PFAS Filtration Market

PFAS Filtration Market by Technology (Water Treatment Systems, Water Treatment Chemicals), Place of Treatment (In-Situ, Ex-Situ), Remediation Technology, Environmental Medium, Contaminant Type, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The PFAS filtration market is projected to reach USD 2.99 billion by 2030 from USD 2.13 billion in 2025, at a CAGR of 7.0% from 2025 to 2030. The global PFAS filtration market is experiencing strong growth driven by increasingly stringent environmental regulations and growing awareness of the health risks associated with PFAS contamination. Industries across chemicals, manufacturing, and water treatment are adopting advanced filtration and destruction technologies to ensure compliance, reduce liabilities, and support sustainability targets.

KEY TAKEAWAYS

-

BY ENVIRONMENTAL MEDIUM TYPEThe PFAS filtration market by environmental medium includes groundwater, surface water & sediment remediation and soil. Groundwater dominates the PFAS filtration market as the primary environmental medium, owing to its high vulnerability to long-term PFAS contamination from industrial discharge, firefighting foams, and landfill leachate. As a key source of drinking water, groundwater remediation has become a top priority for regulatory agencies and municipalities. The need to restore safe aquifer conditions and comply with stringent EPA and EU limits has accelerated the deployment of advanced PFAS filtration and treatment technologies across this segment.

-

BY REMEDIATION TECHNOLOGYThe PFAS filtration market by remediation technology includes activated carbon, ion exchange resin, RO membrane & nanofiltration, In-situ chemical oxidation, bioremediation and others. Activated carbon is the leading technology for PFAS remediation due to its strong adsorption capacity for a wide range of PFAS compounds. It effectively reduces PFAS concentrations in water, making it a preferred choice for municipal and industrial filtration systems. Its market dominance stems from proven performance, scalability, and relatively low operational complexity.

-

BY PLACE OF TREATMENTThe PFAS filtration market by place of treatment includes in-situ, ex-situ. Ex-situ treatment dominates the PFAS remediation market because it allows for controlled processing of contaminated media outside the affected site. This approach enables optimized treatment conditions, higher efficiency, and easier regulatory compliance. Its scalability and reliability make it the preferred choice for large-scale PFAS cleanup projects.

-

BY SERVICE TYPEThe PFAS filtration market by service type includes on-site, and off-site. Off-site treatment leads the PFAS remediation market as it allows contaminated materials to be transported to specialized facilities for processing. This service model reduces on-site operational challenges, ensures access to advanced technologies, and simplifies regulatory compliance. Its convenience and efficiency make it the preferred choice for municipalities and industries handling PFAS contamination.

-

BY TECHNOLOGY TYPEThe PFAS filtration market by technology type includes water treatment systems, water treatment chemicals. Water treatment systems lead the PFAS remediation market as they provide a direct, scalable solution for removing PFAS from contaminated water sources. These systems integrate technologies like activated carbon, ion exchange, and membrane filtration for effective contaminant reduction. Their widespread applicability across municipal, industrial, and residential settings drives market dominance

-

BY END-USE INDUSTRYThe PFAS filtration market by end-use industry includes industrial, municipal, and commercial. The municipal segment dominates the PFAS filtration market as the leading end-use industry, driven by growing regulatory pressure to ensure safe drinking water and manage contaminated wastewater. Municipalities are investing heavily in advanced filtration systems such as activated carbon, ion exchange, and reverse osmosis to meet strict EPA and EU water quality standards. Rising public health concerns, coupled with infrastructure modernization and government funding for water treatment, further strengthen the municipal sector’s leadership in PFAS filtration adoption worldwide

-

BY REGIONThe PFAS filtration market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. North America leads the PFAS remediation market due to stringent environmental regulations and growing public awareness of PFAS contamination. Strong government funding, advanced infrastructure, and early adoption of remediation technologies further drive market growth. The region’s focus on safe water management positions it as the dominant market globally..

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. Veolia (France) , AECOM (US), WSP (Canada), Clean Earth (US), Wood (UK), Xylem (US), Jacobs (US), TRC Companies, Inc. (US), Battelle Memorial Institute (US), Cyclopure, Inc. (US)., Calgon Carbon Corporation (US), Regenesis (US) , Mineral Technologies, Inc. (US), CDM Smith, Inc. (US), Pentair (UK) are some of the major players in the PFAS filtration market.

The global PFAS filtration market is growing rapidly as stricter regulations and rising awareness of PFAS health risks drive industrial action. Companies across chemicals, manufacturing, and water treatment are adopting advanced filtration to ensure compliance and sustainability. North America leads with strong EPA mandates, Europe follows with strict REACH norms, and Asia-Pacific emerges fastest due to industrial expansion and water safety initiatives—making PFAS filtration vital to global environmental protection and ESG goals

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of PFAS filtration products suppliers, which, in turn, impacts the revenues of PFAS filtration products manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing regulatory scrutiny and tightening of environmental regulations regarding PFAS contamination

-

Rising litigation and liability cost for polluters

Level

-

Expensive and complex filtration process

-

Limited availability of trained professional

Level

-

Significant government funding and support for PFAS research, development and filtration efforts

-

Significant potential to expand globally

Level

-

Proper management of treatment residuals generated during PFAS treatment

-

Challenges in retrofitting existing water treatment plants for PFAS filtration

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Increasing regulatory scrutiny and tightening of environmental regulations regarding PFAS contamination

Heightened regulatory pressure and strengthened environmental standards against PFAS pollution are driving top-line growth for the industry for PFAS filtration. PFAS are synthetic chemicals used across several industrial and consumer goods to have heat, water, and oil resistance. But their resilience to the environment and human tissue has led to highly critical ailments like cancer, immune impairment, and developmental delays. Consequently, several regulatory bodies are instituting tighter controls to reduce exposure to PFAS, more specifically to drinking water. On April 2024, the US EPA issued a rule adding two PFAS chemicals—PFOA and PFOS—to the list of hazardous substances. These two chemicals are included on the list hazardous substances under the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA). This step encourages transparency and accountability in cleanup activities for PFAS. The EPA further issued an enforcement discretion policy to ensure that cleaning burdens address the major contributors to PFAS pollution. Moreover, through collaboration with the General Services Administration, the EPA included modifications that require that cleaning products used in federal facilities be PFAS-free and that require the utilization of environmentally certified products such as those carrying EPA's Safer Choice or GreenSeal labels. These federal moves, as well as increasing public scrutiny and pressure for corporate accountability, are fueling need for efficient PFAS filtration technologies, which sets the market up for continued innovation and growth

Restraint: Expensive and complex filtration process

One of the principal limitations on large-scale application of PFAS filtration technologies is the high cost and process intensity of the filtration. It requires advanced treatment processes such as granular activated carbon (GAC), ion exchange resins, and high-pressure membrane systems such as reverse osmosis to eliminate PFAS from water.These cutting-edge technologies, as efficient as they are, cost a lot to use and maintain, particularly in addressing large volumes of contaminated water or attaining ultra-low levels of PFAS concentration. Also, the equipment to install and run these systems—energy-intensive equipment, advanced materials, and technical personnel—may be prohibitively expensive to small towns, factories, and low-resource communities. Elimination of PFAS-contaminated filter media is also of concern to regulation and the environment, adding further cost and complexity. Consequently, even in the face of increasing regulatory and public pressure around PFAS contamination, many stakeholders are faced by cost and logistic barriers in deploying comprehensive filtration solutions. These place a case for continued innovation in affordable, scalable PFAS treatment technologies, as well as facilitatory funding and policy interventions that will match regulatory demands with functioning realization on the ground

Opportunity: Significant government funding and support for PFAS research, development and filtration efforts.

One of the biggest opportunities in the PFAS filtration market is the increasing government investment and institutional support to tackle PFAS contamination and develop filtration technologies. Acknowledging the pervasive environmental and health hazards posed by PFAS—man-made chemicals used in thousands of common products such as firefighting foams, food packaging, and clothing—governments are investing heavily in research and remediation. The U.S. Environmental Protection Agency (EPA), USD 50 million is being specifically targeted to address PFAS contamination. This money goes towards cleanup efforts, as well as the research and deployment of new treatment technologies aimed at more efficiently detecting, capturing, and destroying PFAS compounds in the environment. PFAS, per- and polyfluoroalkyl substances, are a collection of almost 15,000 chemicals that have been recognized as persistent in air, water, and soil due to their enduring nature, popularly referred to as "forever chemicals." According to the National Institute of Environmental Health Sciences, humans get exposed to PFAS from polluted drinking water, food, or common consumer goods. To that end, government-sponsored projects are not just propelling the advancement of technology but also furthering the regulation and financing environment for firms and researchers that enter the business of PFAS removal. This flood tide of support from the government is a phenomenal chance at expanding, collaborating, and innovating in the war against PFAS contamination across the world

Challenge:Proper management of treatment residuals generated during PFAS treatment

The other great challenge in the PFAS filtration business is disposal of treatment residuals created in the course of elimination. While technologies such as granular activated carbon (GAC), ion exchange resins, and reverse osmosis can very effectively eliminate PFAS from contaminated sources of water, they cannot destroy the chemicals. Instead, these operations concentrate PFAS into residual waste streams such as spent carbon, used resin, or severely contaminated brine. Treating these residues is complex, costly, and critical to preventing recontamination of the environment. PFAS-contaminated waste disposal options are few and tightly regulated. Incineration at high temperatures is one of the only several processes capable of degrading PFAS compounds today, but it consumes energy, is costly, and controversial due to concerns over partial combustion and release of secondary pollutants. Landfilling, while more convenient, could leach PFAS into the groundwater and soil over the long term. Without effective residuals management, the environmental benefit of PFAS filtration is lost. Developing safe, scalable, and affordable technologies for managing PFAS treatment waste is key to the long-term sustainability and success of PFAS remediation

PFAS Filtration Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Implementation of advanced membrane and ion-exchange filtration systems for wastewater from specialty chemicals and coatings production. | Achieved regulatory compliance with EU PFAS limits... |

|

Deployment of adsorptive and electrochemical PFAS removal technologies for process water at fluorochemical plants. | Strengthened environmental stewardship and ESG profile. |

|

Adoption of industrial PFAS removal filters for textile dyeing and finishing wastewater treatment | Reduced environmental and social risk exposure. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The PFAS filtration ecosystem analysis involves identifying and analyzing interconnected relationships among various stakeholders, including raw material supplies, equipment suppliers, manufacturers, distributors, and end users. The raw material suppliers provide filters, granular activated carbon, ion exchange resins and others to PFAS filtration manufacturers. The distributors and suppliers establish contact between the manufacturing companies and end users to streamline the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

PFAS Filtration Market, By Remediation Technology

Reverse osmosis (RO) and nanofiltration (NF) are the fastest-growing PFAS treatment technologies. This is due to their ability to effectively remove a wide range of PFAS chemicals, including the short-chain ones that are hard to capture with traditional technologies. Reverse osmosis and nanofiltration membrane technologies filter water by subjecting dirty water to pressure while passing through semi-permeable membranes that block PFAS molecules, among other contaminants. RO, in particular, has the ability to eliminate over 90% of PFAS chemicals and therefore a solution of preference for municipal and industrial water treatment plants. Growing use of RO and NF is driven by growing regulatory requirements for ultra-low PFAS levels in drinking water, along with the need for more scalable and resilient treatment technologies. Methods such as granular activated carbon and ion exchange work on longer-chain PFAS but are prone to failure with shorter-chain compounds that pass through conventional filtration. RO and NF systems present a more comprehensive barrier and, therefore, suit advanced treatment applications. These systems' higher removal capacity and versatility to a range of water quality conditions are driving explosive growth. As regulatory pressure keeps building, RO and nanofiltration will be at the leading edge of future PFAS remediation technologies

PFAS Filtration Market, By Technology Type

PFAS water treatment technologies are developing rapidly to catch up with the growing need for solutions to treat these toxic and persistent chemicals. The most common technologies utilized are granular activated carbon (GAC), ion exchange resins, reverse osmosis (RO), and nanofiltration (NF). GAC is widely applied due to its cost-saving and adsorption capability for long-chain PFAS compounds, but with less efficiency against short-chain types and high frequency of media renewal. Ion exchange resins give higher selectivity and efficiency, particularly for a broader category of PFAS, through the displacement of ions by PFAS molecules in water. However, the fastest-evolving technologies in the PFAS filtration market are nanofiltration and reverse osmosis. These membrane systems function by forcing water through semi-permeable membranes capable of filtering out between 99% of PFAS chemicals, both long- and short-chain types. RO and NF provide a solution for more comprehensive filtration, one that is increasingly necessary as government regulations become tighter and public concern grows. These systems offers, high effectiveness and performance are driving rapid deployment in industrial and municipal uses. With the need for effective and scalable PFAS treatment technology growing, reverse osmosis and nanofiltration technology is emerging as the key drivers of PFAS water treatment's future

REGION

Asia Pacifi to be fastest-growing region in global medical filtration market during forecast period

The Asia-Pacific PFAS filtration market is experiencing very rapid growth with the push from urbanization, industrialization, and growing environmental awareness. Various countries such as China, India, and South Korea are facing rising PFAS contamination as a result of excessive use of these chemicals in several end-use applications. As public concern about the health impacts of PFAS continues to grow, governments in the region are enforcing stricter water quality regulations and demanding improved wastewater treatment standards. Simultaneously, infrastructure development and ESG pledges are prompting public utilities as well as private sectors to invest in sophisticated PFAS filtration technologies. This synergy of regulatory intervention, increasing demand for clean water, and industrial accountability is turning APAC into the fastest-growing market for PFAS filtration solutions

PFAS Filtration Market: COMPANY EVALUATION MATRIX

In the PFAS filtration market matrix, WSP (Star), a Canada based company, leads the market through its high-quality PFAS filtration products, which find extensive applications in various end-use industries such as industrial, municipal and others.Pentair (Emerging Leader) is gaining traction with its technological advancements in PFAS filtration.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.99 Billion |

| Market Forecast in 2030 (Value) | USD 2.99 Billion |

| Growth Rate | CAGR of 7.0% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: PFAS Filtration Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading PFAS Filtration Products Supplier |

|

Supported go-to-market strategy and positioning vs competitors |

| Country-level insights for high-growth regions | Provided detailed market sizing and forecasts for theNorth America , Asia Pacific market | Helped the client identify region-specific growth hotspots and investment opportunities |

| Identify emerging PFAS filtration technologies | Conducted technology scouting and feasibility analysis | Supported investment decisions and innovation roadmap for clients |

| Evaluate regulatory compliance for new market entry | Compiled local emission, safety & efficiency standards per country | Ensured smooth market entry and minimized legal risks |

RECENT DEVELOPMENTS

- June 2024 : AECOM, a globally trusted infrastructure consulting firm, and Aquatech, a leader in water and process technology, partnered to fast-track the deployment of per- and polyfluoroalkyl substances (PFAS) destruction technology. This collaboration combined AECOM’s top-ranked water and environmental practice, along with its innovative DE-FLUORO PFAS destruction technology, and Aquatech’s expertise in process and electrochemical technology, as well as its proven track record in scaling end-to-end technology solutions and services. The combined strengths of these two industry leaders will help accelerate DE-FLUORO as a premier solution for PFAS destruction

- January 2024 : Clean Earth has launched Resolve, a new program that offers a toolbox of innovative solutions to treat and remediate PFAS, and a website detailing news, updates, and guidance on PFAS in the US

- June 2023 : Veolia Water Technologies expanded its mobile water services fleet in China by adding new modular trailer-mounted reverse osmosis (RO) systems. This expansion enhanced the company's range of mobile solutions tailored for the Chinese market. By integrating the latest modular trailer-mounted RO units, Veolia reinforces its commitment to delivering innovative water treatment solutions to its customers in China. Alongside the RO units, the fleet also features filtration, ultrafiltration, and deionization systems. The addition of these new RO mobile units will boost capacity to meet the increasing demand for dependable and efficient water treatment solutions across China

- January 2023 : Xylem acquired Evoqua, a leader a leader in mission-critical water treatment solutions and services. Under the agreement, Xylem will acquire Evoqua in an all-stock transaction that reflects an implied enterprise value of approximately USD 7.5 billion. This acquisition creates a transformative global platform to address water scarcity, affordability, and resilience at an even greater scale

- September 2022 : WSP has announced the acquisition of the environment & infrastructure business of John Wood. With this, WSP expanded its environmental leadership. This move will also enable the company to further seize opportunities in the fast-growing environmental and water sectors

Table of Contents

Methodology

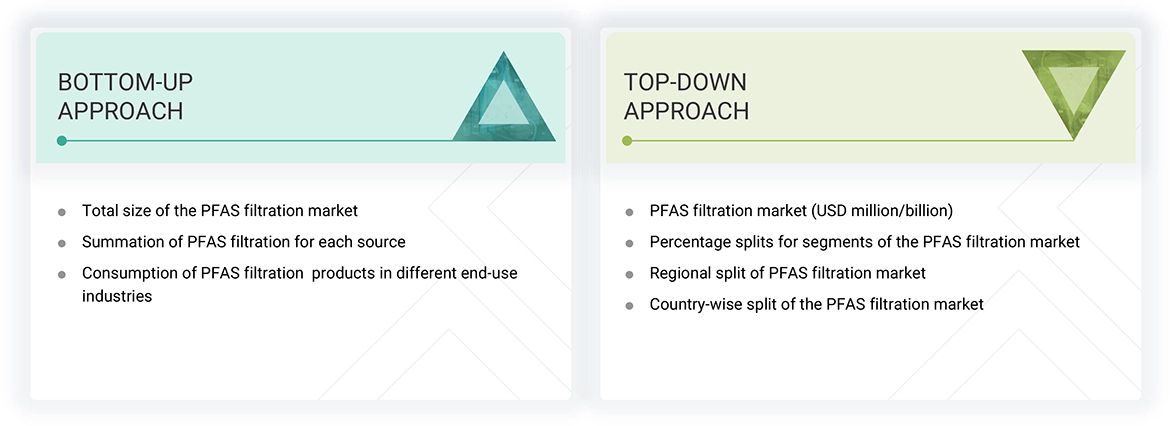

The study involved four major activities to estimate the current size of the global PFAS filtration market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of PFAS filtration through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the PFAS filtration market. Lastly, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study on the PFAS filtration market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The PFAS filtration market comprises several stakeholders in the supply chain, which include raw material suppliers, equipment suppliers, distributors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the PFAS filtration market. Primary sources from the supply side include associations and institutions involved in the PFAS filtration market, key opinion leaders, and processing players.

Following is Breakdown of Primary Respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the PFAS filtration market by contaminant type, environmental medium, remediation technology, service type, technology type, end-use industry, and region. The research methodology used to calculate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that impact the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying reports, reviews, and newsletters of top market players and extensive interviews with leaders such as directors and marketing executives to obtain opinions.

The following figure illustrates the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall size of the PFAS filtration market from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

PFAS filtration refers to the processes and methods employed to remove or neutralize per- and polyfluoroalkyl substances (PFAS) from contaminated environments, such as soil, water, and air. Due to the chemical stability and persistence of PFAS, conventional treatment methods are often ineffective. Therefore, remediation strategies typically involve advanced technologies designed to break down or extract these compounds.

Common filtration techniques include activated carbon adsorption, ion exchange, and advanced oxidation processes. Activated carbon adsorption captures PFAS molecules, while ion exchange replaces PFAS ions with less harmful ions in water. Advanced oxidation processes use reactive species to degrade PFAS into less toxic components. Emerging methods like electrochemical oxidation and bioremediation are also being explored for their potential effectiveness.

Stakeholders

- PFAS filtration product manufacturers

- Raw material suppliers

- Equipment suppliers

- Regulatory bodies and government agencies

- Distributors and suppliers

- End-use industries

- Associations and industrial bodies

Report Objectives

- To define, describe, and forecast the size of the PFAS filtration market in terms of value and volume

- To provide detailed information regarding the key factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To forecast the market size based on contaminant type, environmental medium, remediation technology, service type, technology type, end-use industry, and region

- To forecast the market size for the five main regions—North America, Europe, Asia Pacific, South America, and the Middle East & Africa—along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders

- To strategically profile leading players and comprehensively analyze their key developments, such as product launches, expansions, and deals in the PFAS filtration market.

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the PFAS Filtration Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in PFAS Filtration Market