Respiratory Diagnostics Market: Growth, Size, Share, and Trends

Respiratory Diagnostics Market by Product & Services (Instrument & Devices), Test type (Mechanical, OSA, Imaging, Molecular Test), Disease (Tuberculosis, COPD, Lung Cancer ) and Diagnosis Type (Syndromic, Aetiological, Prognosis) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global respiratory diagnostics market is projected to reach USD 9.02 billion by 2030 from USD 6.17 billion in 2024, at a CAGR of 6.5% from 2024 to 2030. The major factors driving the growth of this market include the rising incidence of respiratory disorders, the expanding geriatric population, growing awareness about respiratory health, and advancements in diagnostic technologies

KEY TAKEAWAYS

-

BY PRODUCT & SERVICEBy product & service, the market is segmented into instruments & devices, assays & reagents, and services & software. The assays & reagents segment is expected to grow at the highest CAGR during the forecast period. This high growth rate of this segment is attributed to the increasing demand for advanced & highly effective assay reagents, improvements in manufacturing capabilities for consumables, and the growing volume of diagnostic samples. Assays & reagents are single-use consumables with a relatively shorter shelf life, hence, steady replenishments contribute to further growth of this segment.

-

BY TEST TYPEThe mechanical tests segment accounted for the largest share of the market as there has been an increase in respiratory health awareness along with advancements in various diagnostic methods. The mechanical test segments are further bifurcated into pulmonary function tests, obstructive sleep apnea diagnostics tests, and other mechanical tests. The pulmonary function tests segment is sub-segmented into three categories: spirometry, peak flow tests, and other pulmonary function tests. Respiratory conditions are being addressed widely, and there is an increasing demand for accurate and reliable diagnostic tests. Increased awareness about health and technological improvement is favoring the market growth for the mechanical test segment in 2024

-

BY DISEASE TYPEBy disease type, the respiratory diagnostics market includes COPD, asthma, tuberculosis, lung cancer, and other diseases. The COPD segment is estimated to grow at the highest CAGR, owing to the increasing prevalence of COPD in young adults & elders, the rising consumption of tobacco products, and the increasing frequency of being exposed to environmental pollutants. Moreover, worsening air quality in emerging markets is expected to further propel the demand for respiratory diagnostics for COPD patients during the forecast period.

-

BY DIAGNOSIS TYPEBased on diagnosis type, the market is clasified into syndromic, etiological, and prognosis dignosis. The syndromic segment accounted for the largest market share in 2023. This methodology detects complex genetic disorders that overlap in phenotypical appearances. Some factors associated with the growth trend include the growing need for early and accurate diagnosis, advancements in diagnostic technologies, and increasing healthcare investments.

-

BY END USERBy end user, the hospitals segment dominated the respiratory diagnostics market. The key factors contributing to the market growth of this segment can be attributed to factors such as the high purchasing rate of hospitals to buy innovative equipment for respiratory diagnostics and the increasing footfall of patients in this end-user segment. The high healthcare expenditure of hospitals; rising technological advancements in diagnostics technologies; and the uptake of technologically advanced solutions across hospitals are also expected to fuel market growth of this segment.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Koninklijke Philips N.V. (Netherlands), BD (US), Abbott Laboratories (US), Thermo Fisher Scientific Inc. (US), and GE Healthcare (US) have entered into a number of agreements and partnerships to cater to the growing demand for adoption of advanced resiratory diagnostics products

The key factors driving market growth include the increasing prevalence of respiratory disorders; expanding geriatric population and rise in sedentary lifestyles; growing awareness about respiratory health; and advancements in diagnostic technologies. However, the high cost of diagnostic tests and limited reimbursements for respiratory surgical procedures are expected to restrain the market growth to a certain extent.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The respiratory diagnostics market's evolving landscape highlights the shift from traditional revenue sources to emerging opportunities. The market primarily relies on devices like spirometers, peak flow meters, pulmonary function testers, and mechanical diagnostic tests. However, the emergence of new technologies and changing healthcare dynamics is reshaping the market. Advanced point-of-care diagnostics, molecular diagnostics, telemedicine, remote diagnostics, and advanced imaging technologies represent significant growth areas. These innovations offer faster, more accurate, and accessible diagnostic solutions catering to various end-users, including hospitals, clinics, diagnostics laboratories, long-term care facilities, specialty centers, and research institutions. Moreover, this transformation is driven by a growing emphasis on early disease detection, personalized medicine, and remote healthcare. As a result, the market is witnessing a shift towards newer revenue sources, presenting exciting opportunities for players in the respiratory diagnostics market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing incidence of respiratory disorders

-

Expanding geriatric population and rise in sedentary lifestyles

Level

-

High cost of diagnostic tests

-

Limited Reimbursements

Level

-

Growing awareness of untreated sleep apnea

-

Increasing demand for POC testing

Level

-

Complexities associated with diagnosis of respiratory infectious diseases

-

Limited access to peripheral lung lesions in bronchoscopy

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing incidence of respiratory disorders

Respiratory ailments like chronic obstructive pulmonary disease (COPD), asthma, lung cancer, and respiratory infections have increasingly become more prevalent through urbanization, pollution, smoking, and the expansive geriatric population worldwide. This prevalence is expected to lead to the demand for advanced diagnostic tools such as spirometry, molecular diagnostics, imaging technologies, and blood gas analyzers for the diagnosis & treatment of respiratory conditions. According to Springer Nature and NCBI, COPD as an illness is the third-leading cause of death in 2023, with 12% of the overall population being recorded to be afflicted with the condition, with 3 million deaths reported in a year. Projections show that 5.4 million deaths will be attributed to COPD by 2060. According to the EU, there is a cost implication of USD 40.14 billion in terms of economic burden subtended by the disease annually. Therefore, the rising incidence of such diseases and the growing need for preventive care are key factors contributing to market growth during the forecast period.

Restraint: High cost of diagnostic tests

Serious discrepancies in the costs of respiratory diagnostic tests, especially in low- and middle-income countries, are expected to limit test uptake during the forecast period. The high cost of diagnostic technologies such as molecular assay tests for conditions such as multidrug-resistant tuberculosis (MDR-TB) further makes patients spend 'mostly out-of-pocket' because of poor insurance or limited public health help. Delayed diagnosis owing to high costs increases the burden of diseases and drives the demand on healthcare facilities for diagnostic services. Therefore, the nonavailability of cost-effective solutions is expected to impact the market's growth significantly during the forecast period.

Opportunity: Growing awareness of untreated sleep apnea

The increasing understanding of the consequences of untreated sleep apnea offers immense potential for respiratory diagnostics. According to ResMed, in the US, the cost of untreated OSA ranges from USD 43 billion to USD 46 billion, whereas undiagnosed cases generate an additional USD 3.4 billion in medical expenses. Similarly, OSA increases the risk for several health outcomes: 140% increased risk for heart failure, 60% increased risk for stroke, and 30% increased risk for coronary heart disease. It is also linked to type 2 diabetes, cognitive deficits, and other health problems. Such considerations have triggered healthcare stakeholders, including government institutions, physicians, and primary stakeholders in the market, to implement programs designed to create awareness concerning the early diagnosis & management of sleep apnea. The trend thus fuels the demand for diagnostic solutions to counter the effects of undiagnosed OSA.

Challenge:Complexities associated with diagnosis of respiratory infectious diseases

Overlapping clinical symptoms with bacterial infection and other conditions like asthma or COPD complicate the diagnosis of viral respiratory infections since these viruses are continuously changing, with most current viral examples being variants of influenza, RSV, and SARS-CoV-2 that could evade existing diagnostic tools. According to the CDC report on RSV in 2022, RSV alone causes 58,000-80,000 hospitalizations annually in the US for children under five; most children, 60-70%, have had an RSV infection by age one. Antigen detector assays, serological tests, and nucleic acid amplification tests (NAATs) are diagnostic technologies developed in recent years. However, each has limitations: rapid immunoassays are limited to specific viruses; serological tests are of little clinical use; and the cost of NAATs is high, coupled with the complexity of PCR, where it may not be feasible in resource-poor settings. Although NAATs, particularly PCR tests, are regarded as the "gold standard" for precision and reliability, the high costs and complexities may restrict widespread implementation, especially in resource-limited settings. This convoluted scenario mandates the rising need for adaptable & low-cost solutions to address the effective prevention of diverse and evolving respiratory pathogens.

Respiratory Diagnostics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of AI-enabled respiratory diagnostic platforms (including cloud-connected spirometry and remote monitoring tools) across hospitals in Spain, Germany, and the UK. | Enhances early detection of COPD and asthma, integrates seamlessly with hospital EHRs and supports telemonitoring for chronic respiratory care. |

|

Implementation of AI-driven algorithms for respiratory rate and airflow analysis through digital ECG data across cardiopulmonary clinics in Poland and the US. | Enables early recognition of respiratory distress via ECG integration and provides automated analysis for clinicians |

|

Integration of cloud-based AI software for respiratory pattern assessment through Holter ECG systems across European research centers. | Improves detection of sleep apnea and breathing irregularities and supports remote diagnostics and continuous monitoring. |

|

Implementation of advanced respiratory monitoring algorithms integrated with patient monitoring systems in hospitals across Japan and the US. | Provides continuous and accurate respiratory rate detection and improves clinical decision-making and patient safety. |

|

Deployment of integrated cardiorespiratory diagnostic systems (pulmonary function tests, CPET, indirect calorimetry, software workflows) across hospitals, clinics, and research centers globally. | Enables high-precision respiratory and metabolic assessments, streamlines workflow via Ascent software, and offers continuity from diagnostics to monitoring |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis of the respiratory diagnostics market comprises the elements present in this market and defines these elements with a demonstration of the bodies involved. It includes products and services, test types, disease indications, type of diagnosis, and end users. Manufacturers include organizations engaged in research, design, product development, optimization, and launch. Distributors include third parties and eCommerce sites linked to the organization for marketing products. Research and product developers include in-house research facilities, contract research organizations, and contract development manufacturing organizations, which play an essential role in outsourcing research for product development to manufacturers. End users are the areas where these devices are used. These end customers include key stakeholders in the supply chain of the respiratory diagnostics devices market and, by extension, the overall medical devices market. However, investors/funders and health regulatory bodies are the primary influencers in this market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Respiratory Diagnostics Market, By Product & Services

By products & services, the instruments & devices sgement held the largest share in the market. Portable diagnostic devices, including hand-held spirometers, peak flow meters, and mobile imaging devices, can allow for immediate evaluation of lung function and conditions. Early appropriate treatment initiation improves patient outcomes due to possible point-of-care respiratory diagnosis improving diagnostic efficacy. Hence, this justifies a transition to a more personalized, timely care, of which respiratory diagnostic instruments are one element of the changing demands of health care. Innovations in the diagnostic device further fuel the trend by allowing for the most accurate, quickest, and least invasive diagnosis of pulmonary diseases.

Respiratory Diagnostics Market, By Test Type

The molecular diagnostic segment, by test type holds the largest share in the respiratory diagnostic market. This trend is attributed to the growing demand for accurate and rapid diagnostics, particularly in the detection of respiratory infections such as COVID-19 and influenza as well as other viral diseases. Techniques such as PCR and next-generation sequencing are known to be included in molecular diagnostics with their high precision and enabling rapid and reliable results. Such growth in these diagnostic practices is brought about by an increase in infectious diseases and technological advances and by increasing awareness of healthcare. Personalized treatment can thus also be facilitated with molecular diagnostics, which add to its demand in clinical scenarios.

Respiratory Diagnostics Market, By Disease Indication

Asthama segment held the largest share in the market. Personalized asthma management increasingly relies on complex and advanced tools of diagnosis, with regard to the individually focused patients. Such advanced diagnostics for asthma like molecular testing and biomarker analyses help providers to explore the various genetics and molecular bases behind a patient's asthma. By understanding these convolutions, it becomes much easier to establish the most personalized and targeted strategies-they almost begin to be called "target medicine." Hence, the segment specific to asthma in respiratory diagnostics is poised for healthy exposure to rapid growth, due to the improving trend toward the adoption of personalized medicine.

Respiratory Diagnostics Market, By DiagnosisType

Among the various type of diagnosis, the syndromic diagnosis segment is expected to grow at a very fast rate in the global respiratory diagnostics market, as it is capable of rapidly identifying a broad range of organisms with a single diagnostic test. It allows the clinician to institute the most appropriate management in the least possible time, especially in an urgent care setting. The increase in incidence of respiratory infections, a growing demand for rapid diagnostic solutions, and advancements in multiplex PCR and next-generation sequencing technologies will boost the segment growth. In addition, the emerging trend of point-of-care testing and the greater need for cost-effective, efficient diagnostics in resource-poor environments further augment the segment's rapid growth.

Respiratory Diagnostics Market, By End User

With the increasing trend, hospitals and clinics are accepting respiratory diagnostics as a complete part of the routine care model. Seamless inclusion of respiratory diagnostics in hospitals and clinics affords convenience for patients to access diagnostic services, whether they come from seeking primary care or specialized services for a problem. Early detection of diseases, as well as the patient's health in terms of being proactive, as measured by the repeated measures of respiratory health within a specific time frame, helps to determine timely intervention with an individualized treatment plan. Integrated diagnostic measures become part of the patient's care pathway and support immediate intervention based on diagnosis. With hospitals and clinics becoming main sites for respiratory diagnosis in a typical care routine, the demand for such services is bound to expand and, therefore, is expected to be a driver for growth in the respiratory diagnostics market.

REGION

Asia Pacific to be fastest-growing region in global respiratory diagnostics market during forecast period

By region, the Asia Pacific market is expected to dominate the respiratory diagnostics market during the forecast period. The gradual increase in healthcare spending across emerging economies is expected to drive enhanced healthcare outcomes and the uptake of technologically advanced diagnostics. The rising establishment of several diagnostic laboratories in the region is expected to lower the cost of respiratory diagnostics. The increasing number of medical device manufacturers in the region is also expected to contribute to market growth.

Respiratory Diagnostics Market: COMPANY EVALUATION MATRIX

In the respiratory diagnostics market matrix, Philips (Star) leads with scale, extensive distribution, and a broad solutions portfolio. MGC Diagnostics Corporation (Emerging Leader) is gaining momentum with innovative respiratory diagnostic devices. While Philips dominates through reach, MGC Diagnostics Corporation' innovation positions it for rapid growth toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6..17 BN |

| Market Forecast in 2030 (Value) | USD 9.02 BN |

| CAGR | 6.5% |

| Years Considered | 2022-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Respiratory Diagnostics Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | In-depth assessment of diagnostics devices by test type | The report included market size, key trends, growth opportunities, and a detailed competitive landscape highlighting leading providers, their product differentiators, and strategic positioning |

| Company Information | Key players: Top 3-5 players market share analysis at APAC and European country level. | Insights on revenue shifts towards emerging device innovations. |

| Geographic Analysis | Detailed analysis on Rest of APAC was provided to one of the top players. | Country level demand mapping for new product launches and localization strategy planning. |

RECENT DEVELOPMENTS

- September 2024 : Becton, Dickinson and Company (US) acquired Edwards Lifesciences Corporation’s Critical Care product group. The product group is now renamed BD Advanced Patient Monitoring, unlocking new value opportunities and enhancing BD's innovative connected care solutions portfolio.

- June 2024 : bioMérieux (France) declared that the BIOFIRE SPOTFIRE Respiratory/Sore Throat (R/ST) Panel Mini has received the US FDA Special 510(k) approval and CLIA-waiver (Clinical Laboratory Improvement Amendments). This unique multiplex PCR test detects five of the most common viral & bacterial causes of respiratory or sore throat infections in about 15 minutes.

- Janary 2024 : Wipro GE Healthcare, a Joint Venture (JV) between GE Precision Healthcare LLC (US) and Wipro Enterprises Limited (India), signed a MoU with the Indian Institute of Science (IISc) (India) to advance healthcare innovation, research, and technology development in India.

Table of Contents

Methodology

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the respiratory diagnostics market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include project/sales/marketing/business development managers, presidents, CEOs, vice presidents, chairpersons, chief operating officers, chief strategy officers, directors, chief information officers, chief medical information officers related to the respiratory diagnostics markets. Primary sources from the demand side include professionals from hospitals and clinics, diagnostics laboratories, professors, and researcher.

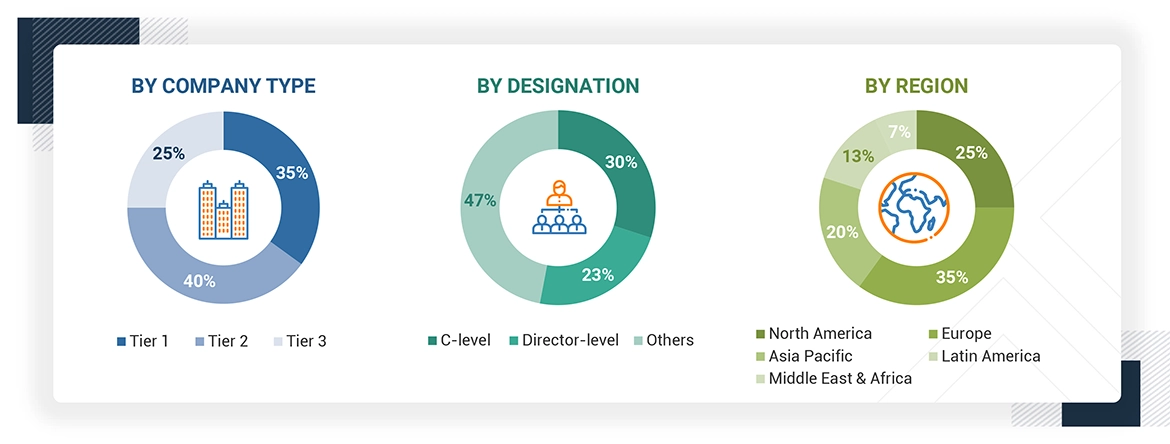

A breakdown of the primary respondents is provided below:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Tiers are defined based on a company’s total revenue. As of 2023: Tier 1 = >USD 500 million, Tier 2 = USD 200 million to USD 500 million, and Tier 3 = < USD 200 million.

To know about the assumptions considered for the study, download the pdf brochure

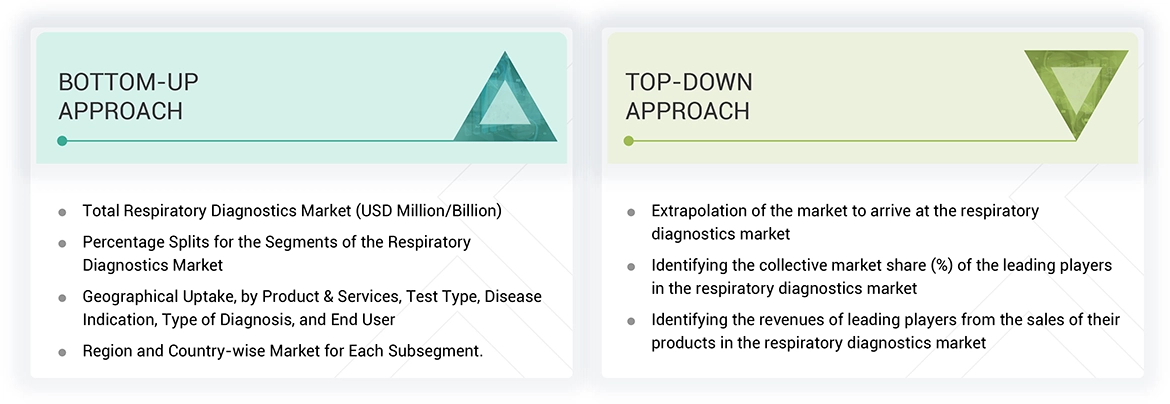

Market Size Estimation

The total size of the respiratory diagnostics market was arrived at after data triangulation from three different approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in the market engineering process.

Market Definition

Respiratory diagnostic devices assess and monitor the functioning of the respiratory system and play a crucial role in diagnosing and managing various respiratory conditions. They include a wide range of equipment that aids in breathing, improves pulmonary function, and assists in the removal of mucus from the airways. Some of the respiratory diagnostic tests include mechanical tests such as Spirometry, Pulse Oximetry, Bronchoscopy, Diagnostic Imaging tests, and in vitro diagnostic tests.

Stakeholders

- Respiratory diagnostic device manufacturers and distributors

- Healthcare institutions (hospitals, laboratories, medical schools, and outpatient clinics)

- Research institutes

- Contract manufacturing organizations (CMOs)

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

- Market research and consulting firms

Report Objectives

- To define, describe, and forecast the respiratory diagnostics market by product and service, test type, disease indication, type of diagnosis, end user, and region

- To provide detailed information about the key factors influencing the market growth, such as drivers, restraints, opportunities, challenges, and industry trends

- To strategically analyze the regulatory scenario, Porter’s Five Forces, value chain, supply chain, ecosystem market/map, recession, and patents in the market

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall respiratory diagnostics market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To strategically profile the key players in this market and comprehensively analyze their market shares and core competencies

- To strategically analyze the respiratory diagnostics market in five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To track and analyze competitive developments such as acquisitions, product launches, partnerships, and expansions in the respiratory diagnostics market.

Key Questions Addressed by the Report

- By Product & Service

- By Test Type

- By Disease Type

- By Diagnosis Type

- By End User

- By Region

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Respiratory Diagnostics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Respiratory Diagnostics Market