LIB Cathode Conductive Auxiliary Agents Market

LIB Cathode Conductive Auxiliary Agents Market by Product Type (Carbon Black, Carbon Nanotubes), Chemistry (NMC, NCA, LFP, LMO, LCO), Application (Automotive, Consumer Electronics, Energy Storage Systems, Industrial) - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The LIB cathode conductive auxiliary agents market is projected to reach USD 4.32 billion by 2029 from USD 1.80 billion in 2024, at a CAGR of 19.1% during the forecast period. A primary reason for market growth in cathode conductive auxiliary agents is the increased cathode demand by lithium-ion batteries (LIBs). As a result of using lithium-ion batteries to improve automotive industry efficiency, boost consumer electronics applications, and store electrical energy, the need has soared for cathode materials with enhanced electrical performance. The overall efficiency of cathodes used within LIBs has to be supported through superior electric conductivity. Conductive auxiliary agents like carbon black, carbon nanotubes (CNTs), and graphene are vital here. The electrical conductivity of cathodes increases by conductive agents.

KEY TAKEAWAYS

-

BY PRODUCT TYPEProduct Type incudes Carbon Black, Carbon Nanotubes, Other Types. Carbon Black is projected to be the fastest-growing product type in the LIB cathode conductive auxiliary agents market.” Carbon black, the fastest-growing lithium-ion battery (LIB) cathode conductive auxiliary agents market is set to become more versatile, cost-effective, and better performing than ever before through its uniqueness, cost-competitiveness, and outstanding properties of the material.

-

BY CHEMISTRYKey chemistries types include NMC, NCA, LFP, LMO, LCO. NMC, driven by outstanding performance and versatility, is the largest chemistry type in the LIB cathode conductive auxiliary agents market, with applications across multiple industries. NMC cathodes offer an exceptional performance per unit mass in terms of energy density, thermal stability, and lifetime, making them optimal for applications with demanding requirements, such as electric vehicles (EVs), consumer electronics and energy storage systems.

-

BY APPLICATIONKey applications are automotive, consumer electronics, energy storage systems, Industrial and Other Applications. The automotive industry is likely to be the biggest application for LIB cathode conductive auxiliary agents due to the increasing use of electric vehicles (EVs) around the world. The demand for lithium-ion batteries in automotive applications shoots up as the world is moving towards cleaner and more sustainable options for transportation, which is the principal driver of growth in this market segment.

-

BY REGIONThe LIB cathode conductive auxiliary agents market covers Europe, North America, Asia Pacific and Rest of the world. The Asia Pacific holds the greatest share in the conducted auxiliary agents market for LIB cathodes of the lithium-ion batteries, because of its domination in lithium-ion battery manufacturing and cathode production. This is home to vital battery manufacturing heavyweights including China, Japan and South Korea, all of which present significant shares of the global cathode production.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including acquisitions and product lauces. For instance, Orion S.A. has introduced PRINTEX kappa 10, a premium conductive additive designed to meet the growing demand from manufacturers of lithium-ion batteries for electric vehicles, energy storage systems, and consumer electronics.

The LIB cathode conductive auxiliary agents market is primarily influenced by key drivers. Advances in cathode material technologies along with the need for cathode materials are currently driving the market of conductive auxiliary agents in the cathode of LIBS significantly. The rapidly increasing demand for high-performance batteries, especially EV's, energy storage systems, and consumer electronics, has caused a rise in demand for such advanced cathode materials as NMC, NCA, and LFP.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on manufacturers’ businesses arises from rapid advancements and shifts across the electric vehicle, renewable energy, and consumer electronics sectors. Key growth hubs include battery producers and OEMs that depend on cathode conductive auxiliary agents to enhance energy density, electrical conductivity, and performance stability. Changes in end-user demand—driven by the acceleration of electric mobility, expansion of energy storage systems, and miniaturization of smart devices—directly influence production priorities and material requirements.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for lithium-ion batteries in end-use industries fuel need for cathode conductive agents

-

Improved electrical conductivity and safety

Level

-

Regulatory requirements for reducing toxic waste to increase costs

-

High prices of conductive agents such as CNT and graphene

Level

-

Government incentives and funding for green energy projects and EV adoption

-

Surge in cathode production capacity

Level

-

Large concentration in Asian countries restricting global demand

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for lithium-ion batteries in end-use industries fuel need for cathode conductive agents

The surging demand for Lithiumlithium-Ion ion Batteries batteries (LIBs) across multiple industries significantly fuels the market for cathode conductive auxiliary agents. In particular, the electric vehicle (EV) sector is a key driver. According to the Indian Trade Administration, India's EV lithium battery demand is projected to skyrocket soar from 4 GWh in 2023 to 139 GWh by 2035, primarily driven by the expanding light vehicle segment. Globally, the lithium battery market is expected to grow 5-–10 times over the next decade, with Bloomberg projecting global EV sales to reach 56 million units by 2040. Such robust growth in EV adoption emphasizes the critical need for advanced auxiliary agents to enhance battery efficiency, durability, and performance. In addition to automotive, the energy storage sector is experiencing unprecedented expansion. A Bloomberg report highlighted that global energy storage capacity grew by over 100 GWh in 2024, marking the largest annual increase in the sector's history. The consumer electronics market is another major contributor, with devices like smartphones, laptops, and wearables driving demand for lightweight, energy-efficient

Restraint:High prices of conductive agents such as CNT and graphene

The high prices of conductive agents, such as carbon nanotubes (CNTs) and graphene, act as a significant restraint forsignificantly restrain the growth of the lithium-ion battery (LIB) cathode conductive auxiliary agents market. These advanced materials are crucial for in enhancing battery performance by improving electrical conductivity, optimizing electron transfer, and maintaining structural stability during charge-discharge cycles. However, their exorbitant costs pose a challenge to widespread adoption, especially specifically in cost-sensitive applications like such as consumer electronics and large-scale energy storage systems.

Opportunity: Surge in cathode production capacity

The rapid expansion in cathode production globally is a key factor driving drives the demand for cathode conductive auxiliary agents in lithium-ion batteries (LIBs). With the rising need for high-performance batteries, particularly for electric vehicles (EVs) and energy storage systems, substantial investments are being made in cathode production facilities worldwide. Recent developments highlight the industry's focus on scaling up production to meet increasing market demands.

Challenge: Large concentration in Asian countries restricting global demand

The cathode production market is heavily concentrated in Asia, posing a significant challenge for the global cathode conductive auxiliary agents market used in lithium-ion batteries (LIBs). According to a 2022 report by the International Energy Agency (IEA), Chinese companies produce 70% of the materials required to manufacture cathodes, while the remaining production is largely concentrated in Japan and South Korea. North America, in comparison, has almost no significant cathode production facilities. A 2025 article stated that according to IEA, that China accounts for nearly 90% of the global cathode active material manufacturing capacity and over 97% of the anode active material production. The remaining gaps in global manufacturing capacity are being filled primarily by South Korea and Japan. Highlighting the dominance of Asian markets.

LIB Cathode Conductive Auxiliary Agents Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Utilizes cathode conductive agents in high-density LIBs for smartphones, laptops, and energy storage systems to improve power output and longevity. | Enhances electrical conductivity, improves cycle stability, and supports compact, lightweight battery designs for consumer electronics. |

|

Applies conductive additives in EV and ESS battery cathodes to ensure uniform electron transport and minimize internal resistance. | Boosts energy efficiency, extends battery life, and enables high-power performance for electric mobility and grid storage. |

|

Integrates LIBs containing cathode conductive agents into EV powertrains for optimized performance and rapid charging. | Provides faster charge–discharge capability, reduces heat generation, and enhances overall driving range and reliability. |

|

Employs advanced conductive materials in cathodes for EV and stationary energy storage applications. | Increases current conductivity, improves high-rate performance, and supports long-term durability under extreme conditions. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The LIB Cathode Conductive Auxiliary Agents market ecosystem comprises raw material suppliers, manufacturers (Cabot Corporation ; Lion Specialty Chemicals Co., Ltd. Birla Carbon), distributors, and end users (Tesla, LG Energy Solution, Samsung SDI). Conductive materials such as carbon black, CNTs, and graphene are processed to enhance cathode conductivity and battery efficiency. Collaboration across the value chain is essential to advance performance, sustainability, and innovation in the lithium-ion battery industry.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

LIB cathode conductive auxiliary agents Market, By Product Type

Carbon black accounted for the largest share, in terms of value, of the global market in 2024. Largest product type in LIB cathode conductive additive the market will be carbon black due to superior properties as well as applications. Carbon black is critical for improving lithium-ion battery performance in terms of a very efficient electron pathway towards the cathode thereby enhancing charge-discharge rates, while its excellent electrical conductivity and high specific surface area, combined with relatively cost-effectiveness, typically make it the most important.

LIB cathode conductive auxiliary agents Market, By Chemistry

Nickel Manganese Cobalt Oxide (NMC) is expected to be the largest based on chemistry. Nickel-Manganese-Cobalt (NMC) cathodes appear to be the most well-balanced material across all aspects in performance, cost, and scalable capability for LIB cathode conductive adjuncts. With this truly incomparable value proposition, NMC becomes more and more relevant in a world facing soaring demand for electric vehicles (EVs), renewable energy storage, and portable electronics.

LIB cathode conductive auxiliary agents Market, By Application

Automotive held largest market, in terms of value, share in the global market in 2024. Given that the transportation system is rapidly transitioning toward electrification, led by the global wave of sustainability along with stringent emissions regulations, automotive industry shall drive the market in lithium-ion battery (LIB) cathode conductive auxiliary agents. Electric passenger cars, electric commercial vehicles, and electric buses require high capacity and high performance batteries to produce extended driving ranges, faster charging and improved energy efficiency.

REGION

Asia Pacific to be fastest-growing region in global LIB Cathode Conductive Auxiliary Agents market during forecast period

Asia Pacific is the largest region for LIB cathode conductive auxiliary agents market. Asia Pacific leads the global lithium-ion battery cathode conductive auxiliary agents' market, particularly due to Asia Pacific's high level of activity in battery manufacture, rapidly accelerating electric vehicle business, and superior industrial infrastructure in the region. Asia Pacific leads with countries producing key battery materials like China, Japan, and South Korea, all three form a majority contribution of the lithium-ion battery material around the world.

LIB Cathode Conductive Auxiliary Agents Market: COMPANY EVALUATION MATRIX

In the LIB cathode conductive auxiliary agents market matrix, Cabot Corporation (Star) leads with a robust market presence, advanced product portfolio, and global supply network. Its strong R&D capabilities and expertise in carbon black and conductive additives position it as a key partner for major battery manufacturers. Lion Specialty Chemicals Co., Ltd. (Emerging Leader), while having a smaller market share and a more regional focus in Asia, is rapidly expanding through product innovation and collaborations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.51 Billion |

| Market Forecast in 2030 (value) | USD 4.32 Billion |

| Growth Rate | CAGR of 19.1% from 2024-2029 |

| Years Considered | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion), Volume (ton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Rest of the World |

WHAT IS IN IT FOR YOU: LIB Cathode Conductive Auxiliary Agents Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Asia-based LIB Cathode Conductive Auxiliary Agents Supplier |

|

|

| Global Battery OEM Partner |

|

|

RECENT DEVELOPMENTS

- October 2023 : n Birla Carbon, part of the Aditya Birla Group, has acquired Belgium-based Nanocyl SA for an undisclosed amount, a move aimed at accelerating growth in battery materials for lithium-ion batteries.

- October 2023 : n Orion S.A. has introduced PRINTEX® kappa 10, a premium conductive additive designed to meet the growing demand from manufacturers of lithium-ion batteries for electric vehicles, energy storage systems, and consumer electronics.

- November 2022 : n Cabot Corporation has unveiled its new LITX® 93 series of conductive carbon additives (CCA), designed for use in lithium-ion batteries for electric vehicles (EVs), energy storage systems, and consumer electronics.

Table of Contents

Methodology

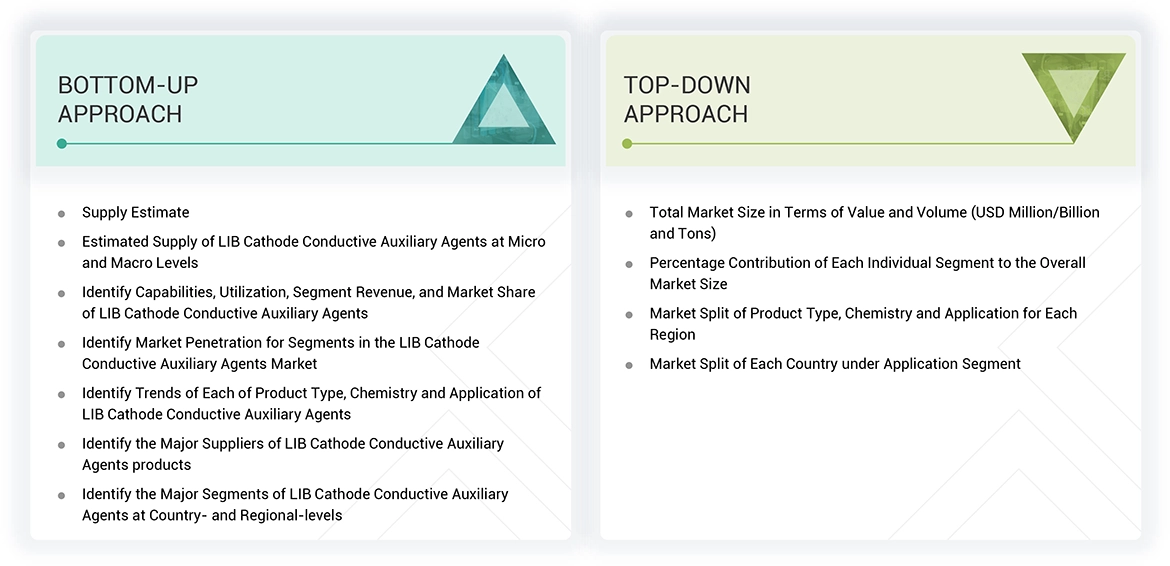

The study involved four major activities in estimating the market size of the LIB cathode conductive auxiliary agents market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The LIB cathode conductive auxiliary agents market comprises several stakeholders in the value chain, which include raw material sourcing, manufacturing of cathode conductive auxiliary agents, quality control and testing, distributors and end users. Various primary sources from the supply and demand sides of the LIB cathode conductive auxiliary agents market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in the lithium-ion battery cathode sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the LIB cathode conductive auxiliary agents market industry.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to product type, chemistry, application and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, fabricators, and their current usage of LIB cathode conductive auxiliary agents market and the outlook of their business, which will affect the overall market.

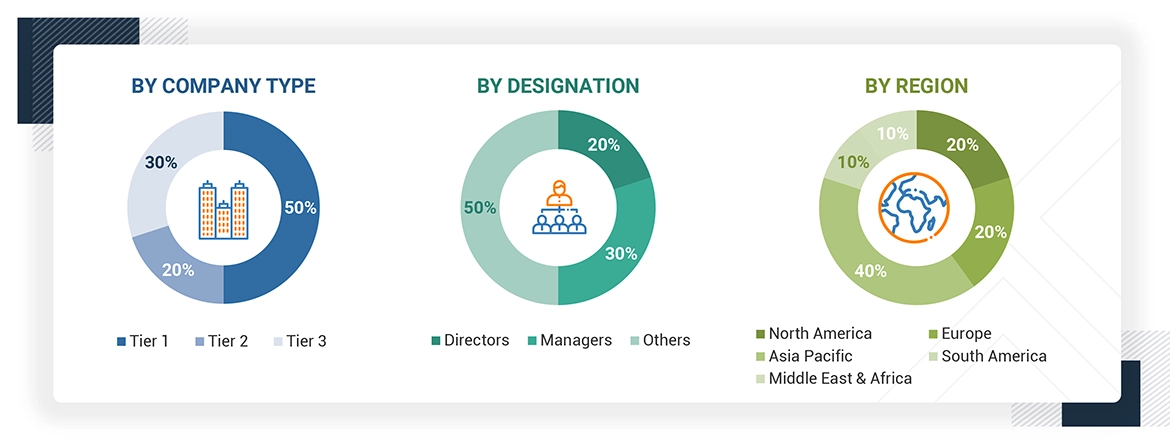

The following is a breakdown of the primary respondents:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023, available in the public domain, product portfolios, and geographical presence.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Orion S.A. | Head of Innovation | |

| Birla Carbon | Assistant Manager | |

| Cabot Corporation | Sales Manager | |

| Imerys | Sales Director | |

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the LIB cathode conductive auxiliary agents market.

- The key players in the industry have been identified through extensive secondary research.

- The industry's supply chain has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Lithium-ion batteries (LIBS) now stand at the center of modern energy storage developments. From electric vehicles (EVs) to portable electronics and renewable energy storage, these batteries cradle it all. LIBS operate based on artificial auxiliary conductive materials such as cathode active materials. They use agents to increase conductivity on the cathode material itself, which gives electrochemical batteries the ability to conduct current within the battery while charging and discharging. These agents are usually carbon-based materials, carbon black, or carbon nanotubes.

Currently, there is high demand from batteries to develop high-performance conductive agents. These not only increase the conductivity but also add energy density, cycling stability, and safety. Innovations like ultra-pure acetylene black, hybrid blends of carbon black and nanotubes, and highly graphitic structures mark new milestones in LIB technology.

The demand for sky-high cathode conductive agents has soared with the fast growth in the markets of EVs, energy storage systems, and consumer electronics. Government incentives on EV adoption, advancements in battery manufacturing, and increased focus on energy density solutions drive the market.

Stakeholders

- Raw Material Suppliers

- LIB Cathode Conductive Auxiliary Agents Manufacturers

- Quality Control and Testing

- Distributors and Suppliers

- Lithium-ion battery Manufacturers

- End user industries

- Research and Development associations

- Regulatory Bodies and Standards Organizations

Report Objectives

- To define, describe, and forecast the size of the LIB cathode conductive auxiliary agents market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on product type, chemistry, application, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, and Rest of the World along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, deals and agreements in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the LIB Cathode Conductive Auxiliary Agents Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in LIB Cathode Conductive Auxiliary Agents Market