Industrial Data Management Market Size, Share, Trends and Growth

Industrial Data Management Market by Type (Data Orchestration & Analytics, Data Storage & Integration, Data Sharing, Data Security, Data Visualization, Data Governance & Compliance), Data Type(Structured, Unstructured) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The industrial data management market is estimated to be USD 105.10 billion in 2025 and is projected to reach USD 213.20 billion by 2030, registering a CAGR of 15.2% during the forecast period. The industrial data management market is growing significantly. It is fueled by several factors such as industrial automation, Industry 5.0, real-time data management, rising need for data analytics, and increasing focus of industries to improve efficiency, facilitate predictive maintenance, and simplify manufacturing processes. The widespread development of Internet of Things (IoT) devices in industries such as manufacturing & processing, BFSI, healthcare & life sciences also plays a critical role. IoT devices require a reliable system to store, gather, and process data. In the energy sectors, data management plays a crucial role in monitoring renewable energy systems, smart grids, etc

KEY TAKEAWAYS

- The Asia Pacific industrial data management market accounted 36.4% revenue share in 2024

- By type, data orchestration & analytics is expected to register highest CAGR of 17.6%

- By data stack, the modern segment is expected to hold a share of 51.3% of the industrial data management market in 2025.

- By offering, software segment is projected to grow fastest during the forecast perod

- By deployment mode, on-premises deployment holds largest market share during forecast period

- By organization type, large organizations are expected to contribute largest market share during forecast period

- By data type mode, unstructured data type holds a significant market share during forecast period

- By deployment mode, On-premises deployment holds a significant market share during forecast period

- The companies such Microsoft, Alphabet and SAP were identified as Star players in the industrial data management market, given their broad industry coverage and strong operational & financial strength.

- The companies such as AVEVA, Confluent, Inc and Palantir Technologies, Inc among others have distinguished themselves among SMEs due to their well-developed marketing channels and extensive funding to build their product portfolios

The industrial data management market is estimated to be USD 105.10 billion in 2025 and is projected to reach USD 213.20 billion by 2030, registering a CAGR of 15.2% during the forecast period. Industrial data management growth is fueled by the growing need in different end-use industries to address different levels of data complexity, serve various user roles across the organization using data-as -a service model, adapt to changing organizational priorities and market conditions which requires to prioritize data storage & integration, scale with growing data volumes and new data types as well as support both quick insights and deep, complex analyses. The rising focus of the industrial sector on cloud deployment, dataOps,AI-driven insights, cloud-native solutions, and data governance are expected to drive the market for industrial data management

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Artificial Intelligence (AI) is revolutionizing industrial data management significantly by automating processes, improving data quality, and enabling real-time decision-making. AI can detect and fix errors, inconsistencies, and duplicates in data, thus improving data quality and integrity. Machine learning principles make consolidating data from multiple sources into a single view easy, enabling improved decision-making. In manufacturing & processing industries, AI helps enable predictive maintenance by interpreting sensor data to forecast equipment failure, reducing downtime and maintenance. It also plays a pivotal role in enhancing data security by detecting anomalies and potential breaches and remaining compliant with data protection regulations. AI-based analytics also provide deeper insights by uncovering concealed patterns and making more strategic choices. Typically, the application of AI in industrial data management systems leads to improved efficiency, reduced operational expense, and enhanced competitiveness across various industries

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expanding unstructured data

-

Increasing cyber threats in industrial environments

Level

-

Complexities associated with integrating industrial data management solutions into existing infrastructure

-

Significant investments in hardware

Level

-

Convergence of information technology and operational technology

-

Increasing adoption of cloud computing in industrial applications

Level

-

Ensuring high-quality and accurate data

-

Lack of standardization in industrial data management

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Increasing cyber threats in industrial environments

The increasing frequency and sophistication of cyber threats in industrial environments drive the need for robust industrial data management solutions. Malware and ransomware attacks targeting critical infrastructure, manufacturing plants, and utilities pose severe risks, including operational downtime, data loss, and potential safety hazards for employees and surrounding communities. The rapid adoption of digital technologies and interconnected systems has expanded the attack surface, making industrial networks more vulnerable to cyberattacks. As a result, businesses must implement comprehensive data management strategies to monitor, analyze, and secure vast amounts of unstructured data, such as security logs, machine-generated data, and real-time threat intelligence, to detect and mitigate risks proactively

Restraint:Complexities associated with integrating industrial data management solutions into existing infrastructure

Integrating industrial data management solutions into existing infrastructure is an organization's biggest challenge. Many industrial environments rely on legacy systems that were not initially designed for modern data analytics, cloud computing, or cybersecurity protocols. These outdated systems often use proprietary formats and protocols that make it difficult to connect with newer technologies, requiring costly customization or replacement.

Opportunity:Convergence of information technology and operational technology

The convergence of Information Technology (IT) and Operational Technology (OT) is driving a significant increase in demand for industrial data management. Traditionally, IT systems managed enterprise applications, data storage, and cybersecurity, while OT systems controlled industrial processes, machinery, and physical operations. However, with the rise of digital transformation and Industrial IoT (IIoT), these two domains are becoming increasingly interconnected, generating massive volumes of real-time operational data that must be integrated, analyzed, and secured. This convergence allows businesses to optimize production efficiency, enable predictive maintenance, and improve decision-making, but it also creates challenges related to data integration, standardization, and security. To address these complexities, industries are adopting advanced data management solutions that facilitate seamless communication between IT and OT systems while ensuring data accuracy and consistency.

Challenge:Ensuring high-quality and accurate data

Ensuring high-quality and accurate data is one of the most significant challenges in industrial data management. Industrial environments generate massive volumes of data from multiple sources, including IoT sensors, machines, human operators, and enterprise software systems. However, raw industrial data is often noisy, incomplete, inconsistent, or duplicated, leading to incorrect insights and poor decision-making. If businesses rely on faulty or low-quality data, it can negatively impact production efficiency, predictive maintenance strategies, and overall operational performance.

Industrial Data Management Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Operational telemetry & historian replacement (ingest OPC-UA / IoT Edge → Azure). |Manufacturing execution systems (MES) and shop-floor transactional workloads. |Predictive maintenance pipelines combining time-series + relational dat | Fully-managed PaaS (Azure SQL) and integrated industrial playbook speeds deployments and reduces DB admin overhead; good high-availability and scale for OLTP + near-real-time analytics |

|

Global transactional systems that need strong consistency and horizontal scale (Spanner). Large-scale analytics / data-warehouse for manufacturing telemetry, digital twins and supply-chain analytics (BigQuery). Real-time fusion of transactional + analytical workloads (Spanner → BigQuery integration | True global scale + strong consistency for OLTP (Spanner) and serverless, fast analytics (BigQuery),reduced ETL friction via native integrations so teams can run real-time analytics on operational data. |

|

ERP + asset management backplane (S/4HANA) for utilities, oil & gas, discrete manufacturing. In-memory processing for near-real-time asset analytics and regulatory reporting. | Tight integration between high-performance HANA DB and SAP business processes (ERP/EAM) shortens time-to-insight for maintenance, compliance and billing use cases; good for industries needing regulatory reporting and integrated transactions + analytics. |

|

Plant & supply-chain data consolidation, manufacturing analytics, and centralized operational repositories. Heavy OLTP workloads and multi-site ERP/PLM integrations in mining, oil & gas, heavy industry... | Mature enterprise DB features (performance tuning, security, monitoring) combined with Oracle industry-cloud solutions reduce integration complexity for large industrial customers and help manage regulatory/operational data at scale |

|

Real-time ingestion and event-stream analytics for sensor/time-series data (Db2 Event Store). Enterprise asset management and APM (Maximo) with a central operational datastore. Hybrid deployments (on-prem / cloud) for utilities and energy.. | Strength in asset-centric workflows (Maximo) plus Db2’s high-availability and real-time ingestion capabilities makes IBM strong for asset-heavy industries that require integrated EAM + operational analytics and hybrid deployment options... |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The industrial data management market is competitive, with Microsoft (US), Alphabet Inc. (US), SAP (Germany), Oracle (US), IBM (US), and AWS (US) being some of the major providers of industrial data management solutions. The market has numerous small and medium-sized vital enterprises. Many players offer industrial data management, while other players offer integration services, which are required in various applications

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Industrial Data Management Market, By Type

Data orchestration & analytics is expected to grow at the highest rate during the forecast period. Data orchestration and analytics are increasingly gaining traction as a cornerstone in the industrial data management (IDM) ecosystem, driving remarkable growth and change among asset-based industries. As much as organizations are bogged down in managing disparate data streams, the demand for strong data orchestration products capable of normalizing data streams and achieving the utmost data continuity has become more powerful. Incorporating artificial intelligence (AI) and machine learning (ML) in data orchestration platforms has enhanced their capabilities further, enabling predictive analytics and proactive operational planning. Such amalgamation increases operational efficiency and makes it possible to meet stringent regulatory demands by guaranteeing data correctness and traceability.

Industrial Data Management Market, By Data Stack

The modern data stack is poised to grow fastest in the industrial data management market due to its flexibility, scalability, and cloud-native architecture. Unlike legacy systems, it enables seamless integration of structured and unstructured data from multiple industrial sources, including IoT devices, sensors, and ERP systems. Real-time analytics, AI-driven insights, and automated workflows make it highly attractive for industries seeking operational efficiency and predictive maintenance. Additionally, lower upfront costs, ease of deployment, and the ability to scale as data volumes grow drive adoption, especially among small-to-mid-sized enterprises aiming to leverage Industry 4.0 and digital transformation initiatives

Industrial Data Management Market, By Industry

The manufacturing & processing segment is expected to lead the industrial data management (IDM) market, fueled by their growing dependence on data-centric technologies to improve operational efficiency, maintain regulatory compliance, and meet sustainability objectives. These industries increasingly embrace IDM solutions to consolidate and analyze huge volumes of data from multiple sources, such as sensors, equipment, and enterprise systems. By incorporating this data, manufacturers can optimize production steps, foresee maintenance needs, and improve product quality. Blending advanced technologies such as artificial intelligence (AI), machine learning (ML), and the Industrial Internet of Things (IIoT) is reconfiguring manufacturing operations. Regulatory compliance and sustainability are other major drivers for IDM implementation in manufacturing. Businesses are compelled to reduce their environmental footprint and comply with stringent regulations. IDM solutions help monitor and maintain sustainability initiatives, including measuring energy consumption, waste management, and carbon footprints. Through transparency and accountability, these systems enable manufacturers to comply with regulatory needs and improve their reputation as a corporate entity

Industrial Data Management Market, By Country

The U.S. is set to dominate the industrial data management market due to its advanced industrial infrastructure, early adoption of Industry 4.0 technologies, and strong presence of leading solution providers like Microsoft, IBM, and Oracle. High investment in digital transformation, cloud computing, and AI-driven analytics enables U.S. industries to optimize operations, enhance productivity, and implement predictive maintenance effectively. Regulatory frameworks promoting data security and compliance further support market growth. Additionally, the country’s focus on smart manufacturing, energy efficiency, and innovation in industrial automation positions it as the largest and most technologically advanced market for industrial data management globally.

REGION

Asia Pacific to be fastest-growing region in global industrial data management market during forecast period

Asia Pacific is expected to be the fastest-growing industrial data management industry, driven by increased industrialization, expanding manufacturing bases, and the increasing use of digital technology. China, India, Japan, and South Korea invest heavily in intelligent manufacturing, industrial automation, and infrastructure construction, relying on efficient data monitoring and control. The strong presence of the automotive, electronics, and semiconductor industries throughout the region generates enormous data, thereby increasing the need for high-performance data management solutions. These industrial data management solutions assist in product testing, quality control, and real-time process optimization. Government initiatives such as "China Manufacturing 2025" and "Smart Nation" in Singapore also promote the adoption of Industry 4.0 technologies such as IoT, AI, and cloud-based data storage and analytics systems. Moreover, the increasing emphasis on electric cars, green energy, and smart grid implementations is broadening the applications of industrial data management solutions in energy measurement and battery testing. A strong resource base of skilled engineers, lower production costs, and rising foreign direct investments in high-technology industries also favor the region. With the advent of 5G infrastructure, smart cities, and digital transformation in industries, Asia Pacific presents enormous opportunities for industrial data management vendors. Thus, it will be the fastest-growing market during the forecast period

Industrial Data Management Market: COMPANY EVALUATION MATRIX

In the industrial data management companies, Microsoft is positioned as a star player due to its Azure cloud, AI analytics, and strong enterprise adoption solutions backed by strong global presence and technological innovation.In contrast, Palantir Technologies, Inc is classified as an emerging player as it continues to gain traction through its AI-driven platforms for complex industrial data and custom analytics solutions. and strengthen its market reach through partnerships and product diversification

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 94.07 Billion |

| Market Forecast in 2030 (Value) | USD 213.20 Billion |

| Growth Rate | CAGR of15.2 % from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, the Middle East, Africa, and South America |

WHAT IS IN IT FOR YOU: Industrial Data Management Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Asia Pacific-based data management software adoption |

|

|

| European Provider Partner Assessment |

|

|

| North American BFSI and Manufacturing End-use Operator |

|

|

| Japan-based Stakeholder for IT and OT data |

|

|

| Technology Integrators |

|

|

RECENT DEVELOPMENTS

- February 2025 : IBM completed the acquisition of HashiCorp for USD 6.4 billion, which was announced in April 2024. This acquisition aims to enhance IBM's hybrid cloud and generative AI offerings

- December 2024 : Google Cloud announced a strategic collaboration with Air France-KLM, a leading global airline group, to harness its data, analytics, and generative AI technologies. This partnership aims to accelerate AFKL’s data-driven, multi-cloud strategy, foster innovation, and redefine the future of the travel industry

- December 2024 : Amazon Web Services, Inc. (AWS) introduced the next generation of Amazon SageMaker, integrating essential capabilities for fast SQL analytics, petabyte-scale big data processing, data exploration, data integration, model development and training, and generative AI into a single, unified platform

- November 2024 : Snowflake acquired Datavolo, a company designed to accelerate the development, management, and monitoring of multimodal data pipelines for enterprise AI. This acquisition is expected to strengthen Snowflake’s capabilities in the ‘bronze layer’ of the data lifecycle, providing data engineering teams a seamless way to integrate their enterprise systems into Snowflake’s unified platform. This enables organizations to unlock data for AI, machine learning, applications, and analytics while benefiting from the scalability, performance, and built-in governance of AI Data Cloud

- November 2024 : AVEVA, a global leader in industrial software driving digital transformation and sustainability, invested USD 1.4 million to expand its research and development center in Derry, Ireland

Table of Contents

Methodology

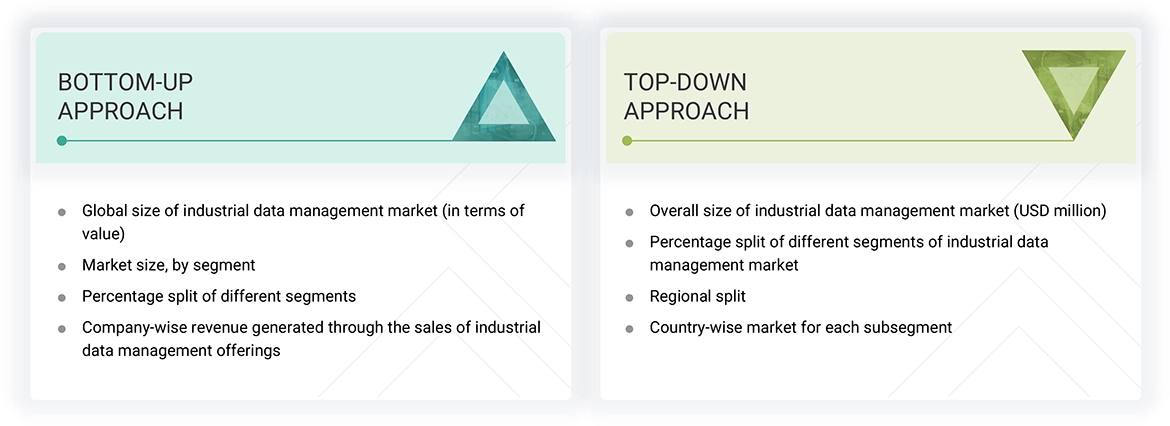

The study utilized four major activities to estimate the industrial data management market size. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information on the industrial data management market for this study. Secondary sources for this research study include corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and professional associations, white papers, certified publications, articles by recognized authors, directories, and databases. Secondary data was collected and analyzed to determine the overall market size, which was further validated through primary research.

List of Key Secondary Sources

|

Source |

Web Link |

|

The International Organization of Motor Vehicle Manufacturers |

https://www.oica.net/ |

|

Energy Information Administration |

https://www.eia.gov/ |

|

Federal Aviation Administration |

https://www.faa.gov/ |

|

ASEAN Automotive Federation |

https://www.asean-autofed.com/ |

|

International Society of Automation |

|

|

International Federation of Robotics |

|

|

Technology & Services Industry Association (TSIA). |

Primary Research

Primary interviews were conducted to gather insights into market statistics, revenue data, market breakdowns, size estimations, and forecasting. Additionally, primary research was used to comprehend the various technologies, types, end-uses, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end-user installation teams using industrial data management offerings and processes, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of industrial data management, which will impact the overall market. Several primary interviews were conducted across major countries in North America, Europe, Asia Pacific, and RoW.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed input and analysis from MarketsandMarkets and presented in this report. The following figure represents this study's overall market size estimation process.

Industrial Data Management Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall size of the industrial data management market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. Various factors and trends from the demand and supply sides were studied to triangulate the data. The market was validated using both the top-down and bottom-up approaches.

Market Definition

The industrial data management market refers to the sector focused on the collection, storage, analysis, and utilization of data generated by industrial operations and processes. This market encompasses a range of solutions, including data storage and analysis systems, historians, cloud platforms, and analytics tools that help organizations manage the vast amounts of data produced by machinery, sensors, and control systems in industries such as manufacturing, energy, oil & gas, and utilities. The primary goal is to improve operational efficiency, enable predictive maintenance, ensure regulatory compliance, and support data-driven decision-making. As industries increasingly adopt Industrial Internet of Things (IIoT) technologies, automation, and digital transformation initiatives, the demand for robust and scalable data management solutions continues to grow.

The report study covers a comprehensive analysis of the industrial data management market based on type, offering, stack, data type, organization type, vertical, and region. A few key providers of industrial data management are Microsoft (US), Alphabet Inc. (US), SAP (Germany), Oracle (US), IBM (US), and AWS (US).

Key Stakeholders

- Technology & Solution Providers

- System Integrators & IT Service Providers

- Research & Academic Institutions

- Government & Regulatory Bodies and Financial Institutions

- ODM and OEM Technology Solution Providers

- Industrial Data Management Software and Services Providers and Distributors

- Market Research and Consulting Firms

- Associations, Organizations, Forums, and Alliances related to the Industrial Data Management Industry

- Technology Investors

- Venture Capitalists, Private Equity Firms, and Start-ups

- End Users

Report Objectives

- To describe and forecast the industrial data management market size by type, offering, stack, data type, organization type, industry, and region, in terms of value

- To describe and forecast the market for various segments across four main regions, namely, North America, Europe, Asia Pacific, and RoW, in terms of value

- To strategically analyze micromarkets about individual growth trends, prospects, and market contributions

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze opportunities for stakeholders by identifying high-growth segments in the market

- To provide a detailed overview of the industrial data management value chain

- To strategically analyze key technologies, indicative selling price trend, trends impacting customer business, ecosystem, regulatory landscape, patent landscape, Porter's five forces, import and export scenarios, trade landscape, key stakeholders and buying criteria, and case studies about the market under study

- To strategically profile key players in the industrial data management market and comprehensively analyze their market share and core competencies

- To analyze competitive developments, such as partnerships, acquisitions, expansions, collaborations, and product launches, along with R&D in the industrial data management market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the industrial data management market

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company in the industrial data management market

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Industrial Data Management Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Industrial Data Management Market