The objective of the study is to analyze the key market dynamics, such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as acquisitions, product launches, expansions, collaborations, agreements, and partnerships of the leading players, the competitive landscape of the pipette calibrators market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments, the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Collecting Secondary Data:

The secondary research data collection process involves the usage of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), annual reports, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the pipette calibrators market. A database of the key industry leaders was also prepared using secondary research.

Collecting Primary Data:

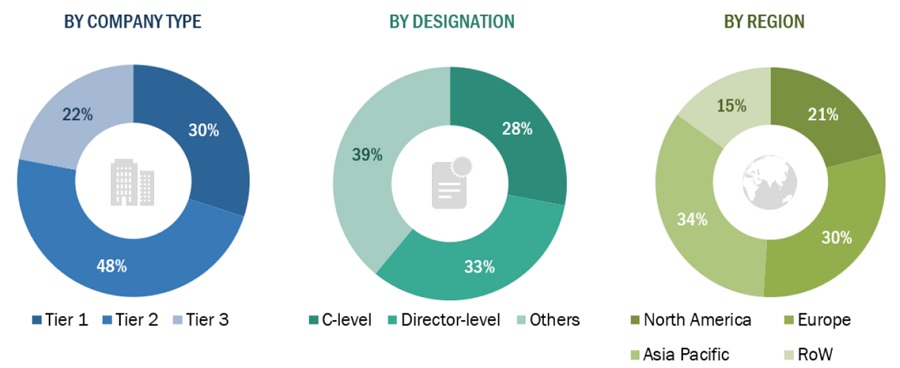

The primary research data was conducted after acquiring knowledge about the pipette calibrators market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such as pharmaceutical & biotechnology industries, hospitals, and research & academic institutes) and supply side (such as included various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing, and product development teams, product manufacturers, wholesalers, channel partners, and distributors) across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Approximately 40% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 60%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Participants:

Note 1: *Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue as of 2022: Tier 1=> USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3=< USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation:

All major product manufacturers offering various pipette calibrators were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value pipette calibrators market was also split into various segments and subsegments at the region and country level based on:

-

Product mapping of various manufacturers for each type of pipette calibrators market at the regional and country-level

-

Relative adoption pattern of each pipette calibrators market among key application segments at the regional and/or country-level

-

Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country level.

-

Detailed secondary research to gauge the prevailing market trends at the regional and/or country level

Global Pipette calibrators Market Size: Top Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Pipette calibrators Market Size: Bottom-Up Approach

Data Triangulation:

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Pipette calibrators industry.

Market Definition:

Pipettes are essential tools for accurately measuring and transferring liquids in various scientific fields, including biology, chemistry, and medicine. The accuracy and precision of pipettes depends on various factors, such as the design of the pipette, the operator’s technique, and the calibration of the pipette. Pipette calibration is a process of verifying the accuracy of a pipette’s volume measurements. The calibration process involves comparing the actual volume dispensed by the pipette with the intended volume. Calibration can be done using either gravimetric or photometric methods.

Key Stakeholders:

-

Senior Management

-

Finance/Procurement Department

-

R&D Department

-

Scientists/Technicians

Report Objectives:

-

To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

-

To define, describe, segment, and forecast the pipette calibrators market by market by type, channel type, method, application, end user, and region

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

-

To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall pipette calibrators market

-

To forecast the size of the pipette calibrators market in five main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific, Rest of the world.

-

To profile key players in the pipette calibrators market and comprehensively analyze their core competencies and market shares

-

To track and analyze competitive developments, such as acquisitions; product launches; expansions; collaborations, agreements, & partnerships; and R&D activities of the leading players in the pipette calibrators market.

-

To benchmark players within the pipette calibrators market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

-

Additional country-level analysis of the Pipette calibrators market

-

Profiling of additional market players (up to 5)

Product Analysis:

-

Product matrix, which provides a detailed comparison of the product portfolio of each company in the Pipette calibrators Market

Growth opportunities and latent adjacency in Pipette Calibrators Market