This research study extensively utilized secondary sources, directories, and databases to identify and gather valuable information for analyzing the global PFAS testing market. Additionally, in-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives from leading market players, and industry consultants. These interviews helped obtain and validate critical qualitative and quantitative data while assessing the market's growth prospects. The global market size, initially estimated through secondary research, was then refined and finalized through triangulation with insights from primary research.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the PFAS testing market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

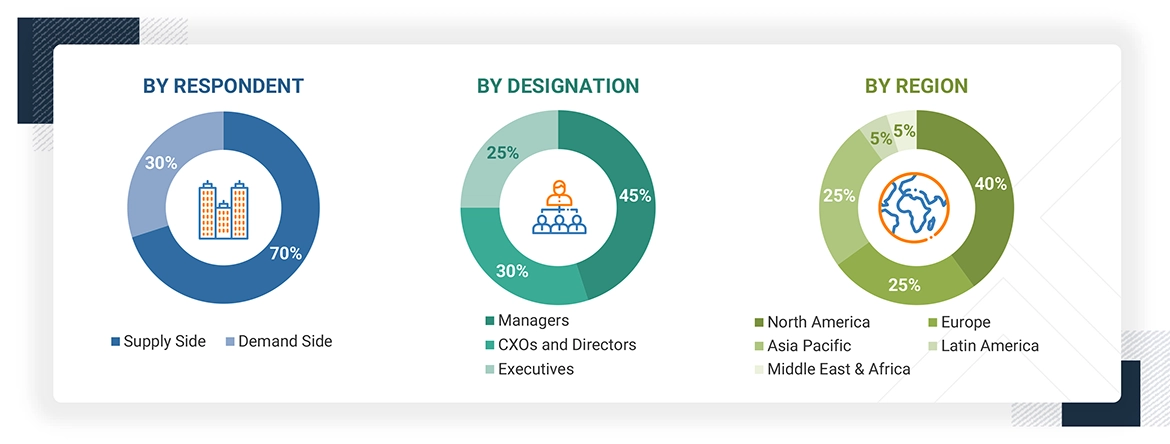

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the PFAS testing market. The primary sources from the demand side include OEMs, private and contract testing organizations and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Bottom-up approach were used to estimate and validate the total size of the PFAS testing market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

-

A list of the major global players operating in the PFAS testing market was generated.

-

Mapping annual revenues generated by major global players from the PFAS testing segment (or nearest reported business unit/service category)

-

Revenue mapping of key players to cover a major share of the global market as of 2024

-

Extrapolating the global value of the PFAS testing industry

Global PFAS Testing Market Size: Bottom-up Approach and Top Down Approach

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Perfluoroalkyl and polyfluoroalkyl substances (PFAS) are synthetic organofluorine compounds known for their resistance to grease, oil, water, and heat. Commonly referred to as "forever chemicals," PFAS are highly persistent in the environment and challenging to break down or eliminate. The PFAS testing market encompasses a range of technologies such as chromatography, mass spectrometry, NMR spectroscopy, and related consumables. These tools are designed to separate chemical mixtures, measure known substances, identify and quantify unknown PFAS compounds, and analyze the structure and chemical properties of various analytes. Additionally, these testing methods are employed to detect contaminants in samples and evaluate pollution levels.

Stakeholders

-

PFAS Testing Products Manufacturing Companies

-

Food & Beverage Manufacturing Companies

-

Environmental Monitoring Product Manufacturers

-

Air Quality Monitoring Product Manufacturers

-

Pollution Monitoring Manufacturers

-

Product Sales and Distribution Companies

-

Government Regulatory Authorities

-

Research Laboratories and Academic Institutes

-

Clinical Testing Organizations (CTOs)

-

Research and Development Companies

-

Market Research and Consulting Firms

Report Objectives

-

To define, describe, and forecast the PFAS testing market on the basis of product type,techniques, methods, application, and region.

-

To provide detailed information regarding the major factors influencing the growth potential of the global PFAS testing market (drivers, restraints, opportunities, challenges, and trends).

-

To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the global PFAS testing market.

-

To analyze key growth opportunities in the global PFAS testing market for key stakeholders and provide details of the competitive landscape for market leaders.

-

To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (the US and Canada), Europe (Germany, the UK, France, Italy, Spain, and Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East and Africa (GCC Countries and Rest of MEA).

-

To profile the key players in the global PFAS testing market and comprehensively analyze their market shares and core competencies.

-

To track and analyze the competitive developments undertaken in the global PFAS testing market, such as agreements, expansions, and & acquisitions.

Growth opportunities and latent adjacency in PFAS Testing Market