Private 5G Market Size, Share & Trends, 2025 To 2030

Private 5G Market by Offering (RAN, Base Station, Antenna, Core Network, Edge Server, Gateway, Delivery Network, Network Management, Managed Services), Spectrum Allocation (Licensed, Shared), Frequency Band (Low, Mid, mmWave) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

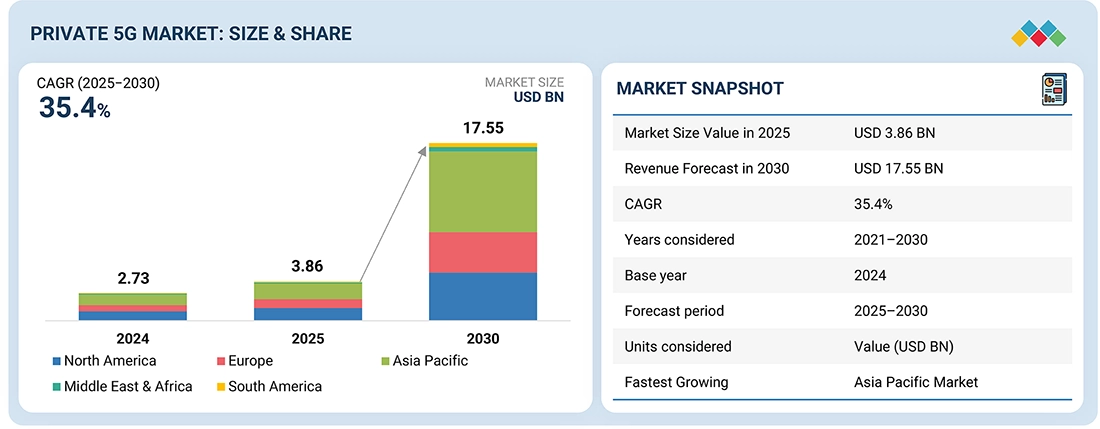

The Private 5G market is projected to reach USD 17.55 billion by 2030 from USD 3.86 billion in 2025, at a CAGR of 35.4% from 2025 to 2030. The growth of the Private 5G industry is driven by the increased demand for high-speed, low-latency, and secure wireless communication.

KEY TAKEAWAYS

-

BY NETWORK TYPEStandalone (SA) 5G is expected to witness the fastest growth, driven by enterprise demand for full 5G capabilities such as ultra-low latency, high reliability, and network slicing. Its dedicated 5G core enables advanced use cases in smart manufacturing, logistics, and autonomous systems, supported by growing investments from telecom vendors and enterprises.

-

BY CLOUD MODELThe public cloud segment is expected to grow at the highest CAGR, driven by its cost-efficiency, scalability, and AI-enabled automation. Increasing adoption by enterprises and CSPs, along with partnerships like Ericsson–Google Cloud, is accelerating 5G workload deployment and expanding private 5G use cases.

-

BY FREQUENCY BANDThe mid-band frequency segment holds the largest share of the private 5G market, offering an optimal balance between coverage and capacity. Widely available and standardized in the 1–6 GHz range, it supports high-speed, low-latency connectivity for diverse enterprise applications, reinforced by government spectrum releases and expanding operator deployments.

-

BY OFFERINGThe private 5G market is segmented by offering into hardware, software, and services. Hardware provides the core infrastructure for connectivity, software enables secure and automated network operations, and services support deployment, management, and security. Market growth is driven by real-time data needs, enterprise network control, and rising cybersecurity demands across key industries.

-

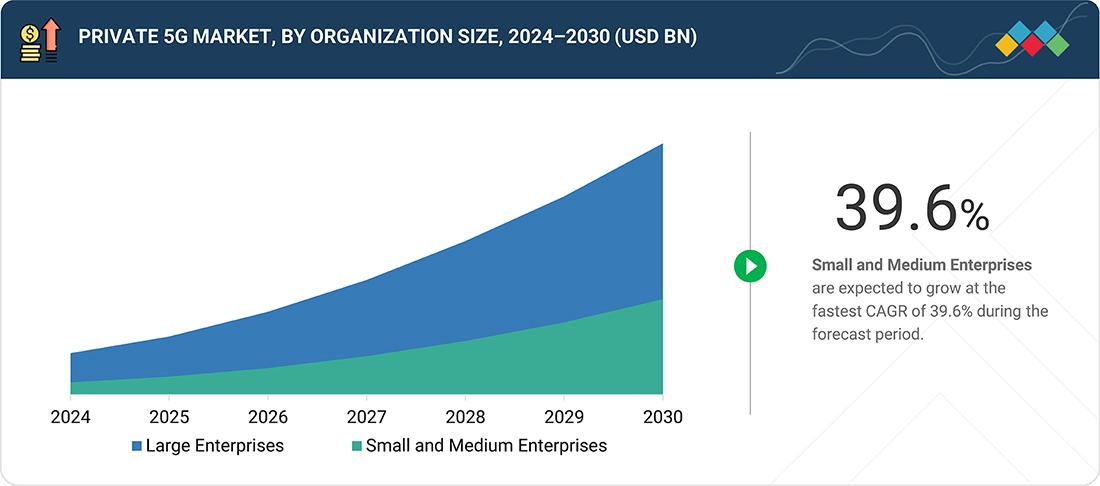

BY ORGANIZATION SIZELarge enterprises dominate the private 5G market due to their substantial budgets, complex operational needs, and focus on digital transformation. They deploy private 5G to enable automation, real-time data processing, and secure communication across multiple sites, leveraging edge computing and smart technologies to enhance control, efficiency, and scalability.

-

BY SPECTRUM ALLOCATIONThe unlicensed/shared spectrum segment holds the largest market share due to its cost-effectiveness, accessibility, and deployment flexibility. Supported by 5G NR-U standards and open bands such as 5 GHz and 6 GHz, it enables faster, affordable rollouts, particularly benefiting small and mid-sized enterprises and driving wider market adoption.

-

BY VERTICALThe manufacturing sector holds the largest share of the private 5G market, driven by Industry 4.0 adoption and the need for real-time automation, machine communication, and predictive maintenance. Private 5G enables secure, low-latency connectivity in smart factories, enhancing operational efficiency and digital transformation.

-

BY REGIONThe Private 5G market covers North America, Europe, Asia Pacific, South America, the Middle East, and Africa. The Asia Pacific region is expected to register the highest CAGR in the private 5G market, driven by digitalization in manufacturing, logistics, mining, and ports.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, in October 2024, Ericsson and Schiphol Airport partnered to pilot a dedicated Ericsson Private 5G network, aiming to support Schiphol's Airport 4.0 vision.

The growing demand for high-speed, low-latency, and secure wireless communication is driving private 5G adoption across industries. Enterprises deploy private networks to support mission-critical applications, IoT connectivity, and edge computing, enhancing digital transformation and operational efficiency in manufacturing, logistics, energy, and healthcare.

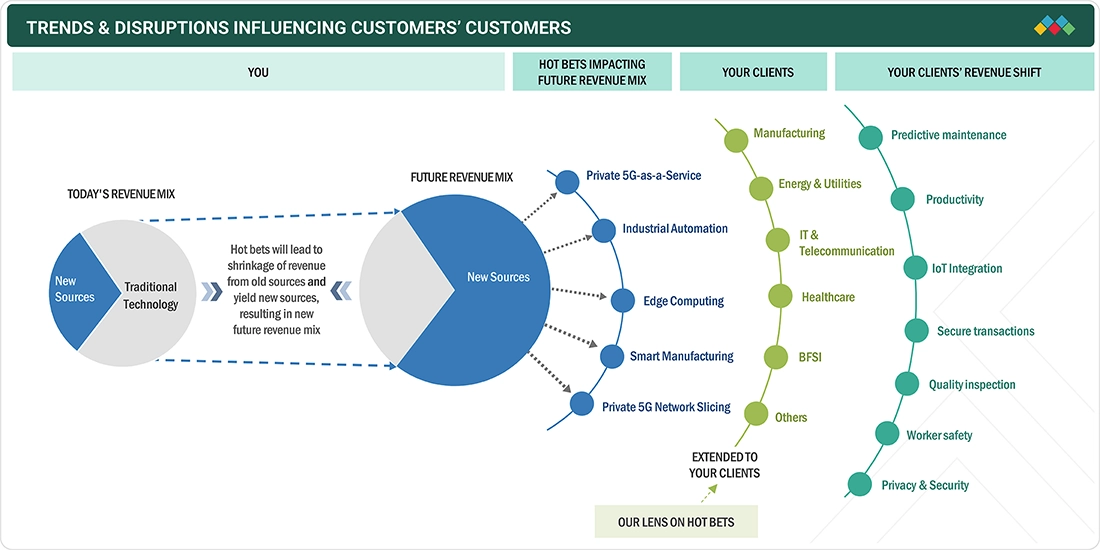

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are clients of Private 5G manufacturers, and target applications are clients of Private 5G manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbets, which will further affect the revenues of Private 5G manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for industrial automation and shift toward smart manufacturing

-

Increasing demand for Industrial Internet of Things

Level

-

Limited availability of spectrum

Level

-

Increasing adoption of Private 5G in healthcare

-

Integration of edge computing in private 5G

Level

-

High initial capital investment

-

Integration with existing systems

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for industrial automation and shift toward smart manufacturing

The growing demand for industrial automation and smart manufacturing is driving private 5G adoption, providing ultra-low latency, high-bandwidth connectivity for real-time control, monitoring, and data analytics. Government and private investments in Industry 4.0 initiatives and AI-powered automation are fueling the need for robust private 5G infrastructure to enable flexible, efficient, and data-driven smart factories.

Restraint: Limited availability of spectrum

Limited spectrum availability is a key restraint for private 5G growth, as enterprises compete with public networks and other technologies for bandwidth. Regulatory complexity, fragmented allocations, and inconsistent global policies further hinder deployment, restricting coverage expansion and cross-border network scalability.

Opportunity: Increasing adoption of Private 5G in healthcare

The healthcare industry is increasingly adopting private 5G to enable secure, high-speed connectivity for applications like remote patient monitoring, AI diagnostics, and real-time video analytics. By supporting digital health technologies, robotics, and IoT, private 5G enhances clinical workflows, data privacy, and patient care, as seen in hospitals across Germany, the UK, and the US.

Challenge: High initial capital investment

High initial capital investment poses a challenge for private 5G adoption, as enterprises must fund infrastructure, edge computing, software, and maintenance. The financial burden, especially for SMEs, coupled with uncertain ROI and regulatory costs, can slow deployment and limit broader market growth.

Private 5G Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Telefónica Germany partnered with Ciena Corporation to drive network cloudification and autonomous network transformation using cloud-native automation software. | Enables dynamic 5G network slicing, streamlined service orchestration, and accelerated time-to-market for next-gen services |

|

STC (Saudi Telecom Company) partnered with Juniper Networks to enhance its 5G-ready network security using AI-Native automation features in Juniper's SRX firewalls. | Improved data processing speed, reduced latency and power consumption, and strengthened security at scale |

|

NEC Corporation launched its commercial virtualized RAN (VRAN) software. Built on fully containerized, open-standard architecture powered by Qualcomm's Dragonwing X100 accelerator. | Enables cloud-native, energy-efficient 5G networks with multi-vendor integration and future scalability toward 5G Advanced and 6G |

|

Cisco Systems and NEC Corporation partnered to launch a market-ready private 5G network solution targeting industries such as logistics and airport operations, combining Cisco's 5G SA Core with NEC's radio network expertise. | Enables enterprises to validate and deploy customized, high-performance private 5G networks to accelerate digital transformation globally |

|

Telefonaktiebolaget LM Ericsson launched Ericsson 5G Advanced in October 2024, a suite of seven new software products designed to enable high-performing programmable networks. | Enhanced network programmability, improved performance, and support for advanced 5G capabilities for enterprise and service provider networks |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The private 5G ecosystem comprises chipset & hardware providers, network equipment vendors & solution providers, cloud & edge platform providers, private 5G system integrators, specialist vendors & managed services, 5G tower providers, and end users. The ecosystem identifies end users, such as manufacturing, energy & utilities, retail & e-commerce, healthcare, BFSI, infrastructure, transportation & logistics, aerospace, media & entertainment, and IT & telecommunication.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Private 5G Market, By Network Type

The private 5G market by network type is segmented into non-standalone (NSA) and standalone (SA) architectures. NSA 5G leverages existing 4G LTE infrastructure for faster and cost-effective deployment, making it suitable for enterprises seeking early 5G adoption. In contrast, SA 5G operates on a dedicated, cloud-native 5G core, enabling full 5G capabilities such as ultra-low latency and network slicing for advanced applications.

Private 5G Market, By Cloud Model

Cloud models are important for how private 5G networks are built and managed. These models include private/dedicated cloud, public cloud, and hybrid cloud. Each model supports different business needs, such as data control, flexibility, and cost. Private or dedicated cloud offers more control and security, public cloud supports fast and low-cost deployment, and hybrid cloud combines both for better flexibility. These models help businesses run SG networks more efficiently. The market is growing because companies want faster service, lower costs, better control of data, and flexible network options that support Al, edge computing, and new industrial use cases.

Private 5G Market, By Frequency Band

The private 5G market, by frequency band, is segmented into low band, mid band, and mmWave. These segments represent different spectrum ranges, each with unique capabilities and enterprise use cases. Low band refers to the spectrum below 1 GHz, mid band ranges from 1 to 6 GHz, and mmWave includes frequencies above 24 GHz. Market growth is driven by the rising demand for high-speed, low-latency connectivity, government-led spectrum allocations, and increasing enterprise adoption of multi-band strategies to optimize network performance across diverse industrial and operational environments.

Private 5G Market, By Offering

The private 5G market, by offering, has been segmented into hardware, software, and services. The hardware segment includes components such as base stations, antenna systems, routers, switches, fiber optic cables, and microwave links, as well as edge computing infrastructure like edge servers and gateways. These components enable high-speed, low-latency connectivity and are critical for deploying robust network infrastructure. The software segment covers network management software, network security software, and cloud-based solutions, which ensure secure, automated, and flexible operations. The services segment includes professional services, managed services, security services, edge computing services, and connectivity services.

Private 5G Market, By Organization Size

The private 5G market by organization size is segmented into large enterprises and small and medium enterprises (SMEs), each with distinct adoption patterns and requirements. Large enterprises are early adopters due to their ability to invest in infrastructure, while SMEs are gradually entering the space through compact, cost-effective solutions. The market growth is driven by rising demand for secure, high-speed, and low-latency connectivity, growing Industry 4.0 adoption, and increasing rellance on edge computing. As businesses prioritize digital transformation, private 5G networks are emerging as critical enablers of automation, operational efficiency, and control over data and network operations.

Private 5G Market, By Spectrum Allocation

Spectrum allocation plays a critical role in the development of private 5G networks by determining how enterprises access the radio frequencies needed for deployment. The market is segmented into unlicensed/shared spectrum and licensed spectrum. Unlicensed/shared spectrum enables cost-effective and flexible deployment, while licensed spectrum offers secure, high-performance connectivity with greater control. Market growth is driven by increasing enterprise demand for reliable wireless connectivity, growing adoption of 5G NR-U standards, regulatory initiatives to open mid-band frequencies, and the need for dedicated networks to support industrial automation, smart Infrastructure, and real-time data-driven operations.

Private 5G Market, By Vertical

Private 5G networks have evolved significantly over the past decade and are now widely deployed across industries. With improvements in wireless technologies, enterprises are adopting private 5G to enhance automation, enable real-time operations, and support advanced digital applications. These networks provide high-speed, low-latency, and secure connectivity, making them suitable for mission-critical tasks and data-intensive workloads. As industries modernize, private 5G allows stakeholders to integrate next-generation technologies such as lot, Al, robotics, and augmented reality, leading to smarter and more responsive operations. This transformation supports greater operational efficiency, Improved worker safety, and better asset utilization across various sectors. The private 5G market, by vertical, has been segmented into manufacturing, energy & utilities, retail & e-commerce, healthcare, BFSI, Infrastructure, transportation & logistics, aerospace, media & entertainment, IT & telecommunications, and other verticals.

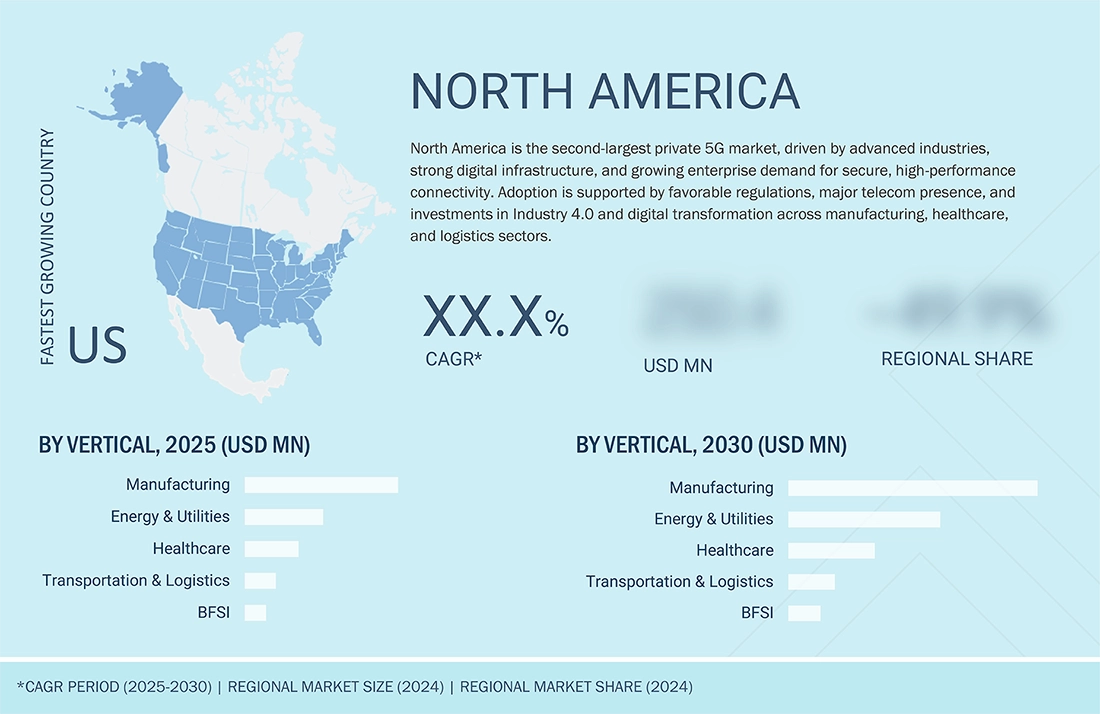

REGION

During the forecast period, US is expected to be the fastest-growing market in North America.

The North American private 5G market, covering the US, Canada, and Mexico, is driven by advanced industries, strong digital infrastructure, and growing demand for secure, high-performance connectivity. Enterprises in manufacturing, logistics, healthcare, and energy adopt private 5G for automation, real-time data exchange, and mission-critical applications. Supportive regulations, available spectrum, and the presence of major telecom and tech companies foster innovation and flexible deployments. Combined with Industry 4.0 adoption and data-driven operations, these factors position North America as a leading region for private 5G growth.

The Asia Pacific Private 5G market is projected to grow from USD 1.5 billion in 2025 to USD 8.0 billion by 2030, at a CAGR of 39.1% from 2025 to 2030. The market is driven by large-scale digital transformation across manufacturing, logistics, and smart infrastructure, supported by strong government-led 5G industrial policies in countries such as China, Japan, India, and South Korea. Rising investments in automation, IoT adoption, and Industry 4.0 initiatives are increasing demand for reliable, low-latency connectivity tailored to enterprise environments.

Private 5G Market: COMPANY EVALUATION MATRIX

In the Private 5G market matrix, Telefonaktiebolaget LM Ericsson (Sweden) leads the private 5G market with a strong service portfolio, wide presence, and strategic growth initiatives, driving widespread adoption. Cisco Systems, Inc. (US) is an emerging leader with a focused, innovative product portfolio, gradually expanding its influence despite a smaller market share.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.73 Billion |

| Market Forecast in 2030 (Value) | USD 17.55 Billion |

| Growth Rate | CAGR of 35.4% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

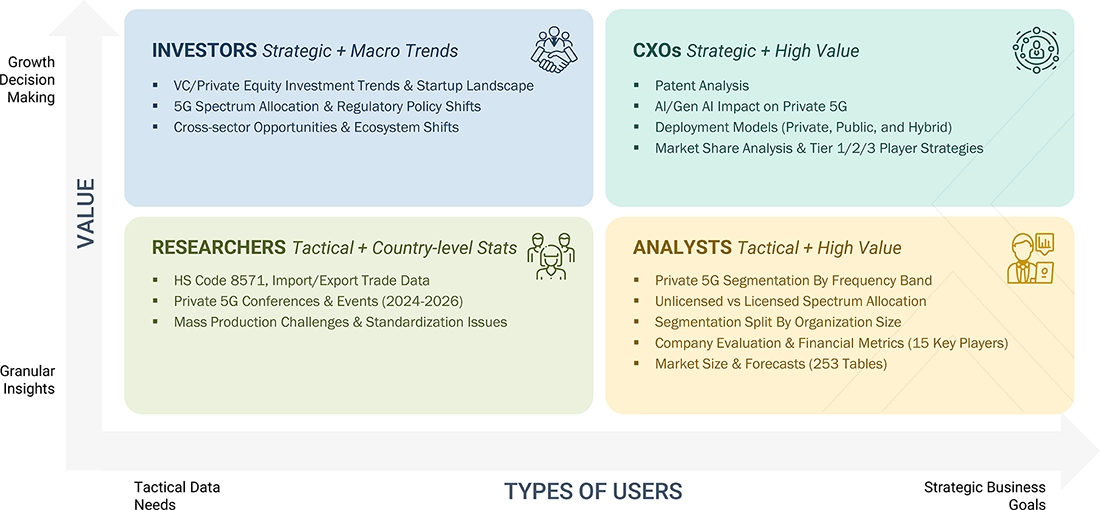

WHAT IS IN IT FOR YOU: Private 5G Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Telecom Equipment Vendor |

|

|

| Leading Mobile Network Operator |

|

|

| Industrial System Integrator |

|

|

| US-Based Private 5G Startup |

|

|

| Europe-Based Leading Private 5G Provider |

|

|

RECENT DEVELOPMENTS

- May 2025 : Telefónica Germany GmbH & Co. partnered with Ciena Corporation to drive network cloudification and autonomous network transformation. The collaboration uses cloud-native automation software to enable dynamic 5G network slicing, streamlined service orchestration, and faster time-to-market for next-gen services.

- March 2025 : STC (Saudi Telecom Company) partnered with Juniper Networks to enhance its 5G-ready network security using AI-native automation features in Juniper's SRX firewalls, improving data processing speed, reducing latency and power consumption, and strengthening large-scale security.

- March 2025 : NEC Corporation launched its commercial virtualized RAN (vRAN) software, targeting deployment of over 50,000 vRAN base stations by FY2026. Built on a containerized, open-standard architecture and powered by Qualcomm’s Dragonwing X100 accelerator, it supports energy-efficient, cloud-native 5G networks ready for 5G Advanced and 6G.

- October 2024 : Cisco Systems, Inc. and NEC Corporation partnered to launch a market-ready private 5G network solution combining Cisco's 5G SA Core and Cloud Control Centre with NEC's radio network and integration expertise. The solution targets industries like logistics and airport operations.

- October 2024 : Telefonaktiebolaget LM Ericsson launched Ericsson 5G Advanced, a suite of seven new software products designed to deliver high-performing, programmable networks.

- July 2024 : Nokia and Telefónica began a three-year collaboration to deploy 100 private wireless and edge solutions across Spain, targeting ports, manufacturing, and logistics sectors to accelerate Industry 4.0 and industrial digitalization.

Table of Contents

Methodology

The study used four major activities to estimate the market size of private 5G. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the size of the private 5G market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. Various secondary sources have been referred to in the secondary research process to identify and collect information for this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, certified publications, and articles by recognized authors; websites; directories; and databases. Secondary research has mainly been used to obtain key information about the value chain of the private 5G market, key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market and technology-oriented perspectives. The secondary research referred to for this research study involves various white papers like Cisco Private 5G Security White Papers and GDIT White Paper. Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect valuable information for a technical, market-oriented, and commercial study of the private 5G market.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include key industry participants, subject-matter experts (SMEs), and C-level executives and consultants from various key companies and organizations in the private 5G ecosystem. After the complete market engineering (including calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research has been conducted to verify and validate the critical market numbers obtained. Several primary interviews have been conducted with market experts from the demand and supply-side players across key regions: North America, Europe, Asia Pacific, and the Rest of the World (Middle East, Africa, and South America).

Primary data has been collected through questionnaires, emails, and telephone interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. This and the opinions of in-house subject matter experts have led us to the findings described in the remainder of this report.

Note: The three tiers of the companies are defined based on their total revenue in 2024: Tier 1 - revenue greater than or equal to USD 1 billion; Tier 2 - revenue between USD 100 million and USD 1 billion; and Tier 3 revenue less than or equal to USD 100 million. Other designations include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were utilized to estimate and validate the size of the private 5G market and its submarkets. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The entire process involved studying top players' annual and financial reports and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

Private 5G Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall size of the private 5G market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both the top-down and bottom-up approaches.

Market Definition

The private 5G market comprises a diverse range of network infrastructure and deployment models designed to deliver secure, low-latency and high-speed connectivity tailored to enterprise environments. By network type, it includes non-standalone 5G and standalone 5G, offering different levels of network independence and control. Deployment is further classified by cloud models such as private/dedicated cloud, public cloud, and hybrid cloud, enabling flexibility in data handling and scalability.

Hardware components essential for private 5G include Radio Access Network (RAN), Core Network, Backhaul & Transport, and Edge Computing Infrastructure. These systems collectively enable real-time communication, ultra-reliable connectivity, and localized data processing, which are crucial for high-performance industrial applications. Industries such as manufacturing, energy, logistics, and healthcare leverage private 5G to support mission-critical operations, automation, and intelligent edge computing.

Key Stakeholders

- Telecom Equipment Providers

- Private 5G Network Operators

- Cloud and Edge Computing Providers

- Private 5G System Integrators

- Private Enterprises

- Government & Regulatory Bodies

- Semiconductor and Chipset Manufacturers

- IT Infrastructure Providers

Report Objectives

- To estimate and forecast the size of the private 5G market, in terms of value, based on offering, network type, cloud models, organization size, spectrum allocation, frequency band, vertical, and region

- To describe and forecast the market size, in terms of value, for four major regions - North America, Europe, Asia Pacific, and Rest of World (RoW)

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing market growth

- To provide a detailed overview of the private 5G value chain

- To strategically analyze micromarkets regarding individual market trends, growth prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with a detailed competitive landscape for the market leaders

- To analyze major growth strategies such as product launches/developments and acquisitions adopted by the key market players to enhance their market position

- To analyze the impact of the macroeconomic factors impacting the private 5G market

- To assess the impact of AI on the growth and adoption of the private 5G market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the private 5G market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the private 5G market

Key Questions Addressed by the Report

Which region is expected to dominate the private 5G market?

The Asia Pacific region is expected to dominate the private 5G market due to the growth in automation and smart manufacturing and increased adoption in renewable energy projects.

What are the opportunities for new market entrants?

There are significant opportunities for start-up companies in the private 5G market. These companies provide innovative and diverse product portfolios.

What are the drivers and opportunities for the private 5G market?

Rising demand for industrial automation and smart manufacturing and increasing demand for security and privacy in enterprise networks are fueling market growth.

What are the major private 5G technologies expected to drive the market's growth in the next five years?

Major private 5G technologies expected to drive market growth include network slicing, edge computing, AI-powered network management, and cloud-native 5G core solutions. These enable scalable, low-latency, and secure connectivity tailored to enterprise needs.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Private 5G Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Private 5G Market