Plant Biotechnology Market

Plant Biotechnology Market by Product Type (Crop Protection & Nutrition Solution Products, Biotech Seed & Traits, Synthetic Biology Enabled Products), Technology Type, Crop Type, End User, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The plant biotechnology market is estimated at USD 51.73 billion in 2025 and is projected to reach USD 76.79 billion by 2030, at a CAGR of 8.2% from 2025 to 2030. Rising global food security concerns, climate-resilient crop development, demand for sustainable agriculture, and resistance to pests and diseases, are boosting the market growth. The plant biotechnology market has been witnessing a huge shift in terms of innovative products and patent registrations, thereby indicating a growing demand for the latest agricultural technologies. Global players are making heavy investments in R&D to manufacture products that are economical and suitable for use with fertilizers and pesticides.

KEY TAKEAWAYS

-

BY PRODUCT TYPEThe plant biotechnology market, by product includes crop protection & nutrition solutions products, biotech seeds/ traits, synthetic biology enabled products. Biotech seeds & traits dominate the market, driven by the widespread adoption of genetically modified crops with insect resistance and herbicide tolerance, particularly in cereals, oilseeds, and vegetables. The segment's dominance is fueled by strong regulatory approvals, increasing demand for high-yielding seeds, and the expanding acreage of genetically engineered crops globally.

-

BY TECHNOLOGYThe plant biotechnology market, by technology, encompasses genetic engineering, marker-assisted breeding, genome editing, tissue culture, synthetic biology, and other emerging methods. Genetic engineering, which involves the direct modification of plant genomes using transgenes to introduce traits like insect resistance and herbicide tolerance, dominates the market due to its extensive adoption in biotech seeds/traits, particularly in major row crops such as corn, soybean, and cotton. This dominance is driven by established regulatory approvals, large-scale commercial adoption, and proven economic benefits to farmers.

-

BY CROP TYPEThe plant biotechnology market, categorized by crop type, includes cereals & grains, oilseeds & pulses, fruits & vegetables, and other crop types. Cereals & grains dominate the market due to their essential role in global food security and high adoption of biotech traits such as insect resistance and herbicide tolerance, particularly in crops like corn, rice, and wheat. Large-scale commercialization of genetically modified (GM) corn and rice varieties, coupled with increasing investments in hybrid and genome-edited cereals, reinforces this segment's leadership.

-

BY END USERThe plant biotechnology market, by end user, encompasses seed companies, agricultural input suppliers, the food & beverage industry, biofuel & biochemical companies, pharmaceutical & biopharma firms, and government & research institutes. Seed companies dominate this market due to their extensive adoption of biotech seeds and traits, particularly in genetically modified (GM) and genome-edited crops. These companies leverage biotechnological advancements such as insect resistance, herbicide tolerance, and stacked traits to enhance crop productivity, resilience, and market acceptance. Their strong integration with plant breeding and CRISPR-based genome editing ensures sustained market leadership.

-

BY REGIONNorth America is dominating the plant biotechnology market. It represents one of the world's most integrated agricultural biotechnology and crop protection markets despite significant regulatory and cultural differences between the United States, Canada, and Mexico. The North American Free Trade Agreement (NAFTA), succeeded by the United States-Mexico-Canada Agreement (USMCA) in 2020, has created deep agricultural trade interdependencies while attempting to harmonize aspects of agricultural input regulation. Currently, the region accounts for approximately 45% of global biotech crop acreage and represents about 25% of the global crop protection market value. Europe and Asia Pacific also hold a significant share in the global plant biotechnology market

-

COMPETITIVE LANDSCAPEKey players in plant biotehnology market include Bayer AG (Germany), Corteva (US), Syngenta Group (Switzerland), BASF SE (Germany), KWS SAAT SE & Co. KGaA (Germany), UPL (India), FMC Corporation (US), Sumitomo Chemical Co., Ltd (Japan), Nufarm (Australia), and ProFarm (US).. These companies adopt organic growth strategies, such as launching new services and expansions, and inorganic growth strategies, such as partnerships, agreements, collaborations, and acquisitions, to strengthen their position in the market.

The plant biotechnology market is primarily driven by the growing need for high-yield and stress-tolerant crops, which are essential to meeting global food demand amidst rising climatic uncertainties. The expansion of biotech seeds and traits, particularly stacked traits combining insect resistance and herbicide tolerance, has led to widespread adoption in key agricultural economies. Furthermore, there is a strong shift toward sustainable and organic agricultural practices, driving the demand for biopesticides, biofertilizers, and plant growth regulators as alternatives to chemical inputs. Advancements in genome editing, particularly CRISPR, are revolutionizing plant breeding by enabling precise genetic modifications, reducing development timelines, and avoiding regulatory hurdles associated with traditional GMOs. Beyond agriculture, plant biotechnology is making significant inroads into industrial applications, including bio-based pharmaceuticals, biofuels, and food enzymes, further broadening its market potential.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The plant biotechnology market is shifting from traditional breeding toward advanced genetic and bio-based solutions driven by demand for high-yield, climate-resilient, and sustainable crops across seed, agrochemical, food, and research sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rise in seed replacement rate

-

High adoption of biotech crops

Level

-

Long approval period for new products

-

High R&D expenses on quality biotech seed development

Level

-

Public-private partnerships in varietal seed development

-

Increasing use of molecular breeding technology

Level

-

Unorganized new entrants with low profit-to-cost ratio

-

Lack of availability and access to high-quality plant biotechnology products

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Rise in seed replacement rate

Seeds act as the foundation for the progress of the food chain and play a significant role in the sustainability of the agri-food system. Farmers across the globe have been gradually shifting from traditional farming methods to gain higher yields and profit from restricted resource availability. Commercial seeds are one of the major trends in the industry. According to a report published by Syngenta, one of the leading players in the commercial seeds industry, the global seeds market has grown by almost 90% since 2000.In the global seeds market, rice's share is minimal, owing to the high importance of other industrial crops such as cotton, corn, and soybeans. For rice, farmers have been sowing hybrid seeds as opposed to open varietal types in Asian countries such as China and India, which can be reflected in the rising seed replacement rate (SRR) across different Asian countries for paddy. According to the FAO, Asia contributed to 90% of the rice production and consumption in the world in 2021, and hence, FAO has supported many Asian countries in various projects to publicize the use of hybrid rice seeds technology through demonstrations and training. These activities contribute significantly to increasing the SRR across other major rice-producing countries, such as Indonesia and Vietnam. Awareness among farmers regarding the advantages of using certified genetically modified seeds has resulted in high demand for them in the past few years. Although the price of GM seeds is higher than farm-saved seeds, the associated advantages of higher yield and better quality have spurred the growth of this market. Furthermore, various private seed producers have also supported the activities to promote the adoption of GM seeds. FAO-supported initiatives in Asia are promoting hybrid rice seed technology through demonstrations and training, increasing the SRR in major rice-producing countries like Indonesia and Vietnam. The rising demand for GM seeds, due to their higher yield potential and better quality, is expanding the market for biotech-enhanced crops.

Restraint: Long approval period for new products

The approval process for plant growth regulators is very lengthy due to multi-location field trials and residual effects for synthetic plant growth regulators. Due to the stringent regulatory approval process, the average time taken to bring a new crop protection product to market can exceed ten years and cost more than USD 100 million. Patent protection and exclusivity are critical in helping companies recover the costs of research & development, incentivizing them to make future investments that will lead to continued industry-wide growth. Increased costs due to product development and a greater regulatory period led to increased retail prices, reducing the net profit value for growers. The decreased profit margins cannot help improve the manufacturers' growth in the market. Even for generic products, it can take up to five years to get the product registered. To bring a new, improved biotechnological product to market, manufacturers must undergo a lengthy and expensive approval process with both state and federal regulators. There is currently no clear regulatory framework for these products in many jurisdictions. The regulatory bodies do not have adequate resources and infrastructure to execute the timely registration of products. At times, the rules are not clearly defined, creating interpretation challenges for the regulatory bodies and leading to confusion, thereby adding to the complexities for crop protection chemical companies. This makes it difficult for companies to commercialize new products and brings down investment in research and development. Regulation (EC) No 1107/2009 governs the marketing of plant protection products (PPPs) within the European Union. Prior to their market availability or usage, PPPs must receive authorization in the respective EU country. This regulation establishes the guidelines and processes for PPP authorization.

Opportunity:Public-private partnerships in varietal seed development

The public sector is strengthening its network to develop improved varieties of seeds; it is also encouraging the private sector to produce hybrid and disseminating technologies. The public sector, which includes research institutes and government organizations, plays a crucial role in facilitating germplasm research in the private sector and joining hands to promote existing technologies among farmers. The public-private partnership is an agreement between public agencies (federal, state, and local) and private sector entities. Through the partnership, the public and private sectors jointly work toward delivering a service or facilities for the use of consumers. In addition, this sharing of resources helps them in sharing risks and reward potentials in the services and facilities. With agriculture employing over 50% of India's workforce and contributing approximately 17% to the national GDP, sustained growth in the sector necessitates the integration of innovative technologies and modern agricultural practices. The private sector has played a crucial role in driving these advancements, particularly through biotechnology and the development of high-yield seed varieties. A notable example is the adoption of genetically modified BT cotton, which by 2022 led to a 24% increase in yield and a 50% reduction in pesticide usage. This underscores the significant impact of public-private partnerships in enhancing agricultural productivity and sustainability.

Challenge: Unorganized new entrants with low profit-to-cost ratio

New technologies, such as breeding methods, are creating opportunities for new entrants in the market, some of which disrupt the market for larger players. New entrants in the market do not have brand recognition, but the seed prices of these small players are very low compared to those of the established players, which affects the market share of the big players. The easy availability of raw materials for seed products is the key aspect for domestic players; however, finding the distributor and adding a layer to the value chain either reduces the profit margin or increases the product cost. The competition with the domestic players and the new, cheaper technologies available for breeding are challenging the larger players. Low brand loyalty is also one of the key factors challenging the plant biotechnology market for seeds globally.

Plant Biotechnology Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Flipper is derived from a natural by-product of extra virgin olive oil, which targets pest insects. Flipper is derived from a natural by-product of extra virgin olive oil, which targets pest insects. | FLiPPER is a contact bio-insecticide/acaricide for the effective control of aphids, whiteflies, thrips and spider mites and good control of mealybugs, leafhoppers, psyllids, suckers and scale insects. It is effective against all insect and spider mite life stages, particularly against motile forms. |

|

Hearken biological insecticide is a virus-based solution specifically targeting Heliothine species, without affecting beneficial or non-target organisms. | Controls Heliothine Species Across Generations |

|

Bazooka helps in the grass and weeds suppression field. It is a variety of Barley seeds. | Deliver a higher yield than conventional feed barley. |

|

Serifel is a preventative fungicide based on Bacillus amyloliquefaciens strain MBI600 with multiple modes of action. | Biological control agents such as biological fungicides and biological insecticides help reduce the damage caused by diseases and pests, including fungi, insects, and slugs. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The plant biotechnology market ecosystem connects biotechnology manufacturers, end-user companies, regulatory bodies, and research institutions in a highly interdependent and innovation-driven landscape. Leading biotechnology manufacturers such as Bayer, Corteva Agriscience, FMC Corporation, Sumitomo Chemical, Syngenta, Nufarm, Koppert Biological Systems, and Limagrain develop and commercialize advanced plant biotechnology solutions including genetically modified seeds, biopesticides, biostimulants, and precision breeding technologies to enhance crop productivity, stress tolerance, and sustainability. Major end-user companies including Cargill, CGC (China Grains and Cereals), GrainCorp, and Wilmar International rely on these biotechnology innovations to secure resilient crop supplies, improve agricultural efficiency, meet food security demands, and achieve sustainability commitments across their supply chains. Oversight from regulatory authorities such as the EPA (Environmental Protection Agency), FDA (Food and Drug Administration), EFSA (European Food Safety Authority), and US Food & Drug Administration ensures rigorous safety assessments, environmental impact evaluations, and compliance with biosafety regulations for genetically modified organisms and novel biotechnology products. In parallel, research and academic institutes such as CGIAR (Consultative Group on International Agricultural Research), ISAAA (International Service for the Acquisition of Agri-biotech Applications), ICAR (Indian Council of Agricultural Research), NSI (National Sorghum Improvement), and specialized university research centers play a vital role in advancing plant genomics, developing climate-resilient varieties, conducting field trials, and translating scientific discoveries into practical agricultural applications. Together, these stakeholders drive innovation in crop improvement, regulatory harmonization, and the development of sustainable agricultural biotechnology frameworks that enhance global food security and environmental stewardship.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Plant Biotechnology Market, By Product

Biotech seeds and traits dominate the plant biotechnology market because they deliver the most direct, scalable, and commercially valuable benefits across the agricultural value chain. Unlike other biotechnology applications that serve as enabling tools or inputs, genetically modified (GM) and gene-edited seeds offer immediate and tangible advantages at the farm level. Farmers experience improved yields, reduced input costs, and greater crop resilience through traits such as insect resistance, herbicide tolerance, and drought tolerance. These benefits are realized within a single planting season, making adoption simple and economically compelling compared to complex or long-term biotech solutions. Moreover, the ability of biotech traits to reduce dependence on agrochemicals and improve resource-use efficiency has strengthened their position as both a productivity and sustainability solution.

Plant Biotechnology Market, By Crop Type

Cereals and grains dominate the plant biotechnology market because they represent the foundation of global food security, trade, and agricultural production, making them the most impactful and commercially viable targets for biotechnology innovation. Crops such as maize, rice, wheat, and sorghum occupy the largest share of global cultivated land and serve as staple foods for the majority of the world’s population. As a result, applying biotechnology to these crops directly addresses key global challenges—food availability, climate resilience, and sustainable productivity—while offering the greatest return on investment for developers and farmers alike. One of the main reasons for their dominance is scale and economic significance. Cereals and grains account for over half of the world’s harvested acreage and contribute significantly to feed, food, and biofuel industries. Biotechnology applications in these crops—such as genetically modified (GM) maize and rice—provide substantial yield improvements, pest and disease resistance, and tolerance to abiotic stresses like drought and salinity. These traits not only enhance farm productivity but also stabilize supply chains and reduce post-harvest losses. Given their high global demand, even incremental gains in yield or stress tolerance translate into major economic and food security benefits, incentivizing continuous biotech investment in this segment.

REGION

Asia Pacific is estimated to be the fastest region in plant biotechnology market

Asia Pacific is projected to be the fastest-growing market, with a high CAGR over the next five years. This growth is propelled by rising food security concerns, government initiatives supporting biotech adoption, and increasing investments in agricultural biotechnology across China, India, and Southeast Asia. As per an article by Reuters published in December 2024, China approved five gene-edited crop varieties and 12 genetically modified (GM) soybean, corn, and cotton varieties to enhance domestic crop yields, reduce import dependence, and ensure food security. The approvals granted by the Ministry of Agriculture and Rural Affairs include seeds from Beijing Dabeinong Biotechnology Co., Ltd. (China) and China National Seed Group (a Syngenta Group subsidiary). This move aligns with China’s broader push to expand biotech adoption in agriculture, particularly for high-yield GM corn and soybean varieties. While China primarily imports GM crops for animal feed, domestic cultivation is gradually expanding under government-backed initiatives. Additionally, as per the same source, China approved the import of an insect-resistant and herbicide-tolerant GM soybean variety from BASF SE (Germany) for processing. The five-year safety certificates for these varieties reflect China’s commitment to biotechnology as a strategy to boost agricultural productivity and food security, supporting its policy shift toward biotech-enabled farming. Moreover, the expanding role of plant biotechnology in biofuels, biopharmaceuticals, and industrial biochemicals further amplifies its market potential globally.

Plant Biotechnology Market: COMPANY EVALUATION MATRIX

In the plant biotechnology matrix Bayer AG (Switzerland), is a leading player in the market. Bayer's commitment to plant biotechnology is integral to its Crop Science division, focusing on enhancing crop yields, improving resistance to pests and diseases, and promoting sustainable farming practices. The company's approach leverages cutting-edge technologies, including genetic modification and advanced breeding techniques, to develop crops that meet the evolving needs of global agriculture. Bayer has a collection of over 125,000 microbial strains, enabling the company to use genetic diversity to develop new and beneficial products. The company provides innovative solutions through advanced research in microbial and RNAi technology, which utilizes RNA interference to enhance the efficiency of its products. Its acquisition of Monsanto (US) has resulted in further advancements in research on RNAi technology to improve crop protection solutions. FMC Corporation (US) is an emerging player in the market.FMC Corporation (FMC) is an agricultural sciences company that advances farming through innovative and sustainable crop protection technologies. The company operates its business in five different segments: Fungicides, Insecticides, Herbicides, Plant Health, and Others. Under the Plant Health segment, the company offers agricultural biological products to farmers globally. The company's biological portfolio encompasses biopesticides, crop and soil enhancers, biostimulants, biofertilizers, and pheromones. FMC acquired BioPhero, a Denmark-based pheromone research and production company, in 2022 to expand its biological platforms.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 47.89 Billion |

| Revenue Forecast in 2030 | USD 76.79 Billion |

| Growth Rate | CAGR of 8.2% from 2025-2030 |

| Actual data | 2020–2030 |

| Base year | 2024 |

| Forecast period | 2025–2030 |

| Units considered | Value (USD Million), Volume (Kilo Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Technology Type: Genetic engineering, Marker assissted breeding, Genome editing, Tissue culture, Synthetic biology, Other technologies • By Product : Crop protection & Nutrition solutions products, Biotech seeds/ traits, Synthetic biology enabled products • By Crop Type : Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Other Crop Types • By End-users: Seed companies, Agricultural input suppliers, Food & beverage industry, Biofuel & biochemical companies, Pharmaceutical & biopharma, Government & research institutes |

| Regions Covered | North America, Europe, Asia Pacific, South America, Row |

WHAT IS IN IT FOR YOU: Plant Biotechnology Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global seed companies and agricultural biotech firms | · Competitive profiling of 20+ regional and global players (financials, product mix, pricing strategies) | · Identified white spaces for novel trait development and licensing opportunities |

| Agricultural input manufacturers (adopters of biotech traits) | Segmentation of plant biotechnology solutions by trait category (herbicide tolerance, insect resistance, drought tolerance, nitrogen use efficiency, yield enhancement, nutritional quality), crop type (corn, soybean, cotton, canola, rice, wheat), and technology platform (transgenic, gene editing, RNA interference, marker-assisted selection) | Identifies high-value trait categories (climate resilience traits command premiums) versus commodity traits (herbicide tolerance) |

| Investment firms and venture capital (agtech investors) | · Market sizing and growth forecasts by trait category, crop segment, and geographic region | · Identified high growth investment segements (gene editing platforms, climate resilient traits, specialty crop biotech) |

RECENT DEVELOPMENTS

- October 2024 : BASF SE (Germany) and AgroSpheres collaborated to develop a novel bioinsecticide designed to improve crop protection. The collaboration utilizes AgroSpheres' AgriCell-powered biomolecules, enabling the product to deliver high efficacy at low dose rates against lepidopteran pests. This aims to provide sustainable crop protection solutions to farmers globally.

- July 2024 : Syngenta (Switzerland) completed the acquisition of Produtécnica, a distributor of agricultural inputs in Maranhão, Piauí, and Tocantins, via its SYNAP Commercial Platform, following CADE's approval. This acquisition strengthens Syngenta's business by expanding its reach in a key agricultural frontier, providing farmers with enhanced access to its innovative technologies and services, including biopesticides, in Brazil's growing agribusiness market.

- April 2024 : Bayer AG (Germany) signed an agreement with UK-based AlphaBio Control for a new biological insecticide. This strategic move will strengthen Bayer's product portfolio, as the new insecticide will be the first of its kind available for arable crops like oilseed rape and cereals, allowing Bayer to enhance its offerings in sustainable crop protection.

- July 2023 : Lavie Bio Ltd., a subsidiary of Evogene Ltd., and Corteva(US) entered into a licensing agreement, granting Corteva exclusive rights to further develop and commercialize Lavie Bio’s lead bio-fungicide product candidates. These products target fruit rots and powdery mildew and were discovered and developed by Lavie Bio. The agreement follows two years of independent field validation conducted by both companies, which will help expand the company’s product offerings.

Table of Contents

Methodology

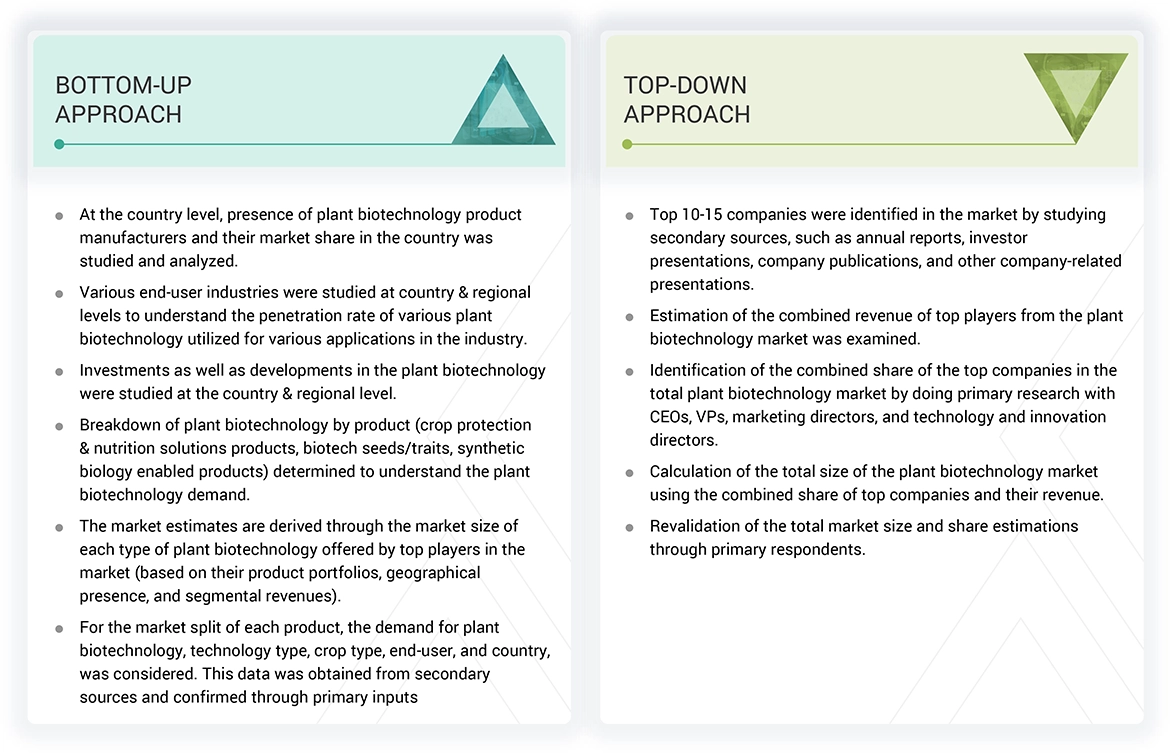

The study involved two major approaches in estimating the current size of the plant biotechnology market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

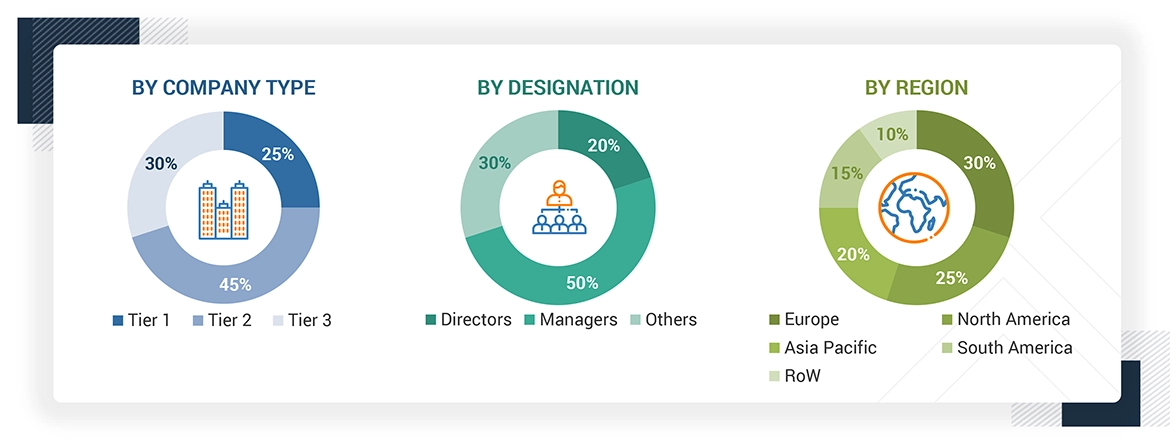

Primary Research

Extensive primary research was conducted after obtaining information regarding the plant biotechnology market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology type, product, crop type, end-user and region. Stakeholders from the demand side, such as research institutions and plant biotechnology distributors and retailers, and manufacturing comapnies were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of plant biotechnology and the outlook of their business, which will affect the overall market.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

BASF SE (Germany) |

General Manager |

|

Bayer AG (Germany) |

Sales Manager |

|

Corteva Agriscience (US) |

Manager |

|

UPL (India) |

Sales Manager |

|

FMC Corporation (US) |

Marketing Manager |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the plant biotechnology market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Plant Biotechnology Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall plant biotechnology market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

According to the US Department of Agriculture, plant biotechnology is a set of techniques used to adapt plants for specific needs or opportunities. Plant biotechnologies supporting the development of new varieties and traits include genetics and genomics, marker-assisted breeding (MAB), biotech (genetically engineered) crops, and others. The biotechnology enable researchers to identify and map genes, determine their functions, selectively breed for desirable genetic traits, and transfer specific genes into plants to enhance targeted characteristics.

Stakeholders

-

Genetic solution providers and biotechnological companies

Technology providers and lab instrument & equipment manufacturers

Commercial and Biotech seed companies

Manufacturers of biopesticides, biofertilizers, and plant growth regulators

Research institutions/agencies/laboratories/academic institutions

Concerned government authorities, commercial R&D institutions, and other regulatory bodies- Food and Agriculture Organization (FAO)

- World Health Organization (WHO)

- US Department of Agriculture (USDA)

- European Food Safety Authority (EFSA)

- European Commission

- Government Agencies

-

Associations

- International Seed Federation (ISF)

- American Seed Trade Association (ASTA)

- US National Corn Growers Association (NCGA)

- American Society of Plant Biologists

- International Association for Plant Biotechnology

- Importers, exporters, distributors, & traders

Report Objectives

- To determine and project the size of the plant biotechnology market with respect to the technology type, end-user, product, crop type and region in terms of value over five years, ranging from 2025 to 2030.

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market.

- To identify and profile the key players in the plant biotechnology market.

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe plant biotechnology market into key countries.

- Further breakdown of the Rest of Asia Pacific plant biotechnology market into key countries.

- Further breakdown of the Rest of South America plant biotechnology market into key countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Plant Biotechnology Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Plant Biotechnology Market