This study involved four major activities in estimating the current size of the immunotherapy drugs market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the immunotherapy drugs market. The secondary sources referred to for this research study include publications from government sources, such as National Institutes of Health (NIH), United States Food and Drug Administration (US FDA), World Health Organization (WHO), European Pharmaceutical Review, American Society of Gene & Cell Therapy (ASGCT), European Society of Gene and Cell Therapy (ESGCT), European Medicines Agency (EMA), and the Alliance for Regenerative Medicine (ARM). Secondary sources also include corporate and regulatory filings, such as annual reports, SEC filings, investor presentations, and financial statements; business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the immunotherapy drugs market, which was validated through primary research. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

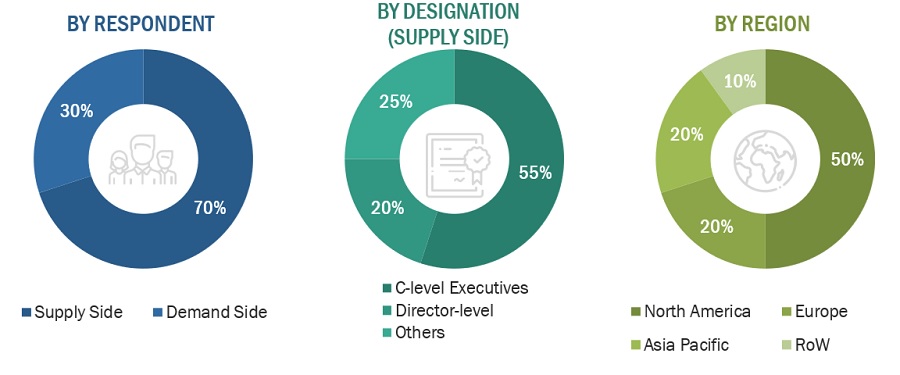

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess the prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The global size of the immunotherapy drugs market was estimated through multiple approaches. A detailed market estimation approach was followed to estimate and validate the value of the immunotherapy drugs and other dependent submarkets. The research methodology used to estimate the market size includes the following:

-

The key players in the industry and markets have been identified through extensive secondary research

-

The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the immunotherapy drugs market.

Market Definition

Immunotherapy drugs are a broad category of therapeutic agents that help stimulate the body's immune system to combat diseases. These drugs include antibody therapies, cell & gene therapy, inhibitor drugs, and other drugs such as oncolytic viral therapy and cancer vaccines. These drugs are engineered to enhance the immune response or counteract the immune system's regulatory mechanisms, thereby enabling the body to effectively target and eliminate disease-causing agents or cells. Immunotherapy drugs are used to treat various medical conditions, including cancer, autoimmune diseases, hematology, osteology, neurology, and other therapy areas (such as ophthalmology, dermatology, and cardiovascular disorders).

Stakeholders

-

Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Venture Capitalists and Investors

-

Contract Development & Manufacturing Organizations

-

Government Associations

-

Healthcare Associations/Institutes

-

Business Research & Consulting Service Providers

Report Objectives

-

To define, describe, and forecast the immunotherapy market based on type, application, route of administrration, end user, and region

-

To provide detailed information about the drivers, restraints, opportunities, and challenges influencing the market growth

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall immunotherapy drugs market

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

-

To forecast the size of market segments in North America, Europe, the Asia Pacific (APAC), Latin America, Middle East and Africa

-

To profile the key players and comprehensively analyze their core competencies2 in terms of key developments, product portfolios, and financials

-

To track and analyze competitive developments, such as partnerships, collaborations, agreements, and acquisitions, in the immunotherapy drugs market

-

Micromarkets are the further segments and subsegments of the immunotherapy drugs market.

-

Core competencies of companies are captured in terms of the key developments, market shares, and key strategies adopted to sustain their positions in the market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

-

Company Information: Detailed analysis and profiling of additional market players (up to five)

-

Geographic Analysis: Further breakdown of the Rest of Europe market, by country, based on approvals and feasibility. Further breakdown of the Rest of Asia Pacific market, by country, based on approvals and feasibility

Mathew

Dec, 2022

To what extent has COVID-19 impacted the global growth of the Immunotherapy Drugs Market?.