Pressure Washer Market Size, Share & Trends, 2025 To 2030

Pressure Washer Market by Component (Pump, Electric Motor, Gas Engine, High-pressure Hose), Power Source (Electric, Battery, Gas), Type (Portable, Non-portable), Pressure (<=103, 103-207, 207-276 Bar), Water Operation (HPW, CPW) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The pressure washer market is projected to reach USD 4.03 billion by 2030 from USD 3.19 billion in 2025, at a CAGR of 4.8% from 2025 to 2030. The demand for pressure washers is rising due to their efficiency, versatility, and growing use across residential, commercial, and industrial sectors.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific Pressure Washer market accounted for a 26.9% revenue share in 2024.

-

By TypeBy type, theportable segment is expected to register the highest CAGR of 5.2%.

-

By Power SourceBy power source, the electric segment is projected to grow at the fastest rate from 2025 to 2030.

-

By PressureBy pressure, the 207-276 bar segment is expected to dominate the market.

-

By Sales ChannelBy Sales Channel, the online segment will grow the fastest during the forecast period.

-

By ApplicationBy Application, the commercial segment is expected to dominate the market, growing at the highest CAGR of 5.2%.

-

Competetive LandscapeCompany Alfred Kärcher SE & Co. KG, Generac Power Systems, Inc., and Techtronic Industries Co. Ltd. were identified as some of the star players in the Pressure Washer market (global), given their strong market share and product footprint.

The pressure washer market is witnessing steady growth, driven by urbanization and infrastructure development drive the need for effective cleaning of buildings, pavements, and public spaces.Add itionally, the rise in DIY home maintenance and facility management services is boosting adoption. Pressure washers offer a cost-effective, time-saving solution for a wide range of cleaning tasks, fueling their increasing global demand.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

With the proliferation of IoT technologies, manufacturers are focusing on the development of pressure washers with the help of sensors that help in measuring and monitoring the pressure, temperature, level, and condition of the machine. Companies are investing heavily in research and development activities to requirements of end users. These developments are estimated to create new revenue streams for the companies operating in the pressure washer market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in automotive & transportation sector

-

Stringent government regulations on cleanliness and sanitation

Level

-

High initial investment and maintenance costs limit market penetration

-

Water consumption and environmental concerns limit widespread adoption

Level

-

Integration of smart features and battery-operated designs creates new market avenues

-

Urbanization and infrastructure development in emerging economies expand market potential

Level

-

Competition from traditional and alternative cleaning technologies hinders market growth

-

Technical limitations restrict use of pressure washers in indoor and sensitive environments

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in automotive & transportation sector

Increase in rental fleets and ride-sharing businesses further drive demand because such cars need instant, constant cleaning between hands. Moreover, stricter environmental rules on the consumption of water and chemicals as used for cleaning drive pressure washer uptake, which is water conserving and uses fewer strong chemicals. Technological advancements in pressure washer models like portable, electric, and battery types enhance their usability and availability in automotive and transportation industries. Typically, the market growth and rising maintenance levels and environmental considerations are pushing pressure washer demand to experience a steady rise.

Restraint: Water consumption and environmental concerns are limiting widespread adoption

Even with greater adoption of pressure washers, environmental concerns and the use of water continue to be main limiting factors against higher adoption. Pressure washers, particularly high volume commercial pressure washers, consume significant amounts of water in use over a sustained period, which presents a challenge as far as sustainability is concerned where areas are not endowed with water. Such high consumption of water is contrary to attempts to save and reduce environmental effects globally.

Opportunity: Integration of smart features and battery operated designs is creating new opportunities

Convergence of battery-based technology and smart technology in pressure washers is introducing new market growth and consumer adoption opportunities. Sensor-enabled, mobile app-controlled Internet of Things-smart pressure washers provide consumers with more convenience, efficiency, and control. The technologies provide real-time water consumption, pressure, and maintenance alerts to improve performance and extend equipment life.

Challenge: Competition from traditional and alternative cleaning technologies is hindering the market growth

Pressure washing business innovation is being curtailed by competition from conventional and other clean technology because consumers can buy cheaper, simpler, or conventional alternatives. Conventional hand wash, hose wash, and mopping are yet present, particularly in low purchasing power or limited access to high technology equipment areas.

Pressure Washer Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Development of electric and cordless pressure washers for residential and light commercial cleaning. | Eco-friendly design, reduced noise levels, and enhanced portability with consistent cleaning efficiency. |

|

Integration of gas-powered engines in heavy-duty pressure washers for industrial and construction applications. | High cleaning power, durability under continuous use, and compatibility with multiple accessories for diverse cleaning tasks. |

|

Production of cordless, battery-powered pressure washers under brands like Ryobi and Milwaukee. | Enhanced mobility, reduced emissions, user convenience through battery interchangeability across tools. |

|

Manufacture of compact and portable residential pressure washers under Stanley and DeWALT brands. | Lightweight construction, ergonomic handling, efficient performance for small to medium cleaning jobs. |

|

Deployment of professional and industrial-grade high-pressure washers for automotive, agriculture, and manufacturing sectors. | Superior water flow and pressure control, long service life, and compliance with industrial safety and environmental standards. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The pressure washer ecosystem connects manufacturers (of parts like pumps and the final washers) with a diverse channel of distributors, retailers, and professional cleaning services. This entire network is built to serve a broad spectrum of end-users, from a homeowner (DIY) washing a car to an industrial plant cleaning heavy equipment.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Pressure Washer Market, By Power Source

Electric pressure washers are expected to grow at the fastest rate in the forecast period due to the fact that they are being used among home consumers as well as small businesses looking for dependable, eco-friendly, and light-hand cleaning equipment. Electric pressure washers are simpler, quieter, and less of a hassle to keep in working condition than gas tools since they do not imply combustion

Pressure Washer Market, By Application

Commercial applications dominate the pressure washer industry due to growing demand for efficient, time-consuming cleaning technology across different industries. Construction, automotive, agriculture, hospitality, logistics, and public infrastructure rely heavily on pressure washers to maintain cleanliness, safety, and sanitation. Pressure washers assist in cleaning surfaces of buildings, equipment, and machinery used in construction and industrial settings, including oil, grime, and trash

Pressure Washer Market, By Water Operation

The growth of hot water pressure washers is primarily driven by their superior ability to remove grease, oil, and heavy industrial grime, making them indispensable in sectors like automotive, manufacturing, and food processing. As industries increasingly prioritize hygiene and compliance with regulatory standards, hot water models are being adopted to meet stringent cleanliness requirements. Their ability to cut through dirt faster also enhances operational efficiency by reducing cleaning time and labor costs. Additionally, the rising demand from commercial cleaning services and rental businesses is further propelling market expansion. These factors collectively position hot water pressure washers as a preferred choice for heavy- duty and professional applications.

Pressure Washer Market, By Type

Portable pressure washers are expected to grow the fastest in the forecast period due to their versatility, convenience, and increasing demand from both residential and commercial users. These units are compact, lightweight, and easy to transport, making them ideal for a wide range of tasks such as vehicle cleaning, outdoor furniture maintenance, and spot-cleaning equipment in industries.

REGION

Asia Pacific to be fastest-growing region in global aerospace materials market during forecast period

The Asia Pacific pressure washer market is expected to register the highest CAGR during the forecast period, due to the factors such as rapid industrialization, urbanization, infrastructure development, and rising consumer awareness. Countries like China, India, Japan, and Southeast Asian nations are investing heavily in manufacturing, construction, and public infrastructure, all of which require efficient cleaning solutions to maintain equipment and facilities.

Pressure Washer Market: COMPANY EVALUATION MATRIX

In the pressure washer market matrix, Alfred Kärcher SE & Co. KG (Star) leads with a strong market presence and an extensive product portfolio, enabling widespread adoption of pressure washers across residential, commercial, and industrial cleaning applications. Deere & Company (Emerging) is steadily gaining traction with innovative equipment solutions focused on agricultural and turf maintenance. While Alfred Kärcher SE & Co. KG dominates through scale and an established customer base, Deere & Company demonstrates solid growth potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.06 Billion |

| Market Forecast in 2030 (Value) | USD 4.03 Billion |

| Growth Rate | CAGR of 4.8% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, RoW |

WHAT IS IN IT FOR YOU: Pressure Washer Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Pressure Washer Manufacturer | Competitive profiling of global and regional manufacturers (Kärcher, Generac, TTI, Stanley Black & Decker, Nilfisk) | End-user adoption mapping (commercial, residential/DIY, industrial) |

| European Electric Pressure Washer OEM | Application benchmarking for cordless battery technology and smart IoT-enabled systems | Sensor integration roadmap for pressure monitoring and auto-shutoff features |

| Asia-Pacific Component Supplier (Water Pump Manufacturer) | Volume-demand forecast for water pumps across pressure ranges (207-276 bar, >276 bar) | Technical benchmarking (axial vs. triplex pump designs, durability, flow rate) |

| US-based Gas Engine Supplier | Global & regional production capacity for gas-powered pressure washers | Pipelines of capacity expansions & new entrants |

| European Cold Water Pressure Washer Manufacturer | Market penetration analysis for cold water vs. hot water pressure washers by application | Regional adoption trends (Europe, North America, Asia Pacific) |

RECENT DEVELOPMENTS

- March 2024 : Kärcher is broadening its range of pressure washers for home and garden use with the launch of the K 2 Horizontal, K 2 Premium Horizontal, and K 3 Horizontal models. These new models feature a horizontal design, offering Kärcher’s renowned quality in a compact form.

- April 2023 : Nilfisk launched the MC 9P and MC 10P – two new Very High Pressure (VHP) washers built to tackle the most demanding cleaning challenges in the professional segment. Delivering up to five times the power of conventional high-pressure washers, these models are engineered for exceptional performance in extreme conditions.

- April 2021 : Alfred Kärcher SE & Co. KG launched the K Mini pressure washer. The K Mini pressure washer extends the product range of the company’s pressure washers and is designed for applications such as bicycles, prams, scooters, flowerpots, and garden furniture.

- February 2021 : Nilfisk Group launched the next-generation high-pressure washers with four new models: 125, 130, 140, and 140 In-Hand Power control pressure washers. These new models are designed with new features, such as an internal hose reel, ultra-flex hose, and in-hand power control.

Table of Contents

Methodology

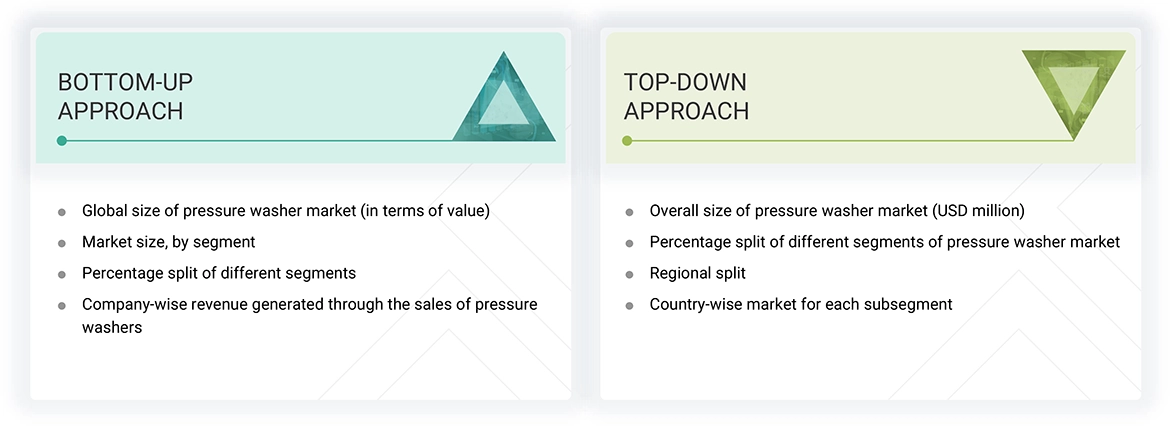

The study utilized four major activities to estimate the pressure washer market size. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

IIn the secondary research process, various sources were used to identify and collect information on the pressure washer market for this study. Secondary sources for this research study include corporate filings (annual reports, investor presentations, and financial statements), trade, business, and professional associations, white papers, certified publications, articles by recognized authors, directories, and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

Primary Research

Primary interviews were conducted to gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting. Additionally, primary research was used to comprehend the various technology, type, end use, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end user installation teams using pressure washer market offerings and processes, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of pressure washer market, which will impact the overall market. Several primary interviews were conducted across major countries in North America, Europe, Asia Pacific, and RoW.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study's overall market size estimation process.

Pressure Washer Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall size of the pressure washer market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. Various factors and trends from the demand and supply sides were studied to triangulate the data. The market was validated using both top-down and bottom-up approaches.

Market Definition

The pressure washer market comprises businesses engaged in designing, manufacturing, and distributing high-pressure cleaning equipment. These machines, ranging from compact residential units to heavy-duty industrial systems, use high-pressure water spray to remove dirt, grime, and other contaminants from surfaces such as vehicles, buildings, and pavements. Market growth is due to rising construction activities, the expansion of car wash facilities, and increasing demand for efficient cleaning solutions across residential, commercial, and industrial sectors. Technological advancements and a growing emphasis on sustainability and water efficiency further support market development.

The report comprehensively analyzes the varistor and GDT market based on product type, application, and region. A few key manufacturers of varistors and GDTs are Littelfuse, Inc. (US), TDK Corporation (Japan), YAGEO Group (Taiwan), KYOCERA AVX Components Corporation (US), Bourns, Inc. (US), Eaton (Ireland), Weidmüller Interface GmbH & Co. KG (Germany), and HUBER+SUHNER (Switzerland).

Key Stakeholders

- Pressure washer manufacturers

- Associations and industrial bodies

- Government bodies, such as regulating authorities and policymakers

- Financial institutions and investment communities

- Market research and consulting firms

- Raw material suppliers and distributors

- Research institutes and organizations

- Original equipment manufacturers (OEMs)

- Pressure washer traders and suppliers

Report Objectives

- To describe and forecast the pressure washer market size, by component, type, power source, water operation, pressure, application, sales channel, and region, in terms of value

- To describe and forecast the market for various segments across four main regions, namely North America, Europe, Asia Pacific, and RoW, in terms of value

- To describe and forecast the market, by type and power source, in terms of volume

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the markets

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing market growth

- To analyze opportunities for stakeholders by identifying high-growth segments in the market

- To provide a detailed overview of the pressure washer market value chain

- To strategically analyze key technologies, average selling price trends, trends impacting customer business, ecosystem, regulatory landscape, patent landscape, Porter's five forces, import and export scenarios, trade landscape, key stakeholders and buying criteria, and case studies pertaining to the market under study

- To strategically profile key players in the pressure washer market and comprehensively analyze their market share and core competencies

- To analyze competitive developments, such as partnerships, collaborations, product launches, and research and development (R&D), in the pressure washer market

Customization Options:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the pressure washer market

Product Analysis

- ? The product matrix provides a detailed comparison of the product portfolio of each company in the pressure washer market.

Key Questions Addressed by the Report

Which region has the highest pressure washer market potential?

Asia Pacific is projected to grow at the highest CAGR in the pressure washer market during the forecast period.

What are the opportunities for new market entrants?

Integration of smart features and battery-operated designs and urbanization and infrastructure development will offer potential growth opportunities for players in this market.

What are the key factors driving the pressure washer market?

Market drivers include rising demand for outdoor cleaning and growth in the automotive and transportation sectors.

What key applications of pressure washers will drive the pressure washer market in the next five years?

Commercial and residential sectors are among the key applications of pressure washers.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Pressure Washer Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Pressure Washer Market