlink enabled resilient internet connectivity in Ukraine during the conflict, supporting government, defense, and civilian networks. | Ensured secure communications, rapid deployment, and uninterrupted connectivity despite infrastructure damage and jamming attempts |

|

OneWeb partnered with BT to provide satellite backhaul in remote regions of the UK lacking fiber or microwave coverage. | Delivered reliable, low-latency broadband for rural communities, enhancing telecom reach with seamless integration into national networks |

|

Delta partnered with Viasat to install Ka-band satellite systems on 1,000+ aircraft, offering free high-speed in-flight Wi-Fi. | Enabled high-speed streaming, secure communications, and free Wi-Fi access across domestic and international flights |

|

Eutelsat Konnect launched prepaid satellite internet in Nigeria, targeting underserved households and SMEs. | Offered affordable, high-speed access, boosting digital inclusion for e-commerce, education, and remote work |

|

SES delivered satellite broadband for maritime operations, ensuring ships and offshore platforms stay connected at sea. | Supported real-time navigation, secure communication, and crew welfare with reliable high-speed coverage |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

In the satellite Internet ecosystem, satellite operators and service providers form the foundation of connectivity delivery across consumer, commercial, and government markets. These stakeholders include vertically integrated players, space infrastructure companies, telecom operators, and cloud service enablers. Their collaboration ensures the successful deployment, operation, and commercialization of satellite internet services globally.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Satellite Internet Market, By Download Speed

The medium-speed segment (25–100 Mbps) dominates the satellite internet market due to its balance of affordability and performance. It supports daily needs like video streaming, calls, and remote work, making it ideal for rural users, small businesses, and households. Cost efficiency, flexible packages, and easy installation further drive adoption.

Satellite Internet Market, By Customer Type

The enterprise network segment is estimated to dominate the satellite internet market in 2025, driven by demand for reliable connectivity in remote areas. Enterprises in energy, maritime, and logistics need secure data transfer, cloud access, and IoT support. Falling terminal costs and SD-WAN integration further strengthen enterprise adoption, ensuring market leadership.

Satellite Internet Market, By Frequency

The super high frequency (SHF) segment, covering 3–40 GHz and bands like Ku and Ka, is set to dominate the satellite internet market. SHF supports high throughput, low latency, and advanced applications like streaming and cloud services. Growing LEO constellations and multi-beam architectures further strengthen SHF’s role in scalable broadband deployment.

Satellite Internet Market, By Orbit

Low Earth Orbit (LEO) satellites dominate the satellite internet market due to their low latency, faster data transfer, and suitability for real-time applications like video calls and gaming. Expanding mega-constellations and cost-efficient launches further strengthen LEO’s role as the preferred orbit for global broadband connectivity.

REGION

Rest of the World to be fastest-growing region in global satellite internet market during forecast period

The Rest of the World, which includes Latin America and Africa, is the fastest-growing satellite internet market due to underserved populations and limited broadband infrastructure. Government initiatives, digital inclusion programs, rapid urbanization, and LEO satellite expansion by operators like Starlink and Eutelsat are driving strong demand for affordable, scalable connectivity solutions.

Satellite Internet Market: COMPANY EVALUATION MATRIX

The company evaluation matrix for the satellite internet market evaluates players based on product footprint and market share. It highlights their competitive positioning and ranks them according to market strength and growth strategies. SpaceX (star) leads the satellite internet market with a strong service portfolio, advanced satellite technologies, and a broad customer base, while Globalstar is recognized as an emerging leader in this market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 11.57 Billion |

| Market Forecast in 2030 (value) | USD 33.44 Billion |

| Growth Rate | CAGR of 18.1% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Middle East, and Rest of the World |

WHAT IS IN IT FOR YOU: Satellite Internet Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segments covered at regional/global level to gain an understanding on market potential by each country |

| Emerging leader | Additional company profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional market leader | Additional country market estimates | Additional country-level deep dive for a more targeted understanding on the total addressable market |

RECENT DEVELOPMENTS

- May 2025 : Telesat was awarded a contract by Saudi Arabia-based geostationary operator Arabsat, for broadband capacity from Telesat’s proposed low Earth orbit constellation.

- March 2025 : Orange Africa and Middle East (OMEA) and Eutelsat signed a strategic partnership to bridge the digital divide through satellite connectivity in Africa and the Middle East. It aims to connect isolated areas with broadband access, thereby strengthening digital inclusion in the region

- November 2024 : Viasat, in partnership with Altán Redes, launched a first-of-its-kind LTE-based home and mobile broadband service in Mexico using satellite backhaul. The service is designed to extend affordable 4G/LTE internet access to underserved rural and remote communities by combining Viasat’s satellite infrastructure with Altán’s Red Compartida network

- October 2024 : The merger of Yahsat and Bayanat formed Space42, an AI-powered space technology company. The entity was listed on the Abu Dhabi Securities Exchange under the ticker “SPACE42.” It combines Yahsat’s satellite communications with Bayanat’s geospatial AI, targeting global markets in geospatial, mobility, broadband, and business-intelligence sectors.

- March 2024 : Viasat launched a new residential satellite internet plan with a single pricing tier, no data caps, and no long-term contracts. The plan targets households looking for a simpler and more predictable broadband option within Viasat's satellite coverage

Table of Contents

Methodology

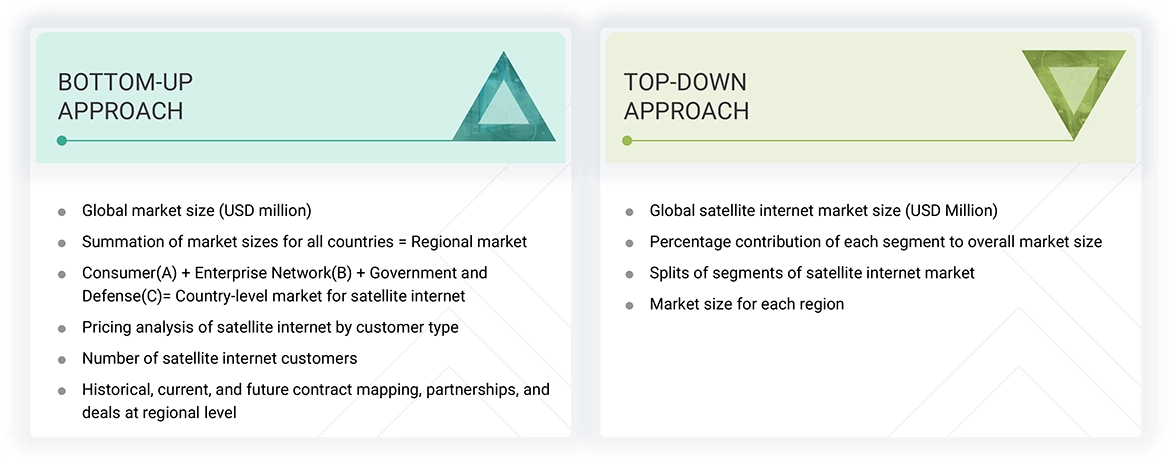

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect useful information on the satellite internet market. Secondary sources included the space library and service brochures of leading satellite internet service providers. Primary sources included experts from core and related industries, preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information and assess the prospects of the satellite internet market. A deductive approach, also known as the bottom-up approach, combined with the top-down approach, was used to forecast the market size of different market segments.

Secondary Research

The ranking of companies in the satellite internet market was carried out using secondary data from paid and unpaid sources and by analyzing their product portfolios and service offerings. These companies were rated based on the performance and quality of their services. The data points were further validated by primary sources.

Secondary sources referred to for this research study included the European Space Agency (ESA), the National Aeronautics and Space Administration (NASA), the United Nations Conference on Trade and Development (UNCTAD), the Satellite Industry Association (SIA), annual reports, investor presentations, and financial statements of the companies offering satellite internet services. The secondary data was collected and analyzed to arrive at the overall size of the market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the satellite internet market through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across five regions, namely North America, Europe, Asia Pacific, the Middle East, and the Rest of the World. This primary data was collected through questionnaires, emails, and telephonic interviews. These interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market size forecasting, and data triangulation. They also helped analyze the technology, hardware, orbit, end use, application, and frequency segments of the market for the regions mentioned above.

Note 1: The tier of companies has been defined based on their total revenue as of 2024. Tier 1 = >USD 1 billion, Tier 2 = USD 100 million to USD 1 billion, and Tier 3 = < USD 100 million

Note 2: C-level designations include CEO, COO, and CTO.

Note 3: Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the market. The research methodology used to estimate the market size also includes the following details:

- Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

- Only those countries where satellite internet is provided by operators were selected, and for forecasting, a statistical analysis of the growing adoption of subscribers was conducted, assuming that people living outside terrestrial connectivity will shift to satellite internet connectivity.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Satellite Internet Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the satellite internet market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various segments and sub-segments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was validated using both top-down and bottom-up approaches.

Market Definition

Satellite internet refers to the delivery of broadband connectivity to end users via satellites orbiting the Earth, eliminating the need for terrestrial infrastructure. It enables high-speed internet access in underserved, remote, or mobile environments where fiber or cellular networks are impractical. Modern satellite internet leverages LEO constellations for low-latency, high-throughput services alongside traditional GEO systems. It serves a diverse set of users, ranging from rural households and mobile transport operators to enterprises, governments, and defense agencies. Strategically, satellite internet plays a pivotal role in closing the global digital divide, enhancing connectivity resilience, and enabling next-generation services like in-flight wi-fi and telecom backhaul.

Key Stakeholders

- Satellite Manufacturers

- System Integrators

- Original Equipment Manufacturers (OEM)

- Service Providers

- Research Organizations

- Investors and Venture Capitalists

- Defense Ministries of Various Countries

Report Objectives

- To define, describe, and forecast the satellite internet market based on customer type, frequency, orbit, download speed, and region

- To forecast the size of market segments across North America, Europe, Asia Pacific, the Middle East, and the Rest of the World

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing market growth

- To identify industry trends, market trends, and technology trends prevailing in the satellite internet market

- To provide an overview of the regulatory landscape with respect to satellite internet regulations across regions

- To analyze micro markets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies

- To evaluate the degree of competition in the market by analyzing recent developments such as acquisitions, agreements, and contracts adopted by leading players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis and revenue analysis of key players

Customization Options

MarketsandMarkets also offers customizations to meet the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of up to five additional market players

Key Questions Addressed by the Report

What is the current size of the satellite internet market?

The satellite internet market is estimated at USD 14.56 billion in 2025.

Who are the winners in the satellite internet market?

The winners in the satellite internet market are SpaceX (US), Viasat (US), EchoStar Corporation (US), Eutelsat Communications SA (US), and SES S.A. (Luxembourg).

What are some of the technological advancements in the market?

- LEO Satellite Constellations: The shift from traditional geostationary satellites to large-scale LEO constellations represents a significant breakthrough. These satellites orbit closer to Earth, greatly reducing signal delay and enabling real-time applications such as video calls, online gaming, and cloud-based collaboration. Companies like SpaceX and Amazon are at the forefront of this innovation, providing faster, lower-latency satellite internet on a global scale.

- Electronically Steered Flat-Panel Antennas: Unlike bulky traditional dishes, modern user terminals now feature flat-panel antennas that electronically steer signals without physical movement. These antennas are lightweight, easier to install, and allow users to stay connected even on moving platforms like vehicles, ships, and aircraft—expanding the reach of satellite internet to mobile and hard-to-serve environments.

What are the factors driving growth in the market?

Key driving factors driving market growth include

- Need for connectivity

- Increasing launches of LEO satellites and constellations

- Rising demand for customized maritime and aviation connectivity

Which region is estimated to account for the largest share of the overall satellite internet market in 2025?

North America is estimated to account for the largest share of 53.7% of the overall satellite internet market in 2025.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the LEO and GEO Satellite Internet Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in LEO and GEO Satellite Internet Market