This research study extensively used secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, and OneSource. It was used to identify and collect information useful for a technical, market-oriented, and commercial study of the Modular Automation Market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Primary sources included experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, technology developers, and organizations related to all segments of the value chain of the Modular Automation ecosystem. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of major secondary sources

|

SOURCE

|

WEB LINK

|

|

International Society of Automation (ISA)

|

https://www.isa.org/

https://www.omac.org/about-omac

|

|

NAMUR

|

https://www.namur.net/en/focus-topics/automation-modular-plants.html

|

|

Organization for Machine Automation and Control (OMAC)

|

https://www.omac.org/about-omac

|

|

OPC Foundation

|

https://opcconnect.opcfoundation.org/2020/03/enabling-modular-procedural-automation-at-air-liquide/

|

|

VDI

|

https://www.vdi.de/en/home/vdi-standards/

|

|

PROFIBUS

|

https://www.profibus.com/technologies/mtp

|

Primary Research

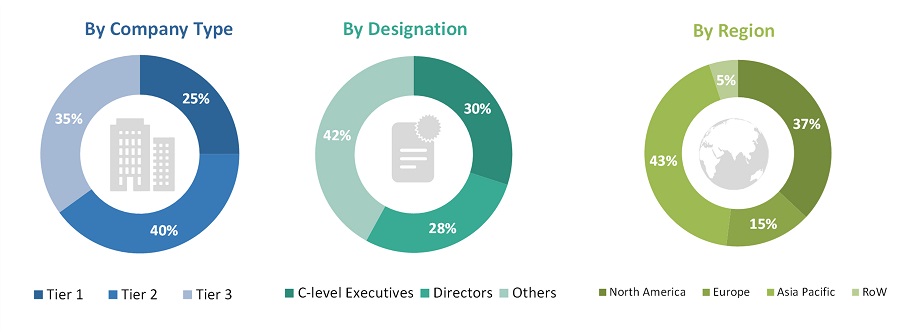

Extensive primary research was conducted after gaining knowledge about the current scenario of the Modular Automation Market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To estimate and validate the size of the Modular Automation Market and its various submarkets, both top-down and bottom-up methods were employed. Leading market players were identified through secondary research, with their market share in specific regions determined through a combination of primary and secondary research. This comprehensive process included reviewing annual and financial reports from key industry players and conducting in-depth interviews with senior industry executives, including CEOs, VPs, directors, and marketing executives. Percentage distributions and breakdowns were initially derived from secondary data and subsequently validated through primary sources. Every relevant parameter influencing the markets in this study was meticulously considered, verified through primary research, and examined to derive final quantitative and qualitative data. The resulting data was aggregated and enhanced with detailed insights and analysis from MarketsandMarkets, ultimately forming the basis of this report.

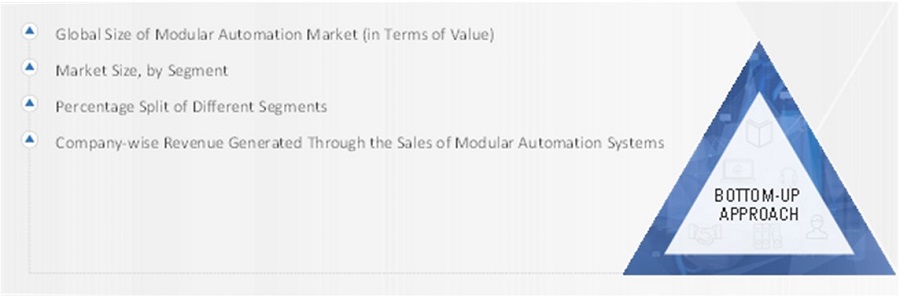

Bottom-Up Approach

The bottom-up approach was used to determine the overall size of the revenues of key players and their shares in the market. The overall market size was calculated based on the revenues of key players identified in the market.

-

The first step involved identifying companies that offer modular automation systems, followed by mapping their products according to various parameters, such as type, mobility, and components.

-

The size of the Modular Automation Market was calculated based on the demand from various application areas and the revenue generated by companies within the modular automation ecosystem.

-

Primary interviews were conducted with a few major players in the Modular Automation Industry to confirm the global market size.

-

Secondary sources, including the International Society of Automation (ISA), NAMUR, Organization for Machine Automation and Control (OMAC), OPC Foundation, VDI, and PROFIBUS, were also used to cross-check market size. Other secondary sources comprised company websites, press releases, and research journals.

-

To determine the Compound Annual Growth Rate (CAGR) of the Modular Automation Market, both historical and projected market trends were analyzed by examining the industry's penetration rate and supply and demand in various application areas.

-

All estimates at each stage were confirmed through discussions with key opinion leaders, including corporate executives (CXOs), directors, sales heads, and industry experts from MarketsandMarkets.

-

Several paid and unpaid information sources, such as annual reports, press releases, white papers, and databases, were also reviewed during the research process.

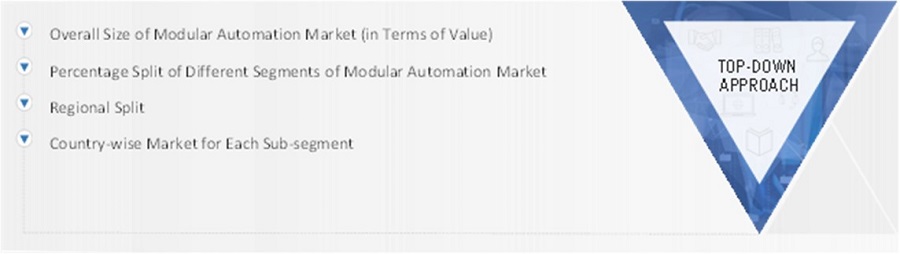

Top-Down Approach

In the top-down approach, the total size of the Modular Automation Market, derived from percentage splits obtained through both secondary and primary research, was used to estimate the sizes of individual markets, as detailed in the market segmentation.

The top-down approach used the overall market size as a reference point to estimate the size of specific market segments. This approach was also applied to secondary research data to confirm the estimated market sizes for different segments.

Each company's market share was calculated to validate the revenue distribution used earlier in the top-down approach. Using data triangulation and validation through primary research, the study established and confirmed the sizes of both the entire parent market and the individual segments. The data triangulation process employed for this study is detailed in the following section.

-

Revenue information from leading manufacturers and providers of Modular Automation systems and solutions was gathered and analyzed to estimate the global size of the Modular Automation Market.

-

The Modular Automation Market is projected to exhibit a steady growth trend during the forecast period, reflecting its maturity and the presence of numerous well-established players across various sectors.

-

The revenues, geographic footprint, key market sectors, and product offerings of all identified players in the Modular Automation Market were studied to estimate the percentage distribution of different market segments.

-

Secondary research identified major players in each category (by component type and end-user industry) within the Modular Automation Market, and information was confirmed through brief discussions with industry experts.

-

Several discussions with key opinion leaders from leading companies involved in developing Modular Automation systems were conducted to validate the market segmentation based on type, mobility, component, end-use industry, and geography.

-

Geographic splits were estimated using secondary sources, considering various factors, such as the number of companies offering Modular Automation systems in a specific country or region and the types of Modular Automation components provided by these players.

Data Triangulation

After arriving at the overall size of the Modular Automation Market from the market size estimation process explained above, the total market was split into several segments and subsegments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using top-down and bottom-up approaches.

Market Definition

Modular automation is a versatile and scalable strategy in industrial automation where production systems consist of interchangeable modules. Each module can function independently or in synergy with others, facilitating effortless customization, swift reconfiguration, and incremental upgrades. This approach allows manufacturers to optimize production processes, minimize downtime, and quickly respond to evolving market demands, thereby improving operational efficiency and cost-effectiveness. Moreover, modular automation promotes innovation by allowing for seamless integration of new technologies

Key Stakeholders

-

Component Manufacturers

-

Government and Research Organizations

-

Modular Automation System Providers

-

Modular Automation Software Providers

-

Original Equipment Manufacturers (OEMs)

-

Professional Services/Solution Providers

-

Research Institutions and Organizations

-

System Integrators

Report Objectives

-

To estimate and forecast the size of the Modular Automation Market in terms of value based on type, mobility, component, end-use industry, and region.

-

To describe and forecast the market size, in terms of volume, based on hardware type.

-

To describe and forecast the market size, in terms of value, for four major regions-North America, Europe, Asia Pacific, and RoW

-

To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the market growth

-

To provide a detailed overview of the value chain of the Modular Automation Market

-

To strategically analyze micromarkets regarding individual market trends, growth prospects, and contributions to the total market

-

To strategically profile key players and comprehensively analyze their market position regarding ranking and core competencies, along with a detailed competitive landscape for the market leaders.

-

To analyze major growth strategies such as product launches, expansions, joint ventures, agreements, and acquisitions adopted by the key market players to enhance their position in the market.

-

To analyze the impact of the recession on the Modular Automation Market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players (up to 5)

-

Additional country-level analysis of the Modular Automation Market Product Analysis

-

Product matrix, which provides a detailed comparison of the product portfolio of each company in the Modular Automation Market.

Growth opportunities and latent adjacency in Modular Automation Market