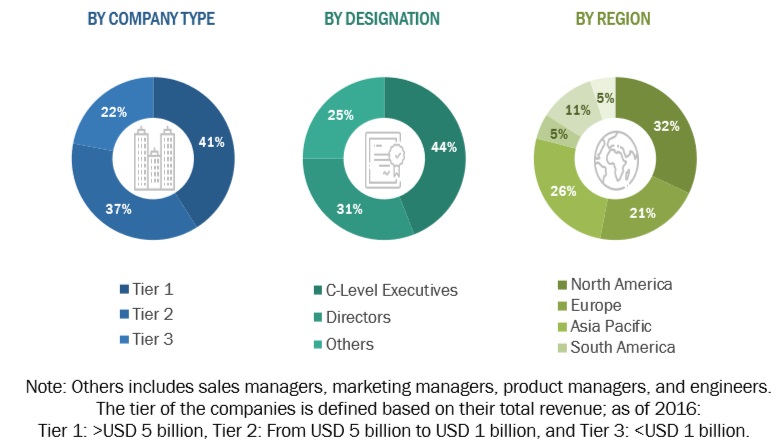

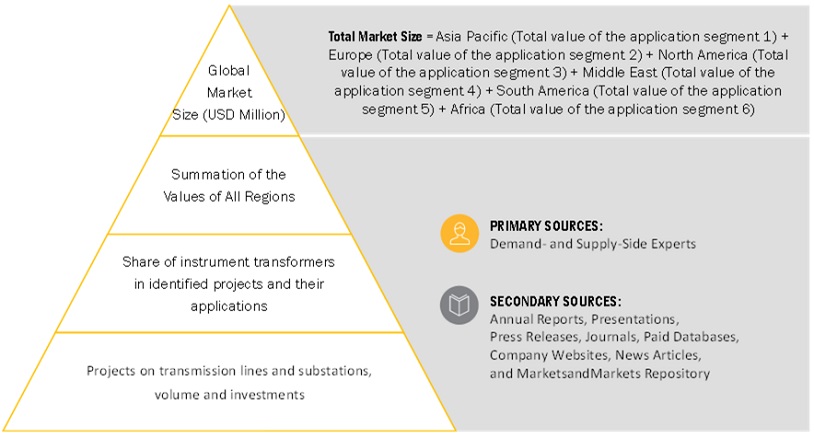

This study involved substantial efforts to determine the current size of the instrument transformers market. It began with a rigorous secondary research procedure to acquire information on the market, analogous markets, and the overall industry. These results, assumptions, and market size projections were then carefully evaluated by contacting industry experts from throughout the whole value chain using primary research methods. The entire market size was determined by completing a country-specific analysis. Following that, the market was dissected further, with data cross-referenced to estimate the size of various market segments and sub-segments.

Secondary Research

Several secondary sources were used during the secondary research process to discover and collect material for this study. Secondary sources include company annual reports, press announcements, investor presentations, white papers, certified publications, articles by recognized writers, manufacturers' organizations, directories, and databases.

Secondary research was primarily conducted to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation based on industry trends to the lowest level, regional markets, and key developments from both market and technology perspectives.

Primary Research

During the main research process, several primary sources were interviewed to gather qualitative and quantitative data for this study. Primary supply-side sources include industry professionals such as CEOs, vice presidents, marketing directors, technology and innovation directors, and other important executives from various top firms and organizations in the worldwide instrument transformers market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The size of the market and its related submarkets was estimated and validated using both top-down and bottom-up techniques. The research method used to estimate market size includes secondary research to identify key firms, as well as primary and secondary research to assess their market shares in relevant areas. This procedure comprises analyzing the annual and financial reports of key market businesses, as well as conducting in-depth interviews with industry specialists such as CEOs, VPs, directors, and marketing executives to gain valuable insights. All percentage shares, splits, and breakdowns were derived using secondary sources and confirmed with original sources. To get at the final quantitative and qualitative data, all conceivable parameters affecting the markets included in this research study were accounted for, examined in great depth, validated by primary research, and assessed.

Global Instrument Transformers Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After calculating the overall market size using the process indicated above, the whole market was divided into several categories and sub-segments. Data triangulation including market breakdown procedures were used, when appropriate, to complete the whole market engineering process and provide correct statistics for all segments and sub-segments. The data has been triangulated by examining numerous aspects and trends on both the demand and supply sides. In addition, the market has been verified using top-down and bottom-up approaches.

Market Definition

The electricity used by residential, commercial, and industrial users comes from centralized power facilities located far from the consumption locations. These power plants are linked to end customers via a complicated transmission and distribution infrastructure. This network extends beyond individual electric companies and, in some cases, across entire countries, such as Europe. To manage energy flow, numerous measurements are taken across the grid to determine its electrical status. Real-time voltage and current measurements at several sites offer information about the system's state. Measurements are taken at power plant outputs, as well as at the input and output of lines that meet at transmission or distribution substations. These metrics are used for invoicing reasons, allowing firms to track their power output and consumer use. Vigilant monitoring avoids overloading, diagnoses defects, and optimizes generation and distribution for efficient grid management.

Instrument transformers are specialized electrical devices that safely and precisely monitor high voltage and current in power networks. They serve as an important connection between high-voltage power lines and low-voltage measuring devices, allowing for safe and reliable monitoring of vital electrical parameters. Instrument transformers essentially convert high voltage or current values into safer and more controllable levels that may be measured by equipment like as meters, relays, and safety devices.

This transformation is accomplished by electromagnetic induction, which occurs when a change in current or voltage in the transformer's main winding causes a proportionate change in the secondary winding.

The scope of this study covers, but is not limited to, all accuracy classes for instrument transformers described by IEEE, CSA, IEC, and ANSI standards..

Key Stakeholders

-

Banks, venture capitalists, financial institutions, and other investors

-

Companies related to electric power generation, transmission, and distribution

-

Energy associations

-

Environment associations

-

Energy efficiency consultants

-

Government and industry associations

-

Government and research organizations

-

Manufacturing industry

-

Public & private power generation, transmission & distribution companies (utilities)

-

Smart grid project developers

-

State and national regulatory authorities

-

Sub-station equipment manufacturing companies

-

Venture capital firms

Objectives of the Study

-

The instruments transformers market will be defined, described, segmented, and forecasted based on installation, insulation, voltage, current, and end-user.

-

To forecast market size for five key regions: North America, South America, Europe, Asia Pacific, and the Middle East and Africa, as well as the key countries within each region.

-

To provide comprehensive information about market growth drivers, restraints, opportunities, and industry-specific challenges.

-

To strategically analyze the subsegments in terms of individual growth trends, prospects, and contributions to overall market size.

-

To examine market opportunities for stakeholders and the competitive landscape for market leaders.

-

To profile the key players strategically and thoroughly analyze their market shares and core competencies.

-

To monitor and analyze competitive developments in the instruments transformers market, such as agreements, sales contracts, partnerships, new product launches, acquisitions, joint ventures, contracts, expansions, and investments.

-

This report examines the value of the instruments transformers market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to your specific needs. The following customization options are available for a report:

Product Analysis

-

Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

-

Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in Instrument Transformers Market