Hydrogen Automotive Testing, Inspection, and Certification (TIC) Market

Hydrogen Automotive Testing, Inspection, and Certification (TIC) Market by Service (Testing, Certification, Inspection, and Other Services), Region (Asia Pacific, North America, Europe) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The hydrogen automotive testing, inspection, and certification (TIC) market is projected to grow from USD 18.3 million in 2024 to USD 35.8 million by 2030 at a CAGR of 11.8%. This growth can be attributed to the increasing adoption of hydrogen fuel cell vehicles (FCVs) and the rising regulatory emphasis on safety and emissions standards. In addition, advancements in hydrogen vehicle technologies, along with the requirement for high-quality, reliable, and certified components, have also led to increased demand for specialized TIC services.

KEY TAKEAWAYS

-

BY REGIONIn 2024, the Asia Pacific accounted for the largest share of the market, 66.2%, driven by government initiatives, expanding hydrogen infrastructure, and increasing deployment of hydrogen-powered vehicles.

-

BY SERVICEThe testing segment is expected to account for the largest market share and grow at the highest CAGR of 13.7% due to the strong demand for these services to establish performance, safety, and compliance.

-

BY VEHICLE TYPEIn 2024, passenger cars held 61.4% of the market, driven by the increasing consumer demand for clean mobility solutions and growing government support for hydrogen-powered vehicles.

-

COMPETITIVE LANDSCAPEKiwa, Applus+, and TÜV Rheinland have been identified as star players in the hydrogen automotive TIC market due to their strong portfolios, wide reach, and customer base.

The hydrogen automotive testing, inspection, and certification (TIC) market is driven by the clean energy transition, stringent safety mandates, and the expansion of hydrogen infrastructure. Rising investments in green hydrogen, public-private partnerships, and decarbonization goals are accelerating demand. Additionally, the adoption of hydrogen in industrial applications, growing export opportunities, and emerging hydrogen corridors further fuel the need for robust TIC services worldwide.

MARKET DYNAMICS

Level

-

Growing need to ensure the safety and reliability of hydrogen vehicles

-

Growing demand for low-carbon fuel transportation

Level

-

Lack of uniformity in global TIC standards

Level

-

Growing initiatives for hydrogen economy

Level

-

Limited hydrogen Infrastructure

-

High competition from battery Evs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing need to ensure the safety and reliability of hydrogen vehicles

Hydrogen is an extremely flammable gas that carries a high degree of risk in transport, making its handling and storage as an energy carrier problematic. The probability of leakage, explosion, and other hydrogen-related mishaps makes it necessary to inspect and monitor it diligently for safety and regulatory reasons. TIC service providers perform a critical role in reviewing the performance, durability, and safety of various components in hydrogen vehicles and help vehicle and component manufacturers to abide by the various regulatory standards. These safety concerns, therefore, drive the demand for TIC services in the hydrogen sector.

Restraint: Lack of uniformity in global TIC standards

TIC companies provide conformity assessment services in accordance with various regulations related to hydrogen vehicles. A lack of uniformity in these standards or regulations acts as a hindrance to the growth of the TIC market. Regulatory standards against which testing is done vary from region to region. Variations in standards for safety, emissions, and fuel efficiency require automotive and component manufacturers to meet different regulations, thus making TIC services complex and requiring specific internal standards. Moreover, disparity in regional regulatory standards becomes a problem for international acceptance of products, leading to additional costs and conflicts between local and international standards. For example, UN Regulation No. 134 does not include liquid hydrogen, whereas regulations such as EU 2021/535 and UN GTR No. 13 do. Also, ANSI provides standards for hydrogen vehicles in North America, whereas the EU provides standards for the European region.

Opportunity: Growing demand for low-carbon fuel transportation

Most motorized transportation relies on fuels like gasoline and diesel, which emit carbon dioxide, causing environmental issues. According to UNEP, transportation accounts for about 25% of energy-related GHG emissions. Countries are shifting to low- or zero-carbon fuels, such as biofuels and hydrogen, which is boosting the growth of hydrogen vehicles. Toyota’s 2023 sales grew by 3.9% from 2022, and US hydrogen vehicle sales increased nearly 11%, as per Hydrogen Insights. This rise presents opportunities for hydrogen TIC services.

Challenge: Limited hydrogen infrastructure

One of the major challenges hindering the adoption of hydrogen vehicles is limited infrastructure. According to H2Stations.org, 921 hydrogen refueling stations were in operation globally as of the end of 2023. The scarcity of refueling stations hinders the widespread adoption of hydrogen fuel cell vehicles (FCVs). The limited hydrogen infrastructure reduces opportunities for the growth of hydrogen vehicles, as well as the establishment and implementation of standardized testing protocols and certification schemes, which are essential for the growth of the TIC market.

MARKET ECOSYSTEM

The hydrogen automotive TIC ecosystem comprises a network of organizations that ensures the safety, performance, and regulatory compliance of hydrogen-powered vehicles and their components. It involves OEMs such as Toyota and Hyundai developing fuel-cell vehicles, component suppliers like Ballard Power Systems and Bosch providing fuel-cell stacks and hydrogen tanks, and TIC companies such as TÜV SÜD, SGS, and Intertek offering specialized testing, inspection, and certification services. The ecosystem is further supported by regulatory bodies, research institutions, and technology partners, who drive standardization, safety validation, and the broader adoption of hydrogen mobility solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Hydogen Auomotive TIC Market, By Services

The hydrogen automotive TIC services market includes testing, inspection, certification, and other services. Testing is expected to see the highest CAGR due to the need to verify hydrogen component performance, safety, and reliability. As hydrogen use increases in mobility, energy, and industry, rigorous testing for storage, fuel cells, pipelines, and refueling is vital. Advances in technology, regulations, and safety concerns drive demand for testing services. Manufacturers also seek third-party validation to ensure compliance and acceptance of hydrogen solutions.

Hydrgen Automotive Market, By Vehicle Type

Vehicle types include passenger cars, buses, light commercial vehicles, medium-duty vehicles, heavy-duty vehicles, and ICE hydrogen vehicles. Passenger vehicles are expected to be the largest segment, driven by increasing consumer demand for clean mobility solutions and the rapid commercialization of hydrogen fuel cell cars. Leading automotive manufacturers are launching fuel cell electric vehicles (FCEVs) to meet emission targets and sustainability goals. Government incentives, the growth of hydrogen refueling infrastructure, and advancements in fuel cell technology further drive adoption. Additionally, the need for stringent safety testing, performance verification, and regulatory compliance in mass-produced vehicles significantly boosts demand for TIC services in this segment.

REGION

Asia Pacific holds the largest share in global hydrogen automotive TIC market.

The Asia Pacific dominates the hydrogen automotive TIC market, driven by robust government initiatives, growing investments in hydrogen infrastructure, and the strong presence of leading automotive manufacturers. Japan, South Korea, and China are at the forefront of hydrogen adoption, with national strategies promoting fuel cell electric vehicles (FCEVs) and supporting the development of refueling networks. Japan’s “Hydrogen Society” vision and South Korea’s Hydrogen Economy Roadmap have accelerated public and private sector participation, increasing demand for TIC services to ensure safety and quality standards across hydrogen vehicles and infrastructure. In China, government subsidies and targets for zero-emission vehicles have spurred the expansion of hydrogen-powered fleets, particularly in commercial vehicles such as buses and trucks. The region also benefits from a robust manufacturing ecosystem, which fosters the rapid development and commercialization of fuel cell technologies. As a result, the need for thorough testing, inspection, and certification to meet both domestic and international regulations has surged.

Hydrogen Automotive TIC Market: COMPANY EVALUATION MATRIX

TÜV SÜD (Market Leader) leads the Hydrogen Automotive Testing, Inspection, and Certification (TIC) market, supported by its deep expertise in safety standards, quality assurance, and global presence. The company provides comprehensive testing and certification services covering fuel cells, hydrogen storage systems, refueling infrastructure, and vehicle safety compliance. TÜV SÜD’s advanced testing facilities and adherence to global regulatory frameworks ensure the highest levels of reliability and safety in hydrogen-powered vehicles. Continuous innovation in hydrogen technology validation, material testing, and digital inspection systems enhances performance and compliance across the hydrogen value chain.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 18.3 Million |

| Market Forecast in 2030 (Value) | USD 35.8 Billion |

| Growth Rate | CAGR of 11.8% from 2024-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific |

WHAT IS IN IT FOR YOU: Hydrogen Automotive TIC Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| European Client |

|

|

RECENT DEVELOPMENTS

- July 2024 : UL LLC, a global leader in applied safety science, acquired TesTneT Engineering GmbH, a Germany-based leader in hydrogen component and system testing. This acquisition deepened UL LLC's expertise in alternative fuels and enhanced its ability to impact global decarbonization efforts.

- ? September 2023 : TUV Rheinland and Daimler Truck AG partnered to test the Mercedes-Benz GenH2 Truck. The Mercedes-Benz GenH2 Truck, developed by Daimler Truck, surpasses the 1,000-kilometer mark with a single fill of liquid hydrogen. The record drive, featuring sealed tanks and controlled mileage, was independently confirmed by an inspection document from TÜV Rheinland.

- December 2022 : Intelligent Energy (IEL) and Applus+ IDIADA signed an agreement to collaborate on Hydrogen Fuel Cell development projects for automotive applications. IEL will utilize these models to support future fuel cell system development and optimization through digital twin simulation. The system model generated will also be utilized by Applus+ IDIADA in comprehensive vehicle simulation platforms to provide accurate fuel cell modeling, thereby reducing FCEV development time and optimizing vehicle performance.

- November 2022 : Kiwa came in partnership with Forze Hydrogen Racing, the student team that specializes in racing on hydrogen. Kiwa not only supports Forze financially, but also contributes through advice and validation of hydrogen systems. Forze Hydrogen Racing has been developing hydrogen racing cars since 2007 and wants to promote hydrogen as the fuel of the future in the automotive sector. They test their hydrogen components in Kiwa labs.

- June 2022 : DEKRA IN entered into partnership with Hylane, a subsidiary of German insurance company DEVK, specializes in providing a comprehensive range of hydrogen solutions to the logistics sector. DEKRA IN experts will be carrying out the trucks’ periodical vehicle inspections and quarterly safety inspections, preparing condition reports and expert assessments.

Table of Contents

Methodology

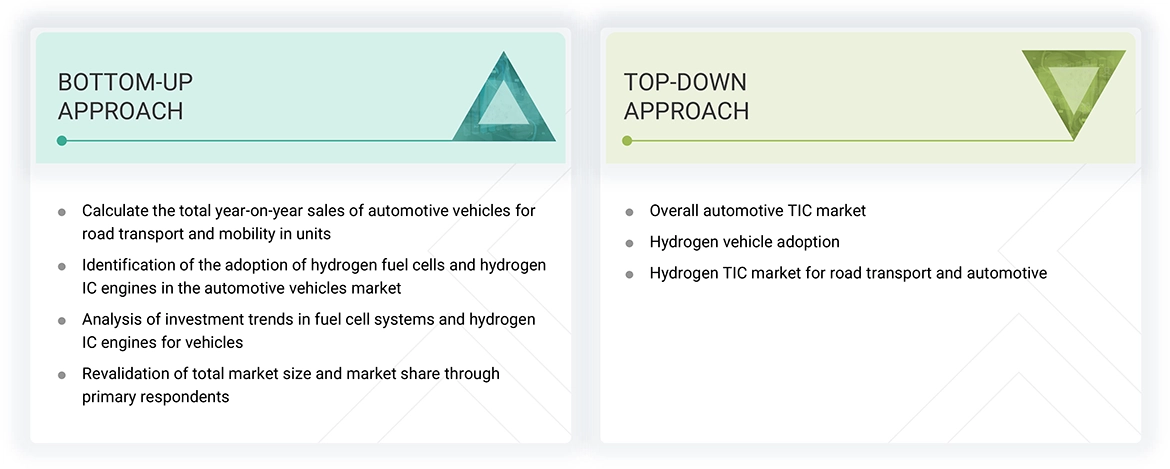

The study involved major activities in estimating the current size of the hydrogen automotive testing, inspection, and certification (TIC) market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, and databases of various companies and associations. Secondary research has been mainly used to obtain key information about the supply chain and to identify the key players offering testing, inspection and certification, market classification, and segmentation according to the offerings of the leading players, along with the paid databases, such as Factiva and ZoomInfo, which were used to extract regional/country-level information for various companies.

Primary Research

In the primary research process, various primary sources from the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, and related key executives from various companies and organizations operating in the hydrogen automotive testing, inspection, and certification (TIC) market.

In the complete market engineering process, top-down and bottom-up approaches, along with several data triangulation methods, have been extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been conducted to complete the market engineering process and list key information/insights throughout the report.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the hydrogen automotive testing, inspection, and certification (TIC) market and its dependent submarkets. The key players in the market have been identified through secondary research, and their market shares in the respective regions have been obtained through both primary and secondary research. The research methodology includes the study of the annual and financial reports of the top market players and interviews with industry experts, such as chief executive officers, vice presidents, directors, sales managers, and marketing executives, for key quantitative and qualitative insights related to the hydrogen automotive testing, inspection, and certification (TIC) market. The following sections provide details about the overall market size estimation process employed in this study.

Hydrogen Automotive Testing, Inspection, and Certification (TIC) Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market has been split into two segments and subsegments. The data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

Hydrogen TIC comprises a comprehensive series of processes to ensure the safety, reliability, and regulatory compliance of hydrogen vehicles. The TIC process is a pivotal, robust licensing pathway to ensure the safe operation of all hydrogen vehicles, as well as focusing on ensuring consumer confidence for market acceptance.

Testing: Hydrogen vehicle testing involves assessing material compatibility, pressure safety, fuel cell system testing, storage tank testing, process safety, hydrogen fuel testing, pressure and leak tests, and safety function.

Inspection: The inspection processes occur both at production and in-service to ensure that the components and systems fitted to hydrogen vehicles meet a particular specification for the safety of their eventual users. This study considers comprehensive inspections of the entire hydrogen fuel cell systems, including valves, dispensers, and fuel tanks.

Certification: Certification of hydrogen vehicles is the last stage, which means the vehicles have met regional and national (if applicable) standards, including existing health, safety, and environmental standards that may apply in the given jurisdiction.

Other services: Other services include consulting and auditing services, training and awareness services, lifecycle assessment, and environmental impact assessments.

Stakeholders

- Automotive OEMs

- TIC Service Providers

- Fuel Cell Manufacturers

- Hydrogen Refueling Infrastructure Providers

- Component and System Suppliers

- Government and Regulatory Bodies

- Research and Development Institutions

- Hydrogen Technology Startups

- Logistics and Fleet Operators

- Investors and Financial Institutions

- Environmental and Safety Standard Organizations

- Energy and Utility Companies

- End Users

Report Objectives

- To analyze the market opportunities for stakeholders in the Hydrogen automotive testing, inspection, and certification (TIC) market

- To provide detailed information on the major drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the market

- To identify the supply chain in the hydrogen transportation ecosystems

- To provide detailed company profiles of TIC and auto engineering key players

- To provide insights on the OEM strategies, public sector outlook, and regulatory landscape

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the hydrogen automotive testing, inspection, and certification (TIC) market, by country, for Europe

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the hydrogen automotive TIC market?

The market size of the hydrogen automotive testing, inspection, and certification (TIC) market was USD 18.3 million in 2024.

What are the major drivers for the hydrogen automotive TIC market?

Favorable government policies and stringent laws are some of the major drivers for the hydrogen automotive TIC market.

Which is the largest market for hydrogen automotive TIC during the forecast period?

Asia Pacific is expected to dominate the hydrogen automotive testing, inspection, and certification (TIC) market between 2024 and 2030, followed by North America.

Which vehicle type segment is expected to be the largest in the hydrogen automotive testing, inspection, and certification (TIC) market during the forecast period?

The passenger cars segment is expected to be the largest vehicle type segment during the forecast period.

Which is expected to be the largest service segment in the hydrogen automotive testing, inspection, and certification (TIC) market during the forecast period?

Testing is expected to be the largest service segment during the forecast period, followed by inspection.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Hydrogen Automotive Testing, Inspection, and Certification (TIC) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Hydrogen Automotive Testing, Inspection, and Certification (TIC) Market