Medical Aesthetics Market Size, Growth, Share & Trends Analysis

Global Medical Aesthetics Market by Product (Botox, Filler, Peel, Liposuction, Microneedling, Hair Removal, Laser Resurfacing, RF, Phototherapy), Procedure (Surgical, Non-surgical), End User (Hospital, Beauty Clinic, Spa), and Region – Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global medical aesthetics market, valued at US$17.30 billion in 2024, stood at US$19.54 billion in 2025 and is projected to advance at a resilient CAGR of 13.0% from 2025 to 2031, culminating in a forecasted valuation of US$40.70 billion by the end of the period. The market is driven by the increasing trend toward minimally invasive and non-surgical treatment options, increased beauty and aesthetic awareness across various demographics, and innovations in injectables, energy-based devices, and combination therapies. Medical aesthetic treatments have become a mainstream healthcare service in place of a luxury cosmetic option, and this has been made possible due to stronger safety profiles and increasing acceptance of aesthetic healthcare as a routine self-care and wellness activity in mainstream healthcare. Moreover, the increasing power of social media platforms, along with aging demographics and increasing disposable incomes in emerging markets, has further fueled this growth.

KEY TAKEAWAYS

-

By ProductThe facial aesthetics products segment is estimated to account for the largest market share of 55% in 2025.

-

By Product TypeThe at-home/self use devices segment is projected to grow at the highest CAGR of 22.0% during the forecast period.

-

By ProcedureThe surgical procedures segment is projected to register a higher CAGR of 13.0% than the non-surgical procedures segment during the forecast period.

-

By End UserThe dermatology clinics, hospitals, and medical spas segment is estimated to account for a share of 95% of the global medical aesthetics market in 2025.

-

Competitive Landscape - Key PlayersCompanies, such as AbbVie (US), Galderma (Switzerland), Johnson & Johnson (US), Merz Pharma (Germany), Cynosure (US), Cutera (US), Alma Lasers (Israel), Lumenis (Israel), Revance Therapeutics (US), and Sinclair Pharma (UK) were identified as key players in the global medical aesthetics market.

-

Competitive Landscape - Startup/SMEsCompanies, such as Venus Concept (Canada), Jeisys Medical (South Korea), Fotona (Slovenia), Sciton (US), Sofwave Medical (Israel), Medytox (South Korea), and PhotoMedex (US) have built a solid foothold in the medical aesthetics market by focus on emerging trends like at-home/self-use devices or non-invasive treatments. These startups/SMEs are capturing share by collaborations with local distributors, beauty centers, and small medispas, Close client relationships, faster response times, and understanding regional client preferences and regulatory nuances.

One of the most dominant trends in the global medical aesthetics market is the rising interest in non-surgical and minimally invasive treatments over conventional surgical treatments. Injectable aesthetics and energy-based products are becoming highly sought after for their short recovery periods and cost-effectiveness. Another important trend is the rise of personalized aesthetic treatments, which involve a combination of different aesthetic solutions, to deliver natural and long-lasting results. Moreover, there is a rising entry of the young population into the aesthetics industry, driven by their interest in preventing and maintaining their aesthetic appeal. Men's aesthetics is also being recognized as a new and steady growth category within the aesthetics industry.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Medical aesthetics market's customers, including clinics and practitioners, are experiencing significant disruption due to changing patient expectations, competitive intensity, and rapid technology cycles. Patients are increasingly demanding personalized, natural-looking outcomes with minimal downtime, which is driving clinics to invest in advanced devices and diversified injectable portfolios. Additionally, the rise of organized med-spa chains and corporate clinic networks is disrupting traditional solo-practice models, leading to changes in procurement behavior and vendor selection. Moreover, regulatory tightening and increased scrutiny around product safety and practitioner qualifications are impacting product adoption timelines and operational compliance for providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for non-invasive and minimally invasive aesthetic procedures

-

Rising influence of social media and digital platforms

Level

-

Safety concerns and risk of adverse effects associated with aesthetic procedures

-

Complex and evolving regulatory frameworks

Level

-

Increasing acceptance of aesthetic treatments among male consumers

-

Technological advancements, such as AI-enabled treatment planning, regenerative aesthetics (PRP, exosomes), and combination therapies

Level

-

High cost of aesthetic treatments and advanced devices

-

Rising medical liability and litigation risks

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand for non-invasive and minimally invasive aesthetic procedures

Social media has a great influence on beauty trends and the public understanding of aesthetic treatments. The promotion of influencers and celebrities, which often becomes viral on social media, is the main factor that drives consumer interest in the procedures. Thus, social media platforms are considered an unavoidable marketing tool by the medical aesthetics industry. Besides, digital platforms have facilitated patient education and consequently, patients have more trust in the services and the demand increases.

Restraint: Complex and evolving regulatory frameworks

The medical aesthetics market in the US is continuously evolving with regulatory framework and federal authorities shaping the market. The market is regulated by centralized FDA regulations for medical devices, drugs, and injectables, along with state governments regulating licensing, ownership and supervision requirements. This fragmented system is creating compliance challenges for the hospitals, clinics, and medspa owners that operate across multiple states.

Opportunity: Increasing acceptance of aesthetic treatments among male consumers

The perception of aesthetics has undergone a drastic change where men are now more inclined to request for non-invasive treatments like Botox, dermal fillers, and laser. The growing acceptance not only allows medical aesthetics professionals to target the male consumer market but also the ever-evolving social standards of masculinity and appearance are in their favor.

Challenge: High cost of aesthetic treatments and advanced devices

The high cost associated with advanced equipment and procedures, though the demand for medical aesthetics is on the rise, still represent a significant barrier for both consumers and companies. The total of expenses includes not only the purchase of the high-priced equipment but also the maintenance costs and the requirement of specialized practitioners, which all together limit the access of certain customer groups.

MEDICAL AESTHETICS MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supports dermatology clinics and medical aesthetic centers across the US with injectable treatments for facial rejuvenation, anti-aging, contouring, and skin quality improvement | Enable clinics to drive high patient acquisition and retention through trusted, clinically validated brands | Support premium service positioning | Generate recurring revenue through repeat maintenance treatments |

|

Provides minimally invasive aesthetic solutions focused on facial volume restoration, wrinkle reduction, and skin health enhancement | Offer effective non-surgical alternatives that reduce dependence on invasive procedures | Improve patient satisfaction and confidence | Strengthen clinic credibility through science-backed products designed for long-term aesthetic and dermatological care |

|

Integrates medical aesthetic injectables and neuromodulators into dermatology clinics and aesthetic practices, often complementing spa-style services and advanced skincare offerings | Align strongly with the US’s growing demand for natural-looking, minimally invasive enhancements | Support cross-selling of medical-grade skincare and cosmeceuticals | Enable clinics to expand service offerings |

|

Delivers energy-based, non-invasive aesthetic device solutions for skin rejuvenation, body contouring, and vascular treatments | Enhance clinic differentiation through advanced device-based treatments | Strengthen brand visibility and patient trust | Support high utilization rates due to repeat treatment protocols |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The medical aesthetics market ecosystem includes manufacturers, distributors, service providers, and end users. Product manufacturers are involved in the development and commercialization of injectables, devices, and consumables. Distributors ensure adequate regional market access and logistics. Service providers strengthen the clinic's credibility and professional image, positioning the practice as innovative, current, and aligned with patient expectations. End users include dermatology clinics, medical spas, hospitals, and ambulatory surgical centers. By offering modern and minimally invasive aesthetic procedures.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Medical Aesthetics Market, By Product

By product, the medical aesthetics market is segmented into facial aesthetic products, cosmetic implants, body contouring devices, skin aesthetic devices, hair removal devices, tattoo removal devices, physician-dispensed cosmeceuticals, and other aesthetic products. The facial aesthetic products segment is dominated the market in 2024. This dominance can be ascribed to a large number of procedures, wider patient applicability, and soaring demand for minimally invasive facial treatments, like injections of botulinum toxin and dermal fillers. Facial aesthetics address the most visible signs of aging and appearance concerns, leading to higher repeat procedure rates and consistent revenue generation for providers.

Medical Aesthetics Market, By Product Type

By product type, the medical aesthetics market is categorized into standalone devices, multimodal devices, and at-home/self use devices. The at-home/self-use devices segment is projected to grow at the highest rate over the forecast period driven by the convenience and non-invasive approaches, such as LED light therapy, microcurrent, radiofrequency (RF), microneedling, and ultrasonic, followed by these devices. These devices are designed to be safe, easy to use, and effective for home use. They target applications, such as acne, wrinkles, and skin rejuvenation, by stimulating collagen production.

Medical Aesthetics Market, By Procedure

By procedure, the medical aesthetics market is segmented into surgical and non-surgical procedures. The non-surgical procedures segment is projected to dominate the during the forecast period, driven by the increasing preference for treatments with minimal downtime, lower risk, and gradual, natural-looking results. Additionally, injectable procedures and energy-based treatments further help the growth of the segment due to their affordability, safety, and repeatability.

Medical Aesthetics Market, By End User

By end user, the global medical aesthetics market is categorized into clinics, hospitals, medical spas; beauty centers; and home care settings. The dermatology clinics, hospitals, and medical spas segment emerge as a leading segment in the global medical aesthetics market owing to the increasing consumer demand for non-surgical treatments along with technology improvements, rise of middle and upper classes with disposable incomes and a general shift toward aesthetic wellness, growing number of men seeking aesthetic procedures, and the rising popularity of non-invasive procedures. Moreover, the offering of individualized treatments along with the general wellness focus helps retain customers by securing their satisfaction and loyalty.

MEDICAL AESTHETICS MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMPANY EVALUATION MATRIX

AbbVie (STAR) is a market leader in the medical aesthetics market, underpinned by its product excellence, strategic integration, and superior commercial execution across key regions. The acquisition of Allergan has positioned the company exceptionally well, delivering a portfolio of highly trusted aesthetic brands, including Botox Cosmetic, Juvéderm Dermal Fillers, CoolSculpting, and complementary facial aesthetics devices that command strong physician confidence, robust clinical evidence, and widespread patient recognition under stringent US FDA standards. Ongoing R&D investments and lifecycle management enable continuous product enhancements, new indications, and next-generation formulations, sustaining AbbVie's competitive edge. Other the other hand, Ipsen (EMERGING PLAYER) has a competitive role to player in the medical aesthetics market. It expands its neuromodulator and aesthetic solutions portfolio. Ipsen is gaining traction in the medical aesthetics market through its botulinum toxin product Dysport and strategic distribution partnerships, expanding its footprint across key regions. The company is also advancing innovative next-generation aesthetic treatments like IPN10200, underscoring its growing role and competitive potential in the industry.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- AbbVie Inc. (US)

- Alma Lasers (Israel)

- Cynosure (US)

- Johnson & Johnson (US)

- Bausch Health Companies Inc. (Canada)

- Cutera (US)

- Galderma (Switzerland)

- El.En. S.p.A. (Italy)

- InMode Ltd (Israel)

- Revance (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 17.30 Billion |

| Market Forecast in 2031 (value) | USD 40.70 Billion |

| Growth Rate | CAGR of 13.0% from 2025–2031 |

| Years Considered | 2023–2031 |

| Base Year | 2024 |

| Forecast Period | 2025–2031 |

| Units Considered | Value (USD Billion), Volume (Units Sold) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: MEDICAL AESTHETICS MARKET: GROWTH, SIZE, SHARE, AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Medical Aesthetic Company |

|

|

| Medical Aesthetic Manufacturer |

|

|

RECENT DEVELOPMENTS

- September 2025 : Dermalogica announced the FDA clearance of its PRO Pen Microneedling System by USFDA as Class II medical device. The distribution is anticipated to begin in 2026.

- June 2025 : MicronJet USA and TRU Biologix announced a distribution deal with EXOBLANC for its pharmaceutical-grade regenerative skincare line.

- March 2025 : Candela announced the launch of Glace solution, which is inspired by K-beauty. The treatment combines dual-mode cupping massage, LED technology, and hydra dermabrasion, providing skin hydration and purification.

Table of Contents

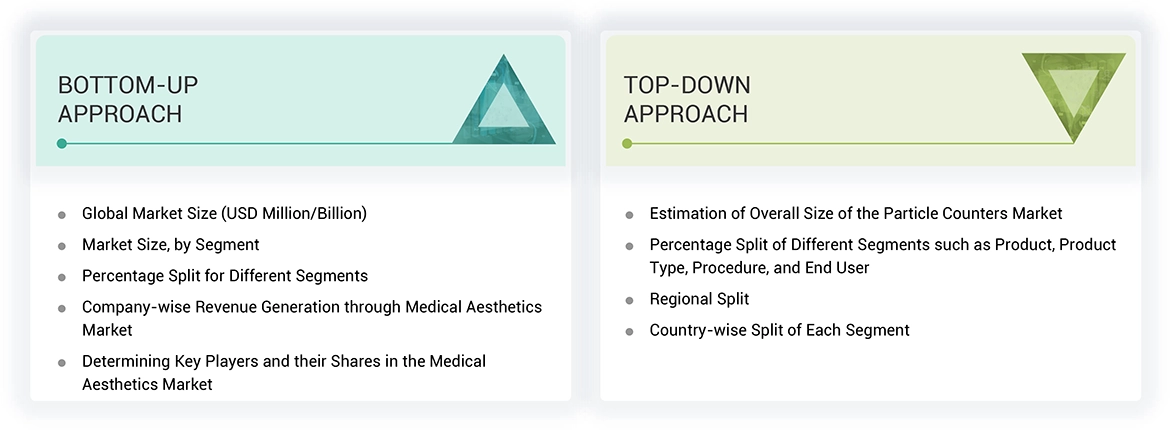

Methodology

Four primary studies have been undertaken to size the medical aesthetics market. Secondary research has been used to obtain preliminary data for the medical aesthetics market and peer and parent markets. Data were collected from 3-5 secondary sources, and validated by primary sources for assumptions and market sizing. Through top-down and bottom-up approaches, the overall market size was informed and further broken down, and data was triangulated for segment and subsegment sizing.

Secondary Research

These included directories, Factiva, white papers, Bloomberg Businessweek, annual reports, SEC filings, business filings, and investor presentations, among others Through these souces, one can gain critical data about market leaders, how the industry is divided into sectors, and how technology varies from one industry level to another within medical aesthetics.

Primary Research

Primary research consisted of interviewing people from the supply side of the business and the demand side to get quantitative and qualitative insights. On the demand side, primary sources involved in the study included physicians, researchers, department heads, staff from diagnostic centers, hospital staff, and those attached to the research institutes, while on the supply side, it involved CEOs, area sales managers, territory and regional sales managers, and various other top executives of relevant companies. These direct meetings with people in key leadership positions helped validate assumptions arising from secondary research and bring them face-to-face so that any assumptions could also be directly

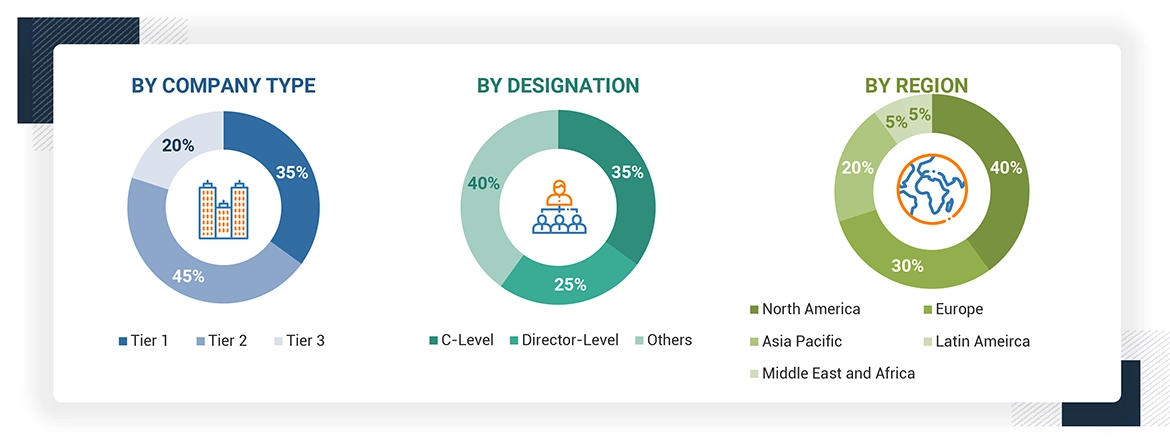

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 1 billion, Tier 2 = < USD 500 million, and Tier 3 = < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The revenue share analysis of major companies was used in this report to determine the size of the global medical aesthetics market. This was accomplished by identifying the major market participants and calculating their medical aesthetics business revenues using a variety of information acquired throughout the primary and secondary research stages. Examining the annual and financial reports of the leading market participants was one aspect of secondary research. On the other hand, primary research involved in-depth interviews with important thought leaders, including directors, CEOs, and important marketing executives.

Segmental revenues were computed using the revenue mapping of the leading solution/service providers to determine the worldwide market value. The following steps were engaged in this process:

- Making a list of the leading international companies in the medical aesthetics industry

- Charting the annual profits made by the leading companies in the medical aesthetics sector (or the closest stated business unit/product category)

- As of 2023, revenue mapping of leading companies to cover a significant portion of the global market

- Calculating the medical aesthetics industry's global value

Global Medical aesthetics Market: Bottom-up and Top-down approach

Data Triangulation

After determining the overall market size through the process of estimation as discussed above, the global medical aesthetics market has been segmented and subsegmented. Data triangulation and market breakdown methods have been used to refine the accuracy of these estimates. This process is based on the analysis of multiple factors and trends from both the demand and supply perspectives. The medical aesthetics market has been validated through both the top-down and bottom-up approaches, ensuring the accuracy of the segment and subsegment statistics.

Market Definition

The medical aesthetics market comprises a broad scope of nonsurgical and minimally invasive treatments and products to improve the aesthetic appearance of an individual. Such procedures are usually aimed at issues concerning skin, body, and dental appearance and are specifically customized to meet individual needs. The use of advanced technologies makes it possible to rejuvenate, contour the body, and enhance dental aesthetics.

Applications under this medical aesthetics market include facial aesthetics, body shaping, skin rejuvenation, hair removal, scar reduction, and pigmentation correction. The market has several end customers, including dermatology and cosmetic clinics, hospitals, beauty centers, medical spas, and even home device consumers.

Stakeholders

- Medical Aesthetic Clinics

- Cosmetic Product Manufacturers

- Aesthetic Device Manufacturers

- Pharmaceutical Companies

- Hospitals and Surgical Centers

- Aesthetic Product Retailers

- Medical Spas and Beauty Spas

- Cosmetologists and Plastic Surgeons

- Media and Influencers

- Medical Aesthetics Device Distributors and Suppliers

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the medical aesthetics market based on product, device type, procedure, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micro markets for individual growth trends, prospects, and contributions to the overall medical aesthetics market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments for five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and analyze their market shares and core competencies

- To track and analyze competitive developments, such as product launches, funding and grants, partnerships, agreements, collaborations, expansions, strategic alliances, and acquisitions

- To benchmark players within the market using the proprietary “Company Evaluation Matrix” framework to analyze players on various parameters within the broad categories of business and product excellence strategy.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Global Medical Aesthetics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Global Medical Aesthetics Market