Hydrogen Tanks Market

Hydrogen Tanks Market by Tank Type (Type 1, Type 2, Type 3, Type 4), Material Type (Metal, Composite), Pressure (Below 250 bar 250 to 500 bar, Above 500 bar), Application (Stationary Storage, Fuel Tank, Transportation), & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The hydrogen tanks market is projected to reach USD 3.78 billion by 2030 from USD 1.37 billion in 2025, at a CAGR of 22.5% from 2025 to 2030. The hydrogen tanks market is mainly driven by the rising global demand for hydrogen as a clean energy source, fueled by increasing decarbonization efforts and sustainability. The development of hydrogen-powered vehicles, particularly fuel cell electric vehicles (FCEVs), is particularly important because hydrogen storage requires high-pressure storage tanks. The development of hydrogen infrastructure, including refueling stations, is significantly propelling the need for hydrogen tanks. As hydrogen-fueled vehicles build momentum in the automotive market, safe and reliable hydrogen storage is increasing in both importance and relevance. Innovation in tank technology, including lightweight composite materials, has led to both improved performance and reduced costs of producing hydrogen storage tanks. Government investments in clean energy and green hydrogen are projected to spur the demand for hydrogen storage tanks, particularly in the FCEV vehicles market and across other industrial sectors.

KEY TAKEAWAYS

-

BY TANK TYPEThe hydrogen tank market comprises of Tank 1, Tank 2, Tank 3 & Tank 4. Type 4 hydrogen tanks are likely to have the largest market share in 2030 because they have better performance, lighter weight, and increasing demand for effective hydrogen storage systems in different applications, particularly transportation. Built of composite materials like carbon fiber, Type 4 tanks have a distinct weight disadvantage compared to metal tanks, essential in applications involving hydrogen fuel cell electric vehicles (FCEVs) and transport systems that use lighter tanks to improve fuel mileage and range. Type 4 tanks are further noted for possessing high strength and safety as well as the potential for withstanding high-pressure levels, which also suits long-duration, high-performing storage needs. As hydrogen vehicle adoption grows and more nations invest in hydrogen infrastructure, the demand for efficient and lightweight storage, such as Type 4 tanks, will rise significantly. This synergy of performance advantages, safety, and demand for lighter, tougher tanks will make Type 4 tanks the market leader by 2030.

-

BY MATERIALKey material types include metals and composites. In the hydrogen tank market, metal segment is expected to have the second largest CAGR because of its better performance, cost, and varied usefulness of applications. Metal tanks are mostly steel or aluminum based, they have a longer durability and can withstand high pressure, which best suits industrial and transport applications. While composite materials are growing in popularity for lighter weight and high strength demands, metal tanks still reign supreme in cost sensitive, and bulk stationary storage environments. As hydrogen storage demand continues to rise across many industries, particularly in developing markets where cost weighs heavy, the metal tank segment can expect high growth as well. The reliability of metal tanks as well as existing and ongoing advances in technology will only continue to provide strong market potential.

-

BY PRESSUREBy Pressure segment, the market of hydrogen tanks is segmented into below 500 bar, 250 to 500 bar and above 500 bar. The hydrogen tank market segment with a pressure exceeding 500 bar is the third largest market segment due to its importance in supporting the efficient and safe storage of hydrogen for higher-demand applications, especially transportation, and some industrial applications. As the consumption of hydrogen grows, especially for fuel cell electric vehicles (FCEVs) and heavy-duty applications such as buses and trucks, the on-board hydrogen tanks for these applications require higher pressure tanks that can store hydrogen as a compact and energy-dense fuel. Pressures of more than 500 bar allows more hydrogen storage within tanks that can be smaller and/or lighter. Storing hydrogen at over 500 bar is important for applications such as ultra-long-range, high-performance vehicles or to meet the higher hygiene standards of some industries.

-

BY APPLICATIONThe hydrogen tank market by application consists of stationery, fuel tanks, transportation. The fuel tank segment is projected to register the highest CAGR in the hydrogen tanks market during the forecast period. This can be attributed to the fast expansion of hydrogen-powered cars, especially fuel-cell electric cars (FCEVs). As the global automobile industry transitions toward cleaner energy technologies to address environmental and regulatory needs, the demand for lightweight and efficient hydrogen storage systems in automobiles is on the rise, especially in countries like South Korea and China. Hydrogen fuel tanks are vital in allowing FCEVs to store hydrogen at high pressure for extended driving ranges, and they are, therefore, critical for the penetration of hydrogen as an alternative fuel. Additionally, innovations in tank technology, including the creation of composite materials, are enhancing the safety and performance of hydrogen fuel tanks, thus increasing their demand.

-

BY REGIONThe aerospace materials market covers Europe, North America, Asia Pacific, Latin America, the Middle East, and Africa. Europe region accounted for the second-largest hydrogen tank market in terms and both value and volume. Due to its resolute devotion to sustainability, decarbonization, and developing green hydrogen infrastructure, Europe ranks second, globally, regarding the hydrogen tank market. The European Union has adopted an ambitious climate goal of carbon neutrality by 2050, with hydrogen being viewed as an essential component of this transition. The regional push for investment in green hydrogen production and developing hydrogen refueling infrastructure has significantly increased the demand for hydrogen storage solutions. Germany, France, and Italy are at the forefront of deploying hydrogen for transport, industry, and energy storage and have created a viable hydrogen tank market. Moreover, Europe has developed an established hydrogen ecosystem consisting of key industry players, research initiatives, and pro-hydrogen policies focused on growing the hydrogen tank market.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Luxfer Gas Cylinders, Hexagon Purus, Worthington Enterprises have entered into a number of agreements and partnerships to cater to the growing demand for hydrogen tanks across innovative applications.

The market for hydrogen tanks is influenced by several primary factors such as the existence of numerous manufacturers, government support, and increased hydrogen production. The rising number of manufacturers around the world is encouraging competition and innovation, and as a result, sophisticated and affordable hydrogen storage technologies are being developed. Government incentives are a key factor through policies and programs for lowering carbon emissions, encouraging clean energy, and advancing hydrogen infrastructure development. These programs entail subsidies, grants, and regulatory policies that facilitate the use of hydrogen technologies. Moreover, the increased production of hydrogen, especially green hydrogen, is fueling the demand for efficient and safe storage facilities to store and transport hydrogen under high pressure. With the pickup of hydrogen uptake in the transportation, industry, and energy sectors, the need for secure, efficient, and long-lasting hydrogen tanks keeps growing, contributing to further market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from customer trends or disruptions. The shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hydrogen tanks manufacturers, which will further affect the revenues of hydrogen tanks manufacturers. The continuous innovation in hydrogen tanks manufacturing and technology and increasing applications and production are changing the dynamics of the hydrogen tanks business revenue mix. Traditionally, industrial applications were the largest consumers of hydrogen tanks for gas storage & transportation. To remain in the business and stimulate the hydrogen tanks market, many manufacturers have focused on new applications, such as hydrogen powered drones & UAVs, hydrogen powered robotics, backup power & grid storage, renewable energy storage that are poised to grow rapidly due to the significant focus on clean energy & zero emissions, and high energy density.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for clean energy solutions

-

Increasing demand for hydrogen fuel cell vehicles

Level

-

High cost of composite based tanks

-

Safety concerns and regulations

Level

-

Growing adoption of hydrogen tanks in military and defense sector

-

Emergence of lightweight composite material-based hydrogen tanks

Level

-

Lack of hydrogen fueling stations

-

Capital Intensive productions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand for clean energy solutions

Among the major drivers of the hydrogen tanks market is the increasing demand for clean and renewable energy. With a move toward cleaner energy solutions, hydrogen has been a potential option to be used for clean energy solutions. Hydrogen does not produce greenhouse gases when used to generate electricity or fuel automobiles. Thus, hydrogen is seen as a clean energy source. Hydrogen storage possibilities and solutions are in more demand with the increasing popularity of hydrogen fuel cells and numerous other hydrogen-based technologies. Hydrogen fuel cell vehicles are gaining traction in Asia Pacific countries like South Korea and China. China is mainly focusing on heavy fuel cell trucks, which are generating huge demand for hydrogen tanks. However, South Korea is the largest market for passenger hydrogen fuel cell vehicles. Hydrogen tanks provide a safe and efficient way of transporting and storing hydrogen gas. Composite cylinders and metal tanks are just a few of the current tanks available. They come with a range of applications, such as fueling hydrogen vehicles and holding the gas for use in power plants and other industrial processes. With governments across the globe setting their eyes on the mitigation of the greenhouse effect due to gas emissions and promoting the utilization of clean energy, the demand for hydrogen tanks is expected to grow tremendously in the coming years

Restraint: Safety Concerns and regulations

Safety issues and regulations are large obstacles in the hydrogen tanks industry. Hydrogen is highly flammable and has low ignition energy, so it is more apt to leak and ignite than normal fuels. Hydrogen tanks need to be highly pressure-resistant and have extensive testing and approvals to evade these hazards. Companies must be certified by controlling authorities or independent inspection agencies. For instance, in the United States, they must meet the Department of Transportation (DOT) and American Society of Mechanical Engineers (ASME) regulations. In many Asia Pacific countries, including India and Pakistan, Type 2, Type 3, and Type 4 cylinders are prohibited for commercial purposes. These strict processes and regulations can discourage hydrogen tank use. Moreover, there are specific safety protocols to be followed in an effort not to lose life or property due to accidents. Incidents normally take place as a consequence of the installation of poor-quality hydrogen cylinders and kits on vehicles, which can have a negative impact on demand and limit the growth of the hydrogen tanks market. These factors could have a negative impact on the industry.

Opportunity: Emergence of lightweight composite material-based hydrogen tanks

Lightweight composite tank production is a significant business opportunity in the hydrogen tanks business since they can meet the growing demand for efficient, high-performance hydrogen gas storage. Composite tanks are built with materials like carbon fiber or glass fiber that have a higher strength-to-weight ratio compared to conventional metal tanks made of steel or aluminum and are therefore ideal for hydrogen storage in applications like fuel cell electric vehicles (FCEVs) and other portable or mobile hydrogen uses, where weight is an issue. These light tanks can store hydrogen under high pressures, sometimes over 500 bar, in a manner that provides optimum vehicle weight saving, thus boosting the range and fuel economy of hydrogen vehicles. With the world going green by moving toward carbon footprint reduction and adopting clean energy technologies, the demand for lightweight and durable hydrogen tanks is bound to grow. Furthermore, advancements in composite manufacturing techniques (such as automated winding techniques and resin infusion) are lowering the production cost, and these tanks are becoming more economically viable for mass deployment. This cost-saving, combined with increased adoption of hydrogen-based products, presents the manufacturer with a once-in-a-generation opportunity to drive innovation and increase production so that lightweight composite tanks are leading the charge in moving to a hydrogen future.

Challenge: Capital Intensive Production

The manufacturing of hydrogen tanks is a very capital-intensifying process that deals with all the requirements of standard materials, leading-edge production technology, and criteria that meet stringent safety requirements. The key cost drivers are the high proportions of carbon fiber reinforced composites because these represent well over 50-70% of the tank cost for Type 3 and Type 4 tanks. These composites are designed to withstand extremely high pressures, often up to 700 bar, which is required for the safe and efficient storage of hydrogen. Carbon fiber, which is the strongest but lightest of materials, is extremely expensive and causes increased production costs. Furthermore, the manufacturing of hydrogen tanks involves advanced and sophisticated methods such as filament winding technology and even automated fiber placement, requiring out-of-reach robotics and precision equipment. Thus, one finds that although the technology makes the tanks structurally sound and safe at very high pressures, it costs massive amounts in initial investment capital for the equipment, expertise, and maintenance. Unlike traditional fuel tanks, hydrogen tanks are not manufactured in large volumes, resulting in no economies of scale. Fuel tanks are produced in large quantities, which helps lower costs, but due to relatively small production runs of hydrogen tanks, manufacturers cannot benefit from similar cost savings. The intricacy of the manufacturing process, as well as the relatively limited market size for hydrogen tanks as compared to other markets, keeps the costs high. While research is continually ongoing to create lower-cost raw materials and manufacturing methods, such as the investigation of alternative fibers or optimizing automation processes, much development must occur before the production of hydrogen tanks can become more affordable

Hydrogen Tanks Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Integration of Type IV carbon fiber-reinforced hydrogen tanks in Mirai fuel cell vehicles. | Enables long driving range with lightweight design, faster refueling, and zero-emission performance. |

|

Use of high-pressure composite hydrogen tanks in NEXO hydrogen SUVs. | Improved fuel efficiency, enhanced safety under high-pressure storage, and extended vehicle lifespan. |

|

Development and testing of hydrogen fuel cell trucks using high-pressure gaseous hydrogen tanks | Enables long-haul capability with zero tailpipe emissions; near diesel-like range; fast refuelling; supports decarbonization in heavy transport. |

|

Adoption of hydrogen-powered locomotives equipped with Type IV composite hydrogen tanks developed in collaboration with Siemens Mobility. These tanks are integrated into the “Mireo Plus H” trains used for regional routes in Germany. | Enables zero-emission rail transport with operational ranges up to 1,000 km per refueling, reduction in diesel dependency, and compatibility with existing rail infrastructure. |

|

Use of dual 700-bar gaseous hydrogen tanks (in e.g. BMW iX5 Hydrogen) storing ~6 kg of hydrogen, enabling ~504 km WLTP range. Also development of cryo-compressed hydrogen storage (CCH2) / “tunnel” style tanks (350 bar) offering higher volumetric efficiency and improved storage capacity. | Faster refueling, long driving range; better packaging / integration of tanks; potential for higher energy density per volume; greater flexibility in storage method (compressed, cryo-compressed) to optimize safety, efficiency and space use. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The hydrogen tanks ecosystem analysis involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, contractors, and end users. The raw material suppliers provide metals, carbon fibers, and glass fibers to the hydrogen tank manufacturers. The distributors and suppliers are the ones who establish contact between the manufacturing companies and end users to streamline the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Hydrogen Tanks Market, By Material

Based on material, the metal segment has the largest market share in the hydrogen tank market in 2024 largely because of its long-standing reliability, strength, and affordability. Steel or aluminum metal tanks have been the conventional option for hydrogen storage because they have a proven safety record and can withstand high pressure. These tanks are extremely strong, damage-resistant, and can withstand the mechanical forces necessary for hydrogen storage. Metal tanks are also cheaper to manufacture than composite tanks, so they are a more cost-effective choice for some uses, particularly in industrial applications where bulk storage is needed. Although composite tank applications are increasing in popularity because of reduced weight and increased performance, metal tanks are still widely used in most segments of the market for applications involving large hydrogen storage volumes at relatively lower pressures.

REGION

Asia Pacific to be fastest-growing region in global hydrogen tanks market during forecast period

The Asia Pacific region dominates the hydrogen tanks market, and this trend is expected to continue during the forecast period due to industrialization in major countries such as China, Japan, and South Korea, which, among other needs, drives the quest for pure, clean energy, where hydrogen plays a very important role in decarbonization efforts, which include the transport sector, manufacturing, and generation of electricity. Proactive measures taken in the region by governments, such as Japan’s Hydrogen Roadmap and China’s initiatives for increasing green hydrogen production, have made it possible for hydrogen technologies to be adopted easily by the populace. Increased demand for efficient hydrogen storage solutions, particularly with respect to transport, is also complemented by the surge of hydrogen fuel cell electric vehicles (FCEVs) in these countries.

Hydrogen Tanks Market: COMPANY EVALUATION MATRIX

In the hydrogen tank market matrix, Worthington Enterprises (Star) leads the hydrogen tank market due to its extensive expertise in high-pressure gas containment, strong R&D in lightweight composite and steel tanks, and focus on hydrogen-specific innovations. Its comprehensive system solutions, global manufacturing presence, and proven safety compliance enhance its competitiveness. Everest Kanto Cylinder Limited (Emerging Leader) is expanding its presence in the hydrogen tank market by investing in advanced manufacturing capacity and diversifying its product portfolio, including high-pressure Type-4 composite cylinders for safe hydrogen storage and transportation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.19 Billion |

| Market Forecast in 2030 (Value) | USD 3.78 Billion |

| Growth Rate | CAGR of 22.5% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Hydrogen Tanks Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Hydrogen Tank OEM | Competitive profiling of Type III & IV tank manufacturers (pressure rating, weight, certification status) I Benchmarking tank cost structures across vehicle classes I Assessment of global regulatory compliance (EU, US, Japan, China) | Identify qualified high-performance tank suppliers I Detect regulatory readiness gaps I Benchmark cost-efficiency vs. competitors |

| Composite Material Manufacturer | Market adoption analysis of carbon fiber and hybrid composites across tank types I Switching cost analysis: metal liners vs. thermoplastics I OEM roadmap for bar tank adoption in mobility & aviation | Quantify demand from mobility OEMs I Identify cross-sector adoption (aerospace, trucking, maritime) I Target tank makers with high carbon fiber intensity |

| Fuel Cell Vehicle Manufacturer (FCEV) | Technology benchmarking of storage solutions (range, refueling time, volumetric efficiency) I Supplier landscape mapping for bar tanks I Cost trajectory for mass production (2025-2030) | Accelerate supply chain development I Identify early access to low-cost suppliers I Align storage roadmap with infrastructure maturity |

| Raw Material Supplier | Global and regional demand forecasting for high-grade carbon fiber I Mapping future capacity expansions of tank OEMs I Tracking qualification timelines for new material suppliers | Secure offtake contracts with tank makers I Assess gaps in supply/demand to target high-margin segments I Develop partnerships for next-gen tanks |

| Heavy-Duty Mobility OEM | Technical & commercial benchmarking of hydrogen tank systems for heavy-duty use cases (range, durability, weight, fill time) I Supply chain analysis of high-volume tank availability by region (EU, NA, APAC) I Analysis of onboard vs. tender (external) tank system architectures | Accelerate design-to-deployment cycle for hydrogen-powered fleets I De-risk procurement with forward visibility on material and system cost trends I Optimize tank system selection for different duty cycles (urban vs. long-haul) |

RECENT DEVELOPMENTS

- October 2024 : Luxfer Gas Cylinders entered a strategic partnership with Hypermotive, a leader in hydrogen integration and control systems, to develop a digital control system for pressurized hydrogen gas storage based on its SYSTEM-H technology

- September 2024 : Eurotainer, a global leader in tank container leasing, partnered with Hexagon Purus to launch Type 4 hydrogen storage solutions and support hydrogen transport for mobility and industrial applications across Norway and beyond, playing a key role in advancing the country’s hydrogen economy

- August 2024 : Hexagon Purus signed a long-term agreement with GILLIG, a leading designer and manufacturer of heavy-duty transit buses, to supply hydrogen fuel storage systems for its new fuel cell-powered transit buses

- May 2024 : Hexagon Purus collaborated with Toyota North America to provide a full hydrogen storage system and high voltage battery pack for the heavy-duty fuel cell electric powertrain kit to help pave the way for zero-emission commercial transportation

- April 2024 : Worthington Enterprises and STOKOTA entered into a partnership to accelerate the design and manufacturing of hydrogen technology. This collaboration aims to enhance the production of hydrogen transport and storage systems, particularly focusing on 20-foot containers for transporting hydrogen at 380 bar

Table of Contents

Methodology

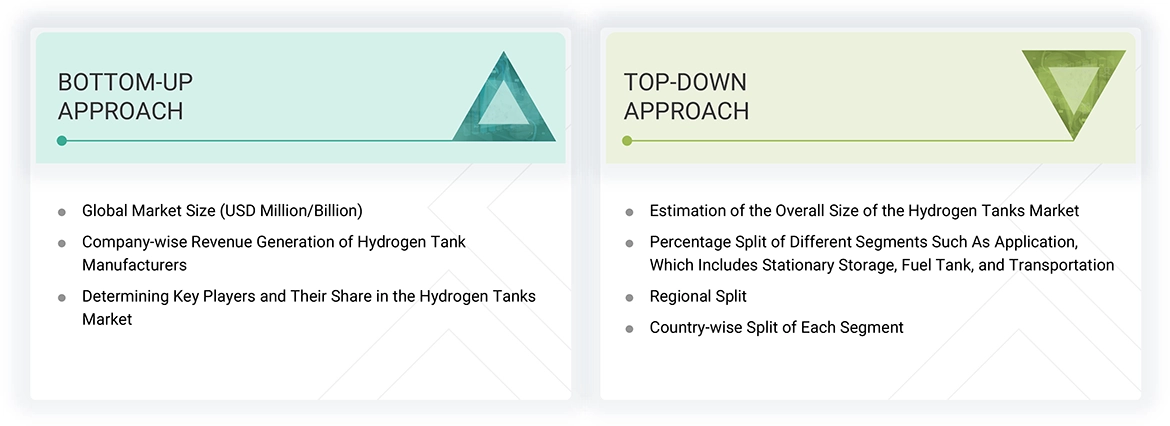

The study involves two major activities in estimating the current market size for the hydrogen tanks market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering hydrogen tanks and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the hydrogen tanks market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the hydrogen tanks market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from hydrogen tanks industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to resin type, fiber type, application, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are seeking hydrogen tanks services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of hydrogen tanks and future outlook of their business which will affect the overall market.

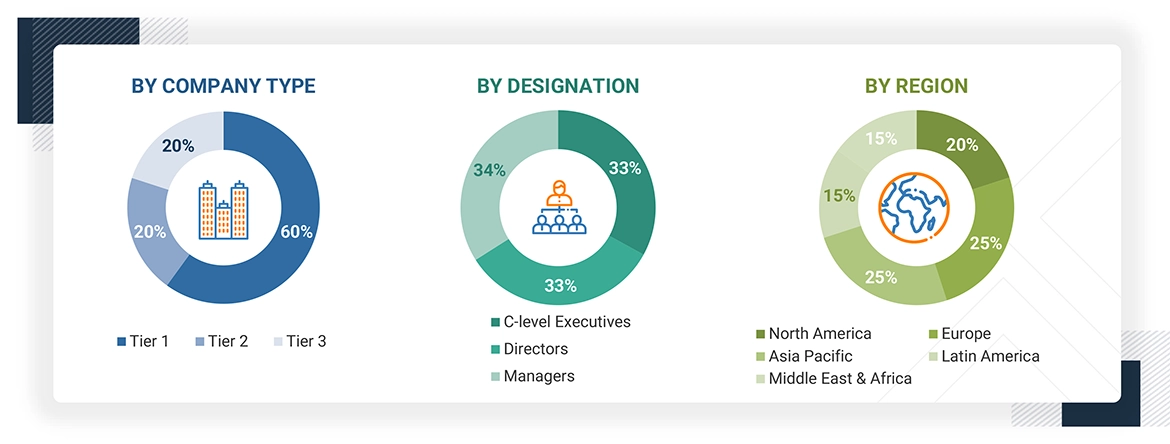

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the hydrogen tanks market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on the demand for hydrogen tanks in different applications at a regional level. Such procurements provide information on the demand aspects of the hydrogen tanks industry for each application. For each application, all possible segments of the hydrogen tanks market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Hydrogen The Office of Energy Efficiency and Renewable Energy has defined that hydrogen can be stored physically as a gas. Storage of hydrogen as a gas typically requires high-pressure [350-700 bar (5,000-10,000 psi)] tanks.

A hydrogen tank can be considered a storage vessel designed for holding or storing hydrogen gas either at low or high temperatures. Hydrogen tank materials mainly consist of carbon fiber, glass fiber, metal, or composite materials. Overall, the choice and preference of materials depend on the applications and required properties and characteristics, including weight, capacity, pressure, and cost. The market covers hydrogen storage tanks used to store hydrogen in gaseous form for stationary and mobile applications.

Stationary hydrogen storage tanks in the form of bundles and cascades are used to store hydrogen gas in hydrogen refueling stations and in chemical, medical & pharmaceutical, and other industries. The mobile applications include hydrogen storage tanks in the form of bundles and cascades for transporting hydrogen at shorter distances. The mobile applications also include onboard (fuel tanks) hydrogen tanks and those transported through tube trailers over a distance of 300 km. The scope of this report is restricted to tanks used to store hydrogen in gaseous form and does not include those used to store cryogenic, cryo-compressed, or material-based hydrogen tanks. The cost of gaseous hydrogen tanks is considered for revenue estimation and depends on various factors such as material, industry, and tank volume.

Stakeholders

- Hydrogen tanks Manufacturers

- Hydrogen tank Distributors and Suppliers

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the hydrogen tanks market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global hydrogen tanks market, by tank type, by material type, by pressure, application, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Hydrogen Tanks Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Hydrogen Tanks Market