India Drone (UAV) Market Size, Share & Trends 2030

India Drone (UAV) Market by Platform (Civil & Commercial, Defense & Government), Type (Fixed Wing, Rotary, Hybrid), Application (ISR, Delivery, Combat Operations, Monitoring, Surveying, Mapping), Point of Sale, Industry and Systems - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

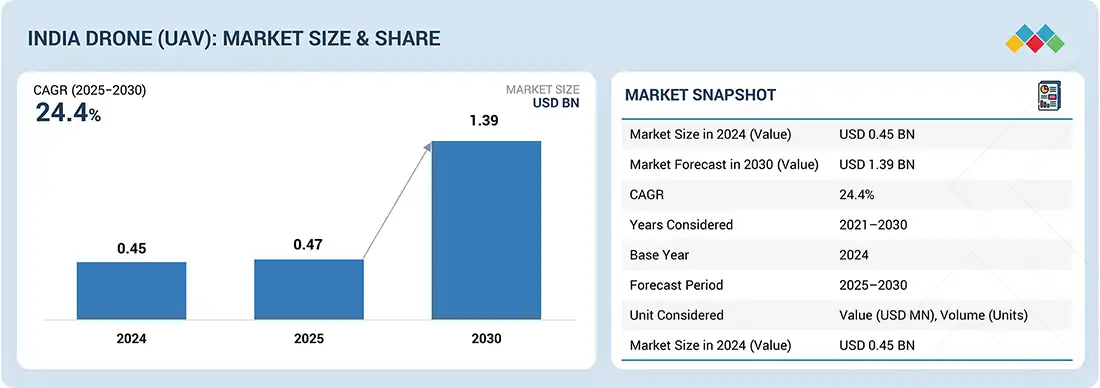

The India Drone (UAV) Market is expected to reach USD 1.39 billion by 2030, from USD 0.47 billion in 2025, with a CAGR of 24.4%. The volume of drones procured in India will likely grow from 8,381 units in 2025 to 16,756 units by 2030. The Drone market is driven by UAV applications in defense, agriculture, logistics, and infrastructure, supported by initiatives such as Drone Shakti, PLI, and defense modernization. Advances in payloads, batteries, autonomy, and regulatory reforms further accelerate adoption.

KEY TAKEAWAYS

- By application, the military segment is expected to account for the largest share of the India drone market during the forecast period.

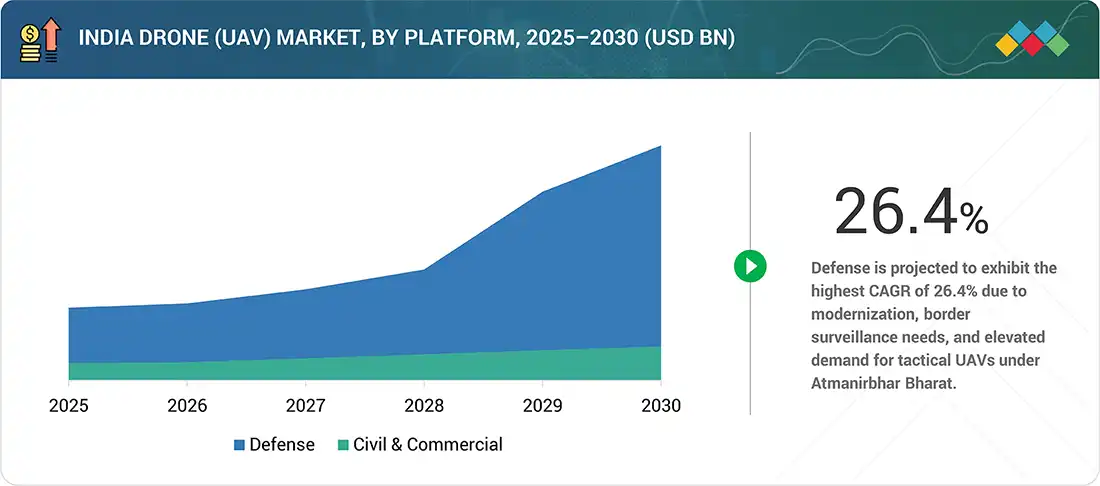

- By industry, the defense and security segment is expected to lead growth, registering the highest CAGR of 26.4%.

- By type, the hybrid wing VTOL segment is projected to register the fastest CAGR of 38.2%.

- ideaForge, Garuda Aerospace, and IoTech World were identified as some of the star players in the India drone market, given their strong market share and product footprint.

- CDSpace, Thanos, and Dronix Technologies, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The future growth of the India drone (UAV) market will be driven by wider integration in agriculture, logistics, infrastructure monitoring, and public services, aligned with government-led digital and industrial initiatives. Defense procurement and indigenization programs are expected to expand drone use for surveillance and tactical operations, while commercial adoption will grow in smart city development, precision farming, and healthcare logistics.

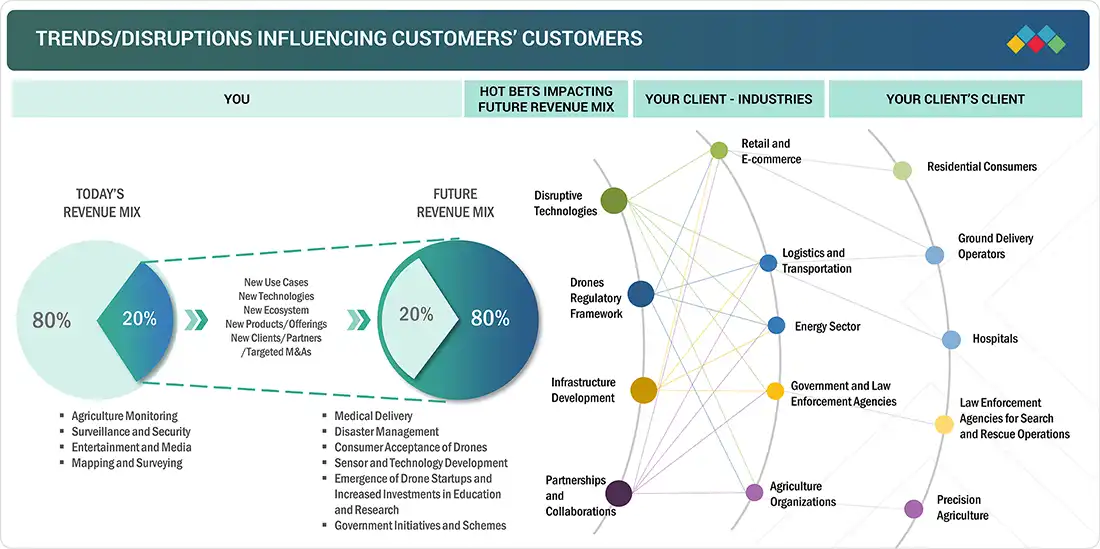

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ businesses comes from customer trends or disruptions. Several drone startups and manufacturers are seeking venture capital, partnerships, collaborations, and joint ventures to advance drone technology. This is expected to help improve drones and related infrastructure significantly, leading to a larger customer base for drones.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Favorable regulatory frameworks and government initiatives

-

Increasing adoption of drones for commercial applications

Level

-

High dependence on foreign suppliers

-

Data privacy and security concerns

Level

-

Rising use of drones in logistics industry

-

Need for real-time traffic monitoring and management

Level

-

Limited payload capacity

-

Complex integration of advanced technologies in drones

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Favorable regulatory frameworks and government initiatives

India’s Drone Rules 2021 relaxed restrictions and established a clear regulatory framework, speeding up adoption beyond defense. Deployment is growing in agriculture, healthcare, surveying, and disaster management. This policy change is enhancing geospatial integration and infrastructure effectiveness, though airspace management and data privacy remain critical considerations.

Restraint: High dependence on foreign suppliers

India’s drone industry depends heavily on imported parts, which increases costs and makes supply chains vulnerable to disruptions from trade restrictions, currency fluctuations, and geopolitical risks. Limited domestic innovation makes local companies less competitive, significantly slowing market growth.

Opportunity: Increasing use of drones in logistics industry

The logistics industry is adopting drones to meet increasing demand for faster and more cost-effective deliveries. Drones lower last-mile costs, shorten delivery times, and assist with warehouse management and hazardous inspections, unlocking significant growth opportunities in India’s logistics ecosystem.

Challenge: Limited payload capacity

Payload limitations restrict drone efficiency, as carrying heavier loads decreases flight range and endurance. Environmental factors such as thin air, humidity, and battery issues make this problem worse, while regulations further limit operations, making capacity expansion a major obstacle.

India Drone Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Aereo offers drone-based solutions tailored for enterprise use. | It enhances business efficiency through aerial solutions. |

|

Aero 360 creates autonomous hybrid drones to improve aerial surveying, surveillance, and disaster response operations. | It improves safety, enables quick disaster response, and supports large-scale monitoring. |

|

Asteria Aerospace provides drone-as-a-service (DaaS) and manufactures drones for agriculture, military, construction, mining, power, and energy sectors. | It provides scalable solutions across industries, reduces costs, and increases operational reach. |

|

BharatRohan serves as an agricultural facilitator by offering drone-based advisory solutions to farmers. | It supports farmers with crop insights, improving yield and reducing risks. |

|

Dhaksha Unmanned Systems delivers seven different drone-based solutions for multiple industries and manufactures both battery-operated and petrol-engine drones. | It offers versatile applications across industries with flexible energy options. |

|

Droneacharya provides drone-based solutions for industrial applications and offers training in piloting, drone building, data processing, and related areas. | It builds workforce skills, enhances data utilization, and supports industrial operations. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Key stakeholders in the India drone (UAV) market ecosystem include component manufacturers, system integrators, service providers, and importers. Major influencers such as investors, researchers, distributors, and technology companies, along with startups advancing UAV innovations, are also shaping the market’s direction and future growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

India Drone (UAV) Market, By Point of Sale

The OEM segment is expected to remain dominant, fueled by government incentives for domestic manufacturing, increasing defense and commercial demand, and technological innovations in Indian-made drones. Competitive cost strategies and export prospects further reinforce this position, making OEMs the main drivers of growth in the country’s drone market.

India Drone (UAV) Market, By Platform

The civil & commercial segment is expected to dominate in terms of volume, fueled by increasing adoption in agriculture, energy, construction, and infrastructure. The trend toward small, tactical drones, known for their versatility and cost-effectiveness, aligns with global patterns in UAV use. This segment’s widespread industry acceptance emphasizes its role as a primary growth driver in India’s drone market.

India Drone (UAV) Market, By Type

Fixed-wing drones are expected to dominate the India drone (UAV) market because of their extended range, high speed, and excellent endurance, facilitating defense, mapping, and infrastructure tasks. Government initiatives and supportive policies are encouraging adoption, while increased use in commercial sectors further enhances their role as the most adaptable option.

India Drone (UAV) Market, By System

The vehicle segment forms the basis of UAV capabilities, including airframe and propulsion systems. Demand is driven by defense upgrades and growing commercial applications, while policy support and local design investments under Atmanirbhar Bharat enhance its role as the core of India’s UAV ecosystem.

India Drone Market: COMPANY EVALUATION MATRIX

The company evaluation matrix for the India drone (UAV) market assesses players based on product footprint and market share. It highlights their competitive positioning and ranks them by market strength and growth strategies. In the India drone (UAV) market, ideaForge Technology Ltd stands out as the leading player, holding a dominant position with a strong product portfolio and widespread market presence.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

List of Top India Drone (UAV) Market Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 0.45 Billion |

| Market Forecast, 2030 (Value) | USD 1.39 Billion |

| Growth Rate (2025–2030) | 24.40% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Unit Considered | Value (USD Million) and Volume (Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Platform: Civil & Commercial (Micro, Small, Medium, large), Defense (Small, Tactical, Strategic); By Industry: Defense & Security, Agriculture, Logistics & Transportation, Energy & Power, Construction & Mining, Media & Entertainment, Insurance, Wildlif |

| Regions Covered | India |

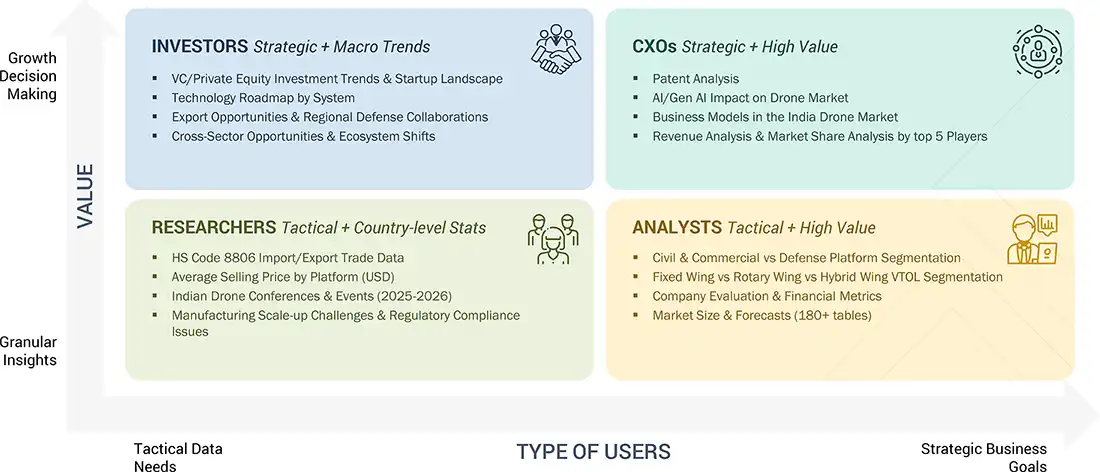

WHAT IS IN IT FOR YOU: India Drone Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|

RECENT DEVELOPMENTS

- June 2025 : ideaForge Technology Ltd. entered into a contract with the Indian Army for hybrid mini UAV systems through the emergency procurement route.

- May 2025 : Paras Defence and Space Technologies Ltd. formed a joint venture with Israeli company Heven Drones Ltd. to establish a new company in India focused on producing logistics and cargo drones for defense and civilian use.

- March 2025 : Garuda Aerospace raised USD 12 million in Series B funding. The funds will be used to expand its production facility and accelerate the development of a new R&D and testing center for advanced defense drones.

- March 2025 : Garuda Aerospace launched a new border patrol surveillance drone, Trishul. Government agencies will use the drone for border security.

- February 2025 : Asteria Aerospace signed an MoU with Drone Destination to expand its UAV services and sales worldwide. The deal will focus on oil & gas, telecom, agriculture, mining, and security sectors, utilizing Asteria’s data analytics platform and Drone Destination’s pilot network.

Table of Contents

Methodology

The research study conducted on the India drone (UAV) market involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, DigiSky, and Factiva, to identify and collect relevant information. Primary sources included industry experts from the market as well as suppliers, manufacturers, technology developers, alliances, and organizations related to all segments of this industry's value chain. In-depth interviews of various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the market and assess the market’s growth prospects. A deductive approach, also known as the bottom-up approach, combined with the top-down approach, was used to forecast the market size of different market segments.

Secondary Research

The share of companies in the India drone (UAV) market was determined based on secondary data made available through paid and unpaid sources and an analysis of the product portfolios of major companies. These companies were rated based on their performance and quality. Primary sources further validated these data points. Secondary sources for this research study included corporate filings, such as annual reports, investor presentations, and financial statements from trade, business, and professional associations. The secondary data was collected and analyzed to determine the overall market size, which primary respondents further validated.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the India drone (UAV) market through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note 1: Others include Sales, Marketing, and Product Managers.

Note 2: The tiers of companies have been defined based on their total revenue as of 2024. Given below is the bifurcation of tiers:

Tier 1 = > USD 1 billion; tier 2 = between USD 100 million and USD 1 billion; and tier 3 = < USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the India drone (UAV) market size. The research methodology used to estimate the market size included the following details:

- Key players in the market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews with industry stakeholders, such as CEOs, technical advisors, military experts, and SMEs of leading companies operating in the market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the India drone (UAV) market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

India Drone (UAV) Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the India drone (UAV) market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The India drone (UAV) market size was also validated using the top-down and bottom-up approaches.

Market Definition

The India drone (UAV) market encompasses the design, manufacturing, assembly, maintenance, repair, and operations (MRO); replacement of parts; and simulation & training (excluding third-party training) of unmanned aerial vehicles (UAVs). The India drone (UAV) market segment covers various drone platforms, such as micro, small, medium, and large models used for civil, commercial, and military purposes. It also covers small, tactical, and strategic models.

Key Stakeholders

- Drone Manufacturers and Developers

- Drone Component Manufacturers and Providers

- Raw Material Suppliers

- Distributors

- Maintenance, Repair, and Overhaul (MRO) Companies

- Government Agencies

- Investors and Financial Community Professionals

- Research Organizations

- Drone Service Providers

- Drone Consultancy

- Drone Legal Advisors

Report Objectives

- To define, describe, and forecast the India drone (UAV) market based on type, system, platform, application, industry, and point of sale from 2025 to 2030

- To forecast the size of various segments of the market with respect to India

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends that are currently prevailing in the market

- To provide an overview of the regulatory landscape with respect to drone regulations across country

- To analyze micro-markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies

- To analyze the degree of competition in the market by identifying key growth strategies, such as product launches, contracts, and partnerships, adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape, along with market ranking analysis, market share analysis, and revenue analysis of key players

Customization Options

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Which are the major companies in the India drone (UAV) market?

Answer: Some of the key players in the India drone (UAV) market are Paras Aerospace, ideaforge Technology Ltd., Throttle Aerospace Systems Pvt. Ltd., Garuda Aerospace, Asteria Aerospace Limited, General Aeronautics, Newspace Research Technologies Pvt. Ltd., Iotechworld, Adani Defense and Aerospace, Tata Advanced Systems Limited, CDSpace, Thanos, Dhaksha Unmanned Systems, Marut Dronetech Private Limited, Hubblefly Technologies, and Raphe.

Which government schemes and initiatives have promoted the use of drones in India?

Answer: Programs like the Digital Sky Platform, the Garuda initiative for COVID-19 operations, and the PLI scheme for drone manufacturing are key government efforts supporting the drone industry.

What are the emerging use cases for drones in India?

Answer: New use cases include drones for delivering medical supplies in rural areas, crowd monitoring during large public events, and using AI-integrated drones for predictive maintenance in industrial settings.

How has drone technology been adopted across different sectors in India?

Answer: The adoption of drones in India varies significantly across sectors. Agriculture, mining, and infrastructure have seen rapid growth in drone usage, mainly for monitoring and surveying tasks.

What factors impact the growth of the India drone (UAV) market?

Answer: Key factors impacting growth in the market include regulatory policies, technological advancements, market demand for various drone applications, and economic conditions influencing funding and investment in drone technology.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the India Drone (UAV) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in India Drone (UAV) Market