The study involved four major activities in estimating the size of the hydrogen valve market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering hydrogen valve have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the hydrogen valve market. Secondary sources considered for this research study include government sources, corporate filings, and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of data center accelerator systems to identify key players based on their products and prevailing industry trends in the hydrogen market by processor, type, application, end-user, and region. Secondary research also helped obtain market information- and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

Primary Research

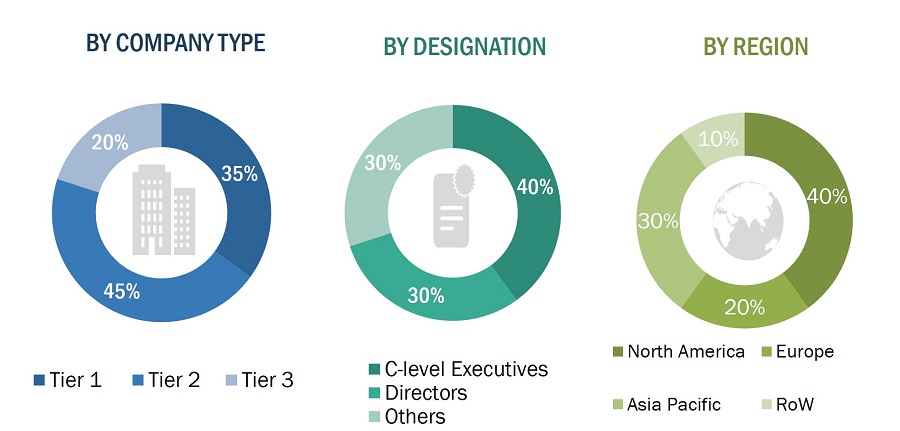

Extensive primary research has been conducted after understanding and analyzing the current scenario of the hydrogen valve market through secondary research. Several primary interviews have been conducted with the key opinion leaders from the demand and supply sides across four main regions—North America, Europe, Asia Pacific, and the Rest of Europe. Approximately 25% of the primary interviews were conducted with the demand-side respondents, while approximately 75% were conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephone interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

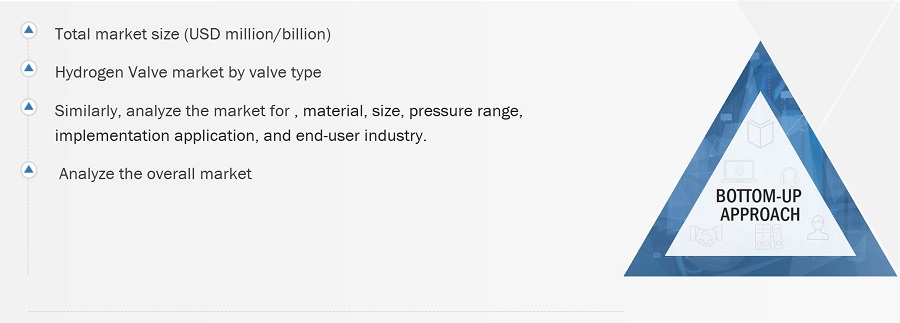

The bottom-up procedure has been employed to arrive at the overall size of the hydrogen valve market.

-

Initially, more than 35 companies offering hydrogen valves were identified. Their offerings were mapped based on valve type, material, application, size, pressure range, implementation, and end user application.

-

After understanding the different types of hydrogen valve offered by various manufacturers, based on the data gathered through primary and secondary sources, the market was categorized into different segments.

-

To derive the global hydrogen valve market, global valve shipments of top players for each valve type that were considered in the scope of the report were tracked.

-

A suitable penetration rate was assigned for the shipment of each of these device types to derive the shipments of hydrogen valves.

-

Using the average selling price (ASP) at which a particular company offers its devices, we derived the hydrogen valve market based on different device types. The ASP of each device was identified based on secondary sources and validated from primaries.

-

For the projected market values of each of the device types, the Y-o-Y projections showed a steep growth initially until 2023. The market is expected to witness a sharp ascent, considering the demand for hydrogen market valve for different applications.

-

For the CAGR, the market trend analysis was carried out by understanding the industry penetration rate and the demand and supply of hydrogen valve in different applications.

-

We also tracked the hydrogen valve market through the data sanity method. The revenues of more than 25 key providers were analyzed through annual reports and press releases and summed to derive the overall market.

-

For each company, a percentage is assigned to its overall revenue or, in a few cases, segmental revenue, to derive its revenue for the data center accelerator. This percentage for each company is assigned based on the company’s product portfolio and its range of data center accelerator offerings.

-

Verifying and crosschecking the estimates at every level by discussing with key opinion leaders, including CXOs, directors, and operation managers, and then finally with the domain experts at MarketsandMarkets

-

Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

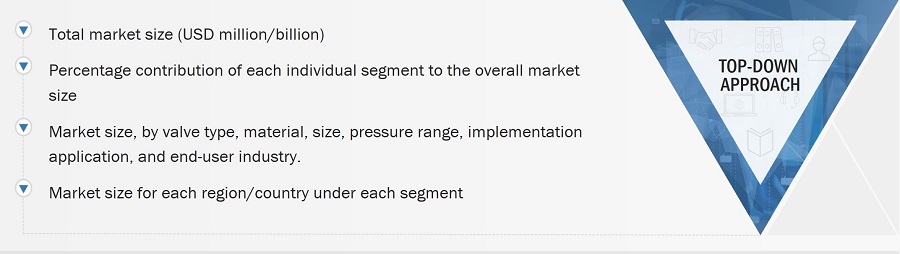

The top-down approach has been used to estimate and validate the total size of hydrogen valve market.

-

The global market size of hydrogen valves was estimated through the data sanity of 35 major companies.

-

The growth of the hydrogen valve market witnessed an upward slope trend during the studied period, as it is currently in the initial stage of the product cycle, with major players beginning to expand their business into various application areas of the market.

-

Types of hydrogen valves, their features and properties, geographical presence, and key applications served by all players in the hydrogen valve market were studied to estimate and arrive at the percentage split of the segments.

-

Different types of hydrogen valves and their penetration for the end-use applications were also studied.

-

The market split for hydrogen valve by valve type, implementation, application, size, pressure range, end user industry, and application based on secondary research was estimated.

-

The demand generated by companies operating in different application segments of the end-use application was analyzed.

-

Multiple discussions with key opinion leaders across major companies involved in the development of hydrogen valve and related components were conducted to validate the market split of type, product, and application.

-

The regional splits were estimated using secondary sources, based on factors such as the number of players in a specific country and region and the adoption and use cases of each implementation type with respect to applications in the region

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides in the hydrogen valve market.

Market Definition

A hydrogen valve is a specialized device designed to control the flow and pressure of hydrogen gas within a system. These valves are critical components in various applications, particularly within the hydrogen economy, including hydrogen production, storage, transportation, and utilization in fuel cells and refineries. Due to hydrogen's small molecular size and high diffusivity, hydrogen valves must be constructed from materials that prevent leakage and ensure safety under high-pressure conditions. Hydrogen valves are essential for the safe and efficient handling of hydrogen in various industrial and energy applications. Their design, material selection, and adherence to safety standards are critical factors that ensure the effective control of hydrogen flow and pressure, minimizing risks associated with hydrogen's highly flammable nature.

Key Stakeholders

-

NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

-

Telecom Services Providers

-

Original Equipment Manufacturers

-

Value-added Service Providers

-

Data Center Operators

-

Software Developers

-

Data Center Colocation Service Providers

-

System Integrators

-

Cloud Service Providers

-

Colocation Service Providers

Report Objectives

-

To define, describe, segment, and forecast the hydrogen valve market, by valve type, size, pressure range, material, implementation, application, and end-user industry, in terms of value

-

To describe and forecast the market for various segments, with respect to four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

-

To forecast and compare the market size of pre-recession with that of the post-recession at the regional level

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the hydrogen valve market

-

To provide a detailed overview of the hydrogen valve market market’s supply chain, along with the ecosystem, technology trends, use cases, regulatory environment, and Porter’s five forces analysis for the market

-

To analyze industry trends, pricing data, patents and innovations, and trade data (export and import data) related to the hydrogen valves.

-

To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

-

To strategically profile the key players and comprehensively analyze their market share and core competencies2

-

To analyze opportunities for stakeholders and provide a detailed competitive landscape of the market

-

To analyze competitive developments, such as product launches/developments, collaborations, partnerships, acquisitions, and research & development (R&D) activities, carried out by players in the hydrogen valve market

-

To profile key players in the hydrogen valve market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies2

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Growth opportunities and latent adjacency in Hydrogen Valve Market