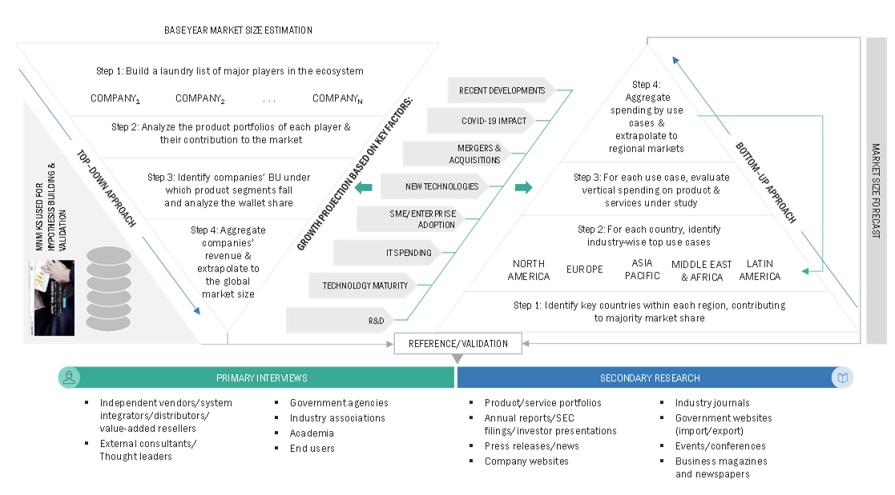

The study comprised four main activities to estimate the private cloud market size. We conducted significant secondary research to gather data on the market, the competing market, and the parent market. The following stage involved conducting primary research to confirm these conclusions and hypotheses and sizing with industry experts throughout the value chain. The overall market size was evaluated using a blend of top-down and bottom-up approach methodologies. After that, we estimated the market sizes of the various market segments using the market breakup and data triangulation techniques.

Secondary Research

We determined the size of companies offering private cloud markets and services based on secondary data from paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, the spending of various countries on the private cloud market was extracted from the respective sources. We used secondary research to obtain the critical information related to the industry's value chain and supply chain to identify the key players based on solutions, services, market classification, and segmentation according to components of the major players, industry trends related to components, users, and regions, and the key developments from both market- and technology-oriented perspectives.

Primary Research

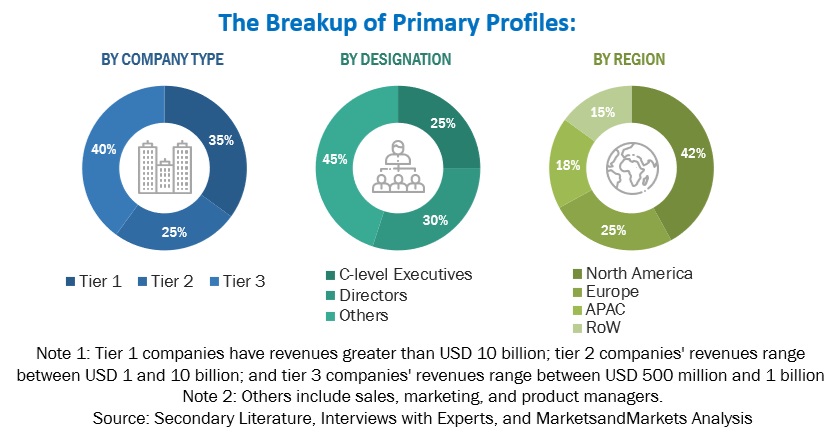

in the primary research process, we interviewed various primary sources from the supply and demand sides of the private cloud market to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from vendors providing private cloud offerings, associated service providers; and is operating in the targeted countries. all possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data.

After the complete market engineering process (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), we conducted extensive primary research to gather information and verify and validate the critical numbers arrived at. The primary research also helped identify and validate the segmentation, industry trends, key players, competitive landscape, and market dynamics, such as drivers, restraints, opportunities, challenges, and key strategies. In the complete market engineering process, the bottom-up approach and several data triangulation methods were extensively used to perform market estimation and market forecasting for the overall market segments and subsegments listed in this report. We conducted an extensive qualitative and quantitative analysis of the complete market engineering process to list the key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The private cloud market and related submarkets were estimated and forecasted using top-down and bottom-up methodologies. We used the bottom-up method to determine the market's overall size, using the revenues and product offerings of the major market players. This research ascertained and validated the precise value of the total parent market size through data triangulation techniques and primary interview validation. Next, using percentage splits of the market segments, we utilized the overall market size in the top-down approach to estimate the size of other individual markets.

Top Down and Bottom Up Approach of Private Cloud Market.

To know about the assumptions considered for the study, Request for Free Sample Report

The research methodology used to estimate the market size included the following:

-

We used primary and secondary research to determine the revenue contributions of the major market participants in each country after secondary research helped identify them.

-

Throughout the process, we obtained critical insights by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

-

We used primary sources to verify all percentage splits and breakups, which we calculated using secondary sources.

Data Triangulation

Once the overall market size was determined, we divided the market into segments and subsegments using the previously described market size estimation procedures. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from government entities' supply and demand sides.

Market Definition

According to MarketsandMarkets, the Private cloud is one of the segments in the Cloud Computing sectors that remains focused on rendering and processing private content, including images, videos & graphic-intensive applications. This platform offers powerful utilities for rendering, video encoding, and real-time streaming work-flows running tailored private online experiences utilizing superior cloud infrastructure. These private cloud solutions are particularly useful for use cases like media and entertainment, gaming, virtual/augmented reality, or SaaS remote work where scalability is required without investing heavily in on-premises hardware. These include video conferencing, virtual desktops, a high-performance small footprint cache for hyper-fast data privatization, or even burst storage accelerated in cloud gaming.

Key Stakeholders

-

Training and consulting service providers

-

Information Technology (IT) infrastructure providers

-

Private cloud solutions providers

-

Private cloud service providers

-

Government organizations and standardization bodies

-

Network Administrators

-

Compliance Officers

-

Application Developers

-

Private Cloud Architects

Report Objectives

-

To define, describe, and forecast the private cloud market based on type, service model, organization size, vertical, and region.

-

To provide detailed information about the significant factors, such as drivers, opportunities, restraints, and challenges, influencing the growth of the market

-

To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

-

To forecast the market size concerning five central regions — North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

-

To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

-

To profile the market's key players and comprehensively analyze their size and core competencies

-

To track and analyze the competitive developments, such as product enhancements, product launches, acquisitions, partnerships, and collaborations, in the private cloud market globally

Available Customizations

MarketsandMarkets provides customizations based on the company's unique requirements using market data. The following customization options are available for the report:

Product analysis

-

The product matrix provides a detailed comparison of each company's portfolio.

Geographic Analysis

-

Further breakup of the private cloud market

Company Information

-

Detailed analysis and profiling of five additional market players

Growth opportunities and latent adjacency in Private Cloud Market