Mining Conveyor System Market

Mining Conveyor System Market by Conveyor Type (Belt, Cable/Steel Cord, Bucket & Side Wall), Service Type (In-pit, In-plant, Overland, Pipe), Application (Open-pit, Underground), Drive Type (Geared, Gearless), & Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The mining conveyor system market is projected to reach USD 359.4 million by 2032, from USD 351.7 million in 2025, at a CAGR of 0.3%. The mining conveyor system market is driven by the increasing demand for efficient, cost-effective, and sustainable material handling solutions in the global mining industry, particularly in regions rich in resources like Asia Oceania, and North America. Technological advancements, such as automation and IoT integration are key drivers enabling mining companies to enhance productivity while meeting stringent environmental regulations. Further, the shift toward underground mining, spurred by the depletion of surface deposits and the demand for rare earth minerals critical for renewable energy technologies, further boosts the market.

KEY TAKEAWAYS

-

BY CONVEYOR TYPEThe belt segment is estimated to account for the largest market share in 2025. Belt conveyors are versatile and can handle a variety of material types and sizes, including coarse, fine, and irregularly shaped ores. They are durable and reliable, performing well even in harsh mining environments with high temperatures and abrasive materials.

-

BY SERVICE TYPEThe in-plant conveyor systems segment is estimated to hold the largest share in the mining conveyor system market. In-plant conveyors enable efficient material handling within mining facilities, reduce manual labor, and support automation and smart mining practices. Its cost-effectiveness for short- to medium-distance transportation and seamless integration with crushers, screens, and storage systems make it the preferred choice for optimizing in-plant operations.

-

BY APPLICATIONThe open-pit mining segment has the highest CAGR in the mining conveyor system market, as open-pit operations require large-scale, continuous material transport over long distances. Conveyor systems in these mines boost efficiency, decrease reliance on trucks, and lower operational costs, making them vital for managing the high volumes of overburden and ore typical of open-pit mining projects.

-

BY DRIVE TYPEThe gearless segment is expected to have a higher CAGR in the mining conveyor system market because of its low maintenance and increased efficiency. By removing the need for regular lubrication, it decreases downtime and costs, while providing better energy efficiency and a longer service life, making it a top choice for mining operators.

-

BY REGIONAsia Oceania is expected to hold the largest share in the mining conveyor system market. This region's dominance is driven by its extensive coal and metal mining activities, especially in China, India, and Australia, which create ongoing demand for high-capacity, durable conveyor solutions.

-

COMPETITIVE LANDSCAPEThe mining conveyor system market is led by major companies like FLSmidth A/S (Denmark), Continental AG (Germany), Metso (Finland), ABB (Switzerland), and BEUMER Group (Germany). These firms have a global distribution network spanning Asia-Pacific, North America, and Europe. They are crucial in their home regions and seek to expand geographically to grow their businesses. Their focus is on increasing market share through expansion, investments, joint ventures, collaborations, and partnerships.

The mining conveyor system market is experiencing consistent growth, driven by rising demand for minerals and metals worldwide, especially in rapidly industrializing countries like India, China, and Brazil. Additionally, environmental regulations and carbon reduction goals are prompting mining operators to switch to electrically powered conveyor systems instead of diesel-powered haul trucks, matching global trends toward sustainable mining practices.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

As technology and customer needs evolve, the adoption of advanced mining conveyor systems is increasing, driven by rising demand for efficiency, safety, and sustainability in mining operations. With the push for automation and digital transformation in the mining industry, the market is moving toward new opportunities, especially in IoT-enabled predictive maintenance, which allows operators to minimize downtime, extend equipment life, and improve overall productivity.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for minerals and metals

-

Expansion of mining activities

Level

-

High installation costs

Level

-

Rising demand for automation

-

Development of green conveyor systems

Level

-

Maintenance and downtime risks

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expansion of mining activities

The expansion of mining into deeper and remote deposits is boosting demand for conveyor systems that handle longer distances and tougher conditions more efficiently than trucks. Rising investment in large-scale coal, iron ore, copper, and critical mineral projects is driving adoption of high-capacity, energy-efficient conveyors. At the same time, labor shortages and stricter safety rules are pushing miners toward automated and enclosed systems to sustain productivity and reduce risks.

Restraint: High installation costs

High upfront costs for design, installation, and specialized equipment act as a barrier to adopting mining conveyor systems. Smaller mining companies often struggle to justify the investment compared to cheaper haulage options like trucks. These high initial expenses slow down market growth despite the long-term efficiency benefits of conveyors.

Opportunity: Rising demand for automation

The rising use of automation in mining operations is increasing the demand for advanced conveyor systems that can handle materials continuously and efficiently. Moreover, combining these systems with AI and IoT enables real-time monitoring and predictive maintenance, reducing downtime and increasing productivity. As a result, mining companies are investing heavily in smart conveyor solutions, creating a significant growth opportunity for the mining conveyor system market.

Challenge: Maintenance and downtime risks

Maintenance requirements and potential downtime significantly restrict the mining conveyor system market. Conveyor failures or extended repairs can stop operations, causing substantial financial losses. The complexity of maintaining long, automated, or high-capacity systems adds to operational difficulties, discouraging adoption in some mining projects.

Mining Conveyor System Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Development of high-capacity overland and pipe conveyor systems integrated with energy-efficient drive technologies | Reduced energy consumption, higher throughput capacity, and lower operational costs for large-scale mining projects |

|

Smart conveyor belts with integrated sensors for real-time condition monitoring and predictive maintenance | Increased system uptime, reduced unplanned downtime, enhanced worker safety |

|

Conveyor solutions optimized for crushing and material handling plants, including wear-resistant components and modular design | Extended equipment life, reduced maintenance costs, and faster installation |

|

Automation and digital control solutions for conveyor systems, including variable speed drives, remote monitoring, and Industry 4.0 integration | Improved operational efficiency, optimized energy use, seamless integration with autonomous mining operations |

|

Tailored conveyor systems (overland, steep incline, pipe conveyors) for bulk materials handling with eco-friendly design | Reduced environmental footprint, flexible layouts for challenging terrains, minimized dust and spillage |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The mining conveyor system ecosystem consists of raw material manufacturers (e.g., Nippon Steel, Tata Steel, Yokohama), belt manufacturers (Bando, Continental Belting, Dunlop Conveyor Belting), part manufacturers (Dorner, Rexnord, Joyroll), system manufacturers (Continental, Metso, TAKRAF), and mining companies (Vale, Rio Tinto, Glencore, LafargeHolcim). Raw materials like steel and rubber are converted into belts and components, which belt and part manufacturers shape into rollers, idlers, and pulleys. System manufacturers then integrate these into complete conveyor solutions, and mining companies deploy them to enhance ore handling, cut haulage costs, and improve safety in mining operations.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Mining Conveyor System Market, By Conveyor Type

The belt segment is expected to lead the mining conveyor system market. The demand for belt-type conveyor systems is driven by their ability to transport bulk materials efficiently over long distances with lower operational costs. These systems offer high reliability and require minimal maintenance, making them ideal for harsh mining environments. Additionally, advancements in automation and energy-efficient technologies are enhancing their adoption.

Mining Conveyor System Market, By Service Type

In-plant conveyors hold the largest share in the mining conveyor system market due to the growing need for efficient material handling within mining facilities. These conveyors streamline internal operations by transporting materials between crushers, screens, storage areas, and loading points, reducing manual labor and operational delays. The rise in automation and smart mining practices further boosts demand for reliable and continuous in-plant conveying systems.

Mining Conveyor System Market, By Drive Type

Geared drive conveyor systems are expected to hold the largest share of the mining conveyor system market. Their strong design, high torque output, and easy integration into existing systems make them ideal for medium-scale mining operations, such as coal mining. Many coal mines in India use geared drive systems for their conveyor belts to efficiently transport bulk materials over short to medium distances. Further, their proven reliability in different mining environments ensures steady performance and minimal downtime, making them the preferred choice for cost-conscious operators.

Mining Conveyor System Market, By Application

By application, the open-pit mining segment dominates the mining conveyor system market due to its high-volume material handling requirements and the need for efficient transportation over long distances. As open-pit operations involve the extraction of large quantities of minerals such as coal, iron ore, and copper from the surface, conveyor systems provide a cost-effective, continuous, and environmentally friendly alternative to truck haulage. Their ability to reduce operational costs, minimize fuel consumption, and improve safety further drives their adoption in open-pit mining, making this segment the dominant force in the market.

REGION

Asia Oceania to be largest market for mining conveyor system during forecast period

Asia Oceania is estimated to lead the global mining conveyor system market due to the region's abundant mineral reserves, high mining activity, and increasing investment in infrastructure development. Countries like China, Australia, and India are major contributors, driven by strong demand for coal, iron ore, and other minerals to support industrial growth and energy needs. The region's rapid urbanization and government initiatives to modernize mining operations with automated and efficient conveyor systems further boost market growth. Additionally, the presence of leading mining companies and equipment manufacturers such as NEPEAN Conveyors (Australia), Shandong Mining Machinery Group Co., Ltd. (China), Conveyor Manufacturers Australia (Australia), and BTL EPC Ltd. (India) enhances technological adoption and scalability across the region.

Mining Conveyor System Market: COMPANY EVALUATION MATRIX

In the mining conveyor system market, FLSmidth A/S (Star) leads with a strong global presence, comprehensive product portfolio, and advanced conveyor technologies that enable efficient material handling, energy optimization, and large-scale adoption across mining majors worldwide. NEPEAN Conveyors (Emerging Leader) is gaining momentum with innovative, cost-effective, and tailored conveyor solutions, supported by strong expertise in bulk materials handling and growing penetration among mid-tier mining operators. While FLSmidth dominates with technological depth, scale, and established relationships with global mining companies, NEPEAN demonstrates strong growth potential to advance toward the leaders' quadrant through agility, customization, and an expanding international footprint.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 349.2 Million |

| Market Forecast in 2032 (Value) | USD 359.4 Million |

| Growth Rate | CAGR of 0.3% from 2025-2032 |

| Years Considered | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million), Volume (Thousand Meter) |

| Report Coverage | Revenue forecast, company share, competitive landscape, growth factors and trends |

| Segments Covered |

|

| Regional Scope | Asia Oceania, Europe, North America, and Rest of the World |

WHAT IS IN IT FOR YOU: Mining Conveyor System Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Mining Conveyor System OEMs | Competitive benchmarking of conveyor types (belt, chain, pipe, overland, and hybrid) based on throughput, energy efficiency, durability, and automation | Identify gaps in conveyor specifications (e.g., load capacity, energy consumption) |

| European Fleet Operator | Benchmarking of conveyor system consumption and deployment by mining type and scale | Identify priority conveyor solutions for different mining conditions |

RECENT DEVELOPMENTS

- February 2025 : FLSmidth announced plans to significantly expand its global service center network in 2025, opening new centers in Ghana, Indonesia, and Saudi Arabia, relocating its Australia site, and expanding facilities in Brazil, Kazakhstan, Mongolia, and South Africa. This expansion aims to strengthen customer proximity, improve access to spare parts, and enhance service capacity, reducing downtime for mining operations.

- October 2024 : FLSmidth (Denmark) signed a strategic cooperation agreement with Enter Engineering (Uzbekistan) to deliver core mineral processing equipment for a new copper concentrator at Almalyk MMC in Uzbekistan.

- September 2024 : Continental AG (Germany) enhanced its app-based service platform Conti+, making it much simpler, faster and more comprehensive. The technology provides advanced options to manage conveyor systems from anywhere and increases efficiency and profitability of an operation across all components and processes.

- September 2024 : TAKRAF Group (Germany) and PSI Minerals Technologies (Sweden) signed a cooperation agreement with a view to offer comprehensive, tailored solutions to mining and mineral processing operations that improve safety, environmental sustainability, and operational efficiency.

- March 2024 : TAKRAF GmbH (Germany) and ABB (Switzerland), a global technology leader in electrification and automation, renewed their ongoing strategic partnership regarding the deployment of Gearless Conveyor Drive (GCD) technology on TAKRAF bulk material handling solutions enabling a more sustainable and resource-efficient future.

Table of Contents

Methodology

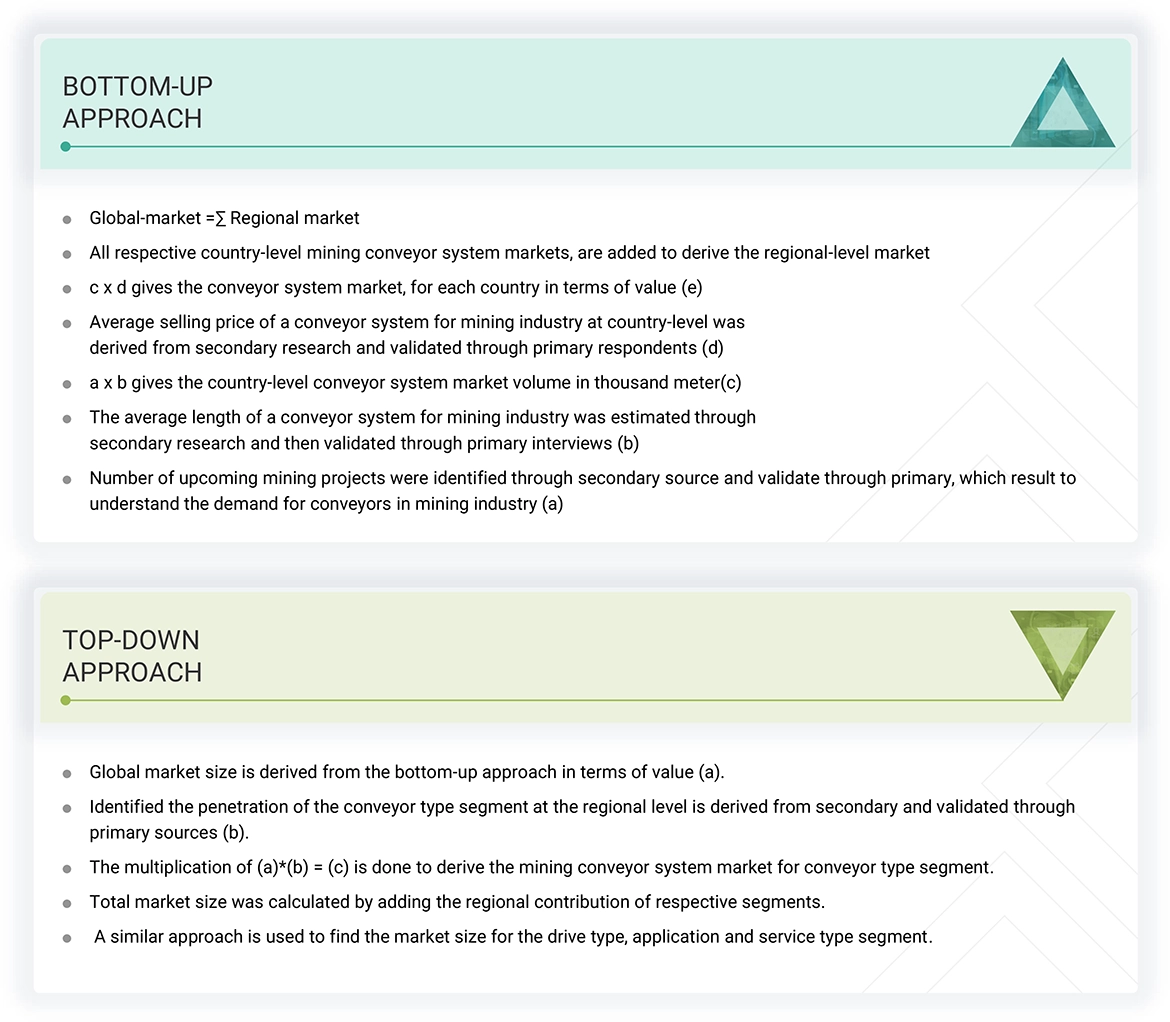

The study involved four major activities in estimating the current size of the mining conveyor system market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step involved validating these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized authors. Secondary research was mainly used to obtain key information about the value chain of the industry, the total pool of key players, market classification, segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market and application perspectives.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the mining conveyor system market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply side participants across four regions: North America, Europe, Asia Oceania, and the Rest of the World. Approximately 70% and 30% of the primary interviews were conducted from the supply and demand sides, respectively. Primary data was collected through questionnaires, e-mails, and telephonic interviews. While canvassing primaries, various departments within organizations, including sales, operations, and administration, were covered to provide a holistic viewpoint in the report.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the opinions/insights of in-house subject matter experts, led to the findings delineated in the rest of this report.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- The market size was derived by considering the conveyor system used in new mining projects.

- Segment split was identified through primary and secondary research.

- Key players in the global mining conveyor system market were identified through secondary research, and their global market ranking was determined through primary and secondary research.

- The research methodology included studying the annual and quarterly financial reports and regulatory filings of major market players and interviewing industry experts for detailed market insights.

- All major penetration rates, percentage shares, splits, and breakdowns for the global market were determined by using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

- The gathered market data was consolidated, added with detailed inputs, analyzed, and presented in this report.

Mining Conveyor System Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand and supply-side participants.

Market Definition

A mining conveyor is a mechanical system used in the mining industry to transport minerals, ores, and blocks within a mine. It is essential for moving heavy materials in challenging terrain and harsh weather conditions.

Britannica defines a mining conveyor as any device that provides mechanized movement of material in mines. It is used principally in mining applications to move raw materials. Mining conveyors are a few kilometers in length.

Stakeholders

- End users of mining automation tools and software

- Distributors of mining conveyor equipment and software

- Manufacturers of mining conveyor systems

- Mining conveyor industry associations

- Professional service/solution providers

- Research institutions and organizations

- Standards organizations, regulatory authorities, government bodies, venture capitalists, and private equity firms related to the mining conveyor system market

- System integrators

Report Objectives

-

To define, describe, segment, and forecast the mining conveyor system market in terms of volume (thousand meters) and value (USD billion/million) between 2025 and 2032.

- To segment and forecast the market size by conveyor type (belt, cable/steel cord, bucket & side wall, and others)

- To segment and forecast the market size by service type (in-pit conveyors, in-plant conveyors, overland conveyors, pipe conveyors, and stackers, reclaimers, & feed conveyors)

- To segment and forecast the market size by application (open-pit mining and underground mining)

- To segment and forecast the market size by drive type (geared drive and gearless drive conveyor systems)

- To segment and forecast the market size by region (Asia Oceania, Europe, North America, and Rest of the World)

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the market growth

- To strategically analyze the market, considering individual growth trends, prospects, and contributions to the total market

-

To study the following factors with respect to the market:

- Case Study Analysis

- Ecosystem Analysis

- Impact of Generative AI

- Key Conferences and Events

- Key Stakeholders and Buying Criteria

- Patent Analysis

- Pricing Analysis

- Regulatory Landscape

- Supply Chain Analysis

- Technology Analysis

- Trade Data

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To analyze the competitive landscape and prepare a competitive leadership mapping/market quadrant for the global players operating in the market

- To analyze recent developments, alliances, joint ventures, mergers & acquisitions, product launches/developments, and other activities carried out by key participants in the mining conveyor system market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with the company’s specific needs.

- Additional Company Profiles (Up To Five)

- Mining Conveyor System Market, By Service Type, At Country Level

- Mining Conveyor System Market, By Conveyor Type, At Country Level

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Mining Conveyor System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Mining Conveyor System Market