The research study involved four major activities in estimating the mobile application security testing (MAST) market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for the study. These included journals, annual reports, press releases, investor presentations of companies and white papers, certified publications, and articles from recognized associations and government publishing sources. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

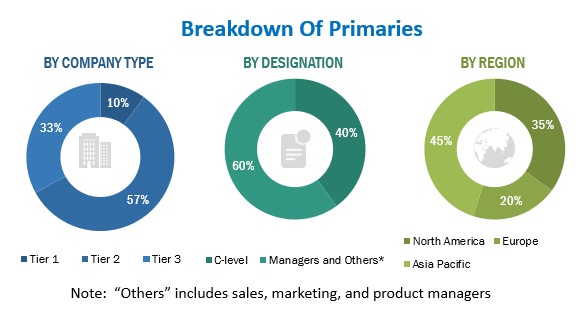

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the Mobile application security testing market. The primary sources from the demand side included consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

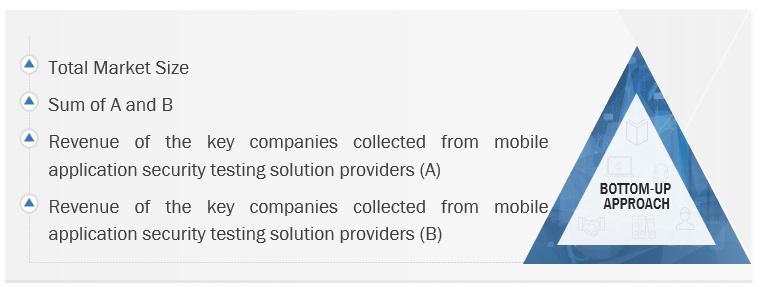

Multiple approaches were adopted to estimate and forecast the Mobile application security testing market. The first approach involved estimating the market size by summating companies’ revenue generated through Mobile application security testing solutions.

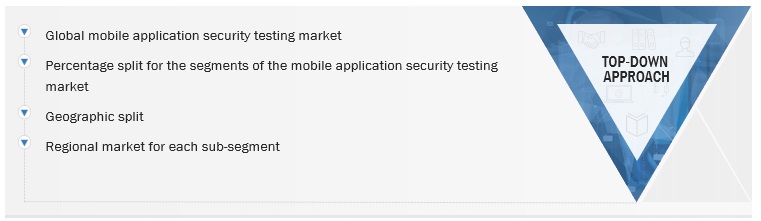

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Mobile application security testing market. The research methodology used to estimate the market size includes the following:

-

Key players in the market have been identified through extensive secondary research.

-

In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-top-down approach

Data Triangulation

The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

According to Guardsquare, "Mobile Application Security Testing (MAST) covers the processes and tools used to identify potential security issues in mobile applications. Some tools also provide input to remediate identified issues to reduce risk. Mobile Application Security Testing can be performed manually or through the use of automated tools which use a variety of techniques."

Key Stakeholders

-

Chief technology and data officers

-

Software and solution developers

-

Integration and deployment service providers

-

Business analysts

-

Information Technology (IT) professionals

-

Investors and venture capitalists

-

Third-party providers

-

Consultants/consultancies/advisory firms

-

Cyber-security firms

The main objectives of this study are as follows:

-

To define, describe, and forecast the Mobile application security testing market based on segments based on offering, OS, deployment mode, organization size, and vertical with regions covered.

-

To forecast the size of the market segments with respect to five regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

-

To provide detailed information on the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the Mobile application security testing market.

-

To analyze each submarket with respect to individual growth trends, prospects, and contributions to the global Mobile application security testing market.

-

To analyze opportunities in the market for stakeholders by identifying high-growth segments of the global Mobile application security testing market.

-

To profile the key market players, such as top and emerging vendors; provide a comparative analysis based on their business overviews, product offerings, and business strategies; and illustrate the market’s competitive landscape.

-

To track and analyze competitive developments in the market, such as new product launches, product enhancements, partnerships, acquisitions, and agreements and collaborations.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Mobile Application Security Testing Market