The study involved four major activities in estimating the current reticulated foam market size—exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and measures with industry experts across the value chain of reticulated foam through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on the revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to to identify and collect information for this study. These secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, notifications by regulatory bodies, trade directories, and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

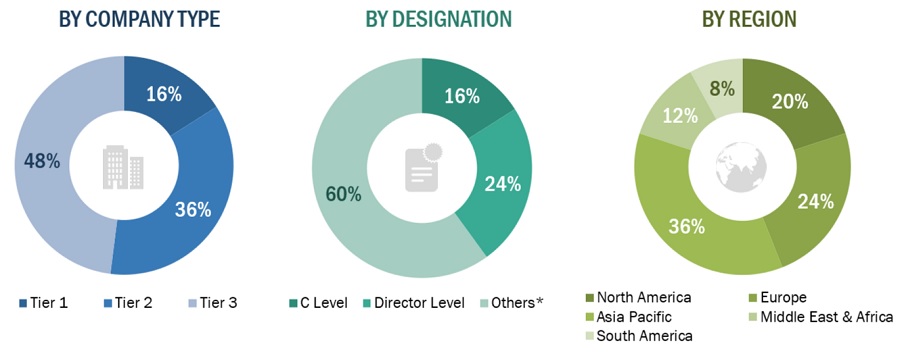

The reticulated foam market comprises several stakeholders in the supply chain, such as manufacturers, equipment manufacturers, traders, associations, and regulatory organizations. The development of various end-use industries characterizes the demand side of this market. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

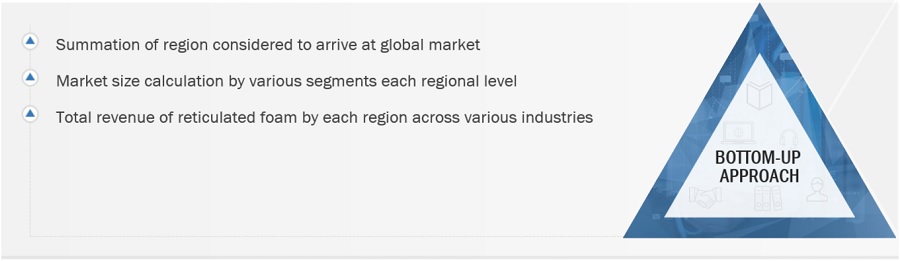

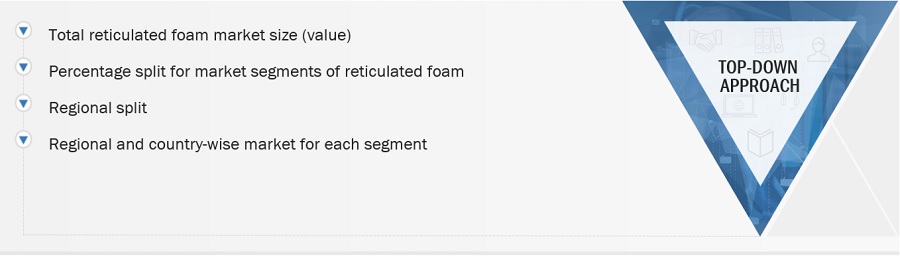

The top-down and bottom-up approaches were used to estimate and validate the total size of the reticulated foam market. These methods were also used extensively to determine the market size of various segments. The research methodology used to estimate the market size included the following:

-

The key players were identified through extensive primary and secondary research.

-

The value chain and market size of the reticulated foam market, in terms of value and volume, were determined through primary and secondary research.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

-

The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Reticulated Foam Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Reticulated Foam Market Size: Top-Down Approach

Data Triangulation

The market was split into several segments and sub-segments after arriving at the overall market size using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine each market segment’s and subsegment’s exact statistics. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

The reticulated foam market refers to the business and economic activities associated with producing, distributing, and consuming reticulated foam products. Reticulated foam is a specialized foam characterized by an interconnected network of open cells, creating a porous and breathable structure. This market encompasses various industries and applications where reticulated foam is utilized, including but not limited to filtration, sound absorption, cushioning, and other specialized uses. Manufacturers produce and supply reticulated foam products within the reticulated foam market, catering to the diverse needs of sectors such as automotive, healthcare, electronics, and more. The market dynamics involve technological advancements, customization capabilities, and the demand for properties like high porosity and durability.

Market participants engage in activities such as research and development, innovation, and strategic partnerships to enhance product offerings and expand their market share. Consumer industries seek reticulated foam solutions that align with their requirements, contributing to the overall growth and evolution of the reticulated foam market.

Key Stakeholder

-

Manufacturers of reticulated foam

-

Traders, distributors, and suppliers of m reticulated foam

-

Government and research organizations

-

Associations and industrial bodies

-

Research and consulting firms

-

R&D institutions

-

Environment support agencies

-

Investment banks and private equity firms

Report Objectives:

-

To define, describe, and forecast the size of the global reticulated foam market in terms of value and volume

-

To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the reticulated foam market.

-

To analyze and forecast the size of various segments (type & application) of the reticulated foam market based on five major regions—North America, Europe, Asia Pacific, South America, Middle East & Africa—along with key countries in each of these regions

-

To analyze recent developments and competitive strategies, such as expansions, new product developments, partnerships, and acquisitions, product launches to draw the competitive landscape of the market

-

To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the report:

-

Additional country-level analysis of the reticulated foam market

-

Profiling of additional market players (up to 5)

-

Product matrix, which gives a detailed comparison of the product portfolio of each company.

Growth opportunities and latent adjacency in Reticulated Foam Market