Industrial Cleaning Solvents Market

Industrial Cleaning Solvents Market by Application (General & Medical Device Cleaning, Metal Cleaners, Disinfectants), End-use Industry (Manufacturing and Commercial Offices, Healthcare, Retail & Food Service), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The industrial cleaning solvents market is projected to reach USD 1.55 billion by 2030 from USD 1.24 billion in 2025, at a CAGR of 4.55% from 2025 to 2030. Industrial cleaning solvents are chemical agents used to dissolve, degrease, and remove contaminants such as oils, resins, dirt, and particulates from machinery, surfaces, and production equipment. The market growth is driven by rising demand across manufacturing, healthcare, electronics, and food processing industries, coupled with increasing emphasis on workplace hygiene and equipment maintenance. Additionally, the transition toward bio-based and low-VOC (volatile organic compound) solvents is reshaping product portfolios in response to environmental and occupational safety regulations.

KEY TAKEAWAYS

-

BY APPLICATIONThe industrial cleaning solvents market comprises general & medical device cleaning, metal cleaners, disinfectants, commercial laundry, food cleaners, and other applications. The general & medical device cleaning segment dominated the market due to its critical role in industrial machinery maintenance, office sanitation, and healthcare equipment sterilization. Rising awareness of hygiene, regulatory compliance in healthcare, and demand for versatile, high-performance solvents that are safe for sensitive surfaces strengthen this segment’s position as the largest application globally.

-

BY END-USE INDUSTRYKey end-use industries of industrial cleaning solvents include manufacturing and commercial offices, healthcare, retail & food services, hospitality, automotive and aerospace, food processing, and other end-use industries. The manufacturing and commercial offices segment accounted for the largest share, driven by increasing industrialization, strict safety standards, and the need to maintain equipment efficiency. Solvent-based cleaners ensure operational reliability, reduce maintenance downtime, and extend the lifespan of machinery and tools used in diverse production environments.

-

BY REGIONAsia Pacific held the largest regional share of the industrial cleaning solvents market. Strong manufacturing output from China, Japan, India, and South Korea, coupled with growing investment in industrial automation and urban infrastructure, underpins regional growth. The rising presence of large-scale industrial facilities, stricter hygiene standards, and government policies promoting cleaner production practices further contribute to the demand for advanced and sustainable cleaning solutions across the region.

-

COMPETITIVE LANDSCAPELeading players in the industrial cleaning solvents market focus on expanding their sustainable and bio-based portfolios through strategic collaborations and R&D initiatives. Exxon Mobil Corporation, Shell plc, BASF SE, Dow Inc., and LyondellBasell Industries N.V. are investing in low-emission and biodegradable solvent technologies to align with evolving environmental regulations. Partnerships with cleaning service providers and OEM manufacturers help enhance distribution efficiency and application-specific innovation, strengthening market presence globally.

The industrial cleaning solvents market is expected to grow steadily, driven by the need for sustainable practices, regulatory compliance, and efficient operations across industries. Companies are using advanced solvent formulations that clean more effectively, reduce environmental impact, and improve workplace safety. By keeping equipment and surfaces hygienic, minimizing downtime, and meeting health and safety standards, these industrial cleaning solvents play a key role in supporting productivity, reliability, and long-term sustainability in industrial and commercial operations worldwide.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from evolving hygiene standards, operational efficiency needs, and regulatory changes. Manufacturers, healthcare facilities, and commercial offices are the primary clients of industrial cleaning solvent suppliers, while their cleaning and maintenance operations represent the target applications. Shifts in sanitation regulations, sustainability requirements, or production processes will directly affect the revenues of these end users. The revenue impact on end users, in turn, influences the sales and growth of solvent suppliers, shaping overall market performance and investment in advanced, eco-friendly cleaning solutions, driving industrial cleaning solvents market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid Industrial growth

-

Rising demand for high-precision cleaning

Level

-

Stringent government and environmental regulations

Level

-

Growing demand for green & bio-based industrial cleaning solvents

-

Advanced cleaning technologies

Level

-

Toxicity of some solvents

-

Reduced production capacity and lack of workforce for industrial cleaning

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Growth in Industrial Activities

Rapid industrial growth in regions like Asia Pacific, Europe, and North America is increasing the need for industrial cleaning solvents. Manufacturing, automotive, electronics, and food processing sectors rely on solvents to keep equipment, machinery, and production lines clean and efficient. As industries expand, the demand for reliable, effective cleaning solutions rises, making industrial solvents essential for smooth operations, maintenance, and hygiene in high-output production environments.

Impact of Regulatory Standards

Regulations such as the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and the U.S. EPA’s Toxic Substances Control Act (TSCA) limit the use of hazardous solvents with high volatile organic compound (VOC) content. These rules restrict certain chemicals, require detailed reporting, and enforce safe handling and disposal practices. Compliance increases operational costs, limits formulation options, and slows adoption of traditional solvent products, making regulatory restrictions a key restraint in the industrial cleaning solvents market.

Demand for Green and Bio-Based Solvents

Sustainability goals and environmental awareness are increasing demand for green and bio-based industrial cleaning solvents. Companies are seeking biodegradable, plant-based alternatives that reduce environmental impact without affecting cleaning performance. Using eco-friendly solvents supports corporate responsibility, enhances brand reputation, and meets regulatory and customer expectations. This trend is creating opportunities for manufacturers to innovate and supply safe, sustainable solvents suitable for manufacturing, healthcare, and commercial facilities.

Safety and Toxicity Challenges

Some industrial solvents can be hazardous due to toxicity, flammability, or chemical residues, creating safety risks for workers and the environment. Proper handling, storage, and disposal are critical to reduce these risks. Manufacturers are developing safer and stable formulations, providing guidance for use, and improving compliance. Addressing toxicity ensures worker safety, protects the environment, and allows wider adoption of solvents in sectors such as healthcare, food processing, and commercial cleaning.

Industrial Cleaning Solvents Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

High-performance industrial cleaning solvents used in automotive assembly lines to remove oils, grease, and residues from engine and metal parts before coating and painting. | Ensures superior surface preparation, enhances coating adhesion, reduces defects, and improves overall production efficiency. |

|

Solvent-based cleaning systems employed in pharmaceutical manufacturing to sanitize reactors, mixing tanks, and filtration units between production cycles. | Maintains sterility and product purity, minimizes contamination risk, and ensures regulatory compliance in large-scale production. |

|

Food-grade cleaning solvents used for degreasing, disinfecting, and maintaining hygiene in food processing and packaging machinery. | Prevents microbial growth, extends equipment life, improves product safety, and supports continuous operation. |

|

Precision cleaning solvents applied in electronics and electrical component manufacturing to remove flux, lubricants, and particulates during assembly. | Enhances component reliability, prevents electrical failures, and improves performance in sensitive electronic systems. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The industrial cleaning solvents ecosystem involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, solvent manufacturers, distributors, cleaning service providers, and end users. Raw material suppliers provide key inputs such as petrochemical derivatives, bio-based compounds, and specialty chemicals to solvent manufacturers. The manufacturers formulate and produce industrial cleaning solvents for different applications, including general cleaning, medical device cleaning, and metal degreasing. Distributors and cleaning service providers connect manufacturers with end users, streamlining the supply chain and enhancing operational efficiency, product availability, and profitability across industrial, healthcare, and commercial industries.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Industrial Cleaning Solvents Market, By Application

The general & medical device cleaning segment dominated the industrial cleaning solvents due to the increasing adoption of automated and robotic cleaning systems in factories, laboratories, and healthcare facilities. These systems require high-performance solvents that operate safely in automated cycles without leaving residues or damaging surfaces. Automation improves cleaning efficiency, reduces human error, and ensures hygiene compliance. Solvents optimized for these systems enhance throughput, lower downtime, and support consistent cleanliness, driving strong demand in industrial and medical cleaning applications.

Industrial Cleaning Solvents Market, By End-use Industry

The manufacturing and commercial offices segment held the largest share as companies increasingly prioritize operational efficiency and equipment longevity. Industrial cleaning solvents help maintain machinery performance, prevent failures, and extend asset life. Clean facilities also support employee safety and productivity. By reducing maintenance downtime and ensuring smooth operations, the use of high-quality solvents becomes critical, linking hygiene practices directly to cost-effective, uninterrupted industrial and commercial workflows.

REGION

Asia Pacific to be fastest-growing region in global industrial cleaning solvents market during forecast period

Asia Pacific is projected to be the fastest-growing region during the forecast period. The growth is due to the strong government initiatives promoting workplace hygiene, safety, and industrial standards. Countries like China, India, and Japan are implementing regulations and cleanliness campaigns that encourage industries to adopt advanced cleaning solvents. Compliance with these regulations ensures safer working environments, protects equipment, and supports sustainability goals. High adoption in manufacturing, healthcare, and commercial industries is boosting regional demand, reinforcing Asia Pacific’s dominance in the industrial cleaning solvents market.

Industrial Cleaning Solvents Market: COMPANY EVALUATION MATRIX

In the industrial cleaning solvents market, ExxonMobil Corporation leads the market with a strong global presence and a comprehensive portfolio of high-performance and sustainable solvents. The company drives large-scale adoption across manufacturing, healthcare, and commercial office applications by offering solutions that combine cleaning efficiency with regulatory compliance and environmental responsibility. ExxonMobil’s focus on innovation, low-VOC formulations, and tailored solvent solutions for diverse industrial needs reinforces its market leadership and strengthens its role in supporting productivity, hygiene, and operational excellence across multiple industries worldwide.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 1.19 Billion |

| Revenue Forecast in 2030 | USD 1.55 Billion |

| Growth Rate | CAGR of 4.55% from 2025-2030 |

| Actual data | 2020-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Application: General & Medical Device Cleaning, Metal Cleaners, Disinfectants, Commercial Laundry, Food Cleaners, and Other Applications By End-use Industry: Manufacturing and Commercial Offices, Healthcare, Retail & Food Services, Hospitality, Automotive and Aerospace, Food Processing, and Other End-use Industries |

| Regional Scope | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Industrial Cleaning Solvents Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based Industrial Cleaning Solvents Manufacturer | • Breakdown of solvent production by facility type, like bio-based or petroleum • Mapping of supplier networks in main industrial areas | • Cut production costs by spotting weak spots • Lower risks with new supplier options |

| Asia Pacific-based Industrial Cleaning Solvents Manufacturer | • Deep dives into ASEAN markets like Vietnam or Indonesia for solvent needs • Checks on plant use rates in key spots | • Enter fast-growing factory zones • Spot chances for buys or team-ups |

RECENT DEVELOPMENTS

- July 2024 : PBI Performance Products, Inc. and TenCate Protective Fabrics formed a partnership to launch PBI Peak5, an ultra-lightweight fire-resistant outer shell fabric specifically designed for firefighters

- May 2024 : Milliken & Company, a global leader in diversified manufacturing, collaborated with NASA to develop and produce flame-resistant intimate apparel fabric for the upcoming Artemis missions.

- May 2023 : Indorama Ventures Public Company Limited renamed Trevira GmbH as Indorama Ventures Fibers Germany GmbH as part of its global brand alignment strategy aimed at establishing a unified corporate identity across its 147 sites in 35 countries.

- February 2022 : DuPont Personal Protection, a subsidiary of DuPont de Nemours, Inc., formed a partnership with Bulwark, the world’s largest flame-resistant (FR) apparel brand

- February 2021 : Teijin Limited launched a new fire-resistant fabric named Tenax. This is a woven carbon fiber fabric coated with a thermoplastic polymer and is completely impregnated.

Table of Contents

Methodology

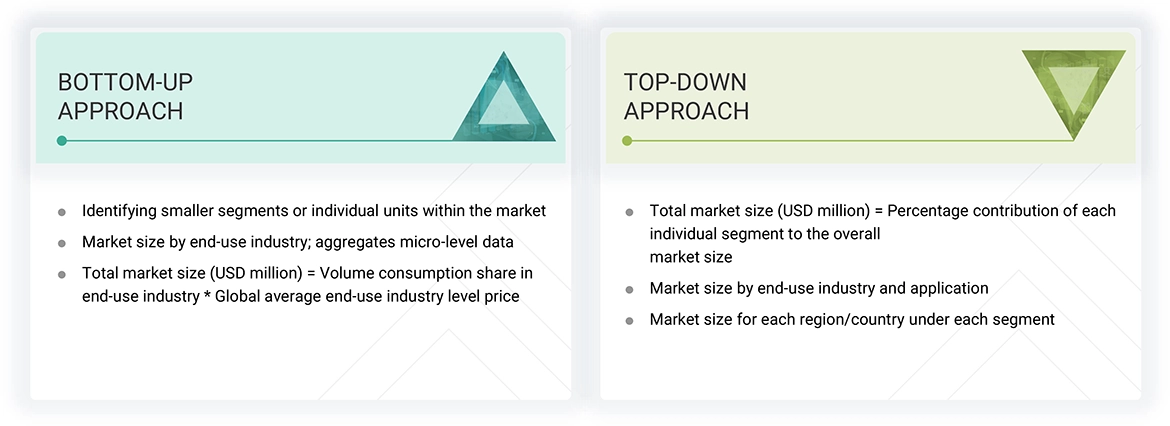

The study involved four major activities in estimating the size of the industrial cleaning solvents market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of the profiles of the primary interviewees is illustrated in the figure below.

Primary Research

The industrial cleaning solvents market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by key opinion leaders in various applications for the industrial cleaning solvents market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023/2024, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Exxon Mobil Corporation | Senior Manager | |

| Shell plc | Innovation Manager | |

| BASF SE | Vice President | |

| Dow Inc. | Production Supervisor | |

| LyondellBasell Industries N.V. | Sales Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the industrial cleaning solvents market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The supply chain of the industry has been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the industrial cleaning solvents industry

Market Definition

According to the American Cleaning Institute (ACI), industrial cleaning solvents are “liquids used to dissolve or disperse other materials, typically for cleaning purposes.” These products are used to remove contaminants such as adhesives, ink, paint, dirt, soil, oil, and grease from parts, products, tools, machinery, and other surfaces. The most common types of industrial cleaning solvents are oxygenated solvents, halogenated solvents, and hydrocarbon solvents.

Stakeholders

- Industrial Cleaning Solvent Manufacturers

- Industrial Cleaning Solvent Distributors

- Raw Material Suppliers

- Service Providers

- Government and Research Organizations

Report Objectives

- To define, describe, and forecast the market size for industrial cleaning solvents in terms of value

- To provide detailed information about the drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze and forecast the industrial cleaning solvents market by application and end-use industry

- To forecast the market based on key regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To track and analyze recent developments, such as product launches, deals, and other developments, in the market

- To analyze the opportunities for stakeholders in the market and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Key Questions Addressed by the Report

Who are the major players in the industrial cleaning solvents market?

Exxon Mobil Corporation (US), Shell plc (UK), BASF SE (Germany), Dow Inc. (US), LyondellBasell Industries N.V. (US), Eastman Chemical Company (US), Arkema (France), Celanese Corporation (US), Solvay S.A. (Belgium), Ashland Inc. (US), and Honeywell International Inc. (US).

What are the drivers and opportunities for the industrial cleaning solvents market?

Major drivers include rapid industrial growth, rising demand from end-use industries post-COVID-19, and workplace hygiene initiatives. Opportunities include increasing demand for green and bio-based solvents and advanced cleaning technologies.

Which strategies are the key players focusing on in the industrial cleaning solvents market?

Leading companies are focusing on joint ventures, agreements, and expansions to enhance their global presence.

What is the expected growth rate of the industrial cleaning solvents market between 2025 and 2030?

The market is projected to grow at a CAGR of 4.55% during the forecast period.

Which major factors are expected to restrain the growth of the industrial cleaning solvents market during the forecast period?

Stringent environmental regulations, health concerns related to solvent exposure, and volatility in raw material prices are key restraints for market growth.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Industrial Cleaning Solvents Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Industrial Cleaning Solvents Market