The study encompassed four primary tasks to determine the present and future scope of the H2-ICE market. Initially, extensive secondary research was conducted to gather data on the market, its related sectors, and overarching industries. Subsequently, these findings, along with assumptions, were corroborated and validated through primary research involving industry experts across the value chain. Employing bottom-up methodology, the complete market size was estimated. Following this, a market breakdown and data triangulation approach were utilized to determine the size of specific segments and subsegments within the market.x

Secondary Research

The secondary sources referred to for the study of the H2-ICE market are directly dependent on end-use industry growth. market sales and end-use industry demand are derived through secondary sources such as the Hydrogen Association of India, Fuel Cell & Hydrogen Energy Association (FCHEA), Hydrogen Mobility Europe, Automotive Research Association of India (ARAI), Hydrogen Small Mobility & Engine Technology Association (HySE), European Automobile Manufacturers Association (ACEA), Department of Transportation (US - DOT), International Council on Clean Transportation (ICCT), corporate filings such as annual reports, investor presentations, and financial statements, and paid repository. Historical production data has been collected and analyzed, and the industry trend is considered to arrive at the forecast, further validated by primary research.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as H2-ICE market sizing estimation and forecast, future technology trends, and upcoming technologies in the market. Data triangulation of all these points was done using the information gathered from secondary research and model mapping. Stakeholders from the demand and supply sides have been interviewed to understand their views on the aforementioned points.

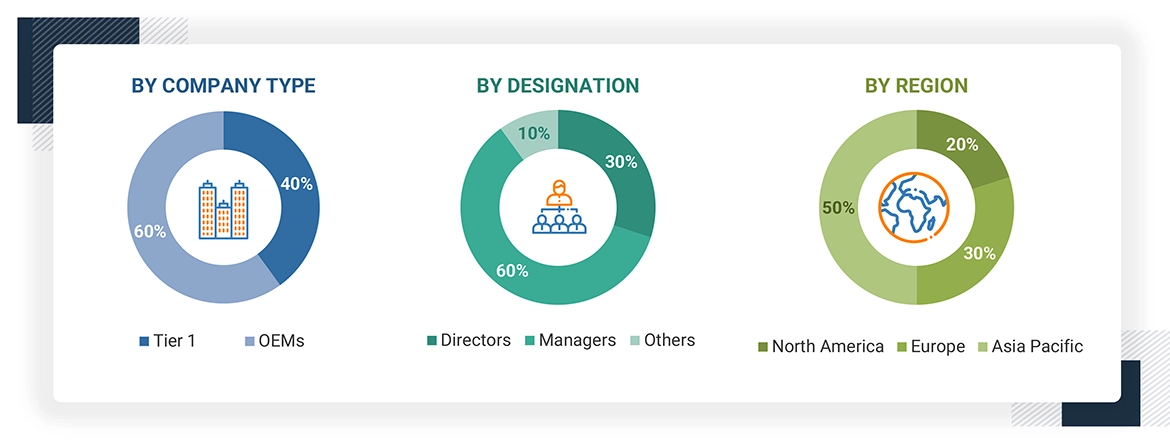

Primary interviews have been conducted with market experts from the demand-side (end-use industries) and supply-side (H2-ICE providers) across four regions, namely North America, Europe, and Asia Pacific. Approximately 60% and 40% of the primary interviews were conducted on the OEMs and component manufacturer sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. After communicating with primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report. After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings described in the remainder of this report.

Note: Others in designation include sales, marketing, and product managers, Others in company tiers include end-use organizations

Company tiers are based on the value chain; the revenue of the company is not considered.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

As mentioned below, a detailed market estimation approach was followed to estimate and validate the volume of the H2-ICE market and the other dependent submarkets.

-

Key players in the H2-ICE market were identified through secondary research, and their global market ranking was determined through primary and secondary research.

-

The research methodology included a study of annual and quarterly financial reports and regulatory filings of significant market players (public), as well as interviews with industry experts for detailed market insights.

-

All vehicle level penetration rates, percentage shares, splits, and breakdowns for the H2-ICE market were determined using secondary sources and verified through primary sources.

-

All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain validated and verified quantitative and qualitative data.

-

The gathered market data was consolidated, enhanced with detailed inputs, analyzed, and presented in this report.

H2-ICE Market : Top-Down and Bottom-Up Approach

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analysed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Market Definition

H2-ICE: A Hydrogen Internal Combustion Engine (H2-ICE) is an engine that uses hydrogen as its primary fuel. The engine operates on a similar principle to traditional gasoline or diesel engines. H2-ICE offers the advantage of zero carbon dioxide (CO2) emissions. The H2-ICE engine uses combustion approaches like PFI with SI and HPDI for hydrogen injection. The main aim of H2-ICE is to reduce the greenhouse gas emissions.

Stakeholders

-

Senior Management

-

End User Finance/Procurement Department

-

R&D Department

Report Objectives

-

To define, describe, and forecast the size of the H2-ICE market in terms of volume (units) between 2027 and 2035 based on the following segments:

-

By Combustion Approach (Port Fuel Injection – Spark Ignition (PFI-SI), Early Cycle Direct Injection – Spark Ignition (ECDI-SI), High-Pressure Direct Injection (HPDI))

-

By Vehicle Type (On-Highway Vehicles (Trucks and Buses) and Off-Highway Vehicles (Construction and Mining Equipment, Farm Tractors, Industrial Forklifts)

-

By Power Output (Below 300 Hp and Above 300 Hp)

-

By Region (Asia Pacific, Europe, and North America)

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the market

-

To analyze the market ranking of leading players in the H2-ICE market and evaluate competitive leadership mapping.

-

To strategically analyze key player strategies and company revenue analysis

-

To study the following with respect to the market

-

Total Cost of Ownership (Diesel Vs. H2-ICE Vs. FCEV)

-

Trends and Disruptions Impacting Customers’ Businesses

-

Market Ecosystem

-

Supply Chain Analysis

-

Patent Analysis

-

Regulatory Landscape

-

Case Study Analysis

-

Key Conferences and Events

-

Investment and Funding Scenario

-

To analyze recent developments, including product launches, partnerships, acquisitions, expansions, and other developments undertaken by key industry participants in the market

-

To give a brief understanding of the H2-ICE market in the recommendations chapter

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Product Analysis

-

On-Highway Vehicle

-

Off-Highway Vehicle

-

Construction and Mining Equipment

-

Farm Tractors

-

Industrial Forklifts

Growth opportunities and latent adjacency in H2-ICE Market